The global market for automotive engine components, including critical parts like idle air control valves (IACVs), has seen steady growth driven by increasing vehicle production and demand for improved fuel efficiency and emission control. According to a report by Mordor Intelligence, the automotive sensors market—under which idle control components fall—is projected to grow at a CAGR of over 7.5% from 2023 to 2028. Similarly, Grand View Research estimates that the global automotive sensors market size was valued at USD 27.5 billion in 2022 and is expected to expand at a CAGR of 7.3% through 2030. As engine management systems become more sophisticated, particularly with the rise of electric and hybrid vehicles requiring precise idle and transition control, manufacturers of idle valves are innovating rapidly to meet evolving performance and regulatory standards. Against this backdrop, a select group of nine manufacturers have emerged as industry leaders, combining technological expertise, global supply chain reach, and rigorous quality certifications to dominate the idle valve landscape.

Top 9 Engine Idle Valve Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 OEM & Aftermarket Idle Air Control Valve (IAC) Manufacturer

Domain Est. 2018

Website: cowtotal.com

Key Highlights: COWTOTAL is a professional OEM & aftermarket IAC Valve / Idle Air Control Valve manufacturer and supplier, providing stable and precise idle control components ……

#2 Idle Air Control Valves (IAC Valves) for Cars & Trucks

Domain Est. 1995

Website: holley.com

Key Highlights: Free delivery over $149 · 90-day returnsShop Idle Air Control Valves (IAC Valves) at Holley.com. Free shipping on orders $149+ and world-class support for every build….

#3 Idle Air Control Motors

Domain Est. 1997

Website: walkerproducts.com

Key Highlights: The Idle Air Control Motor (IAC), also referred to as the Throttle Air Bypass Valve (TABP), is a stepper motor controlled by the vehicle’s onboard computer….

#4 Idle Speed Control

Domain Est. 1998

Website: clewett.com

Key Highlights: Perfect universal IAC valve for smaller engines. The kit includes: 2 wire valve, valve body, 1/2″ straight hose fittings, gasket, electrical….

#5 Idle Air Control (IAC) Valve

Domain Est. 2000

Website: standardbrand.com

Key Highlights: Standard IAC Valves regulate airflow to the engine to ensure smooth idling, and are designed and tested to prevent corrosion….

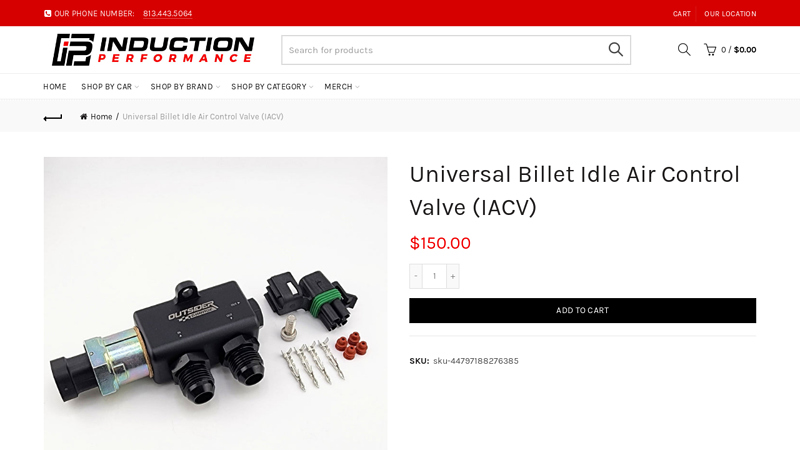

#6 Universal Billet Idle Air Control Valve (IACV)

Domain Est. 2003

Website: inductionperformance.com

Key Highlights: Designed around the common GM 4 pin stepper motor, this IACV is easy to source and setup. We’ve designed this with a 6mm mounting hole and added ORB inlet/ ……

#7 Idle Air Control Valve

Domain Est. 2004

Website: boschautoparts.com

Key Highlights: Bosch Idle Air Control Valves are made with precision engineering and are robustly designed to withstand long engine life….

#8 Idle Air Control (IAC) Valves

Domain Est. 2005

Website: bwdbrand.com

Key Highlights: BWD® IAC Valves regulate airflow to the engine to ensure smooth idling, and are designed and tested to prevent corrosion….

#9 2

Domain Est. 2013

Website: store.classicdmc.com

Key Highlights: 2-day delivery 30-day returnsWorld’s largest source for DeLorean parts, service, restoration and car sales. More than 3.5 million DeLorean parts in stock – NOS, new, reproduction, …

Expert Sourcing Insights for Engine Idle Valve

2026 Market Trends for Engine Idle Air Control (IAC) Valve: Navigating a Transitional Landscape

The Engine Idle Air Control (IAC) Valve market in 2026 is poised at a critical juncture, characterized by significant technological shifts, evolving regulations, and changing vehicle dynamics. While facing long-term structural challenges from electrification, the market exhibits resilience and specific growth pockets driven by the massive existing internal combustion engine (ICE) fleet and incremental innovations.

H2: Declining ICE Penetration vs. Robust Aftermarket Demand

The most defining trend is the ongoing, albeit regionally varied, decline in new ICE vehicle production due to stringent global emissions regulations (e.g., Euro 7, China 6b, US EPA standards) and the accelerating shift towards Battery Electric Vehicles (BEVs) and hybrids. This directly reduces original equipment (OE) demand for new IAC valves. However, this is powerfully counterbalanced by extremely strong aftermarket demand. The global fleet of ICE vehicles (passenger cars, light/medium-duty trucks, commercial vehicles, off-highway equipment) remains vast and will require maintenance and replacement parts for years, if not decades. As these vehicles age, component wear increases, driving significant sales of IAC valves for replacement. The aftermarket is expected to dominate the IAC valve market in 2026, particularly in emerging economies where ICE vehicles will remain prevalent longer.

H2: Consolidation and Specialization Amidst Electrification Pressure

Facing the headwind of electrification, the IAC valve market will see continued consolidation among tier suppliers. Larger players with diversified portfolios (e.g., Denso, Bosch, Continental, Delphi, Motorcraft) will leverage economies of scale and integrated engine management system expertise. Simultaneously, there’s a trend towards specialization and cost optimization. Suppliers will focus on:

* Cost Reduction: Developing more reliable, longer-lasting valves using advanced materials and manufacturing techniques to reduce warranty claims and lifecycle costs for OEMs and end-users.

* Application-Specific Designs: Tailoring valves for specific engine types (e.g., turbocharged downsized engines, engines using alternative fuels like CNG or biofuels) and challenging operating environments (e.g., heavy-duty, off-road).

* Focus on Hybrids: While pure BEVs don’t need IAC valves, many hybrids (especially PHEVs and HEVs with frequent engine start-stop cycles) still require sophisticated idle control, creating a niche but important segment.

H2: Technological Refinement and Integration with Engine Management

Despite being a mature technology, the IAC valve is not static. Key trends include:

* Enhanced Precision and Reliability: Development of valves with improved stepper motor control, better sealing materials (resistant to carbon deposits and modern fuels/additives), and diagnostics capabilities for easier troubleshooting.

* Deeper Integration: IAC valves are increasingly integrated as a subsystem within comprehensive Engine Control Units (ECUs). Their operation is tightly coordinated with throttle control, fuel injection, and emissions systems (EGR, PCV) for optimal idle stability, fuel efficiency, and emissions compliance, particularly during cold starts and accessory load changes.

* Focus on Emissions and Efficiency: Refinements aim to minimize hydrocarbon (HC) and carbon monoxide (CO) emissions at idle and improve fuel economy during idling cycles, contributing to overall vehicle efficiency targets.

H2: Regional Disparities and Supply Chain Dynamics

The market landscape in 2026 will be highly regional:

* North America & Europe: Mature markets with high vehicle ownership. Aftermarket demand is strong, driven by aging fleets. New OE demand is minimal due to rapid EV adoption. Focus is on reliability and meeting strict emissions standards.

* Asia-Pacific (Excl. China): Significant growth potential, especially in Southeast Asia and India, where ICE vehicles dominate new sales and the aftermarket is burgeoning. Cost-effective solutions are crucial.

* China: A complex picture. While EV adoption is rapid, the sheer size of the ICE fleet ensures massive aftermarket demand. Domestic suppliers are becoming increasingly competitive.

* Supply Chain: Geopolitical factors and the push for localization (e.g., “nearshoring,” “friendshoring”) will influence manufacturing locations. Resilience and securing raw materials (specific metals, plastics, magnets) will remain priorities.

Conclusion for 2026:

The Engine IAC Valve market in 2026 is not a growth market in terms of unit volume from new vehicles, but a resilient and substantial aftermarket business. Success will depend on suppliers’ ability to navigate the decline in OE demand by:

1. Dominating the high-volume replacement parts market through reliability, cost leadership, and extensive distribution.

2. Innovating incrementally to support efficiency and emissions goals in remaining ICE and hybrid applications.

3. Adapting to regional market dynamics and supply chain challenges.

4. Potentially leveraging expertise in precision electromechanical actuators for adjacent applications in electrified powertrains (though not the IAC valve itself).

While the long-term trajectory points towards obsolescence as the ICE fleet shrinks, 2026 represents a peak period for aftermarket IAC valve activity, underpinned by the enduring need to maintain the world’s vast inventory of combustion engine vehicles.

Common Pitfalls Sourcing Engine Idle Valve (Quality, IP)

Sourcing reliable Engine Idle Valves (also known as Idle Air Control Valves or IACVs) is critical for engine performance and emissions compliance. However, several common pitfalls can compromise quality and Intellectual Property (IP) protection, leading to operational failures and legal risks.

Poor Quality Components

One of the most frequent issues when sourcing idle valves is receiving substandard components. Low-quality valves often use inferior materials for the solenoid, plunger, and housing, leading to premature wear, sticking, or complete failure. These defects can cause erratic idle speeds, stalling, and increased emissions, resulting in costly warranty claims and reputational damage.

Counterfeit or Non-OEM Parts

The market is rife with counterfeit idle valves that mimic genuine OEM designs. These parts may appear identical but fail to meet precise calibration and durability standards. Using such components not only risks engine performance but also exposes the buyer to IP infringement claims if the counterfeit product copies protected designs or trademarks.

Lack of IP Due Diligence

Failing to verify the intellectual property status of sourced idle valves can lead to legal complications. Suppliers—especially in regions with weak IP enforcement—may produce valves that replicate patented technologies or trade dress without authorization. Purchasers may inadvertently become liable for IP violations, facing litigation, import bans, or financial penalties.

Inadequate Testing and Certification

Many low-cost suppliers do not provide comprehensive testing data or certifications (e.g., ISO/TS 16949, ISO 14001). Without proof of performance under real-world conditions—such as temperature cycling, vibration resistance, and contamination tolerance—there is no assurance that the idle valve will perform reliably in the field.

Inconsistent Manufacturing Processes

Sourcing from suppliers with inconsistent production practices increases variability in valve performance. Differences in calibration, assembly techniques, or quality control can result in mismatched units, even within the same batch. This inconsistency affects engine tuning and increases return rates.

Supply Chain Transparency Gaps

Lack of visibility into the supply chain—such as secondary sourcing or subcontracting—can mask quality and IP risks. Hidden tiers may introduce unapproved components or knock-off parts, undermining traceability and accountability.

Failure to Enforce IP Agreements

Even when contracts include IP clauses, weak enforcement allows suppliers to circumvent obligations. Without regular audits and clear penalties for non-compliance, suppliers may reuse designs or sell identical parts to competitors, diluting competitive advantage and risking IP theft.

Avoiding these pitfalls requires rigorous supplier vetting, thorough IP audits, and adherence to quality standards throughout the procurement process.

Logistics & Compliance Guide for Engine Idle Valve

Overview and Importance

The Engine Idle Valve (also known as the Idle Air Control Valve or IACV) is a critical component in modern internal combustion engines. It regulates the engine’s idle speed by controlling airflow bypassing the throttle plate, ensuring stable operation during idle conditions. Given its essential function, proper logistics handling and compliance with regulatory standards are vital to maintain performance, safety, and legal adherence throughout the supply chain.

Regulatory and Compliance Requirements

Engine Idle Valves must comply with a range of international and regional regulations depending on the target markets. Key compliance considerations include:

– Emissions Standards: Components must align with emissions regulations such as Euro 6 (EU), Tier 3 (USA), and Bharat Stage VI (India), as the IACV influences idle emissions and fuel efficiency.

– RoHS and REACH Compliance: In the European Union, valves must meet the Restriction of Hazardous Substances (RoHS) directive and Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) requirements, restricting the use of lead, cadmium, and other hazardous materials.

– IMDS Reporting: For automotive OEMs in Europe and North America, submission of material data via the International Material Data System (IMDS) is mandatory to ensure traceability and compliance.

– Country-Specific Certifications: Some markets may require additional certifications, such as China CCC or Korean KC Mark, depending on the application and vehicle type.

Packaging and Handling Specifications

Proper packaging ensures the Engine Idle Valve arrives undamaged and remains contamination-free:

– Anti-Static Packaging: Due to the electronic components within the valve, anti-static bags or containers must be used to prevent electrostatic discharge (ESD) damage.

– Moisture Protection: Include desiccant packs and moisture barrier bags (MBBs) for long-term storage or humid climates.

– Cushioning and Rigidity: Use molded foam inserts or corrugated dividers within shipping containers to prevent mechanical shock or vibration damage.

– Labeling: Each package must be clearly labeled with part number, batch/lot number, date of manufacture, and handling symbols (e.g., “Fragile,” “Do Not Stack,” “Keep Dry”).

Storage Conditions

Optimal storage prevents degradation of materials and electronic components:

– Temperature Range: Store between 5°C and 35°C (41°F to 95°F). Avoid freezing or high-heat environments.

– Humidity: Maintain relative humidity below 60% to prevent corrosion and mold.

– Shelf Life: Most electronic valves have a recommended shelf life of 24 months from manufacture; rotate stock using FIFO (First In, First Out) principles.

– Location: Store indoors, away from direct sunlight, chemicals, and sources of electromagnetic interference.

Transportation and Shipping

Ensure safe and compliant transit across all modes:

– Domestic and International Shipping: Adhere to IATA (air), IMDG (sea), and ADR (road) regulations when shipping hazardous or sensitive components. While IACVs are generally non-hazardous, verify if any integrated materials (e.g., certain solder types) require special handling.

– Documentation: Include commercial invoice, packing list, certificate of conformity (CoC), and material safety data sheet (MSDS/SDS) where applicable.

– Tracking and Traceability: Implement barcode or RFID tracking systems for lot-level traceability, essential for recalls or warranty claims.

Customs and Import/Export Procedures

- HS Code Classification: Use appropriate Harmonized System (HS) code—typically under 8409.91 or 8409.99 for engine parts. Confirm country-specific classifications to avoid delays.

- Export Controls: Verify if dual-use or technology control regulations apply (e.g., EAR in the U.S.). Most IACVs are not controlled, but documentation should be retained.

- Duties and Tariffs: Assess duty rates based on trade agreements (e.g., USMCA, EU-Japan EPA) and ensure proper valuation methods are applied.

Returns and Reverse Logistics

Establish a process for managing defective or excess inventory:

– Return Authorization (RMA): Require customers to obtain RMA numbers before returning products.

– Inspection and Quarantine: Inspect returned valves for damage or contamination; quarantine until disposition is determined.

– Environmental Disposal: Recycle or dispose of faulty units in compliance with WEEE and local e-waste regulations.

Quality and Audit Preparedness

- Documentation Retention: Maintain records of compliance, test results, shipping logs, and customer communications for a minimum of 7–10 years (per ISO/TS 16949 or IATF 16949 standards).

- Supplier Audits: Ensure all suppliers of sub-components also comply with relevant standards and can provide necessary certifications.

- Periodic Compliance Review: Conduct internal audits to verify ongoing adherence to changing regulations.

Conclusion

Effective logistics and compliance management for the Engine Idle Valve safeguards product integrity, ensures regulatory adherence, and supports smooth operations across global markets. By following this guide, stakeholders can minimize risks, enhance traceability, and maintain customer trust in automotive supply chains.

Conclusion for Sourcing an Engine Idle Air Control (IAC) Valve:

Sourcing the correct engine idle air control (IAC) valve is critical to ensuring optimal engine performance, stable idle speed, and smooth operation under varying load conditions. After evaluating factors such as vehicle make, model, and engine specifications, as well as compatibility with OEM standards, it is essential to procure the idle valve from reputable suppliers or manufacturers to guarantee quality, durability, and proper functionality. Whether opting for original equipment, aftermarket alternatives, or remanufactured units, verifying part number accuracy, material quality, and compliance with emissions and performance standards is vital. Additionally, considering warranty coverage, technical support, and availability of inventory helps mitigate downtime, especially in commercial or high-utilization applications. Ultimately, a well-sourced idle valve contributes to improved fuel efficiency, reduced emissions, and enhanced driving experience, making due diligence in procurement a worthwhile investment in overall engine reliability.