The global electronic accelerator control market is experiencing robust growth, driven by increasing demand for precision throttle systems in automotive, aerospace, and industrial applications. According to Grand View Research, the global electronic throttle control market size was valued at USD 5.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030. This expansion is fueled by the rising adoption of drive-by-wire technology, stringent fuel efficiency regulations, and the growing production of electric and hybrid vehicles. Mordor Intelligence further projects steady market momentum, highlighting advancements in vehicle electrification and autonomous driving systems as key growth catalysts. As demand for reliable, responsive accelerator control solutions intensifies, a select group of manufacturers has emerged at the forefront of innovation, scalability, and technological leadership. The following analysis identifies the top nine electronic accelerator control manufacturers shaping the future of motion control across industries.

Top 9 Electronic Accelerator Control Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 World leader in particle accelerator technology

Domain Est. 2000

Website: iba-worldwide.com

Key Highlights: IBA designs, produces and markets innovative solutions for the diagnosis and treatment of cancer and other serious illnesses, and for industrial applications….

#2 Accelerator pedal sensor – Our product range

Domain Est. 1996 | Founded: 1996

Website: hella.com

Key Highlights: Accelerator pedal sensor | Precise position measurement with HELLA CIPOS technology ✓ Manufacturing experience since 1996….

#3 Power Electronic Equipment Manufacturer

Domain Est. 1997

Website: americas.fujielectric.com

Key Highlights: Fuji Electric is a global manufacturer of reliable power electronics equipment & products ranging from semiconductors to drives and power supply….

#4 TT Electronics: Engineered Electronics

Domain Est. 2000

Website: ttelectronics.com

Key Highlights: We engineer and manufacture electronics that sense, manage power, connect devices for OEMs in Medical, Aerospace, Defence, Automation and ……

#5 EA-1 Electronic Accelerator

Domain Est. 2001

Website: vikinggroupinc.com

Key Highlights: The EA-1 Electronic Accelerator revolutionizes Dry and Double Interlock Preaction Systems by delivering unmatched speed, efficiency, and ease of use….

#6 Products

Domain Est. 2001

Website: deltaww.com

Key Highlights: DIACFX Electronic Assembly Equipment Communication Standard and Control Application Software. 202501161610094376001.png. DIAWMS Warehouse Management System….

#7 National Electrostatics Corporation

Domain Est. 1996

Website: pelletron.com

Key Highlights: National Electrostatics Corporation (NEC) is the world’s leader in the manufacture of electrostatic ion beam accelerator systems….

#8 LEM

Domain Est. 1997

Website: lem.com

Key Highlights: LEM sensors, transducers and ICS cover all your current and voltage measurement needs from 10 to 2,000 A, and from 10 to 4,200 V. We manufacture thousands of ……

#9 Accelerator

Domain Est. 2011

Website: bosch-mobility.com

Key Highlights: The accelerator-pedal module (APM) consists of the accelerator pedal and an angular-position sensor as potentiometer or touchless hall-effect sensor….

Expert Sourcing Insights for Electronic Accelerator Control

H2: 2026 Market Trends for Electronic Accelerator Control

The Electronic Accelerator Control (EAC) market is poised for significant evolution by 2026, driven by stringent regulations, technological advancements, and shifting end-market dynamics. Key trends shaping the landscape include:

-

Dominance of Electrification & Hybridization: The most profound driver is the global push towards electrified powertrains. While pure battery-electric vehicles (BEVs) don’t require traditional throttle pedals for propulsion control, EAC technology is crucial for:

- Hybrid Electric Vehicles (HEVs & PHEVs): Seamless integration and pedal mapping between internal combustion engines (ICE) and electric motors demand sophisticated EAC systems for optimal performance and driver feel.

- Range Extenders: EAC manages the ICE component in series hybrids.

- Driver Interface: The physical accelerator pedal and its sensor remain a critical human-machine interface (HMI) for regenerative braking blending and overall vehicle response in all electrified vehicles. Demand for high-precision, redundant pedal sensors will remain strong.

-

Stringent Emissions & Fuel Economy Regulations: Global regulations (Euro 7, CAFE standards, China 6b) continue to tighten, forcing OEMs to maximize ICE efficiency, even in transitional hybrid vehicles. EAC enables:

- Precise Air-Fuel Ratio Control: Essential for meeting emissions targets.

- Advanced Engine Management: Facilitating technologies like cylinder deactivation and variable valve timing optimization.

- Start-Stop Systems: Reliable EAC is fundamental for seamless and safe automatic engine restarts.

-

Rise of Advanced Driver Assistance Systems (ADAS) and Automation: EAC is a critical enabler for higher levels of automation (L2+ and beyond).

- Vehicle-to-Everything (V2X) Integration: EAC will receive commands from ADAS/autonomous systems for predictive acceleration based on traffic flow, signal timing, or hazard avoidance.

- Adaptive Cruise Control (ACC) & Traffic Jam Assist: Precise, reliable, and fail-operational EAC is mandatory for these features.

- Increased Demand for Redundancy & Safety: Systems will require higher levels of functional safety (ISO 26262 ASIL B/C) with redundant sensors and communication paths (e.g., dual or triple-redundant pedal sensors, CAN FD).

-

Technological Advancements in Sensors & Integration:

- Non-Contact Sensing: Increased adoption of Hall-effect and magnetoresistive sensors over traditional potentiometers due to higher reliability, longer lifespan, and better resistance to contamination.

- Integrated Modules: Growth in demand for integrated throttle body assemblies with embedded control electronics and diagnostics, reducing complexity for OEMs.

- Enhanced Diagnostics & Predictive Maintenance: EAC systems will provide richer data (pedal wear, signal drift) for onboard diagnostics (OBD) and fleet management.

- Software-Defined Functionality: Greater flexibility in pedal mapping (“drive modes” – Eco, Sport, etc.) implemented through software updates, increasing the value of the EAC ECU.

-

Supply Chain Resilience & Localization: The lessons from recent disruptions (pandemic, chip shortages) will push OEMs and Tier 1s towards:

- Diversified Sourcing: Reducing reliance on single geographic regions or suppliers.

- Nearshoring/Reshoring: Increased manufacturing presence in key markets (North America, Europe) to mitigate geopolitical and logistical risks, impacting EAC component suppliers.

- Inventory Management: More robust buffer stocks for critical electronic components.

-

Focus on Cost Optimization & Sustainability:

- Lightweighting: Development of lighter pedal assemblies and sensor housings.

- Material Efficiency: Use of recyclable materials and design for disassembly.

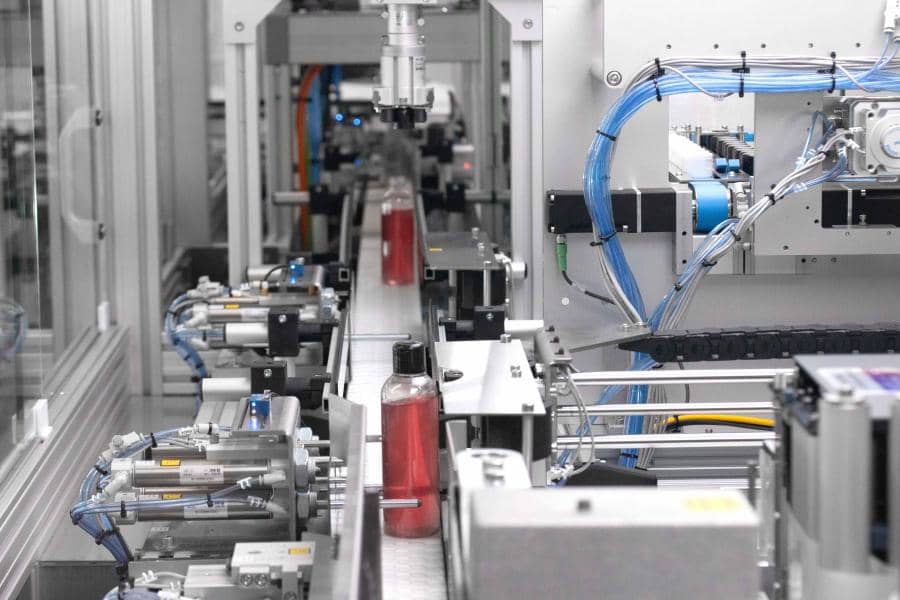

- Manufacturing Efficiency: Automation in sensor calibration and assembly processes to reduce costs.

- Total Cost of Ownership (TCO): Fleet operators will prioritize reliability and longevity of EAC systems.

In Summary for 2026: The EAC market will transition from being purely an ICE enabler to a critical enabling technology for electrification, advanced safety, and automation. While the absolute volume for pure ICE vehicles may plateau or decline in some regions, the complexity, performance requirements, and value content per vehicle will increase significantly, particularly in hybrids and vehicles with advanced ADAS. Success will depend on suppliers’ ability to deliver highly reliable, redundant, safe, cost-effective, and software-capable solutions integrated seamlessly into evolving vehicle architectures. The market will be characterized by consolidation among Tier 1 suppliers and intense competition focused on innovation and system integration.

Common Pitfalls Sourcing Electronic Accelerator Control (Quality, IP)

Sourcing Electronic Accelerator Control (EAC) systems—critical components in automotive, industrial, and aerospace applications—carries significant risks if not managed carefully. Overlooking quality and intellectual property (IP) considerations can lead to product failures, legal disputes, and reputational damage. Below are key pitfalls to avoid:

Quality-Related Pitfalls

Inadequate Supplier Qualification

Failing to thoroughly vet suppliers based on their manufacturing capabilities, quality certifications (e.g., IATF 16949), and track record in safety-critical systems can result in substandard components. Suppliers without proven experience in automotive-grade electronics may not meet stringent reliability and environmental standards.

Insufficient Testing and Validation

Accepting EAC units without rigorous performance, environmental, and lifespan testing (e.g., thermal cycling, vibration, EMC) increases the risk of field failures. Suppliers may provide samples that pass basic checks but fail under real-world operating conditions.

Poor Traceability and Documentation

Lack of component-level traceability (e.g., lot numbers, material certifications) complicates root cause analysis during failures and may hinder compliance with industry regulations. Incomplete documentation also affects product recalls and quality audits.

Inconsistent Production Quality

Even if initial samples meet specifications, inconsistent production processes can lead to variances in performance and reliability. Without ongoing quality audits and statistical process control (SPC) oversight, defects may go undetected until late in the supply chain.

Intellectual Property-Related Pitfalls

Unclear IP Ownership and Licensing

Failing to define who owns the design, firmware, and software IP in the EAC system can lead to legal disputes. Suppliers may claim ownership of custom modifications or embedded code, restricting your ability to switch vendors or make future updates.

Use of Unlicensed or Infringing Third-Party IP

Sourcing EAC systems that incorporate unlicensed software, firmware, or patented technologies exposes buyers to infringement claims. This is especially critical when third-party microcontrollers or communication protocols are involved.

Inadequate Protection of Custom Designs

When providing custom specifications or designs to a supplier, failing to secure proper non-disclosure agreements (NDAs) and IP assignment clauses may allow the supplier to reuse or resell your innovations to competitors.

Lack of Transparency in Firmware and Software

Closed-source or undocumented firmware in EAC units can obscure security vulnerabilities, limit diagnostic capabilities, and prevent compliance with software safety standards (e.g., ISO 26262). Buyers may lose control over updates and patches.

Avoiding these pitfalls requires a structured sourcing strategy that includes rigorous supplier evaluation, detailed contractual agreements, and continuous quality monitoring throughout the product lifecycle.

Logistics & Compliance Guide for Electronic Accelerator Control

This guide outlines the key logistics and compliance considerations for the management, transportation, installation, and operation of electronic accelerator control systems, which are commonly used in industrial, medical, and research applications (e.g., in particle accelerators, radiation therapy, and materials processing). Adherence to these guidelines ensures safety, regulatory compliance, and operational efficiency.

Regulatory Compliance

Electronic accelerator control systems are subject to a range of national and international regulations due to their use of electrical, electronic, and often radiation-emitting components. Key compliance areas include:

- Electromagnetic Compatibility (EMC): Ensure systems comply with EMC standards (e.g., IEC 61326, FCC Part 15) to prevent interference with other equipment.

- Electrical Safety: Adhere to standards such as IEC 61010-1 for electrical safety in measurement, control, and laboratory use.

- Radiation Safety: If the accelerator produces ionizing radiation, compliance with local radiation protection authorities (e.g., NRC in the U.S., IAEA standards, EURATOM directives) is mandatory. This includes shielding, access control, and monitoring.

- Export Controls: Components may be subject to export control regulations (e.g., ITAR, EAR) due to dual-use technology. Verify licensing requirements before international shipment.

- RoHS & REACH: Confirm compliance with environmental directives restricting hazardous substances (RoHS) and chemical safety (REACH) in the EU and similar regulations globally.

Transportation & Handling

Proper logistics planning is critical to prevent damage and ensure safe delivery:

- Packaging: Use anti-static, shock-absorbent, and moisture-resistant packaging. Include desiccants if sensitive to humidity.

- Labeling: Clearly label packages with “Fragile,” “This Side Up,” “Static Sensitive,” and any required hazardous material labels (e.g., for batteries or radiation sources).

- Shipping Documentation: Maintain accurate bills of lading, commercial invoices, certificates of conformity, and export licenses where applicable.

- Climate Control: Transport in temperature- and humidity-controlled environments when specified by the manufacturer (typically 10–35°C, non-condensing).

- Chain of Custody: Track shipments in real time using GPS or RFID tags, especially for high-value or regulated components.

Installation & Site Preparation

Site readiness is essential for seamless integration and regulatory approval:

- Facility Requirements: Ensure adequate power supply (voltage, frequency, grounding), cooling, ventilation, and physical space. Verify electromagnetic shielding if required.

- Access Control: Restrict access to authorized personnel only. Install interlocks and warning systems as per safety standards.

- Calibration & Commissioning: Perform initial calibration and functional testing by qualified engineers. Document all test results for compliance audits.

- Integration with Safety Systems: Connect control systems to emergency stop circuits, radiation monitors, and facility management systems.

Operational Compliance & Maintenance

Ongoing compliance ensures system reliability and safety:

- Regular Inspections: Conduct scheduled inspections and maintenance per manufacturer guidelines and regulatory requirements.

- Software Validation: Maintain validated software versions. Any updates must undergo change control and re-validation if used in regulated environments (e.g., medical devices).

- Personnel Training: Ensure operators and maintenance staff are trained in system operation, emergency procedures, and regulatory compliance.

- Record Keeping: Maintain logs of maintenance, calibration, incidents, and personnel training for audit purposes.

- Decommissioning & Disposal: Follow environmental regulations (e.g., WEEE) for disposal of electronic components. Decontaminate and decommission radiation-associated components under authorized supervision.

Documentation & Auditing

Comprehensive documentation supports compliance and traceability:

- Technical Files: Maintain up-to-date technical documentation, including schematics, user manuals, and conformity declarations.

- Compliance Certificates: Keep copies of CE, UKCA, FCC, or other applicable certification marks and test reports.

- Audit Readiness: Prepare for internal and external audits by ensuring all records are organized and accessible.

Adhering to this logistics and compliance guide ensures the safe, legal, and efficient lifecycle management of electronic accelerator control systems across all operational phases.

Conclusion for Sourcing Electronic Accelerator Controls

In conclusion, sourcing electronic accelerator controls requires a strategic approach that balances performance, reliability, cost, and compliance with industry standards. As vehicles and machinery continue to transition toward electronic throttle systems (drive-by-wire), selecting the right supplier becomes critical to ensuring safety, precision, and integration with broader control systems. Key considerations include the supplier’s technical expertise, product certifications (e.g., ISO 26262, ASIL compliance), quality control processes, and ability to provide scalable, customizable solutions.

Partnering with reputable manufacturers that offer robust technical support, proven durability under diverse operating conditions, and strong after-sales service can significantly reduce development time and mitigate risks in both automotive and industrial applications. Additionally, evaluating total cost of ownership—factoring in longevity, maintenance, and compatibility—rather than focusing solely on upfront pricing—leads to more sustainable sourcing decisions.

Ultimately, effective sourcing of electronic accelerator controls contributes to enhanced vehicle performance, improved fuel efficiency, and greater safety, supporting innovation and competitiveness in an increasingly electrified and automated market.