The global machine manufacturing industry is undergoing robust expansion, fueled by rising industrial automation, advancements in smart manufacturing technologies, and increasing demand across sectors such as automotive, aerospace, and heavy machinery. According to a 2023 report by Mordor Intelligence, the global industrial machinery market was valued at USD 547.8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2028. Complementing this, Grand View Research estimates that the global machine tools market alone is expected to reach USD 142.9 billion by 2030, expanding at a CAGR of 7.8%, driven by precision engineering needs and Industry 4.0 adoption. As competition intensifies and innovation accelerates, a select group of manufacturers have emerged as leaders, setting benchmarks in efficiency, scalability, and technological integration. Below, we identify the top 10 machine manufacturers shaping the future of global industrial output.

Top 10 Machines Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Crown Equipment Corporation

Domain Est. 1998

Website: crown.com

Key Highlights: Crown Equipment Corporation is a global manufacturer of material handling equipment, lift trucks and technology, with a network of more than 500 forklift ……

#2 Makino

Domain Est. 1996

Website: makino.com

Key Highlights: Achieve superior results with Makino’s CNC machining. Makino machines and engineering services provide precision and reliability across applications….

#3 Industrial Machinery

Domain Est. 1998

Website: mhi.com

Key Highlights: Industrial Machinery · Engines (Diesel & Gas) · Engine Output Range Chart · Chemical Plants · CO2 Recovery Plants · Printing Presses · Paper Converting Machinery….

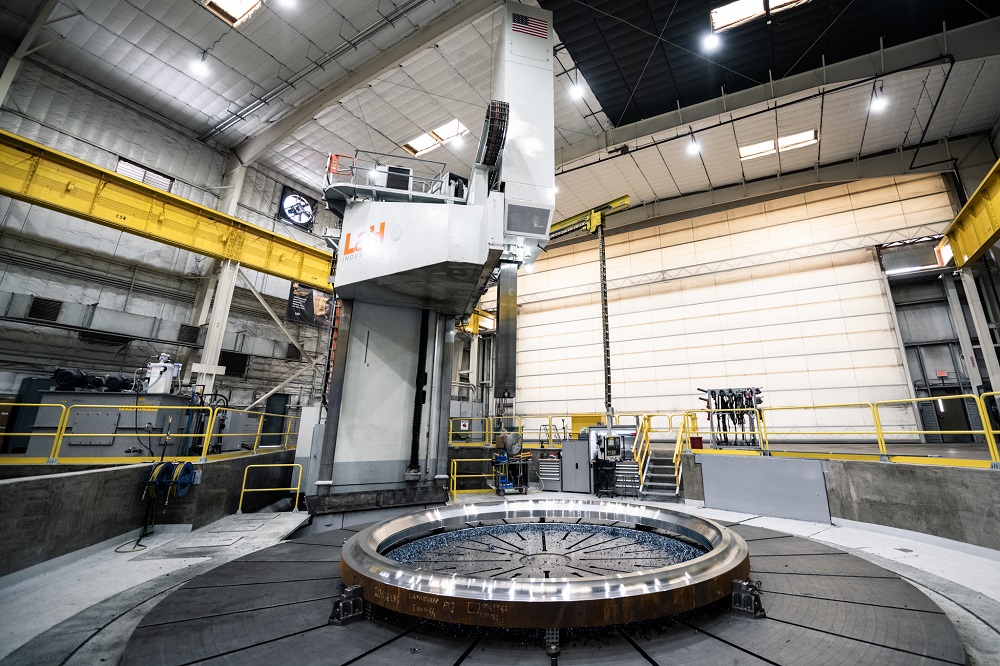

#4 L&H Industrial

Domain Est. 1998

Website: lnh.net

Key Highlights: L&H Industrial specialized teams transform the biggest heavy industry machines with expert design, engineering, and precision manufacturing….

#5 U.S. Industrial Machinery

Domain Est. 1999

Website: usindustrial.com

Key Highlights: U.S. Industrial Machinery in Memphis, TN is an independently owned supplier of industrial-grade and reliable metal-working machine tools for professionals….

#6 UNITED MACHINING

Domain Est. 1999

Website: gfms.com

Key Highlights: UNITED MACHINING delivers comprehensive, integrated solutions for manufacturers of precision parts, tools, and mold-making — helping them move seamlessly from ……

#7

Domain Est. 2015

Website: hitachicm.com

Key Highlights: We are now a leading global manufacturer of mining machinery. We will continuously work on resolving issues which our customers face in the mining sites….

#8 Industrial Manufacturing Machines

Domain Est. 2019

Website: industrialmm.com

Key Highlights: We are makers of industrial machines! Our deep-rooted experience gives us the confidence and perseverance to be considered a pioneer of our sector….

#9 Globe Machine Manufacturing

Domain Est. 1996

Website: globemachine.com

Key Highlights: Globe Machine Manufacturing Company began in 1917 as a supplier of saws and presses for the wood products industry. Today, we serve numerous business sectors….

#10 Metal Fabrication Machinery

Domain Est. 1998

Website: mcmachinery.com

Key Highlights: MC Machinery Systems, a supplier of metal fabrication machines, provides EDM, milling, laser, press brake, finishing, and automation solutions….

Expert Sourcing Insights for Machines

2026 Market Trends for Machines

The global machines market is poised for transformative growth and innovation by 2026, driven by rapid technological advancements, increasing automation across industries, and a strong push toward sustainability. This analysis explores key trends shaping the machines sector, including industrial automation, artificial intelligence integration, green manufacturing, and the evolving role of robotics.

1. Accelerated Industrial Automation and Smart Manufacturing

By 2026, industrial automation will be a cornerstone of manufacturing efficiency. The integration of IoT-enabled machines, predictive maintenance systems, and real-time data analytics will enable smarter factories. The rise of Industry 4.0 and the expansion of digital twins—virtual models of physical machines—will allow manufacturers to simulate performance, optimize workflows, and reduce downtime. Demand for collaborative robots (cobots) will surge, as they offer flexible automation solutions suitable for small and medium-sized enterprises.

2. AI and Machine Learning Integration

Artificial intelligence is revolutionizing machine capabilities. By 2026, AI-powered machines will become standard in sectors such as automotive, healthcare, logistics, and agriculture. These machines will feature advanced decision-making abilities, self-optimization, and adaptive learning. For example, autonomous construction equipment and AI-guided CNC machines will enhance precision and productivity. The fusion of AI with edge computing will enable faster on-site processing, reducing latency and reliance on cloud infrastructure.

3. Shift Toward Sustainable and Energy-Efficient Machines

Environmental regulations and corporate sustainability goals are driving demand for energy-efficient and low-emission machines. By 2026, manufacturers will prioritize electrification, with electric-powered industrial machines and off-highway vehicles gaining traction. Innovations in battery technology and hydrogen fuel cells will support this transition. Additionally, circular economy principles will influence machine design, promoting modular construction, recyclability, and longer product lifecycles.

4. Growth in Service Robotics and Autonomous Systems

Beyond industrial applications, service robotics will expand significantly by 2026. Machines for healthcare (e.g., surgical robots, rehabilitation devices), logistics (e.g., warehouse automation, delivery drones), and domestic use (e.g., cleaning robots, lawn mowers) will see increased adoption. Autonomous mobile robots (AMRs) will become more sophisticated, navigating complex environments with minimal human intervention.

5. Supply Chain Resilience and On-Demand Manufacturing

Global disruptions have highlighted the need for resilient supply chains. In response, companies will invest in decentralized manufacturing using 3D printing and modular machine systems. This shift enables on-demand production, reduces inventory costs, and shortens delivery times. Machines capable of multi-material fabrication and rapid reconfiguration will be in high demand.

6. Regional Market Dynamics

Asia-Pacific, particularly China and India, will remain key growth regions due to industrial expansion and infrastructure development. North America and Europe will focus on high-value, technology-intensive machines, driven by innovation in AI, robotics, and green tech. Emerging markets in Latin America and Africa will gradually adopt automation, supported by foreign investment and technology transfer.

Conclusion

By 2026, the machines market will be defined by intelligence, sustainability, and adaptability. Companies that embrace AI, prioritize eco-design, and leverage data-driven operations will lead the industry. As machines evolve from tools to autonomous partners, their impact on productivity, safety, and environmental performance will be profound, reshaping industries worldwide.

Common Pitfalls Sourcing Machines: Quality and Intellectual Property (IP)

Sourcing industrial machines—whether for manufacturing, automation, or specialized processes—presents significant risks if not managed carefully. Two critical areas where companies often encounter problems are machine quality and intellectual property (IP) protection. Overlooking these aspects can lead to operational disruptions, financial losses, and legal complications.

Quality-Related Pitfalls

-

Inadequate Supplier Vetting

Failing to conduct thorough due diligence on machine suppliers can result in purchasing from manufacturers with poor quality control standards. Red flags include lack of certifications (e.g., ISO 9001), limited client references, or unclear manufacturing processes. -

Insufficient Onsite Inspection or Factory Acceptance Testing (FAT)

Skipping or minimizing FAT procedures increases the risk of receiving machines that do not meet performance, safety, or specification requirements. Without witnessing the machine in operation before shipment, hidden defects may go unnoticed. -

Use of Substandard Components

Some suppliers may substitute high-quality components with cheaper alternatives to cut costs. These substitutions can compromise machine longevity, precision, and reliability, leading to frequent breakdowns and higher total cost of ownership. -

Poor Documentation and Training

Machines delivered without comprehensive operation manuals, maintenance guides, or adequate training hinder effective use and increase downtime. Poor documentation also complicates troubleshooting and future repairs. -

Lack of Spare Parts Availability

Suppliers in certain regions may not maintain reliable spare parts inventories. This can result in prolonged machine downtime when components fail, disrupting production schedules.

Intellectual Property (IP)-Related Pitfalls

-

Unprotected Design and Technology Transfer

Sharing detailed technical specifications or proprietary designs with suppliers, especially in low-cost manufacturing regions, risks unauthorized replication or reverse engineering. Without robust non-disclosure agreements (NDAs) and contractual safeguards, IP can be compromised. -

Ambiguous Ownership of Customized Machines

When machines are custom-designed for a specific process, it’s critical to clarify in contracts who owns the design, software, and any innovations developed during the project. Ambiguity can lead to disputes or prevent future modifications without supplier approval. -

Embedded Software and Licensing Issues

Machines often include proprietary software or third-party licensed control systems. Sourcing without verifying software licensing terms can result in compliance risks, limitations on usage, or unexpected renewal costs. -

Risk of IP Theft by Suppliers or Subcontractors

Suppliers may subcontract parts of the manufacturing process to other vendors without informing the buyer. This increases the risk of IP exposure, especially if subcontractors are not bound by the same confidentiality obligations. -

Inadequate Legal Protections in Contracts

Weak or generic supplier contracts may lack clauses addressing IP ownership, confidentiality, reverse engineering prohibitions, and jurisdiction in case of disputes. This leaves the buyer vulnerable to litigation and loss of competitive advantage.

Mitigation Strategies

- Conduct rigorous supplier audits and request proof of quality management systems.

- Perform detailed Factory Acceptance Tests and consider third-party inspection services.

- Include explicit IP clauses in contracts, specifying ownership, usage rights, and confidentiality.

- Limit technical disclosure to only what is necessary and use phased information release.

- Work with legal counsel to draft enforceable agreements tailored to the jurisdiction and machine complexity.

Avoiding these pitfalls requires proactive planning, clear communication, and strong contractual safeguards to ensure both machine performance and IP security.

Logistics & Compliance Guide for Machines

This guide outlines key considerations for the safe, efficient, and legally compliant logistics and transportation of industrial machinery.

Classification and Documentation

Ensure all machines are correctly classified according to international standards (e.g., HS codes for customs). Maintain accurate documentation including commercial invoices, packing lists, certificates of origin, and technical specifications. For regulated machinery, include compliance certifications (e.g., CE, UL, ISO).

Packaging and Securing

Use robust, weather-resistant packaging suitable for the machine’s weight, dimensions, and fragility. Employ wooden crates, skids, or custom containers as needed. Secure machines internally with braces, foam, or straps to prevent movement. Clearly label packages with handling instructions (e.g., “Fragile,” “This Side Up”).

Transportation Modes

Select the appropriate transport method—road, rail, sea, or air—based on machine size, urgency, and destination. Oversized or heavy machinery may require special permits for road transport or flat-rack containers for shipping. Coordinate multimodal logistics where necessary.

Import/Export Compliance

Verify export controls (e.g., ITAR, EAR) if applicable. Ensure adherence to destination country import regulations, including tariffs, duties, and local safety standards. Submit required customs declarations and secure necessary licenses prior to shipment.

Risk Management and Insurance

Assess transportation risks and procure comprehensive cargo insurance covering damage, loss, and delays. Include coverage for high-value or sensitive components. Implement tracking systems for real-time monitoring during transit.

Installation and Site Compliance

Confirm site readiness before delivery, including access routes, lifting equipment, and foundation requirements. Ensure receiving personnel are trained in safe unloading procedures. Verify post-installation compliance with local environmental, electrical, and operational regulations.

Environmental and Safety Standards

Adhere to environmental regulations regarding emissions, noise levels, and hazardous materials (e.g., oils, coolants). Provide Safety Data Sheets (SDS) for any contained substances. Comply with OSHA, ATEX, or other region-specific safety directives.

Maintenance and Traceability

Maintain detailed logistics records including shipment dates, carrier details, and inspection reports. Establish traceability for parts and compliance documentation throughout the machine’s lifecycle to support audits and service requirements.

Conclusion for Sourcing Factory Machines:

Sourcing factory machines is a critical step in establishing or expanding manufacturing operations, directly impacting production efficiency, product quality, and long-term operational costs. A successful sourcing strategy requires a comprehensive evaluation of technical specifications, supplier reliability, cost-effectiveness, after-sales support, and alignment with production goals. Conducting thorough market research, comparing multiple suppliers, and performing due diligence—such as site visits and reference checks—help mitigate risks and ensure the acquisition of machinery that meets both current and future needs.

Additionally, considering factors like energy efficiency, automation capabilities, and scalability ensures that the investment supports sustainable growth and technological advancement. Engaging in clear contract negotiations and establishing service agreements further safeguard the organization against downtime and unexpected maintenance costs.

Ultimately, strategic sourcing of factory machines is not merely a procurement activity but a key driver of competitive advantage, enabling manufacturers to optimize performance, enhance productivity, and maintain agility in a dynamic industrial landscape.