The global fiber cement siding market is experiencing robust growth, driven by increasing demand for durable, fire-resistant, and low-maintenance building materials in both residential and commercial construction. According to a 2023 report by Mordor Intelligence, the global fiber cement market is projected to grow at a CAGR of approximately 7.3% from 2023 to 2028, fueled by urbanization, infrastructure development, and stricter building codes favoring resilient materials. Similarly, Grand View Research valued the global fiber cement market at USD 23.4 billion in 2022 and anticipates a CAGR of 6.8% from 2023 to 2030, citing rising construction activities in Asia-Pacific and North America as key growth drivers. As sustainability and energy efficiency become central to architectural design, fiber cement siding—known for its weather resistance, longevity, and aesthetic versatility—has emerged as a preferred cladding solution. This momentum has intensified competition among manufacturers, spurring innovation in product performance, environmental footprint, and installation efficiency. Against this backdrop, we spotlight the top nine fiber cement siding manufacturers shaping the industry through scale, technological advancement, and market reach.

Top 9 Fiber Cement Siding Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Swisspearl Group

Domain Est. 2003

Website: swisspearl.com

Key Highlights: With headquarters in Switzerland, Swisspearl is manufacturer of premium fibre cement products for facade, roofing, interior wall cladding and garden ……

#2 WeatherSide™ Profile™ Fiber

Domain Est. 1996

Website: gaf.com

Key Highlights: WeatherSide™ Fiber-Cement Siding is fantastic for replacing old non-existent asbestos siding. Get the details on GAF WeatherSide™ Profile Shingles now….

#3 Fiber Cement, Composite & Engineered Wood Siding

Domain Est. 1998

Website: abcsupply.com

Key Highlights: ABC Supply is a wholesale distributor of fiber cement and engineered wood siding products. Fiber Cement, Composite & Engineered Wood Siding Partners….

#4 Fiber Cement Siding

Domain Est. 2000

Website: nichiha.com

Key Highlights: Fiber cement siding is an engineered building material formed with a dry mix of fly ash, cement, sand, and wood fibers that’s pressed under high pressure ……

#5 Siding

Domain Est. 2000

Website: plygem.com

Key Highlights: Ply Gem Siding Performance Collection vinyl siding products are engineered to be beautiful, long-lasting and virtually maintenance-free to meet to the demands ……

#6 Everlast Advanced Composite Siding from Chelsea Building Products

Domain Est. 2009

Website: everlastsiding.com

Key Highlights: Everlast siding is available in horizontal lap siding and vertical board and batten styles. Both styles feature CedarTouch®, Everlast’s renowned surface finish ……

#7 EQUITONE

Domain Est. 2009

Website: equitone.com

Key Highlights: EQUITONE fibre cement cladding – designed by and for architects. Durable, through-coloured facade panels for modern, sustainable architecture….

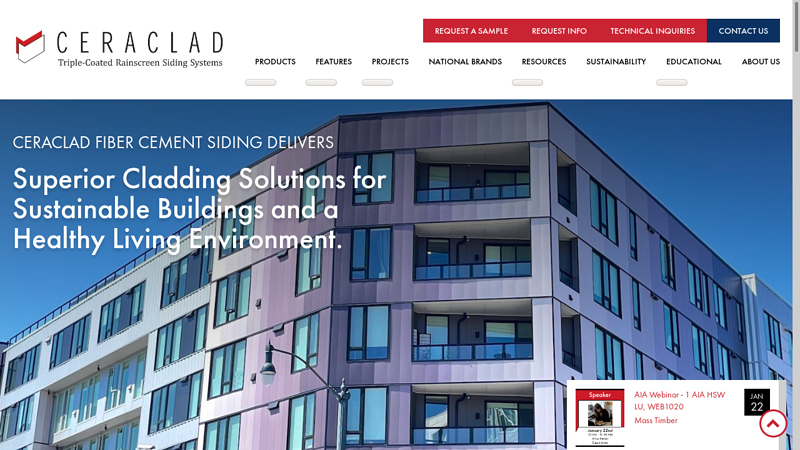

#8 CERACLAD

Domain Est. 2010

Website: ceraclad.com

Key Highlights: Ceraclad Fiber Cement Siding Delivers Superior Cladding Solutions for Sustainable Buildings and a Healthy Living Environment….

#9 Allura USA: #1 Fiber Cement Siding Manufacturer

Domain Est. 2014

Website: allurausa.com

Key Highlights: Long-lasting Allura products are built to last a decade without even breaking a sweat. They remain reliable and won’t lose their looks….

Expert Sourcing Insights for Fiber Cement Siding

H2: 2026 Market Trends for Fiber Cement Siding

The global fiber cement siding market is poised for continued growth and strategic evolution by 2026, driven by shifting construction dynamics, sustainability demands, and technological advancements. Key trends shaping the market include:

1. Accelerated Demand in Residential Renovation and New Construction:

The aging housing stock in North America and Europe will fuel significant demand for durable, low-maintenance exterior solutions. Homeowners and builders increasingly prioritize longevity and curb appeal, positioning fiber cement as a preferred alternative to wood, vinyl, and stucco. Growth in multi-family housing and accessory dwelling units (ADUs) will further expand the market, especially in urban and suburban areas.

2. Dominance of Sustainability and Environmental Performance:

Sustainability will be a major differentiator. Fiber cement’s inherent durability, recyclability, and resistance to mold and pests align with green building standards (e.g., LEED, BREEAM). By 2026, manufacturers will emphasize reduced carbon footprints through optimized production processes, increased use of recycled materials (particularly cellulose fibers), and transparent environmental product declarations (EPDs) to appeal to eco-conscious consumers and meet tightening regulatory requirements.

3. Innovation in Product Design and Aesthetics:

To compete with premium materials like wood and stone, fiber cement manufacturers will continue investing in advanced embossing, coloring, and texturing technologies. Realistic wood grain, slate, and brick finishes will become more sophisticated, offering greater design flexibility. Pre-finished and factory-painted panels will gain market share, reducing on-site labor and improving consistency while expanding color and style portfolios.

4. Expansion of Global Markets and Regional Manufacturing:

While North America remains a key market, Asia-Pacific—particularly China, India, and Southeast Asia—will experience the fastest growth due to rapid urbanization, rising disposable incomes, and infrastructure development. This will drive local production investments to reduce logistics costs and tariffs, creating a more regionally balanced manufacturing footprint.

5. Integration of Smart Building and Resilient Construction Trends:

Fiber cement’s fire resistance, impact durability, and moisture management properties align with the growing emphasis on resilient construction in wildfire-prone and hurricane-affected regions. While not inherently “smart,” its compatibility with insulation systems and integration into rainscreen assemblies will support energy efficiency and building envelope performance, indirectly supporting smart building goals.

6. Competitive Pressure and Consolidation:

The market will see intensified competition between major players (e.g., James Hardie, Nichiha, ETEX) and regional manufacturers. This may lead to strategic mergers, acquisitions, and partnerships to expand product lines, geographic reach, and R&D capabilities. Price sensitivity, especially in cost-driven markets, will push innovation toward cost-effective production without compromising quality.

7. Digitalization and Direct-to-Consumer Channels:

Digital tools—such as augmented reality (AR) visualization apps, online design platforms, and e-commerce sales—will enhance customer engagement and streamline the buying process. Manufacturers and distributors will increasingly adopt B2C and D2C models, especially targeting the DIY and prosumer segments with pre-cut kits and installation support.

In summary, the fiber cement siding market in 2026 will be characterized by innovation, sustainability leadership, and geographic diversification, solidifying its role as a high-performance exterior cladding solution in a competitive and evolving building materials landscape.

Common Pitfalls When Sourcing Fiber Cement Siding: Quality and Intellectual Property Risks

Sourcing fiber cement siding can offer durability and aesthetic appeal, but buyers must navigate several critical pitfalls related to product quality and intellectual property (IP) concerns. Overlooking these risks can lead to performance failures, legal disputes, and reputational damage.

Poor Material Quality and Inconsistent Manufacturing

One of the most frequent issues when sourcing fiber cement siding—especially from low-cost or unverified suppliers—is inconsistent or substandard material quality. Inferior raw materials, improper curing processes, or lack of quality control can result in products prone to cracking, warping, or moisture absorption. Siding that fails prematurely not only increases long-term costs but may also violate building codes or void warranties.

Lack of Third-Party Testing and Certifications

Many suppliers, particularly in emerging markets, may lack independent certifications such as ASTM, EN, or LEED compliance. Without proper testing for fire resistance, freeze-thaw durability, or dimensional stability, buyers risk installing non-compliant or unsafe materials. Always verify that products have been tested by accredited laboratories and meet regional building standards.

Misrepresentation of Product Performance Claims

Some manufacturers exaggerate product lifespan, weather resistance, or maintenance requirements. Buyers should scrutinize technical data sheets and request performance data from long-term field studies. Claims unsupported by evidence can lead to dissatisfaction and costly replacements.

Intellectual Property Infringement Risks

Sourcing from manufacturers that replicate patented designs, textures, or installation systems without authorization exposes buyers to IP litigation. Well-known brands invest in unique profiles, color technologies, and locking mechanisms protected by patents and trademarks. Using counterfeit or copied products—even unknowingly—can result in legal liability, shipment seizures, or forced removal of installed materials.

Inadequate Traceability and Supply Chain Transparency

Opaque supply chains make it difficult to verify the origin of raw materials or production practices. This lack of traceability increases the risk of receiving products made with unethical labor practices or environmentally harmful processes. It also complicates accountability when quality or IP issues arise.

Unreliable Warranty and After-Sales Support

Lower-tier suppliers may offer warranties that are difficult to enforce, especially across international borders. Without reliable technical support or clear claims processes, resolving quality issues becomes costly and time-consuming. Always evaluate the supplier’s service infrastructure and warranty terms before committing.

By carefully vetting suppliers, demanding verifiable certifications, and conducting due diligence on IP rights, buyers can mitigate these common pitfalls and ensure a successful, compliant fiber cement siding project.

Logistics & Compliance Guide for Fiber Cement Siding

Fiber cement siding is a durable, fire-resistant, and low-maintenance building material widely used in residential and commercial construction. Proper logistics planning and adherence to compliance regulations are essential to ensure safe handling, timely delivery, and legal conformity throughout the supply chain. This guide outlines key considerations for transporting, storing, handling, and complying with regulatory standards for fiber cement siding products.

Transportation and Handling

Fiber cement siding is heavy and brittle, requiring specialized handling procedures to prevent breakage and ensure worker safety.

- Packaging and Palletization: Siding boards are typically bundled and shrink-wrapped on sturdy wooden or composite pallets. Ensure bundles are secured to prevent shifting during transit.

- Loading and Unloading: Use forklifts or pallet jacks with wide forks to evenly distribute weight. Never lift bundles by the strapping. Avoid dropping or dragging materials.

- Vehicle Requirements: Use flatbed or enclosed trucks with adequate tie-down points. Secure loads with straps and edge protectors to prevent damage during transit.

- Handling on Site: Store bundles on level, elevated surfaces to avoid moisture absorption. Keep materials under cover or wrapped if exposed to weather.

Storage Guidelines

Proper storage preserves product integrity and prevents warping, moisture damage, or breakage.

- Location: Store in a dry, well-ventilated area away from direct ground contact. Use pallets or skids to elevate bundles at least 6 inches off the ground.

- Stacking: Limit stack height to manufacturer recommendations (usually no more than 5–6 feet or 2–3 pallets high) to prevent crushing and instability.

- Weather Protection: Cover with breathable tarps or store indoors. Avoid plastic sheeting that traps moisture, which can lead to mold or swelling.

- Duration: Minimize storage time on-site. Prolonged exposure to humidity or temperature fluctuations may affect dimensional stability.

Health and Safety Compliance

Fiber cement contains crystalline silica, which poses health risks when cut or drilled without proper controls.

- Silica Dust Exposure: Cutting, grinding, or sanding fiber cement releases respirable crystalline silica, a known carcinogen. OSHA (Occupational Safety and Health Administration) enforces strict Permissible Exposure Limits (PELs).

- Respiratory Protection: Workers must use NIOSH-approved respirators (e.g., N95 or higher) when engineering controls are insufficient.

- Engineering Controls: Use wet-cutting methods or local exhaust ventilation (e.g., HEPA-filtered vacuum systems) during on-site fabrication.

- Training Requirements: Employers must provide OSHA-compliant hazard communication (HazCom) and respiratory protection training under 29 CFR 1910.1053 (Respirable Crystalline Silica Standard).

Environmental and Regulatory Compliance

Manufacturers and installers must comply with environmental and building regulations.

- EPA Regulations: Comply with EPA’s Renovation, Repair, and Painting (RRP) Rule if disturbing painted surfaces on pre-1978 buildings, though fiber cement itself does not contain lead.

- LEED and Sustainability: Many fiber cement products contribute to LEED credits due to durability, recycled content, and low VOC emissions. Verify product-specific Environmental Product Declarations (EPDs) and Health Product Declarations (HPDs).

- Building Codes: Ensure products meet local and national codes, including the International Building Code (IBC) and International Residential Code (IRC). Verify fire ratings (typically Class A), wind resistance, and moisture management requirements.

- Material Safety Data Sheets (MSDS/SDS): Maintain up-to-date Safety Data Sheets for all fiber cement products, detailing composition, hazards, and handling instructions.

Import and Customs Compliance (International Shipments)

For cross-border logistics, additional documentation and standards may apply.

- Harmonized System (HS) Code: Fiber cement siding typically falls under HS Code 6811.40 (other articles of cement, of asbestos-free fiber cement).

- Country-Specific Standards: Confirm compliance with destination country regulations (e.g., CE marking in the EU, NRCAN in Canada, or BCA in Australia).

- Documentation: Provide commercial invoices, packing lists, certificates of origin, and test reports (e.g., fire, durability) as required by customs authorities.

- Tariffs and Duties: Be aware of applicable tariffs, especially under trade agreements or restrictions (e.g., Section 301 tariffs on certain Chinese imports).

Waste Management and Disposal

Proper disposal of off-cuts and packaging is required to meet environmental standards.

- Recycling: Fiber cement is non-biodegradable but can often be recycled through specialized construction waste facilities.

- Landfill Disposal: If recycling is unavailable, dispose of in accordance with local solid waste regulations. Avoid incineration due to silica content.

- Packaging Waste: Recycle plastic wraps, strapping, and wooden pallets where possible.

Best Practices Summary

- Always follow manufacturer handling and storage instructions.

- Conduct regular safety training for all personnel involved in transport, storage, and installation.

- Maintain compliance documentation, including SDS, test reports, and certifications.

- Monitor regulatory updates from OSHA, EPA, and local authorities.

Adhering to this logistics and compliance guide ensures the safe, efficient, and lawful distribution and use of fiber cement siding, minimizing risks to workers, the environment, and project timelines.

In conclusion, sourcing fiber cement siding manufacturers requires a strategic approach that balances quality, cost, sustainability, and reliability. Key considerations include evaluating the manufacturer’s production capabilities, adherence to international standards, product durability, and environmental practices. Whether sourcing domestically or internationally, it is essential to conduct thorough due diligence, including factory audits, sample testing, and verification of certifications such as ISO, CE, or environmental compliance marks.

Establishing relationships with reputable manufacturers—such as James Hardie (global leader), Etex (North America/Europe), Cedral, or emerging suppliers in Asia and South America—can ensure a steady supply of high-performance fiber cement siding suitable for diverse climatic and architectural demands. Additionally, clear communication, favorable terms, and logistics planning are critical for long-term success.

Ultimately, selecting the right fiber cement siding manufacturer supports not only project efficiency and cost-effectiveness but also long-term building performance and sustainability goals. A well-informed sourcing decision enhances value across the supply chain, benefiting contractors, developers, and end-users alike.