The global construction equipment market is experiencing robust growth, driven by rising infrastructure development and urbanization, particularly in emerging economies. According to Mordor Intelligence, the construction equipment market was valued at USD 179.3 billion in 2023 and is projected to grow at a CAGR of 5.8% from 2024 to 2029. As excavators remain one of the most widely used machinery types across sectors, demand for reliable repair and after-sales services has surged in tandem. With equipment downtime directly impacting project timelines and operational costs, the need for high-quality, efficient repair solutions has elevated the importance of specialized excavator repair manufacturers. This growing after-market segment—supported by increased equipment ownership and extended machinery lifespans—is paving the way for innovative and technically advanced service providers. Based on market activity, service offerings, and technological integration, the following are the top 10 excavator repair manufacturers shaping the industry’s after-sales landscape.

Top 10 Excavator Repair Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 MECALAC, Excavators, Loaders, Backhoe Loaders, Dumpers and …

Domain Est. 1999

Website: mecalac.com

Key Highlights: Mecalac is an international manufacturer of wheel excavators, crawler excavators and wheel loaders. So many innovative and compact machines adapted to the wide ……

#2 SANY America

Domain Est. 2006

Website: sanyamerica.com

Key Highlights: SANY excavators, wheel loaders, cranes, port equipment and other machines are globally recognized for their value and durability. SANY is made for America….

#3 ITR

Domain Est. 2017

Website: itrworld.com

Key Highlights: ITR manufactures spare and repair parts for machines, undercarriage components and accessories compatible with machines from leading manufacturers….

#4 Link

Domain Est. 1998

Website: en.lbxco.com

Key Highlights: Link-Belt Excavators is proud to offer a wide range of Link-Belt excavators, scrap/material handlers, and forestry equipment….

#5 Werk

Domain Est. 1998 | Founded: 1947

Website: werk-brau.com

Key Highlights: Since 1947, Werk-Brau has manufactured the highest quality and most innovative specialty products for the heavy equipment industry….

#6 Brikers

Domain Est. 2004

Website: brikers.com

Key Highlights: Our 44,000 square foot facility sits on 5.5 acres and holds over 10,000 components. We dismantle whole equipment on site, rebuild the components to their ……

#7 Leemar Excavator Components

Domain Est. 2011

Website: leemarexcavatorparts.com

Key Highlights: Leemar specializes in John Deere and Hitachi’s major excavator components. The premier and longest standing excavator parts supplier for Canada and the USA….

#8 Genuine Parts, Reliable Service & Powerful Warranty

Domain Est. 2012

Website: kobelco-usa.com

Key Highlights: KOBELCO offers the best warranty in the business, but on the occasion you do need parts or service, we’ll have you back up and running in no time….

#9 Sales and Service

Domain Est. 2016

Website: kobelcocm-global.com

Key Highlights: Global Official Website of Kobelco Construction Machinery,a leading company of excavators and cranes. We globally present business through hydraulic ……

#10 Yanmar Compact Equipment

Domain Est. 2021

Website: yanmarce.com

Key Highlights: Explore Yanmar’s full line of compact construction equipment: mini excavators, compact track loaders, wheel loaders & tracked carriers….

Expert Sourcing Insights for Excavator Repair

H2: 2026 Market Trends for Excavator Repair

The global excavator repair market is poised for significant transformation by 2026, driven by technological advancements, rising construction and mining activities, and a growing emphasis on equipment longevity and sustainability. As infrastructure development continues to expand in emerging economies and aging machinery fleets demand maintenance, the excavator repair sector is expected to experience steady growth and innovation. Below are key trends shaping the industry in 2026:

1. Increased Adoption of Predictive Maintenance Technologies

By 2026, predictive maintenance powered by IoT (Internet of Things), AI (Artificial Intelligence), and telematics will be standard in the excavator repair industry. Sensors embedded in excavators collect real-time data on engine performance, hydraulic pressure, and component wear. This data enables repair services to anticipate failures before they occur, reducing downtime and repair costs. Equipment owners and service providers are increasingly investing in digital platforms that offer remote diagnostics and maintenance alerts.

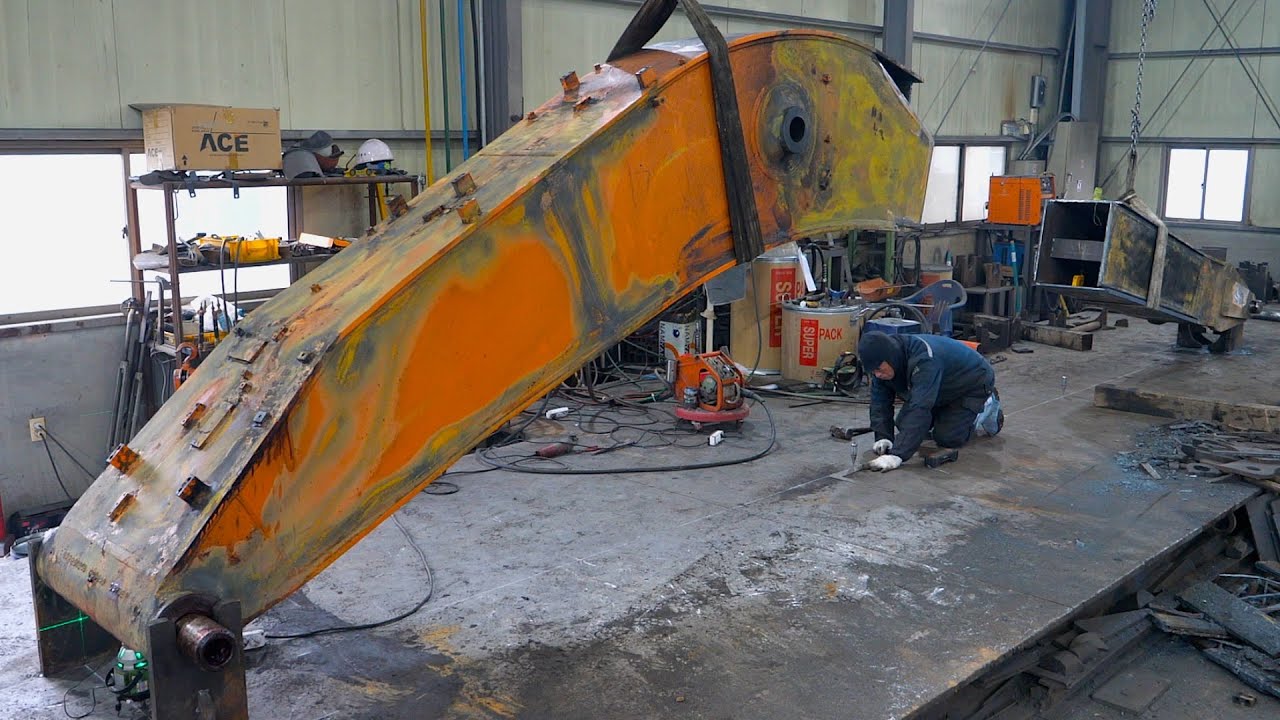

2. Growth in Aftermarket Services and Remanufacturing

With the high cost of new excavators and a focus on cost-efficiency, the aftermarket repair and remanufacturing sector is expanding rapidly. In 2026, remanufactured components such as engines, hydraulic pumps, and undercarriage parts are gaining trust due to improved quality standards and warranties. OEMs and third-party providers are enhancing remanufacturing capabilities, offering sustainable and economical alternatives to new parts.

3. Labor Shortages and Rising Demand for Skilled Technicians

A persistent shortage of skilled technicians remains a challenge. However, by 2026, training programs powered by augmented reality (AR) and virtual reality (VR) are helping bridge the skills gap. Companies are investing in upskilling workers to handle advanced diagnostics and hybrid-electric systems, especially as electrification trends emerge in heavy machinery.

4. Electrification and Hybrid Excavators Driving New Repair Paradigms

As electric and hybrid excavators enter mainstream use, particularly in urban and environmentally sensitive areas, the repair ecosystem must adapt. Traditional diesel engine repairs are being supplemented with expertise in battery systems, electric motors, and power electronics. Repair shops are upgrading facilities and tools to safely service high-voltage components, and certification programs for EV-heavy equipment are becoming more prevalent.

5. Regional Market Growth in Asia-Pacific and Africa

Asia-Pacific, led by China, India, and Southeast Asia, continues to be the largest market for excavator repair due to massive infrastructure projects and rapid urbanization. Similarly, Africa’s construction boom and mining expansion are increasing demand for reliable repair services. Local repair hubs are emerging, supported by partnerships between OEMs and regional service providers.

6. Emphasis on Sustainability and Circular Economy

Environmental regulations and corporate sustainability goals are pushing the industry toward greener repair practices. In 2026, repair centers are adopting eco-friendly processes such as solvent-free cleaning, waste oil recycling, and energy-efficient workshop designs. End-of-life excavator recycling and component recovery are becoming integral parts of the repair value chain.

7. Consolidation of Service Providers and OEM Expansion

Market consolidation is accelerating, with large OEMs expanding their service networks and acquiring independent repair shops to offer end-to-end support. This trend enhances service quality and brand loyalty while enabling better data integration across the equipment lifecycle.

Conclusion

The 2026 excavator repair market is characterized by digitalization, sustainability, and specialization. Companies that embrace smart technologies, invest in workforce development, and adapt to electrification will lead the industry. As the global demand for reliable and efficient heavy equipment grows, the repair sector will play a critical role in maximizing asset uptime and value.

Common Pitfalls When Sourcing Excavator Repair Services (Quality & Intellectual Property)

Sourcing excavator repair services involves more than just finding the lowest price. Overlooking key quality and intellectual property (IP) concerns can lead to costly downtime, safety risks, and legal complications. Below are critical pitfalls to avoid.

Poor Workmanship and Substandard Parts

One of the most common quality-related pitfalls is engaging repair providers who use low-grade replacement parts or lack proper technical expertise. This can result in premature component failure, repeated breakdowns, and reduced machine lifespan. Always verify that technicians are certified and that parts used meet OEM (Original Equipment Manufacturer) specifications or equivalent standards.

Lack of Warranty and After-Service Support

Many third-party repair vendors offer limited or no warranty on their work. Without a clear warranty policy, operators bear the full risk of post-repair failures. Additionally, poor after-service support can delay resolution of emerging issues, increasing downtime and repair costs.

Inadequate Diagnostic and Repair Documentation

Failure to receive comprehensive documentation—including diagnostic reports, repair logs, and replaced parts records—can impact future maintenance planning and resale value. It also makes it difficult to trace recurring issues or hold vendors accountable for recurring faults.

Unauthorized Use of Proprietary Software and Firmware

Modern excavators rely on proprietary control systems and software. Some repair shops may use unauthorized or pirated diagnostic tools, flash non-approved firmware, or bypass security protocols. This not only violates intellectual property rights but can also void OEM warranties and compromise machine performance and safety.

Breach of Intellectual Property Through Reverse Engineering

Certain repair providers may engage in reverse engineering of proprietary components—such as hydraulic valves or electronic control units—without authorization. Sourcing from such vendors exposes your organization to legal risks, including contributory infringement claims, even if unintentional.

Use of Counterfeit or Non-OEM Parts with IP Implications

While not all non-OEM parts are problematic, some vendors supply counterfeit components that infringe on patented designs or trademarks. Using these parts can lead to IP liability, warranty invalidation, and poor reliability. Always confirm the provenance of critical components.

Inadequate Vendor Qualification and Compliance Checks

Failing to vet repair vendors for technical certifications, IP compliance policies, and adherence to industry standards increases exposure to both operational and legal risks. Ensure vendors are authorized service partners where required and comply with relevant IP and regulatory frameworks.

Conclusion

To mitigate risks, prioritize repair providers with proven quality standards, transparent processes, and clear IP compliance. Establish service level agreements (SLAs), require detailed documentation, and verify the legitimacy of parts and software used. Proactive sourcing strategies protect both equipment performance and organizational legal standing.

Logistics & Compliance Guide for Excavator Repair

This guide outlines the essential logistical and compliance considerations when transporting, repairing, and returning excavators to ensure safety, regulatory adherence, and operational efficiency.

Equipment Transportation & Handling

Proper movement of excavators to and from repair facilities is critical. Use heavy-duty lowboy trailers or specialized flatbeds equipped with secure tie-downs, wheel chocks, and safety chains. Ensure operators follow pre-transport checklists, including securing attachments, draining excess fluids, and verifying proper weight distribution. Only certified transport personnel should handle loading and unloading using appropriate cranes or ramps rated for the excavator’s weight.

Regulatory Compliance

All repair activities must comply with local, state, and federal regulations. This includes adherence to OSHA standards for workplace safety, EPA regulations regarding hazardous material handling (e.g., used oil, coolant, hydraulic fluid), and transportation laws such as FMCSA requirements for vehicle weights and dimensions. Maintain up-to-date permits for emissions testing and ensure all repairs meet environmental standards, especially for Tier 4 Final engines.

Documentation & Recordkeeping

Maintain comprehensive records for every repair, including work orders, parts invoices, labor logs, and compliance certifications. Document pre-repair inspections, post-repair test results, and customer approvals. Retain records of hazardous waste disposal manifests and technician qualifications. Digital logs should be securely stored and accessible for audits or warranty claims.

Hazardous Material Management

Excavator repairs often involve handling hazardous substances such as oils, fuels, solvents, and batteries. Store these materials in approved, labeled containers within designated, ventilated areas. Follow proper spill response procedures and maintain a Spill Prevention, Control, and Countermeasure (SPCC) plan if required. Dispose of all hazardous waste through licensed facilities and retain disposal documentation.

Technician Certification & Training

Ensure all repair technicians hold relevant certifications, such as those from NATEF, manufacturer-specific training programs, or OSHA 10/30. Conduct regular safety and technical training, particularly on new equipment models, updated emissions systems, and workplace hazard communication (HazCom). Maintain training records to verify compliance and competency.

Facility Safety & Maintenance

Repair facilities must meet safety standards, including proper fire suppression systems, emergency exits, and PPE availability (gloves, goggles, harnesses). Implement lockout/tagout (LOTO) procedures during repairs to prevent accidental startup. Regularly inspect tools, lifting equipment, and hydraulic systems to ensure operational safety and prevent downtime.

Warranty & Manufacturer Guidelines

Adhere strictly to OEM repair guidelines to maintain warranty coverage. Use only approved parts and follow prescribed service procedures. Unauthorized modifications or use of non-OEM components may void warranties and create liability risks. Coordinate with manufacturers for technical support and software updates, especially for electronic control modules.

Return-to-Service Protocols

Before returning an excavator to the customer, conduct a full post-repair inspection and operational test. Verify hydraulic functions, engine performance, safety systems, and attachment operations. Provide the customer with a detailed service report, safety checklist, and maintenance recommendations. Confirm operator training on any repaired or modified systems.

By following this guide, repair operations can ensure efficient logistics, regulatory compliance, and safe, high-quality service delivery for excavator maintenance and restoration.

Conclusion for Sourcing Excavator Repair Services

Sourcing reliable excavator repair services is a critical factor in maintaining operational efficiency, minimizing downtime, and maximizing the lifespan of heavy equipment. A thorough evaluation of repair providers—taking into account technical expertise, availability of genuine parts, service response time, cost transparency, and customer support—ensures that repairs are performed to the highest standards. Prioritizing certified technicians and reputable service centers helps safeguard equipment performance and compliance with manufacturer recommendations. Ultimately, strategic sourcing of excavator repair services contributes to long-term cost savings, improved productivity, and sustained success in construction, mining, and other equipment-dependent industries.