The global exhaust system components market is experiencing steady growth, driven by increasing vehicle production, stricter emissions regulations, and rising demand for high-performance automotive parts. According to Grand View Research, the global automotive exhaust system market size was valued at USD 33.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.1% from 2023 to 2030. A critical component within this ecosystem is the mandrel bent exhaust pipe, known for maintaining consistent pipe diameter through bends—enhancing exhaust flow, engine efficiency, and overall performance. With original equipment manufacturers (OEMs) and aftermarket players alike prioritizing durability and acoustic optimization, demand for precision-engineered mandrel bends continues to rise. This growing market landscape has elevated the importance of reliable, high-capacity manufacturers capable of delivering consistent quality across diverse applications—from heavy-duty trucks to performance vehicles. Below are nine leading exhaust pipe mandrel bend manufacturers shaping the industry through innovation, advanced fabrication techniques, and global supply chain integration.

Top 9 Exhaust Pipe Mandrel Bends Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Quality Mandrel

Domain Est. 1996

Website: hedman.com

Key Highlights: 30-day returnsHedman Hedders & Trans-Dapt Performance Products are two of the hot rod industries original manufacturers, dating way back to 1954….

#2 Mandrel Bends

Domain Est. 2003

Website: trubendz.com

Key Highlights: Free deliveryWhat are Mandrel Bends? Mandrel bends are smooth, seamless bends in exhaust tubing that maintain a constant internal diameter throughout the bend….

#3 Tubing and Bends

Domain Est. 2000

Website: vibrantperformance.com

Key Highlights: Tubing and Bends ; Aluminum 180° Mandrel Bends. $69.99 – $156.99 ; Aluminum 120° Mandrel Bends. $59.99 – $116.99 ; Aluminum Ultra Tight Radius 120° Bends. $79.99 – ……

#4 Mandrel Bent Pipe, Exhaust Hangers Products

Domain Est. 2003

#5 Mandrel Bends

Domain Est. 2003

Website: stainlessheaders.com

Key Highlights: Free delivery over $200 60-day returns…

#6 Heartthrob Exhaust

Domain Est. 2003

Website: heartthrobexhaust.com

Key Highlights: Mandrel Bending from 1 inch to 6 inch diameter round tube, primarily in aluminized steel, 409 and 304 stainless steel. Custom + Performance Exhaust Installation….

#7 Mandrel Bending Solutions

Domain Est. 2006

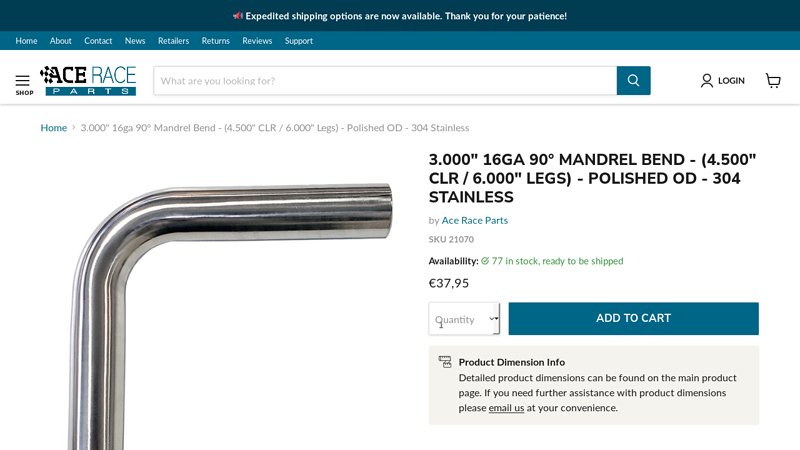

#8 3.000″ Stainless Mandrel Bends

Domain Est. 2014

Website: aceraceparts.com

Key Highlights: In stock Rating 5.0 (3) Our mandrel bent exhaust tubing offers a consistent, high quality welding experience with virtually no need for surface preparation prior to welding….

#9 Mandrel Bends Canada

Domain Est. 2018

Website: mandrelbending.ca

Key Highlights: New Product Added Every Day! Mandrel Bends, Mufflers, Resonators, Tail Pipes, Hot Rod Kits, Exhaust Accessories and more! – Shop Online Now!…

Expert Sourcing Insights for Exhaust Pipe Mandrel Bends

H2: Market Trends for Exhaust Pipe Mandrel Bends in 2026

The global market for exhaust pipe mandrel bends is projected to experience steady growth by 2026, driven by rising automotive production, increased demand for high-performance vehicles, and stricter emissions regulations. Below are key trends shaping the 2026 landscape:

-

Increased Adoption in Performance and Electric Vehicles

Mandrel bends—known for maintaining consistent pipe diameter and improving exhaust flow—are becoming standard in performance tuning and aftermarket modifications. As consumer interest in vehicle customization grows, especially in North America and Europe, demand for mandrel-bent exhaust systems is rising. Additionally, even electric performance vehicles (e.g., Tesla Model S Plaid, Porsche Taycan) with simulated exhaust sounds or heat management systems are incorporating mandrel bends in thermal exhaust components, expanding market reach. -

Stringent Emission and Noise Regulations

Governments worldwide are enforcing tighter emissions and noise standards. Mandrel bends contribute to optimized exhaust flow, enhancing catalytic converter efficiency and reducing backpressure. This improves fuel efficiency and lowers emissions, making them increasingly attractive for OEMs aiming to meet Euro 7, EPA Tier 4, and other regional standards. -

Growth in Aftermarket and Custom Fabrication

The aftermarket automotive sector is a major driver for mandrel bends. Enthusiasts and specialty shops rely on mandrel bending for superior fit, finish, and performance. The proliferation of DIY fabrication content on platforms like YouTube and TikTok is fueling demand for high-quality mandrel-bent kits, particularly in stainless steel and aluminized steel variants. -

Material Innovation and Lightweighting

By 2026, manufacturers are expected to shift toward advanced materials such as high-strength stainless steel alloys and ceramic-coated tubing to enhance durability and thermal resistance. Lightweight composites are also under exploration to reduce overall vehicle weight and improve fuel economy, particularly in hybrid and performance applications. -

Regional Market Expansion

Asia-Pacific, especially China and India, is emerging as a key growth region due to rising vehicle production and a growing middle class investing in vehicle upgrades. Meanwhile, North America remains the largest market for performance exhaust systems, supported by a robust car culture and strong aftermarket infrastructure. -

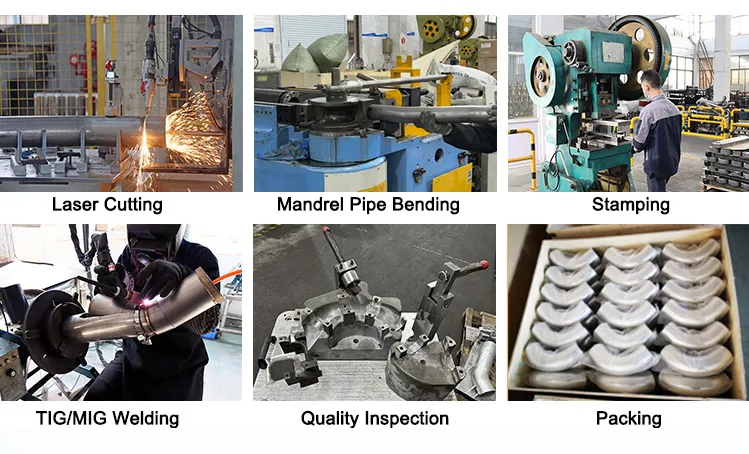

Automation and Precision Manufacturing

CNC-controlled mandrel bending machines are becoming more affordable and widespread, enabling small fabricators to produce high-precision bends efficiently. This technological democratization is improving product consistency and reducing lead times, further boosting market scalability. -

Sustainability and Recycling Trends

With growing environmental awareness, recyclability of stainless steel mandrel bends is becoming a selling point. Manufacturers are investing in closed-loop recycling systems and eco-friendly production processes to align with ESG (Environmental, Social, and Governance) goals.

Conclusion

By 2026, the exhaust pipe mandrel bend market will be defined by technological innovation, regulatory influence, and evolving consumer preferences. Companies that invest in advanced materials, automation, and sustainability will be well-positioned to capitalize on expanding opportunities across OEM, aftermarket, and emerging vehicle segments.

Common Pitfalls When Sourcing Exhaust Pipe Mandrel Bends (Quality, IP)

Sourcing high-quality exhaust pipe mandrel bends requires careful attention to both material integrity and intellectual property (IP) considerations. Overlooking these aspects can lead to performance issues, compliance risks, and reputational damage. Below are the most common pitfalls to avoid:

Poor Material Quality and Inconsistent Dimensions

One of the most frequent issues is receiving mandrel bends made from substandard materials or with inconsistent wall thickness and bend geometry. Low-quality stainless steel may corrode prematurely, while inconsistent bends can cause fitment problems during exhaust system assembly, leading to leaks, reduced engine performance, and increased backpressure.

Inadequate Heat Treatment and Wall Thinning

During the mandrel bending process, improper heat treatment or incorrect tooling can result in excessive wall thinning on the outer radius of the bend. This weakens the pipe, making it prone to cracking or failure under high heat and vibration. Buyers often assume all mandrel bends are equal, but the degree of wall preservation varies significantly between manufacturers.

Lack of Traceability and Certification

Many suppliers, especially offshore or low-cost providers, fail to provide material test reports (MTRs) or mill certifications. Without these documents, it’s impossible to verify the grade of stainless steel used (e.g., 304 vs. 409) or confirm compliance with industry standards like ASTM or ISO. This lack of traceability increases the risk of receiving counterfeit or non-compliant materials.

Ignoring Intellectual Property (IP) Rights

Some suppliers replicate branded mandrel bend designs—such as those from知名 brands like Vibrant, Borla, or AEM—without authorization. Sourcing these counterfeit or cloned parts exposes buyers to legal liability, including infringement claims and customs seizures. Always verify that the supplier holds proper licensing or offers proprietary, non-infringing designs.

Misrepresentation of Manufacturing Origin

Suppliers may claim parts are “Made in USA” or “Precision German-Made” when they are actually produced in unregulated facilities with inconsistent quality control. This mislabeling undermines quality expectations and can violate labeling laws, particularly in automotive aftermarket regulations.

Overlooking Tolerance and Fit Specifications

Mandrel bends must adhere to precise dimensional tolerances to ensure proper fit with flanges, clamps, and other exhaust components. Sourcing from manufacturers without strict quality control can result in parts that require costly modifications or lead to assembly delays.

Failure to Audit Supplier Capabilities

Relying solely on product samples or catalog specifications without auditing the supplier’s production facility, quality management system (e.g., ISO 9001), or IP compliance practices can result in long-term supply chain risks. Regular on-site assessments help ensure consistency and legitimacy.

By addressing these pitfalls proactively—verifying material certifications, enforcing IP compliance, and conducting thorough supplier evaluations—buyers can secure reliable, high-performance mandrel bends that meet both technical and legal standards.

Logistics & Compliance Guide for Exhaust Pipe Mandrel Bends

Overview of Exhaust Pipe Mandrel Bends

Exhaust pipe mandrel bends are precision-engineered components used in automotive and industrial exhaust systems to facilitate smooth, high-flow transitions in piping. Unlike crush bends, mandrel bends maintain a consistent internal diameter throughout the curve, improving exhaust flow efficiency and engine performance. Their production, transport, and use are subject to various logistics considerations and regulatory compliance requirements across international and regional markets.

Material and Manufacturing Standards

Exhaust pipe mandrel bends are typically manufactured from stainless steel (e.g., 304, 409), aluminized steel, or mild steel, depending on application requirements. Compliance with material standards such as ASTM A240 (for stainless steel) and SAE J2002 (for automotive tubing) is essential. Manufacturers must provide material certifications (e.g., Mill Test Certificates) to verify chemical composition and mechanical properties, ensuring suitability for high-temperature and corrosive environments.

International Trade Classification

For customs and import/export purposes, exhaust pipe mandrel bends are classified under the Harmonized System (HS) Code. The most applicable code is typically 7307.99 (Other tube or pipe fittings, of iron or steel), although specific sub-codes may vary by country and material composition. Accurate classification is critical to determine applicable tariffs, anti-dumping duties, and trade restrictions—particularly when shipping between the U.S., EU, China, and other major markets.

Transportation and Packaging Requirements

Mandrel bends must be packaged to prevent deformation, corrosion, and surface damage during transit. Standard packaging includes:

– Anti-rust paper or VCI (Vapor Corrosion Inhibitor) wrapping

– Wooden crates or sturdy cardboard boxes for bulk shipments

– Bundling with straps to prevent movement

For international shipping, compliance with ISPM 15 regulations is required for wooden packaging materials. Freight options (air, sea, or ground) depend on order volume, urgency, and destination. Sea freight (FCL/LCL) is common for large consignments due to cost efficiency.

Regulatory Compliance and Environmental Standards

Exhaust components may be subject to environmental and emissions regulations, especially in automotive applications. While mandrel bends themselves are not emission control devices, they are part of exhaust systems governed by standards such as:

– EPA Standards (U.S.): Compliance with Clean Air Act regulations for vehicle modifications

– Euro 6/7 (EU): Indirect impact on system design for emissions reduction

– CARB (California Air Resources Board): Aftermarket parts may require Executive Order (EO) number if sold in California

Note: Mandrel bends typically do not require certification unless marketed as part of a complete emission-compliant exhaust system.

Customs Documentation and Import Duties

Accurate documentation is vital for smooth customs clearance. Required documents include:

– Commercial Invoice (with detailed product description, HS code, value)

– Packing List

– Bill of Lading or Air Waybill

– Certificate of Origin (especially for preferential tariffs under USMCA, CETA, etc.)

– Material Test Reports (if requested)

Import duties vary by country and trade agreements. For example:

– U.S. import duty for HS 7307.99 is generally 3.5–5%

– EU applies a 4–6% duty depending on member state and material

– China may impose additional anti-dumping duties on certain steel products

Quality Assurance and Traceability

Suppliers should implement a quality management system compliant with ISO 9001. Each batch of mandrel bends should be traceable via heat lot numbers and production records. Buyers may require inspection reports (e.g., dimensional checks, weld integrity) and third-party testing for critical applications.

Aftermarket and Installation Compliance

In the automotive aftermarket, installation of mandrel bends may affect vehicle emissions compliance. Installers and distributors should advise end-users that:

– Modifications may void emissions warranties

– Vehicles must still pass periodic emissions tests (e.g., Smog Check in California)

– Systems must not increase noise beyond legal limits (e.g., FMVSS No. 115 in the U.S.)

Summary and Best Practices

To ensure seamless logistics and compliance for exhaust pipe mandrel bends:

– Verify HS codes and import regulations for the destination country

– Use certified materials and maintain documentation

– Package securely to avoid damage

– Partner with experienced freight forwarders familiar with metal components

– Stay updated on trade policies and environmental regulations

Adhering to these guidelines minimizes delays, reduces compliance risks, and supports reliable supply chain operations.

Conclusion: Sourcing Exhaust Pipe Mandrel Bends

Sourcing high-quality mandrel bends for exhaust pipe fabrication is a critical step in ensuring optimal engine performance, durability, and airflow efficiency. Mandrel bending maintains consistent pipe diameter throughout the bend, minimizing restrictions and maximizing exhaust flow—leading to improved horsepower, torque, and fuel efficiency. When selecting suppliers, key considerations include material quality (such as stainless steel or aluminized steel), precision of bend angles and radii, availability of standard and custom configurations, and compliance with industry standards.

It is essential to partner with reputable manufacturers or distributors who offer consistent product quality, technical support, and reliable lead times. Evaluating cost versus long-term value, rather than focusing solely on upfront pricing, helps avoid performance compromises and potential failures. Additionally, ensuring compatibility with fabrication methods (e.g., welding, clamping) and adherence to application-specific requirements—whether for performance automotive, marine, or industrial use—further strengthens the sourcing decision.

In conclusion, strategically sourcing mandrel bends from trusted suppliers enhances the overall integrity and performance of the exhaust system, providing long-term benefits in both functionality and reliability. A well-informed procurement process ultimately supports superior engine output and customer satisfaction.