The global fiber laser cutting machine market is experiencing robust expansion, driven by increasing demand for high-precision, energy-efficient manufacturing solutions across industries such as automotive, aerospace, electronics, and heavy machinery. According to Mordor Intelligence, the fiber laser market was valued at approximately USD 5.4 billion in 2023 and is projected to grow at a CAGR of over 7.5% through 2029. Similarly, Grand View Research reports that the global laser cutting equipment market size exceeded USD 9 billion in 2022 and is expected to register a CAGR of 7.8% from 2023 to 2030, with fiber lasers capturing an ever-larger share due to their superior beam quality, lower maintenance, and higher efficiency compared to CO₂ alternatives. As industrial automation accelerates and manufacturers prioritize lean production methods, fiber laser cutting systems have become essential tools—fueling investments and innovation among leading equipment suppliers. This rising demand has intensified competition among manufacturers, leading to rapid technological advancements and a consolidation of dominant players worldwide.

Top 10 Fiber Laserskærer Manufacturers (2026 Audit Report)

(Ranked by Factory Capability & Trust Score)

#1 TRUMPF lasers

Website: trumpf.com

Key Highlights: TRUMPF is the world market leader in industrial laser technology. Benefit from a perfectly coordinated entire system comprising beam sources, beam guidance ……

#2 fiber laser metal cutting machine manufacturer

Website: sfcnclaser.com

Key Highlights: SENFENG is a professional manufacturer of metal laser cutting machines,laser cleaning machines and laser welding machine. Email:[email protected]….

#3 EAGLE Lasers

Website: eagle-group.eu

Key Highlights: EAGLE is the producer of the fastest and most efficient laser cutters in the world. Discover our innovative fiber laser products and matching software!…

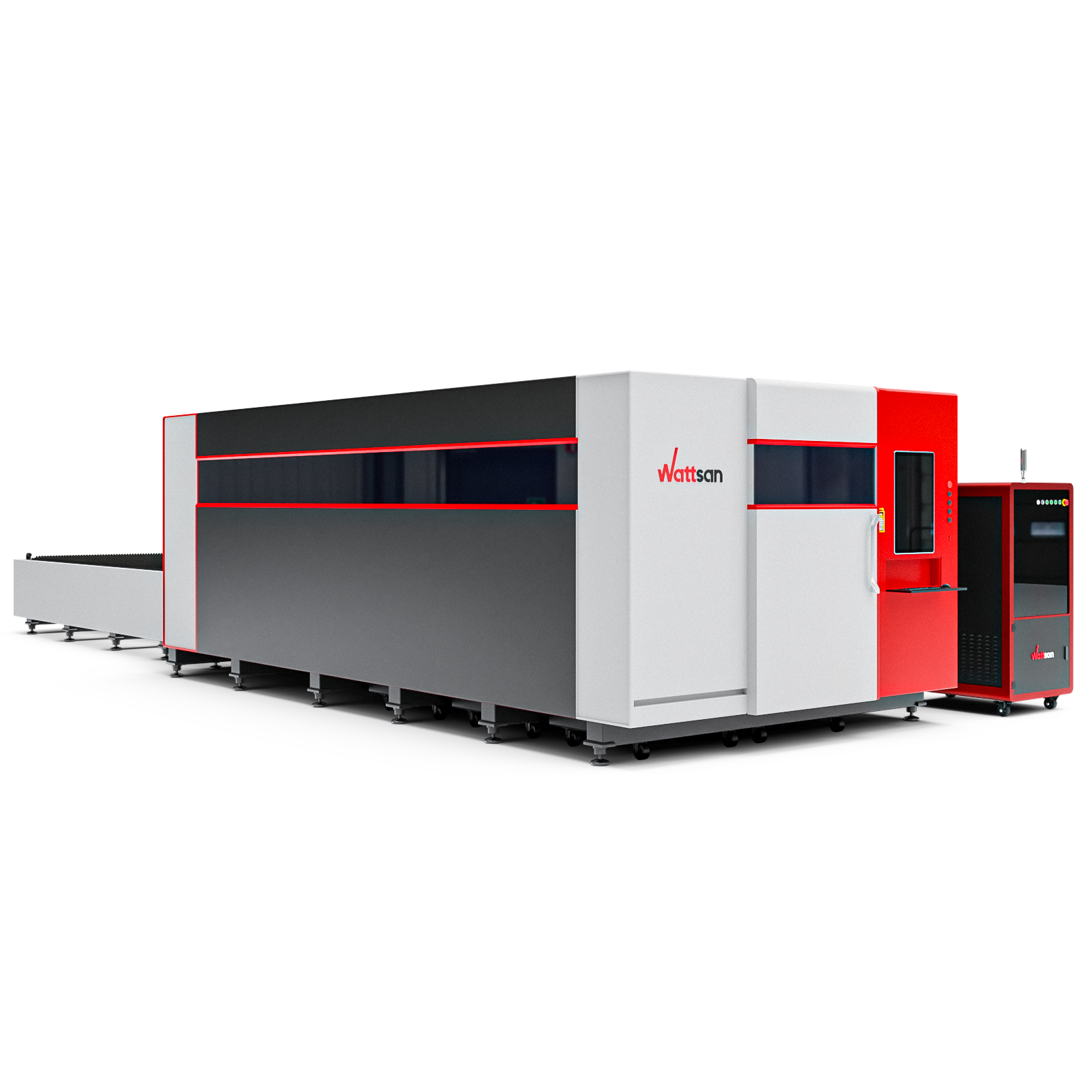

#4 Wattsan

Website: wattsan.com

Key Highlights: Wattsan is a manufacturer of laser and cnc milling machines of European quality at affordable prices with worldwide delivery….

#5 Mazak Leading Laser Machine Manufacturer

Website: mazak.com

Key Highlights: Mazak provides products and solutions that can support a wide range of parts machining processes, such as high-speed and high-accuracy machines….

#6 NEJE.SHOP

Website: neje.shop

Key Highlights: The best-performing 5W+ class laser module, featuring built-in fiber compression technology and premium-grade diodes. It delivers 30% higher optical efficiency ……

#7 OMTech Laser

Website: omtech.com

Key Highlights: Turn your creative dreams into reality with our laser engraving and cutting machines, from desktop CO2 lasers to fiber lasers, which are perfect for ……

#8 Fiber Laser Cutting Machines

Website: amada.com

Key Highlights: AMADA’s Fiber Laser Cutting Systems range from 3kW to 12kW. Their advanced motion and innovative beam delivery systems are engineered to raise productivity….

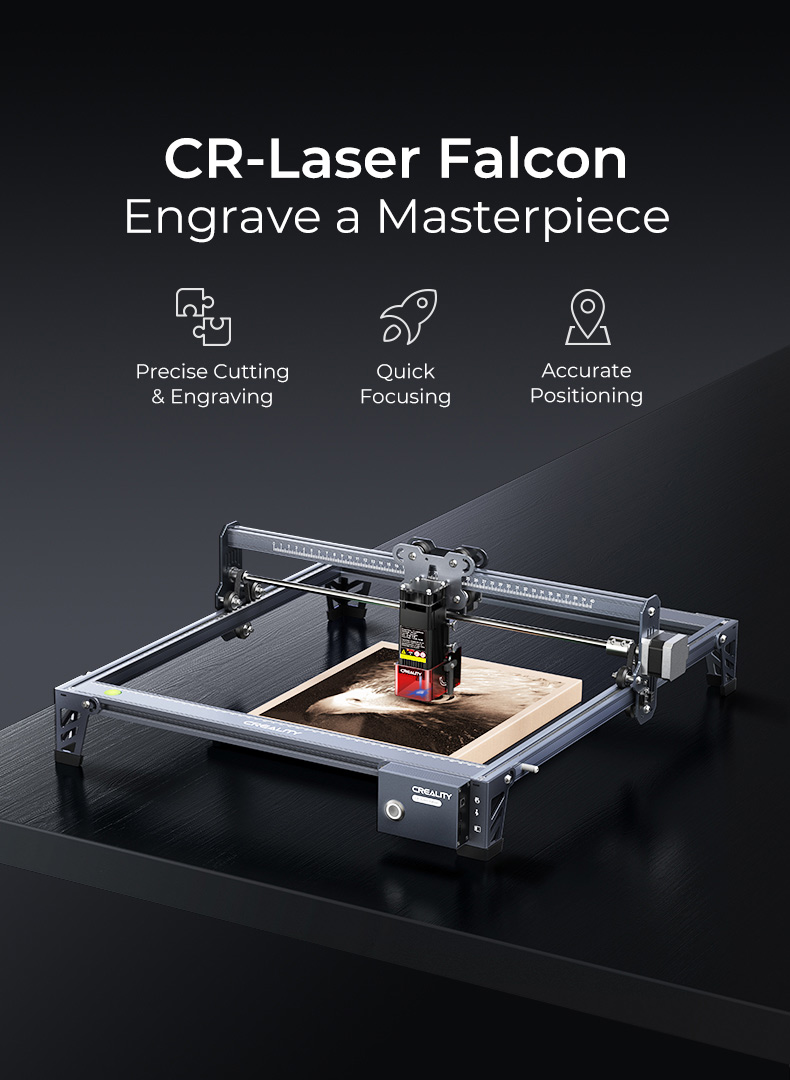

#9 CR-Laser Falcon Laser Engraver

Website: creality.com

Key Highlights: In stock Free deliveryCR-Laser Falcon Laser Engraver offers reliable 5W precision engraving with wide material support—perfect for beginners and hobby users….

#10 Best Fiber Laser Cutter for Sale

Website: oreelaser.com

Key Highlights: Products mainly include Flatbed fiber laser cutting machine, Tube fiber laser cutting machine, Sheet&Tube dual-use fiber laser cutting machine, 3D fiber laser ……

Expert Sourcing Insights for Fiber Laserskærer

H2: 2026 Market Trends for Fiber Laser Cutters

The global fiber laser cutter market is poised for significant transformation by 2026, driven by technological advancements, increasing industrial automation, and rising demand across key manufacturing sectors. Several macro and microeconomic factors are shaping the trajectory of this high-precision cutting technology, positioning fiber laser cutters as a cornerstone in modern fabrication processes.

1. Rising Demand in Automotive and Aerospace Industries

By 2026, the automotive and aerospace sectors are expected to remain primary drivers of fiber laser cutter adoption. As manufacturers shift toward lightweight materials—such as high-strength steel, aluminum, and composites—fiber lasers offer the precision and speed needed for intricate cutting tasks. The push for electric vehicles (EVs) will further boost demand, as EV components require high-accuracy cutting with minimal material waste.

2. Advancements in Laser Power and Efficiency

Fiber laser technology is rapidly evolving, with continuous-wave (CW) and pulsed fiber lasers reaching higher power outputs—some systems now exceeding 30 kW. These advancements allow for faster cutting speeds and the ability to process thicker materials, expanding applications in heavy industries such as shipbuilding and construction. Improved energy efficiency and lower operational costs compared to CO₂ lasers are making fiber systems more attractive for cost-conscious manufacturers.

3. Integration with Industry 4.0 and Smart Manufacturing

By 2026, fiber laser cutting machines are increasingly being integrated into smart factory ecosystems. Features such as IoT-enabled monitoring, predictive maintenance, AI-driven optimization, and real-time data analytics are becoming standard. This connectivity enhances operational efficiency, reduces downtime, and enables remote diagnostics, aligning with global trends toward digitalization and automation.

4. Regional Market Growth and Manufacturing Relocation

Asia-Pacific, particularly China and India, will continue to dominate the fiber laser cutter market due to robust manufacturing expansion and government initiatives promoting advanced industrial technologies. North America and Europe are also experiencing growth, partly driven by reshoring efforts and increased investments in domestic manufacturing. Localized production hubs will demand more flexible and high-speed cutting solutions, further boosting fiber laser adoption.

5. Competitive Landscape and Price Pressure

The market is becoming increasingly competitive, with both established players (e.g., IPG Photonics, TRUMPF, Han’s Laser) and emerging manufacturers offering cost-effective alternatives. Chinese manufacturers, in particular, are gaining market share with competitively priced, high-performance systems. This price competition is expected to drive wider adoption, especially among small and medium-sized enterprises (SMEs).

6. Sustainability and Environmental Considerations

As sustainability becomes a key focus in manufacturing, fiber laser cutters are gaining favor due to their lower energy consumption, minimal waste generation, and reduced need for consumables. These eco-friendly attributes align with corporate ESG (Environmental, Social, and Governance) goals and regulatory requirements in developed markets.

Conclusion

By 2026, the fiber laser cutter market will be characterized by higher power capabilities, smarter integration, and broader industrial adoption. Driven by innovation and evolving manufacturing needs, fiber laser technology will continue to displace traditional cutting methods, solidifying its role as the preferred solution for precision metal fabrication across global industries.

Common Pitfalls When Sourcing Fiber Laser Cutters: Quality and Intellectual Property Issues

Sourcing fiber laser cutters, especially from international markets, can present several challenges that buyers must carefully navigate. Two critical areas where problems often arise are product quality and intellectual property (IP) concerns. Failing to address these can lead to operational inefficiencies, legal complications, and financial losses.

Quality-Related Pitfalls

One of the most significant risks when sourcing fiber laser cutters is receiving equipment that does not meet advertised performance standards or industry requirements.

-

Inconsistent Build and Component Quality

Many low-cost suppliers use substandard materials or components (e.g., lower-grade optics, unreliable motion systems, or underpowered laser sources) to reduce manufacturing costs. This results in reduced cutting precision, shorter machine lifespan, and higher maintenance costs. -

Overstated Performance Specifications

Some suppliers exaggerate key metrics such as laser power output, cutting speed, or accuracy. For example, a machine advertised as a “6kW fiber laser” may deliver significantly less actual power due to inefficient energy conversion or poor cooling systems. -

Lack of Certification and Compliance

Reputable fiber laser cutters should comply with international safety and quality standards (e.g., CE, ISO, or FDA regulations). Suppliers may provide falsified documentation or machines that lack proper safety interlocks, electrical certifications, or emission controls. -

Insufficient After-Sales Support and Spare Parts Availability

Poor-quality machines often require more frequent maintenance and part replacements. Sourcing from suppliers with limited local support or a lack of readily available spare parts can lead to prolonged downtime.

Intellectual Property (IP) Risks

IP infringement is a serious and often overlooked concern when purchasing fiber laser cutting machines, especially from certain manufacturing regions.

-

Counterfeit or Cloned Technology

Some manufacturers produce machines that replicate the design, software, or core technology of established brands without licensing. These clones may infringe on patents related to beam delivery systems, control software, or cooling mechanisms. -

Use of Pirated or Unlicensed Software

Control systems in fiber laser cutters often rely on proprietary software (e.g., for CNC operation or nesting algorithms). Unauthorized use of such software can expose the buyer to legal liability, especially in regulated markets like the EU or North America. -

Exposure to Legal Action

Purchasing a machine that violates IP rights—even unknowingly—can result in customs seizures, lawsuits, or injunctions against usage. End-users may be named in infringement claims if it is proven they benefited from unauthorized technology. -

Difficulty in Warranty and Service Claims

IP-infringing machines often lack official manufacturer support, making it impossible to obtain genuine repairs, updates, or warranty coverage from the original technology provider.

Conclusion

To mitigate these risks, buyers should conduct thorough due diligence, including third-party inspections, verification of certifications, legal review of software licenses, and engagement with reputable suppliers. Investing in quality and IP-compliant equipment ensures long-term reliability, legal safety, and operational efficiency.

Logistics & Compliance Guide for Fiber Laser Cutters

Overview

Fiber laser cutters are high-precision industrial machines used for cutting metals and other materials. Due to their size, weight, sensitive components, and regulatory implications, proper logistics and compliance planning are essential for safe and legal transportation, import, and operation. This guide outlines key considerations for shipping, handling, and regulatory compliance.

Packaging & Handling Requirements

Fiber laser cutters must be securely packaged to prevent damage during transit. Use export-grade wooden crates or reinforced containers with internal bracing to protect optical components, the laser source, and control panels. Ensure all moving parts are immobilized and sensitive electronics are wrapped in anti-static material. Clearly label packages with “Fragile,” “This Side Up,” and “Do Not Stack” indicators. Avoid exposure to moisture, extreme temperatures, and direct sunlight during storage and transport.

Transportation Modes & Considerations

Choose transportation based on destination, urgency, and equipment size. For international shipments, sea freight is cost-effective for full container loads (FCL) or less than container loads (LCL). Air freight offers faster delivery but at a higher cost, suitable for urgent or smaller units. Domestic shipments often use flatbed or enclosed trucks. Coordinate with carriers experienced in handling industrial machinery and confirm equipment dimensions, weight, and lift requirements (e.g., forklift access) in advance.

Import & Export Compliance

Ensure compliance with international trade regulations. Fiber laser cutters may be subject to export controls under regimes like the Wassenaar Arrangement due to their dual-use potential. Verify if an export license is required based on destination country and technical specifications (e.g., laser power output). Prepare accurate documentation including commercial invoice, packing list, bill of lading/air waybill, and certificate of origin. Include Harmonized System (HS) code 8456.20 (for laser cutting machines) for customs classification.

Safety & Regulatory Standards

Fiber laser cutters must comply with regional safety standards. In the EU, adherence to the Machinery Directive (2006/42/EC) and CE marking is mandatory. In the U.S., follow OSHA and ANSI Z136.1 laser safety standards. Ensure equipment includes proper safety interlocks, emergency stops, protective enclosures, and laser warning labels. Provide a Declaration of Conformity and technical file upon delivery. Operators must receive training on laser safety protocols (e.g., eye protection, ventilation for fumes).

Electrical & Environmental Requirements

Verify voltage, phase, and frequency compatibility with local power infrastructure (e.g., 380V 3-phase in Europe vs. 480V in North America). Include transformers or power adapters if necessary. Ensure adequate cooling and ventilation at the installation site. Comply with environmental regulations regarding noise emissions and waste byproducts (e.g., metal particulates). Follow local rules for disposal of consumables and contaminated filters.

Documentation & Labeling

Maintain complete documentation for logistics and compliance, including user manuals, safety data sheets (SDS) for consumables, calibration certificates, and compliance labels. Machines must display required markings such as CE, EAC, or UL as applicable. Include multilingual safety instructions if shipping to non-English-speaking regions. Retain records for audit and warranty claims.

After-Sales & Service Logistics

Plan for spare parts availability, technician access, and remote support. Ship critical spare components (e.g., nozzles, lenses, protective windows) with initial delivery or store locally. Coordinate service visits with local certified technicians. Ensure compliance with data privacy and cybersecurity standards if the machine connects to networks (e.g., Industry 4.0 features).

Conclusion

Proper logistics and compliance management ensures fiber laser cutters arrive safely, meet regulatory requirements, and operate efficiently. Partner with experienced freight forwarders, verify regional legal obligations, and maintain thorough documentation throughout the supply chain. Proactive planning minimizes delays, avoids fines, and supports long-term customer satisfaction.

Conclusion for Sourcing Fiber Laser Cutters

In conclusion, sourcing fiber laser cutters requires a comprehensive evaluation of technical specifications, supplier reliability, total cost of ownership, and after-sales support. Fiber laser technology offers superior cutting speed, precision, and energy efficiency compared to traditional methods, making it a strategic investment for manufacturing and metal fabrication operations. When selecting a supplier, it is essential to prioritize manufacturers or distributors with proven track records, certifications, and technical expertise—particularly in regions like China, Europe, or North America where technology standards and support networks vary.

Key considerations include laser power (ranging from 1 kW to 12 kW or higher), cutting bed size, automation capabilities, software compatibility, and maintenance requirements. Additionally, evaluating service and warranty terms, spare parts availability, and training offerings ensures long-term operational efficiency. By conducting thorough due diligence and aligning supplier capabilities with specific production needs, businesses can successfully integrate high-performance fiber laser cutting systems that enhance productivity, reduce operating costs, and support future growth.