The global fabric dyeing powder market is experiencing robust growth, fueled by rising demand from the textile and apparel industries, especially in emerging economies. According to a report by Mordor Intelligence, the global textile dyes market was valued at USD 9.8 billion in 2023 and is projected to grow at a CAGR of over 5.2% from 2024 to 2029. This expansion is driven by increasing urbanization, fast fashion trends, and advancements in dyeing technologies that improve color fastness and sustainability. Additionally, evolving consumer preferences toward colored and patterned textiles are pushing manufacturers to innovate in powder dye formulations that offer high color yield, reduced water consumption, and compliance with environmental regulations. In this competitive landscape, a select group of manufacturers have emerged as leaders, combining scale, R&D investment, and global distribution networks to cater to diverse industrial needs. The following analysis highlights the top nine fabric dyeing powder manufacturers shaping the future of the industry.

Top 9 Fabric Dyeing Powder Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Liquid & Powder Dye Supplier for Industrial Applications

Domain Est. 1997

Website: organicdye.com

Key Highlights: Organic Dyes and Pigments is a liquid and powder dyes and colorants supplier for textile and industrial applications….

#2 Acid Dyes, Synthetic Food Colors Manufacturer, Acid Dyes Exporter …

Domain Est. 2010 | Founded: 2000

Website: redsundyechem.com

Key Highlights: RED SUN DYE CHEM established in 2000 years at Vatva GIDC, Ahmedabad for the manufacturing of Acid Dyes, Direct Dyes, Food Color, Solvent Dyes, Basic Dyes ……

#3 Fabric Dyes From Dharma Trading Co.

Domain Est. 1996

Website: dharmatrading.com

Key Highlights: 30-day returnsFabric Dyes of all types in one place! We have only the best, freshest, and most vibrant fabric dyes at super great prices for all kinds of fabrics….

#4 Dyes

Domain Est. 1997

Website: jacquardproducts.com

Key Highlights: We offer dyes for a wide variety of fibers, fabrics and applications, including Acid Dye, Basic Dye, Cochineal, Concentrated Vinyl Sulphon, iDye, Indigo, ……

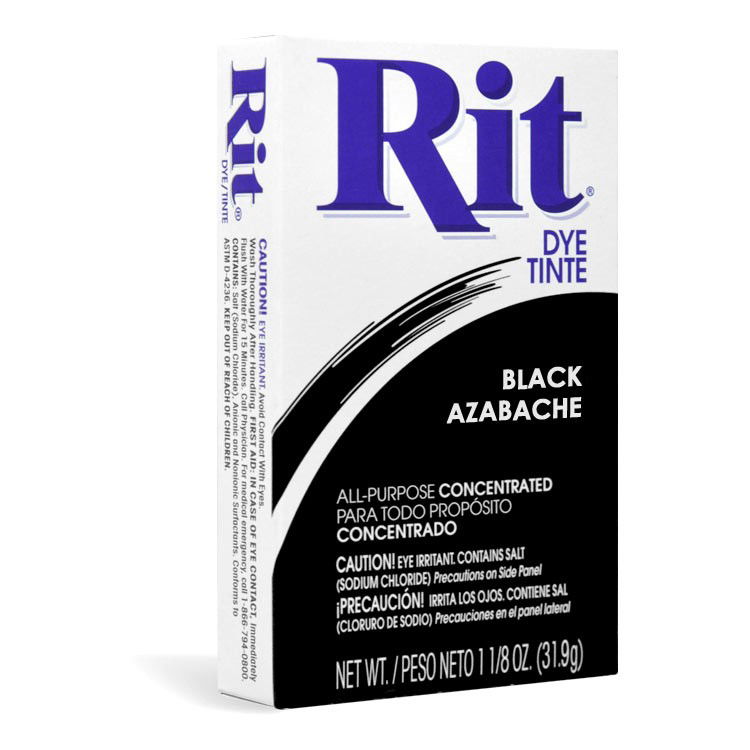

#5 Rit Dye Online Store

Domain Est. 1998

#6 G&S Dye

Domain Est. 1998

Website: gsdye.com

Key Highlights: G&S Dye and Accessories Ltd. is the source for textile design supplies in North America. Along with a wide range of natural silk, cotton and linen fabrics….

#7 PRO Chemical and Dye

Domain Est. 2009

Website: prochemicalanddye.com

Key Highlights: Dyes for Cotton, Silk, & Other Plant Fibers. ICE DYES (PRO MX Fiber Reactive Dye) · PRO Sabracron F Reactive Dyes · Vat Dyes · Dye It! Starter Kits….

#8 Stony Creek Colors: Traceable, Plant

Domain Est. 2012

Website: stonycreekcolors.com

Key Highlights: Stony Creek Colors harnesses the power of nature to replace synthetic, petrochemical-derived colorants with traceable, 100% plant-based dyes….

#9 Yamato Indigo

Domain Est. 2019

Website: yamatoindigo.com

Key Highlights: 3–12 day deliveryYamato Indigo is a high-quality Japanese indigo dye in a convenient powder form, designed for effortless use. Simply mix it with water—no heating or ……

Expert Sourcing Insights for Fabric Dyeing Powder

H2: Global Fabric Dyeing Powder Market Trends Forecast for 2026

The global fabric dyeing powder market is projected to undergo significant transformation by 2026, driven by evolving consumer preferences, technological advancements, and increasing environmental regulations. Key trends shaping the market include a rising demand for sustainable and eco-friendly dyes, growth in the textile and apparel industries—particularly in Asia-Pacific—and the adoption of digitalization in dyeing processes.

-

Sustainability and Eco-Friendly Solutions

A major trend in the 2026 fabric dyeing powder market is the shift toward environmentally sustainable products. Consumers and regulatory bodies are demanding reduced water usage, lower carbon emissions, and non-toxic formulations. As a result, manufacturers are investing in bio-based dyes, low-impact dyeing powders, and formulations free from heavy metals and AOX (adsorbable organic halogens). Certification standards such as OEKO-TEX® and REACH compliance are becoming prerequisites for market entry, especially in Europe and North America. -

Growth in Emerging Markets

The Asia-Pacific region, particularly India, China, and Bangladesh, continues to dominate production and consumption of fabric dyeing powders due to their robust textile manufacturing ecosystems. Rising disposable incomes and urbanization are fueling demand for dyed fabrics in apparel and home textiles, thereby driving the need for cost-effective and high-performance dyeing powders. Government initiatives promoting textile exports in these countries are further boosting market expansion. -

Technological Innovation and Efficiency

Advancements in dye formulation and application technologies are improving color fastness, dye uptake efficiency, and energy consumption. Powder dyes with enhanced solubility and dispersion properties are gaining traction, allowing for uniform dyeing with reduced processing time. Additionally, integration with digital dyeing systems and automation is enabling precise dosing and minimizing waste, appealing to large-scale textile producers aiming for lean manufacturing. -

Regulatory Pressure and Supply Chain Transparency

Stricter environmental regulations, especially in the EU and North America, are pushing manufacturers to adopt cleaner production methods. This includes traceability in raw material sourcing and transparency in the supply chain. Companies are increasingly disclosing their environmental impact, leading to a preference for certified sustainable dyeing powders and fostering partnerships with green-certified suppliers. -

Shift Toward Natural and Plant-Based Dyes

While synthetic dyeing powders still dominate the market, there is growing interest in natural dyes derived from plants, minerals, and microbes. Although currently limited by scalability and color consistency issues, research and development in natural dye stabilization and fixation techniques are expected to expand their commercial viability by 2026, particularly in niche and premium fashion segments. -

Competitive Landscape and Strategic Collaborations

The market is witnessing increased consolidation, with key players such as Huntsman Corporation, Archroma, and Kiri Industries focusing on R&D and strategic partnerships to innovate and expand their product portfolios. Mergers, acquisitions, and joint ventures are common strategies to access new markets and enhance technological capabilities.

In conclusion, by 2026, the fabric dyeing powder market will be characterized by sustainability-driven innovation, regional growth imbalances, and intensified competition. Success will depend on manufacturers’ ability to balance performance, environmental compliance, and cost-efficiency in an increasingly regulated and conscious global marketplace.

Common Pitfalls When Sourcing Fabric Dyeing Powder: Quality and Intellectual Property (IP) Risks

Sourcing fabric dyeing powder involves navigating complex technical and legal challenges. Overlooking key quality and intellectual property (IP) concerns can lead to production delays, compliance failures, reputational damage, and costly legal disputes.

Quality-Related Pitfalls

Inconsistent Color Fastness and Batch Variation

One of the most frequent quality issues is poor color fastness (resistance to fading from light, washing, or rubbing). Suppliers may provide dyes that perform well initially but degrade during consumer use. Additionally, inconsistent dye composition across batches can cause visible shade variations in final products, leading to customer complaints and rejected shipments.

Presence of Restricted or Hazardous Substances

Many dyes, especially lower-cost options from less-regulated regions, may contain banned or regulated chemicals such as azo dyes, heavy metals (e.g., lead, cadmium), formaldehyde, or allergenic colorants. Non-compliance with regulations like REACH (EU), OEKO-TEX® Standard 100, or CPSIA (USA) can result in import bans, product recalls, or fines.

Incorrect Dye Composition or Purity Levels

Suppliers may misrepresent dye concentration or purity, leading to inaccurate dosing during the dyeing process. Under-dosing causes weak coloration; over-dosing increases costs and environmental impact. Some suppliers dilute powders with fillers to reduce costs, compromising performance and consistency.

Inadequate Testing and Documentation

Reliable suppliers provide comprehensive quality data sheets (CoA), including dye content, impurities, and test results. Sourcing without verified documentation increases the risk of receiving substandard materials. Lack of batch-specific testing data makes traceability and problem resolution difficult.

Intellectual Property (IP)-Related Pitfalls

Unauthorized Use of Protected Dye Formulations

Many high-performance dyes are protected by patents or trade secrets. Sourcing from suppliers who replicate patented formulations—especially in regions with weak IP enforcement—exposes buyers to infringement claims. Even unintentional use of counterfeit or reverse-engineered dyes can trigger legal action from original manufacturers.

Lack of IP Warranty or Indemnification

Standard supply agreements often omit clauses that require the supplier to guarantee IP ownership or defend the buyer against infringement claims. Without such protections, the buyer may bear full liability for IP violations, including legal fees and damages.

Grey Market or Diverted Goods

Some suppliers offer branded dyes at unusually low prices because they are sourcing from unauthorized channels (grey market). These dyes may be diverted, expired, or counterfeit. Using such materials not only risks performance issues but also constitutes IP infringement, especially if trademarks are misused.

Insufficient Due Diligence on Supplier Origin

Failing to audit a supplier’s manufacturing processes and sourcing chain increases the risk of inadvertently obtaining IP-infringing products. Suppliers may claim legitimacy while relying on copied technology or unlicensed production methods.

Mitigation Strategies

- Require Third-Party Certifications: Insist on up-to-date OEKO-TEX®, ISO, or ZDHC compliance documentation.

- Conduct Pre-Shipment Testing: Use independent labs to verify color fastness, chemical content, and batch consistency.

- Verify IP Status: Confirm with dye manufacturers whether the supplier is an authorized distributor or licensee.

- Include IP Clauses in Contracts: Demand warranties of non-infringement and indemnification for IP-related claims.

- Perform Supplier Audits: Evaluate production facilities and supply chain transparency to ensure legitimacy and quality control.

By proactively addressing both quality and IP risks, businesses can ensure reliable dye supply, maintain compliance, and protect their brand integrity.

H2: Logistics & Compliance Guide for Fabric Dyeing Powder

Proper logistics and regulatory compliance are critical when shipping and handling fabric dyeing powders. These substances can pose health, safety, and environmental risks, requiring adherence to international, national, and regional regulations. This guide outlines key considerations for the safe and legal transportation, storage, and documentation of fabric dyeing powder.

H2: Regulatory Classification & Identification

-

UN Number & Proper Shipping Name:

Fabric dyeing powders are typically classified under UN 3077 (ENVIRONMENTALLY HAZARDOUS SUBSTANCE, SOLID, N.O.S.) or UN 2811 (TOXIC SOLID, ORGANIC, N.O.S.), depending on toxicity and composition. Always verify using a current Safety Data Sheet (SDS). -

Hazard Class:

Most dyeing powders fall under: - Class 6.1 (Toxic Substances) – if acutely toxic

- Class 9 (Miscellaneous Dangerous Goods) – for environmentally hazardous substances

-

Some inorganic dyes may fall under Class 8 (Corrosive) if pH extremes are present

-

Packing Group:

Determined by toxicity level (PG I, II, or III). Most dyes are PG III (low danger) or PG II (medium danger). -

GHS Classification:

Ensure the product is labeled per GHS (Globally Harmonized System) with hazard pictograms, signal words, hazard statements, and precautionary statements.

H2: Packaging Requirements

-

Outer Packaging:

Use UN-certified packaging (e.g., fiberboard drums, plastic jerricans, or multi-wall paper bags with liners) marked with the appropriate UN specification code. -

Inner Liners:

Include moisture-resistant liners (e.g., polyethylene) to prevent clumping and contamination. -

Sealing & Closure:

Ensure all containers are tightly sealed to prevent leakage or dust release during transit. -

Marking & Labeling:

Packages must display: - Proper shipping name and UN number

- Hazard class labels (e.g., Class 6.1, Class 9)

- GHS hazard pictograms

- Shipper and consignee information

- Orientation arrows (if required)

H2: Transportation & Shipping

- Mode-Specific Regulations:

- Air (IATA DGR): Strict limits on quantity per package; requires Shipper’s Declaration for Dangerous Goods.

- Sea (IMDG Code): Must be listed in the IMDG Dangerous Goods List with proper stowage and segregation.

-

Road/Rail (ADR/RID): Requires orange placards on vehicles, driver training (ADR certificate), and transport documents.

-

Documentation:

- Safety Data Sheet (SDS) – up to date (Version 16+ sections)

- Dangerous Goods Declaration (DGD) – signed by trained personnel

-

Commercial Invoice & Packing List – clearly stating product name, quantity, and hazard info

-

Temperature & Humidity Control:

Avoid extreme temperatures and high humidity to prevent degradation or caking.

H2: Storage & Handling

- Storage Conditions:

- Store in a cool, dry, well-ventilated area

- Keep away from incompatible materials (e.g., oxidizers, acids, bases)

-

Use closed containers; elevate off floors to prevent moisture absorption

-

Handling Precautions:

- Use PPE: gloves, goggles, dust mask/respirator (NIOSH-approved)

- Minimize dust generation; use local exhaust ventilation

-

Prohibit eating, drinking, or smoking in handling areas

-

Spill Response:

- Contain spill with inert absorbent material (e.g., sand, vermiculite)

- Avoid sweeping (creates dust); use damp cloth or HEPA vacuum

- Dispose of as hazardous waste per local regulations

H2: Environmental & Waste Compliance

-

Environmental Hazards:

Many dyes are toxic to aquatic life. Prevent release into drains, soil, or waterways. -

Waste Disposal:

Follow local hazardous waste regulations. Do not dispose of in regular trash. Use licensed waste handlers. -

REACH & RoHS (EU):

Confirm compliance with REACH (registration, evaluation, authorization of chemicals) and RoHS (restriction of hazardous substances in textiles). -

TSCA (USA):

Ensure the dye is listed on the TSCA Inventory if imported into the United States.

H2: Import/Export Requirements

-

Customs Declarations:

Include accurate HS Code (e.g., 3204.11–3204.20 for synthetic organic dyes) and hazard details. -

Permits & Licenses:

Some countries require import permits for hazardous chemicals (e.g., China, India, Brazil). -

Labeling in Local Language:

Ensure packaging and SDS are available in the official language(s) of the destination country.

H2: Training & Documentation

- Personnel Training:

Ensure staff involved in handling, packing, or shipping are trained in: - Hazard communication (HazCom)

- Dangerous goods regulations (IATA, IMDG, ADR, etc.)

-

Emergency response procedures

-

Record Keeping:

Maintain records of SDS, training, shipping documents, and incident reports for minimum 3–5 years (per jurisdiction).

Note: Always consult the latest edition of regulatory texts and obtain a product-specific SDS before shipping. Regulations vary by country and change frequently. Engage a certified dangerous goods safety advisor (DGSA) when in doubt.

In conclusion, sourcing fabric dyeing powder requires careful consideration of several key factors including color consistency, dye fastness, environmental impact, cost-effectiveness, and compliance with safety and regulatory standards. Engaging with reliable suppliers who provide high-quality, sustainable, and competitively priced dyeing powders is crucial to ensuring efficient and eco-friendly textile production. Additionally, conducting thorough testing and maintaining open communication with suppliers supports long-term quality control and supply chain resilience. By prioritizing these aspects, businesses can achieve superior dyeing results while meeting market demands and sustainability goals.