The global fluidized bed filter market is experiencing robust growth, driven by increasing demand for efficient wastewater treatment solutions across municipal, industrial, and aquaculture sectors. According to a report by Mordor Intelligence, the global wastewater treatment market is projected to grow at a CAGR of over 6.5% from 2023 to 2028, with fluidized bed bioreactors (FBBRs) gaining traction due to their high treatment efficiency and compact footprint. Similarly, Grand View Research valued the global water and wastewater treatment equipment market at USD 45.6 billion in 2022 and forecasts a CAGR of 7.2% through 2030, citing technological advancements and stricter environmental regulations as key growth catalysts. As centralized and decentralized treatment systems expand, fluidized bed filters—known for superior biofilm attachment and continuous self-cleaning—are becoming critical components in modern treatment plants. This rising demand has spurred innovation and competition among manufacturers worldwide. Below, we highlight the top 10 fluidized bed filter manufacturers leading the charge in technology, reliability, and market reach.

Top 10 Fluidized Bed Filter Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

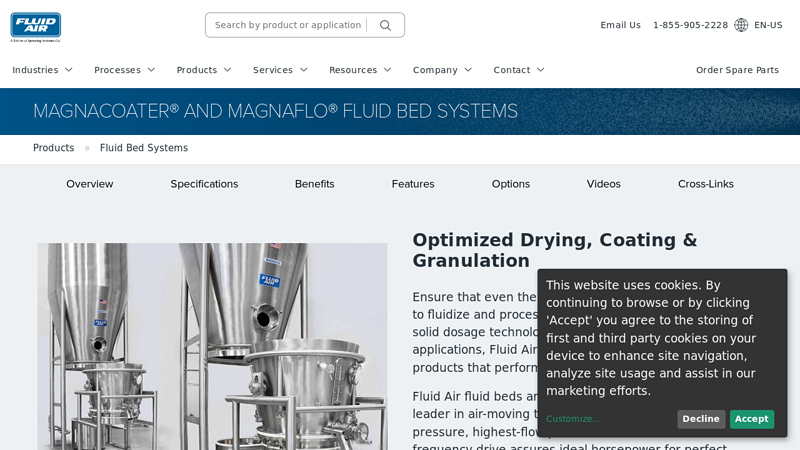

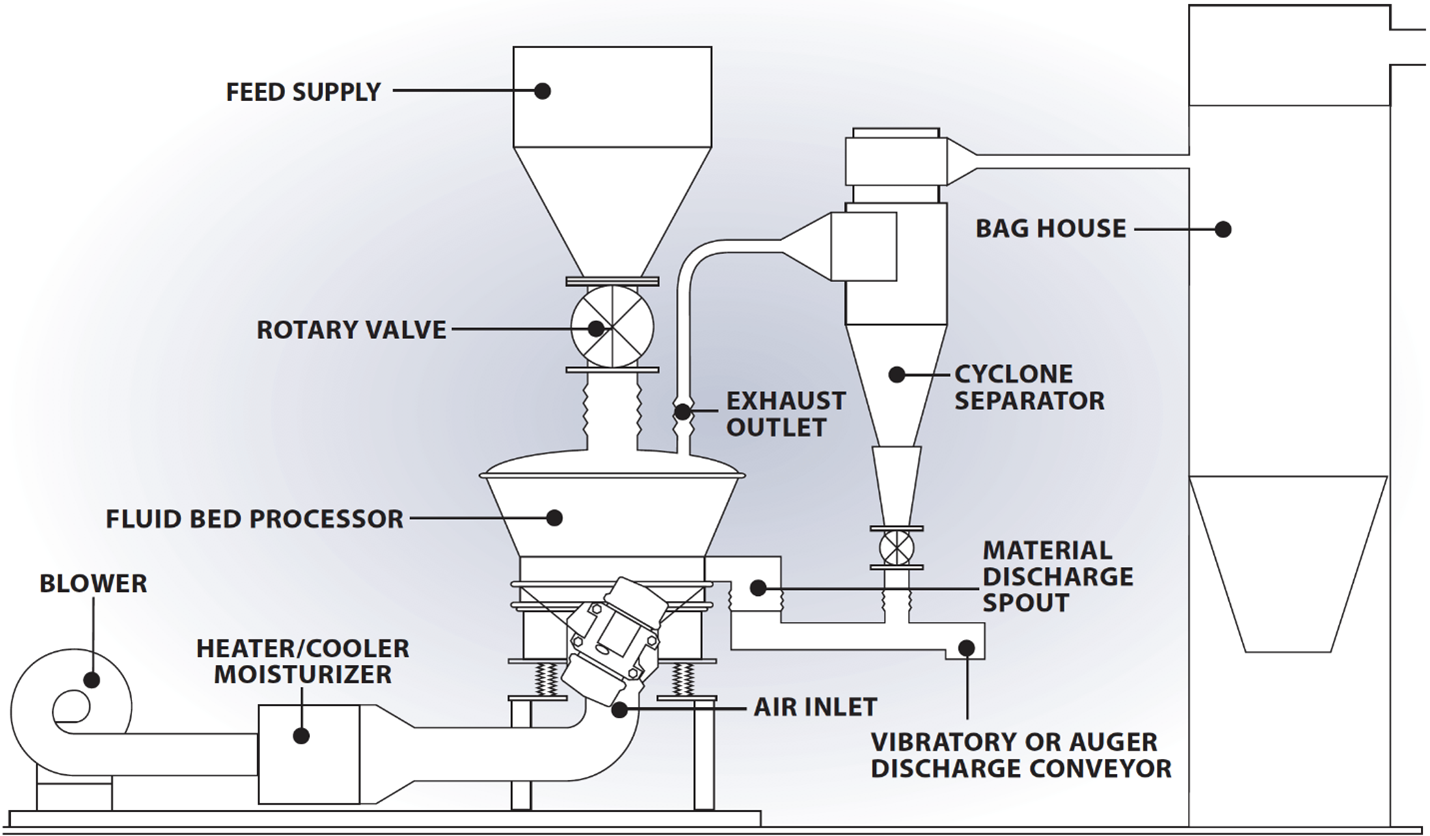

#1 magnacoater® and magnaflo® fluid bed systems

Domain Est. 1997

Website: fluidairinc.com

Key Highlights: Fluid Air fluid beds are recognized in the industry as a leader in air-moving technology using the highest-pressure, highest-flow process blowers….

#2 Biological Fluidized Bed Reactor Technology (FBR)

Domain Est. 2012

Website: envirogengroup.com

Key Highlights: The Envirogen fluidized bed reactor is a proprietary biological water treatment system deployed to remove organics or oxyanions….

#3 Fluidized bed systems

Domain Est. 1995

Website: glatt.com

Key Highlights: We offer our customers a wide range of fluid bed systems for all powder processing industries. From laboratory and pilot plants to complex systems for ……

#4 Bed Filter Tank System

Domain Est. 1996

Website: graymills.com

Key Highlights: Graymills bed filter tanks systems are durable, automatic systems designed to keep your cutting & drilling machinery operating at peak performance….

#5 Paper Bed Filters

Domain Est. 1997

Website: prab.com

Key Highlights: PRAB premium paper bed filters and disposable media for optimal performance | Effective and fast fluid filtration system | Typically ships in under 5 days….

#6 Procedyne Corp.

Domain Est. 1997

Website: procedyne.com

Key Highlights: Procedyne is an engineering and equipment manufacturing company that specializes in fluid bed calciners, catalyst activators, and an array of other products….

#7 Fluid

Domain Est. 2002

Website: diosna.com

Key Highlights: The multifunctional fluidized bed processors from DIOSNA are the ideal solutions for laboratory, pilot and production scale….

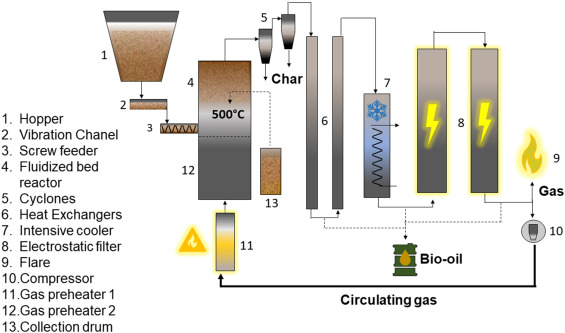

#8 Fluidized Bed Reactor

Domain Est. 2016

Website: filsonfilters.com

Key Highlights: Filson fluidized bed reactor is a kind of chemical reactor that uses gas or liquid to pass through the granular solid layer….

#9 Fluid bed processor

Domain Est. 2019

Website: syntegon.com

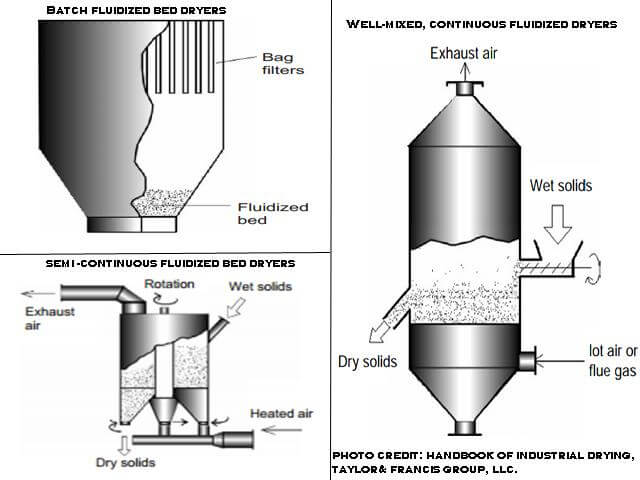

Key Highlights: Unlike other solutions, our fluid bed processor lines allow you to dry, granulate and coat more efficiently with just one product container….

#10 Fluid Bed: Drying

Domain Est. 2024

Website: freundglobal.com

Key Highlights: The FLO-COATER systems are geometrically optimized for efficient and fast drying. Exhaust filters are located well above the effective processing area….

Expert Sourcing Insights for Fluidized Bed Filter

H2: Projected Market Trends for Fluidized Bed Filters in 2026

By 2026, the global market for fluidized bed filters (FBFs) is expected to experience steady growth driven by increasing demand for efficient water and wastewater treatment solutions across industrial, municipal, and aquaculture sectors. Key trends shaping the market include technological advancements, regulatory pressures, and expanding applications in emerging economies.

-

Rising Demand in Wastewater Treatment: Stringent environmental regulations regarding water discharge standards are compelling municipalities and industries to adopt advanced filtration technologies. Fluidized bed filters, known for their high surface area and efficient removal of organic matter, suspended solids, and nutrients like nitrogen and phosphorus, are increasingly being integrated into wastewater treatment plants, especially in regions undergoing rapid urbanization.

-

Growth in Aquaculture and Industrial Applications: The aquaculture industry is a major driver for FBF adoption due to the need for reliable biological filtration in recirculating aquaculture systems (RAS). With global seafood demand on the rise, investments in sustainable and high-density fish farming are propelling the use of FBFs for maintaining optimal water quality. Additionally, industries such as food and beverage, pharmaceuticals, and power generation are adopting FBFs for process water purification and cooling water treatment.

-

Technological Innovations and Automation: By 2026, manufacturers are expected to focus on enhancing FBF systems with automation, real-time monitoring, and energy-efficient designs. Integration with IoT-enabled sensors and process control systems allows for better operational oversight, reduced maintenance, and improved filtration performance—factors that are increasingly important to end-users seeking cost-effective and reliable solutions.

-

Shift Toward Compact and Modular Systems: As space constraints grow in urban wastewater facilities and industrial plants, there is a clear trend toward compact and modular FBF units. These systems offer scalability and faster deployment, making them suitable for both new installations and retrofits. This modularity supports decentralized treatment solutions, particularly in remote or underserved areas.

-

Regional Market Expansion: The Asia-Pacific region is projected to lead market growth due to industrialization, population growth, and government initiatives to improve water infrastructure in countries such as China, India, and Indonesia. North America and Europe will maintain strong demand, primarily driven by environmental compliance and upgrades to aging water treatment infrastructure.

-

Sustainability and Circular Economy Focus: Fluidized bed filters align well with sustainability goals by enabling water reuse and reducing chemical usage in treatment processes. As industries and governments prioritize circular economy practices, FBFs are gaining favor for their role in resource recovery and energy-efficient operations.

In conclusion, the fluidized bed filter market in 2026 is poised for expansion, supported by technological innovation, regulatory support, and growing environmental awareness. Companies investing in R&D, sustainability, and strategic partnerships are likely to gain a competitive edge in this evolving landscape.

Common Pitfalls in Sourcing Fluidized Bed Filters (Quality & IP)

Sourcing Fluidized Bed Filters (FBFs) for applications such as water treatment, wastewater remediation, or industrial processes requires careful attention to both quality assurance and intellectual property (IP) considerations. Overlooking these aspects can lead to performance failures, legal risks, and increased lifecycle costs. Below are key pitfalls to avoid:

1. Prioritizing Low Cost Over Verified Quality

One of the most frequent mistakes is selecting a supplier based solely on the lowest initial price. This often leads to:

– Inferior Materials: Use of substandard plastics, resins, or media that degrade prematurely under operational conditions (e.g., UV exposure, chemical loads).

– Poor Manufacturing Standards: Inconsistent wall thickness, weak welds, or imprecise fluidization nozzles affecting long-term reliability.

– Unverified Performance Claims: Suppliers may exaggerate flow rates, oxygen transfer efficiency, or biomass retention without third-party validation or test data.

Mitigation: Request performance test reports, material certifications (e.g., NSF/ANSI 61), and conduct site visits or factory audits when possible.

2. Lack of Design and Operational Compatibility

FBFs must be precisely matched to the treatment goals and site-specific conditions. Pitfalls include:

– Incorrect Sizing: Undersized units lead to poor treatment; oversized units waste capital and energy.

– Incompatible Media Selection: Using media not suited for the target contaminants (e.g., organic vs. nitrification) or flow dynamics.

– Poor Integration: Failure to account for inlet/outlet configurations, backwash requirements, or control system interfaces.

Mitigation: Engage technical experts early and ensure the supplier provides a detailed design basis document.

3. Ignoring Intellectual Property (IP) Risks

Many advanced FBF designs incorporate patented technologies (e.g., proprietary media shapes, aeration systems, or control algorithms). Sourcing from unauthorized manufacturers poses serious risks:

– Infringement Liability: Purchasing or operating a patented FBF without licensing can lead to lawsuits, injunctions, or fines.

– Gray Market or Counterfeit Products: Unauthorized copies often lack quality control and void warranties.

– Limited Support and Upgrades: Non-licensed units may not receive firmware updates, spare parts, or technical support.

Mitigation: Verify that the supplier is an authorized licensee or original equipment manufacturer (OEM). Request proof of IP ownership or licensing agreements.

4. Inadequate Warranty and After-Sales Support

Low-cost suppliers may offer minimal or geographically limited support, leading to:

– Extended Downtime: Lack of local service technicians or spare parts inventory.

– Voided Warranties: Improper installation or use of non-OEM components.

– Unresponsive Technical Assistance: Delays in troubleshooting operational issues.

Mitigation: Evaluate the supplier’s global service network, warranty terms, and availability of training and maintenance programs.

5. Overlooking Long-Term Total Cost of Ownership (TCO)

Focusing only on purchase price neglects ongoing costs such as:

– Energy Consumption: Inefficient aeration or fluidization design increases power costs.

– Media Replacement: Lower-quality media may require frequent replenishment.

– Maintenance Requirements: Poorly designed units may need more frequent cleaning or repairs.

Mitigation: Conduct a lifecycle cost analysis, including energy, media, labor, and downtime estimates.

By proactively addressing these quality and IP-related pitfalls, organizations can ensure reliable performance, legal compliance, and optimal return on investment when sourcing Fluidized Bed Filters.

Logistics & Compliance Guide for Fluidized Bed Filters

Product Overview

A Fluidized Bed Filter (FBF) is a water treatment system commonly used in aquaculture, wastewater treatment, and industrial applications to remove suspended solids and biological contaminants. It operates by suspending granular media (such as sand or activated carbon) in an upward-flowing water stream, creating a “fluidized” bed that enhances filtration and biological degradation of pollutants.

Shipping & Handling

Packaging Requirements

- Fluidized Bed Filters are typically shipped in robust, protective packaging to prevent damage during transit.

- Units should be crated or palletized with corner protectors and secured using stretch wrap or strapping.

- Internal components (e.g., diffusers, media retainer screens) must be individually wrapped and labeled.

Transportation Guidelines

- Handle with care; avoid dropping or subjecting the unit to mechanical shock.

- Transport upright to prevent internal component displacement.

- Use forklifts or pallet jacks for moving; never drag the unit.

- For international shipments, comply with ISPM 15 regulations for wood packaging materials.

Storage Conditions

- Store indoors in a dry, temperature-controlled environment (5°C to 40°C).

- Protect from direct sunlight, moisture, and corrosive atmospheres.

- Keep sealed until installation to prevent contamination of internal components.

Import & Export Compliance

Documentation

- Commercial Invoice

- Packing List

- Bill of Lading/Air Waybill

- Certificate of Origin

- Test Reports (e.g., pressure, flow rate)

- Material Safety Data Sheet (MSDS), if applicable

Regulatory Requirements

- CE Marking (for EU markets): Complies with Machinery Directive 2006/42/EC and Pressure Equipment Directive 2014/68/EU, if applicable.

- UKCA Marking (for UK market): Required for units placed on the market in Great Britain.

- EPA & NSF Compliance (for U.S. market): If used in drinking water applications, verify NSF/ANSI 61 certification for component materials.

- RoHS & REACH Compliance: Ensure electrical components and materials meet EU environmental standards.

Customs Classification

- HS Code Example: 8421.23.00 (Filters for liquids; centrifugal; other than for domestic use)

Note: Final classification depends on design, capacity, and application. Consult local customs authority.

Installation & Operational Compliance

Site Preparation

- Ensure adequate space for maintenance access (minimum 60 cm clearance on all sides).

- Verify foundation can support the total operating weight (unit + media + water).

- Confirm incoming water quality meets design specifications (e.g., pH 6–9, turbidity < 20 NTU).

Installation Requirements

- Follow manufacturer’s installation manual.

- Comply with local plumbing and electrical codes (e.g., IPC, NEC).

- Use certified personnel for connections involving pressure piping or electrical systems.

Operational Standards

- Monitor flow rate, pressure drop, and backwash cycles per operating manual.

- Conduct periodic inspections to ensure fluidization is uniform and media is not channeling or leaking.

- Maintain records of maintenance, backwashing, and media replacement.

Environmental & Safety Compliance

Waste Management

- Backwash water may contain suspended solids and biofilm; discharge only in accordance with local wastewater regulations.

- Used filter media (e.g., sand, GAC) must be disposed of or recycled per regional environmental laws.

Chemical Handling

- If chemical cleaning is required (e.g., with chlorine or acid), follow OSHA and local regulations for storage, handling, and PPE.

- Neutralize cleaning effluent before disposal, where required.

Worker Safety

- Provide training for operators on lockout/tagout (LOTO) procedures.

- Equip facilities with emergency shut-off valves and eye wash stations if chemicals are used.

Certification & Documentation Archive

- Retain copies of:

- Product conformity certificates (CE, UKCA, NSF)

- Installation and commissioning reports

- Maintenance logs

- Regulatory correspondence

Ensure all documentation is accessible for audits or inspections by regulatory bodies.

Note: This guide provides general guidance. Always consult local regulations and the manufacturer’s specifications for project-specific compliance requirements.

Conclusion for Sourcing a Fluidized Bed Filter

In conclusion, sourcing a fluidized bed filter represents a strategic investment in efficient and sustainable water or wastewater treatment. Its proven effectiveness in removing organic matter, nitrifying ammonia, and reducing sludge production makes it a superior choice for various applications, including aquaculture, municipal wastewater treatment, and industrial process water purification. When selecting a fluidized bed filter, key factors such as system capacity, media type, energy efficiency, ease of maintenance, and compatibility with existing infrastructure must be carefully evaluated.

Procuring from reputable suppliers who offer robust design, technical support, and reliable after-sales service ensures long-term operational success. Additionally, considering lifecycle costs rather than just initial purchase price contributes to better economic and environmental outcomes. With proper sizing, installation, and maintenance, a fluidized bed filter can deliver high performance, resilience, and compliance with regulatory standards, ultimately supporting cleaner water and more sustainable operations.