The global fishing tackle market is experiencing steady growth, driven by increasing participation in recreational fishing and rising demand for high-performance gear. According to Grand View Research, the global fishing gear market size was valued at USD 18.5 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This surge is further supported by expanding e-commerce channels and the growing popularity of sport fishing in emerging economies. As demand climbs, sourcing directly from reliable wholesale manufacturers becomes critical for retailers, distributors, and private-label brands aiming to maintain competitive pricing and product quality. In this landscape, identifying top-tier fishing tackle manufacturers—capable of delivering innovation, scalability, and consistent output—is key to capturing market share. Based on production capacity, global reach, product diversity, and industry reputation, here are the top 10 fishing tackle wholesale manufacturers leading the industry.

Top 10 Fishing Tackle Wholesale Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 OKUMA FISHING TACKLE CO., LTD.

Domain Est. 1996

Website: okumafishing.com

Key Highlights: Okuma designs and manufactures high-quality fishing tackle. With 30 years of fishing reel / rod development experience and providing a completed service….

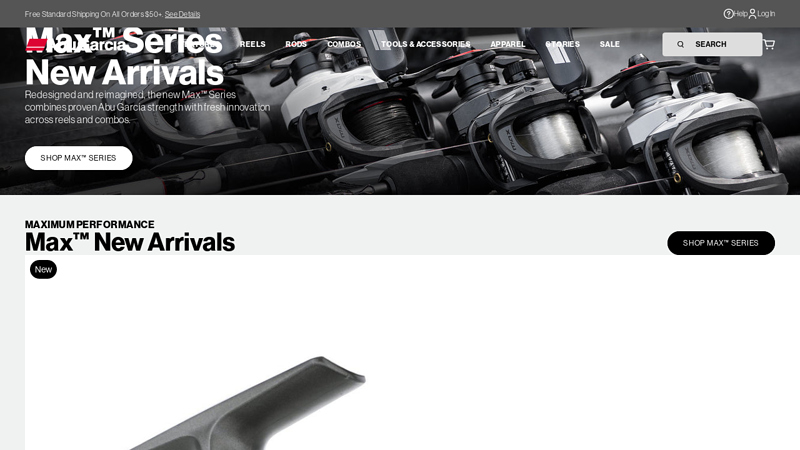

#2 Abu Garcia Fishing Rods, Reels, and other Fishing Tackle

Domain Est. 1996

Website: abugarcia.com

Key Highlights: Free delivery over $50Explore Abu Garcia’s wide range of high-quality rods, reels, and gear designed for anglers of all levels. Elevate your fishing experience with innovation ……

#3 Lurenet Fishing Headquarters

Domain Est. 1996

Website: lurenet.com

Key Highlights: Free delivery over $35 · 30-day returnsFishing Tools · Bundles and Kits · Fishing Tackle Bulk Bundles · Fishing Tackle Kits · Cheat Code Bundles · Bank And Creek · Specials · Spec…

#4 Northland Fishing Tackle

Domain Est. 1997

Website: northlandtackle.com

Key Highlights: Northland Fishing Tackle products are designed by fishermen for the quality-conscious anglers of the new millennium, aimed at walleye fishing….

#5 AFTCO

Domain Est. 1997 | Founded: 1958

Website: aftco.com

Key Highlights: Family Owned & Operated, AFTCO represents a tradition of high performance precision-built fishing gear. Since 1958, AFTCO has been the leader in Men’s, ……

#6 Top Fishing Gear Brands & Fishing Tackle

Domain Est. 1999

Website: purefishing.com

Key Highlights: Explore Pure Fishing® — your destination for the world’s leading family of fishing gear including Berkley®, PENN®, Ugly Stik®, Abu Garcia®, and more….

#7 Wholesale Tackle Supplies

Domain Est. 1999

Website: hagensfish.com

Key Highlights: Hagen’s Fish offers bulk baits, tackle, and fishing components for bait shops and DIY tackle makers. Discount fishing gear Made in the USA!…

#8 Alltackle.com

Domain Est. 1999

Website: alltackle.com

Key Highlights: Free delivery 30-day returnsShop for the fishing tackle and gear you need online at Alltackle.com! We offer high-quality products for both recreational and professional fishermen….

#9 Tsunami Fishing Tackle

Domain Est. 2002

Website: tsunamifishing.com

Key Highlights: Free delivery over $75 30-day returnsNew Arrivals · Best Sellers · Rod & Reel Combos · Rods · Reels · Bait & Tackle · Tools & Gear. Order note. Shipping Discount. Order special ins…

#10 SC Tackle Wholesale Fishing Tackle

Domain Est. 2008

Website: sctackle.com

Key Highlights: SC Tackle is a wholesale fishing tackle distributor providing East Coast & Mid-Atlantic dealers with great customer service & competitive pricing since ……

Expert Sourcing Insights for Fishing Tackle Wholesale

H2: 2026 Market Trends for Fishing Tackle Wholesale

The wholesale fishing tackle market is poised for significant transformation by 2026, driven by technological innovation, shifting consumer behaviors, sustainability demands, and evolving distribution models. As outdoor recreation continues to grow globally—especially in emerging economies—the demand for high-quality, innovative, and eco-conscious fishing gear is reshaping the wholesale landscape. Below are key trends expected to define the fishing tackle wholesale market in 2026.

H2: Growth in Recreational Fishing and Outdoor Engagement

Recreational fishing participation has seen a sustained uptick since the early 2020s, with new demographics—including younger anglers and urban outdoor enthusiasts—entering the sport. The normalization of remote work and increased focus on mental wellness have amplified interest in outdoor activities. By 2026, this trend is projected to drive higher demand for entry-level and mid-tier tackle products, prompting wholesalers to expand product assortments catering to beginners while still supporting advanced anglers.

H2: Rise of E-Commerce and Digital-First Wholesale Platforms

Wholesalers are increasingly adopting digital marketplaces and B2B e-commerce platforms to streamline operations and expand reach. By 2026, online ordering, real-time inventory tracking, and AI-powered demand forecasting will become standard. Smaller retailers and independent bait shops, previously reliant on regional distributors, will leverage digital wholesale channels for faster access to a broader inventory. This shift reduces logistics costs and improves supply chain responsiveness.

H2: Demand for Sustainable and Eco-Friendly Tackle

Environmental consciousness is influencing product development and procurement strategies. By 2026, wholesalers will face growing pressure from retailers and consumers to stock sustainable fishing tackle—such as biodegradable lures, lead-free weights, and gear made from recycled materials. Major brands are expected to certify products under eco-labels, and wholesalers who prioritize green supply chains will gain competitive advantage and appeal to environmentally focused retailers.

H2: Innovation in Smart Fishing Technology

The integration of smart technology into fishing tackle—such as GPS-enabled bobbers, sensor-equipped rods, and app-connected reels—will create a new product category by 2026. Wholesalers will need to adapt by offering tech-integrated solutions, providing training for retailers, and managing higher-margin, electronics-based inventory. This trend is especially strong in North America and Western Europe, where tech adoption in outdoor sports is accelerating.

H2: Consolidation and Strategic Partnerships Among Distributors

Market consolidation is expected to increase as larger wholesale distributors acquire regional players to achieve economies of scale and expand geographic coverage. Strategic partnerships between tackle manufacturers and wholesalers will deepen, with exclusive distribution agreements and co-branded product lines becoming more common. These alliances will enhance inventory control, marketing coordination, and data sharing to better anticipate market needs.

H2: Regional Market Expansion in Asia-Pacific and Latin America

While North America and Europe remain dominant markets, the Asia-Pacific and Latin American regions will see the fastest growth in fishing tackle demand by 2026. Rising middle-class populations, increased tourism, and government support for recreational fisheries are fueling this expansion. Wholesalers with agile logistics and localized product offerings—such as saltwater gear in coastal Southeast Asia or freshwater kits in the Amazon basin—will be well-positioned to capture market share.

H2: Supply Chain Resilience and Localized Manufacturing

Post-pandemic supply chain disruptions have prompted a reevaluation of sourcing strategies. By 2026, many wholesalers will favor nearshoring or regional manufacturing to reduce dependency on single-source suppliers, particularly from Asia. Investments in inventory diversification, buffer stocking, and digital supply chain tools will improve resilience against geopolitical and logistical disruptions.

H2: Customization and Niche Product Offerings

Anglers are increasingly seeking personalized and specialized gear, such as species-specific lures or region-tailored tackle boxes. Wholesalers will respond by offering customizable bulk packages and private-label options for retailers. This trend supports differentiation in a competitive market and strengthens relationships with boutique and specialty fishing stores.

In conclusion, the 2026 fishing tackle wholesale market will be defined by digital transformation, sustainability, technological integration, and global market diversification. Wholesalers who proactively adapt to these trends will be best positioned to thrive in an increasingly dynamic and competitive industry landscape.

Common Pitfalls When Sourcing Fishing Tackle Wholesale

Sourcing fishing tackle wholesale can be highly profitable, but it comes with risks that can undermine your business if not properly managed. Two of the most critical areas where businesses stumble are quality control and intellectual property (IP) issues. Understanding these pitfalls helps ensure long-term success and brand integrity.

Quality Inconsistencies and Substandard Materials

One of the biggest challenges in wholesale fishing tackle sourcing is ensuring consistent product quality. Many suppliers, especially those in competitive low-cost regions, may cut corners to offer lower prices. This often results in:

- Inferior materials: Hooks that rust quickly, lines that snap under pressure, or reels with weak gear mechanisms.

- Inconsistent manufacturing: Batch-to-batch variations in strength, durability, or finish.

- Poor packaging: Leading to damaged goods during shipping or unappealing presentation for resale.

Without rigorous vetting and quality assurance processes—such as pre-shipment inspections or third-party lab testing—retailers risk damaging their reputation due to faulty gear failing in the field.

Intellectual Property (IP) Infringement Risks

Another major pitfall is inadvertently sourcing products that violate intellectual property rights. The fishing tackle market features many patented designs, trademarks, and copyrighted branding elements. Common IP issues include:

- Counterfeit or knockoff products: Items that mimic popular branded gear (e.g., fake reel models or copied lure designs) without licensing.

- Trademark violations: Using logos, names, or branding similar to established companies, risking legal action.

- Patented technology replication: Manufacturing rods, reels, or lures that use protected mechanisms or innovations.

Sourcing such products—even unknowingly—can result in customs seizures, lawsuits, or account suspensions on e-commerce platforms like Amazon or eBay. Always verify that suppliers have the proper rights or licenses to produce and distribute the tackle you’re purchasing.

Mitigation Strategies

To avoid these pitfalls:

– Conduct thorough due diligence on suppliers, including factory audits and sample testing.

– Request compliance certifications and proof of IP rights.

– Work with legal counsel to review contracts and ensure IP safety.

– Build long-term relationships with reputable manufacturers who prioritize quality and legitimacy.

By addressing quality and IP concerns proactively, businesses can secure reliable, compliant, and high-performing fishing tackle for their customers.

Logistics & Compliance Guide for Fishing Tackle Wholesale

Understanding the Fishing Tackle Supply Chain

Fishing tackle wholesale involves a complex supply chain comprising manufacturers, distributors, retailers, and end consumers. Efficient logistics start with identifying reliable suppliers of rods, reels, lures, lines, hooks, tackle boxes, and related accessories. Partnerships with manufacturers—domestic or international—require clear agreements on lead times, minimum order quantities (MOQs), and delivery schedules. Establishing a centralized distribution hub or utilizing third-party logistics (3PL) providers can streamline inventory management and order fulfillment across regions.

Inventory Management Best Practices

Maintaining optimal inventory levels is crucial to meet seasonal demand without overstocking. Use inventory management software to track stock in real time, forecast demand based on fishing seasons and regional trends, and automate reordering from suppliers. Categorize products by type, size, and seasonality to facilitate warehouse organization. Implement barcode or RFID systems to reduce errors in picking and packing, especially for small, high-volume items like hooks and sinkers.

Transportation and Distribution Strategies

Choose transportation modes based on cost, speed, and product sensitivity. Most fishing tackle can be shipped via ground freight for domestic distribution, while air freight may be used for time-sensitive international orders. Work with freight carriers experienced in handling consumer goods and ensure proper packaging to prevent damage during transit. Consider regional warehousing to reduce shipping times and costs for high-demand areas.

Regulatory Compliance: Product Safety & Labeling

Fishing tackle must comply with consumer product safety regulations. In the U.S., the Consumer Product Safety Commission (CPSC) oversees product safety standards. Ensure all products—especially those marketed to children—meet requirements for small parts, sharp edges, and toxic materials (e.g., lead restrictions in sinkers and jigs). Accurate labeling is essential: include product names, warnings (e.g., “Sharp Hook”), country of origin, and compliance marks (e.g., CPSIA tracking label). International sales may require adherence to EU REACH, UK CA, or other regional chemical and safety regulations.

Import/Export Compliance for Global Sourcing

When sourcing tackle from overseas (e.g., Asia), comply with customs and import regulations. Classify products using the correct Harmonized System (HS) codes to determine tariffs and duties. Maintain accurate documentation, including commercial invoices, packing lists, and certificates of origin. Be aware of restrictions on certain materials—such as endangered species parts (e.g., ivory or turtle shell in vintage lures), which are regulated under CITES (Convention on International Trade in Endangered Species). Partner with a licensed customs broker to ensure smooth clearance.

Environmental & Sustainability Regulations

Environmental compliance is increasingly important in the fishing industry. Some states and countries regulate or ban certain types of tackle, such as lead weights, due to wildlife toxicity. Stay informed about local bans and offer eco-friendly alternatives (e.g., tungsten or bismuth weights). Additionally, packaging should comply with state and federal regulations regarding recyclability and plastic content. Consider sustainable sourcing and packaging to meet retailer and consumer expectations.

Hazardous Materials and Shipping Restrictions

While most fishing tackle is non-hazardous, some items (e.g., lantern batteries for fishing lights or flammable adhesives in repair kits) may fall under hazardous materials (hazmat) regulations when shipped. Classify such items correctly under DOT (U.S. Department of Transportation) or IATA guidelines. Use approved packaging, labeling, and documentation when shipping hazmat items, and train staff accordingly.

Recordkeeping and Audit Preparedness

Maintain detailed records of supplier agreements, compliance certifications, import documentation, safety testing reports, and shipping logs. These records are essential for audits by regulatory bodies such as the CPSC, FDA (for bait-related products), or customs authorities. Regular internal audits help identify compliance gaps and improve logistics efficiency.

Building Resilience and Scalability

Develop contingency plans for supply chain disruptions, such as port delays or supplier issues. Diversify your supplier base and maintain safety stock for critical items. As your wholesale business grows, invest in scalable logistics technology and compliance management systems to support expansion into new markets.

In conclusion, sourcing fishing tackle wholesale offers a strategic advantage for retailers, distributors, and e-commerce businesses aiming to maximize profit margins, ensure consistent product availability, and meet growing consumer demand. By partnering with reliable wholesale suppliers, businesses gain access to a broad range of high-quality products—from rods and reels to lures and accessories—at significantly reduced prices. Success in wholesale sourcing hinges on thorough supplier vetting, clear understanding of product quality and compliance standards, and building strong long-term relationships. Additionally, staying informed about market trends and seasonal demands allows for better inventory planning and competitive pricing. Ultimately, a well-executed wholesale sourcing strategy can enhance operational efficiency, support business scalability, and strengthen market position in the competitive outdoor recreation industry.