The global finger joint molding market is experiencing steady growth, driven by rising demand for sustainable, cost-effective wood products in construction and interior design. According to Grand View Research, the global engineered wood products market—under which finger jointed molding falls—was valued at USD 175.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 7.3% from 2023 to 2030. This growth is fueled by advancements in wood processing technologies, increasing urbanization, and a shift toward eco-friendly building materials. Finger joint molding, known for its strength, dimensional stability, and efficient use of timber resources, has become a preferred alternative to solid wood in millwork applications. As demand rises, a select group of manufacturers have emerged as leaders in innovation, quality, and production capacity. Based on market presence, output volume, and technological investment, here are the top 9 finger joint molding manufacturers shaping the industry’s future.

Top 9 Finger Joint Molding Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Mouldings & Millwork

Domain Est. 1998

Website: spi-ind.com

Key Highlights: Sierra Pacific Industries is the nation’s leading moulding and millwork manufacturer. Our customers can depend on a consistent supply of our products….

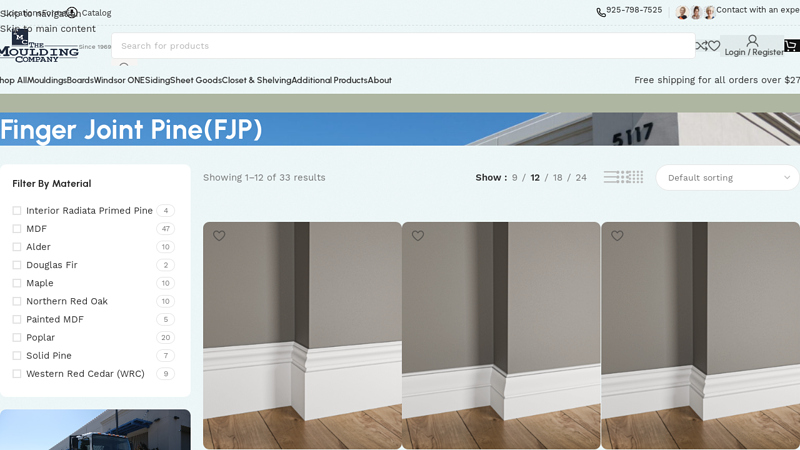

#2 Finger Joint Pine(FJP) Archives

Domain Est. 2003

Website: themouldingcompany.com

Key Highlights: Finger Joint Pine (Primed) refers to mouldings made from pine segments joined with precision finger joints and factory-primed for interior use….

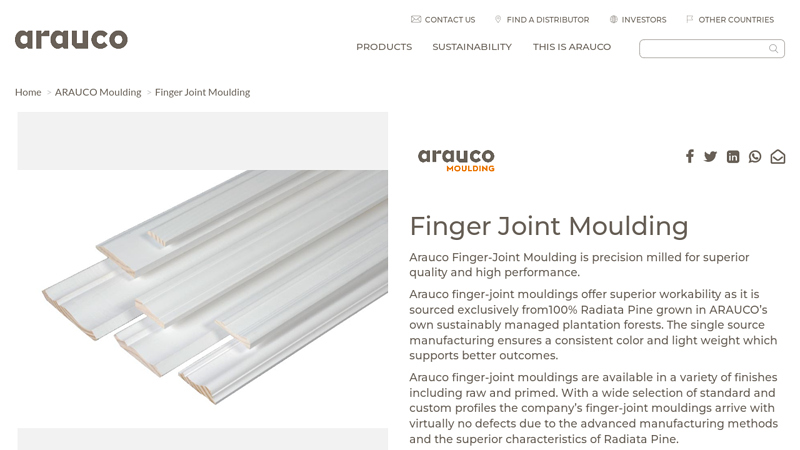

#3 Finger

Domain Est. 1996

Website: na.arauco.com

Key Highlights: Arauco finger-joint mouldings are available in many profiles and finishes including raw and primed. Virtually no defects, 100% Radiata Pine….

#4 ARAUCO Aus/NZ

Domain Est. 1996

Website: arauco.com

Key Highlights: Arauco finger-joint mouldings offer superior workability as it is sourced exclusively from100% Radiata Pine grown in ARAUCO’s own sustainably managed plantation ……

#5 [PDF] Fingerjoint moulding 2023

Domain Est. 1997

Website: masisa.com

Key Highlights: Fingerjoint moulding is a trim made by joining short pieces of wood together using interlocking finger joints. It maximizes wood usage, provides strong and ……

#6 Moulding

Domain Est. 1999

Website: smithanddeshields.com

Key Highlights: Nothing finishes a room like the right moulding. We have a vast selection of mouldings in various sizes, designs and material to get the look you desire….

#7 Wholesale Moulding Suppliers

Domain Est. 2005

Website: taigabuilding.com

Key Highlights: Taiga moulding products are manufactured using medium-density fibreboard (MDF) or finger joint pine (FJP). Our MDF moulding wholesale products are ……

#8 Finger Joint Moulding & Trim

Domain Est. 2010

#9 Stock Finger Joint Moldings

Domain Est. 2022

Website: keimcompany.com

Key Highlights: At Keim, you can choose from more than 11,000 profiles in stock or create your own design from your existing molding or sample drawing….

Expert Sourcing Insights for Finger Joint Molding

H2: 2026 Market Trends for Finger Joint Molding

The Finger Joint Molding market in 2026 is poised for significant evolution, driven by rising construction demand, sustainability imperatives, and technological advancements. While specific 2026 data is inherently predictive, key trends emerging in 2023-2025 are expected to solidify and accelerate by 2026, shaping a dynamic landscape.

1. Sustained Growth in Residential Construction & Renovation:

The primary driver remains robust global demand for affordable housing and home improvement. Finger jointed molding, offering a cost-effective and stable alternative to solid wood, is increasingly favored by builders and homeowners. In 2026, this trend will be amplified by:

* Urbanization & Population Growth: Continued migration to cities fuels demand for multi-family housing where cost-efficiency is paramount.

* Affordability Pressures: As solid wood costs remain volatile or high, finger-jointed products provide a reliable, lower-cost solution without sacrificing aesthetics.

* DIY & Remodeling Boom: The strong DIY culture, particularly in North America and Europe, drives demand for easy-to-install, paintable molding profiles.

2. Dominance of Sustainability & Eco-Certification:

Environmental responsibility will transition from a differentiator to a fundamental market requirement by 2026.

* Waste Minimization: The core benefit of using smaller, often fast-growing or lower-grade wood scraps will be heavily marketed as a key sustainability advantage.

* Certification Focus: Demand for FSC (Forest Stewardship Council) or PEFC (Programme for the Endorsement of Forest Certification) certified finger-jointed products will surge. Builders and consumers will prioritize traceability and responsible sourcing.

* Low-VOC Emissions: Stricter regulations (like TSCA Title VI in the US, CARB) and consumer demand will push manufacturers towards formaldehyde-free or ultra-low-emitting adhesives (e.g., MUF, PVA, soy-based).

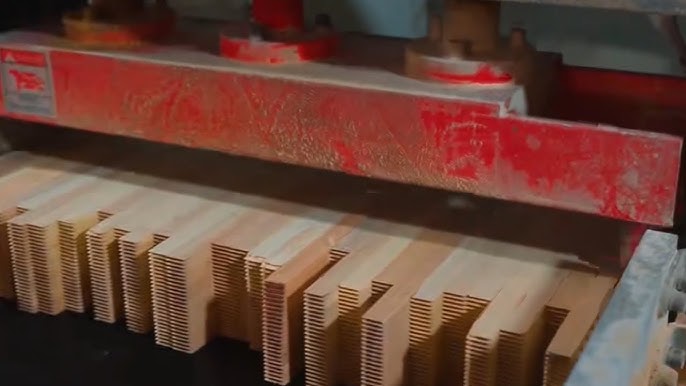

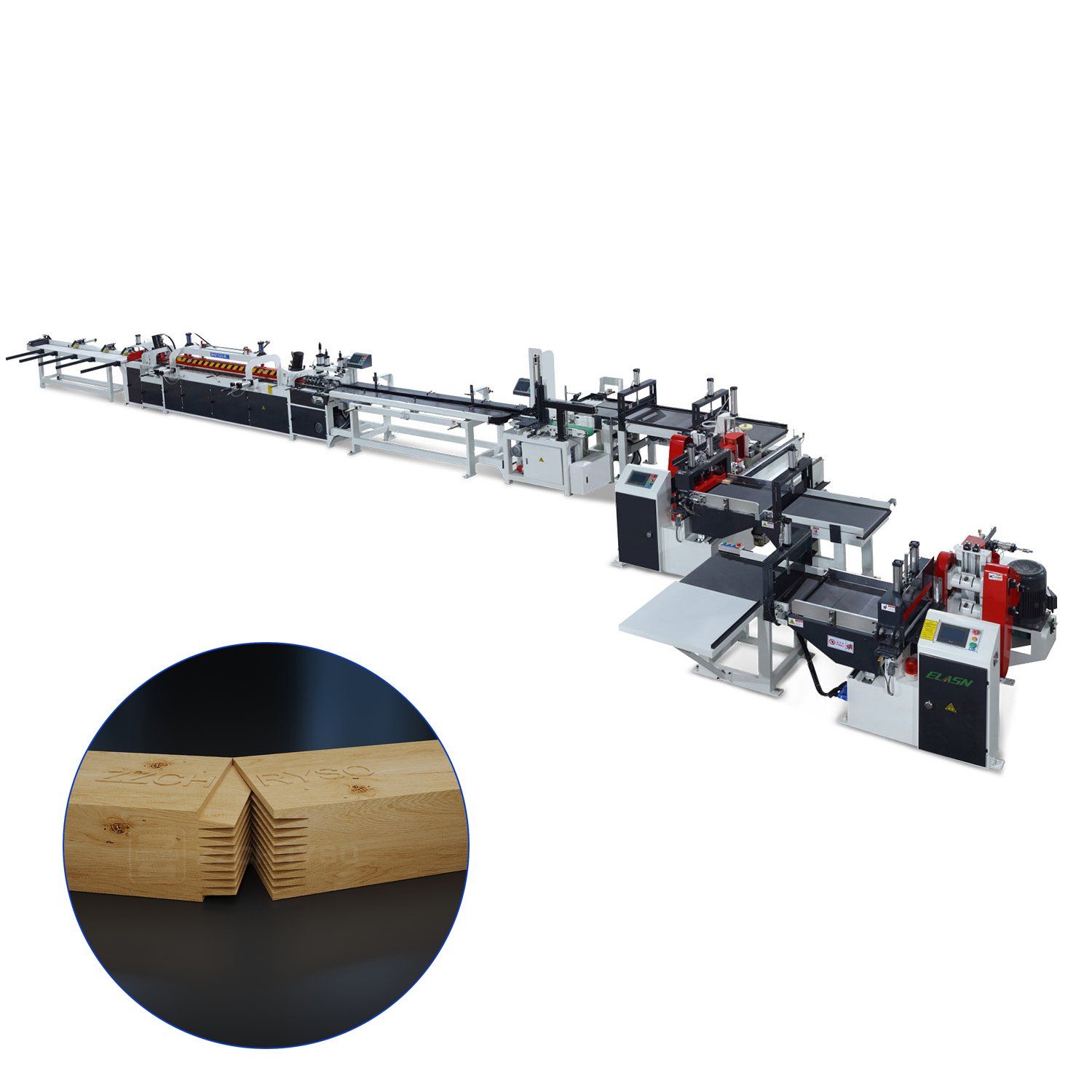

3. Technological Advancements in Production & Quality:

Manufacturers will invest heavily to improve efficiency, consistency, and product performance.

* Precision Machining & Automation: Increased use of CNC machining centers and automated handling will ensure tighter tolerances, consistent joint quality, and reduced waste, enhancing the product’s reputation for reliability.

* Enhanced Adhesive Technologies: Development and adoption of stronger, more durable, and environmentally friendly adhesives will improve the long-term stability and performance of finger-jointed molding, especially in challenging environments (e.g., humidity, temperature fluctuations).

* Improved Drying & Conditioning: Advanced kiln drying and conditioning processes will minimize residual stress and moisture content, reducing the risk of warping or cracking post-installation.

4. Product Diversification & Value-Added Offerings:

Competition will drive innovation beyond basic profiles.

* Expanded Design Libraries: Manufacturers will offer wider ranges of profiles, replicating intricate historical styles and contemporary designs previously only achievable with solid wood.

* Pre-Finished & Pre-Painted Options: To cater to faster construction timelines and DIYers, a significant increase in pre-primed, pre-painted, or even pre-stained finger-jointed molding is expected, reducing on-site labor and improving finish consistency.

* Hybrid Materials: Exploration of combining finger-jointed wood cores with thin veneers of premium hardwood species for high-end aesthetic applications.

5. Supply Chain Resilience & Regionalization:

Post-pandemic and geopolitical uncertainties will lead to strategic shifts.

* Nearshoring/Reshoring: Particularly in North America and Europe, there will be increased pressure and investment to build local/regional manufacturing capacity to reduce dependence on long, vulnerable supply chains and mitigate tariff risks.

* Raw Material Security: Manufacturers will focus on securing long-term, sustainable wood supply agreements and potentially investing in managed fast-growing plantations.

6. Competitive Landscape & Consolidation:

The market will likely see:

* Increased Competition: Entry of new players, particularly in emerging markets and those focusing on niche, high-quality segments.

* Consolidation: Larger players may acquire smaller regional manufacturers to expand capacity, geographic reach, and product portfolios.

* Brand Differentiation: Success will hinge on strong branding around quality, consistency, sustainability credentials, and customer service.

Conclusion for 2026:

By 2026, the Finger Joint Molding market will be characterized by maturity, sustainability focus, and technological sophistication. It will be a mainstream solution firmly established in residential construction and renovation, valued for its cost-efficiency, dimensional stability, and eco-friendly production. Winners will be those manufacturers who successfully leverage automation for quality, embrace transparent and certified sustainability practices, innovate with value-added products (especially pre-finished options), and build resilient, agile supply chains. The perception of finger-jointed molding will continue to shift from a “budget alternative” to a smart, sustainable, and high-performance building material choice.

Common Pitfalls When Sourcing Finger Joint Molding: Quality and Intellectual Property Concerns

Sourcing finger joint molding, especially from overseas suppliers, presents several challenges that can impact both product quality and legal compliance. Two major areas of concern are quality inconsistencies and intellectual property (IP) risks.

Quality-Related Pitfalls

One of the most frequent issues in sourcing finger joint molding is maintaining consistent product quality. Raw material variability—such as differences in wood species, moisture content, and grain structure—can lead to warping, splitting, or poor joint integrity. Inadequate adhesive application or curing processes may result in weak finger joints that fail under stress. Additionally, inconsistent machining precision can cause misalignment or surface imperfections, affecting the final fit and finish. Without rigorous quality control protocols and on-site inspections, buyers may receive substandard batches that do not meet specifications, leading to rework, delays, or customer dissatisfaction.

Intellectual Property Risks

Sourcing finger joint molding also exposes buyers to significant intellectual property concerns, particularly when working with custom profiles or proprietary designs. Suppliers in certain regions may lack strong IP enforcement, increasing the risk of design duplication or unauthorized production. Sharing detailed technical drawings or molds without proper legal safeguards—such as non-disclosure agreements (NDAs) or registered design patents—can enable third parties to replicate and sell similar products. Furthermore, if the supplier uses counterfeit tooling or infringes on existing patents, the buyer could face legal liability. To mitigate these risks, it is essential to conduct due diligence on suppliers, secure IP rights in relevant jurisdictions, and include clear IP clauses in sourcing contracts.

Logistics & Compliance Guide for Finger Joint Molding

Finger joint molding, a composite wood product made by joining shorter lengths of lumber with interlocking “fingers” and adhesive, requires careful attention to logistics and regulatory compliance throughout its supply chain. This guide outlines key considerations for manufacturers, distributors, and importers/exporters.

Material Sourcing & Certification

Ensure raw materials (typically softwood lumber) are sourced from sustainable forests. Verify compliance with forestry regulations such as FSC (Forest Stewardship Council) or SFI (Sustainable Forestry Initiative), especially for projects requiring green building certification. Maintain documentation of chain-of-custody certifications where applicable.

Adhesive & Emissions Compliance

Finger joint molding must comply with formaldehyde emission standards, particularly in regions like the U.S. and EU. In the United States, ensure products meet EPA TSCA Title VI and California Air Resources Board (CARB) ATCM Phase 2 requirements. In the European Union, compliance with EN 717-1 for formaldehyde emissions is essential. Use adhesives that meet these standards and retain test reports for audit purposes.

Product Labeling & Marking

Clearly label products with essential information including:

– Product name and dimensions

– Species of wood

– Grade (e.g., Premium, Select)

– Manufacturer name and production date

– Compliance marks (e.g., CARB Phase 2, FSC)

– Batch or lot number for traceability

Packaging & Handling

Use protective packaging to prevent damage during transit, especially at the ends where finger joints are located. Secure moldings on pallets with banding or shrink wrap. Clearly label packages with handling instructions (e.g., “Fragile,” “This Side Up”) and moisture protection warnings. Avoid direct ground contact in storage to prevent moisture absorption.

Transportation & Shipping

Choose transport methods that minimize vibration and exposure to moisture. In international shipping, comply with ISPM 15 regulations for wooden packaging materials—use heat-treated (HT) or methyl bromide (MB)-treated pallets and mark them accordingly. Ensure proper insurance coverage for loss or damage during transit.

Import/Export Documentation

For cross-border shipments, prepare accurate documentation including:

– Commercial invoice

– Packing list

– Bill of lading or air waybill

– Certificate of Origin

– Phytosanitary certificate (if required)

– Test reports for emissions compliance

Ensure Harmonized System (HS) codes are correctly applied (e.g., 4409.29 for finger-jointed wood molding under HS 2022).

Storage & Inventory Management

Store finger joint molding in a dry, well-ventilated area, off the ground and away from direct sunlight. Maintain stable temperature and humidity to prevent warping or joint failure. Practice FIFO (First-In, First-Out) inventory rotation to reduce the risk of material degradation.

Quality Control & Traceability

Implement quality checks at production and before shipment. Record batch numbers and test results to enable traceability in case of recalls or compliance audits. Maintain logs of adhesive batch numbers and press parameters.

Regulatory Updates & Audits

Stay informed about changes in environmental regulations, building codes, and trade policies. Conduct regular internal audits and be prepared for third-party inspections, especially if supplying to government or institutional projects.

By adhering to this logistics and compliance framework, stakeholders in the finger joint molding industry can ensure product quality, minimize legal risks, and support sustainable practices.

Conclusion for Sourcing Finger Joint Molding:

In conclusion, sourcing finger joint molding requires a strategic approach that balances quality, cost, sustainability, and supply chain reliability. Finger joint molding offers a durable and cost-effective solution for trim and decorative applications, combining aesthetic appeal with structural integrity. By partnering with reputable suppliers who adhere to industry standards and utilize kiln-dried, stress-tested lumber, businesses can ensure consistent product performance and longevity.

Key considerations in the sourcing process include evaluating the supplier’s manufacturing capabilities, quality control procedures, environmental certifications (such as FSC or SFI), and ability to meet volume and lead time requirements. Additionally, conducting sample testing and factory audits can mitigate risks related to material defects or non-compliance.

Ultimately, successful sourcing of finger joint molding not only supports project efficiency and cost savings but also aligns with sustainable building practices. With careful supplier selection and ongoing relationship management, companies can secure a reliable supply of high-quality moldings that meet both technical specifications and market demands.

![[PDF] Fingerjoint moulding 2023](https://www.sohoinchina.com/wp-content/uploads/2026/01/pdf-fingerjoint-moulding-2023-162.png)