The global Titanium (Ti) market is experiencing robust growth, driven by increasing demand from aerospace, industrial, and medical sectors. According to a report by Mordor Intelligence, the titanium market was valued at USD 7.83 billion in 2023 and is projected to reach USD 11.32 billion by 2029, growing at a CAGR of 6.3% during the forecast period. This expansion underscores the critical need for manufacturers to optimize their operations around key performance elements. As competition intensifies and supply chain complexities rise, leading Ti producers are focusing on a core set of eight strategic factors—spanning raw material sourcing, energy efficiency, process innovation, product purity, regulatory compliance, geopolitical risk management, R&D investment, and vertical integration—to maintain cost leadership and meet evolving industry standards. These elements are increasingly data-informed, with analytics driving improvements in yield, quality control, and time-to-market, positioning them as essential pillars for success in a rapidly scaling sector.

Top 8 Element For Ti Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

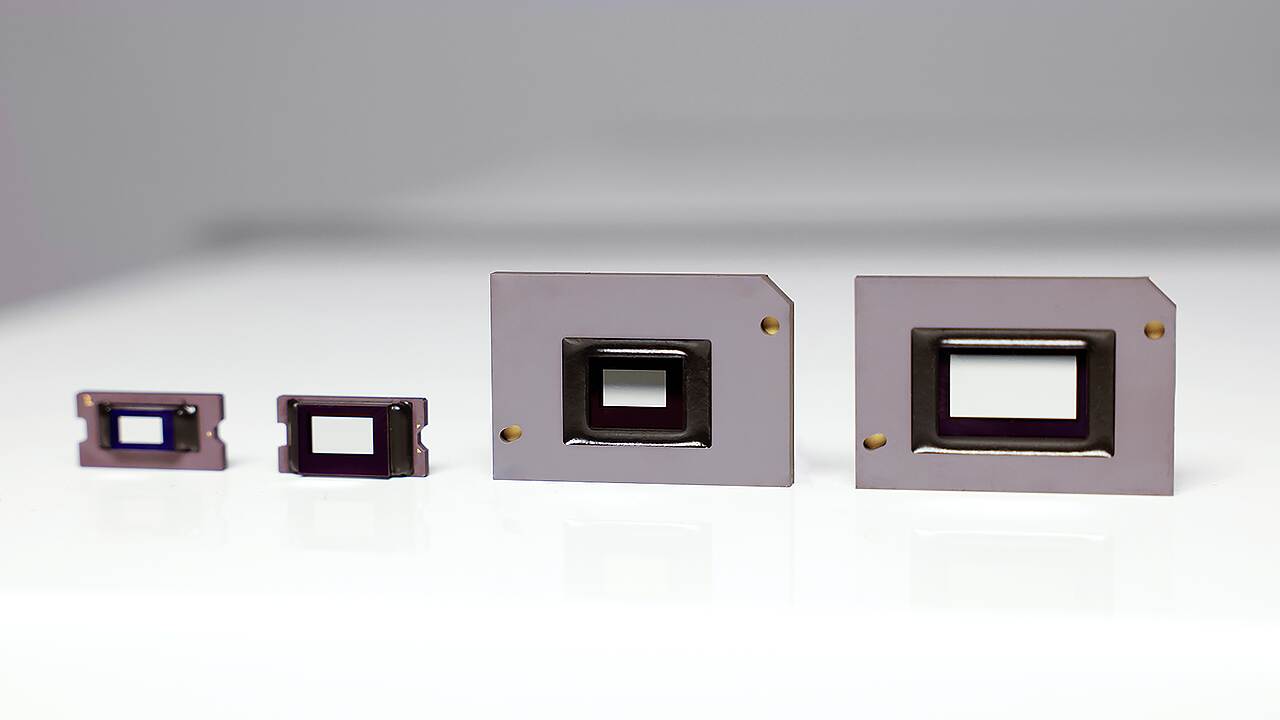

#1 DLP products

Domain Est. 1986

Website: ti.com

Key Highlights: Texas Instruments DLP® technology powers industry-leading projection and display systems through the precise control of millions of microscopic mirrors….

#2 Titanium Industries, Inc.

Domain Est. 1995

Website: titanium.com

Key Highlights: Titanium Industries is a global leader in Specialty Metals supply. Complete inventory of Titanium Round Bar, Titanium Plate & Sheet, and more….

#3 Tronox

Domain Est. 2004

Website: tronox.com

Key Highlights: Tronox mines and processes titanium ore, zircon, rare earths and other materials, and manufactures titanium dioxide pigment….

#4 Titanium – Element information, properties and uses

Domain Est. 1993

Website: periodic-table.rsc.org

Key Highlights: Titanium metal has some very valuable properties. In practice, it is pretty unreactive because, like aluminium, it forms a thin protective layer of the oxide, ……

#5 Titanium Suppliers

Domain Est. 1998

Website: americanelements.com

Key Highlights: Titanium qualified commercial & research quantity preferred supplier. Buy at competitive price & lead time. In-stock for immediate delivery….

#6 ATI

Domain Est. 2013

Website: atimaterials.com

Key Highlights: Our capabilities range from alloy development and vacuum melting to rolling, forging, powder and additive manufacturing, with high-value fabrication services ……

#7 Titanium

Domain Est. 2013

Website: niocorp.com

Key Highlights: Titanium has the highest strength-to-density ratio of any metallic element, and it is used in wide variety of sectors, including aerospace, national defense, ……

#8 Element22

Website: element22.de

Key Highlights: We manufacture titanium parts and components by Metal Injection Molding and 3D printing. You can also purchase our patented materials for your own production….

Expert Sourcing Insights for Element For Ti

H2: 2026 Market Trends for Element For Ti

As of 2026, the market for titanium (Ti) and its associated elemental applications continues to experience dynamic shifts driven by technological advancements, sustainability demands, and evolving industrial needs. While “Element For Ti” may refer to titanium itself or elemental materials used in titanium production or alloying (such as aluminum, vanadium, or magnesium), this analysis focuses on the broader titanium ecosystem, including raw titanium, titanium alloys, and enabling elemental components.

-

Increased Demand in Aerospace and Defense

Titanium remains a cornerstone material in aerospace due to its high strength-to-density ratio, corrosion resistance, and performance at elevated temperatures. By 2026, the global push for next-generation aircraft, hypersonic vehicles, and satellite infrastructure is amplifying demand for Ti-6Al-4V and other advanced titanium alloys. This trend supports sustained growth in the market for elemental additives like aluminum and vanadium, which are critical in alloy formulation. -

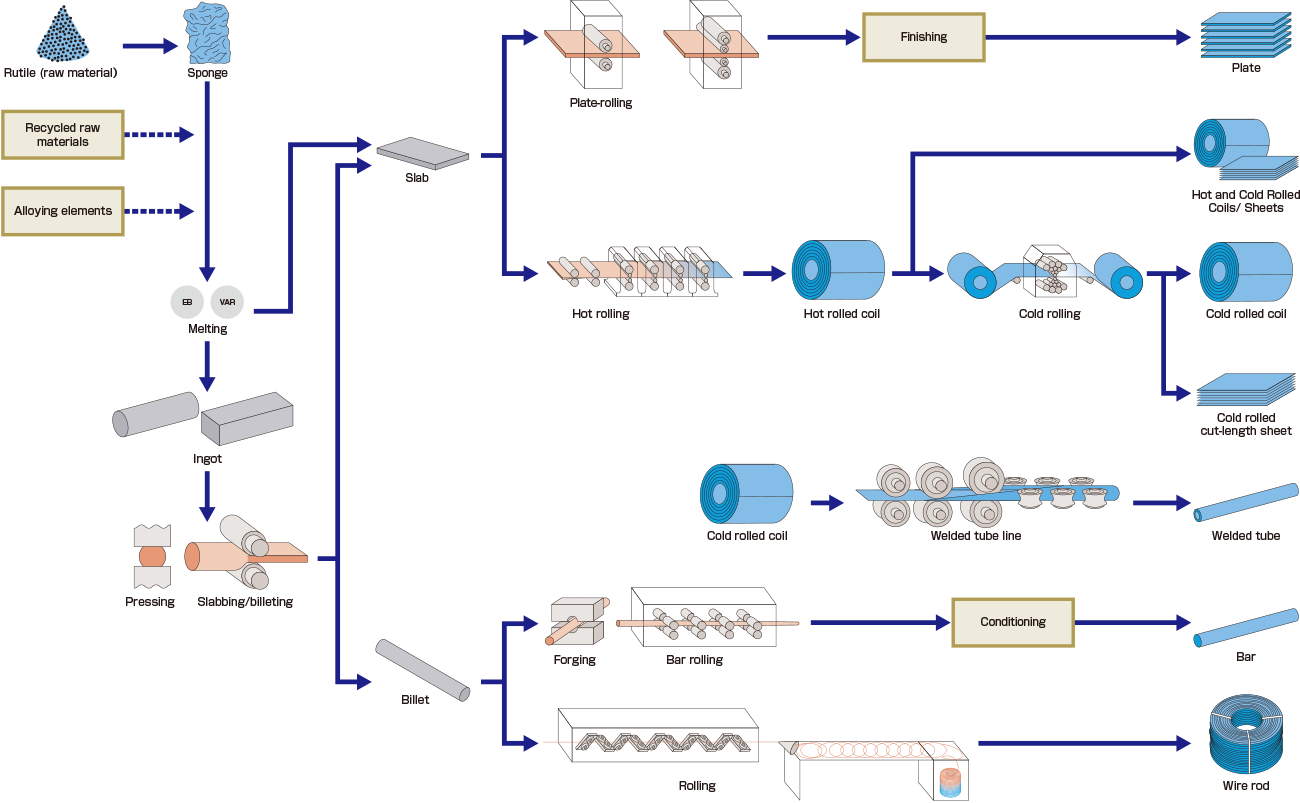

Growth in Additive Manufacturing (3D Printing)

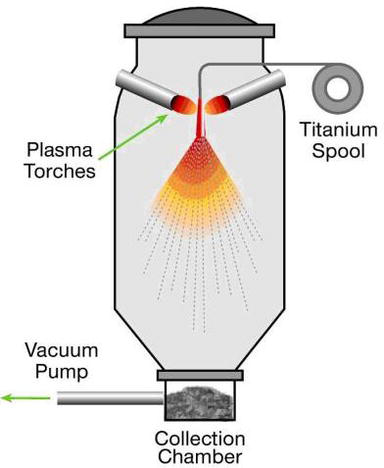

The adoption of titanium powders in additive manufacturing has accelerated across aerospace, medical, and high-performance automotive sectors. In 2026, innovations in powder metallurgy and recycling of titanium scrap are reducing production costs and improving supply chain resilience. This trend is increasing demand for high-purity elemental forms of titanium and alloying elements compatible with 3D printing processes. -

Sustainability and Green Titanium Initiatives

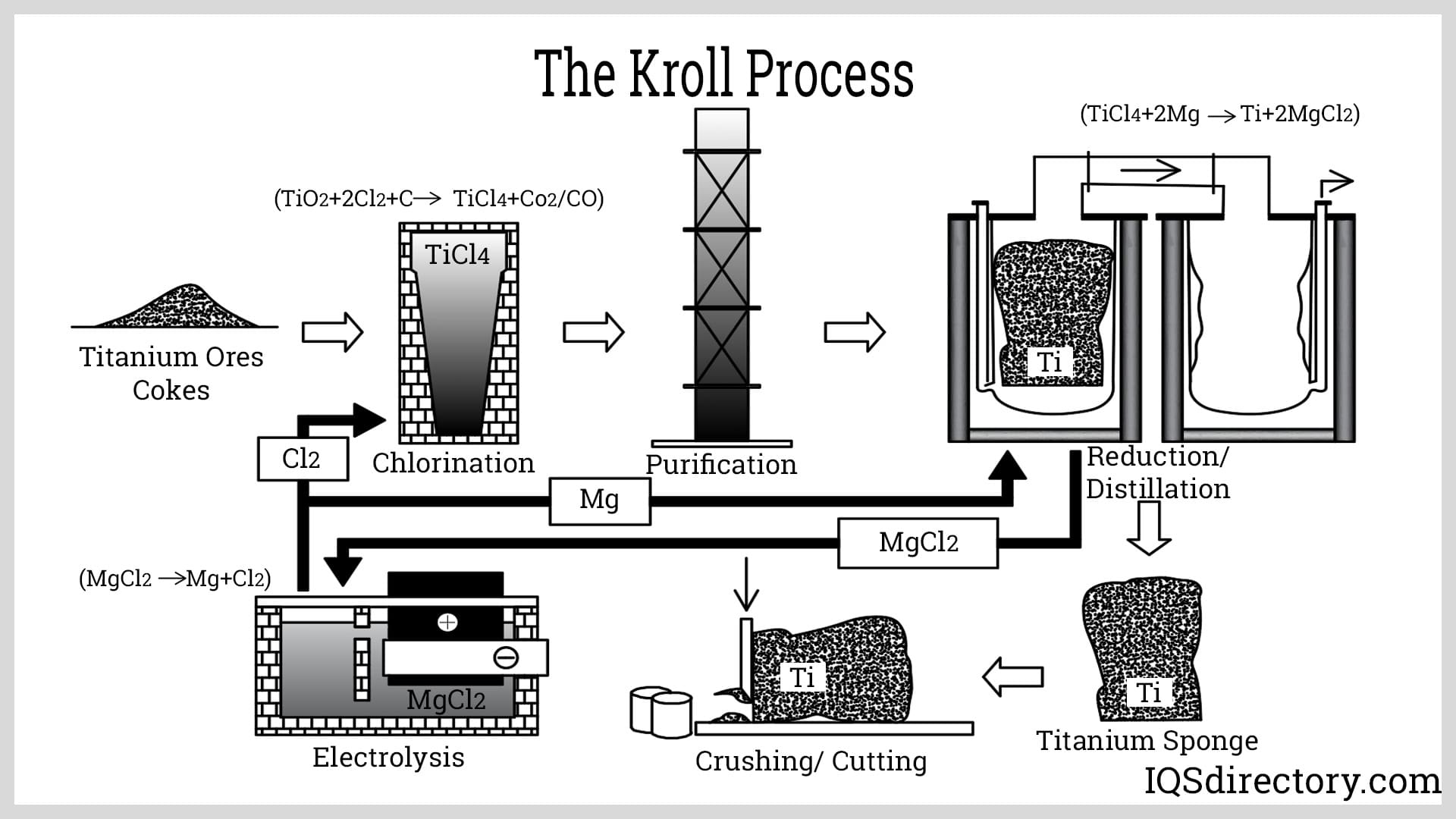

Environmental regulations and corporate ESG (Environmental, Social, and Governance) goals are pushing manufacturers toward low-carbon titanium production. Emerging technologies such as the FFC Cambridge process and molten oxide electrolysis aim to replace the traditional, energy-intensive Kroll process. These developments are expected to reshape the supply chain for elemental titanium and reduce reliance on chlorine and magnesium—key reagents in current extraction methods. -

Rising Use in Medical and Biotech Applications

Titanium’s biocompatibility ensures continued expansion in medical implants, prosthetics, and dental devices. By 2026, nanostructured titanium surfaces and new alloy compositions (e.g., Ti-Nb-Zr) are gaining traction. This drives demand for high-purity elemental niobium, zirconium, and tantalum as alloying agents, signaling growth in niche elemental markets supporting titanium innovation. -

Geopolitical and Supply Chain Realignment

Supply concerns around critical minerals have prompted nations to secure domestic sources of titanium feedstocks (e.g., ilmenite, rutile) and refine processing capabilities. In 2026, countries like the U.S., India, and Australia are investing in titanium sponge production and recycling infrastructure, reducing dependence on dominant suppliers like China and Japan. This shift influences the global trade dynamics of elemental inputs such as magnesium and chlorine. -

Electric Vehicles and Lightweighting Trends

Although aluminum and steel dominate the EV market, titanium is finding niche applications in high-performance electric vehicles—particularly in exhaust systems, fasteners, and battery enclosures. As automakers pursue aggressive weight reduction, titanium’s use is expected to grow modestly, supported by advances in cost-effective alloying techniques and elemental recycling.

Conclusion:

By 2026, the market for elemental materials related to titanium is characterized by innovation, sustainability pressures, and sector-specific growth. While titanium itself remains central, the demand for high-purity elemental additives and enabling technologies signals a maturing and increasingly specialized market ecosystem. Companies investing in green production, advanced manufacturing, and supply chain resilience are best positioned to capitalize on these trends.

Common Pitfalls Sourcing Element For Ti (Quality, IP)

When sourcing materials for titanium (Ti) production—particularly critical elements such as magnesium (Mg) for the Kroll process or other additives—companies often encounter significant challenges related to quality and intellectual property (IP). Understanding these pitfalls is essential for ensuring reliable supply chains, product integrity, and legal compliance.

Quality-Related Pitfalls

Inconsistent Purity Levels

One of the most common quality issues is variability in the purity of sourced elements. Titanium production demands extremely high-purity feedstocks (e.g., magnesium, chlorine, or titanium tetrachloride). Impurities such as iron, oxygen, or hydrogen can compromise the mechanical properties of the final titanium alloy, leading to material failure in aerospace or medical applications.

Lack of Standardized Testing and Certification

Suppliers may not adhere to internationally recognized quality standards (e.g., ASTM, ISO), or may provide incomplete or falsified material test reports. This makes it difficult to verify the actual composition and suitability of raw materials.

Inadequate Traceability

Without full traceability from mine to shipment, it becomes impossible to audit the production process or respond effectively to quality failures. This is particularly problematic when dealing with multi-tier suppliers or complex supply chains.

Poor Process Control at Supplier Level

Even if initial samples meet specifications, inconsistent manufacturing practices—such as fluctuating refining conditions or contamination during handling—can result in batch-to-batch variability.

Intellectual Property-Related Pitfalls

Unlicensed Use of Proprietary Processes

Some suppliers may use patented refining or reduction techniques (e.g., variations of the Kroll or FFC Cambridge processes) without proper licensing. Sourcing from such suppliers can expose the buyer to third-party IP infringement claims, especially when the final titanium product enters regulated markets.

Ambiguous Ownership of Material Formulations

When sourcing specialty alloys or precursor compounds, the IP surrounding specific compositions or processing methods may not be clearly documented. Buyers risk unintentionally using or commercializing materials protected by patents or trade secrets.

Insufficient IP Due Diligence

Companies often fail to conduct thorough IP audits of their suppliers. This oversight can lead to legal disputes, import/export restrictions, or forced redesigns if a sourced element is later found to infringe on protected technology.

Reverse Engineering Risks

In an effort to reduce costs, some suppliers may reverse-engineer proprietary materials or processes. While this can lower prices, it introduces legal exposure and often results in substandard or non-compliant products.

Mitigation Strategies

To avoid these pitfalls, buyers should:

– Require certified quality documentation and conduct independent lab verification.

– Implement strict supplier qualification programs with on-site audits.

– Perform IP risk assessments and ensure contractual indemnification clauses.

– Establish long-term partnerships with transparent, reputable suppliers.

– Monitor evolving patent landscapes related to titanium production technologies.

Proactively addressing quality and IP concerns in the sourcing of elemental inputs for titanium ensures both operational reliability and legal safety in high-stakes industries.

Logistics & Compliance Guide for Element For Ti

This guide outlines the essential logistics and compliance procedures for handling products and materials associated with Element For Ti, ensuring seamless operations, regulatory adherence, and supply chain integrity.

1. Product Classification and HS Codes

Accurate product classification is critical for international shipping and customs clearance. All Element For Ti products must be classified using the appropriate Harmonized System (HS) codes. Consult the latest customs tariff schedule in each destination country to determine the correct codes for titanium-based materials, finished components, or specialty alloys. Misclassification can result in delays, fines, or shipment rejection.

2. Export Controls and Licensing

Element For Ti may involve materials subject to export control regulations such as the U.S. Export Administration Regulations (EAR) or International Traffic in Arms Regulations (ITAR), depending on the product’s technical specifications and end-use. Determine EAR99 or license-required status early in the shipping process. Obtain necessary export licenses or authorizations from the relevant government agency before shipment, particularly for high-purity titanium or aerospace-grade components.

3. Packaging and Labeling Standards

Use packaging that conforms to international standards (e.g., ISTA, ASTM) to protect products during transit. All packages must be clearly labeled with:

– Product name and Element For Ti part number

– Net weight and dimensions

– Handling instructions (e.g., “Fragile,” “This Side Up”)

– Compliance markings (e.g., UN-certified for hazardous materials, if applicable)

– Country of origin

Ensure labels are durable, multilingual (as needed), and placed visibly on all sides of the package.

4. Transportation and Carrier Requirements

Work exclusively with carriers certified for handling specialty metals and compliant with IATA, IMDG, or ADR regulations where applicable. Provide carriers with accurate shipping documentation, including:

– Commercial invoice

– Packing list

– Bill of lading or air waybill

– Material Safety Data Sheet (MSDS), if required

– Export license or exemption statement

Choose transportation modes (air, sea, ground) based on urgency, cost, and product sensitivity.

5. Import Compliance and Duties

Ensure all import documentation meets the destination country’s requirements. This includes accurate valuation, proof of origin (e.g., Certificate of Origin), and compliance with local product safety and environmental standards. Be prepared to pay applicable duties, tariffs, and taxes. Leverage free trade agreements (e.g., USMCA, CPTPP) where eligible to reduce duty costs.

6. Regulatory Certifications and Standards

Element For Ti products may require certifications such as:

– ISO 9001 (Quality Management)

– AS9100 (Aerospace)

– REACH and RoHS compliance (for EU markets)

– ASTM or AMS material certifications

Maintain up-to-date documentation and make it available upon request from regulators or customers.

7. Recordkeeping and Audit Readiness

Retain all logistics and compliance documents for a minimum of five years, or as required by local laws. Records must include:

– Shipping and customs documentation

– Export license applications and approvals

– Certificates of compliance

– Internal compliance audit reports

Regular internal audits should be conducted to ensure ongoing adherence to policies and regulations.

8. Risk Management and Contingency Planning

Identify potential supply chain disruptions such as geopolitical issues, customs delays, or transportation failures. Develop contingency plans including alternate shipping routes, backup suppliers, and expedited clearance options. Monitor global trade developments affecting titanium and advanced materials.

9. Training and Compliance Culture

Provide regular training for logistics, procurement, and operations staff on export controls, dangerous goods handling, and customs procedures. Foster a culture of compliance where team members are empowered to report concerns or discrepancies.

10. Sustainability and Environmental Compliance

Adhere to environmental regulations related to the transport and disposal of titanium byproducts or packaging materials. Implement sustainable logistics practices such as route optimization, recyclable packaging, and carbon footprint tracking. Comply with regulations like the EU’s SCIP database if applicable.

By following this guide, Element For Ti can ensure efficient, lawful, and responsible global operations across its supply chain.

Certainly! Here’s a professional and concise conclusion for sourcing an element for titanium (Ti):

Conclusion:

In conclusion, the sourcing of titanium must prioritize reliable and sustainable supply chains due to its critical applications in aerospace, medical, and industrial sectors. Primary sources of titanium, such as ilmenite and rutile ores, are predominantly mined in countries like Australia, South Africa, and China. Ensuring ethical mining practices, geopolitical stability of suppliers, and advancements in extraction and refining technologies are essential for securing a consistent and high-purity titanium supply. Additionally, recycling and alternative processing methods, such as the Kroll process and emerging reduction techniques, play a vital role in enhancing efficiency and reducing environmental impact. A strategic, diversified sourcing approach combined with investment in innovation will be key to meeting the growing global demand for titanium in a responsible and economically viable manner.

Let me know if you’re focusing on a specific aspect (e.g., sustainability, cost, supply chain logistics) for a more tailored conclusion.