The global fire safety products market is experiencing robust growth, driven by increasing regulatory mandates, urbanization, and rising awareness of fire hazards in industrial, commercial, and residential sectors. According to a 2023 report by Mordor Intelligence, the market was valued at USD 59.6 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 9.8% over the forecast period, reaching an estimated USD 98.7 billion by 2028. This expansion is further fueled by smart building integrations, advancements in detection technologies, and stricter compliance standards worldwide. Amid this upward trend, leading manufacturers are leveraging innovation, scalability, and global distribution networks to dominate the competitive landscape. Our data-driven selection of the top 10 fire safety products manufacturers highlights key players shaping the industry through technological leadership, revenue performance, and market reach.

Top 10 Fire Safety Products Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Larsen’s Mfg.: Fire Protection Equipment Suppliers

Domain Est. 1997

Website: larsensmfg.com

Key Highlights: Larsen’s Mfg Co is a leading fire protection equipment supplier, specializing in building construction, marine, and industrial fire safety….

#2 Fire Equipment Manufacturers Association

Domain Est. 2004

Website: femalifesafety.org

Key Highlights: Fire Equipment Manufacturers’ Association is a trade association of industry experts representing the top global brands in commercial fire protection….

#3 Edwards

Domain Est. 2013

Website: edwardsfiresafety.com

Key Highlights: Edwards provides fire alarm systems, fire detection systems, life safety systems, fire alarm panels, fire alarms, notification systems, for buildings of all ……

#4 Fire Service & First Responders

Domain Est. 1988

Website: 3m.com

Key Highlights: Fire Service and fire responder gear to help you breathe safety, see and communicate in the fire, and help ensure everyone gets out safe….

#5 NFPA

Domain Est. 1994

Website: nfpa.org

Key Highlights: The NFPA Fire & Life Safety Ecosystem™ is a framework that identifies the components that must work together to minimize risk and help prevent loss, injuries, ……

#6 ANSUL

Domain Est. 1995

Website: ansul.com

Key Highlights: ANSUL is a fire suppression company that designs and engineers specail hazard fire suppression systems and solutions for many different industries and many ……

#7 Amerex Fire

Domain Est. 1996

Website: amerex-fire.com

Key Highlights: Supportive information for all of our products, including product manuals, tech tips, safety data sheets, basic usage instructions, videos and a host of other ……

#8 LAKELAND FIRE + SAFETY

Domain Est. 1996

Website: lakeland.com

Key Highlights: Let us help you protect your team. Your team’s safety is our top priority—explore our trusted PPE products or reach out to us directly for personalized support….

#9 Tyco Fire Suppression & Fire Safety Solutions

Domain Est. 2001

Website: tyco-fire.com

Key Highlights: We have innovative and industry-leading fire safety and fire suppression solutions to protect your people and property. From sprinkler systems to valves, ……

#10 Pye

Domain Est. 2022

Website: pyebarkerfs.com

Key Highlights: We offer all the necessary specialties including portable fire extinguishers, restaurant fire suppression, special hazard systems, fire sprinklers, fire alarms ……

Expert Sourcing Insights for Fire Safety Products

H2: 2026 Market Trends for Fire Safety Products

The global fire safety products market is poised for significant transformation by 2026, driven by technological innovation, stricter regulatory frameworks, urbanization, and growing awareness of fire risks in both commercial and residential sectors. As cities expand and building complexity increases—especially with the rise of smart infrastructure and high-rise developments—demand for advanced fire detection, suppression, and evacuation systems is accelerating. The market is expected to grow at a compound annual growth rate (CAGR) of approximately 7.5% from 2021 to 2026, reaching an estimated value of over USD 105 billion by 2026, according to industry forecasts.

One of the most prominent trends shaping the 2026 landscape is the integration of Internet of Things (IoT) and artificial intelligence (AI) into fire safety systems. Smart smoke detectors, connected fire alarms, and AI-driven risk assessment platforms are enabling real-time monitoring, predictive analytics, and faster emergency response. These intelligent systems can communicate with building management systems (BMS) and emergency services, significantly improving fire prevention and reducing response times.

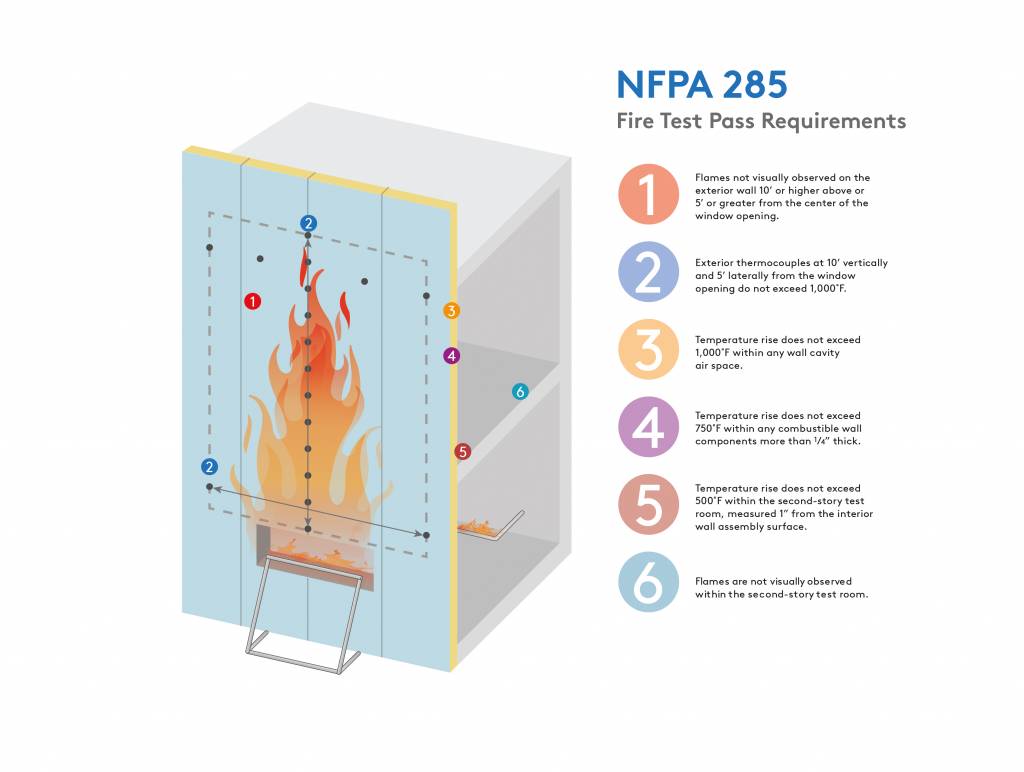

Another key driver is the tightening of fire safety regulations globally. Governments and regulatory authorities in regions such as North America, Europe, and parts of Asia-Pacific are enforcing stricter codes for fire-resistant materials, evacuation routes, and mandatory installation of fire safety equipment in new and existing buildings. For instance, the European Union’s Construction Products Regulation (CPR) and updated National Fire Protection Association (NFPA) standards in the U.S. are compelling property developers and facility managers to upgrade their fire safety infrastructure.

Additionally, the rise in green and sustainable building practices is influencing the development of eco-friendly fire suppression systems. Clean agent fire suppression technologies—such as FM-200 and Novec 1230—are gaining traction due to their minimal environmental impact and effectiveness in protecting sensitive environments like data centers and museums.

The residential sector is also experiencing a surge in demand, particularly in emerging economies. Increased disposable income, urban migration, and government-led safety campaigns are encouraging homeowners to invest in affordable yet reliable fire alarms and extinguishers. Meanwhile, the commercial and industrial sectors continue to dominate demand, especially in high-risk environments such as oil & gas, manufacturing, and transportation.

Finally, supply chain resilience and digital sales channels are becoming increasingly important. The pandemic highlighted vulnerabilities in global supply chains, prompting manufacturers to localize production and adopt digital platforms for distribution and customer support. E-commerce growth is enabling broader access to fire safety products, particularly in remote and underserved regions.

In summary, by 2026, the fire safety products market will be characterized by smart, connected solutions, regulatory compliance, sustainability, and expanded market access—ushering in a new era of proactive and integrated fire safety management.

Common Pitfalls Sourcing Fire Safety Products: Quality and Intellectual Property Risks

Sourcing fire safety products involves critical decisions that directly impact life safety and regulatory compliance. Two major areas where organizations often encounter significant pitfalls are product quality and intellectual property (IP) infringement. Overlooking these aspects can lead to ineffective protection, legal liabilities, and reputational damage.

Quality-Related Pitfalls

1. Selecting Non-Compliant or Substandard Products

A common mistake is sourcing fire safety equipment that does not meet recognized standards (e.g., UL, FM, CE, EN, or local regulatory requirements). Low-cost suppliers may offer products that appear functional but fail under real fire conditions. This compromises building safety and exposes organizations to liability in the event of fire-related incidents.

2. Lack of Proper Certification Verification

Buyers may accept certificates at face value without verifying their authenticity or scope. Some suppliers provide forged or outdated certifications, or certificates that apply to different product models. Failing to validate certifications through official databases or third-party verification increases the risk of non-compliant installations.

3. Inadequate Supplier Due Diligence

Relying on unvetted suppliers—especially from unfamiliar markets—can lead to inconsistent product quality. Without assessing a supplier’s manufacturing processes, quality control systems, or track record, buyers risk receiving products with material defects, poor workmanship, or short lifespans.

4. Ignoring Long-Term Performance and Maintenance Needs

Some fire safety products may function initially but degrade quickly due to poor materials or design. Sourcing decisions that don’t consider environmental resilience (e.g., humidity, temperature, corrosion) or ease of maintenance can result in system failures when needed most.

Intellectual Property-Related Pitfalls

1. Purchasing Counterfeit or Clone Products

The fire safety market is susceptible to counterfeit goods that mimic well-known brands. These products not only pose safety risks but also infringe on intellectual property rights. Organizations that unknowingly install such products may face legal action, especially if the original IP holder pursues liability claims.

2. Lack of IP Compliance in Custom or OEM Sourcing

When sourcing custom-designed fire safety systems or components from OEMs, buyers may not ensure that designs or software do not infringe on existing patents or trademarks. This can lead to costly litigation and product recalls if third-party IP rights are violated.

3. Insufficient Contractual IP Protections

procurement contracts often fail to clearly define IP ownership, usage rights, or indemnification clauses. Without these, buyers risk losing control over proprietary designs or becoming liable for IP violations committed by the supplier.

4. Using Unauthorized Replicas or “Look-Alike” Equipment

Some suppliers offer cheaper alternatives that closely resemble certified equipment but lack proper testing or approvals. These replicas may infringe on design patents or trademarks and fail to perform to the required safety standards, undermining both legal and operational integrity.

Mitigation Strategies

To avoid these pitfalls, organizations should:

– Conduct rigorous supplier audits and request verifiable test reports and certifications.

– Work with authorized distributors or directly with reputable manufacturers.

– Include IP warranties and indemnification clauses in procurement contracts.

– Perform regular product inspections and third-party testing where feasible.

By addressing quality and IP risks proactively, organizations can ensure their fire safety systems are both reliable and legally compliant.

Logistics & Compliance Guide for Fire Safety Products

Overview

Fire safety products—including fire extinguishers, smoke detectors, fire alarms, sprinkler systems, and emergency lighting—are critical for life safety and property protection. Their logistics and compliance management must adhere to strict national and international regulations to ensure reliability, traceability, and performance. This guide outlines key considerations for transporting, storing, and complying with regulatory standards for fire safety equipment.

Regulatory Compliance Requirements

Fire safety products are subject to a range of regulatory standards depending on the region and product type. Key standards include:

– United States: NFPA (National Fire Protection Association) codes, OSHA regulations, and UL (Underwriters Laboratories) certification

– European Union: CE marking under the Construction Products Regulation (CPR) and EN standards (e.g., EN 3 for extinguishers, EN 14604 for smoke alarms)

– United Kingdom: UKCA marking post-Brexit, adherence to BS standards (e.g., BS 5839 for fire alarm systems)

– International: ISO standards such as ISO 7150 (fire extinguishers) and IEC 62945 (smoke detectors)

All products must maintain valid certifications, with documentation readily available for audits or inspections.

Packaging and Labeling Standards

Proper packaging and labeling are essential for compliance and safe handling:

– Use durable, protective packaging to prevent damage during transit

– Clearly label packages with:

– Product name and model number

– Certification marks (e.g., UL, CE, UKCA)

– Hazard warnings (if applicable, e.g., pressurized containers)

– Handling instructions (e.g., “Do Not Invert,” “Keep Dry”)

– Include user manuals, installation guides, and compliance certificates inside or with shipments

Storage Conditions

Fire safety products must be stored under controlled conditions to maintain integrity:

– Temperature: Store between 40°F and 100°F (4°C to 38°C), avoiding freezing or extreme heat

– Humidity: Maintain low to moderate humidity to prevent corrosion or electronic damage

– Ventilation: Ensure adequate airflow, especially for pressurized equipment

– Segregation: Store flammable components or gas cylinders separately, in accordance with local fire codes

– Shelving: Use stable, non-combustible shelving; avoid floor storage to prevent water or impact damage

Transportation and Shipping

Transporting fire safety products—especially pressurized or battery-powered devices—must comply with transportation regulations:

– DOT (U.S.) and ADR (Europe): Regulate the shipment of pressurized fire extinguishers and aerosols

– IATA/IMDG: Apply to air and sea transport of hazardous materials (e.g., extinguishers classified as Class 2.2 non-flammable gas)

– Use certified hazardous materials packaging when required

– Declare contents accurately on shipping documents

– Partner with carriers experienced in handling regulated safety goods

Inventory Management and Traceability

Maintain rigorous inventory controls to ensure product efficacy and compliance:

– Implement a batch/serial number tracking system for full traceability

– Monitor shelf life; many fire safety products (e.g., detectors, extinguishers) require servicing or replacement every 5–10 years

– Conduct regular audits to verify stock condition and certification validity

– Integrate with ERP or warehouse management systems (WMS) for real-time visibility

Installation and Certification Documentation

Post-delivery compliance includes proper installation and documentation:

– Only licensed or certified technicians should install systems like alarms and sprinklers

– Maintain records of:

– Product certifications

– Installation dates and locations

– Inspection and maintenance logs

– Provide end customers with compliance certificates and user documentation

Returns and End-of-Life Handling

Manage product returns and disposal responsibly:

– Establish a return authorization (RMA) process for defective or expired items

– Follow EPA, WEEE, or local regulations for recycling electronic components (e.g., smoke detectors with radioactive material)

– Depressurize and discharge extinguishers before disposal, per environmental guidelines

– Partner with certified waste handlers for safe decommissioning

Conclusion

Effective logistics and compliance for fire safety products are vital to public safety and regulatory adherence. By following proper handling, storage, transportation, and documentation practices—and staying current with evolving standards—suppliers, distributors, and installers can ensure reliable performance and legal compliance across the supply chain.

In conclusion, sourcing fire safety products is a critical responsibility that demands careful consideration of quality, compliance, reliability, and long-term performance. It is essential to partner with reputable suppliers who provide certified products in accordance with national and international safety standards such as NFPA, UL, EN, or local regulatory requirements. Conducting thorough due diligence—evaluating product specifications, warranty terms, maintenance support, and supplier track record—ensures that the chosen solutions effectively protect lives, property, and assets in the event of a fire emergency.

Moreover, investing in high-quality fire safety equipment not only enhances preparedness and response capabilities but also demonstrates a commitment to regulatory compliance and corporate social responsibility. As technology advances, integrating smart and innovative fire detection and suppression systems can further improve safety outcomes. Ultimately, a strategic and informed approach to sourcing fire safety products is indispensable for building a safer, more resilient environment in any residential, commercial, or industrial setting.