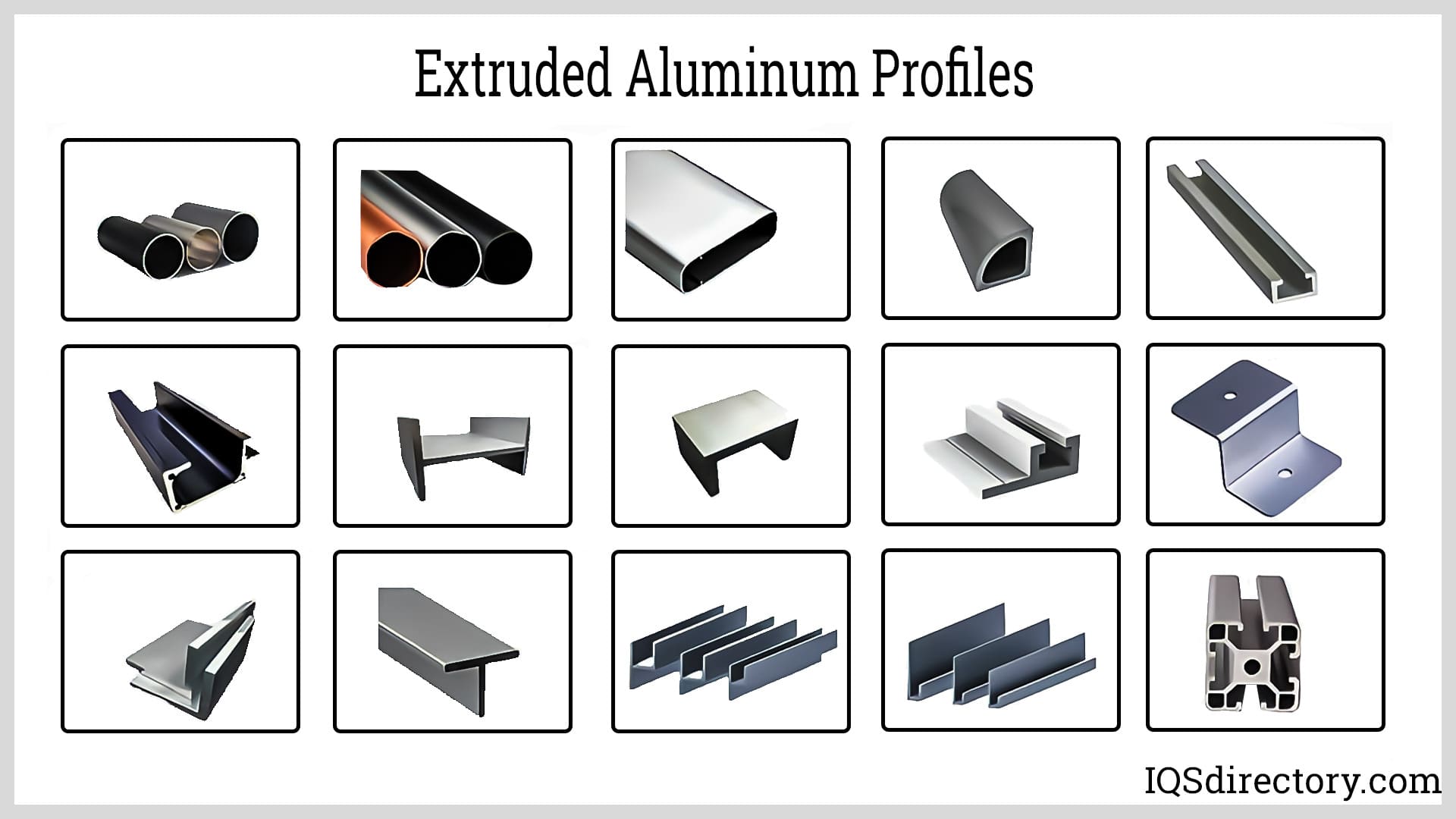

The global extruded aluminum profiles market is experiencing robust growth, driven by rising demand across industries such as construction, automotive, renewable energy, and electronics. According to a 2023 report by Grand View Research, the market was valued at USD 64.2 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. This surge is fueled by aluminum’s lightweight, corrosion-resistant properties and the increasing emphasis on energy efficiency and sustainability—particularly in electric vehicles and green buildings. Additionally, Mordor Intelligence forecasts a CAGR of over 6.5% through 2028, underscoring the expanding footprint of aluminum extrusions in industrial applications worldwide. As demand continues to climb, a select group of manufacturers are leading the charge in capacity, innovation, and global reach. Here are the top 10 extruded aluminum profiles manufacturers shaping the future of this dynamic market.

Top 10 Extruded Aluminum Profiles Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 80/20 Aluminum T-slot Building Systems

Domain Est. 1997

Website: 8020.net

Key Highlights: T-Slots, aluminum extrusions, and parts. Architectural solutions and frames for industrial machine guards, workstations, data center enclosures, and more….

#2 Custom Aluminum Extrusions & Profiles Manufacturer

Domain Est. 2010

Website: eagle-aluminum.com

Key Highlights: Eagle’s aluminum extrusions manufacturer connections give you access to more than 10,000 custom aluminum profiles and extruded shapes….

#3 Custom Aluminum Extrusion Manufacturing

Domain Est. 2022

Website: mmgextrusions.com

Key Highlights: As a leading aluminum extrusion manufacturer, we provide a complete manufacturing solution for custom-extruded aluminum parts and components….

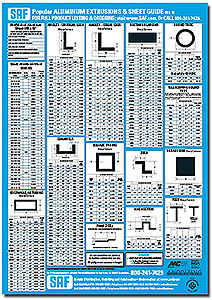

#4 SAF

Domain Est. 1992

Website: saf.com

Key Highlights: As the largest single source for architectural aluminum sheet, extruded shapes, aluminum anodizing, painting, and fabricating services, we look forward to ……

#5 Small Custom Aluminum Extrusions

Domain Est. 1996

Website: minalex.com

Key Highlights: Minalex is a trusted, worldwide supplier of Aluminum Window Extrusions. We manufacture extruded aluminum profiles for windows in various shapes, sizes, and ……

#6 Taber Extrusions

Domain Est. 1998

Website: taberextrusions.com

Key Highlights: Taber is A full service supplier of aluminum extrusions based products. Full range of aluminum alloys and aluminum CNC machining to meet our ……

#7

Domain Est. 2000

Website: tslots.com

Key Highlights: We offer the best aluminum extrusion TSLOTS in the industry and our in-house experts can work with any idea and any CAD drawing you bring to the table. DOWNLOAD….

#8 Tri

Domain Est. 2001

Website: tri-stateal.com

Key Highlights: At Tri-State Aluminum, we specialize in producing custom 6000 series aluminum extrusions tailored to the specific needs of our customers. Contact us today!…

#9 Bonnell Aluminum

Domain Est. 2007

Website: bonnellaluminum.com

Key Highlights: Only Bonnell has the people, resources, assets and technologies needed to deliver the highest quality custom fabricated and finished aluminum extrusions….

#10 Aluminum Extrusion Profiles

Domain Est. 2016

Website: wellste.com

Key Highlights: Wellste provides qualified aluminum extrusions whether standard or customized aluminum extrusions from China, That can meet your needs exactly….

Expert Sourcing Insights for Extruded Aluminum Profiles

H2: 2026 Market Trends for Extruded Aluminum Profiles

The global extruded aluminum profiles market is poised for sustained growth and significant transformation by 2026, driven by macroeconomic shifts, technological advancements, and evolving end-user demands. Key trends shaping the market include:

1. Accelerated Demand from Sustainable Transportation: The electric vehicle (EV) revolution remains the single largest driver. Extruded aluminum profiles are critical for lightweighting EVs, enhancing battery range and efficiency. By 2026, demand from EV manufacturers (chassis, battery enclosures, structural components) will surge, compounded by stricter global fuel efficiency and emissions regulations impacting traditional vehicles.

2. Construction Sector Evolution Towards Sustainability: Green building standards (LEED, BREEAM) and energy efficiency mandates will boost demand for thermally broken aluminum profiles in windows, doors, and curtain walls. Urbanization, particularly in Asia-Pacific and the Middle East, will sustain demand for structural and facade applications, with a growing preference for complex, customizable profiles.

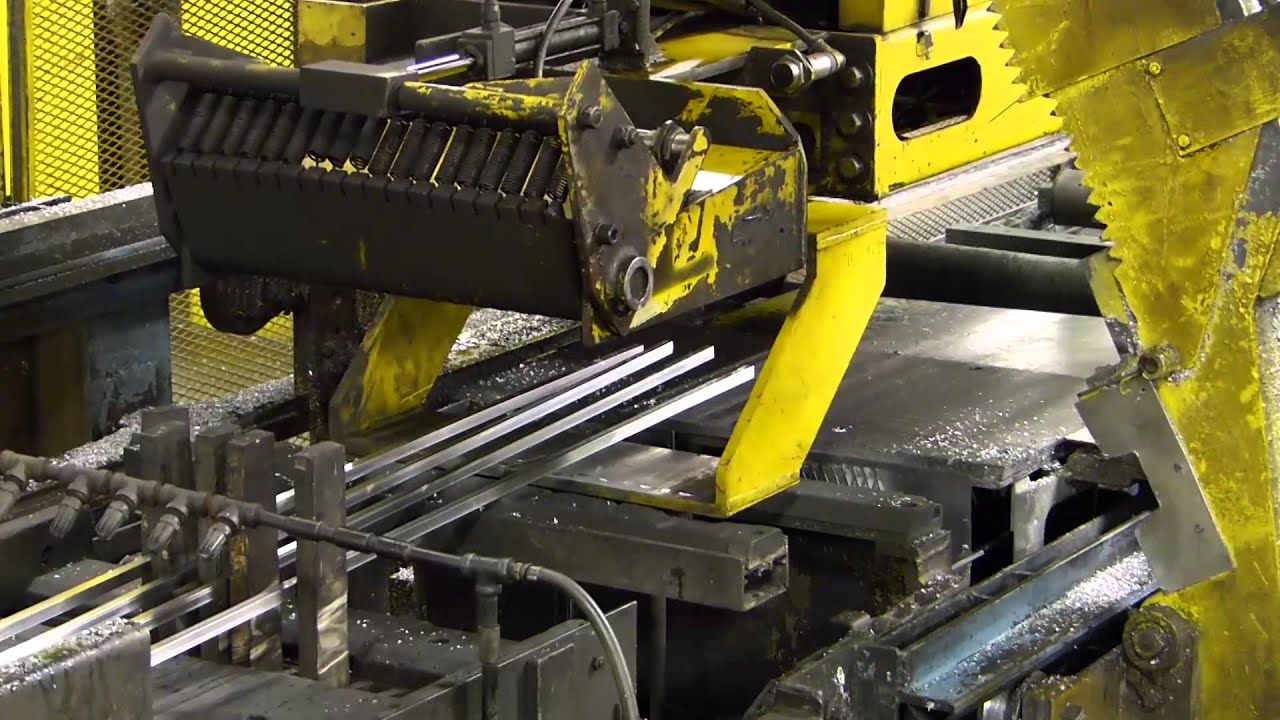

3. Technological Innovation and Process Optimization: Manufacturers will increasingly invest in:

* Advanced Tooling & Simulation: AI-driven design and finite element analysis (FEA) for optimizing profile geometry, reducing material waste, and enabling complex, high-precision shapes.

* Automation & Industry 4.0: Integration of robotics, IoT sensors, and data analytics for improved production efficiency, quality control, and predictive maintenance.

* New Alloys & Processes: Development of high-strength, heat-treatable, and recyclable alloys tailored for specific applications (e.g., EVs, aerospace). Increased focus on near-net-shape extrusion to minimize secondary machining.

4. Heightened Focus on Sustainability and Circularity: Environmental, Social, and Governance (ESG) pressures will intensify:

* Recycled Content: Demand for profiles made with high recycled aluminum content (post-consumer scrap) will rise significantly, driven by carbon footprint reduction goals and regulations (e.g., EU Green Deal).

* Energy Efficiency: Adoption of inert anode technology and increased use of renewable energy in smelting and extrusion will be crucial for reducing Scope 1 & 2 emissions.

* Design for Recycling: Collaboration between designers, OEMs, and recyclers to create easily separable and recyclable aluminum components will gain traction.

5. Geopolitical and Supply Chain Resilience: Manufacturers will actively diversify supply chains and raw material sourcing to mitigate risks from:

* Geopolitical Tensions: Potential disruptions in key bauxite/alumina supply regions or trade policies.

* Regionalization: Growth in “nearshoring” or “friendshoring,” particularly in North America and Europe, to reduce dependency on single regions and shorten lead times.

* Energy Security: Relocation or investment in regions with stable, preferably renewable, energy supplies to ensure cost-competitive production.

6. Expansion in Renewable Energy Infrastructure: Solar panel mounting systems (racks, trackers) and wind turbine components will be significant growth areas, leveraging aluminum’s corrosion resistance and lightweight properties. Government incentives for renewable energy deployment globally will fuel this demand.

7. Consolidation and Strategic Partnerships: The market may see increased M&A activity as larger players seek economies of scale, expanded geographic reach, and enhanced technological capabilities. Strategic partnerships between extruders, material scientists, and OEMs will accelerate innovation for specific high-performance applications.

Conclusion: By 2026, the extruded aluminum profiles market will be characterized by its pivotal role in decarbonization (especially in transport and construction), driven by technological sophistication, stringent sustainability requirements, and a reconfigured global supply chain. Success will depend on manufacturers’ ability to innovate, embrace circularity, ensure supply chain resilience, and align closely with the evolving needs of high-growth, sustainability-focused industries.

Common Pitfalls Sourcing Extruded Aluminum Profiles (Quality, IP)

Sourcing extruded aluminum profiles presents several potential challenges, particularly concerning product quality and intellectual property (IP) protection. Overlooking these pitfalls can lead to supply chain disruptions, increased costs, legal disputes, and reputational damage. Below are key issues to watch for:

Poor Material Quality and Inconsistent Tolerances

One of the most frequent issues is receiving profiles that fail to meet specified mechanical properties or dimensional tolerances. This can result from substandard aluminum alloys, inadequate process control, or lack of proper quality assurance at the supplier’s facility. Variations in wall thickness, twist, bow, or surface finish can render parts unusable in precision applications, leading to rework or assembly failures.

Inadequate Surface Finish and Anodizing Defects

Extrusions often require post-processing such as anodizing, powder coating, or polishing. Poor surface preparation or inconsistent anodizing—such as color variation, pitting, or uneven coating thickness—can compromise both aesthetics and corrosion resistance. Some suppliers may cut corners in pre-treatment or electrolyte control, resulting in non-compliant finishes that fail durability tests.

Lack of Traceability and Certification

Many industries (e.g., aerospace, medical, automotive) require full material traceability and certifications (e.g., ISO, ASTM, EN standards). Suppliers may fail to provide mill test reports (MTRs), heat lot traceability, or compliance documentation, making it difficult to validate quality or meet regulatory requirements.

Intellectual Property (IP) Infringement and Unauthorized Tooling Use

Custom die designs are valuable IP. Unscrupulous suppliers may copy your proprietary profile designs and sell them to competitors, or reuse your dies without permission. This risk is heightened when working with overseas or low-cost manufacturers who may not respect IP rights. Additionally, poor contract terms may fail to assign ownership of the extrusion tooling to the buyer.

Weak Contractual Protections and Ambiguous Ownership

Contracts often lack clear clauses on tooling ownership, usage rights, exclusivity, and confidentiality. Without explicit agreements, suppliers may claim ownership of custom dies or refuse to release them, limiting your ability to switch manufacturers or scale production. Non-disclosure agreements (NDAs) may also be insufficient or poorly enforced.

Supply Chain Transparency and Subcontracting Risks

Some suppliers outsource extrusion work to third-party mills without informing the buyer. This lack of transparency can compromise quality control, as the original supplier may have little oversight over the subcontractor’s processes. It also increases the risk of IP exposure and inconsistent product performance.

Incomplete or Inaccurate Dimensional Reporting

Suppliers may provide incomplete first-article inspection (FAI) reports or fail to measure critical dimensions identified in the design. Without comprehensive inspection data using calibrated equipment, it’s difficult to verify conformance, especially for complex geometries or tight-tolerance features.

Failure to Validate Supplier Capabilities

Procurement teams may select suppliers based solely on price or lead time without assessing technical capabilities, process controls, or quality management systems. This increases the risk of non-conformance and long-term reliability issues. Onsite audits and sample testing are essential but often skipped.

To mitigate these risks, buyers should perform due diligence on suppliers, establish clear contractual terms, secure IP rights, require full documentation, and implement ongoing quality monitoring throughout the supply chain.

Logistics & Compliance Guide for Extruded Aluminum Profiles

Extruded aluminum profiles are widely used across industries due to their strength, lightweight nature, and versatility. Efficient logistics and strict compliance with regulatory standards are essential for successful import/export, handling, storage, and usage. This guide outlines best practices and key compliance considerations.

Transportation & Handling

Proper handling during transportation prevents damage and maintains product integrity. Extruded aluminum profiles are susceptible to scratching, bending, and surface oxidation.

- Packaging: Profiles should be securely bundled using non-abrasive materials such as cardboard edge protectors, foam wraps, or plastic caps on ends. Use moisture-resistant wrapping to prevent corrosion during transit.

- Loading/Unloading: Use forklifts with padded forks or lifting straps to avoid surface damage. Never drag or drop bundles.

- Transport Mode: Choose appropriate transport (truck, rail, sea, or air) based on volume, destination, and delivery timeline. For international shipments, ensure proper containerization to minimize movement and exposure to elements.

- Stacking: Store profiles horizontally on flat, clean surfaces. Avoid over-stacking to prevent bending. Use wooden spacers between layers to ensure even weight distribution.

Storage Requirements

Improper storage can lead to surface degradation, warping, or contamination.

- Environment: Store in a dry, well-ventilated, indoor area away from direct sunlight and moisture. Avoid contact with corrosive substances like acids, salts, or cleaning agents.

- Orientation: Keep profiles horizontal to maintain straightness. Vertical storage is acceptable only for short-term if profiles are securely braced.

- Floor Contact: Use wooden pallets or racks to elevate profiles off concrete floors, which can retain moisture and cause staining or pitting.

- Inventory Rotation: Implement a first-in, first-out (FIFO) system to minimize long-term storage and reduce risk of surface oxidation.

International Trade Compliance

Exporting or importing extruded aluminum profiles requires adherence to international trade regulations.

- HS Code Classification: Use the correct Harmonized System (HS) code. Common codes:

- 7604.10: Aluminum profiles, hollow sections, unwrought

- 7608.10: Aluminum tubes, pipes, and hollow profiles

Ensure accurate classification to avoid customs delays or penalties. - Country-Specific Regulations: Research import requirements in the destination country (e.g., CE marking in the EU, ASTM standards in the U.S., or CCC in China).

- Anti-Dumping Duties: Be aware of anti-dumping or countervailing duties, particularly for shipments from certain countries (e.g., China, India) to the U.S. or EU.

- Documentation: Prepare complete shipping documents including commercial invoice, packing list, bill of lading/air waybill, certificate of origin, and material test reports (MTRs).

Material & Quality Standards

Compliance with international and industry-specific standards ensures performance and safety.

- Common Standards:

- ASTM B221: Standard specification for aluminum and aluminum-alloy extruded bars, rods, wire, profiles, and tubing.

- EN 755: European standard for aluminum and aluminum alloys — Extruded rod/bar, tube, and profiles.

- ISO 20286: Geometric product specifications (GPS) — ISO code system for linear sizes.

- Certifications: Provide mill test certificates (MTCs) or material test reports verifying chemical composition and mechanical properties (e.g., tensile strength, yield strength, elongation).

- Surface Finish Compliance: Follow customer or industry-specific requirements for anodizing, powder coating, or mill finish (e.g., Qualicoat for coatings, AAMA standards in North America).

Environmental & Safety Regulations

Adherence to environmental and workplace safety rules is mandatory.

- REACH & RoHS (EU): Ensure aluminum profiles and surface treatments (e.g., coatings, sealants) comply with restrictions on hazardous substances.

- OSHA (U.S.): Follow safe handling guidelines for manual lifting and machine operations. Use appropriate PPE when cutting, machining, or welding profiles.

- Waste Management: Recycle aluminum scrap responsibly. Follow local regulations for disposal of packaging materials and surface treatment waste.

- Carbon Footprint: Consider using suppliers that provide Environmental Product Declarations (EPDs) and prioritize low-carbon production methods.

Traceability & Documentation

Maintain clear records throughout the supply chain to support compliance and quality control.

- Batch Tracking: Assign lot numbers to production batches for full traceability from raw material to delivery.

- Test Reports: Archive MTRs, inspection reports, and compliance certificates for a minimum of 5–10 years, depending on industry requirements.

- Audit Readiness: Prepare for third-party audits (e.g., ISO 9001, IATF 16949) by maintaining organized documentation and process records.

By adhering to these logistics and compliance guidelines, companies can ensure the safe, efficient, and legal movement of extruded aluminum profiles while meeting customer and regulatory expectations globally.

In conclusion, sourcing extruded aluminum profiles offers significant advantages in terms of design flexibility, material strength, lightweight properties, and cost-effective manufacturing. With the ability to create complex cross-sectional shapes tailored to specific applications, aluminum extrusion supports innovation across industries such as construction, transportation, electronics, and renewable energy. When selecting a supplier, key considerations include material quality, extrusion capabilities, certifications, lead times, and cost-efficiency. Establishing strong partnerships with reliable manufacturers—whether domestic or international—ensures consistent product quality, timely delivery, and opportunities for customization and technical collaboration. Ultimately, a strategic sourcing approach to extruded aluminum profiles enhances product performance, reduces assembly costs, and supports sustainable manufacturing practices due to aluminum’s high recyclability. Proper due diligence and long-term supplier relationships are essential to fully realize these benefits and maintain a competitive edge in the market.