The global flux-cored arc welding (FCAW) wire market has seen steady expansion, driven by increasing demand across key industries such as construction, automotive, and heavy equipment manufacturing. According to a report by Mordor Intelligence, the FCAW wire market was valued at approximately USD 2.8 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 4.5% from 2024 to 2029. This growth is bolstered by the rising preference for high-efficiency welding solutions, particularly in infrastructure development and industrial fabrication across emerging economies. Additionally, advancements in wire formulations that improve weld quality, deposition rates, and all-position welding capabilities are further fueling adoption. As the global push for more durable and cost-effective joining methods intensifies, manufacturers are investing heavily in R&D and strategic expansions. In this competitive landscape, nine key FCAW welding wire manufacturers have emerged as industry leaders—shaping innovation, ensuring quality, and meeting the evolving demands of modern metalworking applications.

Top 9 Fcaw Welding Wire Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 FCAW Wires for Stainless Steel Welding Without Gas

Domain Est. 1996

Website: esab.com

Key Highlights: Weld outdoors and in demanding environments with our self-shielded flux-cored wires for stainless steel, eliminating the need for external shielding gas….

#2 FCAW Cored Wires Overview

Domain Est. 1996

Website: lincolnelectric.com

Key Highlights: Explore Lincoln Electric’s comprehensive overview of FCAW cored wires. Learn about flux-cored arc welding wire types, benefits, and applications to improve ……

#3 Self

Domain Est. 1997

Website: voestalpine.com

Key Highlights: Böhler Welding offers self-shielded flux-cored wires (FCAW-S) with specific solutions for Mild steel, Pipeline steel under the diamondspark and BÖHLER ……

#4 Select-Arc

Domain Est. 1999

Website: select-arc.com

Key Highlights: Select-Arc manufactures a full line of welding wire including: Carbon Steel, Stainless Steel, Hardfacing, Low Alloy, Nickel Alloys and Submerged Arc….

#5 Stainless Steel Flux

Domain Est. 2006

Website: harrisproductsgroup.com

Key Highlights: Harris’ stainless steel flux-cored welding wires provide filler metal for welding stainless steel and other compatible metals….

#6 MIG Process

Domain Est. 2013

Website: zika-welding.com

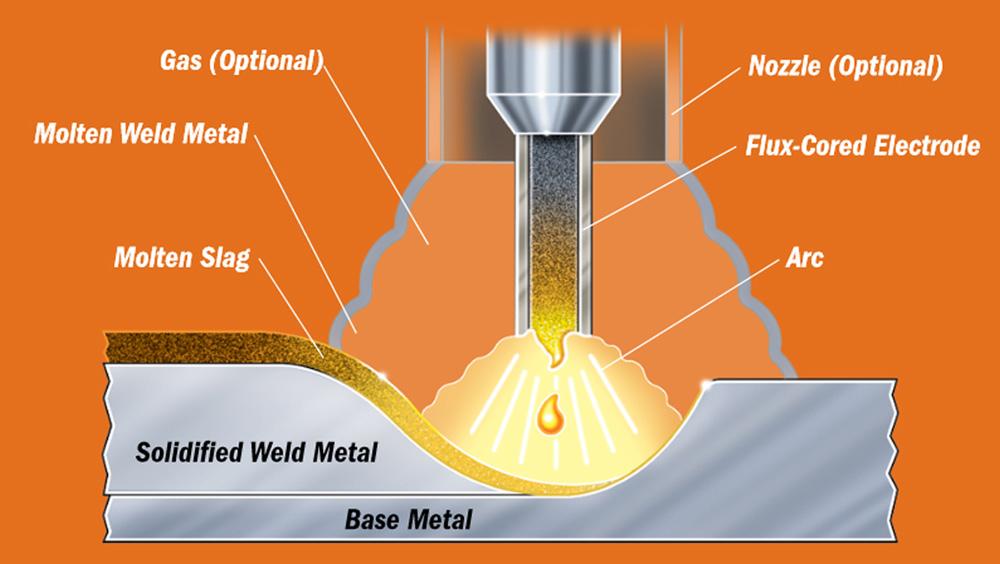

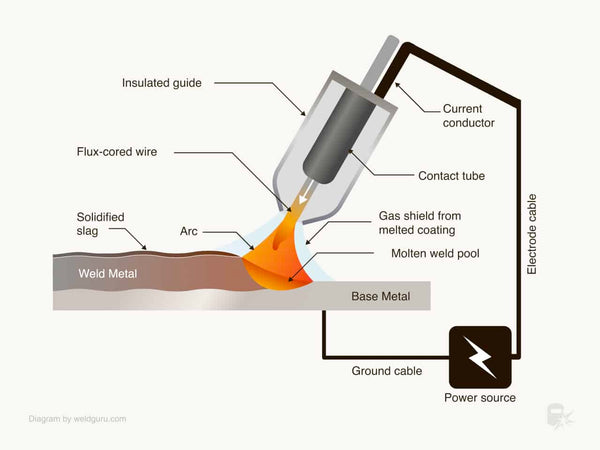

Key Highlights: Flux Cored Arc Welding (FCAW) uses the heat generated by a DC electric arc to fuse the metal in the joint area, the arc being struck between a continuously ……

#7 Victory Welding Alloys*

Domain Est. 2014

Website: victoryweldingalloys.com

Key Highlights: Our product line includes many types of Consumable Filler Metals for GMAW, GTAW, SMAW, FCAW and OFW processes. MIG and TIG Solid Welding Wires, ……

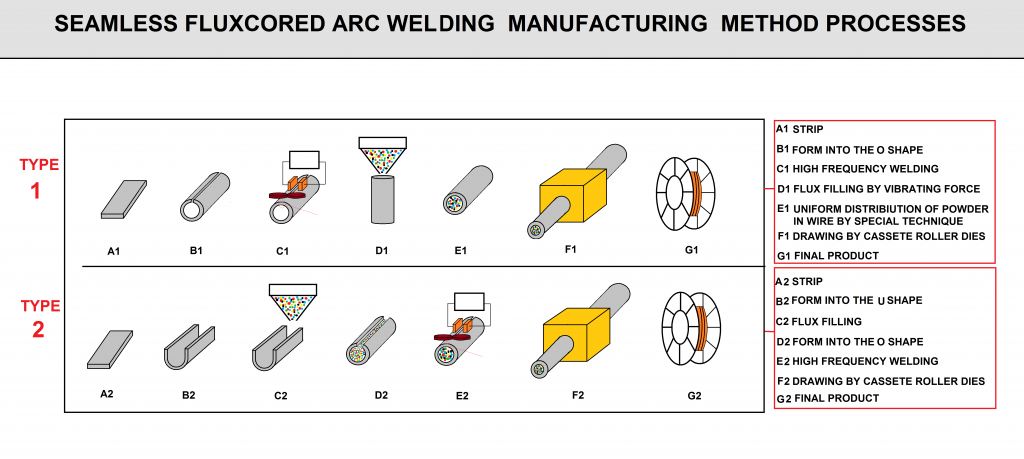

#8 Flux Cored Welding Wire Manufacturing from A to Z by

Domain Est. 2019

Website: wespec.net

Key Highlights: there are two main types of flux core arc welding: Self-shielded (known as FCAW-S) and Gas shielded (which is FCAW-G). In a self-shielded flux core, the weld is ……

#9 Flux cored wires of the highest quality for the best welding economy

Domain Est. 1999

Website: en.nst.no

Key Highlights: See our wide selection of seamless flux cored wires from Nippon Steel. We can also offer folded FCW-wires for any welding operation….

Expert Sourcing Insights for Fcaw Welding Wire

H2: Projected 2026 Market Trends for FCAW Welding Wire

The Flux-Cored Arc Welding (FCAW) welding wire market is expected to experience significant evolution by 2026, driven by industrial growth, technological advancements, and shifting regulatory landscapes. This analysis outlines key trends shaping the FCAW welding wire industry in the lead-up to 2026.

-

Increased Demand from Construction and Infrastructure Sectors

Global infrastructure development, particularly in emerging economies such as India, Southeast Asia, and parts of Africa, is anticipated to drive demand for FCAW welding wire. Government-led infrastructure projects—including bridges, highways, and commercial buildings—favor FCAW due to its high deposition rates and suitability for outdoor and thick-section welding. The U.S. Infrastructure Investment and Jobs Act and similar initiatives worldwide are expected to sustain demand through 2026. -

Growth in Heavy Equipment and Automotive Manufacturing

The heavy machinery, mining, and transportation equipment industries continue to adopt FCAW for its deep penetration and strong weld integrity. With a rebound in global manufacturing post-pandemic and increasing investments in electric and autonomous vehicles, demand for high-strength, durable welds will favor FCAW applications, particularly in chassis and structural components. -

Technological Advancements in Self-Shielded and Gas-Shielded Wires

Innovation in FCAW wire formulations is enhancing performance in diverse environments. By 2026, manufacturers are expected to offer improved self-shielded FCAW wires with better arc stability and reduced spatter, reducing reliance on external shielding gases—especially beneficial in remote or field applications. Simultaneously, gas-shielded FCAW wires are being engineered for higher efficiency and compatibility with automated welding systems. -

Rise of Automation and Robotics in Welding

The integration of FCAW into robotic welding cells is accelerating, especially in high-volume production environments. As industries pursue greater precision and productivity, FCAW’s compatibility with automation—due to consistent feedability and stable arc characteristics—positions it favorably. By 2026, smart welding systems using real-time monitoring and adaptive control will increasingly incorporate FCAW wire, improving quality and reducing waste. -

Sustainability and Environmental Regulations

Environmental concerns are influencing FCAW wire development. Stricter emissions standards are pushing manufacturers to reduce hexavalent chromium and other hazardous fumes. Leading producers are investing in low-fume and lead-free formulations. Additionally, recyclability of wire packaging and energy-efficient production processes will become competitive differentiators. -

Regional Market Shifts

Asia-Pacific is projected to dominate the FCAW wire market by 2026, driven by China and India’s industrial expansion and shipbuilding activities. North America will remain a strong market due to energy sector projects (e.g., pipelines, offshore platforms) and defense manufacturing. Europe’s market will grow steadily, supported by green infrastructure and stringent welding standards. -

Supply Chain Resilience and Raw Material Volatility

Fluctuations in steel and alloy prices (e.g., nickel, manganese) will continue to impact FCAW wire costs. Companies are expected to mitigate risks through vertical integration, long-term supplier contracts, and localized production. Geopolitical factors and trade policies may also influence regional availability and pricing. -

Consolidation and Strategic Partnerships Among Key Players

Major welding consumable manufacturers such as Lincoln Electric, ESAB, and Hobart Brothers are likely to expand their FCAW portfolios through acquisitions, R&D investments, and partnerships with automation firms. This consolidation will drive innovation and market consolidation by 2026.

In conclusion, the FCAW welding wire market in 2026 will be shaped by robust industrial demand, technological innovation, and a shift toward sustainable and automated solutions. Companies that adapt to these trends—by offering high-performance, environmentally friendly, and automation-ready products—are poised to lead the market.

Common Pitfalls Sourcing FCAW Welding Wire (Quality, IP)

Sourcing Flux-Cored Arc Welding (FCAW) wire involves more than just finding the lowest price. Overlooking critical quality and intellectual property (IP) considerations can lead to production delays, compromised weld integrity, safety risks, and legal exposure. Below are common pitfalls to avoid:

Poor Quality Control and Inconsistent Performance

One of the most frequent issues is receiving FCAW wire that fails to meet required mechanical or chemical specifications. This often stems from:

- Inadequate Manufacturing Standards: Suppliers may not adhere to recognized standards (e.g., AWS A5.20, A5.29), leading to inconsistent chemistry, slag formation, or porosity in welds.

- Improper Packaging and Handling: Exposure to moisture due to poor sealing or storage can compromise the flux core, resulting in hydrogen-induced cracking and reduced weld strength.

- Unverified Test Reports: Accepting mill test reports without verification or third-party certification increases the risk of substandard material entering the production line.

Counterfeit or Non-Compliant Products

The FCAW wire market is susceptible to counterfeit goods, especially when sourcing from less-regulated regions. Red flags include:

- Mislabeling of Grade or Specification: Wire may be falsely labeled as meeting AWS or ASME standards when it does not, leading to weld failures in critical applications.

- Inferior Core Filling: The flux composition may be altered or diluted to cut costs, affecting arc stability, spatter levels, and mechanical properties.

- Lack of Traceability: Absence of batch numbers, heat numbers, or certification documentation makes it difficult to verify authenticity and track issues.

Intellectual Property (IP) Infringement

Using or sourcing FCAW wire that infringes on patented formulations or manufacturing processes exposes companies to legal and financial risks:

- Unauthorized Use of Proprietary Formulations: Some premium FCAW wires contain patented flux chemistries designed for specific applications (e.g., low-temperature toughness, high deposition rates). Copying these without licensing constitutes IP theft.

- Supplier IP Violations: Even if your company is unaware, sourcing from a supplier who reverse-engineers or reproduces patented wires can lead to secondary liability.

- Brand and Reputation Damage: Being linked to counterfeit or IP-infringing products can harm customer trust and disqualify you from certified projects (e.g., offshore, pressure vessels).

Overlooking Application-Specific Requirements

FCAW wire is not one-size-fits-all. Sourcing generic wire without considering:

- Base Material Compatibility: Mismatched wire for carbon steel, low-alloy, or stainless applications affects weld integrity.

- Environmental Conditions: Wires designed for indoor use may fail in high-moisture or outdoor settings if not properly formulated (e.g., self-shielded vs. gas-shielded).

- Positional Welding Needs: Not all wires perform well in vertical or overhead positions—using the wrong type increases defects and rework.

Mitigation Strategies

To avoid these pitfalls:

- Audit Suppliers: Conduct on-site audits or require certifications (ISO 9001, AWS Certified Manufacturer).

- Verify Certifications: Demand valid, traceable material test reports (MTRs) and consider third-party testing.

- Protect IP: Work only with reputable suppliers and ensure contracts include IP indemnification clauses.

- Match Wire to Application: Consult welding procedure specifications (WPS) and material data sheets before procurement.

By addressing quality and IP concerns proactively, organizations can ensure reliable weld performance, regulatory compliance, and operational safety.

Logistics & Compliance Guide for FCAW Welding Wire

Product Classification & Regulatory Overview

Flux-Cored Arc Welding (FCAW) welding wire is classified under international trade codes and subject to various regulatory standards depending on the destination country. Typically, FCAW wire falls under Harmonized System (HS) Code 7223.00 (Stainless Steel Wire) or 7213.91 (Other Iron or Non-Alloy Steel Wire), depending on composition. Exporters must verify the correct HS code based on wire material (e.g., carbon steel, stainless steel, low-alloy steel) and form (solid wire with flux core). Compliance with international welding standards such as AWS A5.20, A5.29, or ISO 17632 is essential for market acceptance, particularly in North America, Europe, and Asia.

Packaging & Handling Requirements

FCAW wire must be packaged to prevent moisture absorption, mechanical damage, and corrosion. Common packaging includes sealed plastic wraps, vacuum-sealed bags, or moisture-resistant spools housed in sturdy cardboard or metal containers. Drums or reels should be labeled with product specifications, batch numbers, and handling instructions (e.g., “Keep Dry,” “Do Not Drop”). Proper palletization using wooden or plastic pallets with stretch-wrapping ensures stability during transit. Handling equipment must avoid impact to prevent wire distortion or spool deformation, which can disrupt feeding during welding operations.

Storage Conditions

Store FCAW wire in a climate-controlled, dry environment with relative humidity below 60% and temperatures between 10°C and 30°C (50°F–86°F). Exposure to moisture compromises the flux core, leading to porosity and weld defects. Keep spools off the floor using pallets or racks to avoid ground moisture. Once opened, unused wire should be returned to sealed containers or stored in a wire-keeping oven if specified by the manufacturer. Rotate stock using FIFO (First In, First Out) to prevent aging and ensure optimal performance.

Transport & Shipping Compliance

Transport FCAW wire via ground, sea, or air in accordance with IATA, IMDG, or ADR regulations as applicable. While FCAW wire is generally non-hazardous, packaging must meet drop-test and stacking requirements to prevent damage. For international shipments, include a commercial invoice, packing list, certificate of origin, and material test reports (MTRs) or compliance certificates (e.g., AWS or CE). Ensure declared product descriptions align with customs classifications. Use insured freight services with tracking and require proof of delivery for quality assurance.

Import/Export Documentation

Complete documentation is critical for customs clearance. Required documents include:

– Commercial Invoice (with detailed product description, value, and Incoterms)

– Packing List (itemizing spools, weights, and dimensions)

– Bill of Lading or Air Waybill

– Certificate of Origin (preferably Form A for GSP eligibility)

– Product Compliance Certificate (e.g., AWS A5.20/A5.29, ISO 17632)

– Material Safety Data Sheet (MSDS/SDS) – although typically non-hazardous, an SDS may be required for customs review

Verify destination-specific requirements; for example, the EU may require CE marking, while Canada mandates CSA compliance for certain applications.

Environmental & Safety Compliance

FCAW wire is not classified as hazardous material under DOT, ADR, or IATA, but residues from welding fumes may contain manganese, nickel, or other regulated metals. Provide Safety Data Sheets (SDS) compliant with GHS standards. Recycle spools and packaging materials where possible in accordance with local environmental regulations. Ensure workplace handling follows OSHA (US), WHMIS (Canada), or REACH/CLP (EU) guidelines to protect personnel from metal dust and fume exposure during manufacturing or repackaging.

Quality Assurance & Traceability

Maintain full traceability from raw material to finished product. Each batch of FCAW wire should have a unique lot number linked to mill test reports, process records, and quality inspections. Certification to ISO 9001 (Quality Management) and ISO 14001 (Environmental Management) enhances compliance credibility. Conduct periodic audits of suppliers and logistics partners to ensure consistent adherence to packaging, labeling, and handling standards.

Conclusion for Sourcing FCAW Welding Wire:

In conclusion, sourcing FCAW (Flux-Cored Arc Welding) welding wire requires a strategic approach that balances quality, cost, availability, and technical specifications. Selecting the right supplier involves evaluating factors such as wire chemistry, mechanical properties, certifications (e.g., AWS compliance), consistent quality control, and technical support. Local vs. international sourcing decisions should account for lead times, logistics, and import regulations. Additionally, establishing long-term partnerships with reputable suppliers can ensure supply chain reliability, reduce downtime, and maintain weld integrity across projects. By prioritizing performance requirements and total cost of ownership—rather than just upfront price—organizations can enhance welding efficiency, improve end-product quality, and achieve greater operational success in demanding industrial applications.