The global fiber optics market is experiencing robust expansion, driven by surging demand for high-speed data transmission, 5G network deployment, and the proliferation of data centers. According to a report by Mordor Intelligence, the fiber optics market was valued at USD 9.78 billion in 2023 and is projected to reach USD 13.86 billion by 2029, growing at a CAGR of 5.8% during the forecast period. This growth trajectory underscores the critical importance of precision and reliability in fiber network infrastructure, elevating the role of advanced fiber testing tools. As network complexity increases, so does the need for accurate installation, maintenance, and troubleshooting—making fiber testing equipment an indispensable component of modern telecommunications. Leading manufacturers in this space are innovating rapidly to deliver tools that ensure signal integrity, reduce downtime, and support evolving industry standards. The following list highlights the top 10 fiber testing tools manufacturers shaping this dynamic market with cutting-edge technology, global reach, and proven performance.

Top 10 Fiber Testing Tools Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Softing IT Networks

Domain Est. 1996

Website: itnetworks.softing.com

Key Highlights: At Softing, our mission as a manufacturer of IT infrastructure cable testers is to optimize your work processes whether you are certifying copper and fiber ……

#2 Fiber Optic Testing

Domain Est. 2000

#3 Essential Fiber Optic Testers

Domain Est. 2015

Website: viavisolutions.com

Key Highlights: The VIAVI essential fiber testers lead the industry in helping technicians ensure best practices for handling fiber in every situation….

#4 EXFO

Domain Est. 1995

Website: exfo.com

Key Highlights: EXFO’s unique blend of equipment, software and services accelerate digital transformations related to fiber, 4G/LTE and 5G deployments….

#5 Fiber Optic Tester

Domain Est. 1998

Website: jonard.com

Key Highlights: Fiber Optic Test Equipment Jonard Tools manufactures a large range of fiber optic testers specifically designed for the fiber optics industry….

#6 Fiber Optic Center

Domain Est. 1998

Website: focenter.com

Key Highlights: Shop Now. International distributor for fiber optic components, equipment and accessories while providing invaluable technical consultation and support….

#7 Fiber Instrument Sales: FIS

Domain Est. 1999

Website: fiberinstrumentsales.com

Key Highlights: 7-day returnsLooking for one of the fiber optics industry leaders? Look no further, Fiber Instrument Sales inventories over $10 million in fiber optic merchandise….

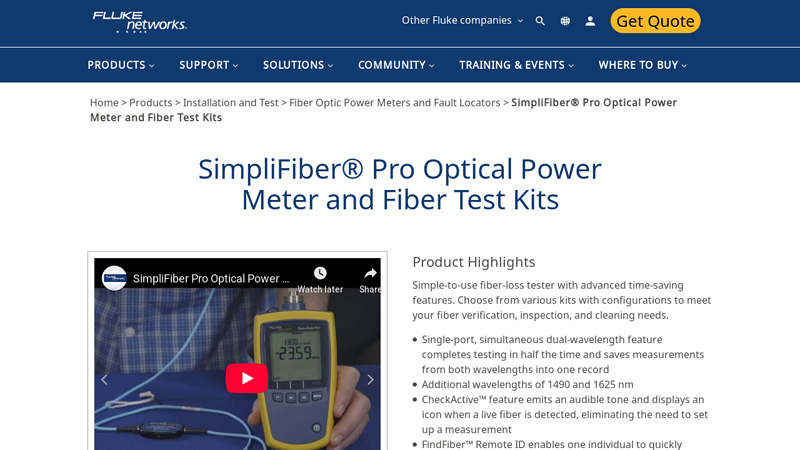

#8 SimpliFiber Pro Optical Power Meter and Fiber Test Kits

Domain Est. 1999

Website: flukenetworks.com

Key Highlights: SimpliFiber® Pro Optical Power Meter and Fiber Test Kits include all the tools necessary to verify and troubleshoot optical fiber cabling systems, measure loss ……

#9 Fiber Optic Tools

Domain Est. 2012

Website: idealind.com

Key Highlights: 30-day returnsSolutions for cutting and stripping fiber optic cables. The Fiber Optic Scribes feature a 30° single bevel – DualScribe™ reversible blade that doubles the ……

#10 Fibercore

Domain Est. 2019

Website: fibercore.humaneticsgroup.com

Key Highlights: Fiber Test & Measurement … World leading laser micromachining and optical-fiber processing tools and services meeting precision manufacturing challenges ……

Expert Sourcing Insights for Fiber Testing Tools

H2: 2026 Market Trends for Fiber Testing Tools

The global fiber testing tools market is poised for significant transformation by 2026, driven by the escalating demand for high-speed data transmission, the expansion of 5G networks, and the widespread deployment of fiber-to-the-home (FTTH) and fiber-to-the-premises (FTTP) infrastructure. This analysis explores key market trends shaping the fiber testing tools industry in 2026, highlighting technological advancements, regional dynamics, competitive landscape shifts, and emerging applications.

1. Surge in Demand Driven by 5G and FTTH Rollouts

By 2026, the rollout of 5G networks across North America, Europe, and Asia-Pacific will continue to be a primary growth catalyst. 5G requires dense fiber backhaul and fronthaul networks, necessitating precise and efficient fiber testing to ensure network integrity. Concurrently, governments and telecom operators are investing heavily in FTTH deployments to meet rising broadband demands, especially post-pandemic. This infrastructure push is expected to significantly increase the demand for fiber testing tools such as Optical Time Domain Reflectometers (OTDRs), power meters, light sources, and inspection scopes.

2. Adoption of Smart and Handheld Testing Devices

The market is witnessing a strong shift toward compact, intelligent, and user-friendly fiber testing tools. In 2026, handheld OTDRs with built-in Wi-Fi, GPS, cloud connectivity, and automated reporting capabilities are becoming standard. These smart devices enable field technicians to perform real-time analysis, streamline documentation, and reduce human error. Integration with mobile apps and cloud-based platforms allows for remote monitoring and data sharing, improving operational efficiency for service providers.

3. Growth in Automated and AI-Integrated Testing Solutions

Artificial Intelligence (AI) and machine learning are beginning to play a pivotal role in fiber testing. By 2026, AI-powered diagnostic tools can automatically identify fault types, predict fiber degradation, and recommend optimal repair strategies. Automation not only enhances accuracy but also reduces training time for technicians. Vendors are increasingly embedding AI algorithms into testing platforms to provide predictive maintenance insights, supporting proactive network management.

4. Expansion in Data Center and Hyperscale Infrastructure

The exponential growth of cloud computing, streaming services, and edge data centers is increasing the need for reliable fiber connectivity within and between data centers. In 2026, high-precision testing tools capable of validating multimode and single-mode fibers at high data rates (400G and beyond) are in high demand. Tools that support MPO (Multi-fiber Push-On) connector testing are becoming essential due to their prevalence in high-density data center environments.

5. Regional Market Dynamics

Asia-Pacific, particularly China, India, and Southeast Asia, is expected to lead market growth in 2026 due to large-scale national broadband initiatives and urbanization. North America remains a key market, driven by 5G infrastructure and private network development. Europe is focusing on green and energy-efficient networks, spurring demand for reliable fiber testing to minimize downtime and optimize performance.

6. Sustainability and Standardization Efforts

Environmental concerns are prompting manufacturers to develop energy-efficient, longer-lasting testing tools with recyclable components. Additionally, standardization bodies such as the International Electrotechnical Commission (IEC) and Telecommunications Industry Association (TIA) are updating fiber testing protocols, influencing tool design and compliance requirements. Compliance with these standards will be a competitive differentiator.

7. Competitive Landscape and Strategic Collaborations

The market is becoming increasingly competitive, with key players like Viavi Solutions, EXFO, Keysight Technologies, Anritsu, and Fluke Networks innovating through R&D and strategic partnerships. By 2026, we expect increased consolidation, joint ventures, and integration of software-defined testing solutions to capture market share and offer end-to-end network validation services.

Conclusion

By 2026, the fiber testing tools market will be characterized by technological sophistication, automation, and integration with digital ecosystems. As fiber networks become the backbone of global communications, the role of advanced, reliable, and intelligent testing tools will be more critical than ever. Stakeholders who invest in innovation, interoperability, and sustainability will be well-positioned to lead in this evolving landscape.

Common Pitfalls When Sourcing Fiber Testing Tools (Quality, IP)

Sourcing fiber optic testing tools is critical for ensuring network performance and reliability. However, organizations often encounter pitfalls related to quality assurance and intellectual property (IP) that can lead to operational risks, legal exposure, and long-term cost increases. Below are key challenges to watch for:

Poor Quality Control and Substandard Components

Many suppliers, particularly from less-regulated markets, offer fiber testing tools at attractive prices but compromise on build quality and calibration accuracy. Inconsistent manufacturing processes, use of inferior optical components, and lack of traceable calibration can result in unreliable test data. This undermines network certification and may lead to undetected faults, increased troubleshooting time, and higher lifecycle costs. Always verify adherence to industry standards (e.g., IEC, Telcordia) and request proof of quality certifications (e.g., ISO 9001).

Lack of Traceable Calibration and Certification

Reputable fiber testing tools must come with NIST-traceable or equivalent calibration certificates. Sourcing tools without verifiable calibration exposes users to measurement inaccuracies, which can invalidate field results and lead to compliance issues. Some vendors provide counterfeit or generic calibration documentation. Ensure each unit includes a unique, authenticated calibration report and supports periodic recalibration through authorized service centers.

Intellectual Property (IP) Infringement Risks

Purchasing cloned or counterfeit testing equipment—often disguised as genuine brands—poses significant IP risks. These tools frequently copy firmware, user interfaces, and proprietary algorithms without licensing. Using such devices may expose your organization to legal liability, especially in regulated industries or international markets. Additionally, cloned tools lack software updates and technical support, compromising long-term usability and accuracy.

Inadequate Firmware and Software Support

Genuine fiber testing tools rely on proprietary software for data analysis, reporting, and device management. Sourced tools from unauthorized channels may come with outdated, pirated, or modified firmware, limiting functionality and creating cybersecurity vulnerabilities. Always confirm software authenticity and ensure access to official updates and technical support.

Misrepresentation of Specifications and Capabilities

Some suppliers exaggerate performance metrics—such as dynamic range, distance measurement accuracy, or wavelength compatibility—to appear competitive. Without independent verification or third-party testing, users may discover too late that tools cannot meet project requirements. Request demonstration units and validate specifications under real-world conditions before large-scale procurement.

Supply Chain Transparency and Vendor Reliability

Opaque supply chains increase the risk of receiving refurbished, used, or non-compliant equipment labeled as new. Choose suppliers with transparent sourcing practices, verifiable distribution authorizations, and established service networks. Avoid gray market resellers lacking direct manufacturer partnerships, as they often void warranties and lack technical accountability.

Conclusion

To mitigate these pitfalls, conduct thorough due diligence: verify supplier credentials, demand quality documentation, confirm IP legitimacy, and prioritize long-term support over initial cost savings. Investing in authentic, high-quality fiber testing tools from reputable sources ensures accurate measurements, regulatory compliance, and protection against legal and operational risks.

Logistics & Compliance Guide for Fiber Testing Tools

This guide outlines the essential logistics and compliance considerations for the shipment, handling, and use of fiber optic testing tools such as OTDRs, power meters, light sources, inspection scopes, and related accessories.

Regulatory Compliance

Ensure all fiber testing equipment complies with applicable international and local regulations. This includes adherence to standards such as IEC 61280 (Fiber Optic Communication Subsystems Test Procedures), IEC 61300 (Fiber Optic Interconnecting Devices and Passive Components – Basic Test and Measurement Procedures), and regional directives like the EU’s CE marking, RoHS, and REACH. In the United States, verify FCC compliance for any tools with wireless or electronic emissions. Documentation, including Declaration of Conformity (DoC), must accompany shipments and be retained for audit purposes.

Export Controls & Licensing

Fiber testing tools may be subject to export control regulations due to their technical specifications and potential dual-use applications. Review applicable export control lists such as the U.S. Export Administration Regulations (EAR), particularly under Export Control Classification Number (ECCN) 3A991, which covers certain test, inspection, and production equipment. Determine if export licenses or authorizations are required based on destination country, end-user, and intended use. Maintain accurate export records for a minimum of five years.

Packaging & Handling Requirements

Package fiber testing tools using manufacturer-recommended protective materials to prevent damage during transit. Use anti-static packaging for sensitive electronic components and ensure tools are securely immobilized within cases to prevent movement. Clearly label packages with “Fragile,” “This Side Up,” and “Protect from Moisture” indicators. Include desiccants in packaging when shipping to humid or variable climates. Avoid extreme temperatures during storage and transportation—maintain conditions within the operating and storage specifications provided by the manufacturer (typically 0°C to 50°C).

Shipping & Transportation

Use reputable carriers experienced in handling high-value technical equipment. For international shipments, provide accurate commercial invoices, packing lists, and Harmonized System (HS) codes (e.g., 9030.89 for electrical measuring instruments). Declare the true value of the equipment to ensure proper insurance coverage. Consider air freight for time-sensitive deliveries but ensure compliance with IATA Dangerous Goods Regulations—particularly if equipment contains lithium-ion batteries (common in portable OTDRs and inspection scopes). Battery-powered devices must comply with UN38.3 testing and be shipped at a state of charge not exceeding 30%.

Customs Clearance

Prepare complete and accurate customs documentation to avoid delays. Include product descriptions, technical specifications, country of origin, and end-use statements. Be aware of import restrictions or tariffs in destination countries—some regions may impose additional testing or certification requirements (e.g., China CCC, India BIS). Engage a licensed customs broker when necessary to facilitate smooth clearance.

Calibration & Traceability

Maintain calibration records for all fiber testing tools to ensure measurement accuracy and compliance with quality standards such as ISO/IEC 17025. Calibration must be performed at regular intervals by accredited laboratories, with certificates traceable to national or international standards (e.g., NIST in the U.S.). Include calibration status labels on devices and ensure documentation is available for audits or customer requests.

End-of-Life & Environmental Compliance

Dispose of or recycle obsolete or damaged fiber testing tools in accordance with environmental regulations. Follow WEEE (Waste Electrical and Electronic Equipment) guidelines in the EU and similar local laws elsewhere. Partner with certified e-waste recyclers to ensure proper handling of electronic components, batteries, and hazardous materials.

Training & Documentation

Provide users with access to up-to-date operation manuals, safety data sheets (if applicable), and compliance documentation. Ensure personnel involved in logistics, handling, and use are trained on proper procedures, including battery safety, electrostatic discharge (ESD) prevention, and regulatory requirements.

Conclusion for Sourcing Fiber Testing Tools

Sourcing the right fiber testing tools is a critical step in ensuring the reliability, performance, and longevity of fiber optic networks. As network demands continue to grow with the expansion of 5G, data centers, and high-speed broadband, selecting accurate, durable, and compatible testing equipment is essential for effective installation, maintenance, and troubleshooting.

After careful evaluation, it is evident that key factors such as measurement accuracy, ease of use, compatibility with existing infrastructure, vendor support, and long-term cost of ownership should guide procurement decisions. Tools such as Optical Time Domain Reflectometers (OTDRs), optical power meters, light sources, inspection scopes, and fiber identifiers each play a vital role in ensuring link integrity and minimizing downtime.

Sourcing from reputable manufacturers with strong service and calibration support enhances tool reliability and ensures compliance with industry standards. Additionally, investing in training for technicians maximizes the value of these tools and improves overall network quality.

In conclusion, a strategic approach to sourcing fiber testing tools—balancing performance, support, and cost—will empower organizations to maintain high-performing fiber networks, reduce operational risks, and meet evolving technological demands efficiently and effectively.