The global organic fertilizer market is experiencing robust growth, driven by increasing demand for sustainable agriculture and rising awareness of soil health. According to a report by Grand View Research, the global organic fertilizers market size was valued at USD 13.1 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 12.4% from 2023 to 2030. This surge is further amplified by regulatory support for eco-friendly farming practices and the push to reduce chemical runoff in intensive agricultural systems. Within this expanding niche, fish-based organic fertilizers—particularly those derived from fish waste and fish feces—are gaining traction due to their high nutrient content, particularly nitrogen, phosphorus, and beneficial organic matter. As aquaculture production increases globally, the byproducts, including fish feces, are being repurposed into value-added fertilizers, supporting circular economy models. With North America and Europe leading in organic farming adoption, and the Asia Pacific region witnessing rapid expansion in aquaculture, the stage is set for innovative manufacturers to capitalize on this underutilized resource. Amid this shift, nine key players have emerged as leaders in developing and commercializing fish feces-based fertilizers, combining waste recovery with agricultural efficiency.

Top 9 Fish Feces Fertilizer Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 From fish scraps to flower scapes

Domain Est. 1997

Website: rd.usda.gov

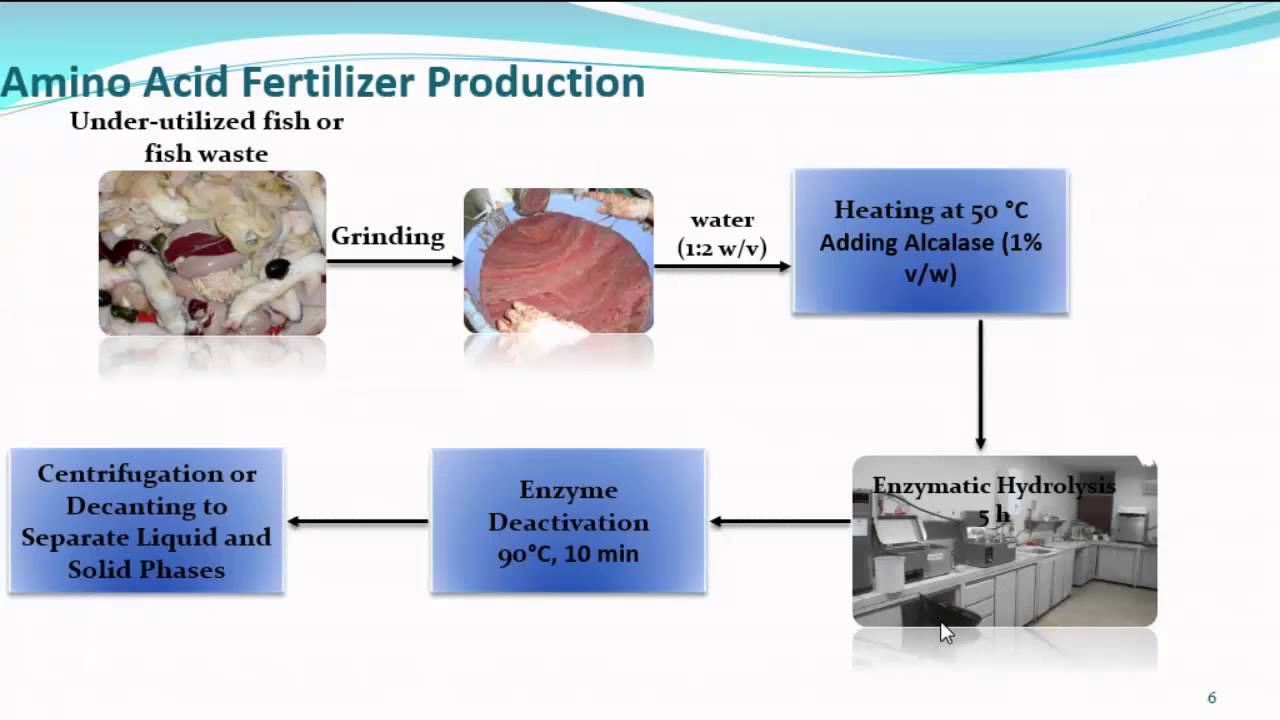

Key Highlights: The fish waste gets processed into a fine paste. A stabilizing acid is added to get rid of pathogens such as listeria and salmonella. Ultimately …Missing: feces manufacturer…

#2 Hydrolyzed Fish Fertilizer Gallon 2

Domain Est. 1999

Website: neptunesharvest.com

Key Highlights: In stock Rating 4.5 8 Neptune’s Harvest Fish Hydrolysate is the perfect fertilizer for organic gardening. Our unique cold process protects heat sensitive nutrients naturally foun…

#3 Fish Head Farms

Domain Est. 2016

Website: fishheadfarms.com

Key Highlights: Over 4,000 species of microbes – more than any beneficial bacteria on the market · Billions of microbes in every dose · OMRI Certified 100% Organic · Crafted at …Missing: feces …

#4 D R Fish Fertilizer Company

Domain Est. 2008

Website: drfishfertilizer.com

Key Highlights: D R Fish Fertilizer Company is an organic fertilizer distributor in Hotchkiss, CO. We offer wholesale fertilizer throughout Colorado; call us today to place ……

#5 Fishnure – Natural Living Organic Fertilizer

Domain Est. 2012

#6 Garden Booster

Domain Est. 2018

Website: gethookedseafood.com

Key Highlights: Our fish-based garden booster restores these critical sea minerals back into the soil, supporting biodiversity and soil health….

#7 Fish Poop.com

Domain Est. 2019

Website: fishpoop.com

Key Highlights: Our fish poop fertilizer feeds plants, microbes, and improves soil structure with rich organic matter. It contains available nutrients for quick feed….

#8 dsm

Domain Est. 2022

Website: dsm-firmenich.com

Key Highlights: We are dsm-firmenich Animal Nutrition & Health (ANH): the global leaders in animal nutrition & health, carotenoids, precision nutrition, ……

#9 Alaska Fish Fertilizer Website

Domain Est. 2024

Website: alaskafishfertilizer.com

Key Highlights: Our Alaska Fish Fertilizer harnesses the natural power of nutrient-rich fish and kelp to provide plants with essential nutrients for strong, healthy growth….

Expert Sourcing Insights for Fish Feces Fertilizer

H2: Projected 2026 Market Trends for Fish Feces Fertilizer

The global market for fish feces fertilizer, an emerging segment within the organic and sustainable agriculture industry, is anticipated to experience notable growth by 2026. Driven by increasing demand for eco-friendly farming inputs and circular economy models in aquaculture, fish feces-based fertilizers are gaining traction as a nutrient-rich, low-waste alternative to synthetic fertilizers.

-

Rising Demand for Organic and Sustainable Inputs

By 2026, consumer preference for organic produce is expected to continue rising, pushing farmers toward natural soil amendments. Fish feces, rich in nitrogen, phosphorus, and micronutrients, offer a sustainable source of slow-release nutrients. Integrated aquaponics systems—where fish waste is directly converted into plant fertilizer—are projected to expand, particularly in urban and peri-urban agriculture, fueling demand for fish feces-derived products. -

Growth in Aquaculture Integration

As aquaculture production increases to meet global protein demand, the volume of fish waste is also rising. Producers are increasingly adopting waste-to-resource strategies, converting fish feces into pelleted or liquid organic fertilizers. This trend is supported by advancements in waste collection, stabilization, and odor-control technologies, making fish feces fertilizer more viable for commercial distribution. -

Regulatory and Environmental Incentives

Environmental regulations targeting nutrient runoff and synthetic fertilizer overuse are expected to tighten in key agricultural markets by 2026. Governments in regions like the EU and North America are likely to incentivize organic soil amendments, creating a favorable policy environment for fish-based fertilizers. Certification programs for sustainable aquaculture by-products may further boost market credibility. -

Regional Market Expansion

Asia-Pacific, particularly countries like China, India, and Vietnam, is expected to lead the fish feces fertilizer market due to high aquaculture output and government support for integrated farming systems. Meanwhile, North America and Western Europe are anticipated to grow steadily, driven by organic farming trends and innovation in closed-loop agricultural systems. -

Challenges and Limitations

Despite positive momentum, challenges remain. Public perception of waste-derived products, logistical complexities in processing and transport, and competition from established organic fertilizers (e.g., compost, manure) may constrain growth. Standardization of nutrient content and pathogen control will be critical for widespread adoption. -

Innovation and Product Development

By 2026, expect increased R&D in microbial treatment and encapsulation technologies to enhance the efficiency and shelf life of fish feces fertilizers. Startups and agri-tech firms are likely to introduce branded, odorless formulations tailored for home gardening and commercial greenhouse use.

In conclusion, the fish feces fertilizer market in 2026 is poised for moderate but steady growth, supported by sustainability trends, technological innovation, and policy alignment with circular agriculture. While niche, it represents a strategic component of the broader movement toward waste valorization in food systems.

Common Pitfalls Sourcing Fish Feces Fertilizer: Quality and Intellectual Property Concerns

Sourcing fish feces fertilizer—often derived from aquaculture effluent or processed fish waste—can offer sustainable nutrient solutions, but it comes with significant quality and intellectual property (IP) challenges. Buyers and suppliers must navigate these pitfalls carefully to ensure product efficacy, regulatory compliance, and legal safety.

Quality-Related Pitfalls

Inconsistent Nutrient Composition

Fish feces fertilizer lacks standardized nutrient profiles due to variations in fish species, feed composition, water quality, and farming practices. This inconsistency can lead to unpredictable plant responses, over-fertilization, or nutrient deficiencies, undermining crop performance and grower trust.

Pathogen and Contaminant Risks

Raw or improperly processed fish waste may harbor pathogens (e.g., E. coli, Salmonella) or accumulate heavy metals (e.g., mercury, lead), antibiotics, or pesticides from aquaculture systems. Inadequate treatment poses health risks and can contaminate soil and water, violating food safety and environmental regulations.

Odor and Stabilization Issues

Unstabilized fish feces can produce strong, unpleasant odors due to anaerobic decomposition. This not only affects handling and storage but may also indicate incomplete processing, reducing shelf life and user acceptance. Poor stabilization can also lead to nutrient loss through volatilization.

Lack of Processing Standards

Many suppliers lack standardized composting, drying, or pasteurization protocols. Inconsistent processing affects product homogeneity, microbial safety, and nutrient availability. Without certification (e.g., OMRI, USDA BioPreferred), credibility and market access suffer.

Intellectual Property-Related Pitfalls

Undisclosed or Infringed Processing Technologies

Some suppliers use proprietary methods for stabilizing or enriching fish feces fertilizer (e.g., bio-fermentation, encapsulation). Sourcing from vendors using patented technologies without licensing exposes buyers to infringement claims, especially in export markets with strict IP enforcement.

Misrepresentation of IP Ownership

Vendors may falsely claim ownership of innovative formulations or branding. Buyers relying on such claims for marketing or partnerships risk legal disputes, reputational damage, and loss of investment if the IP is contested or invalidated.

Absence of IP Protection in Supply Chain

When developing custom blends or co-branded products, failure to secure IP rights (e.g., trademarks, trade secrets) via contracts can lead to disputes over formula ownership, distribution rights, or technology use. Clear agreements are essential to prevent exploitation or reverse engineering.

Export and Regulatory Compliance Conflicts

IP rights may vary by country, and patented processes in one region might not be protected elsewhere. Exporting fish feces fertilizer involving protected technology without due diligence can result in customs seizures, fines, or legal action, particularly in jurisdictions with strong agri-tech IP laws.

Mitigating these pitfalls requires due diligence: verifying processing methods, demanding third-party test results, ensuring regulatory compliance, and conducting IP audits before entering supply agreements.

Logistics & Compliance Guide for Fish Feces Fertilizer

Fish feces fertilizer, often categorized under organic or aquaculture byproduct fertilizers, presents a sustainable nutrient source for agriculture. However, its production, handling, transportation, and marketing are subject to strict regulatory and logistical requirements to ensure safety, environmental protection, and product efficacy. This guide outlines key considerations for stakeholders involved in the fish feces fertilizer supply chain.

Regulatory Classification and Permits

Fish feces fertilizer may be classified as an organic soil amendment, waste-derived fertilizer, or animal byproduct, depending on jurisdiction. Compliance begins with proper classification:

- United States: Regulated by the EPA under the Clean Water Act and by state departments of agriculture. If derived from aquaculture operations, it may fall under biosolids or compost rules. Check with the USDA National Organic Program (NOP) for organic certification eligibility.

- European Union: Falls under the Fertilising Products Regulation (EU) 2019/1009 and the Animal By-Products Regulation (EC) No 1069/2009. Requires treatment to eliminate pathogens and proper authorization for processing and use.

- Canada: Regulated by the Canadian Food Inspection Agency (CFIA) under the Fertilizers Act. Requires registration and compliance with safety standards for pathogen reduction and heavy metal content.

- Other Countries: Consult local environmental, agricultural, and health authorities. Many nations require environmental impact assessments and waste management permits.

Action Steps:

– Obtain permits for collection, processing, and land application.

– Confirm whether fish feces are classified as waste or a resource.

– Ensure compliance with organic certification standards if marketing as organic.

Collection and Processing Standards

Proper handling from the source is critical to maintain quality and safety.

- Source Control: Collect feces from healthy fish in controlled aquaculture systems. Avoid contamination with uneaten feed, medications, or pathogens.

- Stabilization: Use composting, anaerobic digestion, or thermal treatment to reduce pathogens, odor, and vector attraction.

- Pathogen Reduction: Meet regulatory thresholds for fecal coliforms, Salmonella, and other pathogens (e.g., <1,000 MPN/g fecal coliforms and no detectable Salmonella in U.S. standards).

- Contaminant Limits: Test for heavy metals (e.g., cadmium, lead, mercury), antibiotics, and persistent organic pollutants. Must comply with jurisdictional limits.

Best Practices:

– Use enclosed systems to minimize environmental release.

– Monitor pH, moisture, and temperature during composting.

– Maintain documentation of treatment processes for audits.

Packaging, Labeling, and Product Claims

Accurate labeling ensures compliance and consumer trust.

- Label Requirements:

- Nutrient content (N-P-K values).

- Application rates and instructions.

- Safety warnings (e.g., use gloves, avoid inhalation).

- Manufacturer or distributor details.

- Batch number and date of production.

- Organic Claims: Only use if certified by an accredited body (e.g., USDA Organic, EU Organic).

- Marketing Restrictions: Avoid unsubstantiated claims like “pest-resistant” or “increases yield by X%” without scientific validation.

Compliance Tip: Labels must be reviewed and approved by relevant regulatory agencies before sale.

Transportation and Storage

Due to potential odor and biosecurity risks, logistics must follow strict protocols.

- Containment: Use sealed, leak-proof containers to prevent spills and contamination.

- Temperature Control: Store in cool, dry areas to prevent microbial reactivation and odor generation.

- Regulated Transport: If classified as waste or hazardous material, comply with DOT (U.S.), ADR (EU), or other transport regulations.

- Cross-Contamination Prevention: Segregate from food, feed, and sensitive materials during transport and storage.

Documentation: Maintain manifests, treatment records, and chain-of-custody documents for traceability.

Land Application and Environmental Compliance

Improper application can lead to nutrient runoff, groundwater contamination, or odor complaints.

- Application Rates: Base on soil tests and crop needs to avoid over-application of nitrogen and phosphorus.

- Buffer Zones: Maintain setbacks from water bodies, wells, and residential areas (typically 10–100 feet, depending on regulations).

- Timing Restrictions: Avoid application during heavy rainfall, frozen ground, or snow cover.

- Recordkeeping: Document dates, rates, locations, and weather conditions of application.

Environmental Monitoring:

– Conduct periodic soil and water testing near application sites.

– Report any incidents (e.g., spills, runoff) to environmental authorities.

Worker Safety and Training

Handling organic waste materials poses health risks.

- PPE Requirements: Gloves, masks (N95), goggles, and protective clothing.

- Training: Educate staff on pathogen risks, proper handling, spill response, and hygiene.

- First Aid and Emergency Procedures: Ensure access to washing stations and emergency response plans.

International Trade Considerations

Exporting fish feces fertilizer requires additional compliance.

- Phytosanitary Certificates: May be required to prove freedom from pests and pathogens.

- Customs Classification: Use correct HS codes (e.g., 3825 for waste from food industries).

- Import Restrictions: Some countries ban or restrict organic fertilizers from animal sources. Verify recipient country regulations in advance.

Conclusion

Fish feces fertilizer can be a valuable circular economy product, but its success depends on rigorous compliance with environmental, agricultural, and health regulations. Stakeholders must implement transparent processes, maintain thorough documentation, and stay updated on evolving standards to ensure safe and legal operation across the supply chain.

In conclusion, sourcing fish feces as a fertilizer presents a sustainable and nutrient-rich alternative for organic farming and aquaponic systems. Rich in nitrogen, phosphorus, and potassium, fish waste contributes to improved soil fertility and plant growth while supporting circular economy principles by repurposing a byproduct of aquaculture. However, successful implementation requires proper collection, processing, and treatment to eliminate pathogens and reduce odor, ensuring it is safe and effective for agricultural use. With responsible management and adherence to environmental regulations, fish feces fertilizer can play a valuable role in sustainable agriculture, reducing dependency on synthetic fertilizers and minimizing environmental impact. As awareness and technology advance, the integration of fish waste into mainstream farming practices holds promising potential for a greener future.