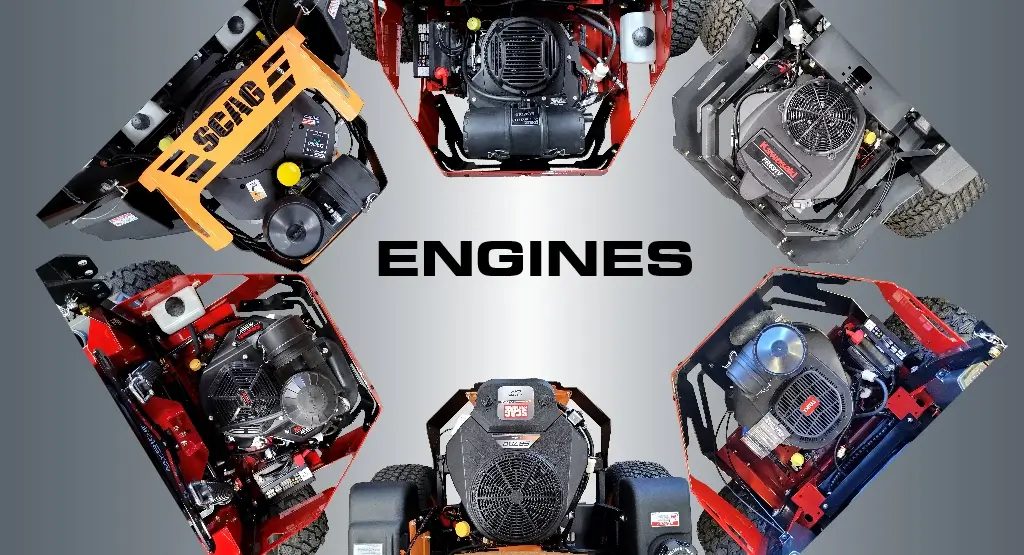

The zero turn mower (ZTM) market has experienced steady expansion over the past decade, driven by rising demand for efficient lawn care solutions across residential, commercial, and municipal sectors. According to Grand View Research, the global lawn and garden equipment market was valued at USD 38.7 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030, with zero turn mowers representing a significant segment of this growth. A key driver in this trend is the increasing reliance on high-performance engines that deliver superior maneuverability, speed, and cutting efficiency—factors that are pushing manufacturers to innovate in engine design and integration. As consumer expectations shift toward durability and fuel efficiency, the engines powering these mowers have become a critical differentiator. This growing emphasis on engine performance has elevated the role of specialized engine manufacturers in the ZTM ecosystem. Based on market presence, technological innovation, and engine reliability, we’ve identified the top 10 engine manufacturers shaping the future of zero turn mowers.

Top 10 Engine For Zero Turn Mower Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 ZTrak™ Commercial Zero

Domain Est. 1990

Website: deere.com

Key Highlights: With its all-new turbo-diesel engine, reconfigurable cutting widths up to 100 inches, and integrated smart technology, the Z998R ZTrak™ Zero-Turn Mower ……

#2 About Kawasaki Engines

Domain Est. 2013

Website: kawasakienginesusa.com

Key Highlights: Discover Kawasaki Engines’ commitment to high quality, professional-grade performance, trusted by OEMs and supported by a nationwide dealer network.…

#3 Zero Turn Riding Lawn Mowers

Domain Est. 1995

Website: husqvarna.com

Key Highlights: Free delivery over $49.99The high-spec, twin-cylinder engines deliver plenty of power for efficient mowing and fast transportation even when the grass is high or under tough cuttin…

#4 Residential Lawn Mower Engines

Domain Est. 1996

Website: briggsandstratton.com

Key Highlights: From push mowers to riding mowers to zero turn mowers, Briggs & Stratton engines power the highest quality lawn care equipment in the market….

#5 Zero

Domain Est. 1997

Website: bobcat.com

Key Highlights: Bobcat® high-performance zero-turn mower engines ranging from 23 hp to 37 hp give you the pro-grade performance you need. View details….

#6 Residential & Commercial Grade Zero Turn Riding Mowers

Domain Est. 1998

Website: swisherinc.com

Key Highlights: 4-day delivery 30-day returnsWith powerful and reliable Briggs & Stratton engines, the zero turn mowers for sale here at Swisher are built to last. We build all our American-made z…

#7 Zero-Turn Riding Mowers

Domain Est. 1998

Website: scag.com

Key Highlights: Scag Power Equipment offers zero-turn riding lawn mowers. Learn about different types of lawn commercial mowers and the features….

#8 Vanguard® V

Domain Est. 2001

Website: vanguardpower.com

Key Highlights: Vanguard® V-Twin engines seamlessly integrate with industry-leading turf equipment like Ferris® zero-turn mowers, creating an unbeatable power duo….

#9 Top

Domain Est. 2005

#10 Zero-Turn Lawn Mowers

Domain Est. 2013

Website: bigdogmowerco.com

Key Highlights: Ideal for up to 1 Acre. 10.5hp Briggs & Stratton Engine. 34” & 42” decks. 5mph mowing speed. 7-year / 100 hour limited warranty ……

Expert Sourcing Insights for Engine For Zero Turn Mower

H2: 2026 Market Trends for Engines in Zero-Turn Mowers

The market for engines used in zero-turn mowers (ZTMs) is poised for significant evolution by 2026, shaped by technological innovation, regulatory pressures, shifting consumer preferences, and broader macroeconomic factors. Here’s an analysis of key trends expected to influence the sector:

-

Increased Demand for Fuel Efficiency and Emission Compliance

By 2026, regulatory standards—particularly from the U.S. Environmental Protection Agency (EPA) and European Union emissions directives—are expected to tighten further. Engine manufacturers are responding by developing smaller-displacement, high-efficiency engines that meet Tier 5 and equivalent emission standards. This includes the widespread adoption of electronic fuel injection (EFI) over traditional carbureted systems, which improves fuel economy and reduces emissions. -

Growth in Electric and Hybrid Powertrains

The push toward sustainability is accelerating the development of electric and hybrid engines for zero-turn mowers. While internal combustion engines (ICEs) still dominate the commercial sector, battery-electric models are gaining traction in residential and light commercial applications. By 2026, major engine suppliers like Briggs & Stratton, Kohler, and Honda are expected to offer integrated electric motor solutions or partner with battery technology firms to deliver scalable electric powertrains. -

Integration of Smart Technology and IoT

Engine systems are increasingly incorporating smart features such as remote diagnostics, performance monitoring, and predictive maintenance via IoT connectivity. In 2026, engines may come standard with telematics that communicate mower health data to fleet managers or service providers, improving uptime and reducing operational costs—especially in commercial landscaping operations. -

Shift Toward Lightweight and Compact Engine Designs

To improve mower agility and fuel efficiency, engine manufacturers are focusing on lightweight materials such as aluminum alloys and advanced composites. Compact engine footprints also allow for better weight distribution and lower center of gravity in ZTMs, enhancing maneuverability and user safety. -

Consolidation Among Engine Suppliers and Vertical Integration

The competitive landscape may see further consolidation as smaller engine makers struggle to meet R&D costs for emissions compliance and electrification. Larger players may acquire niche innovators or form strategic partnerships. Additionally, major mower OEMs (e.g., Toro, Exmark, and Hustler) are increasingly vertically integrating by developing proprietary engine technology or exclusive supply agreements to differentiate their products. -

Rising Demand in Emerging Markets

Urbanization and growth in landscaping services across Asia-Pacific, Latin America, and parts of Africa are expected to increase demand for zero-turn mowers. While entry-level models with basic gasoline engines will dominate these regions in 2026, there is growing interest in more durable, mid-tier engines that balance cost and performance. -

Focus on Noise Reduction and Operator Comfort

As landscaping occurs in noise-sensitive environments (e.g., residential neighborhoods, golf courses), engine noise is becoming a key differentiator. Manufacturers are investing in sound-dampening technologies and quieter combustion processes. This trend supports a premium segment where quieter, smoother engines command higher prices. -

Supply Chain Resilience and Localization

Ongoing global supply chain challenges are pushing engine manufacturers to localize production. By 2026, regional manufacturing hubs in North America, Europe, and Southeast Asia will likely play a larger role in supplying engines, reducing dependency on single-source components and mitigating risks from geopolitical disruptions.

In summary, the 2026 engine market for zero-turn mowers will be defined by sustainability, digitalization, and performance optimization. While internal combustion engines will remain relevant—especially in heavy-duty applications—the rise of electrification and smart engine technology will redefine competitive advantage in the industry.

Common Pitfalls Sourcing an Engine for a Zero Turn Mower (Quality, IP)

Sourcing the right engine for a zero turn mower involves careful consideration of performance, durability, and compatibility. However, buyers—especially when sourcing from third-party or international suppliers—often encounter several critical pitfalls related to quality and intellectual property (IP). Below are the most common issues to watch for.

Inadequate Quality Control

One of the biggest challenges when sourcing engines is inconsistent quality. Engines from unverified manufacturers may use substandard materials or poor assembly practices, leading to premature failure, excessive vibration, or poor fuel efficiency. Without rigorous quality audits or certifications (such as ISO 9001), there’s a high risk of receiving engines that don’t meet performance expectations or safety standards.

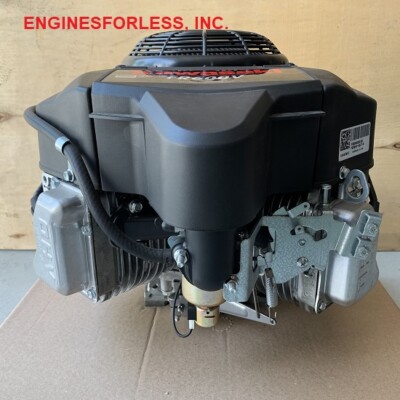

Counterfeit or Replica Engines

Many low-cost suppliers offer engines that mimic well-known brands (e.g., Kawasaki, Kohler, Briggs & Stratton) but are actually counterfeit or unlicensed replicas. These engines may bear fake logos or model numbers, misleading buyers into thinking they’re purchasing genuine OEM parts. Not only do these engines underperform, but they also pose legal risks due to IP infringement.

Intellectual Property (IP) Infringement

Using or distributing engines that violate intellectual property rights—such as patented designs, trademarks, or technical specifications—can result in legal action, product seizures, or damage to brand reputation. Some manufacturers copy engine designs without proper licensing, especially in regions with lax IP enforcement. Buyers who unknowingly source such products may become liable for contributory infringement.

Lack of Certification and Compliance

Engines must comply with emissions, noise, and safety regulations (e.g., EPA, CARB, CE). Sourcing engines without proper certification can lead to non-compliance issues, particularly in regulated markets like the U.S. or EU. Engines lacking documentation or test reports increase the risk of fines or import denials.

Poor After-Sales Support and Warranty

Low-cost engines often come with limited or no warranty, and spare parts or technical support may be unavailable. This becomes a major issue when repairs are needed, as downtime can significantly impact productivity for commercial mowing operations.

Incompatibility with OEM Specifications

Even if an engine appears similar in size and power, subtle differences in mounting points, shaft dimensions, or electrical systems can make integration difficult. Sourcing engines without detailed technical verification can result in costly modifications or operational inefficiencies.

Conclusion

To avoid these pitfalls, always source engines from reputable suppliers, verify certifications, conduct factory audits if possible, and ensure legal compliance with IP and environmental regulations. Due diligence upfront can save significant costs and legal risks down the line.

Logistics & Compliance Guide for Engine for Zero Turn Mower

Product Classification & HS Code

Identify the correct Harmonized System (HS) code for the engine to ensure accurate customs clearance and tariff application. Engines for zero turn mowers typically fall under HS Code 8407 (Spark-ignition reciprocating or rotary internal combustion piston engines). Confirm the specific subcategory based on engine displacement, power output, and intended use. Proper classification avoids delays and ensures compliance with international trade regulations.

Import/Export Regulations

Ensure compliance with export control laws such as the U.S. Export Administration Regulations (EAR) or equivalent regulations in other countries. Most small engines are classified as EAR99, meaning they are generally eligible for export without a license, but exceptions apply based on destination, end-use, and customer. Verify sanctions lists (e.g., OFAC, BIS) and obtain necessary export licenses if required.

Emissions & Environmental Compliance

Engines for zero turn mowers must meet emissions standards set by environmental agencies such as the U.S. Environmental Protection Agency (EPA) and the California Air Resources Board (CARB). Ensure the engine is certified under 40 CFR Part 1054 (Small Spark-Ignition Engines). Include required emission control labels and provide compliance documentation to distributors and end-users. Non-compliant engines may be restricted from sale or subject to penalties.

Packaging & Shipping Standards

Use durable, weather-resistant packaging to protect the engine during transit. Secure all components, including fuel lines, carburetors, and electrical connections, to prevent damage. Clearly label packages with handling instructions (e.g., “Fragile,” “This Side Up”), product identification, and safety warnings. Follow International Safe Transit Association (ISTA) standards for packaging testing to minimize freight damage.

Documentation Requirements

Prepare and maintain accurate shipping and compliance documentation, including:

– Commercial Invoice

– Packing List

– Certificate of Origin

– EPA and CARB Compliance Certificates

– Bill of Lading or Air Waybill

– Export Declaration (e.g., AES filing in the U.S.)

Ensure all documents include correct product descriptions, HS codes, and regulatory certification numbers to prevent customs delays.

Safety & Labeling Compliance

Engines must comply with safety standards such as those from OSHA and ANSI. Include mandatory labels for safety warnings, serial numbers, model numbers, and manufacturer information. Labels must be permanent and legible. Also comply with GHS (Globally Harmonized System) for any hazardous materials (e.g., fuel, lubricants) shipped with the engine.

Aftermarket & Warranty Logistics

Establish clear procedures for handling warranty claims, spare parts distribution, and technical support. Maintain an efficient reverse logistics process for defective units, including return authorizations (RMAs), inspection protocols, and repair or replacement workflows. Ensure compliance with consumer protection laws regarding warranty duration and service availability.

Regional Compliance Considerations

Be aware of country-specific regulations, such as CE marking for European Union markets (under Machinery Directive and Emission Standards), INMETRO in Brazil, or PSE in Japan. Adapt labeling, voltage requirements, and documentation to meet local standards. Partner with certified local distributors or agents when necessary to ensure regulatory alignment.

Maintenance of Compliance Records

Keep detailed records of all compliance certifications, test reports, shipping documents, and customer communications for a minimum of five years. These records may be required during regulatory audits or customs inspections. Implement a digital tracking system to monitor compliance status and renewal dates for certifications.

Training & Internal Procedures

Train logistics, sales, and customer service teams on compliance requirements and shipping protocols. Develop standard operating procedures (SOPs) for order fulfillment, export review, and incident response (e.g., non-compliant shipment discovery). Conduct regular internal audits to ensure ongoing adherence to regulations.

Conclusion: Sourcing an Engine for a Zero-Turn Mower

After evaluating various engine options for a zero-turn mower, it is clear that the choice of engine significantly impacts performance, durability, fuel efficiency, and maintenance requirements. Based on factors such as horsepower, reliability, brand reputation, availability of parts, and compliance with emissions standards, engines from reputable manufacturers like Kohler, Briggs & Stratton, Kawasaki, and Honda emerge as the top contenders.

For commercial applications, high-torque, liquid-cooled engines such as those from Kawasaki or Kohler offer superior longevity and performance under heavy use. In contrast, for residential users, air-cooled engines from Briggs & Stratton or Honda provide a cost-effective, reliable solution with lower maintenance needs.

Additionally, sourcing engines from authorized distributors ensures authenticity, warranty coverage, and technical support—critical for minimizing downtime and servicing costs. Consideration should also be given to future fuel trends, with increasing interest in eco-friendly alternatives such as electric or hybrid powertrains, which may influence long-term sourcing decisions.

Ultimately, the ideal engine depends on the intended use, budget, and operational environment. A thorough comparison of specifications, total cost of ownership, and service network accessibility will ensure optimal performance and customer satisfaction in the final zero-turn mower product.