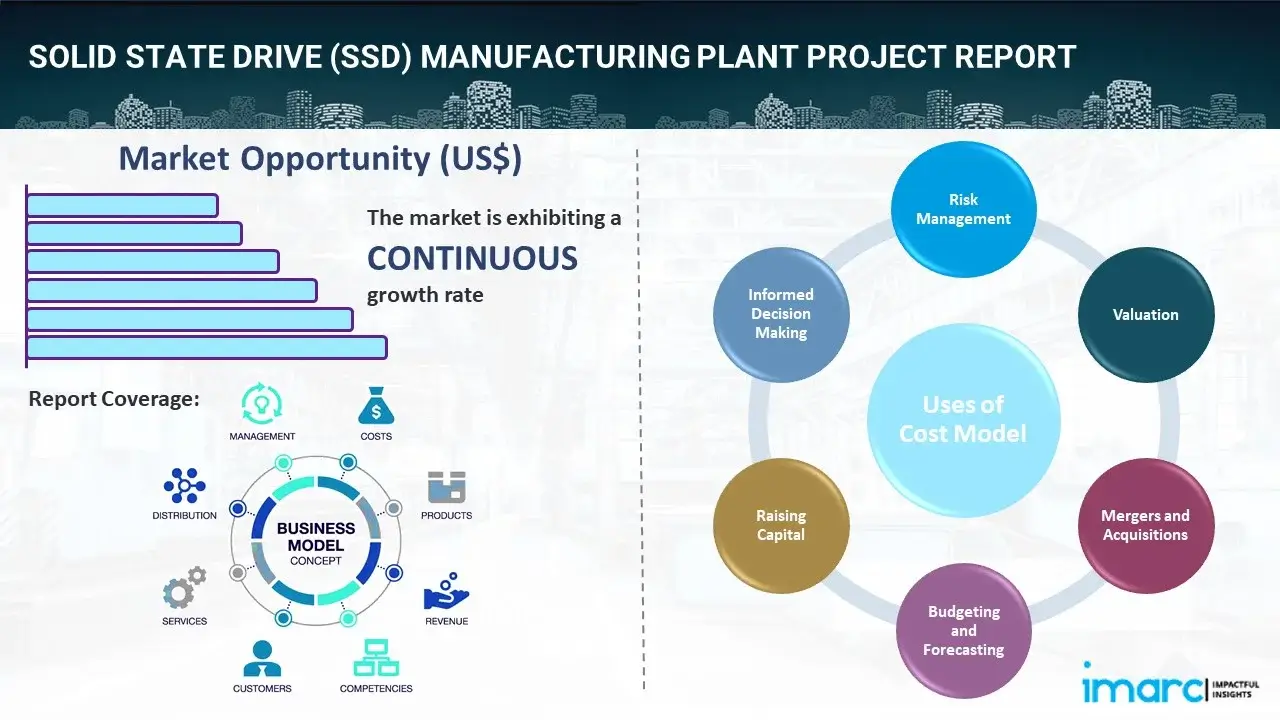

The enterprise solid state drive (SSD) market is experiencing robust expansion, driven by increasing demand for high-performance storage solutions in data centers, cloud computing, and enterprise IT infrastructure. According to a 2023 report by Mordor Intelligence, the global enterprise SSD market was valued at approximately $22.6 billion and is projected to grow at a compound annual growth rate (CAGR) of 12.8% from 2023 to 2028. This growth is fueled by the proliferation of data-intensive applications, rising adoption of AI and machine learning workloads, and the ongoing shift from traditional hard disk drives (HDDs) to faster, more reliable SSDs. As enterprises prioritize speed, scalability, and energy efficiency, the competitive landscape has intensified among leading storage manufacturers. This analysis profiles the top nine enterprise SSD manufacturers that are shaping the future of enterprise storage through innovation, strategic partnerships, and a strong presence in global supply chains.

Top 9 Enterprise Solid State Drive Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Kingston Technology

Domain Est. 1993

Website: kingston.com

Key Highlights: Reliable solid state drives (SSDs), memory modules, USB flash drives, SD cards and microSD cards for consumers, businesses, enterprises and system builders ……

#2 SSD

Domain Est. 1994

Website: micron.com

Key Highlights: Micron SSDs deliver high performance, industry leading reliability, superior data protection, and optimal endurance….

#3 Enterprise Series M.2 NVMe SSD

Domain Est. 2000

Website: synology.com

Key Highlights: Enterprise Series M.2 NVMe SSDs are designed to intelligently work with Synology DiskStation Manager (DSM) to boost I/O performance….

#4 Industrial SSD

Domain Est. 2002

Website: atpinc.com

Key Highlights: Discover extensive Industrial SSD options in M.2, 2.5″, mSATA, and U.2 Drives with Industrial Temp, Power Loss Protection, and Security AES 256 and TCG 2.0….

#5 SSSTC|Industrial|Enterprise|Solid State Drives|SATA、Nvme

Domain Est. 2013

Website: ssstc.com

Key Highlights: We are a global leader in the design, development and manufacturing of Solid-State Drives (SSDs) for Enterprise/Data Center, Cloud Computing, Personal computers ……

#6 CM7-V Series (2.5-inch)

Domain Est. 2018

Website: americas.kioxia.com

Key Highlights: KIOXIA CM7-V Series is a mixed use SSD that is optimized to support a broad range of enterprise applications and associated workloads.Missing: solid manufacturer…

#7 HPE Server Solid State Drives (SSDs)

Domain Est. 1995

#8 Enterprise Data Storage Solutions

Domain Est. 2016

Website: exascend.com

Key Highlights: Discover Exascend’s cutting-edge enterprise data storage solutions, featuring high-performance SSDs tailored for diverse business needs….

#9 Solidigm: World

Domain Est. 2019

Website: solidigm.com

Key Highlights: Solidigm delivers class-leading SSD data storage solutions for the most demanding workloads. Empower your data center and AI with our solid-state drives….

Expert Sourcing Insights for Enterprise Solid State Drive

H2: 2026 Market Trends for Enterprise Solid State Drives

The enterprise solid-state drive (SSD) market is poised for transformative growth and technological evolution by 2026, driven by accelerating digital transformation, increasing data center workloads, and the proliferation of artificial intelligence (AI) and machine learning (ML) applications. Key trends shaping the 2026 landscape include advancements in NAND flash technology, the rise of computational storage, increased adoption of PCIe Gen5 and emerging Gen6 interfaces, and growing emphasis on sustainability and total cost of ownership (TCO).

One of the most significant trends is the widespread transition to higher-density 3D NAND architectures, including 232-layer and beyond, enabling greater storage capacities and improved cost efficiency per gigabyte. Vendors are also investing heavily in quad-level cell (QLC) and even penta-level cell (PLC) NAND for read-intensive enterprise workloads, expanding use cases in archival storage and large-scale data analytics.

Performance demands are pushing the adoption of PCIe Gen5 interfaces, with early entrants already shipping Gen5 NVMe SSDs in 2024–2025. By 2026, Gen5 will become mainstream in high-performance data centers, while the first Gen6 SSDs are expected to enter the market, doubling bandwidth to 256 GB/s per lane and supporting next-generation AI/ML and real-time processing applications.

Computational storage is emerging as a key innovation, with SSDs integrating processing capabilities to reduce data movement between storage and CPU. This trend is particularly relevant for edge computing and AI inference workloads, where latency and bandwidth constraints necessitate smarter, in-storage compute functions. Major vendors and standards bodies, including SNIA and NVM Express, are advancing protocols to support computational storage deployment at scale.

Data center sustainability is also becoming a critical factor. Enterprises are prioritizing energy-efficient SSDs with lower power consumption and higher performance-per-watt metrics. Innovations such as Zoned Namespaces (ZNS) and Key-Value (KV) SSDs—part of the NVMe 2.0 specification—are enabling more efficient data placement and garbage collection, reducing write amplification and extending drive lifespan.

Geopolitical factors, supply chain resilience, and onshoring of semiconductor manufacturing (e.g., via the U.S. CHIPS Act and EU Chips Act) are influencing sourcing strategies. This is prompting diversification of NAND suppliers and increased investment in domestic fabrication, affecting pricing and availability trends through 2026.

Finally, competition is intensifying among established players (Samsung, Kioxia, SK hynix, Micron, Solidigm) and emerging entrants, leading to rapid innovation cycles and aggressive pricing in high-capacity and high-performance segments. Cloud service providers (CSPs) continue to drive demand, often co-designing custom SSDs optimized for their infrastructure, further shaping product roadmaps.

In summary, the 2026 enterprise SSD market will be defined by higher performance, smarter storage architectures, energy efficiency, and tighter integration with AI and cloud-native workloads—positioning SSDs as foundational components of modern data-centric infrastructure.

Common Pitfalls When Sourcing Enterprise Solid State Drives (Quality, IP)

Sourcing enterprise-grade Solid State Drives (SSDs) requires careful due diligence to avoid performance, reliability, and intellectual property (IP) risks. Overlooking key aspects can lead to system failures, data loss, or legal exposure. Below are common pitfalls to avoid:

Quality and Performance Pitfalls

Using Consumer-Grade SSDs in Enterprise Environments

A frequent mistake is deploying consumer or prosumer SSDs in data centers or mission-critical systems. These drives lack the endurance (measured in Drive Writes Per Day or DWPD), error correction, power-loss protection, and sustained performance required in enterprise workloads. This can result in premature failures and unplanned downtime.

Ignoring Endurance and Workload Ratings

Enterprise SSDs are rated for specific workloads (e.g., read-intensive, mixed-use, write-intensive). Selecting a drive with insufficient endurance for the application—such as using a read-intensive SSD for a logging or database server—leads to rapid wear-out and failure.

Overlooking Firmware Stability and Update Support

Firmware bugs can cause data corruption, performance degradation, or complete drive failure. Sourcing drives from vendors without a track record of reliable firmware, transparent update processes, or long-term support risks operational instability.

Inadequate Validation and Testing

Some vendors rebrand or lightly modify drives from OEMs without rigorous in-house testing. Always verify that the SSD has undergone extensive validation for enterprise environments, including temperature, vibration, and power cycling tests.

Intellectual Property and Sourcing Pitfalls

Purchasing from Unauthorized or Grey Market Distributors

Buying from unverified resellers increases the risk of counterfeit, stolen, or reconditioned drives. These may lack warranty coverage, have tampered firmware, or infringe on IP rights. Always source through authorized channels to ensure authenticity and legal compliance.

Lack of Transparency in Supply Chain and IP Ownership

Some SSD vendors use proprietary controllers or firmware developed in-house, while others rely on third-party IP. If the vendor lacks clear IP ownership or relies on unlicensed technology, customers may face legal exposure or discontinuation risks. Verify the vendor’s design authority and IP licensing.

OEM Rebranding Without Value-Add

Many enterprise SSDs are rebranded products from major OEMs (e.g., Kioxia, Samsung, Solidigm). While not inherently problematic, some resellers offer no meaningful differentiation—such as firmware optimization, enterprise support, or extended validation. This can result in paying a premium without added value or accountability.

Inadequate Warranty and Support Terms

Enterprise environments require robust support, including advanced replacement, remote diagnostics, and long warranty periods (typically 5 years). Vendors with weak support infrastructure or ambiguous warranty terms can leave organizations stranded during failures.

Conclusion

To mitigate these risks, enterprises should evaluate SSD vendors based on proven reliability, transparent supply chains, strong IP foundations, and comprehensive support. Conducting technical due diligence and purchasing through authorized partners ensures quality, performance, and legal safety in critical infrastructure.

Logistics & Compliance Guide for Enterprise Solid State Drive

Overview

This guide outlines the logistics and compliance requirements for the handling, transportation, storage, and regulatory adherence of Enterprise Solid State Drives (SSDs) throughout the supply chain. It ensures operational efficiency, data security, and compliance with international standards.

Regulatory Compliance

Enterprise SSDs must comply with regional and global regulations to ensure legal distribution and safe operation. Key compliance standards include:

– RoHS (Restriction of Hazardous Substances): Ensures SSDs are free of lead, mercury, cadmium, and other harmful materials.

– REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals): Requires disclosure of chemical substances used in manufacturing.

– WEEE (Waste Electrical and Electronic Equipment): Mandates proper end-of-life recycling and disposal procedures.

– CE Marking: Required for sale in the European Economic Area, indicating conformity with health, safety, and environmental protection standards.

– FCC (Federal Communications Commission): Regulates electromagnetic interference (EMI) in the U.S.

– UL/ETL Certification: Validates safety standards for electrical components.

– Export Control Regulations (e.g., EAR, ITAR): Governs international shipment, especially for products containing encryption technology.

Packaging & Handling

Proper packaging and handling are essential to prevent damage and ensure product integrity:

– Use anti-static packaging materials (e.g., static-shielding bags) to protect against electrostatic discharge (ESD).

– Include cushioning (foam, molded inserts) inside boxes to absorb shock during transit.

– Label packages with handling indicators (e.g., “Fragile,” “This Side Up”) and ESD-sensitive symbols.

– Avoid exposure to extreme temperatures, moisture, and direct sunlight during handling and storage.

Transportation & Shipping

Enterprise SSDs must be shipped under controlled conditions:

– Use temperature-controlled environments when shipping in extreme climates (typically -20°C to 60°C for non-operational storage).

– Ship via certified logistics providers with experience in high-value, sensitive electronics.

– Implement tamper-evident seals to prevent unauthorized access.

– Maintain chain-of-custody documentation for high-security deployments.

– Comply with IATA/ICAO regulations for air transport of lithium-containing components (if applicable, e.g., in self-encrypting drives with backup batteries).

Storage Conditions

Optimal storage preserves SSD performance and longevity:

– Store in a clean, dry environment with humidity between 5% and 80% RH.

– Maintain ambient temperatures between 0°C and 35°C.

– Limit storage duration; rotate inventory using FIFO (First In, First Out) to avoid component aging.

– Keep SSDs in original packaging until deployment to protect against contaminants and ESD.

Data Security & Chain of Custody

Enterprise SSDs may contain sensitive data or encryption keys:

– Enforce secure wipe procedures (e.g., ATA Secure Erase, cryptographic erase) before return, repair, or disposal.

– Maintain audit trails for SSD movement, especially for drives used in regulated industries (e.g., finance, healthcare).

– Use encrypted drives with FIPS 140-2 or Common Criteria certification where required.

– Implement asset tagging and tracking (e.g., RFID, barcode systems) throughout logistics lifecycle.

Import/Export Documentation

Ensure all international shipments include:

– Commercial invoice with detailed product description, value, and Harmonized System (HS) code (e.g., 8471.80 for SSDs).

– Bill of lading or air waybill.

– Certificate of Origin.

– Export declaration forms compliant with local regulations (e.g., AES filing for U.S. exports).

– Compliance statements for RoHS, REACH, and conflict minerals (e.g., Dodd-Frank Section 1502).

End-of-Life Management

Responsible disposal and recycling are critical:

– Partner with certified e-waste recyclers compliant with R2 or e-Stewards standards.

– Document destruction or recycling for audit and compliance purposes.

– Recover and properly dispose of rare earth materials and hazardous components.

Audit & Recordkeeping

Maintain records for a minimum of 5–7 years, including:

– Compliance certifications and test reports.

– Shipping and handling logs.

– Data sanitization records.

– Inventory and asset tracking history.

Regular internal audits ensure adherence to logistics and compliance protocols.

Conclusion

Adhering to this logistics and compliance guide ensures the secure, legal, and efficient handling of Enterprise SSDs across their lifecycle. Continuous monitoring and updates to align with evolving regulations are essential for global operations.

Conclusion for Sourcing Enterprise Solid State Drives (SSDs):

Sourcing enterprise-grade solid state drives requires a strategic evaluation of performance, reliability, scalability, and total cost of ownership. Enterprise SSDs offer significant advantages over traditional hard disk drives, including faster data access, lower latency, higher IOPS, and improved energy efficiency—making them ideal for data centers, cloud environments, and mission-critical applications.

When selecting enterprise SSDs, organizations must prioritize factors such as endurance (measured in drive writes per day), data protection features (e.g., power-loss protection, error correction), and vendor support. Leading manufacturers like Samsung, Western Digital, Micron, Kioxia, and SK hynix offer a range of solutions tailored for different workloads—read-intensive, mixed-use, or write-intensive—ensuring compatibility with diverse IT infrastructure needs.

Additionally, adopting a lifecycle management approach—including warranty terms, firmware updates, and end-of-life planning—ensures long-term stability and support. As data demands continue to grow, investing in high-quality, enterprise-grade SSDs not only enhances system performance but also supports future scalability and business continuity.

In conclusion, the decision to source enterprise SSDs should be aligned with organizational IT goals, workload requirements, and long-term technology roadmaps. By partnering with reputable vendors and performing due diligence in product evaluation, businesses can maximize ROI, improve operational efficiency, and build a resilient storage foundation for the digital era.