The global manufacturing sector is undergoing a transformation driven by technological innovation, rising demand for customized production, and the expansion of advanced supply chain networks. According to a 2023 report by Mordor Intelligence, the global manufacturing market was valued at USD 14.3 trillion and is projected to grow at a CAGR of 4.2% from 2023 to 2028. This sustained growth is fueled by the increasing adoption of automation, reshoring initiatives, and the growing need for specialized, high-efficiency manufacturing partners. As businesses seek to remain competitive in an evolving industrial landscape, identifying the right manufacturers has become more critical than ever. With market expansion accelerating across Asia-Pacific, North America, and Europe—highlighted in research from Grand View Research, which notes a projected CAGR of 4.5% for the global contract manufacturing market from 2023 to 2030—companies must leverage data-driven insights to pinpoint reliable, scalable, and innovative manufacturing partners. The following list highlights ten leading manufacturers poised to support next-generation production demands across key industries.

Top 10 Find Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

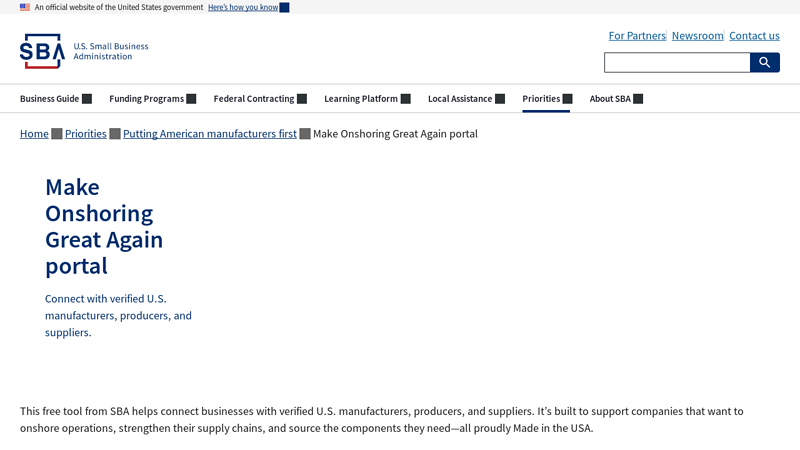

#1 Make Onshoring Great Again portal

Domain Est. 1997

Website: sba.gov

Key Highlights: Search for verified U.S. manufacturers, producers, and suppliers, find inputs and goods that are Made in America, and connect with domestic organizations ……

#2 Materials Science & Chemical Manufacturing

Domain Est. 1992

Website: dow.com

Key Highlights: Dow is a materials science company that offers a wide range of products and services, including agricultural films, construction materials, ……

#3 National Association of Manufacturers

Domain Est. 1995

Website: nam.org

Key Highlights: 90% of the NAM’s members are small and medium-sized manufacturers. Thanks to leading manufacturers who step forward to be their voice, we’re a powerful force ……

#4 How To Find a Manufacturer or Supplier for a Product (2026)

Domain Est. 2005

Website: shopify.com

Key Highlights: This guide walks you through finding a manufacturer or supplier for your product ideas, with advice for evaluating manufacturers, deciding between domestic and ……

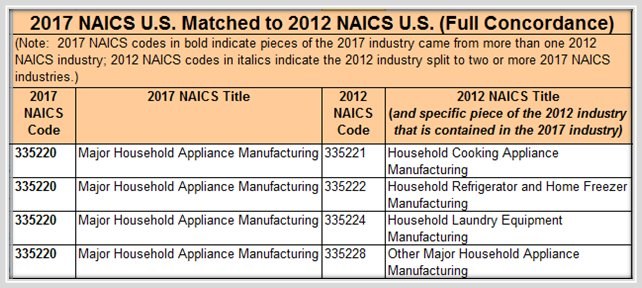

#5 NAICS Code & SIC Identification Tools

Domain Est. 1996

Website: naics.com

Key Highlights: Find accurate NAICS code and SIC codes for your business using our identification tools and services. Contact NAICS Association Today….

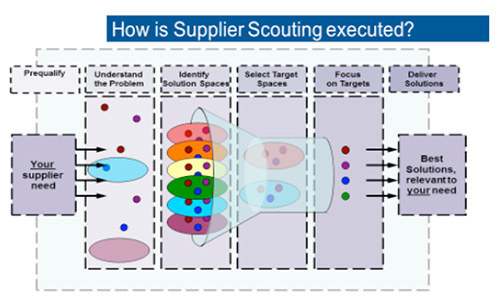

#6 Supplier Scouting

Domain Est. 1997

Website: nist.gov

Key Highlights: The MEPNN’s supplier scouting service provides a viable means by which domestic manufacturing suppliers can be catalyzed to produce needed items domestically….

#7 Manufacturing.gov

Domain Est. 2003

Website: manufacturing.gov

Key Highlights: The manufacturing.gov website serves as the primary hub for information about federal manufacturing programs, funding opportunities, and other valuable ……

#8 Supplier.io

Domain Est. 2013

Website: supplier.io

Key Highlights: Supplier.io provides a Supplier Intelligence Platform for tracking, finding, and measuring the impact of sourcing with small, diverse and sustainable ……

#9 Made in America

Domain Est. 2021

Website: madeinamerica.gov

Key Highlights: Made in America. Buying and hiring American is the key to building economic prosperity and guaranteeing our national security….

#10 IQS Directory: OEM Manufacturers

Domain Est. 2004

Website: iqsdirectory.com

Key Highlights: Discover a comprehensive industrial directory at IQS, connecting you to top OEM manufacturers, suppliers & distributors. Streamline your sourcing needs ……

Expert Sourcing Insights for Find

H2: 2026 Market Trends for Find

As we approach 2026, the market landscape for Find—presumably a search technology, AI-driven discovery platform, or consumer-facing search application—will be shaped by rapid advancements in artificial intelligence, evolving user behaviors, and increasing demand for personalized, context-aware information retrieval. Below is an analysis of key market trends expected to influence Find’s trajectory in 2026.

-

Dominance of AI-Powered Search

By 2026, traditional keyword-based search will increasingly give way to AI-driven semantic and intent-based search models. Find is likely to leverage large language models (LLMs) and multimodal AI to interpret complex queries, understand context, and deliver more accurate, conversational responses. Integration with generative AI will allow Find to summarize, compare, and synthesize information on-demand, setting it apart from legacy search engines. -

Rise of Personalized Discovery Ecosystems

Users will expect hyper-personalized experiences based on real-time behavior, preferences, and context. Find will need to utilize advanced user profiling (with privacy safeguards) to offer anticipatory search—surfacing relevant content before explicit queries are made. This shift will position Find not just as a search tool, but as a proactive digital assistant embedded across devices and platforms. -

Privacy-First Search Models

With tightening global data regulations (e.g., GDPR, CCPA, and emerging AI governance laws), trust will be a key differentiator. In 2026, market leaders like Find will prioritize on-device processing, anonymized data handling, and transparent AI practices. Privacy-compliant personalization will become a competitive edge in consumer and enterprise markets. -

Integration with Ambient and Multimodal Interfaces

The proliferation of smart wearables, AR/VR, and voice-activated devices will drive demand for multimodal search. Find is expected to expand beyond text input, supporting voice, image, and gesture-based queries. Seamless integration into ambient computing environments—such as smart homes and vehicles—will broaden its utility and user engagement. -

Growth of Vertical and Niche Search Platforms

General-purpose search will face competition from specialized search engines in sectors like healthcare, e-commerce, education, and legal research. Find may differentiate itself by offering modular, industry-specific search solutions powered by domain-optimized AI, enabling deeper insights and faster retrieval in professional contexts. -

Monetization Through Value-Added Discovery Services

Traditional advertising models will decline in effectiveness. Instead, Find will likely pivot toward subscription-based services, API access for developers, and premium features such as real-time data analysis, citation tracking, or AI-curated content streams. B2B partnerships and enterprise search solutions will drive revenue growth. -

Competition and Consolidation in the Search Arena

The search market will remain competitive, with tech giants, startups, and open-source initiatives vying for dominance. Find’s ability to innovate rapidly, maintain ethical AI standards, and form strategic alliances will determine its market position. Consolidation—through acquisitions or partnerships—may accelerate to capture market share and talent.

In conclusion, the 2026 market for Find will be defined by intelligent, privacy-conscious, and context-aware discovery solutions. Success will depend on balancing cutting-edge AI capabilities with user trust, seamless integration across platforms, and adaptability to evolving consumer and enterprise needs.

Common Pitfalls When Sourcing Find (Quality, IP)

Sourcing “Find” — often referring to components, materials, or services discovered outside established supply chains — introduces significant risks, particularly concerning quality and intellectual property (IP). Failing to manage these risks properly can lead to product failures, legal disputes, and reputational damage. Below are common pitfalls to avoid:

Overlooking Supplier Vetting and Qualification

Many organizations rush to source from new or unknown suppliers offering lower prices or faster delivery, but neglect thorough due diligence. Without verifying a supplier’s certifications, production capabilities, and quality management systems, companies risk receiving substandard components that compromise product performance and safety.

Assuming Quality Based on Price or Availability

A common mistake is equating low cost or immediate availability with acceptable quality. Unqualified suppliers may cut corners in materials or processes, leading to inconsistent or non-compliant outputs. Relying on visual inspections alone or skipping batch testing increases the likelihood of defective parts entering the supply chain.

Inadequate Quality Assurance Protocols

Even with a seemingly reliable supplier, failing to implement ongoing quality checks — such as incoming inspections, statistical process control, or third-party audits — can allow quality issues to go undetected. Without standardized procedures, deviations in tolerance, materials, or performance may not be caught until after integration.

Ignoring Intellectual Property Risks

Sourcing from unverified suppliers increases the risk of IP infringement. Components may be counterfeit, reverse-engineered, or produced using stolen designs or proprietary technology. Using such parts can expose the buyer to legal liability, product recalls, or injunctions — especially in regulated industries.

Lack of Traceability and Documentation

Poor record-keeping or missing documentation (e.g., material certifications, test reports, origin proofs) makes it difficult to verify component authenticity or troubleshoot failures. Without full traceability, identifying the source of quality issues or defending against IP claims becomes nearly impossible.

Failing to Secure IP Ownership in Custom Designs

When sourcing custom parts or tools, companies often neglect to formalize IP ownership in contracts. Suppliers may claim rights to designs, tooling, or process innovations, limiting the buyer’s ability to switch vendors or protect competitive advantages.

Relying on Verbal Agreements or Weak Contracts

Informal arrangements or contracts lacking clear quality standards, IP clauses, and compliance requirements leave companies vulnerable. Ambiguity can lead to disputes over responsibilities, warranties, and liabilities when problems arise.

Not Monitoring for Counterfeits and Gray Market Goods

Unqualified sourcing channels are prone to counterfeit or gray market components. These parts may appear authentic but fail under stress or have shortened lifespans. Without verification methods like part marking checks, electrical testing, or supply chain mapping, these risks go unnoticed.

Underestimating Regulatory and Compliance Exposure

Components sourced without regard for industry standards (e.g., RoHS, REACH, ISO certifications) can lead to non-compliance, especially in aerospace, medical, or automotive sectors. This jeopardizes product certifications and exposes the company to fines or market withdrawal.

Conclusion

To mitigate these pitfalls, companies must establish rigorous sourcing protocols that include supplier qualification, contractual IP protections, ongoing quality monitoring, and robust documentation practices. Proactive management of both quality and IP in the sourcing process is essential to ensure reliability, compliance, and long-term competitiveness.

Logistics & Compliance Guide for Find

This guide outlines the essential logistics and compliance requirements for operating Find, ensuring smooth operations, regulatory adherence, and customer satisfaction.

Order Fulfillment Process

All orders placed on the Find platform must be processed within 24 hours of receipt. This includes order confirmation, inventory allocation, and shipment initiation. Sellers are required to use approved shipping carriers and provide real-time tracking information to both the platform and the customer. Orders must be accurately packaged to prevent damage during transit, and all shipments must include a packing slip with the order details.

Inventory Management

Sellers must maintain accurate, up-to-date inventory levels on the Find platform to prevent overselling. Integration with a certified inventory management system is mandatory. Physical inventory audits must be conducted quarterly, and records must be retained for a minimum of two years. In the event of stock discrepancies, sellers must report the issue to Find support within 48 hours and initiate corrective action immediately.

Shipping & Delivery Standards

Standard shipping must be fulfilled within 2 business days of order processing. Express shipping options, if offered, must be delivered within 1–2 business days. All packages must be shipped with insurance covering the full value of the contents. International shipments must comply with destination country regulations, including customs documentation, import duties, and restricted items policies. Delivered packages must be confirmed via electronic proof of delivery.

Import & Export Compliance

Sellers engaging in cross-border trade through Find must adhere to all applicable import and export regulations. This includes securing proper export licenses, completing accurate commercial invoices, and complying with sanctions lists (e.g., OFAC, EU). Prohibited or restricted goods (e.g., hazardous materials, counterfeit items) are strictly forbidden. All documentation must be retained for a minimum of five years and made available for audit upon request.

Data Privacy & Security

All seller operations must comply with data protection laws such as GDPR, CCPA, and applicable local regulations. Customer data collected through Find must be encrypted, stored securely, and used only for order fulfillment and customer service purposes. Unauthorized data sharing or retention beyond the required period is prohibited. Sellers must report any data breaches to Find within 24 hours of discovery.

Product Compliance & Labeling

Products listed on Find must meet all safety, labeling, and regulatory standards of the destination market. This includes compliance with FCC, CE, RoHS, CPSIA, and other relevant certifications where applicable. Products must be accurately described, and all required labels (e.g., country of origin, ingredients, safety warnings) must be present. Misrepresentation or sale of non-compliant products may result in account suspension.

Returns & Refunds

A clear and accessible returns policy must be displayed on all product listings. Returns must be accepted within 30 days of delivery for eligible items, provided they are unused and in original packaging. Refunds must be processed within 5 business days of receiving the returned item. Sellers must provide a prepaid return label for defective or incorrect items. All return activity must be logged and reported through the Find seller portal.

Regulatory Audits & Reporting

Sellers are subject to periodic compliance audits by Find or its designated third parties. Audit requests may include inspection of inventory, shipping records, compliance certifications, and financial documentation. Sellers must respond to audit requests within 7 business days and provide all requested documentation. Failure to comply may result in penalties, suspension, or termination of platform access.

Environmental & Ethical Standards

Sellers are expected to adhere to sustainable and ethical business practices. Packaging should be recyclable and minimize plastic use. Suppliers must not engage in forced labor, child labor, or unsafe working conditions. Sellers may be required to provide evidence of ethical sourcing upon request. Find reserves the right to delist products that do not meet these standards.

Conclusion: Sourcing and Finding a Manufacturer

Successfully sourcing and finding the right manufacturer is a critical step in bringing a product to market efficiently and profitably. It requires thorough research, clear communication of specifications, and careful evaluation of potential partners based on factors such as production capabilities, quality standards, cost efficiency, lead times, and ethical practices. Utilizing various sourcing methods—such as online platforms, trade shows, industry referrals, or sourcing agents—can help identify viable manufacturing options, particularly in competitive markets like China, Vietnam, or Mexico.

Due diligence, including factory audits, sample testing, and verifying certifications, minimizes risks related to product quality, compliance, and supply chain disruptions. Building strong, transparent relationships with manufacturers fosters long-term collaboration, scalability, and adaptability in response to market demands.

In conclusion, a strategic and well-executed manufacturer sourcing process not only ensures product quality and cost-effectiveness but also lays the foundation for a resilient and sustainable supply chain, ultimately contributing to the success and growth of your business.