The global end mill milling cutter market is experiencing robust expansion, driven by rising demand across industries such as automotive, aerospace, mold & die, and general manufacturing. According to a 2023 report by Mordor Intelligence, the market was valued at USD 4.8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.6% from 2023 to 2028, reaching an estimated USD 6.7 billion by 2028. This growth is fueled by the increasing adoption of advanced machining technologies, tighter manufacturing tolerances, and the need for higher efficiency in CNC machining operations. Additionally, Grand View Research highlights that the expanding industrial automation landscape and the proliferation of high-precision components—especially in electric vehicles and aerospace applications—are further accelerating demand for high-performance end mills. As competition intensifies, innovation in coating technologies, substrate materials, and design optimization has become a key differentiator among leading manufacturers. In this evolving marketplace, identifying the top players who combine technological excellence with global reach is critical for procurement professionals and manufacturing leaders alike. Below, we explore the top 10 end mill milling cutter manufacturers shaping the future of precision machining.

Top 10 End Mill Milling Cutter Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 High-Quality Cutting Tools

Domain Est. 1996

Website: widia.com

Key Highlights: WIDIA offers a wide range of cutting tools and solutions for industrial applications. Explore their website for high-quality tools and expert advice….

#2 Carbide End Mills

Domain Est. 1995

Website: guhring.com

Key Highlights: Guhring is somewhat unique amongst carbide end mill manufacturers in that Guhring produces its own carbide rod, which is the substrate material for all Guhring ……

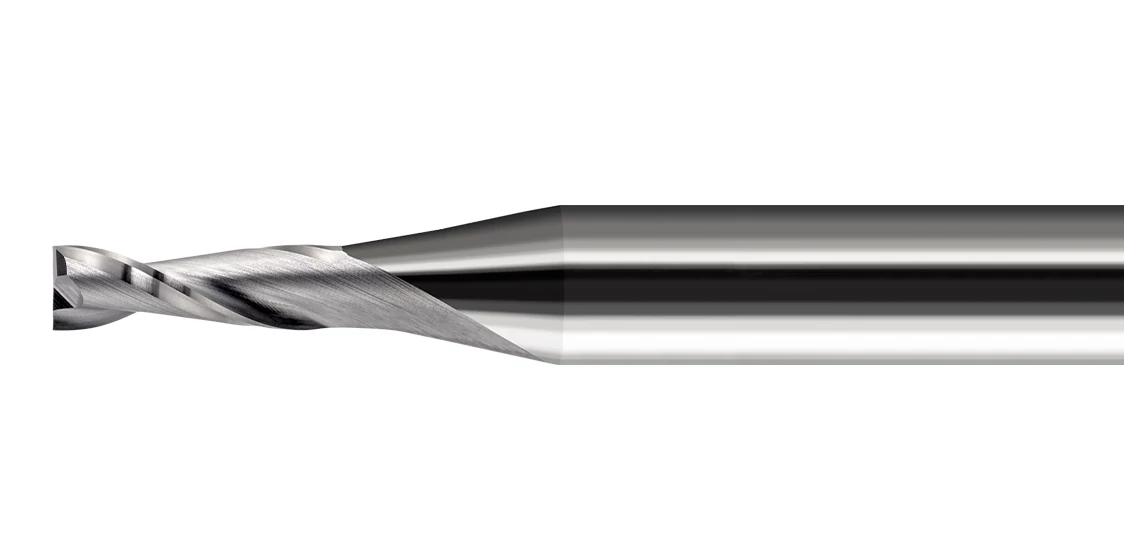

#3 SPEED TIGER

Domain Est. 2020 | Founded: 1998

Website: speedtigertools.com

Key Highlights: Speed Tiger, founded in 1998, is the leading manufacturer of carbide end mills and the largest cutting tools manufacturer in Taiwan….

#4 Solid Carbide End Mills for Any Milling Operation

Domain Est. 1996

Website: fullertontool.com

Key Highlights: Our Fantom high-performance end mill is a robust cutter that allows heavier chip loads and produces superior part finishes in steels, super alloys, ……

#5 Harvey Tool

Domain Est. 1997

Website: harveytool.com

Key Highlights: For over 30 years Harvey Tool has been providing specialty carbide end mills and cutting tools to the metalworking industry. Find your local cutting tool ……

#6 Ingersoll Cutting Tools

Domain Est. 2001

Website: ingersoll-imc.com

Key Highlights: A world leader in the design and manufacture of milling, turning, and holemaking tools, an expert in project – focused engineering of special cutting tool ……

#7 Gorilla Mill

Domain Est. 2011

Website: gorillamill.com

Key Highlights: Carbide End Mills · Knuckle Roughers · Rougher/Finishers · Chip Breakers · High Feed … GORILLA MILL NAMED A 2023 FUTURE 50 COMPANY. LEARN MORE. My orders. View ……

#8 High Performance End Mills

Domain Est. 2016

Website: kyocera-sgstool.com

Key Highlights: 4 Flute End Mills: Negative rake, heavy core, and higher helix for strength and shearing of hard mold & die materials….

#9 Milling

Domain Est. 2017

Website: archcuttingtools.com

Key Highlights: We provide cutting tools for your milling application including high performance carbide end mills, PCD Mills, Tapered Rib Cutters, Ball End Mills, Corner ……

#10 YG

Domain Est. 2001

Website: yg1usa.com

Key Highlights: Indexable Insert Modular Milling. CBN; CBN 2 FLUTE 30 DEGREE HELIX BALL END MILL · CBN 2 FLUTE 30 DEGREE HELIX CORNER RADIUS END MILL … Company Profile…

Expert Sourcing Insights for End Mill Milling Cutter

2026 Market Trends for End Mill Milling Cutters

The global end mill milling cutter market is poised for significant transformation by 2026, driven by technological advancements, evolving manufacturing demands, and shifting industrial landscapes. Key trends shaping the market include:

Advancement in Cutting Materials and Coatings

The adoption of advanced materials such as polycrystalline diamond (PCD), cubic boron nitride (CBN), and next-generation carbide grades is accelerating. Enhanced PVD and CVD coatings—including AlTiN, TiSiN, and diamond-like carbon (DLC)—are improving tool life, heat resistance, and performance in high-speed machining. These innovations enable end mills to tackle harder materials like titanium, Inconel, and high-strength alloys prevalent in aerospace and medical sectors.

Growth in High-Performance and Specialized End Mills

Demand for high-efficiency milling (HEM) and variable helix/helix end mills is rising to support aggressive material removal rates and improved surface finishes. Industry-specific solutions—such as micro-end mills for electronics and long-reach tools for mold & die—are gaining traction. Customized and application-specific tooling will be a competitive differentiator by 2026.

Integration with Smart Manufacturing and Industry 4.0

End mills are increasingly being integrated into smart machining ecosystems. Sensors embedded in tool holders and spindle systems enable real-time monitoring of tool wear, vibration, and temperature. Predictive maintenance algorithms and digital twins are optimizing tool life and reducing unplanned downtime, aligning with broader Industry 4.0 initiatives.

Sustainability and Circular Economy Focus

Manufacturers are prioritizing sustainable practices, including regrinding and reconditioning programs to extend tool life. Reduced coolant consumption through minimum quantity lubrication (MQL) and dry machining is influencing end mill design for better thermal management. Eco-friendly production processes and recyclable materials are becoming key selling points.

Regional Manufacturing Shifts and Supply Chain Resilience

Geopolitical dynamics and nearshoring trends are reshaping production hubs, particularly in North America, India, and Southeast Asia. This shift is driving localized demand for precision cutting tools. Companies are diversifying supply chains and investing in regional production to mitigate risks and respond faster to customer needs.

Rising Demand from Key Industries

The aerospace, automotive (especially electric vehicles), energy (wind and renewable), and medical device sectors are primary growth drivers. These industries require high-precision, durable end mills capable of machining complex geometries and advanced materials, further fueling innovation and market expansion.

In summary, the 2026 end mill market will be defined by material innovation, digital integration, sustainability, and responsiveness to high-tech industrial demands—positioning advanced milling cutters as critical enablers of modern precision manufacturing.

Common Pitfalls When Sourcing End Mill Milling Cutters: Quality and Intellectual Property Risks

Logistics & Compliance Guide for End Mill Milling Cutters

Product Classification and HS Code

End Mill Milling Cutters are typically classified under the Harmonized System (HS) Code 8207.50, which covers interchangeable tools for hand tools or machine tools, involving cutting tools made of metal. Accurate classification is essential for customs clearance, duty assessment, and international shipping. Confirm the exact HS code based on material composition (e.g., solid carbide vs. high-speed steel) and country-specific tariff schedules.

Import and Export Regulations

Compliance with import/export regulations is required in both the origin and destination countries. Exporters must verify whether end mills are subject to export controls, especially if made from strategic materials or intended for military applications. In the U.S., check the Commerce Control List (CCL) under the Export Administration Regulations (EAR); most standard end mills fall under EAR99 and are low-risk, but verification is recommended.

Customs Documentation

Ensure all shipments include the following documentation:

– Commercial Invoice (with detailed product description, unit value, total value, and HS code)

– Packing List (itemizing quantity, weight, and packaging type)

– Bill of Lading or Air Waybill

– Certificate of Origin (required by some countries for preferential tariff treatment)

– Export Declaration (if required by exporting country)

Packaging and Labeling Requirements

End mill cutters must be securely packaged to prevent damage during transit. Use anti-corrosion materials (e.g., VCI paper) and rigid containers. Label packages with:

– Product name and model number

– Quantity and net weight

– Manufacturer name and address

– HS code and country of origin

– Handling symbols (e.g., “Fragile,” “This Side Up”)

Transportation and Handling

Use reliable freight forwarders experienced in tooling shipments. For air freight, comply with IATA regulations; for ocean freight, adhere to IMDG Code if applicable (though end mills are typically non-hazardous). Avoid exposure to moisture and extreme temperatures. Implement proper inventory rotation (FIFO) to prevent stock obsolescence.

Country-Specific Compliance

Different markets have unique requirements:

– European Union: CE marking is not typically required for end mills, but REACH and RoHS compliance regarding restricted substances (e.g., cobalt in carbide) must be assessed.

– United States: No special certification needed for standard end mills, but ensure compliance with OSHA and EPA guidelines if coatings or packaging involve hazardous materials.

– China: May require CCC certification for certain industrial tools—verify based on product specifications.

– Russia/Eurasian Economic Union (EAEU): May require EAC certification depending on tool type and application.

Intellectual Property and Branding

Ensure trademarks and designs do not infringe on existing IP in target markets. Counterfeit or unlicensed reproduction of branded end mills (e.g.,模仿知名品牌) can lead to seizure at customs and legal penalties.

Environmental and Safety Compliance

Dispose of damaged or expired end mills per local environmental regulations, especially those containing tungsten carbide or cobalt. Provide Safety Data Sheets (SDS) if requested, particularly for coated or chemically treated cutters.

Recordkeeping and Audit Readiness

Maintain complete records of shipments, compliance checks, certifications, and supplier documentation for a minimum of five years. This supports audits and resolves customs inquiries efficiently.

Best Practices Summary

- Verify HS codes and duty rates before shipping.

- Partner with customs brokers familiar with industrial tooling.

- Monitor changes in trade policies (e.g., tariffs, sanctions).

- Train logistics staff on proper classification and documentation.

- Conduct periodic compliance reviews for all international shipments.

Conclusion for Sourcing End Mill Milling Cutters

In conclusion, sourcing end mill milling cutters requires a strategic approach that balances quality, cost, and supplier reliability. Selecting the right end mills involves understanding the specific machining requirements, including material type, application, precision needs, and production volume. High-performance materials such as solid carbide, cobalt steel, or coated variants significantly impact tool life and machining efficiency.

When sourcing, it is essential to evaluate suppliers based on product quality certifications, technical support, delivery timelines, and after-sales service. Establishing relationships with reputable manufacturers or authorized distributors ensures authenticity and consistency. Additionally, considering total cost of ownership—rather than just initial price—helps achieve long-term savings through improved tool life and reduced downtime.

Ultimately, effective sourcing of end mill cutters contributes directly to enhanced machining performance, reduced operational costs, and improved manufacturing output. Regular review of supplier performance and staying updated on technological advancements in cutting tools will further support continuous improvement in production capabilities.