The global expansion joint systems market is experiencing steady growth, driven by increasing construction activities, stringent building codes, and the need for structural safety in both commercial and infrastructure projects. According to Grand View Research, the global expansion joint market was valued at USD 1.78 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This growth is fueled by rising urbanization, the expansion of smart cities, and growing investments in transportation infrastructure—particularly in Asia-Pacific and North America. Floor expansion joint covers, a critical component in maintaining architectural integrity while ensuring occupant safety and aesthetic continuity, have become increasingly sophisticated, integrating noise reduction, fire resistance, and design flexibility. With demand on the rise, several manufacturers have emerged as leaders in innovation, quality, and global reach. Below, we spotlight the top 9 floor expansion joint covers manufacturers shaping the industry through advanced engineering and data-backed market presence.

Top 9 Floor Expansion Joint Covers Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Expansion joint covers

Domain Est. 2012

Website: groupesanik.com

Key Highlights: Floor joint covers are designed to integrate seamlessly in areas where minimal visual impact is required. They are compatible with most types of flooring….

#2 Expansion Joints Systems

Domain Est. 1995

Website: nystrom.com

Key Highlights: Nystrom has a full line of expansion joint systems backed by 75+ years of Hassle-Free service that includes our team of customer-focused pros….

#3 Floor Expansion Joint Covers – Thermal & Seismic Joints

Domain Est. 1996

Website: inprocorp.com

Key Highlights: Inpro offers a varity of Floor Systems for both thermal and seismic applications. Search all Floor Expansion Joint Covers using the filters on the left….

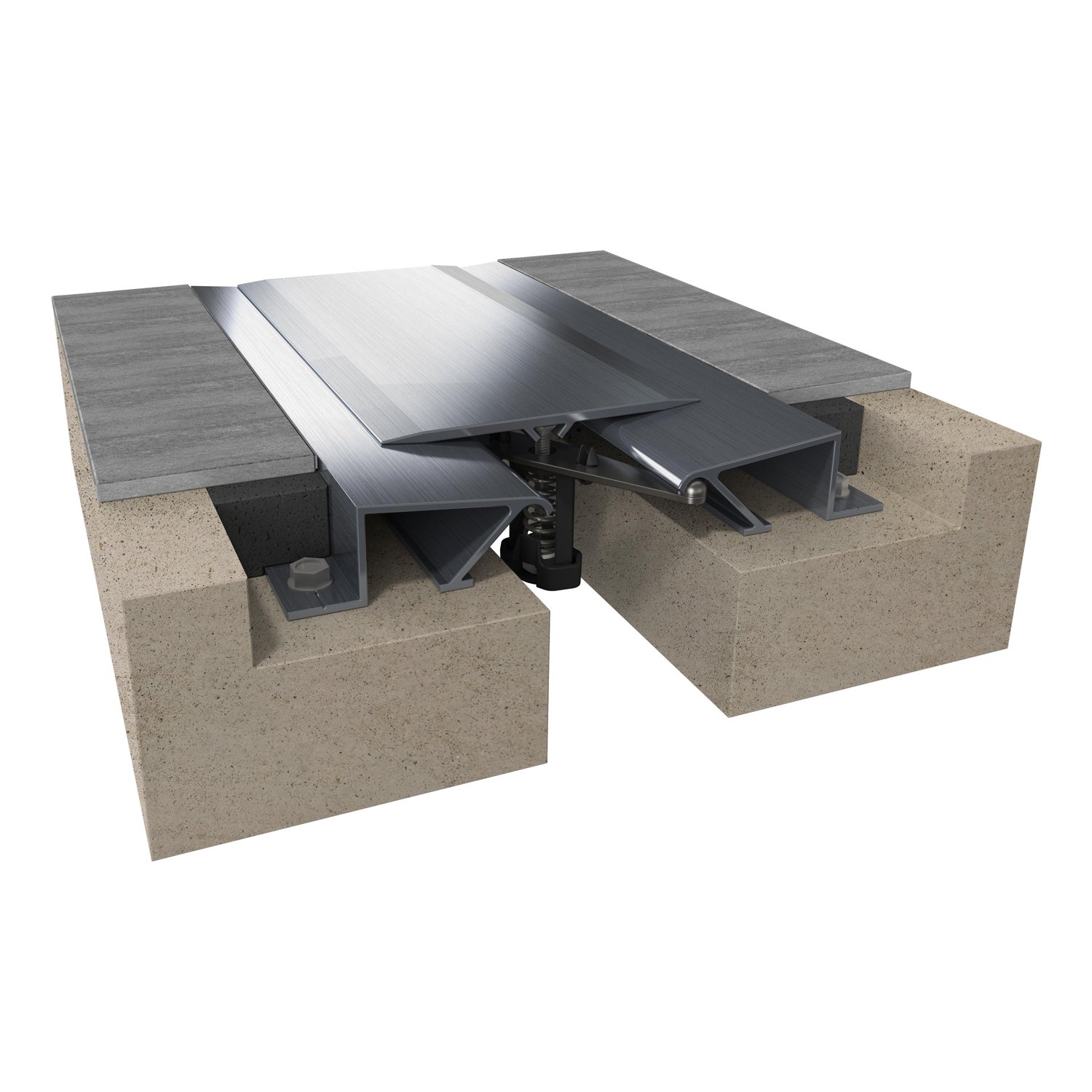

#4 MM Systems

Domain Est. 1996

#5 Expansion Joint Systems

Domain Est. 1997

Website: balcousa.com

Key Highlights: Balco Expansion Joint Systems and Seismic Joint Covers are the vanguards of architecturally specified products. We constantly innovate and incorporate the ……

#6 Floor Expansion Joint Covers

Domain Est. 1999

Website: kofflersales.com

Key Highlights: 30-day returnsDurable and effective surface-mounted metal covers anchored to one concrete slab either floor or wall that allows lateral movement….

#7 the company – official supplier of building joints

Domain Est. 2001

Website: vedafrance.com

Key Highlights: We design, develop, manufacture and market a complete range of standard and seismic joints for the building industry: floor joints, special heavy duty joints, ……

#8 Expansion Joints & Stair Nosing

Domain Est. 2008

Website: x-calibur.us

Key Highlights: Expansion joints are an essential component in the construction of buildings. They help accommodate the thermal expansion and contraction of building materials….

#9 Floor Expansion Joint Covers

Domain Est. 2010

Website: c-sgroup.dk

Key Highlights: A range of metal floor joint covers requiring very little maintenance, whilst offering up to ±100mm of movement, and often being able to close up to 100%….

Expert Sourcing Insights for Floor Expansion Joint Covers

H2: 2026 Market Trends for Floor Expansion Joint Covers

The global market for floor expansion joint covers is poised for steady growth leading up to 2026, driven by evolving construction practices, rising urbanization, and increasing focus on building safety and aesthetics. As infrastructure development accelerates worldwide—particularly in emerging economies—demand for high-performance architectural components like expansion joint covers is expected to rise significantly. Key trends shaping the 2026 market landscape include:

-

Increased Construction of High-Rise and Seismic-Resilient Buildings

Urban densification and the growing need for earthquake-resistant infrastructure are pushing architects and engineers to integrate advanced expansion joint systems. Floor expansion joint covers that offer flexibility, durability, and fire resistance are becoming essential in high-rise residential, commercial, and public buildings. Regions prone to seismic activity, such as the Pacific Rim and parts of the Middle East, are expected to see heightened demand. -

Shift Toward Sustainable and Eco-Friendly Materials

With green building certifications like LEED and BREEAM gaining prominence, manufacturers are developing expansion joint covers using recycled metals, low-VOC finishes, and recyclable composites. This trend reflects broader sustainability goals in construction and is expected to influence product innovation and procurement decisions by 2026. -

Aesthetic Integration and Architectural Design Emphasis

Modern architectural designs prioritize seamless interior finishes. As a result, floor expansion joint covers are being engineered to blend invisibly with flooring materials such as hardwood, terrazzo, and polished concrete. Customizable profiles, color-matching capabilities, and minimalist designs are increasingly in demand, especially in high-end commercial and retail spaces. -

Technological Advancements in Material Science

Innovations in materials—such as thermoplastic elastomers, aluminum alloys with enhanced corrosion resistance, and noise-dampening composites—are improving the performance of joint covers. These materials offer better movement accommodation, longer service life, and reduced maintenance, making them attractive for large-scale infrastructure projects. -

Growth in Infrastructure and Public Projects

Government investments in transportation hubs (airports, train stations), healthcare facilities, and educational institutions are major growth drivers. These projects require robust expansion joint systems to handle heavy foot traffic and structural movement, further boosting the market for durable floor joint covers. -

Regional Market Expansion

Asia-Pacific is expected to dominate market growth due to rapid urbanization in countries like India, China, and Vietnam. North America and Europe will maintain steady demand, supported by building code updates and retrofitting of aging infrastructure. The Middle East, fueled by mega-projects linked to tourism and smart city initiatives, will also contribute significantly. -

Consolidation and Innovation Among Manufacturers

Leading players are expanding product portfolios and investing in R&D to meet evolving performance standards. Strategic partnerships with architectural firms and contractors are enabling faster adoption of integrated joint solutions. By 2026, companies offering smart joint systems with monitoring capabilities (e.g., movement sensors) may begin to emerge.

In conclusion, the 2026 market for floor expansion joint covers will be defined by innovation, sustainability, and integration with modern architectural requirements. As buildings become more complex and safety standards more stringent, the role of expansion joint covers will expand beyond functionality to include design harmony and long-term resilience.

Common Pitfalls Sourcing Floor Expansion Joint Covers (Quality, IP)

Sourcing floor expansion joint covers involves more than just selecting an attractive design—overlooking critical quality and intellectual property (IP) considerations can lead to costly failures, safety hazards, and legal risks. Below are key pitfalls to avoid:

Inadequate Material Quality and Durability

Many suppliers offer joint covers made from substandard materials that degrade quickly under foot traffic, rolling loads, or environmental exposure. Low-grade aluminum, brittle plastics, or thin stainless steel can crack, warp, or corrode, compromising both function and safety. Always verify material specifications and request third-party test reports for load-bearing capacity, fire resistance, and weather durability—especially for high-traffic or exterior applications.

Poor Sealing and Insufficient IP (Ingress Protection) Ratings

A common oversight is selecting joint covers without verifying their Ingress Protection (IP) rating. If the cover does not meet required IP standards—such as IP54 for dust and splash resistance or IP66 for high-pressure water resistance—debris, liquids, or contaminants can penetrate the joint, damaging building infrastructure or triggering mold growth. Ensure the IP rating aligns with the installation environment (e.g., washdown areas, parking garages, hospitals).

Lack of Compliance with Building and Safety Codes

Some imported or low-cost joint covers fail to meet local building regulations, fire safety codes (e.g., ASTM E84, EN 13501), or accessibility standards (e.g., ADA compliance for flush finishes). Using non-compliant products can result in failed inspections, liability issues, or costly retrofits. Always confirm that products have necessary certifications and are tested to relevant regional standards.

Intellectual Property (IP) Infringement Risks

Purchasing from unauthorized suppliers or counterfeit manufacturers can expose your project or business to intellectual property violations. Many reputable joint cover designs are patented or trademarked. Sourcing knock-offs—even unknowingly—may lead to legal disputes, supply chain disruptions, or reputational damage. Work only with authorized distributors and request documentation proving IP legitimacy.

Inconsistent Manufacturing Tolerances

Low-cost suppliers may have inconsistent production processes, leading to dimensional inaccuracies. Covers that don’t align precisely with the joint width or floor level create tripping hazards, poor aesthetics, and compromised movement accommodation. Request sample pieces and inspect for precision in fit, finish, and ease of installation.

Insufficient Movement Accommodation

Some joint covers are rated for minimal expansion/contraction, but real-world structural movement may exceed these limits. Using underspecified products can result in buckling, disengagement, or damage to adjacent flooring. Always match the cover’s movement capacity (e.g., ±25mm, ±50mm) to the building’s expected thermal and seismic movement.

Hidden Costs from Poor Long-Term Performance

Choosing the cheapest option often leads to higher lifecycle costs due to premature replacement, maintenance, or damage to surrounding materials. Invest in high-quality, IP-rated, and code-compliant covers from reputable manufacturers to ensure longevity, safety, and reduced total cost of ownership.

Logistics & Compliance Guide for Floor Expansion Joint Covers

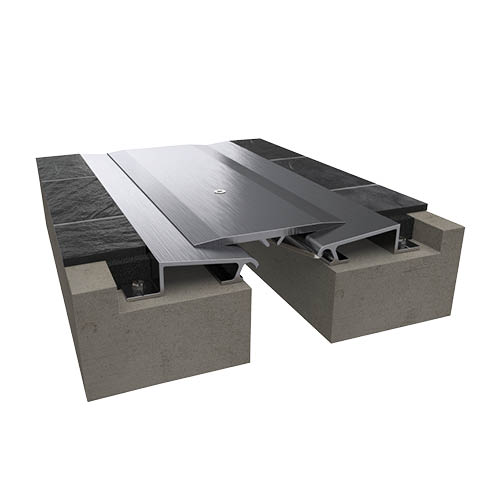

Product Overview and Classification

Floor expansion joint covers are specialized architectural components designed to bridge movement joints in flooring systems, accommodating structural shifts due to temperature, seismic activity, or building settling. These covers are typically fabricated from materials such as aluminum, stainless steel, PVC, or rubber composites. Proper classification under international trade systems (e.g., HS Code: 7308.90 for metal structural components or 3918.90 for plastic floor coverings) is essential for import/export compliance and duty assessment.

Packaging and Handling Requirements

To prevent damage during transit, floor expansion joint covers must be packaged securely based on material and length. Metal profiles should be bundled with protective end caps and separated by cardboard or foam spacers, then wrapped in moisture-resistant wrapping. Plastic or rubber-based covers require shrink-wrapping and palletization with edge protectors. All packages must be labeled with handling instructions (e.g., “Fragile,” “This Side Up”) and product details including SKU, length, finish, and installation orientation.

Transportation and Shipping Considerations

Due to their length and susceptibility to bending, long expansion joint profiles require flatbed or enclosed freight transport with adequate support to prevent sagging. International shipments must comply with carrier-specific dimensional and weight restrictions. Use of wooden pallets must meet ISPM-15 standards for international phytosanitary compliance. Temperature-controlled transport is recommended for polymer-based covers in extreme climates to avoid warping or embrittlement.

Import/Export Documentation

Accurate documentation is critical for global shipments. Required documents typically include commercial invoice, packing list, bill of lading or air waybill, and certificate of origin. Depending on the destination, additional certifications such as a Certificate of Conformity (CoC) or test reports for fire resistance (e.g., ASTM E84) may be required. For EU-bound products, a Declaration of Performance (DoP) under the Construction Products Regulation (CPR) Regulation (EU) No 305/2011 is mandatory.

Regulatory and Safety Compliance

Floor expansion joint covers used in commercial or public buildings must comply with local building codes and fire safety standards. In the United States, products may need to meet ASTM E119 (fire resistance) and ADA requirements for trip hazards and accessibility. In the European Union, CE marking is required, demonstrating compliance with essential health and safety requirements under CPR. VOC emissions may also be regulated for indoor installations under schemes such as LEED or BREEAM.

Customs Clearance and Duties

Ensure Harmonized System (HS) codes are correctly applied to avoid delays or incorrect tariff assessments. Be aware of anti-dumping duties that may apply to metal components from certain countries. Engage licensed customs brokers in destination countries to manage duties, taxes (e.g., VAT), and conformity assessments. Maintain records of compliance documentation for a minimum of five years for audit purposes.

Installation and Site Logistics

Coordinate delivery schedules with construction timelines to avoid on-site storage. Deliver materials to a dry, level staging area protected from weather and construction traffic. Provide installers with technical data sheets, installation manuals, and safety data sheets (SDS) for adhesives or sealants used in conjunction with the covers. Ensure compliance with site-specific safety regulations, including PPE requirements and worksite access protocols.

Sustainability and Disposal Compliance

Select materials and packaging with environmental impact in mind. Recyclable aluminum and PVC components should be marked accordingly. Comply with local waste disposal regulations for packaging materials and offcuts. For projects pursuing green building certification (e.g., LEED, WELL), provide Environmental Product Declarations (EPDs) and documentation on recycled content upon request.

Supplier and Quality Assurance

Source floor expansion joint covers from suppliers with certified quality management systems (e.g., ISO 9001). Verify that products meet specified tolerances, finish standards, and performance criteria through batch testing and inspection reports. Maintain a traceability system for materials and manufacturing batches to support warranty claims and compliance audits.

In conclusion, sourcing floor expansion joint covers requires a thorough evaluation of material quality, design compatibility, durability, and compliance with building codes and safety standards. It is essential to select products that not only accommodate structural movement effectively but also enhance the aesthetic appeal of the space. Working with reputable suppliers, considering long-term performance, and factoring in installation requirements will ensure a cost-effective and reliable solution. Properly sourced expansion joint covers contribute significantly to the longevity and safety of flooring systems in both commercial and residential applications.