The global air filtration manufacturing market is experiencing robust expansion, driven by increasing industrialization, stringent environmental regulations, and growing health awareness. According to Mordor Intelligence, the air filter market was valued at USD 11.56 billion in 2023 and is projected to reach USD 16.54 billion by 2029, growing at a CAGR of 6.16% during the forecast period. Complementary insights from Grand View Research highlight similar momentum, attributing growth to rising demand in HVAC systems, healthcare facilities, and automotive applications. With air quality emerging as a critical public health priority, manufacturers are scaling innovation in filter efficiency, sustainable materials, and smart monitoring capabilities. In this competitive landscape, the top 10 air filtration manufacturers stand out through technological leadership, global reach, and compliance with evolving air quality standards—shaping the future of clean air solutions across industries.

Top 10 Filtration Air Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Engine and Industrial Air, Oil and Liquid Filtration

Domain Est. 1995

Website: donaldson.com

Key Highlights: Donaldson Company, Inc. is a global leader in providing engine and industrial air, oil and liquid filtration solutions….

#2 AAF International

Domain Est. 1997

Website: aafintl.com

Key Highlights: We design advanced air filtration systems and technology to give you more control over the air inside commercial, industrial, and residential living spaces….

#3 Camfil USA: High

Domain Est. 1998

Website: camfil.com

Key Highlights: As a leading manufacturer of premium clean air solutions, we provide commercial and industrial systems for air filtration and air pollution control that improve ……

#4 Filtra Systems: Industrial Filtration Systems Manufacturer

Domain Est. 1998

Website: filtrasystems.com

Key Highlights: Filtra-Systems is a global leader in custom-engineered industrial filtration & separation solutions with over 40 years of experience….

#5 Air Filters Inc.

Domain Est. 2000

Website: airfilterusa.com

Key Highlights: As an air filter manufacturer, we are uniquely positioned to custom make any and all types of air filters. Customize Your Filter. Choose your. Application….

#6 APC Filters

Domain Est. 2002

Website: apcfilters.com

Key Highlights: APC Filtration provides over 40 years experience as a manufacturer in filter design, engineering, and filter testing for global OEM’s….

#7 Air Filtration Company

Domain Est. 2000

Website: afcfilters.com

Key Highlights: Air Filtration Co., Inc. was established by Carl Hagan Sr. in 1967 in Southern California as a provider of air filter products and spray booth maintenance….

#8 Freudenberg Filtration Technologies

Domain Est. 2007

Website: freudenberg-filter.com

Key Highlights: Discover your world of filtration solutions. Freudenberg Filtration Technologies provides a wide range of air, gas and liquid solutions….

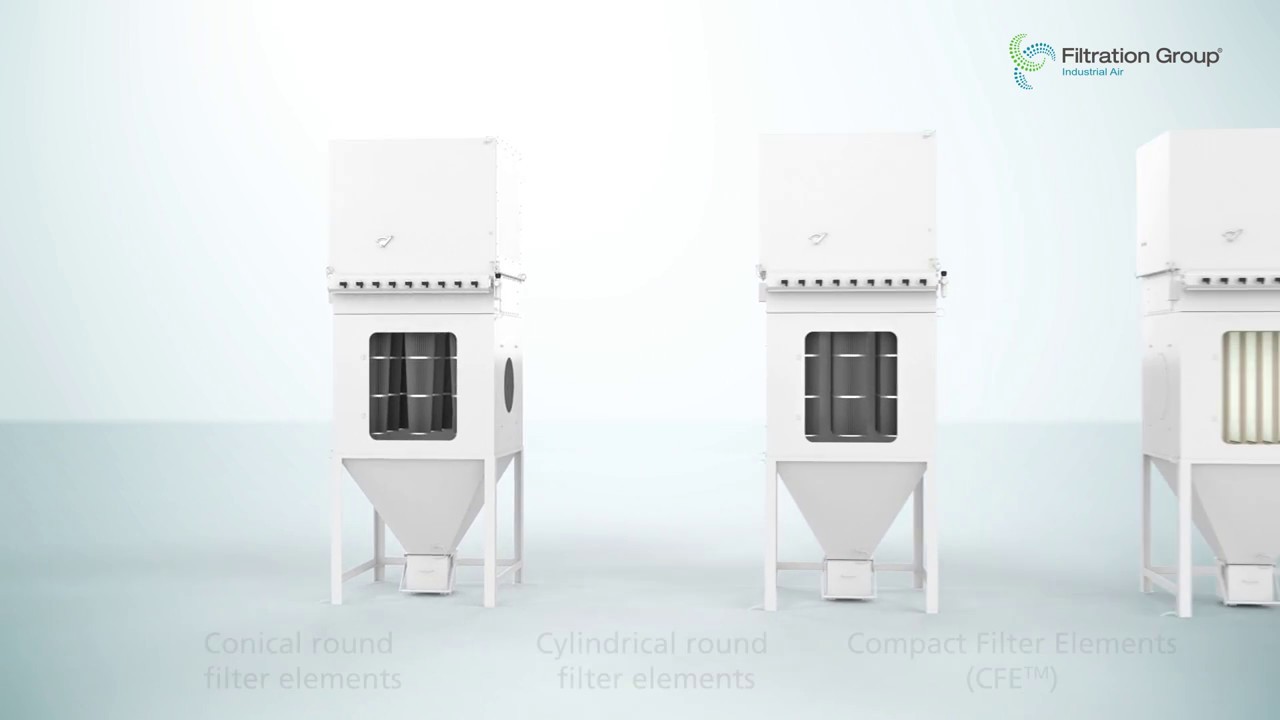

#9 Filtration Group

Domain Est. 1998

Website: filtrationgroup.com

Key Highlights: We are a global market-leading provider of mission-critical filtration solutions designed to enable advanced healthcare capabilities, provide clean air and ……

#10 Air Filtration North America

Domain Est. 1998

Website: airfiltration.mann-hummel.com

Key Highlights: With centuries of combined experience, our team of industry leaders serves the Americas with manufacturing plants and operations across the continent….

Expert Sourcing Insights for Filtration Air

H2: Projected 2026 Market Trends in the Air Filtration Industry

The global air filtration market is poised for significant transformation by 2026, driven by heightened public awareness of air quality, stringent environmental regulations, and technological advancements. This analysis outlines key trends expected to shape the industry in the coming years.

-

Increased Demand from Urban and Industrial Sectors

Rapid urbanization, especially in emerging economies across Asia-Pacific and Africa, will drive demand for advanced air filtration systems in residential, commercial, and industrial applications. Governments are increasingly implementing air quality standards, pushing industries to adopt high-efficiency particulate air (HEPA) and ultra-low penetration air (ULPA) filters. Additionally, industrial emissions control mandates will boost demand for electrostatic precipitators and activated carbon filters. -

Growth in Smart and IoT-Enabled Air Filters

By 2026, smart air filtration systems integrated with Internet of Things (IoT) technology are expected to dominate premium segments. These systems offer real-time air quality monitoring, predictive maintenance alerts, and remote control via mobile applications. The integration with smart home ecosystems (e.g., Amazon Alexa, Google Home) will enhance consumer appeal and drive market penetration. -

Focus on Energy Efficiency and Sustainability

Regulatory bodies such as the U.S. Department of Energy (DOE) and the European Union are tightening energy efficiency standards for HVAC systems. In response, manufacturers are developing low-resistance filters that maintain high filtration efficiency while reducing energy consumption. There is also a growing shift toward recyclable filter media and bio-based materials to meet sustainability goals. -

Expansion of Healthcare and Cleanroom Applications

The healthcare sector, especially post-pandemic, will continue to prioritize air purity. Hospitals, laboratories, and pharmaceutical facilities will invest heavily in HEPA and molecular filtration systems to prevent contamination. The rise of biotechnology and semiconductor manufacturing—both requiring cleanroom environments—will further elevate demand for advanced filtration technologies. -

Rising Adoption in Transportation

Automotive and aerospace sectors are incorporating advanced cabin air filters to improve indoor air quality. Electric vehicle (EV) manufacturers are integrating filtration systems capable of removing ultrafine particles and volatile organic compounds (VOCs). Similarly, commercial aviation is upgrading filtration systems to meet passenger health expectations post-COVID-19. -

Regional Market Shifts

Asia-Pacific is expected to lead global market growth, driven by severe air pollution in countries like China and India, coupled with government initiatives such as China’s Air Pollution Prevention and Control Action Plan. North America and Europe will maintain strong markets due to regulatory compliance and high consumer spending on indoor air quality products. -

Innovation in Filter Media and Nanotechnology

Advancements in nanofiber-based filter media will enhance filtration efficiency while reducing pressure drop. Antimicrobial coatings and photocatalytic oxidation (PCO) technologies are being incorporated to neutralize pathogens and VOCs, offering multi-functional air purification solutions.

Conclusion

By 2026, the air filtration market will be characterized by innovation, regulation, and expanding application areas. Companies that invest in smart technologies, sustainable materials, and high-efficiency solutions will be well-positioned to lead in this evolving landscape. The convergence of health concerns, environmental policy, and digital integration will define the next generation of air filtration products.

Common Pitfalls in Sourcing Filtration Air (Quality, IP)

When sourcing filtration air systems, particularly concerning air quality and Intellectual Property (IP), organizations often encounter critical challenges that can compromise performance, compliance, and innovation. Failing to address these pitfalls can lead to increased operational costs, legal risks, and reduced system efficiency.

Inadequate Air Quality Specifications

One of the most frequent mistakes is failing to clearly define required air quality standards during procurement. Many buyers assume “clean air” is sufficient without referencing internationally recognized classifications such as ISO 8573-1. This oversight can result in filters that do not meet the necessary purity levels for particulates, oil content, or moisture—leading to equipment damage, product contamination, or non-compliance in regulated industries like pharmaceuticals or food processing.

Overlooking Application-Specific Requirements

Not all filtration needs are the same. A common pitfall is selecting off-the-shelf solutions without assessing the specific environmental and operational conditions—such as ambient pollution levels, humidity, or temperature fluctuations. This mismatch can degrade filter lifespan and efficiency, increasing maintenance frequency and downtime.

Insufficient Verification of Supplier Claims

Suppliers may overstate filter performance or certification compliance. Without third-party testing or validation, buyers risk investing in substandard products. Always verify claims with test reports, certifications (e.g., ISO, HEPA classifications), and independent lab data to ensure authenticity and reliability.

Neglecting Intellectual Property Protection

When custom filtration solutions are developed, failing to secure IP rights is a significant risk. Organizations may inadvertently allow suppliers to retain ownership of design innovations, limiting exclusivity and future scalability. Ambiguous contracts can also expose proprietary processes or system configurations to misuse or reverse engineering.

Poor Contractual IP Clauses

Vague or missing IP clauses in sourcing agreements can lead to disputes over ownership, usage rights, and modifications. Ensure contracts explicitly define who owns the design, improvements, and technical documentation—especially in collaborative development scenarios.

Supply Chain Transparency Gaps

Limited visibility into a supplier’s manufacturing processes and component sourcing increases the risk of counterfeit parts or inconsistent quality. This lack of transparency can undermine both air quality performance and IP integrity, particularly when critical filter media or control systems are involved.

Avoiding these pitfalls requires thorough due diligence, clear technical specifications, robust contractual agreements, and ongoing supplier engagement to ensure both air quality standards and IP assets are protected throughout the sourcing lifecycle.

Logistics & Compliance Guide for Filtration Air

Overview

This guide outlines the logistics and compliance procedures for the safe and efficient handling, transportation, storage, and regulatory adherence related to Filtration Air products. Filtration Air includes air filtration units, filters, and associated components used in industrial, commercial, and healthcare environments. Proper logistics and compliance are essential to ensure product integrity, regulatory approval, and customer safety.

Regulatory Compliance

International Standards

Filtration Air products must comply with relevant international standards, including:

– ISO 16890: Classification of air filters based on particulate matter (PM) efficiency

– ISO 29463: High-efficiency filters (HEPA and ULPA)

– EN 779: European standard for general ventilation air filters (now superseded by ISO 16890 but may still apply in legacy systems)

– ASHRAE Standard 52.2: Method of testing general ventilation air-cleaning devices

Ensure all products are tested and certified by accredited laboratories and carry necessary markings (e.g., CE, UKCA, or other regional certifications).

Regional Regulations

- United States: Compliance with EPA standards, OSHA guidelines for workplace air quality, and NIOSH recommendations where applicable.

- European Union: Adherence to REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) and RoHS (Restriction of Hazardous Substances) directives.

- United Kingdom: Compliance with UK REACH and the Environmental Protection Act.

- Canada: Conformity with Health Canada and CSA Group standards.

- Asia-Pacific: Meet local standards such as CNS (Taiwan), GB (China), and JIS (Japan) as required.

Transportation & Handling

Packaging Requirements

- Use robust, moisture-resistant packaging to prevent damage during transit.

- Clearly label with handling instructions: “Fragile,” “This Side Up,” and “Protect from Moisture.”

- Include product identification, batch number, expiration date (if applicable), and regulatory compliance marks.

Shipping Modes

- Air Freight: Suitable for urgent deliveries; ensure compliance with IATA Dangerous Goods Regulations if applicable (e.g., filters with treated media). Most filtration products are non-hazardous, but verification is required.

- Ground Transport: Primary method for domestic and regional shipments; use climate-controlled vehicles if sensitive to temperature/humidity.

- Sea Freight: For bulk international shipments; use sealed containers with desiccants to prevent moisture damage.

Temperature and Humidity Control

- Store and transport within 5°C to 35°C (41°F to 95°F) and relative humidity below 70% unless otherwise specified.

- Avoid prolonged exposure to direct sunlight or extreme conditions that may degrade filter media.

Storage Guidelines

Warehouse Conditions

- Maintain clean, dry, and well-ventilated storage areas.

- Store products off the floor (on pallets) and away from walls to ensure air circulation.

- Implement a first-in, first-out (FIFO) inventory system to prevent aging of stock.

- Segregate hazardous or treated filter types (e.g., carbon-impregnated filters) from standard filters.

Shelf Life Management

- Monitor shelf life; most filters have a recommended shelf life of 3–5 years when stored properly.

- Document receipt and storage dates. Flag and quarantine expired or damaged inventory.

Documentation & Traceability

Required Documentation

- Certificate of Conformance (CoC)

- Test reports (e.g., efficiency, airflow resistance)

- Material Safety Data Sheets (MSDS/SDS) for treated or specialty filters

- Customs documentation (commercial invoice, packing list, bill of lading) for international shipments

- Regulatory compliance certificates (e.g., CE, ISO)

Batch Traceability

- Assign unique batch/lot numbers to all products.

- Maintain digital records linking batches to production data, test results, and shipping details.

- Support rapid recall procedures if non-conformance is identified.

Import/Export Compliance

Export Controls

- Verify that Filtration Air products do not contain controlled materials subject to export restrictions (e.g., certain composite materials or dual-use technologies).

- Obtain necessary export licenses when required by destination country regulations.

Customs Clearance

- Accurately classify products under the Harmonized System (HS) Code (e.g., 8421.39 for air filtering equipment).

- Provide complete documentation to customs brokers to avoid delays.

- Be aware of import duties, taxes, and potential anti-dumping measures in target markets.

Environmental & Safety Compliance

Waste Management

- Used filters may be classified as hazardous waste if contaminated (e.g., with oils, chemicals, or biological agents).

- Follow local regulations for disposal, recycling, or incineration. Provide customers with disposal guidelines.

- Offer take-back programs where feasible.

Worker Safety

- Train warehouse and logistics staff on safe handling procedures.

- Provide personal protective equipment (PPE) such as gloves and masks when handling spent or contaminated filters.

- Comply with OSHA, WHMIS, or equivalent workplace safety standards.

Audit & Continuous Improvement

Internal Audits

- Conduct regular audits of logistics and compliance processes.

- Verify adherence to storage conditions, labeling, and documentation requirements.

- Review shipping logs, customs records, and customer feedback.

Corrective Actions

- Establish a non-conformance reporting system.

- Investigate and resolve issues such as damaged goods, delays, or compliance violations.

- Update procedures and provide retraining as needed.

Conclusion

Effective logistics and compliance management for Filtration Air products ensures regulatory adherence, customer satisfaction, and operational efficiency. By following this guide, organizations can maintain product quality, reduce risks, and support sustainable and responsible supply chain practices. Regular review and updates to this guide are recommended to reflect evolving regulations and industry standards.

Conclusion on Sourcing Filtration Air

In conclusion, sourcing filtration air for industrial, commercial, or medical applications requires a comprehensive understanding of air quality requirements, environmental conditions, and system specifications. Selecting the appropriate air filtration solution involves evaluating factors such as filtration efficiency (e.g., HEPA, ULPA, or standard particulate filters), airflow capacity, energy efficiency, maintenance needs, and compliance with regulatory standards.

Effective sourcing should prioritize reliable suppliers offering certified products with traceable quality control processes. Additionally, considering lifecycle costs—rather than just initial purchase price—ensures long-term performance and cost savings. With increasing emphasis on health, safety, and sustainability, investing in high-quality air filtration systems not only enhances operational efficiency but also supports environmental and human well-being.

Ultimately, a strategic approach to sourcing air filtration solutions—grounded in technical requirements, supplier reliability, and total cost of ownership—leads to improved air quality, regulatory compliance, and system longevity across diverse applications.