The global energy meter market is undergoing rapid transformation, driven by increasing demand for accurate energy measurement, rising adoption of smart grid technologies, and aggressive energy efficiency initiatives worldwide. According to Grand View Research, the global smart electricity meter market size was valued at USD 10.2 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. Similarly, Mordor Intelligence projects the overall energy meter market to grow at a CAGR of over 5.5% during the forecast period (2023–2028), fueled by utility modernization programs and the integration of renewable energy sources into power grids. As digitalization accelerates across energy infrastructure, manufacturers leading the charge are combining IoT-enabled features, advanced metering infrastructure (AMI), and data analytics to meet evolving regulatory and consumer needs. In this dynamic landscape, the top nine energy meter manufacturers have emerged as key innovators, shaping the future of energy monitoring across residential, commercial, and industrial sectors.

Top 9 Energy Meter Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 E

Domain Est. 1988

Website: buildings.honeywell.com

Key Highlights: E-Mon Submetering System. Honeywell’s leading technology provides precise and reliable metrics to enable effective energy management throughout your building….

#2 Power Metering & Monitoring

Domain Est. 2000

Website: dentinstruments.com

Key Highlights: At DENT Instruments, we take great pride in the design and manufacture of industry-leading power meters, submeters, and current sensors. Our ……

#3 Itron

Domain Est. 1993

Website: na.itron.com

Key Highlights: Itron is innovating new ways for utilities and cities to manage energy and water · 8,000+. Customers in 100 countries · 285M+. Communicating Endpoints Delivered….

#4 to Diehl Metering

Domain Est. 1996

Website: diehl.com

Key Highlights: We pioneer solutions and services to make water and energy metering more intelligent. Through innovation, digitalization and customization….

#5 Kamstrup

Domain Est. 1996

Website: kamstrup.com

Key Highlights: Kamstrup provides smart metering solutions for utilities and submetering within electricity, water, heat energy and cooling. See our solutions….

#6 Sensus

Domain Est. 1996

Website: sensus.com

Key Highlights: From cutting-edge electric, gas, and water meters to advanced infrastructure solutions, you can infuse intelligence into every corner of your network. Drive ……

#7 EIG

Domain Est. 1996

Website: electroind.com

Key Highlights: Improving Reliability, Efficiency, Sustainability. Exclusively Integrated Energy & PQ Monitoring Solutions Utilizing AI & Deep Expertise….

#8 IOT(Internet Of Things) Hardware & Software Company, Solution …

Domain Est. 2017

Website: iammeter.com

Key Highlights: Iammeter is a dedicated Energy Monitoring System, to which you can connect our Wi-Fi energy meters and then start to track the electricity usage of your home….

#9 Energy meters

Website: iskra.eu

Key Highlights: Our energy meters with power displays have housing for panel mounting. Some of them can also display momentary power in single and three phase systems with ……

Expert Sourcing Insights for Energy Meter

H2 2026 Market Trends for Energy Meters

The global energy meter market in H2 2026 is poised for significant transformation, driven by accelerating decarbonization goals, grid modernization efforts, and technological advancements. Key trends shaping the market include:

-

Accelerated Smart Meter Rollout & AMI Maturation:

- Global Expansion: Large-scale Advanced Metering Infrastructure (AMI) deployments, particularly in Europe, North America, and parts of Asia-Pacific (e.g., India, Japan), will reach critical mass. Mature markets will focus on replacing first-generation smart meters nearing end-of-life.

- Beyond Basic Billing: Focus shifts from basic remote reading to leveraging AMI data for grid optimization, outage management, voltage monitoring, and integrating distributed energy resources (DERs). Two-way communication becomes standard.

- Regulatory Push: Government mandates and incentives for grid resilience and renewable integration will continue to be primary drivers, especially in regions with high renewable penetration targets.

-

Rise of Advanced Metering & Grid Edge Intelligence:

- Advanced Metering Applications (AMA): Increased adoption of meters with enhanced functionalities like:

- High-Frequency Sampling: Enabling detailed load profiling, power quality monitoring, and non-intrusive appliance load monitoring (NILM) for consumer insights and grid analytics.

- Integrated Grid Edge Devices: Meters evolving into grid edge platforms, incorporating functionalities like local control logic, basic DER integration management, and enhanced cybersecurity features.

- Power Quality Meters: Growing demand for meters capable of monitoring voltage sags/swells, harmonics, and transients, crucial for grid stability with variable renewables and sensitive electronics.

- Advanced Metering Applications (AMA): Increased adoption of meters with enhanced functionalities like:

-

Deepening Integration of Distributed Energy Resources (DERs):

- Bidirectional Metering: Essential for net metering and feed-in tariffs, bidirectional meters (especially for solar PV and EVs) will see surging demand. Accuracy under reverse power flow is critical.

- EV Charging Integration: Meters will increasingly be bundled with or communicate directly with EV chargers, enabling dynamic load management, time-of-use (TOU) billing for charging, and vehicle-to-grid (V2G) readiness.

- Prosumer Management: Meters will play a key role in enabling and managing “prosumers” (consumers who also produce energy), requiring sophisticated data handling for settlement and grid services.

-

Focus on Cybersecurity and Data Privacy:

- Heightened Threats: As meters become critical grid nodes and data sources, they are prime targets. H2 2026 will see stricter cybersecurity standards (e.g., NIST, ENISA, IEC 62351) being enforced globally.

- Enhanced Security Features: Widespread adoption of secure hardware (HSMs, TPMs), robust encryption (end-to-end), secure update mechanisms, and zero-trust architectures in new meter deployments.

- Data Privacy Regulations: Compliance with evolving data privacy laws (like GDPR, CCPA, and regional equivalents) will be paramount, influencing data collection, storage, and anonymization practices.

-

Technology Convergence and Communication Evolution:

- Multi-Technology Networks: AMI networks will increasingly utilize a mix of communication technologies (RF Mesh, Cellular NB-IoT/LTE-M/5G, PLC, LoRaWAN) for optimal coverage, cost, and bandwidth, managed by convergent platforms.

- 5G & IoT Impact: Early adoption of 5G for specific high-bandwidth, low-latency applications (e.g., real-time grid control, V2G) will begin, while NB-IoT/LTE-M solidify as the backbone for massive IoT meter connectivity.

- Edge Computing: Processing data closer to the source (at the meter or substation) will increase for faster response times, reduced network load, and enhanced privacy.

-

Sustainability and Circular Economy:

- Eco-Design: Increased focus on energy-efficient meter designs, reduced material usage, and recyclability driven by regulations (e.g., EU Ecodesign) and ESG pressures.

- Lifecycle Management: Utilities will prioritize meter lifecycle management, including secure data wiping and responsible recycling/reuse programs for end-of-life devices.

-

Market Consolidation and Value-Added Services:

- Vendor Consolidation: The market will likely see further consolidation among meter manufacturers and AMI solution providers as competition intensifies and scale becomes crucial.

- Shift to Services: Vendors will increasingly offer bundled solutions beyond hardware, including managed services, data analytics platforms, cybersecurity services, and DER integration consultancy.

In summary, H2 2026 will see the energy meter market transition from a simple measurement device to an intelligent, secure grid edge node. The focus will be on enabling grid flexibility, integrating renewables and EVs, leveraging data for grid optimization, and ensuring robust cybersecurity, all within an increasingly regulated and sustainability-conscious landscape. Vendors and utilities that embrace these advanced functionalities and service-oriented models will be best positioned for success.

Common Pitfalls When Sourcing Energy Meters (Quality, IP)

Sourcing energy meters involves more than just comparing prices and specifications—overlooking critical aspects related to quality and intellectual property (IP) can lead to long-term operational, legal, and financial risks. Below are common pitfalls to avoid:

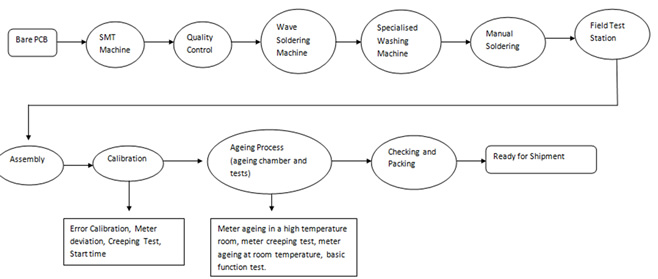

Poor Quality Control and Inconsistent Performance

One of the most frequent issues when sourcing energy meters—especially from low-cost manufacturers—is inconsistent quality. Meters may pass initial inspections but degrade quickly in the field due to substandard components (e.g., inferior current sensors, low-grade PCBs, or unreliable firmware). This leads to inaccurate readings, frequent failures, and increased maintenance costs. Buyers often discover too late that the supplier lacks robust quality management systems (e.g., ISO 9001 certification) or skips essential testing phases like temperature cycling, electromagnetic compatibility (EMC), or long-term calibration stability.

Lack of Regulatory and Certification Compliance

Energy meters must comply with regional standards such as IEC 62053, MID (Measuring Instruments Directive) in Europe, or ANSI C12 in North America. A common pitfall is assuming that a supplier’s claim of compliance is valid without verifying certified test reports or official certification marks. Some suppliers may provide meters with counterfeit or expired certifications, exposing the buyer to regulatory penalties, rejected installations, or safety hazards. Always request valid, third-party test certificates and verify them with certification bodies.

Inadequate IP Protection and Risk of Infringement

When sourcing, especially from regions with lax IP enforcement, there’s a risk of procuring meters that infringe on patented technologies (e.g., communication protocols, metering algorithms, or housing designs). Using such products may expose your organization to legal action from original equipment manufacturers (OEMs). Additionally, if you’re developing a branded meter solution, failing to secure IP rights for firmware, software interfaces, or hardware modifications can result in loss of exclusivity or revenue.

Hidden Software and Firmware Risks

Many modern energy meters include embedded firmware for data logging, communication (e.g., via Modbus, M-Bus, or DLMS/COSEM), and remote updates. A critical pitfall is not auditing the firmware’s origin or licensing. Some suppliers use open-source software without complying with license terms (e.g., GPL), potentially exposing downstream users to legal risks. Furthermore, backdoors or weak cybersecurity in firmware can compromise data integrity and grid security.

Insufficient Supplier Transparency and Traceability

Suppliers may not disclose their component sources or manufacturing locations, making it difficult to assess quality or respond to failures. Lack of traceability—such as serial numbers linked to production batches or firmware versions—complicates root cause analysis during field failures. Always require documentation on bill of materials (BOM), component sourcing, and production traceability.

Overlooking Long-Term Support and Calibration

Energy meters require periodic recalibration and technical support over their lifecycle (often 10–15 years). A common oversight is selecting suppliers without a clear roadmap for long-term support, spare parts availability, or firmware updates. If the supplier discontinues a model or goes out of business, maintaining meter accuracy and compliance becomes extremely difficult.

Inadequate Testing for Environmental Conditions

While IP (Ingress Protection) ratings indicate resistance to dust and water (e.g., IP51, IP65), not all meters perform reliably under real-world conditions. A meter rated IP65 may still fail due to poor sealing design or material degradation when exposed to UV radiation, extreme temperatures, or chemical pollutants. Buyers should verify environmental testing beyond IP ratings, such as salt spray tests or UV resistance, particularly for outdoor installations.

By addressing these pitfalls early—through rigorous supplier vetting, independent testing, IP audits, and contractual safeguards—organizations can ensure reliable, compliant, and legally secure energy meter deployments.

Logistics & Compliance Guide for Energy Meters

This guide outlines the key logistics and compliance considerations for the transportation, handling, and regulatory approval of energy meters, ensuring smooth deployment and adherence to international and local standards.

Regulatory and Certification Requirements

Energy meters must comply with a range of national and international standards to be legally installed and used. Key certifications include:

- IEC 62055 & IEC 62053: International standards for payment systems and general requirements for static electricity meters.

- MID (Measuring Instruments Directive): Required for energy meters sold in the European Economic Area (EEA); mandates CE marking and a Notified Body assessment.

- ANSI C12.20: Applies to electricity meters in North America, specifying accuracy and performance criteria.

- NMI (National Measurement Institute) Approval: Required in countries like Australia; ensures compliance with local metrology laws.

- Type Approval by Local Authorities: Many countries require specific type approval from national regulatory bodies (e.g., PTCRB in the U.S., KTC in South Korea).

Ensure all meters are supplied with valid test reports, calibration certificates, and conformity declarations before shipment.

Packaging and Handling Specifications

Proper packaging is critical to prevent damage during transit and maintain calibration integrity:

- Use anti-static, shock-absorbent packaging materials to protect sensitive electronic components.

- Secure meters in rigid containers with internal dividers to prevent movement.

- Label packages with “Fragile,” “This Side Up,” and “Protect from Moisture” indicators.

- Include desiccant packs in packaging for humid environments.

- Avoid stacking packages beyond recommended weight limits to prevent crushing.

Transportation and Shipping Considerations

Energy meters must be transported under controlled conditions to maintain performance and compliance:

- Use climate-controlled transport where possible to avoid exposure to extreme temperatures (typically -25°C to +70°C for storage).

- Avoid prolonged exposure to high humidity (>95% RH) to prevent condensation and corrosion.

- Choose freight partners experienced in handling precision instrumentation.

- Maintain a documented chain of custody, especially for meters requiring sealed or tamper-proof transport.

- For international shipments, ensure compliance with IATA/IMDG regulations if batteries (e.g., for backup) are included.

Import and Export Compliance

Cross-border shipments require adherence to customs and trade regulations:

- Classify meters correctly under the Harmonized System (HS Code), typically under 9028.30 (electricity meters).

- Prepare commercial invoices, packing lists, and certificates of origin.

- Verify export controls (e.g., ECCN under the U.S. EAR) to determine if licenses are required.

- Comply with import duties, VAT, and local customs clearance procedures in the destination country.

- Ensure all documentation includes model numbers, serial numbers, and certification references.

Installation and Field Compliance

Post-delivery compliance ensures accurate operation and regulatory acceptance:

- Install meters only by certified personnel following local electrical codes (e.g., NEC in the U.S., IEC 60364 internationally).

- Perform initial calibration verification and seal application as required by utility or regulatory authorities.

- Record meter serial numbers and installation locations for traceability and audit purposes.

- Submit required documentation (e.g., installation reports, verification certificates) to the local grid operator or regulatory body.

Maintenance and Recertification

Energy meters require periodic testing and recertification to remain compliant:

- Follow manufacturer-recommended maintenance schedules.

- Recalibrate and retest meters at intervals specified by local regulations (e.g., every 5–10 years).

- Keep detailed service logs and update certification records.

- Decommission and dispose of obsolete meters in accordance with WEEE (Waste Electrical and Electronic Equipment) directives or local e-waste regulations.

Adhering to this logistics and compliance framework ensures that energy meters meet technical, legal, and operational standards throughout their lifecycle.

Conclusion for Sourcing Energy Meters:

In conclusion, sourcing energy meters requires a strategic approach that balances accuracy, reliability, cost-effectiveness, and compliance with regulatory standards. Selecting the right energy meter involves evaluating technical specifications, energy efficiency features, communication capabilities (such as smart metering and remote monitoring), and long-term maintenance requirements. It is essential to partner with reputable suppliers who offer certified products, technical support, and scalable solutions that can adapt to future energy management needs.

Furthermore, considering the growing emphasis on sustainability and energy conservation, investing in advanced metering infrastructure not only enhances billing accuracy but also supports demand-side management, reduces energy losses, and contributes to overall operational efficiency. A well-informed sourcing decision today ensures long-term benefits in energy monitoring, cost savings, and environmental responsibility.