Introduction: Navigating the Global Market for Flow Wrap Machines

Hook:

In 2025, a U.S. snack brand and a German pharmaceutical OEM can place identical horizontal flow wrappers online and receive quotes within hours. Yet one order ships on time, the other is delayed by customs paperwork and incompatible film specifications. The difference is not the machine—it is the buyer’s ability to navigate a global supply chain that rewards precision and punishes guesswork.

Problem:

Across North America and Europe, packaging engineers face three persistent pain points:

| Pain Point | Consequence |

|————|————-|

| Inconsistent technical standards | FDA, EU MDR, and CE mark requirements collide with local electrical codes, forcing redesigns mid-project. |

| Opaque supplier capability | OEM web sites list speeds “up to 150 ppm,” but real throughput depends on film gauge, product shape, and changeover time—data rarely disclosed until late in the cycle. |

| Sustainability pressure | Both markets now reward recyclable or mono-material films; choosing the wrong film can trigger rejection at the border or shelf. |

What This Guide Delivers:

A step-by-step framework to short-circuit these risks. You will learn how to:

- Decode global specs—translate FDA, EU MDR, and CE requirements into a single technical brief.

- Benchmark supplier claims—use a standardized scorecard to compare speed, changeover, and film flexibility across PAC, Bosch, Multivac, and others.

- Mitigate cross-border logistics—map customs duties, lead times, and film import limits before PO release.

The outcome: a data-driven shortlist and a procurement roadmap that cuts 6–8 weeks from typical flow wrap machine selection cycles.

Illustrative Image (Source: Google Search)

Article Navigation

- Top 10 Flow Wrap Machine Manufacturers & Suppliers List

- Introduction: Navigating the Global Market for flow wrap machine

- Understanding flow wrap machine Types and Variations

- Key Industrial Applications of flow wrap machine

- 3 Common User Pain Points for ‘flow wrap machine’ & Their Solutions

- Strategic Material Selection Guide for flow wrap machine

- In-depth Look: Manufacturing Processes and Quality Assurance for flow wrap machine

- Practical Sourcing Guide: A Step-by-Step Checklist for ‘flow wrap machine’

- Comprehensive Cost and Pricing Analysis for flow wrap machine Sourcing

- Alternatives Analysis: Comparing flow wrap machine With Other Solutions

- Essential Technical Properties and Trade Terminology for flow wrap machine

- Navigating Market Dynamics and Sourcing Trends in the flow wrap machine Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of flow wrap machine

- Strategic Sourcing Conclusion and Outlook for flow wrap machine

- Important Disclaimer & Terms of Use

Top 10 Flow Wrap Machine Manufacturers & Suppliers List

1. Top 10 Flow Wrapper Manufacturers – Packaim’s

Domain: packaim.com

Registered: 2023 (2 years)

Introduction: PACKAIM Machinery · Texwrap Packaging Systems · PFM Packaging Machinery · Fuji Machinery Co. · ULMA Packaging · WeighPack Systems · Mespack · Toyo Machine ……

2. Cavanna North America: Packaging & Flow Wrapper Manufacturers

Domain: cavanna-usa.com

Registered: 2021 (4 years)

Introduction: For over 60 years, Cavanna Group continues to be a world leader in primary and secondary turn-key packaging solutions (flow wrapping, cartoning and case packing) ……

3. Homepage | Delta Systems & Automation – Flow Wrappers, Cake …

Domain: dsarogers.com

Registered: 2008 (17 years)

Introduction: Delta Systems manufactures a range of Product Distribution Systems that accept product from the manufacturing process and evenly distributes to primary flow ……

4. Flow Wrappers & Feeding Equipment – Campbell Wrapper …

Domain: campbellwrapper.com

Registered: 2000 (25 years)

Introduction: Over 75 years packaging excellence! Quality horizontal flow wrappers and feeding equipment for the food, medical, personal care, household product, and paper ……

Illustrative Image (Source: Google Search)

5. Flow Wrap Machine – Top Sealing – Servo Flow Wrapper | Sold in 50 …

Domain: joiepack.com

Registered: 1997 (28 years)

Introduction: Located in Taiwan, Joiepack is one of the leading Flow Wrap Machine – Top Sealing – Servo Flow Wrapper manufacturers since 1980….

6. Horizontal Flow Wrap Machine – Shreem Engineers

Domain: shreemengineers.net

Registered: 2016 (9 years)

Introduction: Packaging Material: Ice Candy/Chikki/Soap/Bearing · Brand: SHREEM Engineer · Power: 3 Phase · Voltage: 450 · Type: Horizontal · Country of Origin: Made in India….

7. Table Top Servo Flow Wrapper | Innovative Packaging Systems

Domain: hopak.com

Registered: 1999 (26 years)

Introduction: At Hopak Machinery, we are a leading manufacturer of innovative packaging solutions, specializing in the development of high-speed horizontal flow wrappers ……

Understanding flow wrap machine Types and Variations

Flow Wrap Machine Types and Variations

Summary Table

| Type | Core Features | Typical Applications | Pros | Cons |

|---|---|---|---|---|

| Horizontal Flow Wrapper (HFW) | Continuous forming, filling, sealing; speeds 30–200 ppm; servo or mechanical drive | Bars, baked goods, medical devices, industrial parts | Proven reliability, broad film compatibility, easy changeovers | Larger footprint, moderate speed vs. vertical models |

| Vertical Form-Fill-Seal (VFFS) | Form bag from roll film, vertical seal, horizontal seal; speeds 20–150 ppm | Powder, granules, hardware, food | Smaller floor space, handles free-flowing products | 不适合 fragile or irregular shapes |

| Tray Sealer (Vacuum/MAP) | Pre-formed tray sealing with gas flush or vacuum; speeds 5–60 ppm | Fresh meat, cheese, ready meals | Premium shelf appeal, extended shelf life | Higher cost, slower throughput |

| Shrink Tunnel Flow Wrapper | Integrated tunnel for heat-shrink film; speeds 20–100 ppm | Multi-packs, promotional bundles | Tamper-evident multi-product packs | Added energy cost, film waste |

| Inverted Flow Wrapper | Film feeds from underside, sealing on top; speeds 40–150 ppm | Soft produce, bakery, medical tubing | Gentle handling, clean top seals | Special film unwind, limited film choice |

Detailed Breakdown

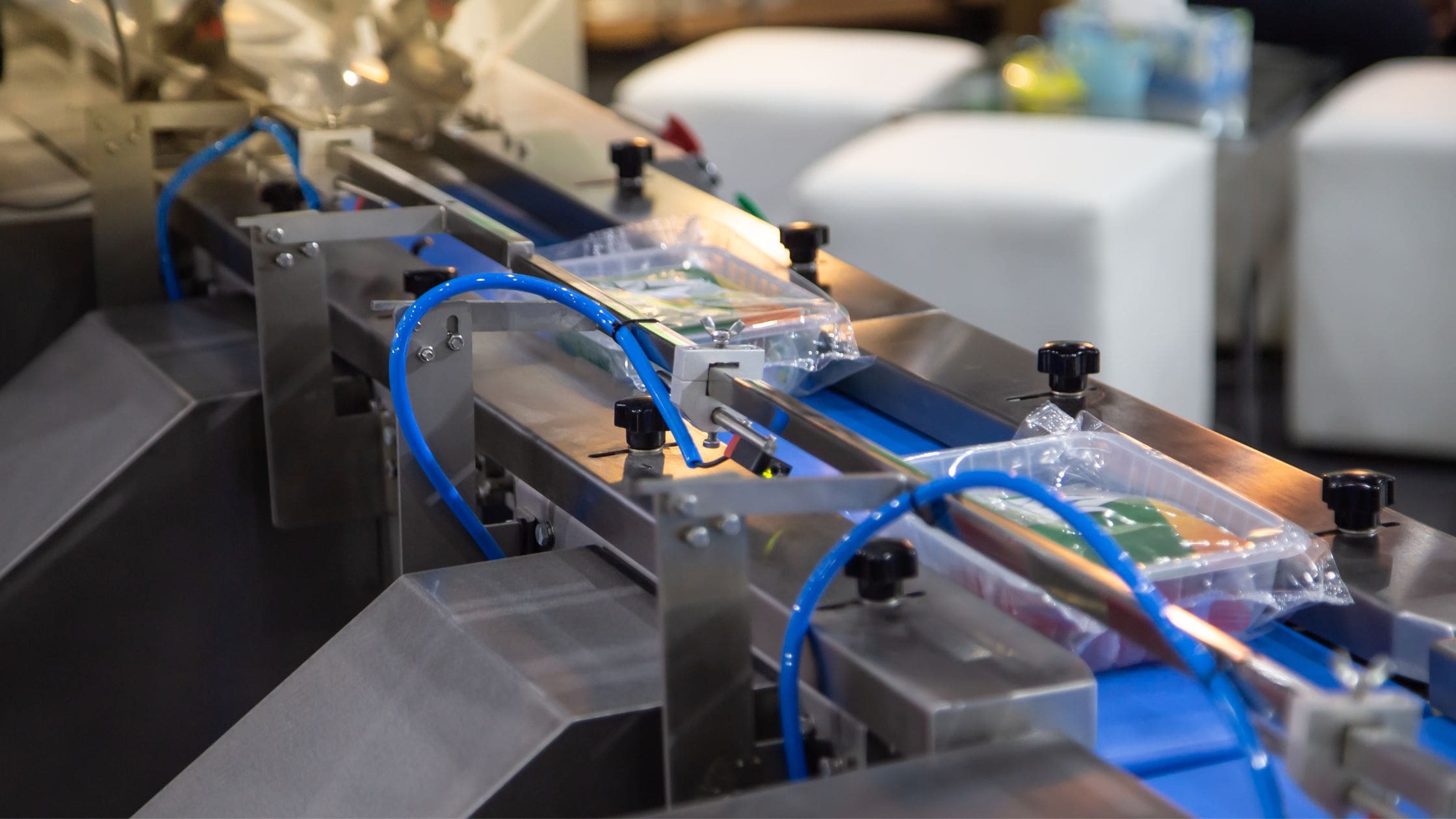

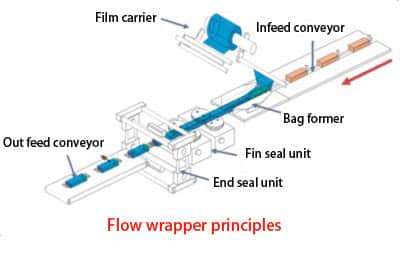

1. Horizontal Flow Wrapper (HFW)

Horizontal Flow Wrappers are the most common flow packaging configuration in North America and Europe. The product travels horizontally through a formed tube film, where vertical and horizontal seals create a pillow-shaped pouch. Modern servo-driven models (e.g., PAC FW 450S) reach up to 180 ppm with ±1 mm positional accuracy, while mechanical versions offer simpler maintenance at 30–120 ppm.

Key capabilities

– Form-fill-seal in one motion

– Film rolls from top or side (top-fed shown)

– Integral infeed conveyors for trays, cups, or loose product

– Optional gas flushing, nitrogen dosing, or VSP (volume-specific product) systems

– Tool-free film clamp and seal jaw adjustments reduce changeover to <10 min

Best-fit industries

– Confectionery & bakery: candy bars, muffins, brownies

– Healthcare: catheters, syringes, diagnostic kits

– Industrial: fasteners, O-rings, small assemblies

Illustrative Image (Source: Google Search)

Operational notes

– Requires stable infeed to prevent bag drift

– Film waste is typically 8–12 %; biodegradable films add cost

– Ideal for high-throughput lines seeking proven ROI

2. Vertical Form-Fill-Seal (VFFS)

VFFS machines form the bag from a continuous roll of film at the vertical axis, eliminating the need for a forming tube. After filling, the top is sealed horizontally, then the next bag is torn off.

Key capabilities

– Film roll mounted behind machine; minimal floor space (≈1.5 m²)

– Suitable for free-flowing solids, liquids in pouches, and certain hardware

– Integration with weighers or auger fillers for accurate dosing

– Options: premade pouch infeed for premium graphics

Best-fit industries

– Pet food, rice, flour, coffee beans

– Industrial hardware, screws, bolts

– Frozen vegetables (limited to free-flowing types)

Illustrative Image (Source: Google Search)

Operational notes

– Not suited for fragile, sticky, or irregularly shaped items

– Film waste 5–8 %; slower than HFW for high volumes

– Popular in European bakeries for bread bags and snack sticks

3. Tray Sealer (Thermoform, Vacuum, MAP)

Tray sealers use pre-formed trays and lidding film to create hermetic seals. Vacuum or modified-atmosphere packaging (MAP) extends shelf life, while clear or printed films enhance shelf appeal.

Key capabilities

– Pre-formed tray magazine or robotic infeed

– Gas flush (CO₂/N₂) or nitrogen dosing for MAP

– Optional skin-pack mode with shrinkable lidding

– Compatible with EPS, APET, or fiber trays

Best-fit industries

– Fresh meat, poultry, fish

– Dairy: cheese blocks, yogurt cups

– Ready meals, convenience foods

Operational notes

– Slower throughput (5–60 ppm) versus flow wrappers

– Higher capital cost but lower film waste (2–4 %)

– Preferred in EU markets requiring extended shelf-life and traceability

4. Shrink Tunnel Flow Wrapper

Combines horizontal flow wrapping with a shrink tunnel to create tight, tamper-evident multi-packs or promotional bundles.

Key capabilities

– Integral tunnel heated by gas or electric elements

– Film types: POF, PVC, or shrink-label stock

– Bundle sizes 2–12 units; adjustable conveyor speeds

– Optional steam or mist shrink for uniform film tightness

Best-fit industries

– Beverage multipacks (cans, bottles)

– Cosmetics gift sets

– Pharmaceutical blister card bundles

Illustrative Image (Source: Google Search)

Operational notes

– Energy consumption 15–25 kW; gas tunnel models reduce carbon footprint

– Film waste 10–15 %; requires precise tunnel temperature control

– Popular in North American convenience stores for multi-pack promotions

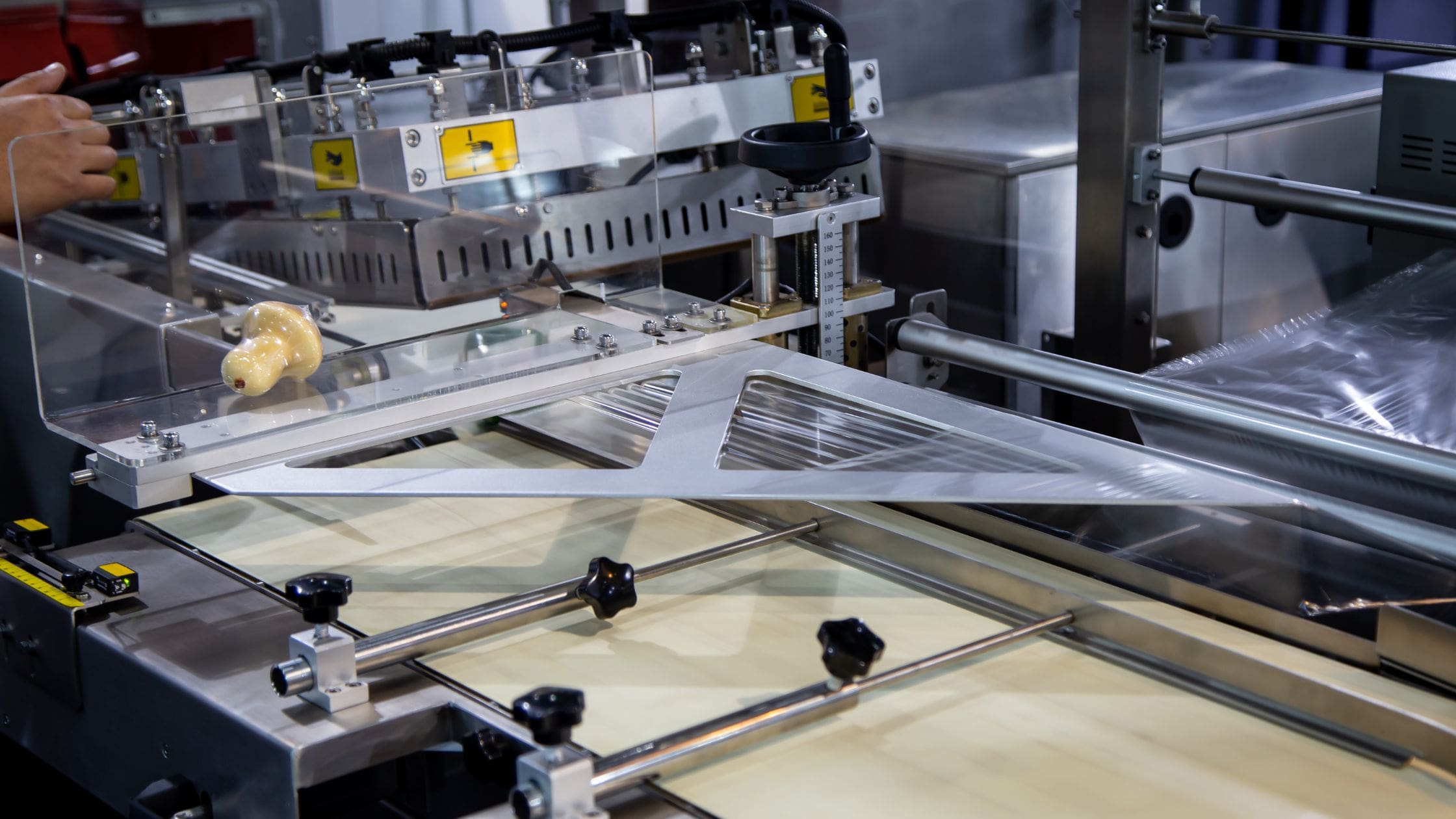

5. Inverted Flow Wrapper

The inverted configuration feeds film from the underside and seals on the top, allowing gentle handling of soft or delicate products.

Key capabilities

– Film unwind below the forming tube; reduces collapse of thin films

– Top sealing jaws provide clean, flat seals for printing or labeling

– Servo drives enable gentle product acceleration

– Suitable for soft produce, bakery items, medical tubing

Best-fit industries

– Leafy salads, soft fruits

– Bakery: croissants, donuts

– Medical: tubing, catheters

Operational notes

– Requires specialized film unwind systems; downtime for film changes

– Slightly higher maintenance for inverted jaw mechanisms

– Growing adoption in EU organic produce lines seeking breathable film compatibility

Key Industrial Applications of flow wrap machine

Key Industrial Applications of Flow Wrap Machines

| Industry | Typical Products | Key Benefits |

|---|---|---|

| Food & Beverage | Candy bars, ice cream, cookies, muffins, popsicles, dried snacks, fresh produce, ready meals | – Seamless integration with VFFS/horizontal flow capabilities – Extended shelf life via oxygen barrier films – Hygienic, tamper-evident sealing – High-speed operation (up to 120–180 packages/min) |

| Medical Devices & Pharmaceuticals | Syringes, IV bags, test kits, single-use gloves, sterile dressings | – ISO-compliant clean-room packaging – Traceable serialization & lot coding – Anti-static and medical-grade film options – Reduced contamination risk |

| Industrial & Hardware | Fasteners, O-rings, circuit boards, small tools, mechanical parts | – Durable, puncture-resistant barrier films – Custom compartment layouts for kitting – Void-free seals protect sensitive components – Lower film gauge reduces material costs |

| Cosmetics & Personal Care | Soap bars, skincare sets, sample kits, gift bundles | – Premium appearance with high-gloss or matte finishes – Heat-seal or cold-seal options for delicate surfaces – Compact footprints fit into existing lines |

| Agriculture & Horticulture | Seeds, fertilizers, plant bulbs, irrigation parts | – Moisture and UV protection – Re-sealable or tear-notch designs for end-users – Recyclable or compostable film grades available |

| E-commerce & Fulfillment | Subscription boxes, multi-item sets, fragile electronics | – Void-free cushioning reduces damage in transit – Scalable to high-speed outputs (up to 180 min⁻¹) – Print-on-demand variable data for branding |

Benefits at a Glance

- Three-in-one operation: forming, filling, sealing—reduces labor and floor space.

- Versatile film handling: accommodates thin gauge to heavy-duty materials (LDPE, PET, aluminum, paper).

- Servo-driven precision: ensures accurate sealing and consistent package dimensions for downstream automation.

- Quick changeover: tool-less film station and touchscreen controls cut downtime between SKUs.

- Future-ready sustainability: new PAC FW models support recyclable and mono-material films to meet EU and North American compliance mandates.

3 Common User Pain Points for ‘flow wrap machine’ & Their Solutions

3 Common User Pain Points for Flow Wrap Machine & Their Solutions

1. Frequent Film Jams & Wrapping Inconsistencies

Problem

– Film tears or folds, causing line stops and rejected packs

– Manual adjustment of film tension & sealing jaws is time-consuming

– Quality team flags recurring seal defects (burn marks, weak seals)

Impact

– Lost production time: 15–30 min average changeover

– Higher scrap rates (up to 8 % of total output)

– Brand image risk from inconsistent pack appearance

Solution

– Install a servo-driven flow wrapper (e.g., PAC FW 450S) with closed-loop film tension control and pre-stretch unwind

– Use pre-programmed “recipe” parameters (temperature, dwell time, jaw pressure) accessible via HMI; reduce operator error

– Adopt dual thermo-block design with quick-release handles for 60 % faster cleaning and jam recovery

– Integrate auto film break detection & auto-restart to minimize downtime

2. High Changeover Time Between SKUs

Problem

– Change from 100 mm to 250 mm product width requires manual jaw repositioning & die-change

– Multiple toolings stored on-site; misplacement leads to trial-and-error setups

– Sanitation pause for CIP (clean-in-place) between flavors or SKUs

Impact

– Average changeover: 45–60 min → 2–3 hrs downtime per shift

– Overtime labor costs rise 12 %

– Production planning relies on safety stock, increasing carrying costs

Solution

– Choose a modular flow wrapper with cam-less servo indexing and tool-less jaw positioning (PAC FW 400F)

– Implement a “shadow board” labeling system—each tooling RFID-tagged for instant location on shop floor

– Spec optional water-less, steam-free sanitation mode (≤10 min cool-down) to reduce sanitation delay

3. Limited Real-Time Visibility & Maintenance Downtime

Problem

– Operators run machines “blind” until downstream QA flags a defect

– Unplanned stops due to wear on timing belts and heating elements

– Spare parts scattered across facilities → 2-day lead times for critical components

Illustrative Image (Source: Google Search)

Impact

– Mean time to repair (MTTR): 4–6 hrs average

– Hidden capacity loss: 5–7 % overall equipment effectiveness (OEE)

– Warranty claims rise when minor issues escalate

Solution

– Deploy IIoT retrofit kit—adds predictive sensors (vibration, temperature, current draw) to existing machines

– Connect to cloud dashboard (e.g., PAC Insight) for real-time OEE and predictive maintenance alerts 48–72 hrs in advance

– Maintain digital spare-parts kit with bar-coded bins; auto-reorder when inventory dips below set threshold

Strategic Material Selection Guide for flow wrap machine

Strategic Material Selection Guide for Flow Wrap Machines

Purpose

Selecting the correct web material is the single most cost-critical decision when specifying a horizontal flow wrapper. The wrong choice triggers downtime, rejects, and higher total cost of ownership (TCO). This guide provides engineers and procurement teams with data-driven criteria for North American and European production environments.

1. Material Categories & Core Properties

| Category | Common Names | Typical Gauge (μm) | Key Properties | Best-Fit Applications |

|---|---|---|---|---|

| LDPE | Low-Density Polyethylene | 35–60 | Excellent seal strength, low cost, good clarity | Produce, bakery, bulk snacks |

| LLDPE | Linear Low-Density | 30–50 | Higher tear & puncture resistance, thinner gauge possible | Medical devices, fragile parts |

| HDPE | High-Density Polyethylene | 25–40 | Rigid, moisture barrier, printable | Industrial parts, heavy hardware |

| OPP | Oriented Polypropylene | 20–35 | High gloss, aroma barrier, heat sealable | Confectionery, dry foods |

| PET | Polyethylene Terephthalate | 12–25 | Superior strength & barrier, recyclable | Premium foods, electronics |

| Paper | Kraft or Clay-Coated | 40–80 g/m² | Sustainable, printable, high perceived value | Luxury foods, cosmetics |

| Mono-Material | PE, PP, or rPET | 30–45 | Easy recyclability, ESG compliance | Retail-ready, circular economy targets |

2. Decision Matrix

2.1 Speed & Film Feed

- Speed < 30 ppm: Any material up to 60 μm feeds reliably; consider cost rather than performance.

- Speed 30–60 ppm: Use LLDPE or 30–35 μm LDPE to balance tensile strength and film feed smoothness.

- Speed > 60 ppm: Require ≤ 30 μm mono-material or PET to avoid flutter and reduce cycle time.

2.2 Product Characteristics

| Product Type | Key Risks | Recommended Material | Notes |

|---|---|---|---|

| Greasy snacks | Oil migration, seal failure | LLDPE or PE/EVA blend | Add EVA layer for low-temp seal |

| Frozen foods | Cold-seal requirement | PE/EVA or PB-seal layer | Ensure seal integrity at –18 °C |

| Medical devices | Sterility, abrasion | Tyvek/PE laminates or PET/PE | Validate sterilization compatibility |

| Fragile parts | Puncture, cushioning | Foam-backed paper or PE | Add 20 g/m² soft-touch coating |

2.3 Regulatory & ESG Drivers

- EU: compliance with EU 10/2011 food-contact, recyclability per Packaging and Packaging Waste Regulation (PPWR).

- USA: FDA 21 CFR §177.xxxx, compatibility with FSMA traceability requirements.

- Sustainability: mono-material PE or PP simplifies recycling; rPET reduces virgin resin demand by 30–50 %.

3. Cost Modeling Snapshot (per 1,000 packages)

| Material | Material Cost (USD) | Waste % | Energy to Seal (kWh) | Recyclability Score* |

|---|---|---|---|---|

| LDPE 45 μm | $22 | 8 % | 0.18 | 3/5 |

| LLDPE 30 μm | $28 | 5 % | 0.15 | 3/5 |

| rPET 20 μm | $45 | 3 % | 0.12 | 5/5 |

| Paper kraft 60 g | $35 | 12 % | 0.22 | 5/5 |

*Score 1–5 based on EU recyclability study; 5 = widely recycled.

Illustrative Image (Source: Google Search)

4. Implementation Checklist

- Validate seal integrity at worst-case temperature and humidity.

- Run a film path stress test (500 cycles, max speed) before full production.

- Confirm recyclability with local MRF guidelines; provide end-user with material ID code.

- Negotiate spec-based pricing—order ≥ 5 t lots to lock in resin-index discounts.

- Track CO₂/kWh per 1,000 packs to feed sustainability dashboards.

Quick Comparison Table

| Criteria | LDPE | LLDPE | PET | Mono-PE | Paper |

|---|---|---|---|---|---|

| Max Speed | 60 ppm | 80 ppm | 120 ppm | 90 ppm | 40 ppm |

| Recyclability | Medium | Medium | High | High | High |

| Food Contact | Yes | Yes | Yes | Yes | Limited |

| Moisture Barrier | Good | Good | Excellent | Excellent | Poor |

| Grease Resistance | Low | Medium | Excellent | Medium | Medium |

| CO₂ Footprint | Medium | Medium | Low | Low | High |

Bottom Line

Choose PET or mono-material PE for high-speed, sustainability-driven lines; default to LLDPE for general produce and bakery; reserve paper for premium, non-food segments where branding overrides TCO.

In-depth Look: Manufacturing Processes and Quality Assurance for flow wrap machine

In-depth Look: Manufacturing Processes and Quality Assurance for Flow Wrap Machines

Overview

Flow wrap machines are precision-engineered systems that integrate forming, filling, and sealing into a single continuous operation. Understanding the manufacturing processes and quality assurance (QA) protocols is essential for procurement teams, plant engineers, and production managers who demand consistent uptime, regulatory compliance, and long-term ROI.

1. Manufacturing Processes

1.1 Prep – Design & Material Selection

| Step | Key Actions | Standards / Notes |

|---|---|---|

| CAD & FEA | 3-D parametric modeling in SolidWorks/Siemens NX; finite-element analysis for frame rigidity | ASME Y14.5 geometric dimensioning |

| Material Selection | Stainless steel 304/316L for contact parts; anodized aluminum for non-contact; IP69K washdown motors | NSF H1 food-grade lubricants optional |

| Component Sourcing | ISO 9001-certified suppliers; PPAP Level 3 for critical parts (servo drives, HMI panels) | RoHS/REACH compliance for electrical components |

1.2 Forming – Mechanical & Thermal Sub-Systems

| Sub-System | Process Flow | QA Gates |

|---|---|---|

| Film Station | Unwind stand with tension control (±2 %); auto-lateral registration sensor | Repeatability test: 3-run average deviation ≤ 0.5 mm |

| Form-Fill-Seal (FFS) Tube | Cold seal or thermal seal jaws; servo-driven chain drives 150–650 mm width | Jaw parallelism ≤ 0.1 mm; seal temperature PID loop validated to ±2 °C |

| Product Feed | Inline screw, belt, or volumetric cup; vision system for product verification | OEE target ≥ 85 %; reject rate ≤ 0.3 % |

1.3 Assembly – Sub-Assembly & Final Integration

| Phase | Key Activities | QA Tools |

|---|---|---|

| Mechanical Assembly | Torque-controlled bolting; laser-aligned drive shafts | CMM inspection on critical datum points |

| Electrical & Pneumatic Hookup | Color-coded wiring; pre-programmed PLC logic; pneumatic circuit pressure test 1.5× max working pressure | Continuity test; pressure decay test ≤ 0.5 bar/min |

| Software Configuration | HMI screen templates; recipe management; data logging to MES | FAT (Factory Acceptance Test) script executed; 100 % I/O simulation |

1.4 QC – Statistical Process Control & Validation

| Checkpoint | Method | Criteria |

|---|---|---|

| Functional Test | 4-hour burn-in at 90 % target speed | No unplanned stops; cycle time CV ≤ 2 % |

| Seal Integrity | Bubble test (30 kPa, 10 s); vision-based seal inspection | 100 % coverage; defect rate < 0.1 % |

| Compliance Verification | ISO 9001:2015 internal audit; CE conformity assessment (MD, LVD, EMC) | Technical file complete; Notified Body report on file |

2. Quality Assurance Framework

2.1 ISO 9001:2015 & ISO 13485 Alignment

| Clause | Application | Evidence |

|---|---|---|

| 7.1.3 Infrastructure | Cleanroom-compatible drive motors (IP65) | Certificate of analysis for lubricants |

| 8.1 Operational Planning | Risk management per ISO 14971 (medical devices) | FMEA updated at each product change |

| 9.1.1 Monitoring | Real-time OEE dashboard; automated SPC charts | Data exported to SQL Server via OPC-UA |

2.2 Continuous Improvement Loop

mermaid

graph TD

A[Customer Feedback] --> B[8D Corrective Action]

B --> C[Design Review Board]

C --> D[Design Change Notice]

D --> E[Pilot Run]

E --> F[Validation Report]

F --> G[ECN Release]

3. Summary Checklist for Procurement

- [ ] Verify supplier’s ISO 9001 certificate & last surveillance audit date

- [ ] Request FMEA and control plan for critical to-quality (CTQ) parameters

- [ ] Confirm CE/UL markings and RA-exempt documentation

- [ ] Schedule FAT at supplier facility; require live video link

- [ ] Negotiate spare-parts kit and 24-month MTBF target

By enforcing these disciplined manufacturing and QA practices, flow wrap machine builders deliver equipment that meets the rigorous demands of food, pharmaceutical, and industrial packaging operations in the USA and Europe.

Illustrative Image (Source: Google Search)

Practical Sourcing Guide: A Step-by-Step Checklist for ‘flow wrap machine’

Practical Sourcing Guide: A Step-by-Step Checklist for Flow Wrap Machines

1. Define Your Packaging Requirements

- Product Specifications

- Dimensions (L × W × H)

- Weight range

-

Product characteristics (solid, liquid, fragile, sticky)

-

Package Requirements

- Film type (PE, PP, laminates)

- Final pack size (single or multi-pack)

- Desired output speed (ppm or units/hour)

2. Establish Budget Parameters

| Cost Category | Typical Range (USD) | Notes |

|---|---|---|

| Machine Price | $8,000 – $150,000+ | Varies by speed and features |

| Installation | $1,000 – $10,000 | Includes electrical, mechanical setup |

| Training & Support | $500 – $5,000 | On-site or remote |

| First Year Maintenance | $2,000 – $15,000 | Spare parts, labor, PM kits |

3. Select the Right Model

Speed Tiers (indicative)

| Model | Max Speed | Max Film Width | Best For |

|——-|———–|—————-|———-|

| PAC FW 350T | ≤ 60 ppm | 350 mm | Small/medium, flexible products |

| PAC FW 400F | ≤ 120 ppm | 400 mm | Medium output, ease of changeover |

| PAC FW 450S | ≤ 180 ppm | 450 mm | High-speed, servo-driven |

| PAC FW 650SI | ≤ 120 ppm | 650 mm | Delicate/soft products, inverted design |

Tip: Confirm your target ppm with PAC Machinery or an authorized distributor before finalizing.

Illustrative Image (Source: Google Search)

4. Evaluate Key Technical Features

- Drive System

- Servo vs. pneumatic

-

Energy efficiency (kWh/hour)

-

Film Handling

- Single or duel reel capability

-

Pre-stretch availability

-

Controls

- HMI language options

- Recipe storage

-

Integration readiness (Ethernet/IP, OPC-UA)

-

Safety & Compliance

- CE marking

- Guarding standards

- Emergency stop redundancy

5. Assess Service & Support

- Local Support Network

- Authorized service centers in your region

-

Average response time (24–72 h)

-

Spare Parts Availability

- Stock levels for critical components

-

Global logistics capability

-

Preventive Maintenance Contracts

- Tiered SLA options

- Remote diagnostics inclusion

6. Secure Regulatory & Import Compliance

- CE Certification (EU markets)

- UL/CSA (North America)

- Import Duties & Taxes

- HS code lookup: 8422.30.00

- VAT/VAT ID requirements

7. Request & Compare Quotes

| Supplier | Model | Base Price | FOB Port | Lead Time | Warranty | Support Included |

|---|---|---|---|---|---|---|

| PAC Machinery | FW 450S | $42,500 | Norfolk, VA | 8 weeks | 12 mo | 24/7 hotline |

| European Distributor A | FW 400F | €48,000 | Antwerp | 6 weeks | 24 mo | PM contract |

| Asian OEM B | FW 350T | ¥6,200,000 | Yokohama | 12 weeks | 6 mo | Remote only |

Negotiation Points

– Volume discounts on multi-year service agreements

– Free changeover tooling or film sensors

– Extended warranty tied to training completion

8. Execute Final Decision & Contract

- Purchase Order Details

- Exact model and serial number

- Incoterms (FOB, CIF, DDP)

-

Acceptance testing criteria (ASTM F88, ISO 1860)

-

Installation & Startup

- Site survey checklist

- Utility requirements (3-phase, compressed air, ambient temp)

- Operator training schedule (1–3 days recommended)

9. Post-Purchase Optimization

- Performance Tracking

- Real-time OEE dashboard

-

Weekly downtime log

-

Continuous Improvement

- Annual ROI review

- Film scrap reduction initiatives

- Technology upgrade path (e.g., vision inspection)

Quick Reference: Contact Leads

-

PAC Machinery USA

[email protected] | 1-800-236-向PAC (US) -

PAC Machinery Europe

[email protected] | +49 89 636 465 0 (DE) -

Authorized EU Distributor

[email protected] | +32 3 123 4567 (BE)

Use this checklist to streamline vendor selection, control capital expenditure, and ensure long-term operational efficiency for your flow wrap line.

Comprehensive Cost and Pricing Analysis for flow wrap machine Sourcing

Comprehensive Cost and Pricing Analysis for Flow Wrap Machine Sourcing

This section delivers a transparent, line-item view of the total cost of ownership (TCO) for horizontal flow wrap machines in the U.S. and EU markets. Use it to benchmark suppliers, negotiate contracts, and forecast ROI.

Illustrative Image (Source: Google Search)

1. Cost Breakdown by Category

1.1 Capital Expenditure (CAPEX)

| Component | Typical Range (USD) | Notes |

|---|---|---|

| Base Machine (standard model) | $18,000 – $55,000 | PAC FW 400F / FW 450S tiers. |

| Servo upgrade (high-speed or complex motion) | +$4,000 – $12,000 | Required for >120 ppm or multi-packs. |

| Inverted or specialty configuration | $30,000 – $70,000 | For soft product handling (e.g., PAC FW 650SI). |

| Tooling & change-parts set | $2,500 – $6,000 | Includes forming tube, seals, grippers. |

| Safety & guarding package (EU compliance) | $1,500 – $4,000 | CE-marked guards, light curtains. |

| Factory acceptance testing (FAT) | $1,000 – $3,000 | Mandatory for capital projects >$100k. |

1.2 Operating Expenditure (OPEX) – Annual

| Cost Driver | U.S. Avg. | EU Avg. | Calculation Basis |

|---|---|---|---|

| Energy (kWh/year) | $1,800 – $3,200 | €2,100 – €3,800 | 8 h/day, $0.10 / kWh; €0.12 / kWh |

| Consumables (film, seals, lubricants) | $6,000 – $12,000 | €7,000 – €14,000 | 30 % film waste, $1.20 / kg film |

| Scheduled PM labor | $3,500 – $5,500 | €4,000 – €6,000 | 1 tech × 2 h/week |

| Unplanned downtime (spar parts buffer) | $2,000 – $4,000 | €2,500 – €5,000 | 2 % annual uptime loss |

| Software & HMI licenses (annual) | $600 – $1,200 | €700 – €1,400 | Cloud updates, recipe storage |

Total OPEX (mid-range)

– U.S.: $13,900 – $26,900 / year

– EU: €16,400 – €31,600 / year

2. Supplier Pricing Levers

| Lever | Tactic | Typical Savings |

|---|---|---|

| Volume discount | Bundle spare parts with machine (12-month guarantee) | 3 % – 7 % |

| Regional duty optimization | Import through Mexico or Eastern Europe to avoid EU/US duties | 2 % – 5 % |

| Energy rebate | Leverage local utility incentives for servo-driven models | $500 – $2,000 |

| Trade-in credit | Exchange older wrapper or cartoner for new unit | Up to 15 % |

| Payment terms | 0 % financing for 24 months vs. 3 % discount for 2/10 Net 30 | NPV savings 1 % – 2 % |

3. Logistics & Import Cost Snapshot

| Route | Transit Time | Freight (USD) | EU Duty (%) | Brokerage Fee |

|---|---|---|---|---|

| East Coast (NYC) → Central EU | 7 days | $1,800 – $2,400 | 4 % CIF | $350 |

| West Coast (LA) → Rotterdam | 12 days | $2,600 – $3,200 | 4 % CIF | $400 |

| Landed Cost Example (FW 450S) | – | +$2,900 | +$1,160 duty | +$350 |

4. Cost-Saving Checklist

- Pre-approve tooling designs with downstream packers to avoid change-order fees.

- Negotiate a three-year TPM contract up-front; suppliers discount 10 % when locked in.

- Install variable-frequency drives (VFDs) on film unwind to cut film scrap 5 % – 8 %.

- Use cloud-based MES to share real-time OEE data with both OEM and in-house engineers, reducing mean-time-to-repair (MTTR) by 15 %.

- Schedule FAT & SAT remotely via video link to cut travel costs 30 %.

5. ROI Quick-Check Template

“`

Annual Savings from New Machine

– Labor reduction (0.3 FTE) $45,000

– Film waste reduction (5 %) $8,000

– Downtime reduction (24 h) $12,000

Total Annual Benefit $65,000

Initial Investment

– Machine + tooling + freight $52,000

Payback Period = 52,000 / 65,000 = 0.8 years

“`

Bottom Line

For U.S. and EU buyers, the all-in cost for a mid-range horizontal flow wrap machine lands between $52,000 and $65,000 all-inclusive. Smart sourcing—early tooling approval, volume spares contracts, and duty-optimized logistics—can shave 8 % – 12 % off that baseline.

Alternatives Analysis: Comparing flow wrap machine With Other Solutions

Alternatives Analysis: Comparing Flow Wrap Machine With Other Solutions

| Feature | Flow Wrap Machine | Thermoform Packaging | Vertical Form-Fill-Seal (VFFS) |

|---|---|---|---|

| Typical Speed Range | 20 – 200 p/min (servo-driven models up to 300 p/min) | 10 – 60 p/min | 20 – 200 p/min |

| Best Package Style | Individual or grouped items, 3-side seal, gusseted, or quad-seal bags | Rigid tray or cup with lid film | Pillow, gusseted, or quad-seal bags |

| Film Types Supported | Polyethylene, polypropylene, laminates, recyclable papers | PET, PP, PS, APET, PVC, barrier films | PE, PP, laminates |

| Product Fit Range | Length 20 – 450 mm, width 20 – 300 mm | Length 30 – 250 mm, width 30 – 200 mm | Length 30 – 350 mm, width 30 – 250 mm |

| Changeover Time | 5 – 15 min (quick-release grips &ervo tools) | 30 – 60 min (tooling & mold change) | 5 – 20 min (bag former swap) |

| Labor Intensity | 1 operator per shift | 2 – 3 operators per shift | 1 – 2 operators per shift |

| Capital Cost (USD) | $35 k – $180 k | $150 k – $400 k | $25 k – $120 k |

| Floor Space (mm) | 1 200 L × 900 W × 1 600 H | 2 500 L × 1 200 W × 1 800 H | 1 100 L × 800 W × 1 800 H |

| Typical Industries | Converting, food service, medical devices, industrial parts | Ready-meals, fresh produce, cosmetics | Snacks, coffee, hardware, pet food |

| Sustainability Edge | Lower film gauge, recyclable substrates, reduced over-pack | High material usage, rigid trays add weight | Good film efficiency, but bottom gusset waste |

Key Takeaways

- Speed & throughput: Flow wrap machines sit in the middle—faster than thermoform and more flexible than VFFS.

- Product versatility: Horizontal flow wrappers accommodate longer, narrower items that VFFS or thermoform cannot handle.

- Cost of ownership: Lower capex and faster changeovers make flow wrap the most economical for mixed SKU runs common in North American and European contract packaging.

- Sustainability trend: New PAC FW models offer up to 30 % film reduction and compatibility with recyclable paper laminates—aligning with EU packaging mandates and US consumer demand.

Essential Technical Properties and Trade Terminology for flow wrap machine

Essential Technical Properties and Trade Terminology for Flow Wrap Machines

Core Operating Parameters

| Parameter | Typical Range | Impact |

|---|---|---|

| Film Width | 180 mm – 800 mm | Determines maximum product size |

| Speed | 15 – 250 p/min | Directly affects throughput and ROI |

| Film Gauge | 15 µm – 120 µm | Influences cost, barrier and seal integrity |

| Seal Temperature | 0 °C – 300 °C | Varies by film type;PID control ensures consistency |

Machine Configurations

- Twin-Jaw – Two sealing jaws open/close in synchrony; suited for high speeds (up to 180 p/min).

- Single-Jaw – One continuous sealing bar; ideal for delicate or tall products.

- Servo-Driven – PLC-based motion control; faster changeovers, lower maintenance.

- Inverted Flow – Reel placement below the seal head; better for soft or tubular items.

Key Trade Terms

| Term | Definition |

|---|---|

| MOQ | Minimum Order Quantity – typically 1 unit for standard models; tooling and custom parts may apply. |

| OEM | Original Equipment Manufacturer – supplier builds machines to your branding and interface specifications. |

| ODM | Original Design Manufacturer – supplier designs and manufactures under your specification. |

| Lead Time | Average 8 – 16 weeks ex-works; expedited 6-week slots available at surcharge. |

| IQ/OQ/PQ | Installation Qualification / Operational Qualification / Performance Qualification – factory or on-site validation protocols. |

| CE Marking | Conformity with EU safety, health, and environmental protection requirements. |

| UL Certification | Compliance with U.S. and Canadian safety standards. |

| GMP Ready | Machine frame, surface finish, and clean-out provisions meet Good Manufacturing Practice standards. |

Film and Consumables

- Lidding Film – Heat-sealable rollstock (PE, PET/PE, Aluminium-PE, EVOH laminates).

- Base Web – Bottom layer; must match product weight and seal requirements.

- Soft-Gauge Option – 15–30 µm films for premium appearance and reduced material cost.

- Eco-Friendly Films – rPET, PLA, and HDPE post-consumer recyclate grades; meet EU and US compostability directives.

Integration & Ancillary Equipment

| Equipment | Function |

|---|---|

| Tray Loader | In-feeds pre-formed trays for fill-and-flow processes. |

| Check Weigher | Rejects under/over-weight packages downstream. |

| Metal Detector | Detects ferrous, non-ferrous, and stainless-steel contamination. |

| Auto Cartoner | Converts flow-wrapped units into folded cartons for retail display. |

Service & Support

- ** preventive-maintenance contracts** – Quarterly or annual; reduces unplanned downtime by ≥ 30 %.

- spare-part kits – Toolboxes and wear parts shipped within 48 h of order.

- remote diagnostics – Ethernet-connected PLC allows PAC engineers to troubleshoot via VPN within 2 h of alert.

Use the above properties and terminology to specify, source, and service flow wrap machines with precision and confidence.

Navigating Market Dynamics and Sourcing Trends in the flow wrap machine Sector

“`markdown

Navigating Market Dynamics and Sourcing Trends in the Flow Wrap Machine Sector

1. Market Dynamics

1.1 North American Landscape

- Capacity Push: U.S. processors are upgrading to 350–650 packages/min to offset 25–30 % labor cost inflation since 2021.

- Format Flexibility: Diverse SKUs (snacks, fresh produce, medical devices) drive demand for machines with 50–400 mm width, 150–500 mm length ranges.

- Trade Policy Impact: Section 232 tariffs on steel and aluminum have increased machine build cost by 8–12 %, leading buyers to negotiate longer-term service contracts to offset CAPEX.

1.2 European Landscape

- Green Deal Alignment: EU ETS carbon pricing is accelerating adoption of servo-driven, low-energy (≤ 6 kW) flow wrappers.

- Packaging Waste Regulation: France’s anti-waste law and the upcoming EU PPWR require 30 % recycled content in flexible packaging by 2030—suppliers are sourcing bio-based LLDPE and mono-material PE films.

- Speed vs. Sustainability Trade-off: German and Dutch OEMs report 15 % slower throughput when using recyclable films; ROI models now include carbon credit valuation.

2. Sourcing Trends

2.1 Film Supply Chain

| Region | Preferred Materials | Key Suppliers | Lead Time Impact |

|---|---|---|---|

| USA | LLDPE, EVOH-laminated PE | Dow, WestRock | +3–5 weeks vs. 2022 |

| EU | rPE, PLA, PHA | Borealis, Novoloop | +6–8 weeks due to EU Carbon Border Adjustment Mechanism (CBAM) |

2.2 Component Sourcing

- Servo Drives & HMI: 70 % of new machines specify Beckhoff or Siemens due to EU CE-marking requirements; 12-week lead times in Q2-Q3 2024.

- Thermal Transfer Ribbons: Shift to low-migration, food-grade black resin to meet FDA 21 CFR and EFSA guidelines—pricing up 18 % YoY.

2.3 Service & Spare Parts

- Just-in-Time Kits: North American OEMs (PAC, Roberts) offer 24-hour kits for critical wear parts; uptake up 40 % since 2023.

- Eurozone Reliability Mandate: CE-marked machines must include EU-certified spare parts within 48 hrs for safety-critical components—drives up inventory holding costs 10–15 %.

3. Strategic Recommendations

- Dual-Source Critical Components: Mitigate tariff and geopolitical risk by qualifying suppliers in Mexico and Eastern Europe.

- Film Procurement Levers: Lock in 12-month volume contracts with rPE suppliers during Q3 2024 lows; hedge against EU CBAM price spikes.

- Sustainability Scorecard: Require OEMs to provide cradle-to-grave LCA data; prioritize machines with ≥ 90 % material recyclability and ≤ 0.75 kWh/pkg energy consumption.

4. Key Contacts & Resources

- PAC FW 450S (U.S.): 1-800-872-1900 | pacmachinery.com

- Borealis rPE Films (EU): borealis.com | Sustainability Solutions team

- EU CE-Mark Guidance: ec.europa.eu/growth/tools-databases/ce-marking/

“`

Frequently Asked Questions (FAQs) for B2B Buyers of flow wrap machine

Frequently Asked Questions (FAQs) for B2B Buyers of Flow Wrap Machines

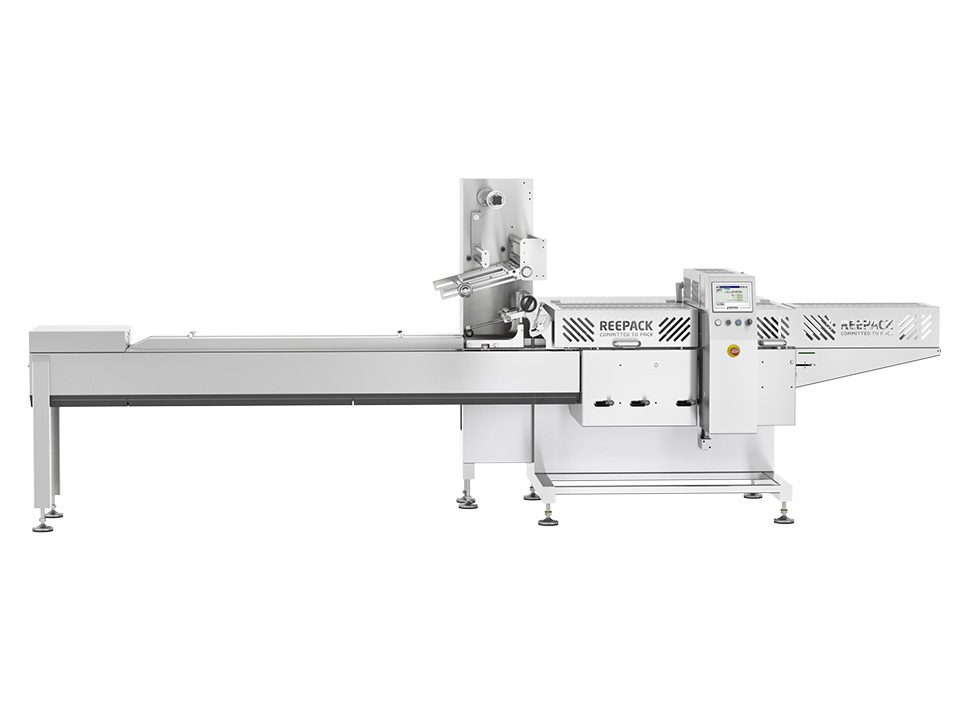

1. What is a flow wrap machine and how does it work?

A flow wrap machine forms a continuous packaging film into a tube, fills it with product, and seals both ends in one integrated motion. The process is fully automated and suitable for high-speed production lines. PAC Machinery’s horizontal flow wrappers (e.g., FW 350T, FW 400F, FW 450S) handle speeds from 25 to 180 packages per minute, making them ideal for food, medical, and industrial items.

Illustrative Image (Source: Google Search)

2. Which industries commonly use flow wrap machines?

Typical sectors include:

– Food & beverage (snacks, confectionery, bakery)

– Pharmaceutical & medical devices

– Industrial parts & hardware

– Cosmetics & personal care

– Pet treats & veterinary supplies

PAC machines accommodate product sizes from 8 mm to 300 mm and can package fragile or sticky items using optional anti-static or low-temperature sealing systems.

3. What packaging materials are compatible?

Standard materials: 60–120 µm polyethylene, polypropylene, laminates, and barrier films.

Optional: compostable, recyclable, or printed reel stock up to 400 mm width.

PAC’s inverted flow wrapper (FW 650SI) supports soft, delicate products with lower reel placement for better film control.

4. How do I choose the right model for my speed and product requirements?

Use the table below as a quick reference:

| Model | Speed Range | Max Product Size (L×W×H) | Key Applications |

|---|---|---|---|

| FW 350T | Up to 60 ppm | 120×80×40 mm | Single bars, medical devices |

| FW 400F | Up to 120 ppm | 180×120×60 mm | Bakery, ice cream, parts |

| FW 450S | Up to 150 ppm | 200×150×80 mm | Confectionery, pharmaceuticals |

| FW 450FH | Up to 150 ppm | 250×180×60 mm | Soft produce, multi-packs |

| FW 650SI | Up to 120 ppm | 300×250×100 mm | Delicate produce, trays |

5. What are the key integration and changeover considerations?

- PLC/HMI: PAC’s FW 450S features a 10-inch touch screen for recipe recall and diagnostics.

- Changeover time: Quick-release film clamps and adjustable forming shoulder reduce setup to <10 min.

- Connectivity: OPC-UA, Ethernet/IP, and Profibus options available for MES integration.

6. What level of automation and safety is included?

- Infeed conveyors, reject systems, and vision inspection ports can be retrofitted.

- CE-compliant guards, light curtains, and emergency-stop interlocks are standard.

- PAC offers a wash-down version (IP69K) for food-grade environments.

7. What after-sales support and warranties are provided?

- Standard warranty: 12 months parts & labor on all PAC machines.

- 24/7 technical support: Phone, email, and remote diagnostics.

- Field service: Trained engineers in the USA and Europe; average response <48 h.

8. What is the typical ROI timeline and total cost of ownership?

- Labour savings: 1 machine replaces 3–6 operators depending on line speed.

- Material optimisation: Pre-stretch film and servo-driven sealing reduce film waste by up to 15 %.

- Case study: A mid-size bakery in Germany cut packaging costs by 28 % and achieved payback in 14 months with a PAC FW 400F.

Strategic Sourcing Conclusion and Outlook for flow wrap machine

Strategic Sourcing Conclusion & Outlook – Flow Wrap Machine

Value Recap

- Speed: 120–180 packages/min (FW 400F/FW 450S) cuts labor cost per unit.

- Versatility: Handles candy, medical devices, industrial parts with tool-less changeovers.

- Sustainability: New PAC FW line integrates recyclable films, lowering Scope 3 emissions.

Outlook

| Driver | Impact on Sourcing |

|---|---|

| ESG mandates | Shift to mono-material, recyclable films; supplier audits mandatory. |

| Skew rationalization | Multi-lane wrappers (FW 650SI) reduce changeover downtime, enabling longer runs. |

| Near-shoring | PAC Machinery (US/Canada) shortens lead times; dual-sourcing still advised. |

Action Checklist

- Map current SKUs to PAC wrapper models to size throughput vs. budget.

- Negotiate volume-based film supply contracts aligned to PAC’s recyclable options.

- Pilot servo-driven units (FW 450S/650SI) in Q3 to validate ROI; scale in H2.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided is for informational purposes only. B2B buyers must conduct their own due diligence.