The global demand for horizontal and directional drilling, driven by the rising need for efficient hydrocarbon extraction and infrastructure development, has propelled the growth of flexible drilling solutions. According to Grand View Research, the global drilling services market was valued at USD 36.8 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 6.4% from 2024 to 2030. This growth is underpinned by increasing shale gas exploration, offshore drilling activities, and advancements in drilling technologies that enhance operational efficiency and reduce environmental impact. As energy companies prioritize cost-effective and adaptable drilling methods, flexible drilling systems—offering maneuverability in complex geological formations—have become increasingly vital. In this evolving landscape, a select group of manufacturers has emerged as leaders in innovation, reliability, and market reach. Based on market presence, technological advancement, and performance metrics, the following are the top five flex drilling manufacturers shaping the future of the industry.

Top 5 Flex Drilling Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Lifestyle

Domain Est. 1991

Website: flex.com

Key Highlights: As a global leader in design and manufacturing of smart and connected devices, Flex builds products that enhance the way we live….

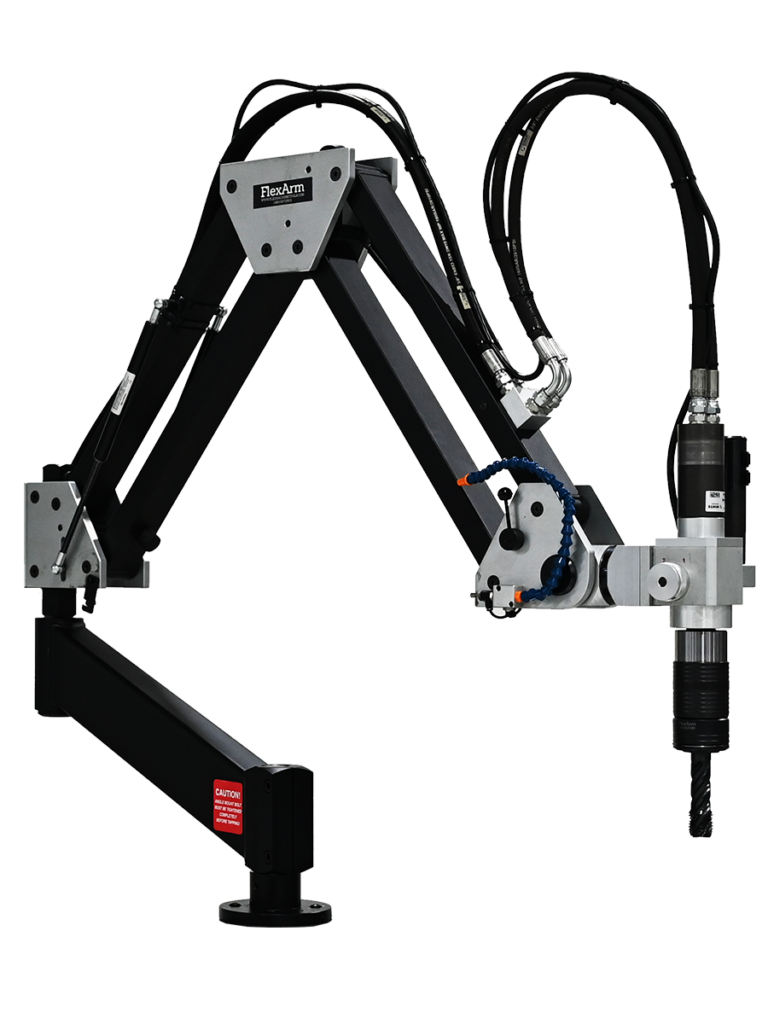

#2 FlexArm Tapping Arms, Drilling Arms, Ergonomic Solutions

Domain Est. 1997

Website: flexarminc.com

Key Highlights: Flexarm provides custom ergonomic solutions to improve workspace efficiency and team well-being. Their engineers design tailored solutions to address ……

#3 Contact Us

Domain Est. 1998

Website: flexpowertools.com

Key Highlights: Need Help? We’re Here 5 Days a Week. Contact Icon. CALL US. 833-FLEX-496 (833-353-9496). SUPPORT HOURS. Monday–Friday: 8 AM–8 PM EST ……

#4 Power tools for professional craftsmen

Domain Est. 1999

Website: flex-tools.com

Key Highlights: FLEX power tools ✚ accessories for professional craftsmen. System solutions for: Renovation, refurbishment & modernising, metalworking, automotive, ……

#5 Flex Machine Tools

Domain Est. 2019

Website: flexmachinetools.com

Key Highlights: Flex Machine Tools is a leading provider of high-quality machine tool solutions with a legacy spanning over 50 years….

Expert Sourcing Insights for Flex Drilling

H2: Analysis of 2026 Market Trends for Flex Drilling

As we approach 2026, the outlook for Flex Drilling—a company historically focused on land-based contract drilling services in North America—reflects both persistent challenges and emerging opportunities within the broader oil and gas industry. The company, which emerged from Chapter 11 bankruptcy in 2021 with a leaner operational structure, is positioned to navigate a complex and evolving energy landscape. This analysis examines key market trends expected to influence Flex Drilling’s performance and strategic direction in 2026.

1. Resurgence in U.S. Onshore Drilling Activity

The U.S. onshore drilling market, particularly in the Permian Basin, is projected to experience moderate growth in 2026, driven by sustained demand for crude oil, both domestically and internationally. Despite global pushes toward decarbonization, oil remains a foundational component of the energy mix. According to EIA projections, U.S. crude oil production is expected to reach record highs by 2026, supported by improved well productivity and resilient drilling economics at moderate oil prices (~$70–$85 per barrel). This trend favors contract drillers like Flex Drilling, especially those with modern, efficient rigs capable of horizontal drilling.

Flex Drilling’s fleet, restructured to focus on high-spec AC electric rigs, positions the company well to capitalize on this demand. Increased rig utilization and improved dayrates—driven by tightening supply of available rigs—are expected to boost revenue and margins in 2026.

2. Consolidation and Competitive Landscape

The drilling services sector continues to consolidate, with larger players acquiring smaller or financially strained competitors. In this environment, Flex Drilling’s niche strategy—focusing on operational efficiency and customer service rather than scale—allows it to compete effectively in select basins. However, pressure from larger firms like Helmerich & Payne, Nabors Industries, and Patterson-UTI may limit pricing power. Flex’s ability to maintain long-term contracts with major E&P companies will be critical to sustaining market share.

3. Technological Advancements and Efficiency Gains

Automation, data analytics, and remote operations are becoming standard in modern drilling operations. By 2026, Flex Drilling is expected to continue investing in digital rig technologies to improve safety, reduce non-productive time, and meet ESG expectations. Integration of real-time monitoring and predictive maintenance systems will enhance rig uptime and appeal to operators focused on operational efficiency.

4. ESG and Regulatory Pressures

Environmental, Social, and Governance (ESG) considerations are increasingly influencing capital allocation in the energy sector. While drilling contractors are not direct emitters to the same extent as producers, operators are demanding lower-emission, more sustainable drilling practices. Flex Drilling may face pressure to adopt cleaner-burning power sources (e.g., hybrid or dual-fuel engines) and reduce flaring and methane emissions during operations. Compliance with evolving state and federal regulations—particularly in Texas and New Mexico—will require ongoing investment and operational adaptation.

5. Labor Market and Supply Chain Dynamics

The skilled labor shortage in the oilfield services sector persists, with experienced drillers in high demand. Flex Drilling’s ability to attract and retain talent will be a key determinant of operational reliability in 2026. Additionally, supply chain constraints—particularly for critical rig components—could impact maintenance schedules and capital project timelines. Strategic partnerships with equipment suppliers and investment in inventory management will be essential.

6. Energy Transition and Long-Term Outlook

While oil demand remains strong in the short to medium term, the long-term energy transition toward renewables poses structural risks to the drilling services industry. Flex Drilling may explore diversification opportunities, such as supporting geothermal drilling or carbon capture and storage (CCS) projects, which require similar drilling expertise. Though these markets are nascent, early engagement could provide growth avenues beyond traditional oil and gas.

Conclusion

In 2026, Flex Drilling is expected to benefit from sustained U.S. onshore drilling activity, improved operational efficiency, and a favorable pricing environment for contracted drilling services. However, the company must navigate competitive pressures, regulatory demands, and the broader energy transition. Success will depend on disciplined capital management, technological adoption, and strategic positioning within high-growth basins. While challenges remain, Flex Drilling’s focused business model and modern fleet provide a solid foundation for resilience and targeted growth in the evolving energy landscape.

Common Pitfalls Sourcing Flex Drilling (Quality, IP)

Poor Material Quality and Inconsistent Flexibility

A major pitfall when sourcing flex drilling components is receiving substandard materials that fail to meet required mechanical or thermal specifications. Low-quality polyimide or adhesive layers can lead to cracking, delamination, or reduced lifespan under dynamic flexing. Inconsistent thickness or copper adhesion across batches compromises reliability, especially in high-cycle applications. Without stringent quality control from the supplier, these defects may not be detected until late in production, causing costly rework or field failures.

Inadequate Process Control and Drilling Precision

Flex circuits demand high precision in microvia and through-hole drilling due to tight tolerances and thin materials. Sourcing from vendors with outdated or poorly maintained laser or mechanical drilling equipment can result in misaligned holes, excessive taper, or carbon residue (in laser-drilled vias), leading to electrical opens or intermittent connections. Lack of process validation and statistical process control (SPC) increases the risk of yield loss and inconsistent performance.

Intellectual Property (IP) Exposure and Leakage

Outsourcing flex drilling—especially to offshore or third-party manufacturers—poses significant IP risks. Design files containing proprietary stack-ups, via arrangements, or signal routing may be exposed to unauthorized parties. Without strong non-disclosure agreements (NDAs), secure data transfer protocols, and audits of supplier practices, there’s a heightened risk of design theft, reverse engineering, or unauthorized replication by competitors.

Insufficient Traceability and Documentation

Many suppliers fail to provide full traceability for materials and processes used in flex drilling. Missing or incomplete documentation—such as drill logs, impedance reports, or material certifications—makes it difficult to troubleshoot failures or meet regulatory requirements (e.g., aerospace, medical). This lack of transparency complicates quality assurance and can delay product certification or recall investigations.

Overlooking Compliance and Certification Requirements

Flex drilling for regulated industries often requires adherence to standards like IPC-6013 (flexible circuit performance), RoHS, or UL. Sourcing from vendors without proper certifications risks non-compliant products entering the supply chain. This can result in rejected shipments, compliance fines, or safety hazards, especially when halogen-free materials or lead-free processing are mandated.

Hidden Costs from Rework and Yield Loss

While a supplier may quote a low unit price, hidden costs can emerge from poor drilling yields, requiring extensive rework or scrapping of expensive flex panels. Inadequate first-pass yield rates due to drilling defects inflate total cost of ownership. Without clear metrics on yield and defect tracking, buyers may unknowingly absorb these inefficiencies, undermining cost-saving intentions.

Logistics & Compliance Guide for Flex Drilling

This guide outlines the essential logistics and compliance procedures for Flex Drilling operations. Adherence to these standards ensures operational efficiency, regulatory compliance, safety, and environmental protection across all drilling projects.

Scope and Applicability

This guide applies to all Flex Drilling personnel, contractors, and third-party vendors involved in the transportation, handling, and operation of drilling equipment and materials. It covers onshore and offshore operations and aligns with international, federal, state, and local regulatory frameworks.

Regulatory Compliance Framework

Flex Drilling is committed to full compliance with all applicable laws and regulations, including but not limited to:

- Occupational Safety and Health Administration (OSHA) standards

- Environmental Protection Agency (EPA) regulations

- Department of Transportation (DOT) hazardous materials transportation rules

- International Maritime Organization (IMO) guidelines (for offshore operations)

- Bureau of Safety and Environmental Enforcement (BSEE) requirements

- Local environmental and land use permits

All operations must be supported by up-to-date permits, safety data sheets (SDS), and environmental impact assessments where required.

Equipment Transportation and Logistics

All drilling equipment and components must be transported in accordance with DOT and carrier-specific regulations. Key requirements include:

- Pre-shipment inspections to verify load stability and securement

- Proper documentation, including bills of lading, equipment manifests, and route permits

- Use of certified transport providers with experience in oversized and heavy haul operations

- Route planning to avoid low-clearance bridges, weight-restricted roads, and environmentally sensitive areas

- Real-time GPS tracking for high-value or time-sensitive shipments

Equipment must be clearly labeled and staged at the drill site according to operational sequence and safety zones.

Hazardous Materials Management

The handling, storage, and transportation of hazardous materials (e.g., drilling fluids, fuels, chemicals) must comply with:

- Hazardous Materials Regulations (HMR), 49 CFR Parts 100–185

- Spill Prevention, Control, and Countermeasure (SPCC) Plan requirements

- Global Harmonized System (GHS) for chemical labeling and SDS compliance

All hazardous materials must be stored in approved containers with secondary containment and clear signage. Personnel must be trained in emergency response procedures.

Site Setup and Environmental Compliance

Prior to drilling operations, the site must meet all environmental and logistical requirements:

- Erosion and sediment control measures implemented

- Spill kits and containment barriers deployed and accessible

- Waste management plan in place for drill cuttings, used oil, and non-hazardous waste

- Compliance with water discharge permits and air quality standards

- Coordination with local authorities and indigenous communities, where applicable

Daily inspections and documentation are mandatory.

Personnel and Contractor Compliance

All personnel and contractors must:

- Possess valid certifications (e.g., H2S Alive, Well Control, First Aid, Rig Pass)

- Complete site-specific safety orientations prior to deployment

- Adhere to company policies on drug and alcohol use, PPE, and incident reporting

- Participate in regular safety meetings and drills

Contractors must provide proof of insurance and compliance with Flex Drilling’s Code of Conduct.

Documentation and Recordkeeping

Accurate records must be maintained for:

- Equipment maintenance and inspection logs

- Personnel training and certifications

- Chemical inventories and SDS files

- Environmental monitoring data (e.g., emissions, noise, water quality)

- Incident reports and near-miss documentation

Records must be retained for a minimum of five years or as required by regulation.

Incident Response and Reporting

In the event of a spill, injury, or regulatory violation:

- Activate the Emergency Response Plan immediately

- Notify relevant internal and external authorities within mandated timeframes

- Secure the area and initiate containment procedures

- Conduct a root cause analysis and implement corrective actions

All incidents must be documented and reported through the company’s safety management system.

Audits and Continuous Improvement

Flex Drilling conducts regular internal and third-party audits to verify compliance with this guide. Findings are reviewed by management, and corrective actions are tracked to completion. Continuous improvement is driven by feedback, technological advancements, and evolving regulatory standards.

Contact Information

For compliance or logistics support, contact the Flex Drilling Logistics & Compliance Team at:

Email: [email protected]

Phone: 1-800-FLEX-LOG (1-800-353-9564)

24/7 Emergency Line: 1-800-DRILL-911 (1-800-374-55911)

Conclusion for Sourcing Flexible (Flex) Drilling Solutions:

Sourcing flexible drilling solutions is a strategic move for organizations aiming to enhance operational efficiency, reduce costs, and improve adaptability in dynamic drilling environments. Flex drilling offers significant advantages over traditional drilling models, including faster deployment, reduced capital expenditure, access to specialized expertise, and improved scalability. By partnering with reliable flex drilling providers, companies can maintain greater operational agility while focusing on core competencies such as exploration, production, and asset management.

However, successful sourcing requires careful evaluation of potential providers based on safety records, technological capabilities, equipment reliability, and contractual flexibility. Strong vendor relationships, clear performance metrics, and effective contract management are essential to maximize value and minimize risks.

In conclusion, sourcing flex drilling services presents a viable and often advantageous alternative to traditional rig contracting, particularly in volatile markets or for short-term and challenging drilling projects. With the right partner and a well-structured sourcing strategy, organizations can achieve improved project timelines, cost efficiency, and operational performance in today’s competitive energy landscape.