The global fabricated metal products market is experiencing steady expansion, driven by rising demand across construction, automotive, industrial machinery, and aerospace sectors. According to Grand View Research, the market size was valued at $4.37 trillion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.1% from 2023 to 2030. This growth is fueled by advancements in metal fabrication technologies, increasing adoption of automation, and the shift toward lightweight and high-strength materials in manufacturing. Additionally, Mordor Intelligence forecasts continued momentum, citing infrastructure development in emerging economies and re-shoring trends in North America as key drivers. As competition intensifies and customer requirements evolve, a select group of fabricated metal manufacturers are distinguishing themselves through scale, precision, innovation, and sustainability. These industry leaders are not only meeting current market demands but are also shaping the future of manufacturing through strategic investments in digitalization and lean production techniques.

Top 10 Fabricated Metal Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Fabricated Metals

Domain Est. 2000

Website: fabricatedmetals.com

Key Highlights: Fabricated Metals is a U.S. based manufacturer who provides custom design and fabrication of metal products. Submit a RFP. Superior Customer Service….

#2 Fabricators and Manufacturers Association

Domain Est. 2020

Website: fmamfg.org

Key Highlights: FMA provides training programs, exclusive networking events, and market-leading publications and trade shows to help metal fabrication professionals……

#3 Tendon Manufacturing

Domain Est. 1996

Website: tendon.com

Key Highlights: We offer a wide range of metal fabrication services tailored to your needs. From laser cutting to complex assemblies, we deliver precision and quality….

#4 BTD Manufacturing

Domain Est. 1997

Website: btdmfg.com

Key Highlights: Your reliable and innovative partner for custom metal fabrication, welding, tool & die, CNC, EDM and more from locations in MN, IL and GA….

#5 All Metals Fabricating

Domain Est. 1998

Website: ametals.com

Key Highlights: All Metals Fabricating is a family owned and operated contract manufacturing company that specializes in custom metal fabrication and precision machining….

#6 Sheet Metal Fabrication

Domain Est. 1999

Website: metalfx.com

Key Highlights: Fabricated Metal Willits CA. METALfx is a trusted provider of precision sheet metal fabrication and CNC machining, proudly headquartered in Willits, California ……

#7 Piranha Metal Fabrication Equipment by MegaFab

Domain Est. 1999

Website: piranhafab.com

Key Highlights: Piranha manufactures Ironworker Machines, Plasma Tables, Press Brakes, Fiber LASER, Bending Rolls, Shears, CNC Fabricators and other metal fabrication ……

#8 Fabricated Metal Products

Domain Est. 2000

Website: fabmet.com

Key Highlights: Fabricated Metal Products. It is our mission to be the BEST supplier in the United States within the framework of our core fabrication competency. Discover ……

#9 SendCutSend

Domain Est. 2015

Website: sendcutsend.com

Key Highlights: Online sheet metal fabrication service. Get custom parts delivered in just a few days—upload STEP or DXF files for instant pricing!…

#10 Metal Fabrication Excellence

Domain Est. 2018

Website: sscmetalfabrication.com

Key Highlights: SSC is the partner you need for projects of every scope and scale. We offer virtually endless steel, stainless steel, and aluminum fabrication capabilities, for ……

Expert Sourcing Insights for Fabricated Metal

H2 2026 Market Trends for the Fabricated Metal Product Industry

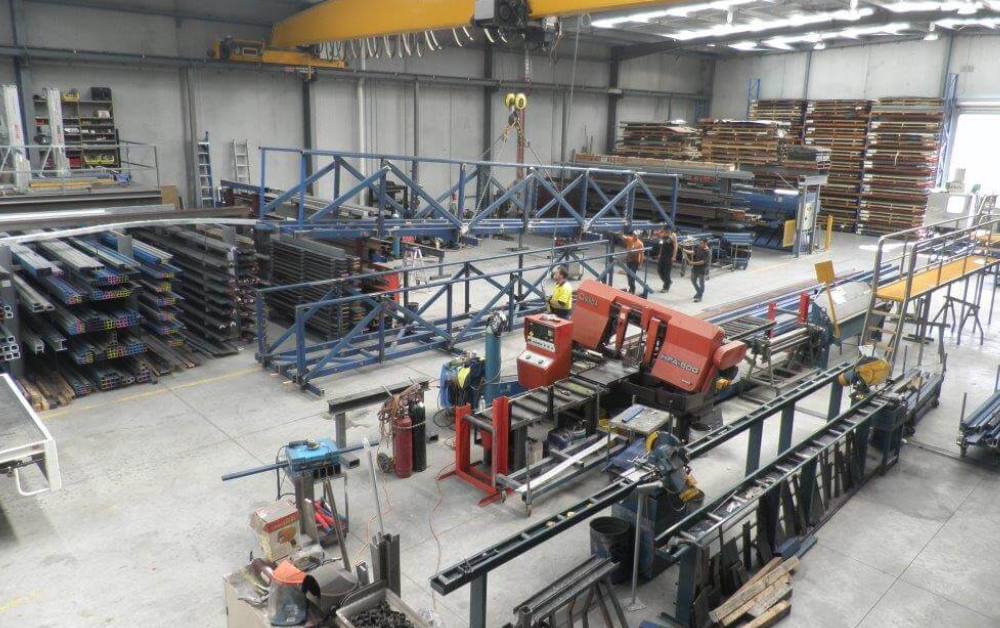

As the global economy progresses through 2026, the fabricated metal product manufacturing sector is undergoing a transformative phase shaped by technological innovation, evolving demand patterns, and macroeconomic forces. In the second half of 2026 (H2 2026), several key trends are defining the trajectory of the industry, influencing production, supply chains, and competitiveness.

1. Accelerated Adoption of Industry 4.0 Technologies

Fabricated metal manufacturers are increasingly deploying smart manufacturing technologies such as IoT-enabled machinery, AI-driven predictive maintenance, and digital twins. These tools enhance precision, reduce waste, and improve operational efficiency. In H2 2026, mid-sized fabricators are catching up with large enterprises in automation adoption, driven by falling technology costs and government incentives for digital transformation.

2. Rising Demand from Renewable Energy and Infrastructure Sectors

The global push toward decarbonization is fueling demand for fabricated metal components in wind turbines, solar panel mounting systems, and energy storage infrastructure. In North America and Europe, federal infrastructure programs continue to support construction of bridges, pipelines, and transit systems—key end markets for structural metal fabrication. This sustained public and private investment is bolstering order backlogs through H2 2026.

3. Reshoring and Regional Supply Chain Reconfiguration

Geopolitical tensions and supply chain vulnerabilities have prompted a continuation of reshoring and nearshoring initiatives. In the U.S. and EU, manufacturers are prioritizing domestic sourcing of fabricated metal parts to reduce lead times and comply with new trade regulations. This trend is supporting regional capacity expansion and fostering partnerships between OEMs and local fabricators.

4. Labor Shortages and Workforce Transformation

The industry continues to face skilled labor shortages, particularly in welding and CNC operation. In response, companies are investing in upskilling programs and human-machine collaboration systems. Robotics and collaborative robots (cobots) are increasingly deployed for repetitive tasks, allowing human workers to focus on higher-value activities. Workforce development remains a strategic priority in H2 2026.

5. Sustainability and Circular Economy Pressures

Environmental regulations and customer demands are pushing fabricators to reduce carbon footprints. In H2 2026, more companies are adopting energy-efficient equipment, recycling scrap metal, and using low-emission coatings and treatments. Certifications like ISO 14001 and participation in green procurement programs are becoming competitive differentiators.

6. Price Volatility and Input Cost Management

Steel and aluminum prices, while stabilizing compared to previous years, remain sensitive to global trade flows and energy costs. Fabricators are leveraging long-term supply contracts, hedging strategies, and alternative materials (e.g., high-strength steels, aluminum alloys) to manage input costs. Just-in-time inventory models are being balanced with strategic stockpiling to mitigate disruption risks.

7. Growth in Customization and On-Demand Manufacturing

Customers across industrial machinery, aerospace, and construction are demanding more customized, low-volume fabricated components. Advances in CAD/CAM software and flexible fabrication systems (e.g., laser cutting, bending automation) are enabling faster turnaround for custom orders, supporting a shift toward agile, customer-centric production models.

Conclusion

H2 2026 marks a period of strategic adaptation for the fabricated metal industry. Companies that embrace digitalization, sustainability, and supply chain resilience are best positioned to capitalize on growing demand from clean energy, infrastructure, and advanced manufacturing sectors. While challenges around labor and input costs persist, innovation and regional collaboration are driving long-term growth and competitiveness.

Common Pitfalls in Sourcing Fabricated Metal: Quality and Intellectual Property Concerns

Logistics & Compliance Guide for Fabricated Metal Products

Understanding Fabricated Metal Products

Fabricated metal products encompass a wide range of items created through cutting, bending, welding, machining, and assembling raw metal materials. These include structural components, machinery parts, enclosures, frames, and custom assemblies used across industries such as construction, automotive, aerospace, and manufacturing. Due to their weight, size variability, and material composition, shipping and regulatory compliance for fabricated metal require specialized planning.

Regulatory Compliance

Material Specifications and Standards

Fabricated metal parts must comply with industry-specific standards such as ASTM, ASME, ISO, or MIL-SPEC, depending on the application. Documentation including material test reports (MTRs), certificates of conformance (CoC), and weld procedure specifications (WPS) must accompany shipments, especially for regulated sectors like aerospace or pressure vessels.

Export Controls and Trade Regulations

Metal components may be subject to export controls under regulations such as the Export Administration Regulations (EAR) or International Traffic in Arms Regulations (ITAR), particularly if used in defense or dual-use applications. Accurate classification using Harmonized System (HS) codes and compliance with destination country import requirements are essential to avoid delays or penalties.

Environmental and Safety Regulations

Fabricated metals may be coated, treated, or contain substances regulated under REACH (EU), RoHS, or TSCA (USA). Ensure all surface treatments (e.g., galvanizing, powder coating, plating) comply with environmental directives. Proper handling documentation is required for any hazardous residues or processes involved in fabrication.

Packaging and Handling

Protective Packaging

Metal parts are prone to corrosion, scratching, and deformation. Use VCI (Vapor Corrosion Inhibitor) paper, rust-preventative coatings, and desiccants for long-term storage or overseas shipping. Crating with wooden or metal frames may be necessary for large or irregularly shaped components to prevent damage during transit.

Load Securing and Weight Distribution

Due to high density and uneven weight distribution, fabricated metal parts must be properly secured in containers or on flatbed trailers. Use dunnage, blocking, bracing, and straps to prevent shifting. Comply with freight carrier weight limits and axle load regulations to ensure road safety and legal compliance.

Transportation and Shipping

Mode Selection

Choose the appropriate transport mode based on part size, weight, and urgency:

– Trucking: Ideal for domestic shipments and just-in-time delivery; suitable for oversized loads with proper permits.

– Rail: Cost-effective for heavy, bulk shipments over long distances.

– Ocean Freight: Best for international shipments; use flat-rack or open-top containers for oversized items.

– Air Freight: Reserved for urgent, high-value, or time-sensitive components due to high cost.

Documentation and Tracking

Prepare accurate shipping documents including commercial invoices, packing lists, bills of lading, and export declarations. Use HS codes specific to fabricated metal goods (e.g., 7308 for structural elements, 8479 for machine parts). Implement real-time tracking systems to monitor shipment progress and manage supply chain visibility.

Customs Clearance and Duties

Accurate Classification and Valuation

Correct HS code classification determines duty rates and eligibility for free trade agreements (e.g., USMCA, CETA). Provide detailed descriptions of the fabrication process (e.g., “welded steel frame, machined to tolerance”) to support classification. Ensure transaction value includes all costs (materials, labor, overhead) to meet customs valuation rules.

Duty Mitigation Strategies

Leverage duty drawback programs, foreign trade zones (FTZs), or bonded warehouses where applicable. Consider tariff engineering—modifying design or processing steps—to qualify for lower duty rates, provided it complies with customs regulations.

Quality Assurance and Traceability

In-Process and Final Inspection

Adhere to documented quality management systems (e.g., ISO 9001). Conduct dimensional inspections, non-destructive testing (NDT), and weld inspections as required. Maintain traceability through batch/lot numbering and digital records to support compliance audits and recalls.

Supplier and Subcontractor Oversight

Ensure all subcontractors (e.g., plating shops, heat treaters) meet required standards and provide compliant documentation. Include compliance obligations in vendor agreements and conduct periodic audits.

Risk Management and Contingency Planning

Insurance and Liability

Obtain cargo insurance covering damage, loss, or delay during transit. Clarify liability terms (e.g., Incoterms® 2020) such as FOB, EXW, or DDP to define responsibility for transport and risk transfer.

Supply Chain Resilience

Diversify transportation routes and freight partners to mitigate disruptions. Maintain safety stock for critical components and develop contingency plans for port delays, customs holds, or material shortages.

By adhering to this guide, manufacturers and distributors of fabricated metal products can ensure efficient logistics operations while maintaining full compliance with domestic and international regulations.

In conclusion, sourcing fabricated metal requires a strategic approach that balances quality, cost, lead time, and supplier reliability. By clearly defining project specifications, evaluating potential suppliers based on capability and certifications, and considering factors such as material traceability, production capacity, and geographic location, businesses can establish a dependable supply chain. Additionally, fostering strong supplier relationships and conducting ongoing performance assessments contribute to long-term success. Effective sourcing of fabricated metal not only ensures the integrity and performance of end products but also supports operational efficiency and competitive advantage in the marketplace.