The global engine manufacturing industry continues to expand at a robust pace, driven by rising demand across automotive, aerospace, marine, and industrial sectors. According to a 2023 report by Grand View Research, the global internal combustion engine (ICE) market was valued at USD 186.3 billion and is expected to grow at a compound annual growth rate (CAGR) of 4.8% from 2023 to 2030, bolstered by advancements in fuel efficiency and stringent emission regulations. Meanwhile, the broader engine market—including electric and hybrid propulsion systems—is projected to experience even stronger momentum. Mordor Intelligence forecasts that the global engine market will grow at a CAGR of over 5.2% from 2023 to 2028, with Asia-Pacific leading in both production and consumption due to rapid industrialization and increasing vehicle adoption. As innovation accelerates and sustainability becomes a core focus, the competitive landscape is being reshaped—making it essential to recognize the top players driving technological leadership, market share, and global supply chain influence. Below are the top 10 engine manufacturers shaping the future of power generation and mobility worldwide.

Top 10 Engine Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Engines

Domain Est. 1990

Website: cummins.com

Key Highlights: We offer an expansive lineup of engine technologies, including diesel, natural gas, and alternative fuel engines….

#2 Lycoming

Domain Est. 1998

Website: lycoming.com

Key Highlights: 90+ Years General Aviation Leader, 1 Mil Flight Hours, Monthly Award-Winning Manufacturer, 200K Active Engines….

#3 Kubota Engine America

Domain Est. 1999

Website: kubotaengine.com

Key Highlights: Kubota Engine America is the world-leading manufacturer of compact, multi-cylinder, liquid-cooled diesel engines up to 210HP and generators….

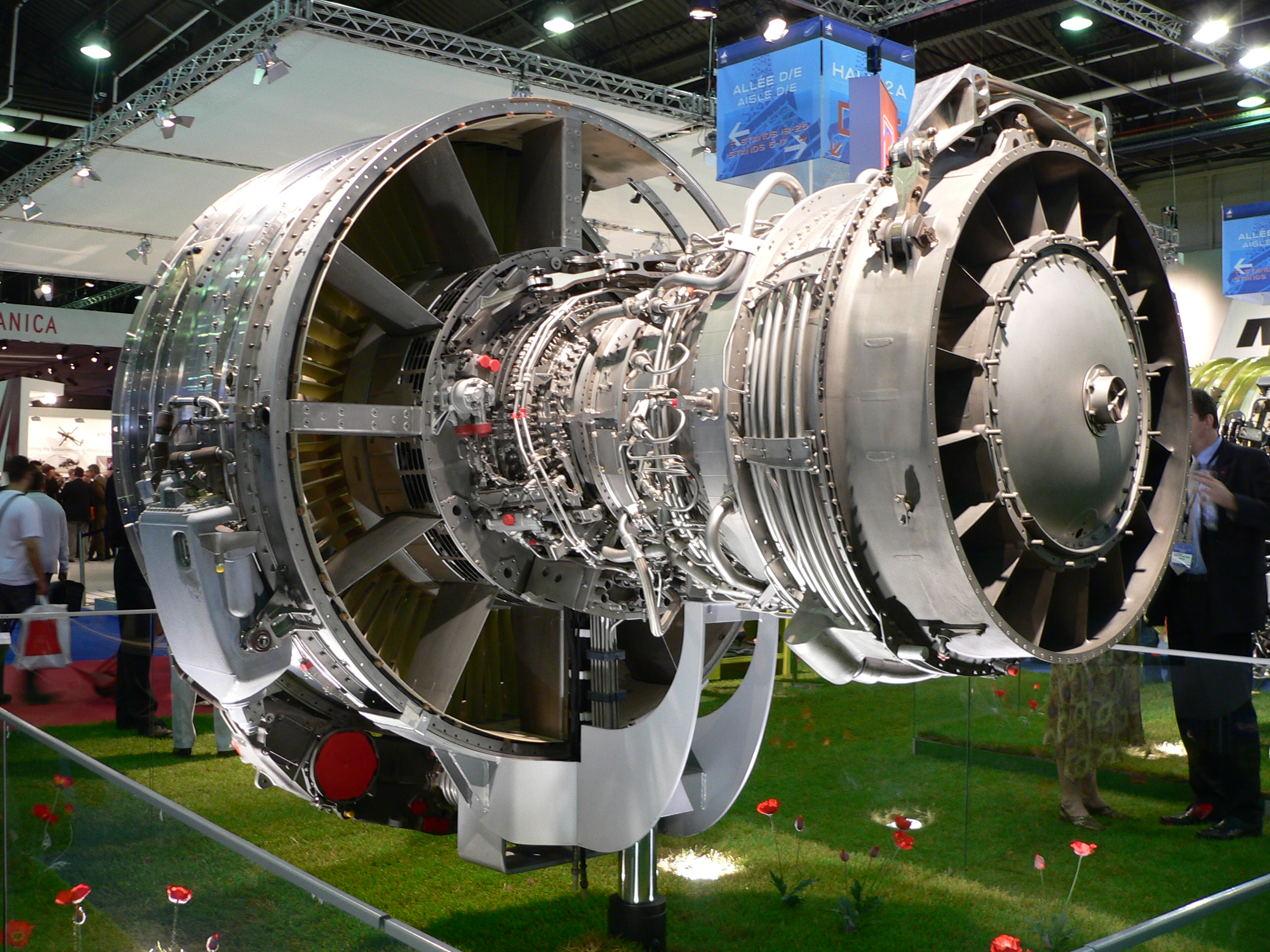

#4 CFM International

Domain Est. 2012

Website: cfmaeroengines.com

Key Highlights: The LEAP engine is the culmination of cutting-edge technology and unparalleled performance with an up to 20% improvement to fuel and CO₂ emissions. See the LEAP ……

#5

Domain Est. 1996

Website: rtx.com

Key Highlights: Marquee Products. Pratt & Whitney is a world leader in the design, manufacture and service of aircraft engines and auxiliary power units….

#6 YANMAR USA

Domain Est. 1996

Website: yanmar.com

Key Highlights: Corporate website of Yanmar America which contains news releases, products, R&D and CSR information, and much more….

#7 INNIO Waukesha Engine

Domain Est. 1996

Website: waukeshaengine.com

Key Highlights: INNIO’s Waukesha engines are purposely designed for the energy industry’s most challenging and remote applications….

#8 DEUTZ Americas

Domain Est. 1996

Website: deutzusa.com

Key Highlights: DEUTZ Corporation is a sales, service, genuine parts, and application engineering center for the Americas, supporting the DEUTZ product range….

#9 Perkins

Domain Est. 1998

#10 Detroit Engines

Domain Est. 2011

Website: demanddetroit.com

Key Highlights: Detroit® engines perform at their peak for miles and miles, with best-in-class fuel economy and low-cost maintenance and service….

Expert Sourcing Insights for Engine

H2 2026 Market Trends for Engine

As we look toward the second half of 2026, the global engine market is poised for significant transformation, driven by regulatory pressures, technological advancements, and shifting consumer demands. Here’s an analysis of the key trends expected to dominate the landscape:

1. Accelerated Electrification Across Sectors

- Automotive Dominance: Electric vehicle (EV) adoption will surge, with BEVs (Battery Electric Vehicles) capturing over 35% of new light-duty vehicle sales globally. Major OEMs will phase out internal combustion engine (ICE) development for passenger cars, focusing R&D on high-efficiency electric drivetrains.

- Commercial & Heavy-Duty Shift: Medium- and heavy-duty transport will see increased deployment of electric and hydrogen fuel cell engines, particularly in urban logistics and regional haulage, supported by expanding charging infrastructure and government incentives.

- Hybrid Resurgence: Advanced hybrid powertrains (e.g., range-extended EVs and PHEVs with larger batteries) will remain vital in markets with underdeveloped charging networks or long-distance driving patterns.

2. Sustainable Fuels Gain Traction

- E-Fuels and Biofuels: Synthetic fuels (e-fuels) and next-gen biofuels (e.g., renewable diesel, e-methanol) will see increased use in aviation, maritime, and legacy ICE vehicles, especially in regions with strict carbon neutrality targets.

- Regulatory Push: Policies like the EU’s ReFuelEU and U.S. Clean Fuel Standards will mandate minimum sustainable fuel blends, creating new markets for drop-in alternatives to fossil fuels.

3. Hydrogen Engine Development Momentum

- Heavy Industry & Transport: Hydrogen combustion engines will progress beyond pilot stages, particularly in mining, rail, and long-haul trucking, where battery weight and charging times remain constraints.

- Technology Maturity: Improved hydrogen storage, combustion efficiency, and NOx emission control will drive viability, with pilot projects scaling to commercial deployment by late 2026.

4. AI and Smart Engine Management

- Predictive Optimization: AI-powered engine control units (ECUs) will optimize fuel efficiency, emissions, and performance in real time by learning driver behavior and route conditions.

- Digital Twins & Remote Diagnostics: OEMs will deploy digital twin technology for remote monitoring, predictive maintenance, and over-the-air (OTA) updates, reducing downtime and lifecycle costs.

5. Supply Chain Resilience and Localization

- Battery & Material Security: Geopolitical concerns will accelerate regionalization of battery and critical mineral supply chains (e.g., lithium, cobalt), with North America and Europe expanding domestic refining and cell production.

- Modular Engine Platforms: Manufacturers will adopt modular designs for both ICE and electric powertrains to streamline production and adapt quickly to market shifts.

6. Stricter Emissions and Efficiency Standards

- Global Regulations: New regulations, such as Euro 7 in Europe and updated CAFE standards in the U.S., will push remaining ICE engines to near-zero emissions, favoring advanced after-treatment systems and downsized turbocharged units.

- Carbon Accounting: Lifecycle emissions (including manufacturing and fuel production) will increasingly influence policy and consumer choice, driving demand for low-carbon engine solutions.

7. Marine and Aviation Innovation

- Marine Electrification: Short-sea shipping and ferries will adopt hybrid and fully electric propulsion, while larger vessels explore ammonia and hydrogen engines.

- Aviation Transition: Urban air mobility (eVTOLs) will enter commercial service with electric propulsion, while regional aircraft developers advance hybrid-electric and hydrogen turbine prototypes.

Conclusion

By H2 2026, the engine market will be defined not by the decline of the internal combustion engine, but by the diversification of powertrain solutions. Electrification will lead in light-duty segments, while hydrogen and sustainable fuels open pathways for decarbonizing harder-to-abate sectors. Success will depend on integration of digital technologies, supply chain agility, and alignment with global sustainability goals. Companies that embrace hybrid strategies and invest in scalable, clean engine technologies will lead the next phase of mobility innovation.

Common Pitfalls Sourcing Engines (Quality, IP)

Sourcing engines—whether for vehicles, industrial equipment, or power generation—presents several critical challenges, particularly concerning quality assurance and intellectual property (IP) protection. Overlooking these aspects can lead to operational failures, legal disputes, and reputational damage. Below are key pitfalls to avoid:

Poor Quality Control and Inconsistent Standards

Engines sourced from unreliable suppliers may not meet required performance, durability, or emissions standards. Variability in manufacturing processes, lack of certification (e.g., ISO, EPA, CE), or insufficient testing protocols can result in premature failures, increased maintenance costs, and safety risks. Buyers often assume compliance without verifying production audits or requesting third-party validation, leading to substandard units.

Counterfeit or Recycled Components

A major quality risk is receiving engines containing counterfeit, used, or refurbished parts misrepresented as new. This is especially prevalent when sourcing from regions with weak regulatory oversight. Such components compromise reliability, void warranties, and may fail under load or in critical applications.

Inadequate Supplier Vetting

Failing to conduct thorough due diligence on engine manufacturers or distributors can expose buyers to unreliable partners. Red flags include lack of transparency in supply chain, absence of service history, or limited technical support. Suppliers may also subcontract without disclosing, reducing traceability and accountability.

Intellectual Property Infringement

Sourcing engines that infringe on patented designs, trademarks, or proprietary technology can lead to legal action, import seizures, or forced product recalls. This is common with “clone” engines that mimic well-known brands but violate IP rights. Buyers may unknowingly become complicit in infringement, especially when documentation is falsified or unclear.

Unclear Ownership of Design and Modifications

When sourcing custom or modified engines, ambiguity around IP ownership—especially for engineering changes or performance upgrades—can result in disputes. Suppliers may claim rights to modifications, limiting the buyer’s ability to service, replicate, or integrate the engine elsewhere.

Lack of Documentation and Traceability

Incomplete technical documentation, missing serial numbers, or absent certification records hinder quality verification and IP validation. Without traceability, it becomes difficult to confirm authenticity, conduct recalls, or prove legal use in case of IP challenges.

Insufficient Warranty and Support Agreements

Weak or poorly defined warranty terms can leave buyers exposed when quality issues arise. Some suppliers offer limited or region-locked support, making repairs or replacements difficult. Additionally, lack of access to firmware, software tools, or diagnostic systems may restrict maintenance and violate usage rights.

To mitigate these pitfalls, buyers should implement rigorous supplier qualification processes, demand full documentation and IP clearances, conduct on-site audits, and include protective clauses in contracts regarding quality standards and IP indemnification.

Logistics & Compliance Guide for Engine

This guide outlines the essential logistics and compliance considerations for the transportation, handling, storage, and regulatory adherence related to engines—whether internal combustion, electric, or hybrid—throughout the supply chain. Following these protocols ensures safety, regulatory compliance, and operational efficiency.

Transportation Requirements

Engines are classified as heavy, high-value, and potentially hazardous cargo due to fluids, materials, and size. Proper transportation planning is critical.

- Packaging & Crating: Engines must be securely crated using wooden or metal frames with internal bracing to prevent movement. Corrosion-inhibiting coatings and desiccants should be used for long-term storage or international shipping.

- Labeling: Clearly label crates with handling instructions (e.g., “Fragile,” “This Side Up”), engine model, serial number, weight, and hazardous material indicators if applicable (e.g., residual oil or coolant).

- Mode of Transport: Choose transport mode based on engine size and destination:

- Road: Standard for domestic shipments; use flatbed or step-deck trailers with load securement (straps, chains).

- Sea: Use 20’ or 40’ containers; engines must be secured to avoid shifting. Comply with IMDG Code for any hazardous residues.

- Air: Limited to smaller engines; requires IATA-compliant packaging and documentation. Declare weight and dimensions for cargo restrictions.

Hazardous Material Compliance

Engines may contain or retain substances regulated under hazardous materials (hazmat) laws.

- Residual Fluids: Oil, coolant, fuel, or hydraulic fluid must be drained per EPA and DOT regulations (49 CFR in the U.S.). Engines shipped with fluids may be classified as hazardous.

- Battery Compliance: If the engine includes or is part of a system with batteries (e.g., start-up batteries), comply with UN 38.3 testing requirements for lithium batteries under IATA/IMDG regulations.

- Documentation: Include Safety Data Sheets (SDS), hazardous waste manifests (if applicable), and proper shipping names (e.g., “Internal Combustion Engine, n.o.s., 9, UN3528”).

Import/Export Regulations

International movement of engines is subject to multiple regulatory frameworks.

- HS Codes: Use accurate Harmonized System codes (e.g., 8407 for spark-ignition engines, 8408 for compression-ignition engines) for customs declaration.

- Export Controls: Check EAR (U.S. Export Administration Regulations) or equivalent for dual-use or high-performance engines that may require licenses.

- Certificates of Origin: Required for preferential tariff treatment under trade agreements (e.g., USMCA, EU agreements).

- Customs Clearance: Provide commercial invoice, packing list, bill of lading/airway bill, and import permits if required by destination country.

Storage & Handling

Proper on-site storage prevents damage and maintains compliance.

- Indoor Storage: Store engines in dry, temperature-controlled environments to prevent condensation and corrosion.

- Orientation: Keep engines in their designated upright position unless otherwise specified by manufacturer.

- Inventory Management: Track engine serial numbers, storage dates, and compliance status (e.g., drained, preserved) using a warehouse management system (WMS).

Environmental & Safety Compliance

Adhere to environmental protection and workplace safety standards.

- Spill Prevention: Use drip trays during handling. Comply with SPCC (Spill Prevention, Control, and Countermeasure) plans if storing large quantities.

- Worker Safety: Provide PPE (gloves, steel-toe boots, lifting equipment) and training for manual handling. Use forklifts or engine hoists rated for the engine’s weight.

- End-of-Life Management: Follow WEEE (Waste Electrical and Electronic Equipment) or local recycling regulations when disposing of or recycling engines.

Regulatory Agencies & Standards

Key governing bodies and standards include:

- DOT (U.S. Department of Transportation) – Governs hazmat transport.

- EPA (Environmental Protection Agency) – Regulates emissions and hazardous waste.

- OSHA (Occupational Safety and Health Administration) – Workplace safety.

- IMO/IMDG Code – International maritime transport.

- IATA – Air transport regulations.

- ISO Standards – e.g., ISO 9001 (quality), ISO 14001 (environmental management).

Documentation Checklist

Ensure the following documents accompany engine shipments:

- Commercial Invoice

- Packing List

- Bill of Lading / Air Waybill

- Certificate of Origin

- SDS (Safety Data Sheet)

- Export License (if required)

- Customs Declarations

- Compliance Certifications (e.g., EPA, CARB, CE marking)

Maintaining accurate, up-to-date documentation is vital for audit readiness and customs clearance.

Summary

Effective logistics and compliance for engine shipments require coordination across packaging, transportation, regulatory adherence, and documentation. By following this guide, organizations can mitigate risks, avoid delays, and ensure safe, lawful distribution of engine products globally. Regular training and compliance audits are recommended to maintain standards.

Conclusion for Sourcing Engine:

In conclusion, the sourcing engine plays a pivotal role in streamlining procurement processes, enhancing supplier discovery, and improving decision-making through data-driven insights. By leveraging automation, intelligent matching algorithms, and comprehensive supplier databases, it enables organizations to identify the most suitable vendors based on cost, quality, reliability, and compliance criteria. The implementation of a robust sourcing engine not only increases operational efficiency and reduces time-to-hire or time-to-supply but also supports strategic sourcing initiatives, fosters supplier diversity, and ensures greater transparency across the supply chain. As businesses continue to face increasing market complexity and demand for agility, investing in an advanced sourcing engine becomes essential for achieving sustainable competitive advantage and long-term supply chain resilience.