The global fire alarm system market is experiencing robust growth, driven by increasing urbanization, stringent government safety regulations, and the rising adoption of smart building technologies. According to Grand View Research, the global fire alarm system market size was valued at USD 34.5 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 7.2% from 2024 to 2030. This growth trajectory reflects heightened awareness around fire safety, especially in commercial, industrial, and high-density residential sectors. With technological advancements such as IoT integration, wireless systems, and AI-driven detection enhancing response accuracy and system reliability, manufacturers are under growing pressure to innovate while meeting international safety standards. In this evolving landscape, leading FACP (Fire Alarm Control Panel) manufacturers play a pivotal role in shaping the future of fire detection and emergency response systems. The following list highlights the top 9 FACP manufacturers, evaluated based on market presence, product innovation, global certifications, and customer reach.

Top 9 Facp Fire Alarm Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Potter Electric

Domain Est. 1998

Website: pottersignal.com

Key Highlights: Potter Electric Signal Company is a St. Louis, Missouri based manufacturer of sprinkler monitoring devices, fire alarm systems, & corrosion solution products ……

#2 Edwards

Domain Est. 2013

Website: edwardsfiresafety.com

Key Highlights: Edwards provides fire alarm systems, fire detection systems, life safety systems, fire alarm panels, fire alarms, notification systems, for buildings of all ……

#3 Notifier Fire Alarm Systems

Domain Est. 1988

Website: buildings.honeywell.com

Key Highlights: Explore Honeywell’s Notifier fire alarm systems for advanced protection and reliable performance. Learn about innovative solutions for safety, compliance, ……

#4 Fire Alarm Systems

Domain Est. 1996

Website: napcosecurity.com

Key Highlights: NEW! FIRELINK FACP FLX2-255 WITH 5G STARLINK FIRE MAX DUAL SIM INSIDE NOW AVAILABLE AT THE DISTRIBUTOR NEAR YOU. 255-Zone Fire Alarm Control Panel, Dual SIM ……

#5 Fire Alarm Panel & Safety Solutions

Domain Est. 1999

Website: advancedco.com

Key Highlights: Our fire alarm panels are manufactured in the UK to exacting local and international standards. Careful design and rigorous testing before despatch….

#6 Fire Alarm Control Panel (FACP) Interface

Domain Est. 2001

Website: alertus.com

Key Highlights: Alertus’ Fire Alarm Control Panel (FACP) Interface captures fire panel events, processes them with intelligent logic, and issues broadcasts through multiple ……

#7 Fire Detection Solutions and Fire Alarm Systems

Domain Est. 2005

Website: simplexfire.com

Key Highlights: Fire Detection and Life Safety Solutions You Know You Can Trust. In the world of fire protection, Simplex is synonymous with innovation and value. Discover why ……

#8 End of life FACP

Domain Est. 2012

Website: forums.thefirepanel.com

Key Highlights: I have been scouring the internet trying to find a list of discontinued and unsupported FACP’s. Does any such site exist?…

#9 The Best Fire Alarm Control Panel (FACP) Manufacturers

Domain Est. 1996

Website: digitize-inc.com

Key Highlights: We have a strong familiarity with many of the most common FACP manufacturers. This list is not exhaustive, and it may miss some important industry players….

Expert Sourcing Insights for Facp Fire Alarm

H2: 2026 Market Trends for FACP (Fire Alarm Control Panel) in the Global Fire Safety Industry

As the world moves toward smarter, safer, and more connected infrastructure, the Fire Alarm Control Panel (FACF) market is poised for significant evolution by 2026. Driven by technological innovation, regulatory changes, urbanization, and heightened safety awareness, the FACP landscape is undergoing a transformation that will redefine fire protection systems across commercial, industrial, and residential sectors.

1. Smart Building Integration and IoT Adoption

One of the most prominent trends shaping the 2026 FACP market is the deep integration of fire alarm systems into smart building ecosystems. Internet of Things (IoT)-enabled FACPs are becoming standard, allowing real-time monitoring, remote diagnostics, and predictive maintenance. These systems can communicate with HVAC, lighting, access control, and security systems to enable coordinated emergency responses. By 2026, over 60% of new commercial installations are expected to feature networked FACPs with cloud-based management platforms.

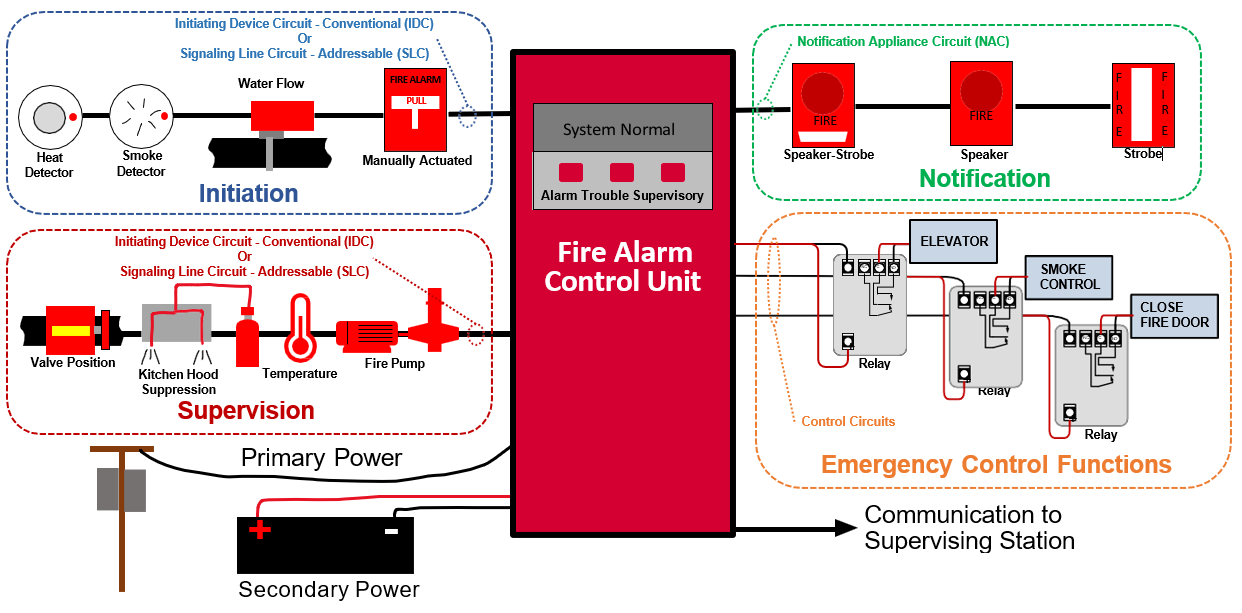

2. Increased Demand for Addressable Fire Alarm Systems

Addressable FACPs—capable of identifying the exact location of a triggered device—are gaining dominance over conventional systems. Their precision, scalability, and diagnostic capabilities make them ideal for large and complex facilities. The demand is being driven by stringent fire codes in regions like North America and Europe, as well as growing construction in high-rise buildings and data centers. The addressable segment is projected to grow at a CAGR of over 8% through 2026.

3. Regulatory and Code Compliance Push

Updated fire safety standards, including NFPA 72 (2022 and 2025 editions), EN 54 revisions, and regional building codes, are mandating more advanced fire alarm functionalities. Features like voice evacuation, emergency communication integration, and system redundancy are becoming non-negotiable. These regulatory drivers are accelerating the replacement of legacy panels and pushing manufacturers to innovate compliant, future-ready FACPs.

4. Rise of Hybrid and Wireless FACP Solutions

Wireless and hybrid (wired + wireless) FACP systems are gaining traction, especially in retrofit applications and heritage buildings where cabling is impractical. Advancements in wireless reliability, battery life, and encryption are making these systems viable for mission-critical environments. By 2026, the wireless FACP segment is expected to grow at nearly 10% CAGR, particularly in Europe and parts of Asia-Pacific.

5. Cybersecurity as a Critical Concern

As FACPs become network-connected, cybersecurity is emerging as a top priority. Vulnerabilities in fire alarm networks could be exploited to disable systems or trigger false alarms. In response, manufacturers are embedding end-to-end encryption, secure boot mechanisms, and regular firmware updates into FACP designs. By 2026, cybersecurity certification (e.g., UL 2900) will likely be a key differentiator in procurement decisions.

6. Asia-Pacific as a High-Growth Market

While North America and Europe remain mature markets with steady growth, the Asia-Pacific region—especially China, India, and Southeast Asia—is expected to see the fastest expansion. Rapid urbanization, industrial development, and government-led safety initiatives are fueling demand for advanced FACP systems. Local manufacturing and partnerships with global brands are enabling cost-effective solutions tailored to regional needs.

7. Sustainability and Energy Efficiency

Green building standards such as LEED and BREEAM are influencing FACP design. Energy-efficient panels with low standby power consumption and recyclable components are increasingly preferred. Additionally, intelligent alarm systems that reduce false alarms contribute to operational efficiency and lower environmental impact by minimizing unnecessary emergency responses.

Conclusion

By 2026, the FACP market will be defined by intelligence, connectivity, and compliance. The convergence of IoT, AI-driven analytics, and stricter safety regulations will drive innovation and market growth. Companies that invest in scalable, secure, and interoperable fire alarm platforms will lead the next generation of fire safety solutions, ensuring not only protection but also integration with the broader smart infrastructure ecosystem.

Common Pitfalls When Sourcing FACPs (Fire Alarm Control Panels) – Quality and IP Considerations

Sourcing Fire Alarm Control Panels (FACPs) requires careful attention to both product quality and intellectual property (IP) compliance. Overlooking these aspects can lead to safety risks, regulatory non-compliance, and costly liabilities. Below are the key pitfalls to avoid:

1. Prioritizing Cost Over Certified Quality

One of the most frequent mistakes is selecting FACPs based solely on price, often leading to substandard products. Low-cost panels may use inferior components, lack rigorous testing, or fail to meet required performance standards under stress. Always verify that the FACP is certified by recognized testing laboratories such as UL (Underwriters Laboratories), FM Global, or equivalent international bodies (e.g., CE with EN 54 certification in Europe). Avoid uncertified or “UL-recognized” components marketed as full systems—only UL-listed panels are approved for life-safety use.

2. Ignoring Environmental and Ingress Protection (IP) Ratings

FACPs must operate reliably in diverse environments, including areas with dust, moisture, or extreme temperatures. A common oversight is neglecting the Ingress Protection (IP) rating appropriate for the installation site. For example, a panel installed in a parking garage or industrial facility may require at least IP54 (dust-protected and splash-resistant), whereas outdoor enclosures may need IP65 or higher. Using a panel with inadequate IP protection risks water intrusion, corrosion, and false alarms, compromising system integrity.

3. Sourcing from Unauthorized or Grey Market Distributors

Purchasing FACPs through unauthorized channels increases the risk of receiving counterfeit, stolen, refurbished, or non-compliant units. These products may lack proper documentation, warranties, or software updates. Always buy directly from the manufacturer or authorized distributors to ensure authenticity, traceability, and access to technical support. Grey market panels may also violate licensing agreements, leading to voided certifications and liability issues.

4. Overlooking Software and Firmware IP Compliance

Modern FACPs rely heavily on proprietary software and firmware for monitoring, diagnostics, and integration. A major pitfall is using systems with pirated, cracked, or unauthorized software versions. This not only breaches intellectual property rights but can introduce security vulnerabilities, disable critical updates, and violate code requirements. Ensure that all software is licensed, up to date, and supported by the manufacturer.

5. Failing to Verify Long-Term Support and Obsolescence Risks

Some low-cost or generic FACPs may lack long-term manufacturer support, firmware updates, or spare parts availability. This creates risks when maintenance or system upgrades are needed. Before procurement, confirm the manufacturer’s commitment to product lifecycle support and check whether the FACP model is nearing end-of-life. Choosing obsolete or unsupported systems jeopardizes ongoing compliance and increases future replacement costs.

6. Neglecting Integration and Compatibility Standards

FACPs must integrate seamlessly with other building systems (e.g., HVAC, elevators, access control). A common quality pitfall is selecting a panel that uses proprietary protocols without open-standard support (e.g., BACnet, Modbus), limiting future scalability and creating vendor lock-in. Ensure compatibility with existing infrastructure and adherence to industry-standard communication protocols to avoid costly integration challenges.

7. Assuming All “Equivalent” Panels Meet Code Requirements

Some suppliers offer “equivalent” or “compatible” FACPs claiming to match major brands. However, these may not undergo the same third-party testing or meet jurisdictional codes. Fire safety regulations often require listed equipment specifically evaluated for performance under real-world conditions. Never assume equivalence—always demand certification documentation and verify compliance with local fire codes and AHJ (Authority Having Jurisdiction) requirements.

By avoiding these common pitfalls, stakeholders can ensure the procurement of high-quality, code-compliant FACPs that protect life and property while respecting intellectual property rights and long-term operational reliability.

Logistics & Compliance Guide for FACPs (Fire Alarm Control Panels)

This guide outlines the essential logistics and compliance considerations for handling, installing, and maintaining Fire Alarm Control Panels (FACPs) to ensure safety, code adherence, and operational reliability.

Regulatory Standards and Codes

FACPs must comply with national and local fire safety regulations. Key standards include:

- NFPA 72: National Fire Alarm and Signaling Code – Governs the application, installation, location, performance, inspection, testing, and maintenance of fire alarm systems.

- NFPA 70: National Electrical Code (NEC) – Specifies electrical wiring and installation requirements, including power supply, grounding, and circuit integrity for FACPs.

- UL 864: Standard for Control Units and Accessories for Fire Alarm Systems – Certification standard ensuring FACPs meet performance and safety requirements.

- Local Building and Fire Codes – Always verify jurisdiction-specific requirements, which may include additional permits, inspections, or equipment approvals.

Product Certification and Listings

Ensure all FACPs are:

- Listed by a Nationally Recognized Testing Laboratory (NRTL) such as UL, FM Global, or Intertek.

- Labeled with certification marks indicating compliance with UL 864 and other applicable standards.

- Accompanied by documentation proving listing status, including submittal sheets and test reports.

Shipping and Handling Requirements

Proper logistics are critical to prevent damage:

- Use original packaging or equivalent protective materials during transit.

- Handle panels with care; avoid dropping, tilting, or compressing.

- Store in a dry, temperature-controlled environment (typically 32°F to 104°F / 0°C to 40°C).

- Avoid exposure to moisture, dust, and corrosive substances during transport and storage.

Installation Compliance

Installation must adhere to:

- Manufacturer’s installation instructions and layout diagrams.

- Separation from non-fire alarm circuits as required by NEC Article 760.

- Dedicated branch circuits with proper overcurrent protection.

- Secondary power source (batteries or generator) capable of powering the system for at least 24 hours of standby and 5 minutes of alarm time (per NFPA 72).

- Clear labeling of all circuits, zones, and devices.

Inspection, Testing, and Maintenance

Routine compliance activities include:

- Initial Acceptance Testing – Conducted by a certified technician upon installation, documented and submitted to the Authority Having Jurisdiction (AHJ).

- Periodic Inspections – Required annually (minimum) per NFPA 72; includes visual checks, battery testing, and signal verification.

- Functional Testing – Full system tests, including alarm and supervisory signal operation, conducted per the prescribed schedule.

- Recordkeeping – Maintain logs of all inspections, tests, maintenance, and repairs for a minimum of five years.

Documentation and Submittals

Required documentation includes:

- As-built drawings and system schematics.

- Equipment cut sheets and compliance certificates.

- Test reports and inspection records.

- Operation and maintenance manuals.

- Submittal to the AHJ for approval prior to system activation.

Training and Personnel Qualifications

Only qualified personnel should handle FACPs:

- Installers and technicians must be trained and certified by the manufacturer or an accredited body.

- Regular training updates on code changes and system updates are recommended.

- AHJs may require proof of technician credentials during inspections.

Emergency Preparedness and System Reliability

Ensure ongoing compliance through:

- Redundant communication paths (if monitored by a central station).

- Monitoring of system trouble signals and prompt response.

- Backup power system testing under load.

- Integration with emergency response plans and building safety procedures.

Adhering to this logistics and compliance guide ensures FACPs operate effectively during emergencies and meet all regulatory and safety requirements. Always consult the AHJ and manufacturer specifications for project-specific needs.

Conclusion for Sourcing FACP (Fire Alarm Control Panel):

Sourcing a Fire Alarm Control Panel (FACP) is a critical step in ensuring the safety, compliance, and reliability of a building’s fire protection system. It requires careful evaluation of technical specifications, regulatory standards (such as NFPA 72, local fire codes, and certification requirements like UL), and compatibility with existing or planned fire detection and notification systems. Key factors in the sourcing decision include system scalability, brand reputation, service and support availability, cybersecurity features (for networked panels), and total cost of ownership.

Procuring a FACP from reputable manufacturers—such as Siemens, Honeywell, Johnson Controls, Notifier (by Honeywell), or Simplex (by Gentex)—ensures adherence to quality and reliability standards. Additionally, working with certified suppliers and integrators helps guarantee proper installation, commissioning, and ongoing maintenance.

In conclusion, a well-informed sourcing strategy for a FACP should balance performance, compliance, support, and long-term reliability to protect life, property, and operational continuity. Prioritizing certified, future-ready solutions will ensure the system remains effective and adaptable to evolving safety requirements and technological advancements.