The global flax tow market is experiencing steady growth, driven by rising demand for sustainable and natural fibers across industries such as textiles, automotive composites, and eco-friendly construction. According to Grand View Research, the global flax fiber market was valued at USD 548.3 million in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. A key contributor to this growth is the increasing use of flax tow— a coarser grade of flax fiber— in technical textiles and biocomposites, particularly in Europe, which remains the largest producer and consumer of flax. With sustainability at the forefront of material innovation, manufacturers are leveraging flax tow’s low environmental impact, high strength-to-weight ratio, and biodegradability to meet evolving industry standards. As demand intensifies, a select group of producers are leading the way in quality, scalability, and innovation. Here are the top 10 flax tow manufacturers shaping the future of natural fiber supply chains.

Top 10 Flax Tow Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Short fibre

Domain Est. 2001

Website: vandebiltzadenvlas.com

Key Highlights: Van de Bilt zaden en vlas bv can supply flax tow suitable for application in various processing industries (paper, textiles, automotive, etc.)….

#2 European supplier of flax

Domain Est. 2003 | Founded: 1965

Website: fibrex.be

Key Highlights: Fibrex NV has been one of the leading European suppliers of Flax since 1965. The company was founded by, and is still owned by the same family, Vanneste….

#3 TeXtreme®

Domain Est. 2006

Website: textreme.com

Key Highlights: Explore TeXtreme® advanced composite reinforcements engineered for ultimate strength, lightness, and performance in aerospace, sports, automotive, ……

#4 Eurolinen

Domain Est. 2013

Website: eurolinen.lt

Key Highlights: This production site predominantly manufactures flax tows (papermaking, automotive industry, insulation, and fabrics), flax threads (agriculture, ropes and ……

#5 Hypetex

Domain Est. 2013

Website: hypetex.com

Key Highlights: Hypetex advanced coloured materials bring composites to life, with stunning visuals meeting high technical performance….

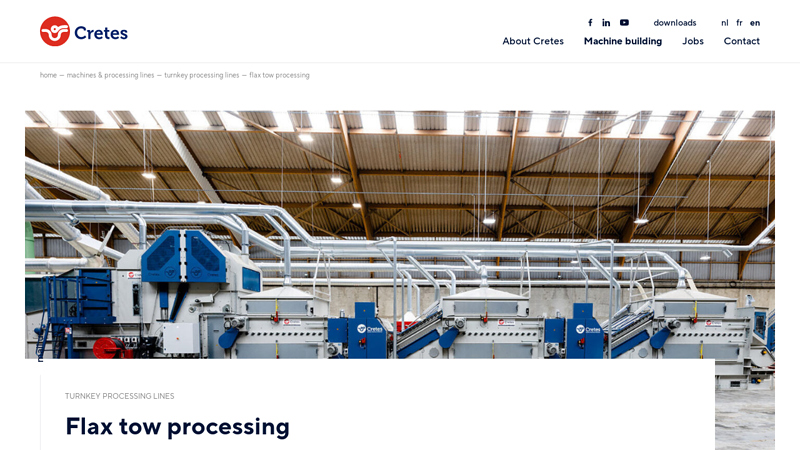

#6 Flax tow processing

Domain Est. 2013

Website: cretes.be

Key Highlights: Complete processing line for cleaning of flax tow. A modular design with components for opening, cleaning and baling of flax tow fibres….

#7 Flax

Domain Est. 2018

Website: linenconco1.com

Key Highlights: The products include: linseeds, flax, scutching fiber and flax tow, organic linseeds and organic flax sliver. For more information please visit their web site ……

#8 Flax tow

Domain Est. 2020

Website: deltaflax.com

Key Highlights: Flax tow refers to the shorter fibers obtained from the flax plant. These fibers are typically around 20 to 50 centimeters in length and are separated from ……

#9 Products

Domain Est. 2021

Website: flaxfibers.net

Key Highlights: Name: Flax Tow. HS Code: 530130. Color: Natural. Shivs %:. From 5% – 25%. Fiber Length: <30cm. Packaging: Pressed in bales of 200 or 250 kg. Min-Quantities:...

#10 About Us

Domain Est. 2022

Website: korelichilen.by

Key Highlights: The main activity of the company is growing flax, harvesting flax, primary processing of flax, production of long and short flax fiber. Along with these ……

Expert Sourcing Insights for Flax Tow

H2: 2026 Market Trends for Flax Tow

The global flax tow market is poised for moderate but steady growth by 2026, driven by increasing demand for sustainable, biodegradable, and renewable textile and industrial fibers. Flax tow—the coarse, shorter fibers separated during the scutching process of flax processing—is gaining renewed interest across multiple sectors due to its environmental advantages and expanding applications.

-

Rising Demand in Eco-Friendly Textiles

With consumers and brands increasingly prioritizing sustainability, flax tow is being integrated into eco-conscious textile lines. Although traditionally considered a lower-grade fiber compared to long line flax, advancements in processing technologies have improved the quality and usability of flax tow in blended fabrics. By 2026, demand is expected to grow in the production of casual wear, home textiles, and non-woven fabrics, especially in Europe and North America where green certifications (e.g., EU Ecolabel, GOTS) are influencing purchasing decisions. -

Expansion in Composite and Industrial Applications

One of the most significant growth drivers for flax tow is its use in bio-composites. The automotive and construction industries are exploring flax-based materials as lightweight, renewable alternatives to glass and synthetic fibers. Flax tow, due to its availability and lower cost, is being used in particleboards, insulation materials, and molded composites. By 2026, partnerships between flax producers and material science firms are expected to scale up these applications, particularly in the EU’s green building and circular economy initiatives. -

Regional Production Shifts and Supply Chain Resilience

Europe—especially France, Belgium, and the Netherlands—remains the dominant producer of high-quality flax, including tow. However, rising interest in domestic production for supply chain security is prompting countries like Poland, Lithuania, and even parts of Canada to expand flax cultivation. By 2026, localized processing facilities may reduce reliance on imports and lower carbon footprints, enhancing the appeal of flax tow in regional markets. -

Price Stability and Competition with Synthetic Alternatives

While flax tow prices are expected to remain relatively stable due to consistent supply, it continues to face competition from low-cost synthetic fibers such as polyester and polypropylene. However, regulatory pressures on single-use plastics and carbon emissions are tilting the balance in favor of natural fibers. Carbon taxation and extended producer responsibility (EPR) schemes in key markets may further improve the cost-competitiveness of flax tow-based products by 2026. -

Innovation in Processing and Fiber Enhancement

Technological improvements in retting, scutching, and fiber refining are increasing the yield and strength of flax tow. Enzymatic and mechanical treatments are enabling better fiber separation, making flax tow suitable for higher-value applications. Research into functionalization (e.g., flame retardancy, moisture resistance) is also opening doors in technical textiles, with potential commercialization expected by 2026.

Conclusion

By 2026, the flax tow market is projected to benefit from a convergence of environmental regulations, consumer demand for sustainability, and technological innovation. While it will remain a niche segment compared to premium flax fibers, its role in circular economy models and industrial biocomposites positions flax tow for incremental but meaningful growth. Strategic investments in processing infrastructure and cross-sector collaboration will be key to unlocking its full market potential.

Common Pitfalls Sourcing Flax Tow (Quality, IP)

Sourcing flax tow—a byproduct of flax fiber processing used in textiles, composites, and insulation—can present several challenges, particularly concerning quality consistency and intellectual property (IP) risks. Being aware of these pitfalls helps ensure reliable supply and protects your business interests.

Inconsistent Fiber Quality

Flax tow quality varies significantly based on cultivation practices, retting methods, and processing techniques. Sourcing from suppliers without stringent quality controls can result in inconsistent fiber length, strength, color, and cleanliness. Poorly processed tow may contain excessive shives, lignin, or moisture, reducing its suitability for technical applications.

Lack of Standardized Specifications

Unlike primary flax fibers, flax tow often lacks industry-wide quality standards. This absence of standardization makes it difficult to compare offerings across suppliers and increases the risk of receiving non-conforming material. Buyers should define clear technical specifications (e.g., fiber length, fineness, moisture content) and insist on test reports.

Unreliable Supply Chain Transparency

Many flax tow suppliers source material through complex, multi-tiered supply chains with limited visibility. This opacity can mask issues such as unethical farming practices, environmental non-compliance, or adulteration with lower-grade fibers. Without traceability, verifying sustainability claims or fiber origin becomes nearly impossible.

Intellectual Property Risks in Processing Technology

Advanced treatments—such as enzymatic retting, mechanical refining, or chemical modifications—may be protected by patents or trade secrets. Sourcing flax tow processed using proprietary methods without proper licensing can expose your company to IP infringement claims, especially if you resell or further process the material.

Misrepresentation of Fiber Origin or Processing

Some suppliers may misrepresent the geographic origin (e.g., claiming European flax when sourcing from less-regulated regions) or processing method (e.g., stating “enzymatic retting” when using chemical alternatives). Such mislabeling affects performance and may violate labeling regulations or customer sustainability requirements.

Overlooking Environmental and Regulatory Compliance

Flax tow processing may involve chemicals or generate waste streams subject to environmental regulations. Sourcing from non-compliant facilities can pose reputational and legal risks, particularly if your end-products are marketed as eco-friendly. Ensure suppliers adhere to REACH, OEKO-TEX®, or other relevant standards.

Failure to Secure Long-Term Supply Agreements

Flax production is subject to crop variability and climate conditions. Without long-term contracts or supply assurances, businesses risk shortages or price volatility. Relying on spot purchases from multiple small suppliers increases inconsistency and supply chain fragility.

Inadequate Testing and Certification

Many suppliers provide limited or no third-party certification (e.g., for tensile strength, microbial content, or residual pesticides). Assuming quality without independent verification can lead to production delays, product failures, or recalls—especially in high-performance applications like automotive composites.

By proactively addressing these pitfalls through rigorous supplier vetting, clear contractual terms, and independent quality validation, companies can mitigate risks and ensure a reliable, compliant supply of flax tow.

Logistics & Compliance Guide for Flax Tow

Flax tow, a byproduct of flax fiber processing, is used in various industries including textiles, paper, composites, and bio-based materials. Efficient logistics and strict compliance are essential to ensure the product meets international standards, reaches customers in optimal condition, and adheres to environmental and trade regulations.

Product Overview

Flax tow consists of shorter, coarser fibers separated during the scutching process of flax. It typically appears as a loose, heterogeneous mass and may vary in moisture content, color, and cleanliness. Proper classification and documentation begin with accurate product specification.

Classification & HS Code

The Harmonized System (HS) code for flax tow is generally 5305 00 00 (Flax, raw or processed but not spun; tow, waste (including yarn waste and garnetted stock) of flax). However, classification may vary depending on processing level (e.g., degummed, bleached) and end use. Always verify with local customs authorities to ensure correct tariff classification and eligibility for trade preferences.

Packaging & Handling

- Packaging Type: Flax tow is commonly compressed into bales (typically 200–300 kg) using steel or plastic strapping. Custom packaging (e.g., netting, big bags) may be used for specific markets.

- Moisture Control: Maintain moisture content below 12% to prevent mold and degradation during storage and transit.

- Labeling: Each bale must be clearly labeled with batch number, net weight, origin, date of baling, and supplier information. Include handling instructions (e.g., “Keep Dry,” “Fragile”).

- Loading & Storage: Store in dry, well-ventilated warehouses off the ground. Avoid direct contact with concrete to prevent moisture absorption. Use pallets or wooden planks.

Transportation

- Mode of Transport: Flax tow is typically shipped via sea freight in dry container loads (DCL) or as break-bulk cargo. Road and rail are viable for regional distribution.

- Container Requirements: Use clean, dry, and pest-free containers. Utilize moisture barriers (e.g., plastic lining) if shipping through humid climates.

- Stowage: Ensure even weight distribution and secure bales to prevent shifting. Avoid stacking beyond recommended limits to prevent compaction damage.

- Transit Time: Minimize exposure to extreme temperatures and humidity. Transit should ideally not exceed 4–6 weeks without climate monitoring.

Customs Documentation

Essential documentation includes:

– Commercial Invoice (with full product description, HS code, value, and Incoterms)

– Packing List (per bale weight and dimensions)

– Certificate of Origin (required for preferential tariffs under trade agreements)

– Phytosanitary Certificate (if required by importing country)

– Bill of Lading or Air Waybill

– Export Declaration (filed with national customs authority)

Regulatory Compliance

- Phytosanitary & Plant Health: Some countries require certification that flax tow is free from pests, seeds, and soil contaminants. EU, USA, and Australia have strict biosecurity regulations.

- REACH & Chemical Compliance: If flax tow has been chemically treated (e.g., bleached), ensure compliance with REACH (EU) or TSCA (USA) regulations. Provide Safety Data Sheets (SDS) if applicable.

- Import Restrictions: Verify whether the destination country imposes restrictions on raw plant materials. For example, New Zealand’s MPI requires advance notification and inspection.

- Organic Certification: If marketed as organic, ensure certification under recognized standards (e.g., EU Organic, USDA NOP) with full traceability.

Sustainability & Environmental Considerations

- Waste Management: Ensure processing facilities comply with local environmental regulations for waste and water discharge.

- Carbon Footprint: Optimize transport routes and consolidate shipments to reduce emissions.

- Recyclability: Promote flax tow as a renewable, biodegradable material in marketing and compliance documentation.

Incoterms & Liability

Clearly define responsibilities using internationally recognized Incoterms® (e.g., FOB, CIF, DAP). Specify:

– Point of risk transfer

– Responsibility for customs clearance

– Insurance coverage

– Inspection and quality control procedures

Quality Control & Inspection

Implement pre-shipment inspections to verify:

– Moisture content (using moisture meters)

– Absence of foreign matter (e.g., stones, metal)

– Consistent bale weight and density

– Cleanliness and odor

Third-party inspection services (e.g., SGS, Bureau Veritas) are recommended for international shipments.

Risk Mitigation

- Insurance: Obtain comprehensive cargo insurance covering fire, water damage, and spoilage.

- Contamination Prevention: Use dedicated handling equipment to avoid cross-contamination with other fibers or allergens.

- Traceability: Maintain batch-level traceability from source to delivery for compliance and recall readiness.

By adhering to this logistics and compliance guide, exporters and importers of flax tow can ensure smooth, legal, and efficient movement of goods across international borders while meeting sustainability and quality standards.

In conclusion, sourcing flax tow requires a strategic approach that balances quality, sustainability, cost, and supply chain reliability. As a natural fiber by-product of flax processing, flax tow offers excellent potential for use in textiles, composites, insulation, and eco-friendly materials, aligning well with growing market demands for sustainable alternatives. To ensure a successful supply, it is essential to partner with reputable suppliers who adhere to ethical and environmentally responsible practices, particularly in regions known for flax cultivation such as Western Europe, Belarus, and China. Additionally, establishing long-term relationships, verifying fiber specifications, and staying informed about fluctuations in agricultural yields and market prices will enhance sourcing efficiency. Ultimately, integrating flax tow into your materials sourcing strategy supports innovation and sustainability goals, positioning your business competitively in a green economy.