The global epoxy-based paint market is experiencing robust growth, driven by rising demand across industrial, marine, infrastructure, and protective coating applications. According to a report by Mordor Intelligence, the global epoxy coatings market was valued at USD 11.37 billion in 2023 and is projected to grow at a CAGR of over 6.2% from 2024 to 2029. This expansion is fueled by the material’s superior adhesion, chemical resistance, and durability, making it a preferred choice in harsh environments. Grand View Research further supports this outlook, noting increasing infrastructure investments and stringent regulatory standards for corrosion protection as key growth accelerators. With Asia-Pacific emerging as the fastest-growing region due to rapid industrialization and urban development, the competitive landscape is evolving. The following list highlights the top 9 epoxy-based paint manufacturers leading innovation, market share, and global supply, positioned to capitalize on this sustained industry momentum.

Top 9 Epoxy Based Paint Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Allnex

Domain Est. 2000

Website: allnex.com

Key Highlights: Allnex, the global leader in industrial coating resins. A market-leading manufacturer of adhesives, sealants and specialty coatings….

#2 Wolverine Coatings Corporation

Domain Est. 2001

Website: wolverinecoatings.com

Key Highlights: Wolverine Coatings Corporation – bringing unique resin technologies and innovative techniques to resolve worries in industrial environments….

#3 Endura Paint

Domain Est. 2002

Website: endurapaint.com

Key Highlights: Endura is a manufacturer of high performance polyurethane and epoxy industrial coatings. Product lines include, industrial paint systems, ……

#4 World Leader in Specialty Coatings

Domain Est. 1996

Website: rpminc.com

Key Highlights: RPM International Inc. owns subsidiaries that are world leaders in specialty coatings, sealants, building materials and related services….

#5 EpoxyMaster Epoxy Floor Paint Kits For Garages, Basements …

Domain Est. 2008

Website: epoxymaster.com

Key Highlights: EpoxyMaster is your source for the finest in industrial epoxy floor paint coatings and DIY kits for garages, basements, kitchens, workshops and much more….

#6 Spartan Epoxies

Domain Est. 2016

Website: spartanepoxies.com

Key Highlights: Spartan Epoxies delivers professional-grade epoxy flooring and waterproofing solutions for residential, commercial, and industrial projects. From DIY garages to ……

#7 PPG

Domain Est. 1990

Website: ppg.com

Key Highlights: Discover how PPG’s global team of innovators drives sustainable solutions, enhances productivity, and celebrates 140 years of color leadership. Join us!…

#8 Concrete Floor Coating & Blacktop Coating

Domain Est. 1995

Website: rustoleum.com

Key Highlights: EpoxyShield offers garage floor coatings, basement floor coatings, blacktop coatings, concrete floor paint and more….

#9 Advanced Materials

Domain Est. 1997

Website: huntsman.com

Key Highlights: Our Araldite® and Aradur® brands provide our customers with one of the broadest epoxy resins portfolios in the industry and we are a global leader in curing ……

Expert Sourcing Insights for Epoxy Based Paint

H2: Market Trends for Epoxy-Based Paint in 2026

The global epoxy-based paint market is poised for significant evolution by 2026, driven by technological advancements, sustainability demands, and shifting industrial needs. Key trends shaping the market include rising infrastructure investments, growth in protective coatings across industrial and marine sectors, and a growing emphasis on eco-friendly formulations.

-

Increased Demand in Infrastructure and Construction

By 2026, rapid urbanization—particularly in Asia-Pacific and emerging economies—will fuel demand for durable, high-performance coatings. Epoxy-based paints are favored for concrete protection, flooring, and steel structures due to their exceptional adhesion, chemical resistance, and longevity. Government-led infrastructure projects in countries like India, China, and Indonesia are expected to boost consumption significantly. -

Growth in Industrial and Marine Applications

Epoxy coatings remain critical in industrial maintenance, oil & gas facilities, and marine environments. The push for asset longevity and corrosion protection will sustain demand. Upstream oil & gas activity and offshore construction, especially in the Middle East and Southeast Asia, will support market growth. Additionally, stricter regulations on asset maintenance are driving industries to adopt high-quality epoxy systems. -

Shift Toward Low-VOC and Water-Based Epoxy Formulations

Environmental regulations such as REACH (EU) and EPA standards (U.S.) are accelerating the transition from solvent-based to water-based and low-VOC epoxy paints. By 2026, manufacturers are expected to prioritize sustainable product development. Innovations in waterborne epoxy resins offer comparable performance with reduced environmental impact, appealing to environmentally conscious consumers and compliance-driven industries. -

Technological Innovations and Hybrid Systems

Advancements in epoxy chemistry—such as self-healing coatings, UV-curable epoxies, and hybrid epoxy-polyurethane systems—are enhancing performance characteristics. These innovations improve scratch resistance, faster cure times, and better weatherability, expanding applications into automotive refinishing and high-traffic commercial spaces. -

Regional Market Dynamics

Asia-Pacific will remain the largest and fastest-growing market, driven by industrialization and construction booms. North America and Europe will focus on renovation and infrastructure upgrades, with strong demand in the U.S. under the Bipartisan Infrastructure Law. Latin America and Africa show emerging potential due to expanding industrial sectors and port development. -

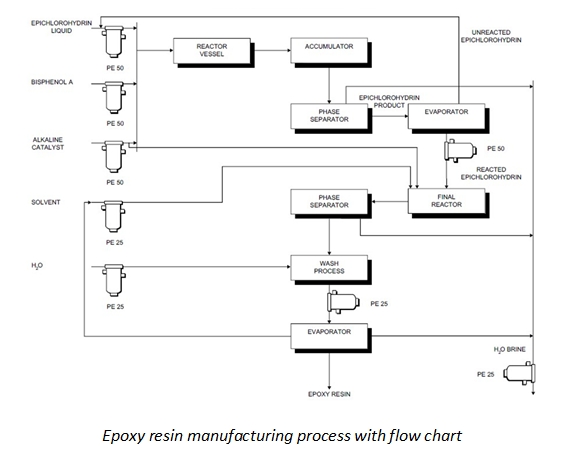

Supply Chain and Raw Material Volatility

The market remains sensitive to fluctuations in raw materials like epichlorohydrin and bisphenol-A. By 2026, leading players are expected to invest in vertical integration and alternative feedstocks to mitigate supply risks. Bio-based epoxy resins may gain traction as companies aim for circular economy models. -

Consolidation and Strategic Partnerships

Market competition will intensify, prompting mergers, acquisitions, and R&D collaborations among key players such as PPG, AkzoNobel, Sherwin-Williams, and Jotun. These strategies aim to expand product portfolios, enhance distribution networks, and accelerate innovation in high-growth regions.

In conclusion, the 2026 epoxy-based paint market will be characterized by a balance between performance-driven demand and sustainability imperatives. Companies that innovate sustainably, adapt to regulatory landscapes, and cater to regional infrastructure needs will lead the market forward.

Common Pitfalls When Sourcing Epoxy-Based Paint (Quality and Intellectual Property)

Sourcing epoxy-based paint involves more than just comparing prices—overlooking quality and intellectual property (IP) considerations can lead to significant project failures, legal risks, and long-term costs. Here are key pitfalls to avoid:

Poor Quality Control and Inconsistent Formulations

One of the most frequent issues is inconsistent product quality, especially when sourcing from lower-cost or unverified suppliers. Epoxy paints are chemically sensitive; even minor variations in resin, hardener ratios, or additives can drastically affect performance. Poor quality control may result in:

- Inadequate adhesion or premature delamination

- Reduced chemical and abrasion resistance

- Incomplete curing due to improper stoichiometry

- Shortened service life, leading to frequent recoating

Always request technical data sheets (TDS), material safety data sheets (MSDS), and third-party test certifications (e.g., ISO, ASTM) to verify consistency and performance claims.

Counterfeit or Misrepresented Products

The high demand for industrial-grade epoxy paints has led to an increase in counterfeit or falsely branded products. These may mimic genuine packaging but contain substandard or entirely different formulations. Risks include:

- Failure to meet environmental or safety standards

- Poor durability under operational conditions

- Voided warranties due to unauthorized use

To mitigate this, source only from authorized distributors or directly from manufacturers with verifiable supply chains.

Lack of Technical Support and Application Guidance

Epoxy systems are sensitive to application conditions such as temperature, humidity, and surface preparation. Sourcing from suppliers who do not offer technical support increases the risk of improper application, leading to coating failure. Ensure the supplier provides:

- Detailed application guidelines

- On-site or remote technical assistance

- Training for applicators, if needed

Intellectual Property Infringement

Using or sourcing epoxy paint formulations that infringe on patents or proprietary technology exposes buyers to legal liability. Some suppliers may offer “generic” versions of patented epoxy systems that replicate the performance claims but violate IP rights. Consequences include:

- Legal action from the patent holder

- Seizure of materials or finished products

- Damages and reputational harm

Always verify that the supplier owns or is licensed to produce and sell the formulation. Request documentation on IP ownership or licensing, particularly for custom or high-performance epoxies.

Inadequate Regulatory Compliance

Epoxy paints may be subject to environmental, health, and safety regulations (e.g., VOC content, REACH, FDA compliance for food-grade coatings). Sourcing non-compliant products can result in:

- Project delays or rework

- Fines or regulatory penalties

- Liability in case of health or environmental incidents

Confirm that the product meets all applicable regional and industry-specific regulations.

Short-Term Cost vs. Long-Term Value

Opting for the lowest-cost epoxy paint often leads to higher lifecycle costs due to premature failure, maintenance, and downtime. High-quality epoxies with proven performance and strong IP backing may have a higher upfront cost but offer better durability, warranty protection, and total cost of ownership.

Conclusion

To avoid these pitfalls, conduct thorough due diligence when sourcing epoxy-based paint. Prioritize suppliers with transparent quality assurance processes, full regulatory compliance, strong technical support, and verifiable intellectual property rights. Investing time upfront ensures reliable performance and legal safety in critical applications.

H2: Logistics & Compliance Guide for Epoxy-Based Paint

Epoxy-based paints are high-performance coatings widely used for industrial, marine, and protective applications due to their durability, chemical resistance, and strong adhesion. However, their chemical composition necessitates strict logistics and compliance protocols to ensure safety, regulatory adherence, and environmental protection throughout storage, handling, transportation, and disposal.

H2: 1. Classification & Regulatory Framework

Epoxy-based paints typically contain reactive resins (epoxy) and hardeners (amines, polyamides), often in solvent-based or water-based formulations. These components are subject to multiple international and national regulations.

Key Regulatory Standards:

- GHS (Globally Harmonized System): Epoxy paints are commonly classified as:

- Hazardous to the aquatic environment (Acute and Chronic)

- Skin and eye irritants

- May cause allergic skin or respiratory reactions

- Flammable (if solvent-based; flash point <60°C)

-

Hazardous decomposition products (e.g., CO, NOx upon combustion)

-

OSHA (USA): Regulated under HCS 2012 (Hazard Communication Standard). Requires Safety Data Sheets (SDS), labeling, and employee training.

- REACH (EU): Registration, Evaluation, Authorization, and Restriction of Chemicals. Requires notification of Substances of Very High Concern (SVHC) if present above threshold.

- CLP Regulation (EU): Classification, Labeling, and Packaging. Mandates GHS-compliant labeling.

- DOT (USA): 49 CFR regulates transportation of hazardous materials. Epoxy paints may fall under:

- UN 1263, PAINT or UN 1139, XYLENE, depending on flash point and formulation.

- Packing Group II or III based on flammability.

- IMDG Code (Maritime), IATA DGR (Air), ADR (Road in Europe): All require proper classification, packaging, marking, documentation, and training for transport.

H2: 2. Safety Data Sheet (SDS) Management

- Maintain up-to-date, GHS-compliant SDS for each epoxy paint product (Part A: Resin; Part B: Hardener if sold separately).

- SDS must include:

- Hazard identification

- First-aid and firefighting measures

- Accidental release procedures

- Handling and storage guidance

- Exposure controls and PPE

- Regulatory information

- SDS must be accessible to all personnel and emergency responders.

H2: 3. Packaging & Labeling Requirements

Packaging:

- Use UN-certified, leak-proof containers compatible with epoxy components (e.g., HDPE, metal pails).

- Prevent contamination; keep lids tightly closed.

- Segregate resin and hardener components during storage and transport if reactive upon mixing.

- Use inner liners for added protection if needed.

Labeling:

- Primary Containers: GHS-compliant labels with:

- Product identifier

- Signal word (e.g., “Warning” or “Danger”)

- Hazard pictograms (e.g., flame, exclamation mark, health hazard, environment)

- Hazard and precautionary statements

- Transport Labels: Include:

- Proper shipping name (e.g., “PAINT”)

- UN number (e.g., UN 1263)

- Class 3 (Flammable Liquid) or Class 8 (Corrosive) if applicable

- Packing Group

- Shipper/consignee information

- Hazard labels and orientation arrows

H2: 4. Storage Guidelines

- Location: Store in a cool, dry, well-ventilated area away from direct sunlight, heat sources, and ignition sources.

- Temperature: Maintain between 10°C and 25°C (50°F–77°F); avoid freezing or excessive heat to prevent premature curing or separation.

- Segregation:

- Separate from oxidizers, acids, and strong bases.

- Keep hardeners (often amine-based) away from isocyanates or acid-catalyzed products.

- Spill Containment: Use spill pallets or berms. Secondary containment should hold at least 110% of the largest container.

- Shelving: Use non-combustible materials. Label shelves clearly.

- Inventory Control: Implement FIFO (First In, First Out) to avoid aging and degradation.

H2: 5. Handling & Worker Safety

- PPE Requirements:

- Nitrile or neoprene gloves

- Chemical-resistant apron

- Safety goggles or face shield

- Respiratory protection (organic vapor cartridges if ventilation is inadequate)

- Ventilation: Use local exhaust ventilation (LEV) or fume hoods during dispensing and mixing.

- Training: Employees must be trained on:

- Hazards of epoxy components

- Proper handling techniques

- Emergency procedures

- PPE use and maintenance

- Skin hygiene (epoxy can cause sensitization)

- Avoid Skin Contact: Wash immediately with soap and water if contacted. Do not use solvents for cleaning skin.

H2: 6. Transportation & Shipping

- Mode-Specific Rules:

- Road (USA): Comply with DOT 49 CFR; use placarded vehicles if bulk quantities exceed thresholds.

- Air (IATA): Limited quantities may be allowed; full regulations apply for larger shipments. Check state-of-charge and packaging instructions.

- Sea (IMDG): Proper stowage and segregation; avoid proximity to heat or foodstuffs.

- Documentation:

- Shipper’s Declaration for Dangerous Goods (if required)

- Commercial invoice with accurate UN number and classification

- Transport Emergency Card (TREM Card) for ADR

- Segregation During Transport:

- Do not transport with food, oxidizers, or incompatible chemicals.

- Secure containers to prevent tipping or leakage.

H2: 7. Environmental & Waste Management

- Spill Response:

- Contain spill with absorbent materials (e.g., vermiculite, clay-based absorbents).

- Do not wash into drains or waterways.

- Collect contaminated material for hazardous waste disposal.

- Waste Disposal:

- Empty containers: Triple-rinse or puncture and dispose as hazardous waste if residue remains.

- Unused paint: Classified as hazardous waste if flammable, toxic, or reactive.

- Follow local regulations (e.g., RCRA in USA, Waste Framework Directive in EU).

- Use licensed waste handlers with proper manifests.

- Environmental Protection:

- Prevent runoff from washout areas.

- Use closed-loop cleaning systems where possible.

H2: 8. Emergency Preparedness

- Maintain spill kits (absorbents, gloves, goggles, disposal bags) at storage and use areas.

- Post emergency contact numbers (fire, poison control, spill response).

- Conduct regular drills for spill response and fire scenarios.

- Ensure fire extinguishers (CO₂, dry chemical) are available and accessible.

H2: 9. Compliance Audits & Recordkeeping

- Conduct regular internal audits of storage, labeling, SDS availability, and training records.

- Maintain records for:

- SDS versions and distribution

- Employee training logs

- Waste manifests

- Spill and incident reports

- Transport documentation

- Retention period: Typically 3–5 years (check local regulations).

Conclusion:

Proper logistics and compliance management for epoxy-based paint is essential to ensure safety, legal compliance, and environmental responsibility. Adherence to GHS, DOT, OSHA, REACH, and transport regulations, combined with robust internal procedures, minimizes risk and supports sustainable operations. Always consult the product-specific SDS and engage with regulatory experts when in doubt.

Conclusion on Sourcing Epoxy-Based Paint:

Sourcing epoxy-based paint requires a strategic approach that balances quality, cost, and supplier reliability. Epoxy coatings are highly valued for their durability, chemical resistance, and strong adhesion, making them ideal for industrial, marine, automotive, and commercial applications. When sourcing, it is essential to identify suppliers with proven track records in providing consistent product quality and technical support.

Key considerations include evaluating the epoxy formulation (solvent-based vs. water-based), compliance with environmental and safety regulations (such as low VOC content), and performance suitability for the intended application. Establishing long-term relationships with reputable manufacturers or distributors can ensure supply chain stability and access to innovation and custom solutions.

Additionally, conducting thorough due diligence—such as requesting samples, reviewing certifications (e.g., ISO, REACH, or ASTM compliance), and comparing total cost of ownership—helps mitigate risks and optimize value. In conclusion, successful sourcing of epoxy-based paint hinges on a comprehensive supplier assessment, clear understanding of application requirements, and attention to regulatory and sustainability trends in the coatings industry.