The global collectible figures market has witnessed robust growth, driven by rising consumer demand for pop culture memorabilia, limited-edition releases, and increased engagement from hobbyist communities. According to Grand View Research, the global action figure market size was valued at USD 3.1 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.8% from 2023 to 2030. Alternatively, Mordor Intelligence projects a CAGR of approximately 5.2% during the forecast period of 2024–2029, citing expanding franchise-based licensing, growth in e-commerce platforms, and rising anime and gaming fandoms as key drivers. As the market becomes increasingly competitive, a select group of manufacturers has emerged as industry leaders, combining craftsmanship, brand partnerships, and innovative production techniques to capture significant market share. Based on revenue, product diversity, and fan reception, the following are the top 10 figure companies shaping the future of the collectibles landscape.

Top 10 Figure Companies Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

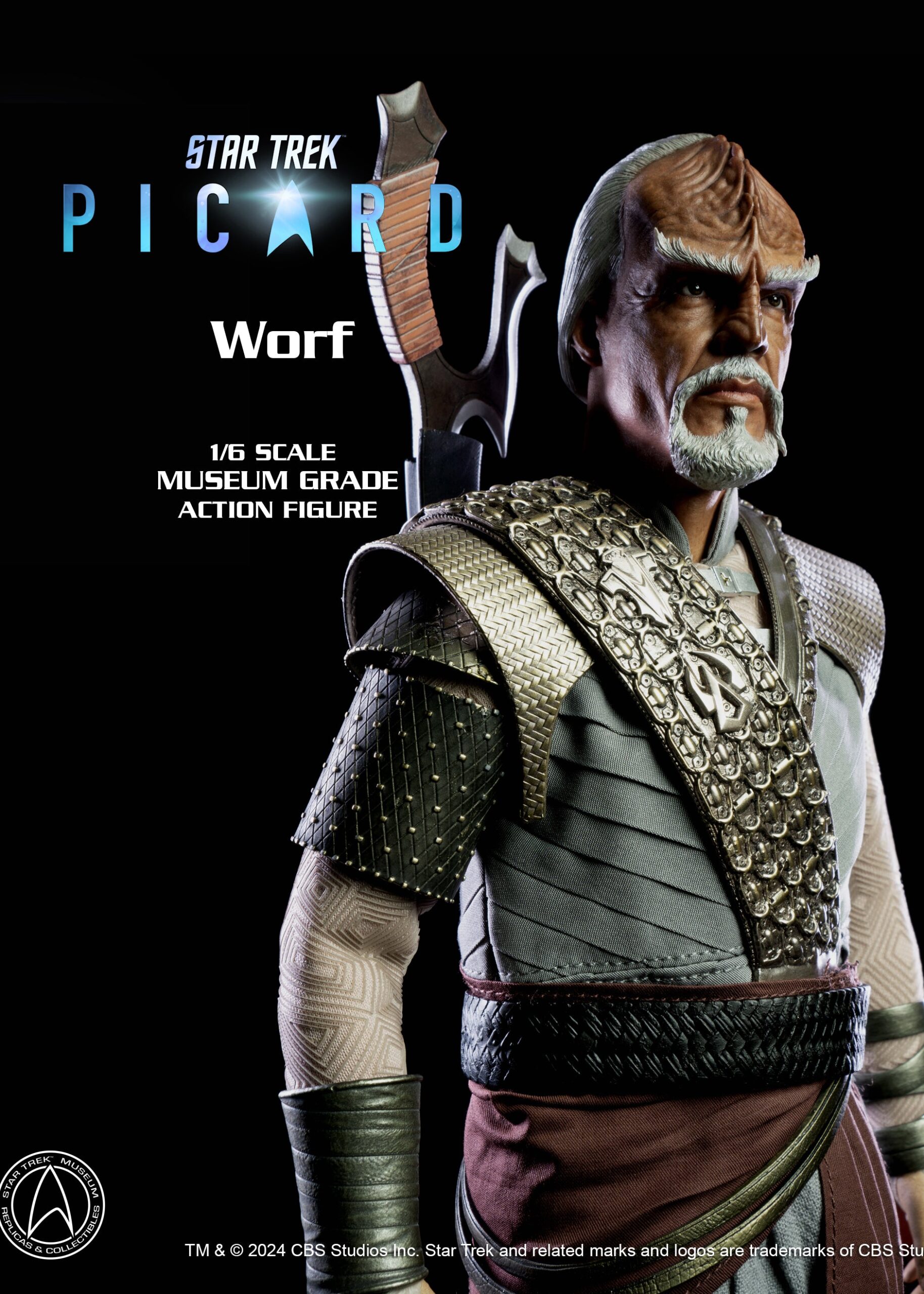

#1 EXO-6

Domain Est. 2020

Website: exo-6.com

Key Highlights: At EXO-6, we are the sole manufacturer and producer for our products. Your search for accurate and realistic collectibles will lead you back to us. Our workers ……

#2 Bandai Namco

Domain Est. 1995

Website: bandai.com

Key Highlights: Bandai Namco Toys & Collectibles America Inc. Product Categories Discover expertly crafted toys and exclusive collectibles….

#3 Happy Worker Toys & Collectibles

Domain Est. 2001

Website: happyworker.com

Key Highlights: Toy Manufacturing. We lovingly make vinyl figures, action figures, plush toys, polyresin and resin figurines, and other fan-friendly toys and collectibles….

#4 First 4 Figures

Domain Est. 2004

Website: first4figures.com

Key Highlights: 30-day returnsEmbark on a legendary and nostalgic journey with our premium collectible figures, carefully designed to bring iconic characters to life….

#5 Iron Studios Official Store

Domain Est. 2002

Website: ironstudios.com

Key Highlights: 2-day delivery · 30-day returnsSite specializing in Geek products for collectors. Statues from Iron Studios and Mini Co. Exclusive Collectibles for those passionate about collecti…

#6 PureArts Gaming & Pop Culture Figures, Statues and Collectibles

Domain Est. 2004

Website: purearts.com

Key Highlights: High End Video Game and Pop Culture Movie Figures, Statues and Collectibles including Michael Jackson, The Witcher, Star Wars Stormtrooper, Terminator, ……

#7 DID Corp. The Leading Collectible Action Figure Company!

Domain Est. 2010 | Founded: 2003

Website: did.co

Key Highlights: We are DID, a leading company of authentic highly-detailed 1/6 and 1/12 collectible action figures for collectors all over the world since 2003….

#8 Mego Toys

Domain Est. 2017

Website: megofigures.com

Key Highlights: Mego became famous for their 8” scale figures with interchangeable bodies. Eventually this became an industry standard. Mego Corporation re-launched in 2018 ……

#9 86fashion

Domain Est. 2020

Website: 86fashion.net

Key Highlights: Thousands of custom toys for a variety of industries and clients, such as Disney, Marvel, Bandai, Ubisoft, NECA and more, are created at 86fashion….

#10 Good Smile Company

Expert Sourcing Insights for Figure Companies

H2 2026 Market Trends Analysis for Figure Companies

As we look ahead to the second half of 2026, the market for figure companies—encompassing collectible action figures, statues, designer toys, and character-based merchandise—is poised for significant evolution, driven by technological innovation, shifting consumer behaviors, and expanding licensing landscapes. Below is a detailed analysis of the key trends expected to shape the industry in H2 2026.

1. AI-Driven Personalization and Design

By H2 2026, artificial intelligence will play a central role in figure design and customization. Leading companies are leveraging generative AI to:

– Create hyper-personalized figures based on user-uploaded images or avatars.

– Rapidly prototype limited-edition variants by analyzing social media trends and fan sentiment.

– Optimize sculpting and paint applications through machine learning, reducing production time and costs.

This trend enables on-demand manufacturing models, reducing inventory risks and appealing to niche audiences seeking unique collectibles.

2. Expansion of Web3 and Digital-Physical Collectibles

The integration of blockchain and NFTs into the figure market will mature significantly by late 2026. Expect:

– Major brands to launch “phygital” figure lines, where each physical figure is paired with a verified NFT containing unlockable digital content (e.g., AR experiences, exclusive game items, or metaverse wearables).

– Secondary market platforms with smart contracts ensuring artists and IP holders receive royalties on resales.

– Increased consumer trust due to improved authentication via NFC chips embedded in figures.

Though still selective, Web3 adoption will be most prominent in high-end collectibles and collaborations with gaming or anime IPs.

3. Sustainability as a Competitive Advantage

Environmental responsibility will become a key differentiator. By H2 2026:

– Leading figure manufacturers will transition to bioplastics, recycled PVC alternatives, and compostable packaging.

– Carbon footprint labeling on packaging will become standard among premium brands.

– “Circular economy” initiatives—such as trade-in programs for old figures and modular figure systems—will gain traction.

Consumers, especially Gen Z and younger millennials, will increasingly favor brands with transparent and verifiable sustainability practices.

4. Licensing Diversification Beyond Traditional Media

While superhero and anime licenses remain dominant, H2 2026 will see a surge in unexpected IP collaborations:

– Figures based on viral internet culture, indie video games, and social media influencers.

– Partnerships with museums and cultural institutions to produce historically or artistically inspired figures.

– Crossovers between nostalgic ’90s/’00s franchises and modern pop culture (e.g., retro-style figures of TikTok stars).

This diversification caters to fragmented audiences and drives innovation in design and marketing.

5. Rise of Direct-to-Consumer (DTC) and Subscription Models

E-commerce will continue to dominate distribution, with premium figure companies investing heavily in:

– Enhanced DTC platforms offering AR preview tools, exclusive member content, and early access.

– Subscription boxes tailored to themes (e.g., horror, sci-fi, kaiju) with curated, limited-run figures.

– Community-driven voting for upcoming figure releases, increasing fan engagement and reducing production risk.

These models foster loyalty and provide valuable data for product development.

6. Augmented Reality (AR) and Interactive Experiences

Figures will increasingly serve as gateways to immersive digital experiences:

– Companion mobile apps using AR to bring figures to life in users’ environments (e.g., animated battles, storytelling modes).

– Integration with AR-enabled home displays and mixed-reality headsets.

– Location-based AR scavenger hunts tied to figure releases, enhancing real-world engagement.

This trend transforms static collectibles into interactive entertainment, appealing to both collectors and younger audiences.

7. Global Market Expansion and Localization

Asian markets (particularly Japan, South Korea, and Southeast Asia) will remain strong, but H2 2026 will see growth in:

– Latin America and the Middle East, driven by rising disposable income and digital connectivity.

– Region-specific figures reflecting local myths, folklore, and pop culture.

– Multilingual packaging and localized marketing campaigns to support global reach.

Conclusion

H2 2026 represents a pivotal moment for figure companies, where innovation, sustainability, and digital integration converge. Success will depend on agility in adopting new technologies, authentic community engagement, and responsible business practices. Companies that embrace AI personalization, phygital experiences, and eco-conscious production will lead the market, turning collectible figures into dynamic, multi-dimensional products for a global, tech-savvy audience.

Common Pitfalls Sourcing Figure Companies (Quality, IP)

Sourcing collectible figures from third-party manufacturers—especially in regions like China, where many production facilities are based—can offer cost advantages and creative opportunities. However, companies often encounter significant challenges related to quality control and intellectual property (IP) protection. Understanding these pitfalls is crucial to mitigating risk and ensuring a successful product launch.

Quality Control Issues

One of the most prevalent challenges when sourcing figure companies is maintaining consistent product quality. Many manufacturers may provide excellent samples but fail to uphold the same standards during mass production. Common quality issues include inconsistent paint application, poor material durability, misaligned parts, and packaging defects. These inconsistencies can damage brand reputation and lead to customer dissatisfaction. Additionally, communication barriers, differing quality expectations, and lack of on-site oversight can exacerbate these problems. Without rigorous inspection protocols—such as pre-production checks, in-line quality audits, and final random inspections—brands risk receiving subpar inventory that fails to meet market expectations.

Intellectual Property Risks

Another major pitfall involves intellectual property (IP) protection. When sharing detailed designs, molds, and proprietary artwork with external manufacturers, there is a heightened risk of IP theft or unauthorized replication. Unscrupulous factories may produce and sell counterfeit versions of your figures, either independently or to competitors, particularly in markets with lax enforcement of IP laws. Furthermore, without properly structured legal agreements—such as non-disclosure agreements (NDAs), work-for-hire contracts, and registered trademarks—companies may find it difficult to pursue legal action. Ensuring that molds and tooling remain the property of the brand and are not reused without permission is also essential to safeguarding long-term IP interests.

To avoid these pitfalls, companies should conduct thorough due diligence on manufacturers, establish clear quality benchmarks, enforce robust legal protections, and consider using third-party inspection services. Proactive management of both quality and IP concerns is critical to building a reliable and trustworthy supply chain in the figure manufacturing industry.

Logistics & Compliance Guide for Figure Companies

This guide outlines essential logistics and compliance considerations specifically tailored for Figure Companies—businesses involved in the design, manufacturing, distribution, and sale of figurines, collectibles, and related merchandise. Adhering to these standards ensures smooth operations, regulatory compliance, and customer satisfaction.

Supply Chain Management

Establish a reliable and transparent supply chain to maintain product quality and delivery timelines. Key practices include:

– Partner with vetted manufacturers and suppliers who comply with international labor and safety standards.

– Conduct regular audits of production facilities to ensure ethical practices.

– Maintain documented contracts outlining delivery schedules, quality expectations, and responsibilities.

International Shipping & Import/Export Compliance

When shipping figures across borders, compliance with international regulations is crucial:

– Classify products correctly using Harmonized System (HS) codes to determine tariffs and duties.

– Prepare accurate commercial invoices, packing lists, and certificates of origin.

– Comply with import regulations of destination countries, including safety standards (e.g., CPSIA in the U.S., CE marking in the EU).

– Ensure restricted materials (e.g., phthalates, lead paint) meet regional safety thresholds.

Product Safety & Labeling Requirements

Figures, especially those marketed to children, are subject to strict safety regulations:

– Adhere to ASTM F963 (U.S.), EN 71 (EU), or other applicable toy safety standards.

– Include required labels: age grading, manufacturer details, country of origin, and safety warnings.

– Conduct third-party testing for compliance with chemical, mechanical, and flammability requirements.

Intellectual Property (IP) Compliance

Protecting and respecting intellectual property is critical in the collectibles industry:

– Obtain proper licensing agreements when producing figures based on copyrighted characters or trademarks.

– Register trademarks and designs for original figure lines.

– Monitor for counterfeit products and enforce IP rights through legal channels when necessary.

Inventory & Warehouse Compliance

Maintain efficient and compliant warehouse operations:

– Use inventory management systems to track stock levels, batch numbers, and expiration dates (if applicable).

– Follow fire safety codes, OSHA standards (in the U.S.), and local regulations for storage facilities.

– Implement climate control where necessary to protect sensitive materials (e.g., resin, paint finishes).

Sustainability & Environmental Regulations

Address growing consumer and regulatory demands for eco-friendly practices:

– Minimize packaging waste using recyclable or biodegradable materials.

– Comply with Extended Producer Responsibility (EPR) laws in applicable regions.

– Properly dispose of hazardous waste from manufacturing (e.g., solvents, paints).

Data Privacy & E-Commerce Compliance

For online sales, ensure compliance with data protection laws:

– Adhere to GDPR (EU), CCPA (California), or other regional privacy regulations.

– Secure customer data through encryption and compliant payment processing (PCI-DSS).

– Provide clear privacy policies and honor consumer rights regarding data access and deletion.

Recordkeeping & Audit Preparedness

Maintain accurate, up-to-date records to support compliance and respond to audits:

– Retain shipping documents, safety test reports, licensing agreements, and customs filings for a minimum of 5–7 years.

– Prepare for third-party or regulatory audits with organized documentation and trained personnel.

By following this guide, Figure Companies can mitigate risks, enhance operational efficiency, and maintain trust with customers, partners, and regulators worldwide.

Conclusion: Sourcing Figure Companies

Sourcing figure manufacturing or design companies requires a strategic approach that balances quality, cost, lead times, and reliability. After evaluating various suppliers—whether domestic or overseas—it is clear that successful sourcing hinges on thorough due diligence, clear communication of specifications, and strong supply chain management. Key factors such as material quality, production capacity, compliance with safety standards (especially for collectibles or children’s products), and intellectual property rights must be carefully considered.

Establishing long-term relationships with reputable figure companies can lead to improved product consistency, better pricing, and collaborative innovation. Additionally, leveraging digital platforms, trade shows, and industry networks can uncover emerging manufacturers offering competitive advantages. Ultimately, a well-executed sourcing strategy not only ensures high-quality figures but also supports brand integrity, customer satisfaction, and sustainable business growth in a competitive market.