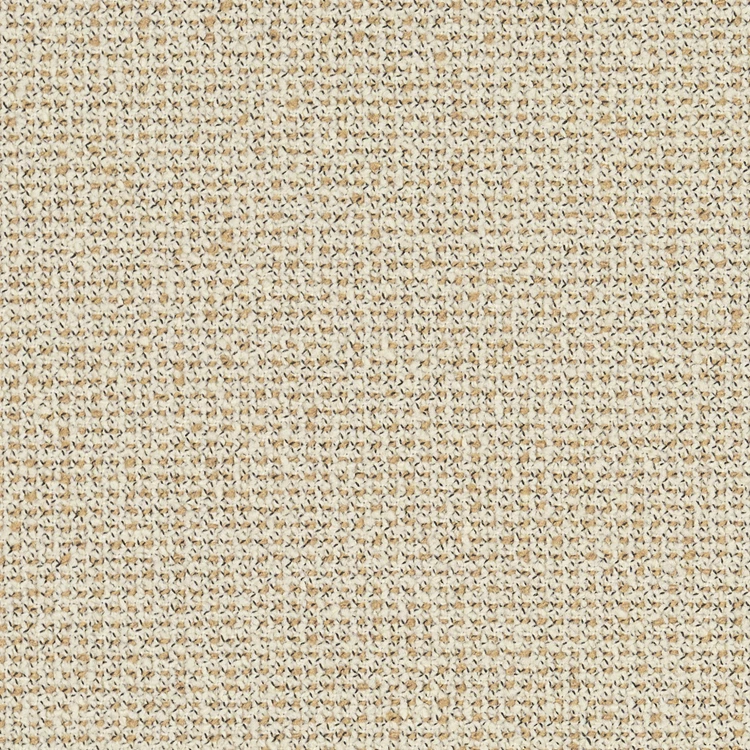

The global carpet and rug market is experiencing steady expansion, driven by rising demand in residential, commercial, and hospitality sectors. According to Grand View Research, the market was valued at USD 97.8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030. Factors such as urbanization, increasing disposable incomes, and a growing emphasis on interior aesthetics are fueling demand for high-performance, durable, and aesthetically versatile carpeting solutions. As manufacturers scale production to meet this demand, the choice of fabric becomes a critical differentiator in quality, sustainability, and cost-efficiency. From nylon’s resilience to wool’s natural elegance and the rise of recycled polyester, the top eight fabrics used by leading carpet manufacturers reflect a blend of innovation, performance, and market responsiveness. These materials not only define the tactile and visual appeal of carpets but also play a pivotal role in meeting environmental standards and evolving consumer preferences worldwide.

Top 8 Fabric For Carpet Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Aquafil Group

Domain Est. 1997

Website: aquafil.com

Key Highlights: Nylon Yarn for Carpets. We are the number 1 producer and supplier of textile flooring yarn at a global level. We serve clients in a wide range of ……

#2 Royal Thai: Carpet Company

Domain Est. 1998

Website: royalthai.com

Key Highlights: For over half a century, we’ve built on our core values of artisanship and service to help redefine how the world experiences carpeting wherever people gather….

#3 Textiles

Domain Est. 1994

Website: milliken.com

Key Highlights: Products. Explore our diverse portfolio of textiles, from wovens and knits to nonwovens, reinforcements, and contract fabrics….

#4 PTFE Release Fabrics & Belting for Flooring & Carpet Manufacturing

Domain Est. 1996

Website: 4taconic.com

Key Highlights: High-performance PTFE coated fabrics and belting for flooring & carpet manufacturing. Durable release surfaces for efficient production and clean releases….

#5 Lantal’s

Domain Est. 1997

Website: lantal.com

Key Highlights: LANTAL is a Swiss-based company established in 1886. Our journey began with the production of cheese linen, showcasing our deep-rooted expertise in textiles….

#6 Designer Fabrics

Domain Est. 1998

Website: perennialsfabrics.com

Key Highlights: Perennials and Sutherland offers premier designer furnishings, acrylics fabrics, custom rugs accessories perfect for indoor and outdoor applications….

#7 Designtex

Domain Est. 2005

Website: designtex.com

Key Highlights: We design and manufacture applied materials for the built environment. For over sixty years, we have been inspired to improve how materials fit into life….

#8 Gabriel

Domain Est. 2018

Website: gabrielfabrics.com

Key Highlights: Gabriel Group offers products and solutions for the global furniture industry, including development, design, and manufacturing of fabrics, furniture, and ……

Expert Sourcing Insights for Fabric For Carpet

H2: 2026 Market Trends for Fabric for Carpet

The global market for fabric used in carpet manufacturing is poised for significant transformation by 2026, driven by evolving consumer preferences, technological advancements, and sustainability imperatives. Key trends shaping the landscape include:

1. Rising Demand for Sustainable and Recycled Materials

Environmental concerns are pushing manufacturers toward eco-friendly fabric solutions. By 2026, a growing share of carpet fabrics is expected to be made from recycled polyester, bio-based nylon, and natural fibers such as wool and jute. Brands are increasingly adopting circular economy principles, with closed-loop recycling systems allowing post-consumer carpet waste to be converted into new fabric feedstock.

2. Innovation in Performance and Smart Textiles

Carpet fabric is evolving beyond aesthetics to include functional properties. By 2026, antimicrobial, stain-resistant, and moisture-wicking fabrics will gain traction, especially in commercial and healthcare sectors. Additionally, integration with smart textile technology—such as embedded sensors for foot traffic monitoring or temperature regulation—may begin to emerge in high-end applications.

3. Growth in Commercial and Hospitality Sectors

The recovery and expansion of commercial real estate, office spaces, and the hospitality industry post-pandemic are driving demand for durable, aesthetically versatile carpet fabrics. Design flexibility, sound absorption, and underfoot comfort are key factors boosting the use of textile-based flooring solutions in these settings.

4. Regional Shifts in Production and Consumption

Asia-Pacific, particularly China and India, will remain dominant in both production and consumption due to urbanization and rising disposable incomes. Meanwhile, North America and Europe are focusing on premium, sustainable products, with stricter regulations influencing fabric selection and manufacturing processes.

5. Digitalization in Design and Manufacturing

Digital printing and computer-aided design (CAD) are enabling rapid prototyping and customization of carpet fabrics. By 2026, on-demand production and digitized supply chains are expected to reduce lead times and inventory waste, supporting a shift toward made-to-order models.

6. Cost Volatility and Supply Chain Resilience

Fluctuations in raw material prices—especially petroleum-based synthetics—are prompting companies to diversify sourcing and invest in localized production. Supply chain transparency and traceability of fabric origins will become critical competitive advantages.

In summary, the 2026 fabric for carpet market will be defined by sustainability, innovation, and adaptability. Manufacturers who invest in green technologies, digital capabilities, and responsive supply networks are likely to lead the next phase of industry growth.

Common Pitfalls When Sourcing Fabric for Carpet: Quality and Intellectual Property Issues

Logistics & Compliance Guide for Fabric for Carpet

Overview

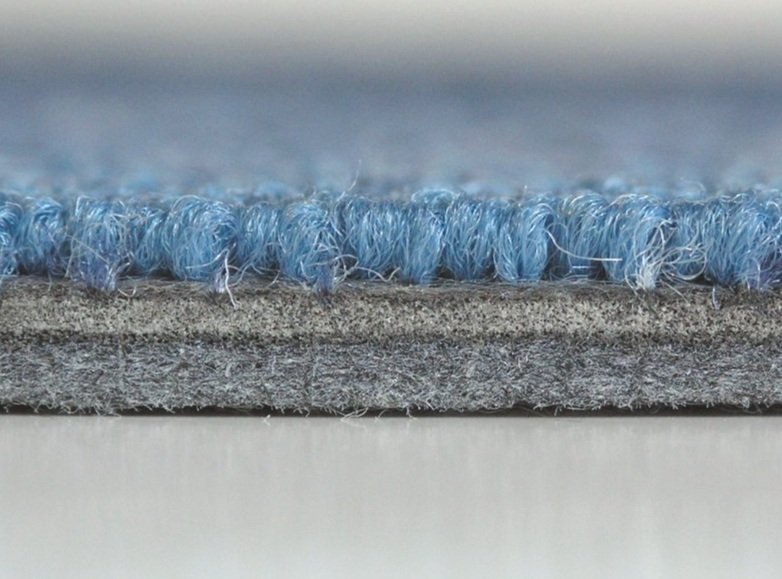

Fabric for carpet, whether used as primary backing, secondary backing, or decorative overlay, requires careful handling, storage, and documentation throughout the supply chain. This guide outlines key logistics and compliance considerations to ensure quality, safety, and adherence to international and regional regulations.

Classification and HS Code

Accurate classification is essential for customs clearance and duty assessment.

– Typical HS Code: 5407 or 5512 (varies by fiber composition, weave type, and finish)

– Always verify the specific code based on country of import/export and material details (e.g., polypropylene, polyester, jute)

– Provide detailed product descriptions: fiber content, weight (gsm), width, and intended use

Packaging and Handling

Proper packaging ensures product integrity during transit.

– Roll Packaging: Use sturdy cardboard cores (typically 3″ or 6″ diameter), wrapped in polyethylene film to prevent moisture and dust ingress

– Palletization: Secure rolls on wooden or plastic pallets using stretch wrap or strapping; avoid overstacking

– Labeling: Include product name, batch/lot number, dimensions, weight, fiber content, and handling instructions (e.g., “Keep Dry,” “This Side Up”)

– Protection: Use corner boards and edge protectors to prevent damage during transport

Storage Conditions

Maintain optimal storage to prevent degradation.

– Environment: Store in a dry, well-ventilated area; avoid direct sunlight and extreme temperatures

– Humidity: Maintain relative humidity between 45% and 65% to prevent mold or static buildup

– Stacking: Limit stack height to prevent crushing; store rolls vertically when possible

– Shelf Life: Monitor inventory rotation (FIFO); most synthetic fabrics have an indefinite shelf life if stored properly

Transportation Requirements

Select appropriate transport modes and carriers.

– Container Type: Use dry van containers for sea freight; ensure containers are clean and moisture-free

– Temperature Control: Not typically required for synthetic fabrics, but avoid prolonged exposure to high heat

– Documentation: Include commercial invoice, packing list, bill of lading, and certificate of origin

– In-Transit Monitoring: Use humidity and temperature loggers for sensitive or long-haul shipments

Regulatory Compliance

REACH (EU)

- Ensure all chemical substances used in fabric treatment (e.g., flame retardants, binders) are registered under REACH

- Provide Safety Data Sheets (SDS) upon request

- Comply with SVHC (Substances of Very High Concern) restrictions

RoHS (Applicable for Technical/Backing Fabrics with Coatings)

- Restrict use of lead, mercury, cadmium, and certain flame retardants if electronics or coated components are integrated

EPA and TSCA (USA)

- Comply with Toxic Substances Control Act regulations for chemical use and importation

- Report any intentionally added chemical substances

California Proposition 65

- Evaluate for presence of listed carcinogens or reproductive toxins (e.g., certain dyes or formaldehyde-based finishes)

- Provide warnings if applicable

Fire Safety Standards

- USA: Comply with 16 CFR Part 1630/1631 (surface flooring flammability)

- UK/EU: Adhere to BS EN 13501-1 (reaction to fire classification)

- Other Regions: Check local building codes and fire safety requirements

Customs and Import Documentation

Ensure all paperwork supports smooth clearance.

– Commercial Invoice: Must detail value, currency, Incoterms, and buyer/seller information

– Certificate of Origin: Required for preferential tariffs under trade agreements

– Textile Declaration: Some countries require fiber composition labeling at import

– Import Licenses: Verify if needed (rare for standard textile fabrics)

Sustainability and Environmental Compliance

- Recyclability: Declare recyclability status of fabric (e.g., 100% PP is recyclable)

- Environmental Labels: Consider OEKO-TEX® STANDARD 100 certification for consumer safety

- Carbon Footprint: Maintain data for Scope 3 emissions if required by buyer or regulation

Traceability and Quality Assurance

- Implement batch tracking from production to delivery

- Retain samples and test reports (e.g., tensile strength, shrinkage, colorfastness) for at least 2 years

- Conduct regular audits of logistics partners for compliance with storage and handling standards

Conclusion

Effective logistics and compliance management for fabric for carpet minimizes risks, avoids customs delays, and ensures customer satisfaction. Partner with certified suppliers and logistics providers, maintain accurate documentation, and stay updated on evolving regulations in target markets.

In conclusion, sourcing fabric for carpet production requires a strategic approach that balances quality, cost, sustainability, and supply chain reliability. Selecting the right materials—whether natural fibers like wool or synthetic options such as nylon, polyester, and polypropylene—depends on the intended application, performance requirements, and environmental considerations. It is essential to partner with reputable suppliers who adhere to ethical practices and industry standards, ensuring consistent quality and timely delivery. Additionally, staying informed about innovations in sustainable textiles and recycling technologies can provide a competitive edge and support long-term environmental goals. Ultimately, effective fabric sourcing for carpets not only enhances product durability and aesthetics but also contributes to a more responsible and resilient manufacturing process.