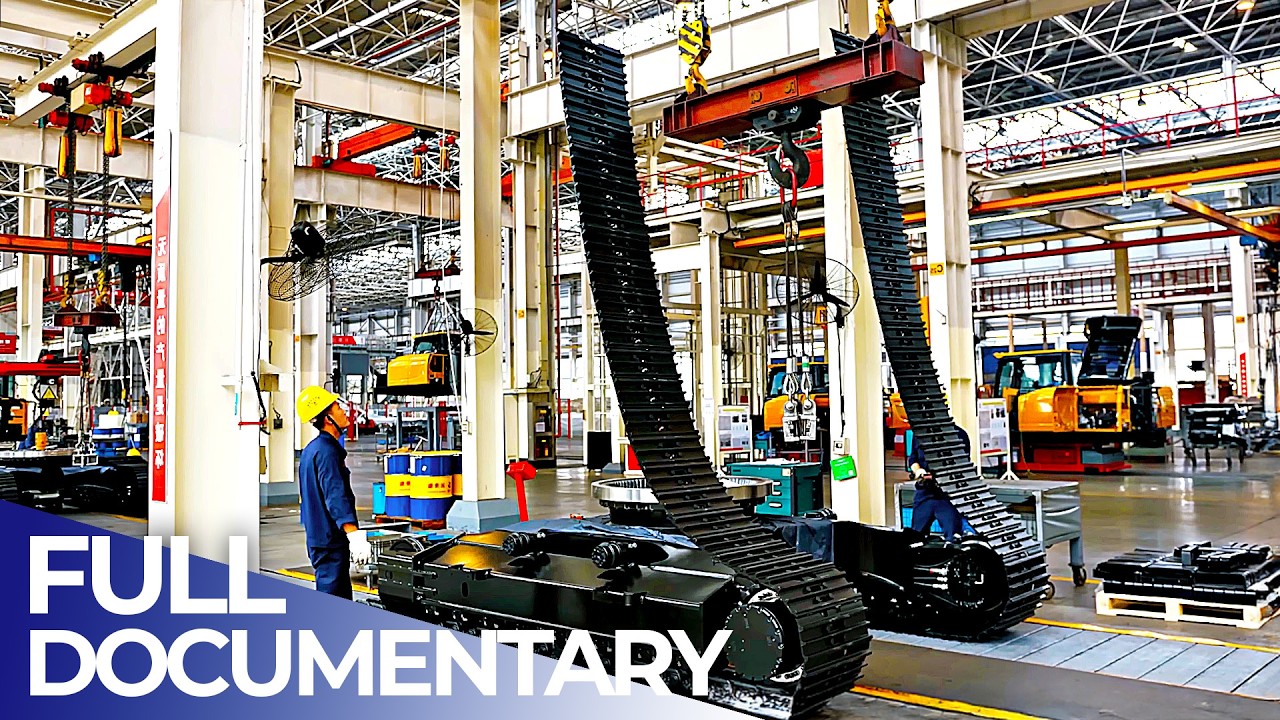

The global excavator market has experienced robust growth over the past decade, driven by increasing infrastructure development, urbanization, and rising investments in construction and mining activities. According to Grand View Research, the global construction equipment market—of which excavators are a key segment—was valued at USD 189.7 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. Similarly, Mordor Intelligence projects steady demand for excavators, citing growth in Asia-Pacific, particularly in China and India, as a major market driver due to large-scale government infrastructure initiatives. As of 2024, hydraulic excavators dominate the equipment landscape, accounting for over 35% of total construction machinery usage worldwide. With technological advancements such as electrification, telematics integration, and autonomous operation reshaping the industry landscape, competition among manufacturers has intensified. In this evolving market, nine companies have emerged as leaders, combining innovation, global reach, and production scale to maintain a strong foothold in both mature and emerging regions.

Top 9 Excavador Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Excavators

Domain Est. 1995

Website: komatsu.com

Key Highlights: Excavators … Komatsu is a leading manufacturer of construction, mining, forestry, and industrial heavy equipment. Global corporate website….

#2 Cat® Excavators

Domain Est. 1993

Website: cat.com

Key Highlights: Discover Cat® excavators worldwide. Designed for digging, trenching and loading with fuel efficiency, advanced technology and durable performance….

#3 MECALAC, Excavators, Loaders, Backhoe Loaders, Dumpers and …

Domain Est. 1999

Website: mecalac.com

Key Highlights: Mecalac is an international manufacturer of wheel excavators, crawler excavators and wheel loaders. So many innovative and compact machines adapted to the wide ……

#4 How to Choose the Right Excavator for Your Needs

Domain Est. 1990

Website: deere.com

Key Highlights: Not all excavators are created equal. Explore the full range of John Deere excavators and attachments designed for every jobsite need….

#5 Hydraulic excavators

Domain Est. 1996

Website: liebherr.com

Key Highlights: Discover the wide range of Liebherr excavators for your application: from cable to hydraulic excavators, from crawler undercarriages to mobile….

#6 Link

Domain Est. 1998

Website: en.lbxco.com

Key Highlights: Link-Belt Excavators is proud to offer a wide range of Link-Belt excavators, scrap/material handlers, and forestry equipment….

#7 Excavators & Wheeled Excavators

Domain Est. 2000

Website: volvoce.com

Key Highlights: Volvo offers a range of construction and mining excavation equipment from large crawler excavators or trackhoes to mini excavators, wheeled excavators and ……

#8 Kobelco USA

Domain Est. 2012

#9

Domain Est. 2015

Website: hitachicm.com

Key Highlights: The history of Hitachi Construction Machinery mining business began in 1979 with the development of UH801 Ultra-large Hydraulic Excavator for US market. After ……

Expert Sourcing Insights for Excavador

H2 2026 Market Trends for Excavators

The global excavator market is poised for a dynamic and transformative second half of 2026 (H2 2026), shaped by a convergence of economic recovery, technological acceleration, regulatory shifts, and evolving end-user demands. While overall growth may moderate compared to previous boom cycles, significant opportunities and strategic shifts will define the landscape.

1. Stabilizing Demand Amidst Infrastructure Momentum:

* Moderated but Sustained Growth: After potential volatility in H1, H2 2026 demand is expected to stabilize. Growth rates may be more measured than in 2024-2025 peaks, but remain positive, driven by the continued execution of large-scale infrastructure projects (transportation, energy transition, water management) globally, particularly in North America, Europe, and parts of Asia (e.g., India). Pent-up demand from earlier delays and ongoing urbanization will provide a baseline.

* Regional Divergence: China’s market, a major driver, may see continued cautious recovery, influenced by government stimulus effectiveness and property sector stabilization efforts. North America and Europe are likely to show stronger momentum, fueled by significant infrastructure legislation (e.g., US IIJA, EU Green Deal investments). Emerging markets in Southeast Asia and Latin America could see increased activity, dependent on commodity prices and financing.

* Replacement Cycle: A significant driver will be the replacement of aging fleets, particularly mid-sized and larger excavators used in construction and mining, reaching end-of-life thresholds set during the previous peak (2018-2020).

2. Acceleration of Electrification and Alternative Fuels:

* Electric Excavator Adoption Surge: H2 2026 will likely mark a tipping point for battery-electric excavators (BEEs). Expect significant market share growth, especially in the 20-30 ton class, driven by:

* Stricter Emissions Regulations: Implementation of Stage V/Euro V final phases and anticipation of future standards (e.g., potential CO2 targets) in Europe and North America.

* Urban Construction Demand: Tightening restrictions on diesel equipment in city centers (low/zero-emission zones) will push contractors towards electric options for efficiency and compliance.

* Total Cost of Ownership (TCO) Improvement: Advancements in battery technology (higher energy density, faster charging) and lower electricity costs vs. diesel will increasingly make BEEs economically viable for specific use cases (duty cycles, operating hours).

* Hydrogen and Hybrid Exploration: While still nascent, pilot projects and prototype development for hydrogen-powered and hybrid excavators (diesel-electric, hydrogen-electric) will gain traction among major OEMs, setting the stage for future commercialization. Focus will be on larger machines for mining and heavy construction.

3. Technology Integration and Digitalization Deepening:

* AI and Machine Learning Maturation: H2 2026 will see AI move beyond basic automation towards predictive maintenance, optimized fuel efficiency, and enhanced machine learning for site-specific task automation (e.g., slope grading, material loading). Integration with site management software will be key.

* Telematics as Standard: Advanced telematics (machine health monitoring, utilization tracking, geofencing, security) will become standard equipment, not an add-on. Data analytics from this fleet of connected machines will be a major competitive differentiator for OEMs and service providers.

* Enhanced Operator Assistance & Automation: Features like terrain-following, collision avoidance, and semi-automated digging cycles will become more sophisticated and widespread, improving safety, productivity, and reducing operator fatigue. Remote monitoring and control capabilities will expand.

* Focus on Cybersecurity: As connectivity increases, protecting machine and site data from cyber threats will become a critical priority for OEMs and operators.

4. Supply Chain Resilience and Sustainability Focus:

* Supply Chain Optimization: OEMs will have largely implemented strategies to mitigate past disruptions (geopolitical, logistics). Expect greater regionalization/nearshoring of components, increased use of digital supply chain twins for visibility, and stronger supplier partnerships. Availability of critical components (e.g., specific batteries, electronics) will be less of a bottleneck but require ongoing management.

* Circular Economy & Sustainability: Pressure will intensify on OEMs regarding environmental impact beyond just emissions.

* Remanufacturing & Refurbishment: Growth in certified remanufactured components and full machine refurbishment programs to extend lifecycle and reduce resource consumption.

* Sustainable Materials: Increased exploration and use of recycled materials in manufacturing and packaging.

* End-of-Life Management: Development of take-back programs and improved machine recycling processes.

5. Competitive Landscape and Business Model Evolution:

* OEM Consolidation & Partnerships: Strategic partnerships between OEMs, tech companies (for AI, autonomy), and battery specialists will be common. Potential for further consolidation in the competitive market.

* Shift Towards Services & Solutions: OEMs will increasingly compete on service offerings (uptime guarantees, predictive maintenance contracts, financing/leasing, fleet management software) rather than just hardware. “As-a-Service” models for certain machine types or technologies may emerge.

* Aftermarket Intensification: The aftermarket (parts, service, attachments) will be a crucial profit center. OEMs will leverage data from connected machines to offer proactive service and customized solutions, competing fiercely with independent dealers and third parties.

Key Challenges for H2 2026:

* Economic Uncertainty: Potential for inflationary pressures, interest rate fluctuations, or geopolitical tensions impacting investment decisions.

* Battery Technology & Charging Infrastructure: While improving, battery cost, charging time (especially for larger machines), and availability of on-site charging solutions remain hurdles for widespread BEE adoption in heavy-duty applications.

* Skill Gap: The need for operators and technicians skilled in maintaining and operating advanced, connected, and electric machinery will grow, requiring significant training investment.

* Regulatory Complexity: Navigating differing emission and safety regulations across global markets.

Conclusion:

H2 2026 for the excavator market will be characterized by consolidation, electrification, and digitalization. Demand will be underpinned by infrastructure and replacement cycles, but the real transformation will occur in technology adoption. Electric excavators will move from niche to mainstream in key segments, driven by regulation and TCO. Data, AI, and connectivity will redefine machine value and service models. OEMs that successfully navigate the shift towards sustainable, connected, and service-oriented offerings, while ensuring supply chain resilience, will be best positioned to lead in this evolving landscape. The focus will shift from merely selling machines to providing integrated, efficient, and sustainable construction solutions.

Common Pitfalls Sourcing Excavators (Quality, IP)

Sourcing excavators—especially in international markets—exposes buyers to significant risks related to equipment quality and intellectual property (IP) infringement. Being aware of these pitfalls is crucial to making informed, cost-effective, and legally compliant procurement decisions.

Poor Build Quality and Substandard Components

Many low-cost excavators, particularly from less-regulated manufacturing regions, use inferior materials and lack rigorous quality control. This can result in premature wear, frequent breakdowns, and higher total cost of ownership due to increased maintenance and downtime. Buyers may receive machines that look identical to reputable brands but perform poorly under real job site conditions.

Counterfeit or Replica Equipment

A major concern is the proliferation of “clone” or replica excavators that mimic well-known brands in design and branding. These machines often infringe on trademarks and design patents, posing legal risks. Purchasing such equipment can lead to IP violations, customs seizures, and reputational damage, especially in regulated markets.

Lack of Genuine Technical Documentation and Support

Counterfeit or low-quality excavators frequently lack authentic technical specifications, service manuals, or software access. This limits the ability to perform proper maintenance or diagnostics. Additionally, the absence of authorized service networks can result in extended downtimes and difficulty sourcing compatible spare parts.

Non-Compliance with Safety and Emissions Standards

Some excavators sourced from certain regions may not meet international safety, emissions (e.g., Tier 4, Stage V), or noise regulations. Importing or operating such equipment in regulated markets can lead to fines, operational bans, or refusal of customs clearance.

Hidden IP Infringement in Components

Even if the main machine appears legitimate, critical components (e.g., hydraulic pumps, engines, control systems) may use patented technology without licensing. This exposes the buyer and end-user to secondary liability, particularly in jurisdictions with strict IP enforcement.

Inadequate Warranty and After-Sales Accountability

Low-cost suppliers may offer weak or non-enforceable warranties. When issues arise, buyers often find it difficult to hold the seller accountable due to ambiguous contracts, lack of legal jurisdiction, or dissolved supplier entities.

Misrepresentation of Origin and Specifications

Suppliers may mislabel the country of origin or exaggerate performance specs (e.g., engine power, digging depth). This misrepresentation can mislead buyers about compliance, durability, and suitability for specific applications.

Supply Chain Opacity and Traceability Gaps

Without transparent supply chains, it’s difficult to verify the authenticity of components or ensure ethical manufacturing practices. This opacity increases the risk of inadvertently sourcing equipment tied to IP theft or forced labor.

Recommendations to Mitigate Risks

- Conduct thorough due diligence on suppliers, including site audits and third-party inspections.

- Verify equipment serial numbers and cross-check with original equipment manufacturers (OEMs).

- Require proof of compliance with relevant standards and certifications.

- Consult legal experts to assess IP risks, especially when sourcing lower-cost alternatives.

- Prioritize suppliers with transparent supply chains and established after-sales support networks.

Avoiding these pitfalls ensures not only reliable equipment performance but also protects against legal and financial liabilities associated with quality defects and IP violations.

Logistics & Compliance Guide for Excavator

This guide outlines key logistics considerations and compliance requirements for the transportation, operation, and maintenance of excavators, ensuring safe, legal, and efficient project execution.

Transportation Logistics

Ensure excavators are transported using appropriately rated lowboy trailers or flatbeds. Secure the machine with heavy-duty chains or straps anchored to certified tie-down points. Confirm that transport dimensions (height, width, length) comply with local road regulations; permits may be required for oversized loads. Always retract attachments, lower the blade (if equipped), and lock the house in travel position prior to transport.

Regulatory Compliance

Adhere to all applicable local, state, and federal regulations. This includes compliance with OSHA standards for equipment operation and worksite safety, EPA emissions requirements (such as Tier 4 Final for newer models), and DOT regulations for on-road transport. Operators must hold valid certifications (e.g., OSHA 10-Hour, manufacturer-specific training) and maintain up-to-date documentation.

Environmental Considerations

Minimize environmental impact by preventing fuel and hydraulic fluid leaks. Use secondary containment during refueling and maintenance. Follow site-specific environmental management plans, especially in sensitive areas (wetlands, protected habitats). Comply with stormwater pollution prevention plans (SWPPP) to control sediment runoff from equipment movement.

Import/Export Requirements (if applicable)

For international movement, ensure compliance with customs regulations, including proper documentation (commercial invoice, bill of lading, certificate of origin). Verify that the excavator meets destination country emissions and safety standards. Pay applicable duties and taxes; consider engaging a licensed customs broker for complex shipments.

Maintenance and Inspection Compliance

Perform routine maintenance in accordance with the manufacturer’s schedule. Keep detailed maintenance logs for audit purposes. Conduct pre-operation inspections (e.g., fluid levels, track tension, hydraulic hoses, lights) daily to meet safety compliance and reduce downtime.

Operator Accountability

Assign trained and authorized personnel only to operate the excavator. Maintain operator logs to track usage, fuel consumption, and any observed issues. Enforce strict adherence to site safety protocols, including signaling procedures, exclusion zones, and personal protective equipment (PPE) requirements.

Recordkeeping and Documentation

Retain all compliance-related documents, including equipment registration, inspection reports, operator certifications, maintenance records, and transport permits. Organized records support audits, insurance claims, and regulatory inspections.

By following this guide, organizations can ensure efficient logistics operations and full regulatory compliance throughout the lifecycle of excavator use.

Conclusion for Sourcing an Excavator

In conclusion, sourcing an excavator requires a comprehensive evaluation of project needs, budget constraints, equipment specifications, and supplier reliability. Whether purchasing new or used, or opting for local versus international suppliers, each decision impacts long-term operational efficiency, maintenance costs, and productivity. It is essential to prioritize quality, after-sales support, warranty options, and compliance with safety and environmental standards. Additionally, conducting thorough market research, comparing multiple vendors, and considering total cost of ownership—rather than just initial price—will ensure a sound investment. By aligning the excavator’s capabilities with project requirements and leveraging trusted suppliers, organizations can enhance performance, reduce downtime, and achieve optimal return on investment. Ultimately, a strategic and well-informed sourcing approach is critical to securing the right excavator for successful project execution.