The global fiber rayon market is experiencing steady growth, driven by rising demand for sustainable and semi-synthetic textiles in the apparel, home furnishings, and industrial sectors. According to Grand View Research, the global rayon fiber market was valued at USD 7.9 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. This growth is fueled by increasing consumer preference for eco-friendly fabrics and advancements in closed-loop production technologies that reduce environmental impact. As sustainability becomes a key priority for brands and consumers alike, fiber rayon—particularly modal and lyocell variants—has emerged as a favored alternative to conventional cotton and synthetic fibers. With production hubs in Asia-Pacific, Europe, and North America, leading manufacturers are scaling capacity and investing in innovation to meet tightening environmental regulations and evolving market demands. In this competitive landscape, the following ten companies have distinguished themselves through production scale, technological advancement, and global market reach, positioning them at the forefront of the fiber rayon industry.

Top 10 Fiber Rayon Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 to THAI RAYON PUBLIC COMPANY LIMITED

Domain Est. 1997 | Founded: 1984

Website: thairayon.com

Key Highlights: Thai Rayon is the pioneer as well as sole manufacturer of viscose staple fibre (VSF) in Thailand and is listed on the Thailand Stock Exchange since 1984. Our ……

#2 Asia Pacific Rayon (APR)

Domain Est. 2000

Website: rgei.com

Key Highlights: Asia Pacific Rayon (APR) is the first fully integrated viscose rayon producer in Asia from plantation to viscose fibre. APR produces natural and biodegradable ……

#3 Viscose Rayon Fibres

Domain Est. 2004

Website: goonveanfibres.com

Key Highlights: Our Milled Viscose Rayon fibres are commonly used by manufacturers to produce paper and packaging, as well as for filtration, hygiene, and oil well drilling ……

#4 Sateri Viscose Rayon Producer

Website: sateri.com

Key Highlights: Sateri is a global leader in viscose rayon – the natural, sustainable fibre found in soft, comfortable fabrics and skin-friendly hygiene products….

#5 Viscose CV

Domain Est. 1996

Website: swicofil.com

Key Highlights: Rayon viscose is the first man made natural filament yarn and staple fiber for versatile end uses such as apparel, domestic textiles, ……

#6 Lenzing fabric

Domain Est. 1999

Website: lenzing.com

Key Highlights: Discover Lenzing’s fiber products ✓ Designed for textiles and nonwovens ✓ Explore our eco-friendly solutions now….

#7 Bombay Rayon Fashions Ltd.

Domain Est. 2002

Website: bombayrayon.com

Key Highlights: BRFL is a vertically integrated textile company, engaged in the manufacture of a wide range of fabrics and garments from state of the art production facilities….

#8 Viscose Fibers For Fabrics and Textile

Domain Est. 2011

Website: ecovero.com

Key Highlights: LENZING™ ECOVERO™ is a viscose fiber brand that practices responsible production to maximize resource efficiency and minimize environmental impact….

#9 Asia Pacific Rayon

Domain Est. 2017

Website: aprayon.com

Key Highlights: APR produces 100% natural and biodegradable viscose rayon used in textile products. Made from renewable wood cellulose, APR is committed to sustainable ……

#10 Top 100 Rayon Fabric Suppliers in 2025

Domain Est. 2022

Website: ensun.io

Key Highlights: Fabric Pandit offers a range of pure rayon fabric, crafted with the finest viscose yarns, making it ideal for everyday garments like Kurtis and shirts….

Expert Sourcing Insights for Fiber Rayon

H2: Market Trends for Fiber Rayon in 2026

As the global textile and fiber industry evolves in response to environmental concerns, technological advancements, and shifting consumer preferences, fiber rayon is poised for significant transformation by 2026. H2 of 2026 is expected to reflect the culmination of several key trends that have been developing throughout the year, shaping the production, demand, and sustainability profile of rayon fibers. Below is an analysis of the major market trends influencing fiber rayon in the second half of 2026.

1. Rising Demand for Sustainable and Bio-Based Textiles

By H2 2026, consumer and regulatory pressure for eco-friendly materials will continue to drive demand for sustainable rayon variants such as lyocell, modal, and bamboo-based rayon. With increasing awareness of microplastic pollution and the environmental cost of synthetic fibers like polyester, brands are pivoting toward cellulosic fibers sourced from renewable wood pulp and agricultural residues. Certification schemes such as FSC (Forest Stewardship Council) and CanopyStyle will become standard requirements, ensuring responsible forestry practices in viscose production.

2. Expansion of Closed-Loop Production Technologies

The adoption of closed-loop manufacturing processes—particularly in lyocell production using non-toxic solvents like NMMO—will accelerate. By H2 2026, major producers like Lenzing AG and Birla Cellulose are expected to expand their capacity in eco-efficient facilities across Asia and Eastern Europe. These technologies reduce water and chemical usage by over 90%, aligning with global ESG (Environmental, Social, and Governance) goals and attracting investment from sustainable fashion brands.

3. Geopolitical Shifts in Supply Chains

Ongoing supply chain reconfiguration post-pandemic and amid U.S.-China trade dynamics will influence raw material sourcing and manufacturing locations. India, Indonesia, and Vietnam are emerging as key hubs for rayon production, benefiting from lower energy costs, government incentives, and proximity to bamboo and eucalyptus plantations. Conversely, environmental regulations in China are pushing less sustainable viscose producers to modernize or exit the market, creating space for cleaner alternatives.

4. Innovation in Blended and Functional Rayon Fabrics

H2 2026 will see increased commercialization of high-performance rayon blends incorporating antimicrobial, moisture-wicking, and UV-protective properties. These innovations are being driven by demand from activewear, medical textiles, and technical apparel sectors. Nanotechnology and bio-engineering are enabling the development of next-generation rayon with enhanced durability and functionality, narrowing the performance gap with synthetic fibers.

5. Price Volatility and Raw Material Constraints

Wood pulp prices—especially for hardwood used in viscose—will remain volatile due to competition from paper and packaging industries, coupled with climate-related disruptions in key producing regions (e.g., Brazil, South Africa). This pressure is expected to push manufacturers toward alternative feedstocks such as agricultural waste (e.g., cotton linters, straw) and recycled textiles, supporting the circular economy.

6. Regulatory and Certification Pressures

Environmental regulations, particularly in the EU (via the EU Strategy for Sustainable and Circular Textiles), will mandate stricter disclosure requirements for fiber origin and chemical use. By H2 2026, compliance with the EU Ecolabel, ZDHC (Zero Discharge of Hazardous Chemicals), and upcoming digital product passports will be essential for market access. Non-compliant producers may face tariffs or import restrictions.

7. Growth in Fast-Fashion and Affordable Eco-Apparel

Fast-fashion retailers, responding to consumer demand for “green” options at low price points, will increase their use of cost-effective, responsibly produced rayon. This trend will drive volume growth, particularly in viscose, provided it meets transparency and sustainability criteria. Retail partnerships with certified suppliers will become common, ensuring traceability from forest to fabric.

Conclusion

By H2 2026, the fiber rayon market will be characterized by a strong shift toward sustainability, technological innovation, and supply chain resilience. While traditional viscose will still hold a significant market share, its growth will be contingent on environmental compliance. In contrast, advanced rayon types—especially lyocell and recycled variants—are expected to outperform, capturing premium segments and driving long-term industry transformation. Companies that invest in green technologies, transparent sourcing, and product innovation will be best positioned to capitalize on these evolving dynamics.

Common Pitfalls in Sourcing Fiber Rayon: Quality and Intellectual Property Concerns

Sourcing fiber rayon presents unique challenges, particularly regarding consistent quality and intellectual property (IP) protection. Overlooking these aspects can lead to supply chain disruptions, product failures, and legal risks.

Inconsistent Quality Standards

One of the primary pitfalls in sourcing rayon fiber is the variability in quality due to differences in manufacturing processes, raw materials, and quality control practices among suppliers. Rayon—especially viscose rayon—can vary significantly in tensile strength, moisture absorption, colorfastness, and shrinkage depending on production methods. Suppliers in different regions may follow varying standards (e.g., ISO, Oeko-Tex, or none at all), leading to batch inconsistencies. Buyers may receive substandard fiber that affects downstream processing or final product performance, resulting in rework, customer complaints, or brand damage.

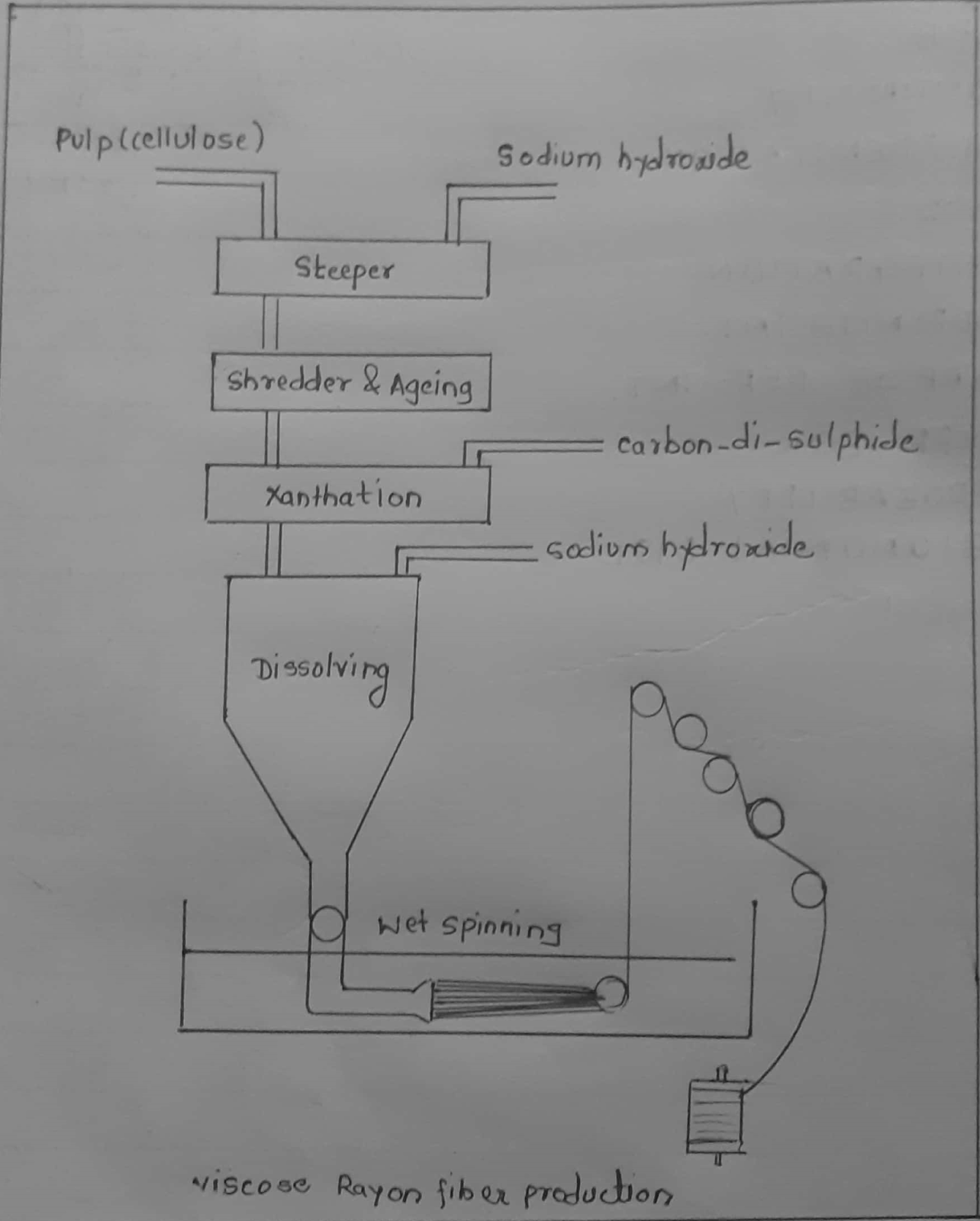

Lack of Transparency in Supply Chain

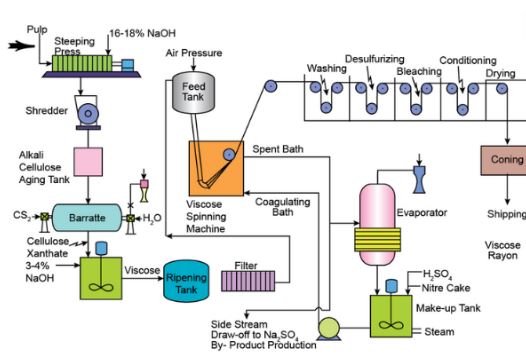

Rayon production involves multiple stages—from wood pulp sourcing to chemical processing—making traceability complex. Many suppliers lack transparent documentation about the origin of raw materials, use of chemicals (e.g., carbon disulfide), or environmental compliance. This opacity increases the risk of sourcing fiber linked to deforestation, unethical labor practices, or non-compliance with environmental regulations (e.g., REACH, ZDHC). Without full supply chain visibility, brands expose themselves to reputational and regulatory risks.

Intellectual Property Infringement Risks

Advanced rayon variants—such as lyocell (e.g., TENCEL™) or modal—often involve patented technologies and trademarked branding. Sourcing “generic” versions of these high-performance fibers from unauthorized suppliers can result in IP violations. Some manufacturers may falsely claim compliance with proprietary standards or misuse certification logos. Purchasing such counterfeit or non-licensed fibers can lead to legal action, shipment seizures, and damage to brand integrity. Due diligence on supplier licensing and certification is essential to avoid infringement.

Insufficient Supplier Vetting and Certification

Many buyers fail to conduct thorough audits of rayon suppliers, particularly regarding environmental practices and ethical sourcing. Certifications like FSC, PEFC, or OEKO-TEX provide assurance, but falsified or outdated certifications are not uncommon. Relying solely on paper-based claims without on-site audits or third-party verification increases the risk of non-compliant sourcing. Additionally, smaller suppliers may lack the infrastructure to maintain consistent quality or traceability systems.

Overlooking Regulatory Compliance

Different markets have stringent regulations governing chemical residues, labeling, and sustainable sourcing in textiles. For example, the EU’s Ecodesign Directive and Green Claims initiatives require proof of environmental performance. Sourcing rayon without verifying compliance can result in customs delays, product recalls, or fines. Suppliers may not be aware of or adhere to these evolving standards, placing the burden of compliance on the buyer.

Conclusion

To mitigate these pitfalls, sourcing professionals should prioritize certified and audited suppliers, demand full supply chain transparency, verify IP rights and licensing, and implement robust quality control protocols. Engaging with reputable producers and leveraging third-party testing can safeguard both product integrity and brand reputation.

Logistics & Compliance Guide for Fiber Rayon

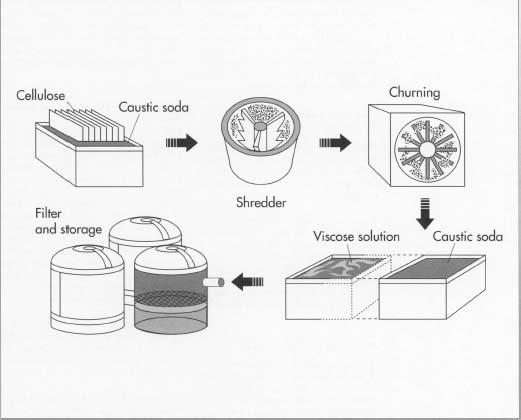

Overview of Fiber Rayon

Fiber Rayon, also known as viscose rayon, is a semi-synthetic textile fiber made from regenerated cellulose, typically derived from wood pulp. Due to its origin and manufacturing process, transporting and handling rayon fiber involves specific logistical considerations and compliance requirements across international and domestic regulations.

Classification and HS Code

Fiber Rayon is typically classified under the Harmonized System (HS) Code:

– 5504.10 – Artificial staple fibers (including waste), not carded, combed or otherwise processed for spinning.

This classification is crucial for customs clearance, duty assessment, and trade compliance. Always verify the specific sub-category based on form (staple, tow, or filament) and end-use.

Packaging and Handling Requirements

- Moisture Protection: Rayon is highly hygroscopic; it must be packed in moisture-resistant materials (e.g., plastic-lined bags or sealed containers).

- Ventilation: During ocean transport, ensure container ventilation to prevent mold and mildew.

- Stacking: Palletized bales or spools should be stacked securely to avoid compression damage.

- Labeling: Packages must be clearly labeled with product name, weight, batch number, country of origin, and handling instructions (e.g., “Protect from Moisture,” “Keep Dry”).

Storage Conditions

- Store in dry, well-ventilated areas with relative humidity below 65%.

- Avoid direct contact with concrete floors; use wooden pallets.

- Keep away from heat sources and direct sunlight to prevent fiber degradation.

Transportation Modes

- Marine Shipping: Most common for bulk shipments. Use dry, ventilated containers. Consider cargo insurance for moisture-related risks.

- Rail and Road: Suitable for regional distribution. Ensure trucks or railcars are enclosed and weatherproof.

- Air Freight: Used for high-value or time-sensitive orders. Requires strict weight and packaging compliance due to higher costs and IATA regulations.

Regulatory Compliance

- REACH (EU): Comply with Registration, Evaluation, Authorisation and Restriction of Chemicals. Ensure no restricted substances (e.g., certain dyes or finishes) are present.

- Proposition 65 (California, USA): Verify that no chemicals known to cause cancer or reproductive harm are present in detectable levels.

- Oeko-Tex Standard 100: While voluntary, certification enhances market access by confirming the fiber is free from harmful levels of toxic substances.

- Customs Documentation: Provide commercial invoice, packing list, bill of lading, certificate of origin, and any required import licenses.

Environmental and Sustainability Regulations

- FSC or PEFC Certification: If sourced from responsibly managed forests, documentation may be required to meet buyer or regulatory demands.

- Eco-Labeling: Adhere to labeling standards such as EU Ecolabel or Global Organic Textile Standard (GOTS) if applicable.

- Waste Disposal: Follow local regulations for handling production waste containing chemicals from the viscose manufacturing process.

Safety and Hazard Communication

- Non-hazardous classification: Raw rayon fiber is generally not classified as hazardous under transport regulations (e.g., IMDG, IATA).

- Safety Data Sheet (SDS): Provide an updated SDS reflecting the physical and chemical properties, even if the material is not hazardous, to support occupational safety.

- Worker Protection: Ensure safe handling procedures to avoid dust inhalation during processing (use PPE such as masks and gloves).

Import/Export Restrictions

- Check for import quotas, tariffs, or anti-dumping duties in destination countries.

- Some countries may impose restrictions on viscose production due to environmental concerns (e.g., carbon disulfide emissions), which may indirectly affect fiber trade.

- Verify if the country of destination requires pre-shipment inspection or phytosanitary certificates (rare, but possible if wood pulp origin raises biosecurity concerns).

Due Diligence and Traceability

- Maintain documentation of fiber origin, manufacturing process, and chain of custody.

- Implement traceability systems to support sustainability claims and respond to audits or customer inquiries.

- Ensure suppliers comply with environmental and labor standards (e.g., ZDHC, BSCI).

Emergency Response

- In case of water exposure, isolate affected bales and assess for mold or quality degradation.

- For spills during handling, clean dry debris with proper PPE; avoid water if it may spread contamination.

- Report significant incidents to relevant authorities per local environmental regulations.

Conclusion

Safe and compliant logistics for Fiber Rayon require attention to moisture control, accurate documentation, adherence to chemical and environmental regulations, and proactive supply chain management. Staying updated on evolving regulations—especially those related to sustainable sourcing and chemical safety—is essential for uninterrupted global trade.

In conclusion, sourcing fiber rayon requires careful consideration of environmental impact, supply chain transparency, and production methods. As a semi-synthetic fiber derived from natural cellulose, rayon offers a soft, versatile, and biodegradable alternative to synthetic textiles. However, its production—especially the conventional viscose process—can involve harmful chemicals and significant environmental degradation if not managed responsibly. Therefore, prioritizing sustainably sourced rayon, such as ECOVERO™, lyocell (TENCEL™), or closed-loop production systems, is essential for minimizing ecological harm and ensuring ethical sourcing practices. Engaging with certified suppliers, adhering to industry standards (e.g., FSC, OEKO-TEX), and promoting traceability throughout the supply chain will support more sustainable and socially responsible procurement. Ultimately, responsible sourcing of rayon can align economic goals with environmental stewardship and meet the growing consumer demand for eco-friendly textiles.