The global epoxy coatings market continues to expand, driven by rising demand across industrial, commercial, and consumer applications. According to a report by Mordor Intelligence, the global epoxy resin market was valued at USD 10.57 billion in 2023 and is projected to grow at a CAGR of over 6.8% from 2024 to 2029. This growth is fueled by increasing adoption in construction, automotive, and woodworking industries, where durability, chemical resistance, and aesthetic finish are paramount. Among the most sought-after products in the woodworking segment are high-performance clear epoxy coat solutions that enhance grain definition, offer UV resistance, and provide long-term surface protection. As demand for premium wood finishes rises—particularly in furniture, flooring, and artisanal woodworking—manufacturers are innovating to deliver superior clarity, faster cure times, and eco-friendly formulations. In this evolving landscape, a select group of companies has emerged as leaders in epoxy clear coat technology for wood applications, combining technical excellence with scalable production and global distribution. Below is a data-informed overview of the top nine manufacturers shaping the future of wood epoxy coatings.

Top 9 Epoxy Clear Coat Wood Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 POLYMERES TECHNOLOGIES

Domain Est. 2001

Website: polymerestechnologies.com

Key Highlights: 2–7 day delivery 14-day returnsPremium Canadian-made resins for industrial, construction, and manufacturing applications. Search our product range or contact us for tailored resin …

#2 EcoPoxy

Domain Est. 2004

Website: ecopoxy.com

Key Highlights: Epoxy Coating for Woodworkers & Artists. UVPoxy has been formulated with a simple 1:1 mix ratio and is designed for tabletops, wood finishing, and fluid art….

#3 Clear Coat

Domain Est. 1996

#4 Abatron

Domain Est. 1997

Website: uccoatings.com

Key Highlights: Discover Abatron wood & concrete restoration products at U-C Coatings. Perfect for repairing and restoring damaged wood and structural materials….

#5 KopCoat

Domain Est. 2002

Website: kopcoat.com

Key Highlights: Welcome to KopCoat, where we keep your farms flourishing, your forests thriving, and your buildings boldly standing against the effects of time and nature….

#6 WiseBond Deep Pour Epoxy Table Top Countertop Epoxy Art …

Domain Est. 2003

Website: wisebond.com

Key Highlights: Free delivery over $200 30-day returnsOur WiseBond® Deep Pour 2:1 Ratio, 2-Part Epoxy is a premium commercial grade live-edge wood slab river table and thick casting epoxy resin….

#7 Woodworkers

Domain Est. 2009

Website: entropyresins.com

Key Highlights: Clear Laminating Epoxy. This is our flagship, high-performance, clear-coating epoxy system. It’s water-clear and UV-stabilized for applications that require ……

#8 UltraClear Epoxy

Domain Est. 2012

Website: bestbartopepoxy.com

Key Highlights: Free deliveryPremium bar and table top epoxy. Scratch resistant. Heat resistant. Food Safe. Zero VOC. Made in USA. Receive FREE same-day shipping. Order today!…

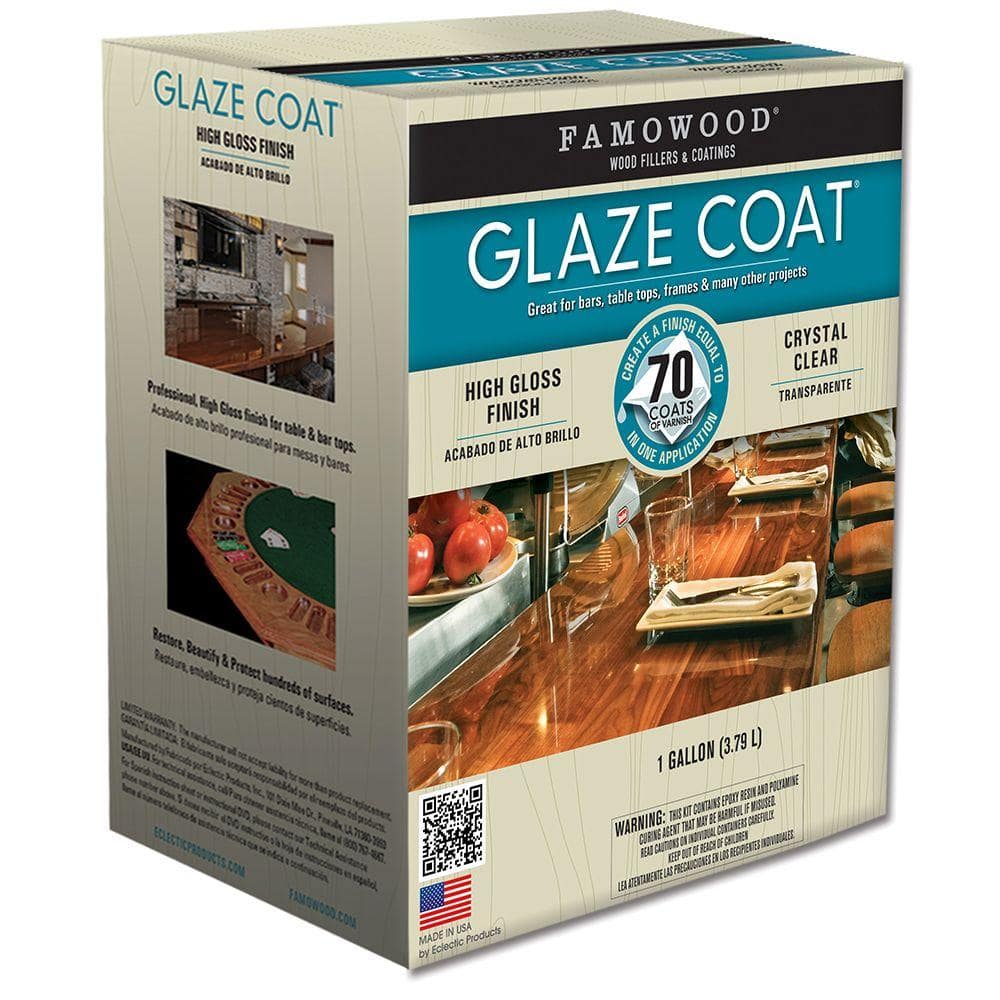

#9 Bar & Table Top Epoxy Resin

Domain Est. 2017

Website: primaloc.com

Key Highlights: In stock Rating 4.8 (654) Primaloc Epoxy specializes in crystal-clear epoxy solutions for bar tops, table tops, and countertops. Made 100% in the USA, our epoxy is designed to re…

Expert Sourcing Insights for Epoxy Clear Coat Wood

2026 Market Trends for Epoxy Clear Coat Wood

The epoxy clear coat wood market is poised for significant evolution by 2026, driven by advancements in material science, growing consumer demand for durable and aesthetically pleasing finishes, and a rising emphasis on sustainability. This analysis explores key trends expected to shape the industry in the coming years.

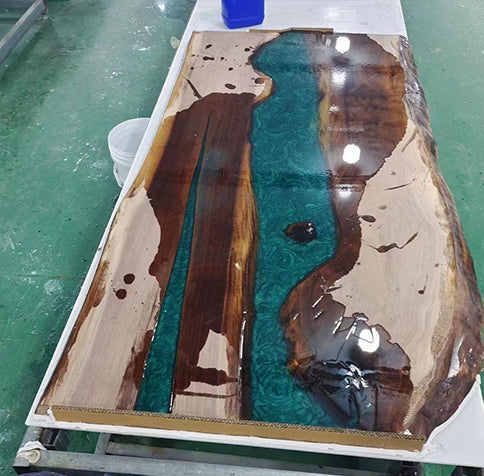

Increasing Demand in Residential and Commercial Interiors

Epoxy clear coat wood finishes are gaining popularity in both residential and commercial applications due to their high-gloss, glass-like finish and durability. By 2026, the demand for epoxy-coated wood surfaces in modern interior design—especially for countertops, tabletops, flooring, and bar tops—is projected to grow substantially. The trend toward minimalist, industrial, and luxury aesthetics continues to fuel adoption, particularly in urban housing and boutique commercial spaces.

Advancements in UV and Chemical Resistance

Product innovation is a major driver in the epoxy clear coat wood market. Manufacturers are developing formulations with enhanced UV stability to prevent yellowing and degradation when exposed to sunlight. Additionally, improved chemical resistance ensures longevity in high-traffic or moisture-prone environments. These advancements make epoxy coatings more viable for outdoor and semi-outdoor applications, expanding their use beyond traditional indoor settings.

Sustainability and Low-VOC Formulations

Environmental concerns are reshaping the coatings industry. By 2026, there will be a stronger market preference for low-VOC (volatile organic compound) and bio-based epoxy resins. Regulatory pressures and consumer awareness are pushing manufacturers to adopt greener chemistries without compromising performance. Water-based epoxy systems and plant-derived alternatives are expected to gain traction, aligning with global sustainability goals.

Growth in DIY and Artisanal Markets

The do-it-yourself (DIY) movement continues to influence the epoxy clear coat wood market. Online tutorials, e-commerce platforms, and accessible retail kits have empowered hobbyists and small-scale artisans to create custom epoxy-coated wood pieces. This trend is expected to persist and grow by 2026, especially with younger demographics embracing handmade, personalized home decor.

Regional Market Expansion

While North America and Europe currently lead in epoxy clear coat adoption, the Asia-Pacific region is expected to witness the highest growth rate by 2026. Rapid urbanization, rising disposable incomes, and expanding construction sectors in countries like China, India, and Vietnam are creating new opportunities for high-performance wood finishes.

Integration with Smart and Multifunctional Surfaces

Emerging trends point toward the integration of epoxy-coated wood with smart technologies—such as embedded lighting, antimicrobial properties, or self-healing coatings. While still in early stages, R&D efforts are focusing on multifunctional epoxy systems that combine aesthetics with added value, setting the stage for innovation by 2026.

In conclusion, the 2026 epoxy clear coat wood market will be defined by performance enhancement, environmental responsibility, and diversification across applications and geographies. Stakeholders who invest in sustainable innovation and consumer-centric design will be best positioned to capitalize on these evolving trends.

Common Pitfalls When Sourcing Epoxy Clear Coat for Wood: Quality and Intellectual Property Concerns

When sourcing epoxy clear coat for wood applications, buyers often encounter critical challenges related to product quality and intellectual property (IP) risks. Overlooking these pitfalls can lead to subpar finishes, project delays, legal complications, and reputational damage. Below are key areas to watch:

Quality-Related Pitfalls

1. Inconsistent Formulation and Performance

Many suppliers—especially lower-cost or offshore manufacturers—lack rigorous quality control, resulting in batch-to-batch variability. This inconsistency can affect critical properties like cure time, clarity, UV resistance, and adhesion. Without standardized testing, end users may face yellowing, cracking, or delamination over time.

2. Misrepresented Technical Specifications

Some suppliers exaggerate performance data such as hardness (e.g., pencil hardness), abrasion resistance, or pot life. Independent lab verification is often absent, leading to mismatched expectations. Always request third-party test reports or conduct in-house trials before large-scale procurement.

3. Use of Substandard or Recycled Resins

To cut costs, some manufacturers substitute high-purity epoxy resins with lower-grade or recycled materials. These alternatives may compromise clarity, increase VOC content, or reduce long-term durability—especially under direct sunlight or high humidity.

4. Inadequate Technical Support and Documentation

Reliable suppliers provide detailed application guidelines, safety data sheets (SDS), and troubleshooting support. Sourcing from vendors without robust technical assistance can result in improper mixing ratios, surface preparation errors, or inadequate curing—leading to costly rework.

Intellectual Property (IP) Risks

1. Unauthorized Use of Proprietary Formulations

Some manufacturers reverse-engineer branded epoxy systems (e.g., mimicking high-performance products like those from Masco or Eastwood) without licensing. Sourcing such knock-offs may expose buyers to legal liability, especially in commercial or export applications where IP enforcement is strict.

2. Trademark and Brand Infringement

Suppliers may falsely label their products to resemble well-known brands, using similar packaging or naming conventions. Purchasing these counterfeit goods can damage customer trust and result in recalls or legal action, particularly in regulated markets.

3. Lack of IP Due Diligence in Supplier Vetting

Buyers often fail to investigate whether a supplier holds legitimate IP rights or operates under proper licensing agreements. This oversight becomes problematic when scaling production or entering international markets with stringent IP laws.

4. Grey Market and Unauthorized Distribution

Even genuine products can pose IP risks if sourced through unauthorized distributors. These channels may offer lower prices but lack warranty coverage, technical support, and legal protection—increasing the risk of receiving tampered or expired materials.

Mitigation Strategies

- Conduct Supplier Audits: Evaluate manufacturing processes, quality certifications (e.g., ISO 9001), and IP compliance history.

- Request Sample Testing: Validate product claims through independent lab analysis or pilot applications.

- Review Legal Agreements: Ensure contracts include IP indemnification clauses and clear warranties.

- Source from Reputable Channels: Prioritize authorized distributors or directly engage with original manufacturers.

By proactively addressing these quality and IP-related pitfalls, businesses can ensure reliable performance, legal compliance, and long-term success in wood finishing projects.

Logistics & Compliance Guide for Epoxy Clear Coat for Wood

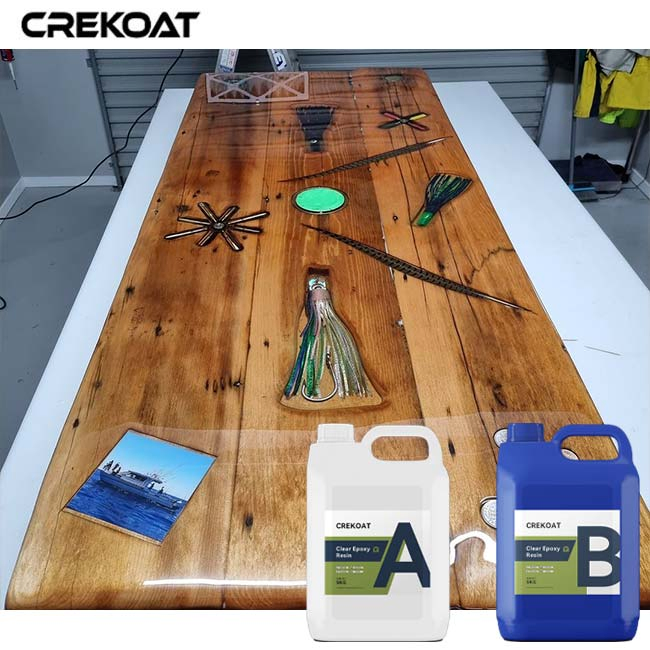

Product Overview

Epoxy Clear Coat for Wood is a two-component protective finishing system designed to provide a high-gloss, durable, and chemically resistant finish on wooden surfaces. Commonly used for countertops, tables, floors, and decorative items, epoxy coatings enhance the natural beauty of wood while offering long-term protection against moisture, scratches, and UV degradation.

Regulatory Classification & Compliance

Chemical Composition & Regulatory Status

Epoxy Clear Coat for Wood typically consists of a resin component (containing epichlorohydrin and bisphenol-A derivatives) and a hardener (usually amine-based). Due to its chemical nature, it is subject to multiple regulatory frameworks globally.

- GHS (Globally Harmonized System): Classified as hazardous due to potential skin/eye irritation, respiratory sensitization, and environmental hazards. Product labels must include GHS pictograms, signal words (e.g., “Danger” or “Warning”), hazard statements (e.g., H317: May cause an allergic skin reaction), and precautionary statements.

- REACH (EU): Must comply with registration, evaluation, authorization, and restriction of chemicals. Manufacturers/importers must register substances produced or imported in quantities ≥1 tonne/year. No SVHCs (Substances of Very High Concern) should be present above threshold limits unless authorized.

- TSCA (USA): Must conform to the Toxic Substances Control Act. All chemical substances must be listed on the TSCA Inventory or pre-manufactured notified.

- Proposition 65 (California): Requires warnings if the product contains chemicals known to cause cancer or reproductive harm (e.g., certain glycidyl ethers or bisphenol-A derivatives). Labels must include clear consumer advisories.

VOC Content & Environmental Regulations

- VOC (Volatile Organic Compounds): Epoxy systems generally have low to zero VOCs when correctly formulated. Must comply with regional VOC limits (e.g., <100 g/L under SCAQMD Rule 1113, EU Directive 2004/42/EC).

- EPA & CARB Compliance: Products sold in the U.S., especially California, must meet EPA and CARB (California Air Resources Board) standards for architectural coatings.

Safety Data Sheet (SDS) Requirements

An up-to-date SDS (per ISO 11014 or ANSI Z400.1) is mandatory and must include:

– Section 1: Product identifier and recommended use

– Section 2: Hazard identification (GHS classification)

– Section 3: Composition/information on ingredients (including % of hazardous components)

– Section 4: First-aid measures

– Section 5: Fire-fighting measures

– Section 6: Accidental release measures

– Section 7: Handling and storage

– Section 8: Exposure controls/personal protection

– Section 9: Physical and chemical properties

– Section 10: Stability and reactivity

– Section 11: Toxicological information

– Section 12: Ecological information

– Section 13: Disposal considerations

– Section 14: Transport information

– Section 15: Regulatory information

– Section 16: Other information (including revision date)

Handling & Storage Guidelines

Safe Handling Practices

- Use in well-ventilated areas or with local exhaust ventilation.

- Avoid skin and eye contact. Wear nitrile gloves, chemical-resistant aprons, and safety goggles.

- Use respiratory protection (e.g., NIOSH-approved organic vapor respirator) when vapors exceed exposure limits.

- Do not eat, drink, or smoke while handling.

- Prevent contamination of soil, drains, and waterways.

Storage Conditions

- Store in original, tightly sealed containers in a cool, dry, well-ventilated area.

- Temperature range: 15–25°C (59–77°F); avoid freezing and direct sunlight.

- Keep away from heat sources, sparks, and ignition sources.

- Store hardeners and resins separately if recommended by the manufacturer.

- Shelf life: Typically 12–24 months; check manufacturer’s label.

Transportation & Shipping

Classification for Transport

- UN Number: UN 1866 (Resin solution, flammable, n.o.s.) or UN 3082 (Environmentally hazardous substance, liquid, n.o.s.) — depends on formulation.

- Proper Shipping Name: As per UN model regulations.

- Hazard Class: Class 3 (Flammable liquid) if flash point <60°C; may also include Class 8 (Corrosive) or Class 9 (Miscellaneous hazardous material) depending on constituents.

- Packing Group: II or III based on degree of hazard.

Packaging Requirements

- Use UN-certified packaging with compatible liners (e.g., HDPE containers).

- Ensure containers are leak-proof and secured to prevent movement during transit.

- Outer packaging must display correct hazard labels, orientation arrows, and proper shipping name.

Domestic & International Regulations

- DOT (USA): Comply with 49 CFR for ground transport.

- IMDG Code (Maritime): Required for ocean freight.

- IATA (Air): Follow Dangerous Goods Regulations (DGR) for air transport; note that many epoxy systems are prohibited or restricted on passenger aircraft.

- ADR (Europe): For road transport within Europe.

Disposal & Environmental Considerations

Waste Management

- Uncured resin/hardener mixtures are hazardous waste (EPA Waste Code D001 for ignitable waste, or others based on toxicity).

- Clean-up materials (rags, brushes, PPE) contaminated with uncured epoxy are also hazardous due to potential for spontaneous combustion (exothermic reaction).

- Dispose of waste through licensed hazardous waste handlers in accordance with local regulations (e.g., RCRA in the U.S.).

- Do not pour into drains or dispose of in regular trash.

Environmental Precautions

- Prevent release to the environment. Collect spillage using absorbent materials (e.g., vermiculite, sand).

- Report significant spills to local environmental authorities as required.

- Biodegradability: Epoxy resins are generally not readily biodegradable; treat as persistent in the environment.

Labeling & Documentation

Product Labeling

- GHS-compliant label with:

- Product identifier

- Supplier details

- Pictograms

- Signal word

- Hazard and precautionary statements

- Batch number and expiry date

- Include usage instructions and first-aid measures on consumer packaging.

Required Documentation

- Safety Data Sheet (SDS)

- Certificate of Conformance (CoC)

- VOC compliance certificate (if applicable)

- Prop 65 warning (if applicable for CA sales)

- REACH SVHC Declaration (for EU market)

Customer & End-User Compliance Support

Training & Instructions

- Provide detailed technical data sheets (TDS) covering mixing ratios, application methods, cure times, and surface preparation.

- Offer safety training materials for commercial users.

- Include curing safety notices (e.g., do not sand uncured epoxy; allow full cure before use).

Regulatory Updates

- Monitor changes in chemical regulations (e.g., new SVHC listings, VOC limits).

- Update SDS and labels accordingly; notify distributors of revisions.

Summary of Key Compliance Actions

- Maintain GHS-compliant SDS and labeling.

- Ensure VOC content meets regional limits.

- Classify and package correctly for transport.

- Train staff and inform customers on safe handling.

- Dispose of waste through authorized hazardous waste channels.

- Stay current with REACH, TSCA, Prop 65, and other applicable regulations.

Adhering to this guide ensures safe, legal, and environmentally responsible handling, transport, and use of Epoxy Clear Coat for Wood across global markets.

In conclusion, sourcing an epoxy clear coat for wood requires careful consideration of several key factors, including desired durability, finish appearance (gloss level), UV resistance, application method, and environmental conditions. High-quality epoxy clear coats offer excellent protection against moisture, scratches, and wear, making them ideal for tabletops, bar tops, floors, and other high-traffic wooden surfaces. When selecting a product, prioritize reputable suppliers or manufacturers known for consistent quality and technical support. Reading customer reviews, requesting product samples, and verifying compliance with safety and environmental standards can further ensure suitability for your project. Proper surface preparation and adherence to application instructions are equally critical to achieving a flawless, long-lasting finish. Ultimately, investing time in sourcing the right epoxy clear coat will enhance both the aesthetic appeal and longevity of your wood projects.