The global electronics components market continues to expand at a robust pace, driven by rising demand across industries such as consumer electronics, automotive, industrial automation, and telecommunications. According to a 2023 report by Mordor Intelligence, the market was valued at USD 387.4 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2028, reaching an estimated USD 578.6 billion by the end of the forecast period. This expansion is fueled by advancements in miniaturization, increasing adoption of IoT devices, and the proliferation of 5G technology. As supply chains evolve and demand for high-reliability components intensifies, a handful of manufacturers have emerged as dominant players, shaping innovation and setting industry benchmarks. The following list highlights the top 10 electronics components manufacturers leading this transformation—companies that combine scale, R&D investment, and global reach to power the next generation of electronic systems.

Top 10 Electronics Components Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Newark Electronics

Domain Est. 1994

Website: newark.com

Key Highlights: Newark Electronics – We’re a fast and reliable distributor of products and technology for electronic and industrial system design, maintenance, and repair….

#2 FDH Electronics

Domain Est. 2019

Website: electronics.fdhaero.com

Key Highlights: Welcome to. FDH Electronics. A Fully Franchised Value-added Distributor for the World’s Leading Manufacturers of Electrical Products….

#3 Electronic Components and Parts Search

Domain Est. 1995

Website: digikey.com

Key Highlights: $16.99 delivery · 30-day returnsDigiKey is your authorized distributor with over a million in stock products from the world’s top suppliers. Rated #1 in content and design support…

#4 Peerless Electronics

Domain Est. 1996

Website: peerlesselectronics.com

Key Highlights: Authorized stocking distributor of switches, circuit breakers, relays, contactors, sensors, indicator lights, connectors, and more….

#5 Heilind Electronics

Domain Est. 1996

Website: heilind.com

Key Highlights: Heilind Electronics is a global electronic components distributor. Shop the largest selection of interconnect, electromechanical and sensor products….

#6 netCOMPONENTS

Domain Est. 1997

Website: netcomponents.com

Key Highlights: netCOMPONENTS is the world’s premier destination for the sourcing and procurement of electronic components, connecting members (buyers) and suppliers (sellers) ……

#7 Jameco Electronics

Domain Est. 1998

Website: jameco.com

Key Highlights: Jameco Electronics is an authorized electronics component distributor with over 50 years in business, selling electronic components, parts, ……

#8 Distributor of Electronic Components and Provider of Value Added …

Domain Est. 1998

Website: marshelectronics.com

Key Highlights: Distributor of electronic components and provides value-added services including inventory management solutions, Engineering concepts, application research ……

#9 Buy Electrical Components Online

Domain Est. 2003

Website: masterelectronics.com

Key Highlights: Your Trusted Global Partner for Electronic Components. Master Electronics is a leading global authorized distributor of electronic components….

#10 TrustedParts.com

Domain Est. 2008

Website: trustedparts.com

Key Highlights: Electronic components search for instant prices, datasheets, & inventory from Authorized Distributors of electronic parts….

Expert Sourcing Insights for Electronics Components

2026 Market Trends for Electronics Components

The electronics components market is poised for significant evolution by 2026, driven by rapid technological innovation, shifts in global supply chains, and the increasing demand for smarter, more efficient devices. This analysis explores key trends expected to shape the industry over the next few years.

Growth in Semiconductor Demand

Semiconductors will remain at the core of electronics component demand in 2026. With the proliferation of AI, 5G infrastructure, electric vehicles (EVs), and edge computing, the need for advanced chips—especially logic, memory, and power semiconductors—will continue to surge. The adoption of next-generation process nodes (sub-3nm and below) will accelerate, particularly for high-performance computing (HPC) and data center applications. Foundries like TSMC, Samsung, and Intel are expected to expand capacity to meet demand, although supply constraints may persist in niche areas such as analog and power management ICs.

AI and Machine Learning Integration

Artificial intelligence is transforming electronics component design and usage. By 2026, AI-specific components—including dedicated neural processing units (NPUs), AI accelerators, and sensor fusion chips—will be integrated into a broader range of devices, from smartphones and IoT endpoints to industrial automation systems. The demand for low-power, high-efficiency AI chips will rise, especially for edge AI applications, pushing innovation in heterogeneous integration and chiplet-based designs.

Expansion of Electric Vehicle and Power Electronics

The global transition to electric vehicles will drive sustained demand for power electronics components such as IGBTs, SiC (silicon carbide), and GaN (gallium nitride) devices. By 2026, SiC MOSFETs are expected to gain significant market share in EV inverters and onboard chargers due to their superior efficiency and thermal performance. This trend will extend to renewable energy systems and energy storage, further boosting demand for high-voltage, high-frequency components.

Supply Chain Resilience and Localization

Geopolitical tensions and recent supply chain disruptions have prompted a strategic shift toward regionalization. By 2026, North America and Europe are expected to increase domestic semiconductor manufacturing, supported by initiatives like the U.S. CHIPS Act and the European Chips Act. This localization will reduce dependency on Asia-centric supply chains and promote nearshoring of key components such as passive components, PCBs, and assembly services.

Sustainability and Green Electronics

Environmental regulations and corporate sustainability goals will influence electronics component design and sourcing. In 2026, demand for energy-efficient components, recyclable materials, and RoHS-compliant parts will rise. Manufacturers will focus on reducing carbon footprints across the product lifecycle, including through innovations in lead-free soldering, low-power ICs, and modular component designs that support repairability and reuse.

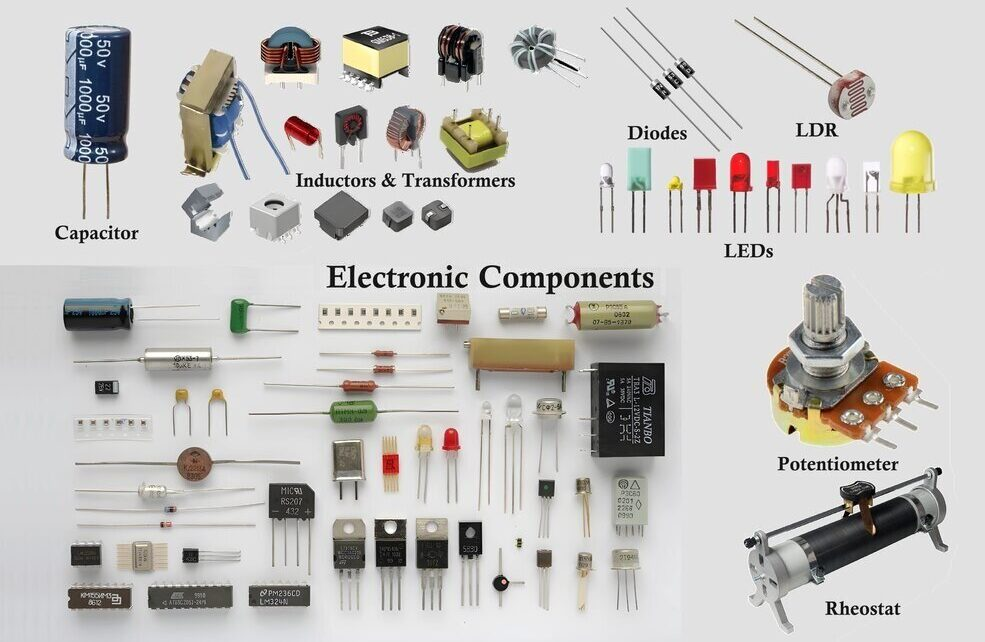

Advancements in Passive Components

Passive components—resistors, capacitors, and inductors—will see steady growth driven by miniaturization and performance demands. The rise of 5G and IoT devices requires smaller, more reliable passives with improved thermal and electrical characteristics. Multilayer ceramic capacitors (MLCCs) will remain in high demand, while advancements in materials science will enable higher capacitance densities and greater stability under extreme conditions.

Rise of Advanced Packaging and Heterogeneous Integration

As Moore’s Law slows, the industry will increasingly adopt advanced packaging solutions such as 2.5D/3D ICs, fan-out wafer-level packaging (FOWLP), and chiplets. These technologies allow better performance, lower power consumption, and reduced form factors—key for mobile, AI, and high-speed communication applications. By 2026, these packaging innovations will become mainstream, especially in premium consumer electronics and data center hardware.

IoT and Smart Devices Proliferation

The Internet of Things ecosystem will continue expanding, with billions of new connected devices expected by 2026. This growth will fuel demand for low-power microcontrollers, wireless modules (Wi-Fi 6E/7, Bluetooth LE, LoRa), sensors, and energy harvesting components. Integration and system-on-chip (SoC) solutions will dominate to reduce size, cost, and power consumption in smart home, industrial, and healthcare applications.

Conclusion

The electronics components market in 2026 will be shaped by innovation, regionalization, and sustainability. Key drivers—AI, EVs, 5G, and IoT—will demand higher performance, efficiency, and integration. Companies that adapt to these trends through R&D investment, supply chain agility, and eco-conscious design will be best positioned for success in the evolving landscape.

Common Pitfalls Sourcing Electronics Components (Quality, IP)

Sourcing electronic components is a critical aspect of product development and manufacturing, but it comes with significant risks—especially concerning quality and intellectual property (IP). Falling into common pitfalls can lead to costly delays, product failures, or legal complications. Below are key challenges to watch for:

Poor Component Quality and Counterfeit Parts

One of the most pervasive risks in electronics sourcing is receiving substandard or counterfeit components. These parts may fail prematurely, cause system malfunctions, or compromise safety. Counterfeits are often recycled, remarked, or cloned components that do not meet original specifications. Sourcing from unauthorized distributors or gray market channels increases this risk significantly.

Lack of Supply Chain Transparency

Many procurement teams struggle with tracing the full supply chain of components. Without visibility into the origin, handling, and distribution history, it’s difficult to verify authenticity or ensure consistent quality. This opacity also makes it harder to respond to recalls or compliance issues.

Inadequate Supplier Vetting

Choosing suppliers based solely on price or lead time—without verifying their credibility, certifications, or track record—can lead to reliability issues. Reputable suppliers should comply with standards such as ISO 9001, AS9100 (for aerospace), or have authorization from original component manufacturers (OCMs).

Intellectual Property Infringement Risks

Using components that incorporate protected IP—especially in integrated circuits or firmware—without proper licensing can expose companies to legal action. This is particularly relevant when sourcing from regions with weak IP enforcement. Cloned or reverse-engineered chips may infringe on patents, trademarks, or copyrights.

Use of Obsolete or End-of-Life (EOL) Components

Sourcing obsolete components increases dependency on secondary markets, where counterfeit risk is higher. While sometimes necessary for legacy systems, using EOL parts without proper lifetime planning and alternatives analysis can jeopardize long-term product support and reliability.

Non-Compliance with Regulatory Standards

Components must meet regional and industry-specific regulations (e.g., RoHS, REACH, UL, AEC-Q100). Sourcing parts that lack proper certifications can result in failed audits, rejected shipments, or non-compliant end products, especially in automotive, medical, or aerospace applications.

Inadequate Documentation and Traceability

Missing or falsified documentation—such as certificates of conformance, test reports, or lot traceability—makes it difficult to validate quality or respond to field failures. Reliable suppliers provide full traceability from manufacturer to delivery.

Overreliance on Single-Source Components

Depending on a single supplier or manufacturer for critical components creates supply chain vulnerability. Any disruption—natural disaster, geopolitical issue, or factory shutdown—can halt production. A dual-sourcing or multi-vendor strategy mitigates this risk.

Failure to Monitor Market Trends and Allocation Risks

Global component shortages (e.g., during the 2020–2023 semiconductor crisis) highlight the importance of monitoring market dynamics. Failing to anticipate allocation constraints or price volatility can lead to project delays and inflated costs.

Insecure Firmware and Embedded Software

Some components, especially microcontrollers and FPGAs, contain embedded software or firmware that may include unlicensed or vulnerable code. This poses both IP and cybersecurity risks if not properly audited and secured.

Avoiding these pitfalls requires rigorous supplier qualification, supply chain mapping, quality assurance protocols, and legal review—especially when sourcing from high-risk regions or cost-driven markets.

Logistics & Compliance Guide for Electronic Components

Navigating the logistics and compliance landscape for electronic components is essential for ensuring timely delivery, minimizing risks, and maintaining regulatory adherence across global supply chains. This guide outlines key considerations for manufacturers, distributors, and procurement teams.

Supply Chain Planning & Inventory Management

Effective supply chain planning begins with accurate demand forecasting and strategic component sourcing. Utilize Material Requirements Planning (MRP) or Enterprise Resource Planning (ERP) systems to track inventory levels, manage lead times, and prevent stockouts or overstocking. Consider dual sourcing for critical components to mitigate supply disruptions. Implement Just-In-Time (JIT) or vendor-managed inventory (VMI) models where appropriate to reduce carrying costs while maintaining production continuity.

Component Sourcing & Supplier Qualification

Select suppliers based on quality certifications (e.g., ISO 9001), traceability practices, and adherence to industry standards. Conduct regular supplier audits and require detailed documentation, including Certificates of Conformance (CoC) and material declarations. Prioritize authorized distributors to avoid counterfeit components, which pose significant reliability and safety risks. Maintain up-to-date supplier lists and monitor geopolitical and economic factors affecting component availability.

Packaging & Handling Requirements

Electronic components are sensitive to electrostatic discharge (ESD), moisture, and mechanical stress. Use ESD-safe packaging (e.g., conductive foam, shielding bags) and label packages accordingly. For moisture-sensitive devices (MSDs), follow IPC/JEDEC J-STD-033 guidelines, including use of Moisture Barrier Bags (MBB), desiccants, and humidity indicator cards. Clearly label handling instructions and storage conditions on all packaging.

Transportation & Shipping Considerations

Choose carriers experienced in handling high-value, sensitive electronics. Utilize temperature-controlled and shock-monitored shipping for precision components. Ensure packaging meets ISTA 3A or similar standards for drop, vibration, and compression resistance. For international shipments, comply with Incoterms® rules (e.g., FCA, DDP) to clarify responsibilities. Maintain real-time shipment tracking and insurance coverage for loss or damage.

Import/Export Compliance

Adhere to export control regulations such as the U.S. Export Administration Regulations (EAR) and the International Traffic in Arms Regulations (ITAR), where applicable. Determine if components require an Export Control Classification Number (ECCN) and whether a license is needed. Comply with destination country import requirements, including customs declarations, tariffs, and product conformity assessments. Use Automated Export System (AES) filings for U.S. shipments and ensure accurate Harmonized System (HS) codes.

Environmental & Product Compliance

Ensure components comply with environmental directives such as:

– RoHS (Restriction of Hazardous Substances) – Limits lead, cadmium, mercury, and other hazardous materials.

– REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) – Requires disclosure of Substances of Very High Concern (SVHC).

– WEEE (Waste Electrical and Electronic Equipment) – Mandates proper recycling and disposal.

Maintain compliance documentation, including Declarations of Conformity (DoC) and material content reports, and verify supplier compliance through audits or third-party testing.

Counterfeit Prevention & Traceability

Implement an anti-counterfeit program aligned with AS6496 or IDEA-1010 standards. Require full traceability from manufacturer to end user, including batch/lot numbers, date codes, and factory information. Use authentication techniques such as X-ray inspection, decapsulation, and electrical testing. Train procurement and quality teams to identify suspicious components and reporting channels for suspected counterfeits.

Regulatory Documentation & Recordkeeping

Maintain comprehensive records for at least seven years, including:

– Bills of Materials (BOM)

– Supplier agreements and CoCs

– Compliance declarations (RoHS, REACH, etc.)

– Shipping and customs documentation

– Audit reports and non-conformance records

Digital document management systems can streamline access, version control, and audit readiness.

Risk Management & Business Continuity

Develop a risk mitigation strategy that includes:

– Monitoring component obsolescence (via lifecycle tracking tools)

– Creating contingency plans for supply chain disruptions

– Diversifying supplier base and geographic sourcing

– Engaging in long-term agreements (LTAs) for high-risk components

Regularly review and update risk assessments to adapt to market changes and emerging regulations.

By integrating these logistics and compliance practices, organizations can ensure reliable component supply, reduce legal and operational risks, and maintain product integrity across global markets.

In conclusion, sourcing electronic components successfully requires a strategic and well-informed approach. Identifying reliable suppliers involves evaluating key factors such as product quality, pricing, lead times, certifications, and supply chain transparency. Building strong relationships with both franchised distributors and reputable independent suppliers helps ensure consistency, authenticity, and timely delivery. Additionally, leveraging tools like component sourcing platforms, inventory management systems, and market trend analysis can enhance procurement efficiency and risk mitigation, particularly in times of shortages or supply chain disruptions. As the electronics industry continues to evolve, maintaining a diversified supplier base, staying compliant with regulatory standards, and adapting to emerging technologies will be critical for long-term success. Ultimately, effective component sourcing is not just about cost savings—it’s about ensuring reliability, scalability, and resilience in the entire manufacturing and product development lifecycle.