The global coins market continues to show resilient growth, driven by rising demand for numismatic and investment-grade coins, expanding e-commerce platforms, and increasing interest in precious metals as a hedge against inflation. According to Mordor Intelligence, the coin minting and trading market was valued at over USD 15 billion in 2023 and is projected to grow at a CAGR of approximately 6.8% from 2024 to 2029. Similarly, Grand View Research highlights a surge in collector and bullion coin production, fueled by central bank initiatives and private mints capitalizing on commemorative and limited-edition releases. As demand escalates across North America, Europe, and parts of Asia-Pacific, a select group of manufacturers have emerged as industry leaders, combining historical legacy with advanced minting technology to dominate production and distribution. These top 10 coins manufacturers not only supply official legal tender to governments but also lead innovation in anti-counterfeiting features, custom designs, and sustainable production practices—positioning them at the forefront of a rapidly evolving market.

Top 10 Coins Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Osborne Coinage

Domain Est. 1997

Website: osbornecoin.com

Key Highlights: We combine old world craftsmanship with cutting edge technology to make custom coins, medallions, key tags and tokens in our Cincinnati, Ohio factory….

#2 Medalcraft Mint Inc.

Domain Est. 1997

Website: medalcraft.com

Key Highlights: Medalcraft Mint Inc. specializes in the design and production of custom medallions, challenge coins, and commemoratives for corporate, education, military, law ……

#3 Custom Challenge Coins Made in the USA, Custom Military Coins

Domain Est. 2010

Website: militarycoinsusa.com

Key Highlights: We feature a full range of great looking coins, with all the design options you want, made right here in our US factory….

#4 The Coin Factory

Domain Est. 2011

Website: the-coin-factory.com

Key Highlights: The Coin Factory specializes in creating high-quality custom challenge coins for military, corporate, and personal use. Expert craftsmanship with fast ……

#5 Factory Priced & Quality Guaranteed Custom Coin

Domain Est. 2022

Website: relmetal.com

Key Highlights: We manufacture coins that are authentic on designs straight from customers. Design assistance can be provided if customers needs to revise their artwork….

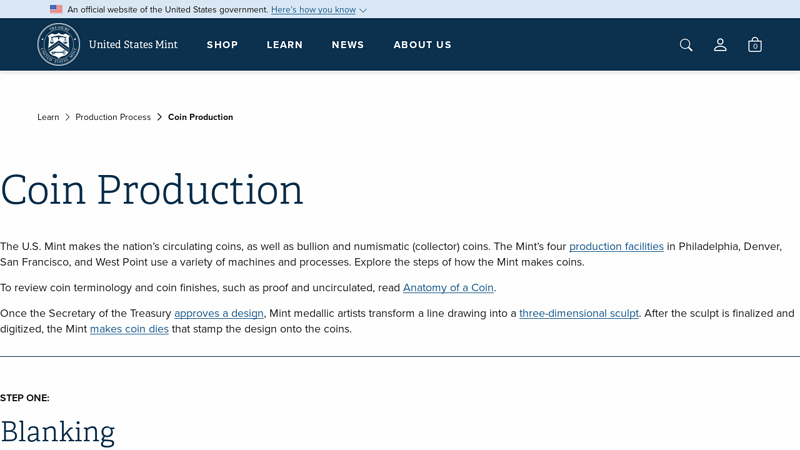

#6 Coin Production

Domain Est. 1997

Website: usmint.gov

Key Highlights: Mint makes the nation’s circulating coins, as well as bullion and numismatic (collector) coins. The Mint’s four production facilities in Philadelphia, Denver, ……

#7 Challenge Coin Company

Domain Est. 1999 | Founded: 1995

Website: challengecoin.com

Key Highlights: Challenge Coin Company was officially founded in 1995, it was the only military coin design and manufacturing company solely owned by a retired US Veteran….

#8 MünzManufaktur

Domain Est. 2011

Website: muenzmanufaktur.com

Key Highlights: Rating 4.9 (22) We manufacture your custom coin or medal exactly as you imagine it. At MünzManufaktur, we turn your ideas into reality and create custom coins, medals, and bars ….

#9 Coin USA

Domain Est. 2012

Website: coin-usa.com

Key Highlights: Custom Coins Manufactured For You. We Mint Your Design to Your Size Specifications. Unique and Handcrafted. Excellent Quality and Precision. Precious Metals ……

#10 Custom Challenge Coins

Domain Est. 2014

Website: customadecoins.com

Key Highlights: Maker of custom challenge coins or custom coins at the lowest prices available. Create your own custom coins! We offer free artwork, quotes, and shipping….

Expert Sourcing Insights for Coins

H2 2026 Market Trends for Coins

As we look toward the second half of 2026, the cryptocurrency market is poised to navigate a complex landscape shaped by macroeconomic forces, regulatory developments, technological innovation, and shifting investor sentiment. While precise predictions remain speculative, several key trends are likely to define H2 2026:

1. Regulatory Clarity Begins to Take Hold

By H2 2026, major jurisdictions—including the U.S., EU, and parts of Asia—are expected to have implemented clearer regulatory frameworks for digital assets. The U.S. may have passed comprehensive crypto legislation following increased political attention, reducing uncertainty for institutional investors. The EU’s MiCA (Markets in Crypto-Assets) regime will be fully operational, standardizing compliance across member states. This clarity is likely to encourage traditional financial institutions to deepen their involvement through ETFs, custody services, and tokenized assets.

2. Institutional Adoption Accelerates

Building on the momentum from Bitcoin and Ethereum ETFs launched earlier in the decade, H2 2026 could see a surge in institutional-grade financial products. Expect increased interest in altcoin ETFs (e.g., Solana, Cardano) and structured products tied to DeFi yields or real-world asset (RWA) tokenization. Pension funds and asset managers may allocate larger portions of portfolios to crypto, viewing digital assets as a diversified inflation hedge and growth play.

3. Technological Maturity Fuels Real-World Utility

Layer-2 scaling solutions and modular blockchain architectures will have matured, enabling faster, cheaper, and more secure transactions across major networks. This scalability will drive broader adoption of blockchain in supply chain, identity verification, and cross-border payments. Projects focusing on interoperability (e.g., Polkadot, Cosmos) and privacy-preserving technologies (e.g., Zcash, Monero derivatives) may see renewed interest as use cases expand beyond speculation.

4. Shift Toward Sustainable and Ethical Coins

Environmental, social, and governance (ESG) considerations will increasingly influence investment decisions. Proof-of-Stake (PoS) and other energy-efficient consensus mechanisms will dominate, with investors favoring networks that prioritize sustainability. Coins with transparent governance, community-driven development, and real-world impact (e.g., climate tracking, charitable disbursements) are likely to outperform purely speculative assets.

5. Geopolitical and Macroeconomic Influences

Global macro trends—such as inflation rates, central bank digital currency (CBDC) rollouts, and geopolitical tensions—will continue to impact crypto markets. In economies facing currency instability or capital controls, cryptocurrencies may serve as a critical store of value. Meanwhile, the integration of CBDCs could coexist with or compete against decentralized coins, depending on regional policies.

6. Retail Re-Engagement and Financial Inclusion

User-friendly wallets, simplified onboarding, and educational initiatives will lower barriers to entry, especially in emerging markets. Mobile-first crypto platforms could empower unbanked populations, turning digital coins into tools for financial inclusion. Gamification and social tokens may also attract younger demographics, blending finance with digital culture.

Conclusion

H2 2026 is expected to mark a maturation phase for the crypto market, transitioning from speculative frenzy to utility-driven growth. While volatility will persist, the convergence of regulation, institutional capital, and technological advancement could set the stage for sustainable long-term value creation. Investors should focus on fundamentals, network activity, and real-world adoption when evaluating coin opportunities in this evolving landscape.

Common Pitfalls in Sourcing Coins (Quality, Intellectual Property)

Sourcing coins—whether for收藏, investment, or commercial use—can be fraught with risks, particularly concerning quality assurance and intellectual property (IP) rights. Being aware of these common pitfalls is essential to avoid financial loss, legal complications, and reputational damage.

Poor Quality and Counterfeit Coins

One of the most significant risks in coin sourcing is receiving substandard or counterfeit items. Unscrupulous suppliers may pass off replicas, altered coins, or low-grade specimens as authentic or high-quality collectibles.

- Lack of Authentication: Many sellers do not provide third-party certification from reputable grading services (e.g., PCGS, NGC), increasing the risk of receiving fake or misrepresented coins.

- Overgraded or Cleaned Coins: Some coins may be dishonestly graded or chemically cleaned to enhance appearance, reducing their true market value and collectability.

- Inconsistent Sourcing Channels: Purchasing from unverified online marketplaces or private sellers without proven track records heightens exposure to fraud.

Intellectual Property Infringement

Coins often feature national symbols, historical figures, or copyrighted designs, and unauthorized reproduction or commercial use can lead to IP violations.

- Unauthorized Replicas and Medals: Producing or distributing coins that mimic official government-issued currency or protected designs may infringe on trademarks or sovereign emblems.

- Use of Protected Imagery: Even if a coin is authentic, using images of it commercially (e.g., in marketing or merchandise) without permission might violate copyright or portrait rights.

- Misrepresentation of Affiliation: Implying endorsement or affiliation with a national mint or government agency when none exists can lead to legal action for false advertising or trademark misuse.

Inadequate Due Diligence

Buyers often overlook essential verification steps, especially when sourcing in bulk or from international suppliers.

- Ignoring Provenance: Failing to verify the origin and ownership history of rare coins increases the risk of acquiring stolen or illegally exported items.

- No Contracts or IP Clauses: Absence of clear agreements specifying authenticity guarantees, IP rights, and liabilities leaves buyers vulnerable in disputes.

Conclusion

To mitigate these pitfalls, always source coins from reputable dealers, demand third-party certification for valuable items, conduct thorough IP checks before commercial use, and formalize transactions with clear legal agreements. Due diligence is key to ensuring both quality and compliance.

Logistics & Compliance Guide for Coins

Handling coins—whether for circulation, collection, investment, or commercial use—requires careful attention to logistics and compliance with legal, financial, and regulatory standards. This guide outlines best practices and requirements for the secure and lawful transportation, storage, reporting, and handling of coin shipments.

Transportation and Handling

Secure and reliable transportation is essential when moving coins, especially in bulk or high-value consignments.

- Secure Packaging: Use tamper-evident, sealed containers or bags appropriate for coin type and volume. Coin rolls, mint-sealed tubes, or certified slabs should remain intact during transit.

- Insured Shipping: Always use insured and trackable shipping methods. For high-value coin shipments, consider armored transport services.

- Chain of Custody: Maintain detailed records of who handles the coins at each stage—from origin to destination—to ensure accountability and reduce risk of loss or theft.

- Environmental Controls: Store and transport coins in climate-controlled conditions when necessary to prevent damage from moisture, heat, or contaminants.

Regulatory Compliance

Compliance with national and international regulations is critical, particularly when crossing borders or dealing with precious metal coins.

- Customs Declarations: When shipping coins internationally, declare contents accurately on customs forms. Include details such as coin type, country of origin, metal composition, and declared value.

- Import/Export Restrictions: Some countries restrict or tax the import/export of certain coins, especially those with historical or cultural significance. Verify requirements with relevant customs authorities.

- Anti-Money Laundering (AML) Regulations: In jurisdictions like the U.S. (FinCEN) and the EU, dealers in precious metal coins may be classified as Money Services Businesses (MSBs) and must comply with AML rules, including:

- Customer identification (KYC)

- Recordkeeping for transactions over certain thresholds (e.g., $10,000 in the U.S.)

- Suspicious Activity Reporting (SAR)

- Reporting Requirements: Large cash transactions (including coin payments) may require reporting. For example, in the U.S., Form 8300 must be filed for cash payments exceeding $10,000 received in a trade or business.

Storage and Inventory Management

Proper storage ensures the preservation of coin value and facilitates accurate inventory tracking.

- Secure Storage: Store coins in vaults, safe deposit boxes, or high-security facilities with surveillance and access controls.

- Inventory Records: Maintain a detailed digital ledger including:

- Coin type (denomination, year, mint mark)

- Condition or grade (e.g., MS-65, AU-58)

- Acquisition date and cost

- Current appraised value

- Regular Audits: Conduct periodic physical audits to reconcile inventory records and detect discrepancies.

Tax Implications

Coins—especially bullion and collectibles—may have specific tax reporting obligations.

- Capital Gains Tax: Profits from the sale of collectible coins are often taxed at higher rates (e.g., 28% in the U.S. for collectibles).

- Sales Tax: Applicable in some states or countries on coin purchases, depending on type and value.

- Record Retention: Keep purchase/sale documentation for at least 7 years to support tax filings and audits.

Authentication and Grading

To ensure value and legitimacy, especially for rare or high-value coins:

- Certified Grading Services: Use reputable third-party services (e.g., PCGS, NGC) to authenticate and grade coins.

- Avoid Counterfeits: Train staff to recognize counterfeit coins and use detection tools (e.g., weight, diameter, magnetic testing).

Conclusion

Effective logistics and compliance for coins involve a combination of secure handling, regulatory awareness, and accurate recordkeeping. Whether you’re a dealer, collector, financial institution, or logistics provider, adhering to these guidelines helps protect assets, ensure legal compliance, and maintain trust in coin-related transactions. Always consult with legal and financial experts to stay current with evolving regulations.

Conclusion for Sourcing Factory Coins:

Sourcing factory coins—whether for promotional use, employee recognition, collectibles, or internal tracking—requires a strategic approach that balances quality, cost, and reliability. After evaluating potential suppliers, it is clear that selecting the right manufacturer involves assessing factors such as production capabilities, material options, customization flexibility, minimum order quantities, lead times, and overall reputation.

Working with established metal crafting or promotional product factories, especially those with experience in precision minting and die-struck techniques, ensures durable and professional-looking coins. Factories in regions such as China, the USA, or Europe offer varying advantages in terms of cost-efficiency and quality control. Ultimately, building a strong relationship with a trusted supplier, requesting samples, and verifying certifications (e.g., ISO standards, ethical manufacturing practices) are critical steps in ensuring consistent results.

In conclusion, successful sourcing of factory coins hinges on thorough due diligence, clear communication of design and quality requirements, and an emphasis on long-term partnership to support scalability and brand integrity. With the right vendor, businesses can efficiently produce high-impact, custom coins that serve their intended purpose—whether for commemoration, motivation, or branding.