The global electromyography (EMG) sensors market is experiencing robust growth, driven by rising demand for diagnostic tools in neurology and rehabilitation, increased prevalence of neuromuscular disorders, and advancements in wearable and portable medical devices. According to Grand View Research, the global EMG market size was valued at USD 4.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 7.3% from 2023 to 2030. Similarly, Mordor Intelligence projects a CAGR of approximately 7.1% during the forecast period of 2024–2029, citing expanding applications in sports science, ergonomics, and brain-computer interfaces as key growth accelerants. With increasing integration of AI and wireless technologies in EMG systems, leading manufacturers are focusing on innovation, miniaturization, and enhanced signal accuracy. As competition intensifies, a select group of companies are emerging as market leaders, shaping the future of neuromuscular diagnostics and biofeedback applications. Here’s a look at the top 10 electromyography sensor manufacturers at the forefront of this evolving landscape.

Top 10 Electromyography Sensor Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Delsys

Domain Est. 1996

Website: delsys.com

Key Highlights: For 30 years, Delsys have been at the forefront of innovation in wearable sensor technology for understanding and augmenting human movement….

#2 Advanced EMG Sensors for Muscle Analysis

Domain Est. 1997

Website: biometricsltd.com

Key Highlights: Biometrics Ltd’s advanced EMG sensors are designed with cutting-edge technology, built on years of dedicated research and development….

#3 Wearable Sensor Technology

Domain Est. 2013

Website: shimmersensing.com

Key Highlights: Shimmer Research is a world leading wearable technologies services and sensor manufacturing company supplying customized sensor development services….

#4 Surface EMG Systems

Domain Est. 1995

Website: noraxon.com

Key Highlights: Ultium and Core EMG sensors use high-resolution 24-bit converters to capture precise muscle signals without heavy amplification. This hardware design minimizes ……

#5 Natus Medical Incorporated

Domain Est. 1998

Website: natus.com

Key Highlights: We deliver innovative and trusted solutions to screen, diagnose, and treat disorders affecting the brain, neural pathways and eight sensory nervous systems….

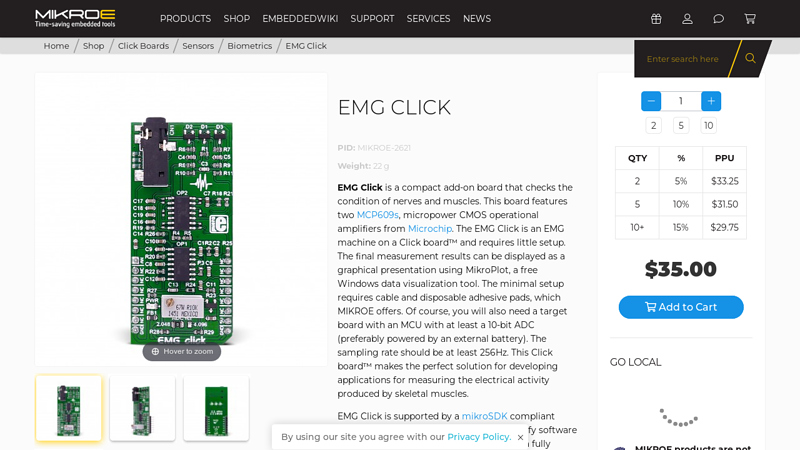

#6 EMG Click

Domain Est. 2004

Website: mikroe.com

Key Highlights: In stock $12 deliveryEMG Click is a compact add-on board that checks the condition of nerves and muscles. This board features two MCP609s, micropower CMOS operational amplifiers …..

#7 Discover Cometa’s emg systems

Domain Est. 2010

Website: cometasystems.com

Key Highlights: Discover our EMG and Motion Tools software, a completely free and yet powerful instrument to acquire, analyze and report EMG and IMU data….

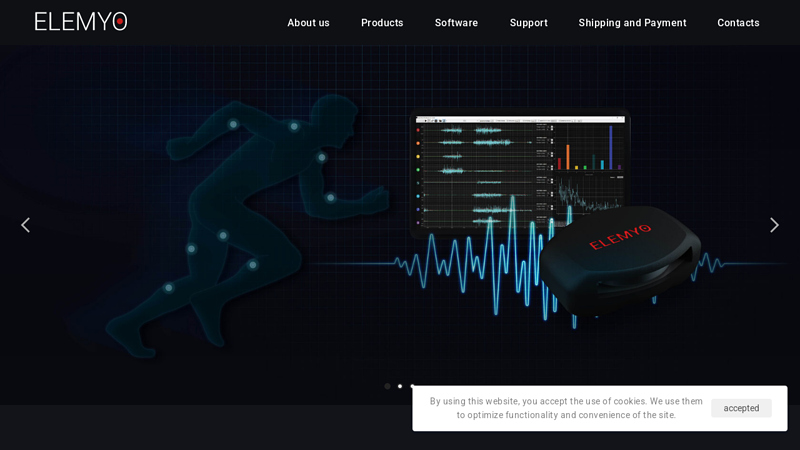

#8 ELEMYO

Domain Est. 2018

Website: elemyo.com

Key Highlights: EMG sensors and wireless EMG systems with myoelectric sensors for your development, research or project tasks regarding muscle activity….

#9 MR EMG

Domain Est. 2019

Website: mremg.com

Key Highlights: The MR EMG Sensors are state of the art Bluetooth wireless EMG recorders. They simply stick on to the subject and send data to an iPad running our MR EMG app….

#10 Electromyography (EMG) Sensor

Domain Est. 2021

Expert Sourcing Insights for Electromyography Sensor

2026 Market Trends for Electromyography Sensors

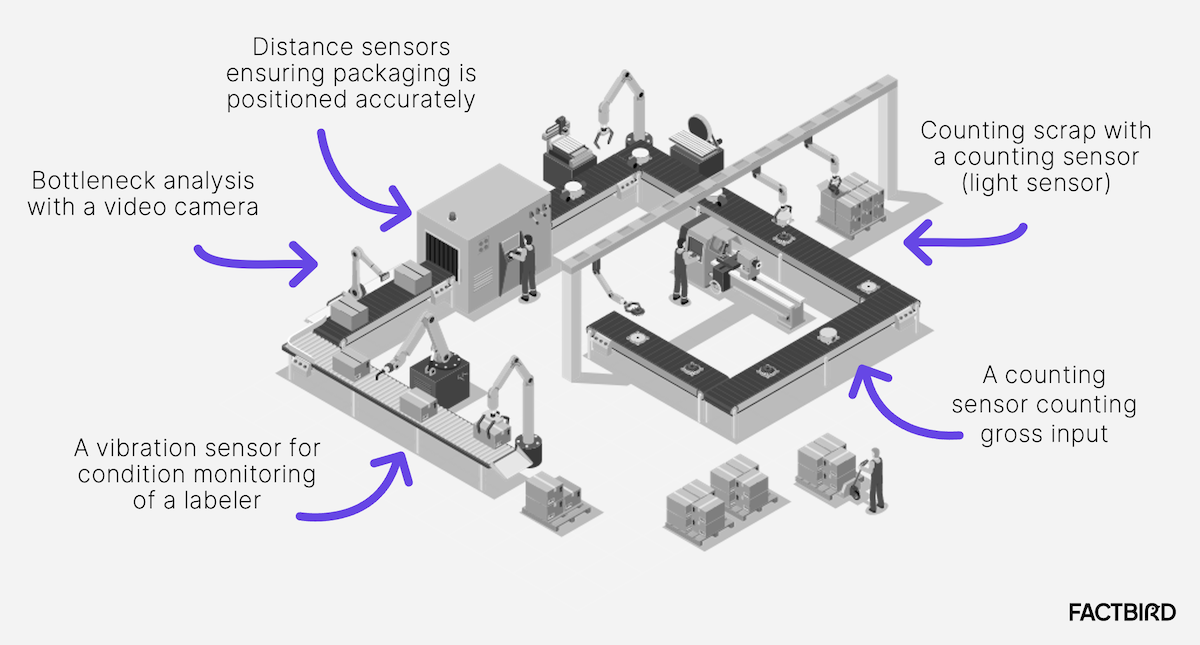

The global electromyography (EMG) sensor market is poised for significant transformation by 2026, driven by technological innovation, rising healthcare demands, and expanding applications beyond traditional medical diagnostics. As wearable health technology and human-machine interfaces gain momentum, EMG sensors are emerging as critical components across multiple industries. This analysis explores key trends shaping the EMG sensor market through 2026.

Rising Demand in Healthcare and Rehabilitation

The healthcare sector continues to be the primary driver of EMG sensor adoption. By 2026, increasing prevalence of neuromuscular disorders—such as amyotrophic lateral sclerosis (ALS), muscular dystrophy, and peripheral nerve injuries—is expected to boost demand for precise diagnostic tools. EMG sensors enable clinicians to assess muscle function and nerve conduction, supporting early diagnosis and treatment planning. Advancements in non-invasive, high-resolution surface EMG (sEMG) sensors are improving patient comfort and data accuracy, making routine monitoring more feasible in outpatient and home-care settings.

Moreover, integration with telemedicine platforms and AI-powered data analytics is expanding remote patient monitoring capabilities. This shift is particularly impactful in aging populations across North America and Europe, where chronic disease management and post-stroke rehabilitation services are in high demand.

Expansion into Wearable and Consumer Electronics

By 2026, EMG sensors are expected to play a pivotal role in the wearable technology market. Consumer-focused applications—including fitness trackers, smart clothing, and gesture-controlled devices—are increasingly incorporating EMG to provide real-time muscle activity feedback. Companies are developing compact, low-power EMG sensors that can be embedded in wristbands, armbands, or textiles, enabling users to monitor muscle fatigue, optimize workouts, and prevent injury.

Notably, tech giants and startups alike are exploring EMG for next-generation human-computer interaction (HCI). Devices like EMG-enabled smart gloves or neural wearables aim to translate subtle muscle movements into digital commands, offering new control paradigms for virtual reality (VR), augmented reality (AR), and prosthetic limb operation.

Growth in Prosthetics and Assistive Technologies

The prosthetics industry is a major adopter of advanced EMG sensors. By 2026, the market for myoelectric prostheses—controlled by muscle signals detected via EMG—is projected to expand significantly. Improvements in signal processing algorithms, sensor miniaturization, and machine learning integration are enhancing the responsiveness and intuitiveness of prosthetic limbs.

In parallel, assistive robotics and exoskeletons are leveraging EMG sensors to adapt support in real time based on user intent. Applications in industrial ergonomics and rehabilitation are gaining traction, particularly in countries with aging workforces such as Japan and Germany.

Technological Innovations and Miniaturization

A key trend shaping the 2026 EMG sensor landscape is rapid technological advancement. Innovations in flexible electronics, dry electrode designs, and wireless transmission are overcoming longstanding challenges related to signal noise, skin irritation, and cumbersome setup. Flexible and textile-based EMG sensors are enabling long-term wearability and integration into everyday garments.

Additionally, the integration of edge computing and on-sensor data preprocessing reduces latency and bandwidth requirements, enabling real-time applications in robotics and sports science. These advancements lower barriers to entry for non-clinical use and support the scalability of EMG solutions.

Regional Market Dynamics

North America is expected to maintain its dominance in the EMG sensor market by 2026, fueled by strong healthcare infrastructure, high R&D investment, and favorable reimbursement policies. Europe follows closely, with growing emphasis on digital health and aging population care.

Meanwhile, the Asia-Pacific region is emerging as a high-growth market, driven by increasing healthcare spending, rising awareness of neuromuscular conditions, and expanding manufacturing capabilities in countries like China and South Korea. Local innovation hubs are also fostering startups developing affordable EMG solutions for broader accessibility.

Regulatory and Standardization Challenges

As EMG sensors enter consumer and industrial domains, regulatory scrutiny is intensifying. By 2026, harmonization of standards for data accuracy, biocompatibility, and cybersecurity will be critical to ensure safety and interoperability. Regulatory bodies such as the FDA and CE are expected to refine guidelines for wearable medical devices incorporating EMG, influencing product development timelines and market entry strategies.

Conclusion

The 2026 EMG sensor market reflects a convergence of medical necessity, technological innovation, and consumer demand. With expanding applications in healthcare, wearables, prosthetics, and robotics, EMG sensors are transitioning from niche diagnostic tools to foundational elements of intelligent human-machine systems. Stakeholders who invest in miniaturization, AI integration, and user-centric design are likely to lead this evolving market.

Common Pitfalls When Sourcing Electromyography (EMG) Sensors

Sourcing high-quality Electromyography (EMG) sensors involves navigating technical, regulatory, and intellectual property (IP) challenges. Avoiding common pitfalls is essential to ensure performance, compliance, and protection against legal risks. Below are key considerations under two critical categories.

Quality-Related Pitfalls

Inadequate Signal Fidelity and Noise Performance

One of the most frequent issues is selecting EMG sensors with poor signal-to-noise ratios (SNR) or insufficient amplification. Low-quality sensors may introduce motion artifacts, electromagnetic interference, or baseline drift, compromising data accuracy—especially in dynamic environments. Always verify specifications such as input-referred noise, common-mode rejection ratio (CMRR), and bandwidth (typically 10–500 Hz for surface EMG).

Lack of Biocompatibility and Skin Interface Quality

Sensors with non-biocompatible materials or poorly designed electrodes can cause skin irritation or inconsistent contact, leading to unreliable readings. Ensure electrode materials (e.g., Ag/AgCl) meet ISO 10993 standards and are suitable for prolonged wear. Dry electrodes may offer convenience but often sacrifice signal stability compared to gel-based alternatives.

Insufficient Validation and Calibration

Many off-the-shelf EMG sensors, especially from lesser-known suppliers, lack proper calibration documentation or independent validation. This can result in inconsistent amplitude measurements across devices or users. Source sensors backed by published technical validation studies and consistent manufacturing quality control processes.

Inadequate Environmental and Mechanical Durability

EMG sensors used in real-world applications (e.g., sports, rehabilitation) must withstand sweat, temperature changes, and physical stress. Sensors without proper ingress protection (e.g., IP67) or robust encapsulation may fail prematurely. Assess mechanical durability and environmental resistance based on intended use cases.

Intellectual Property (IP)-Related Pitfalls

Unlicensed Use of Proprietary Technologies

Many EMG sensors incorporate patented signal processing algorithms, electrode configurations, or wireless transmission methods. Sourcing from vendors without proper IP clearance—or using their components in unlicensed designs—can expose your product to infringement claims. Conduct thorough IP due diligence and request documentation of freedom-to-operate (FTO).

Ambiguous or Restrictive Licensing Agreements

Some suppliers provide EMG modules with restrictive licenses that limit integration, resale, or modification rights. These restrictions can hinder product development or scalability. Carefully review licensing terms before procurement, especially for OEM or embedded applications.

Risk of Reverse Engineering and IP Leakage

When working with contract manufacturers or overseas suppliers, there is a risk of design replication or unauthorized production. Protect your innovations through non-disclosure agreements (NDAs), secure supply chains, and strategic IP filings (e.g., patents, design rights) before engaging third parties.

Overlooking Background IP in Development Kits

Development kits and evaluation modules from EMG sensor manufacturers often include proprietary firmware or software libraries. Using these in final products without proper licensing can lead to legal exposure. Confirm which components are licensed for production use and which are restricted to evaluation only.

By proactively addressing these quality and IP-related pitfalls, organizations can ensure reliable EMG sensor performance while mitigating legal and operational risks in their product development lifecycle.

Logistics & Compliance Guide for Electromyography (EMG) Sensors

Regulatory Classification and Approvals

Electromyography (EMG) sensors are typically classified as medical devices and are subject to stringent regulatory requirements depending on the target market. In the United States, the Food and Drug Administration (FDA) regulates EMG sensors under 21 CFR Part 882, usually as Class II devices, requiring either a 510(k) premarket notification or, in some cases, a De Novo classification. In the European Union, EMG sensors must comply with the Medical Device Regulation (MDR) (EU) 2017/745 and carry the CE mark, typically falling under Class IIa or IIb depending on their intended use. Manufacturers must establish a Quality Management System (QMS) compliant with ISO 13485 and ensure adherence to technical documentation, clinical evaluation, and post-market surveillance requirements. Other regions, such as Canada (Health Canada), Australia (TGA), and Japan (PMDA), have their own regulatory pathways that must be navigated before market entry.

Labeling and Packaging Requirements

Proper labeling and packaging are critical for regulatory compliance and user safety. EMG sensors must be labeled with essential information including the device name, model number, manufacturer details, UDI (Unique Device Identifier), expiration date (if applicable), storage conditions, and applicable regulatory marks (e.g., CE, FDA listing number). Instructions for Use (IFU) must be provided in the languages of the target markets and include warnings, contraindications, setup procedures, and maintenance guidelines. Packaging must ensure sterility (if applicable), protect the device during transit, and comply with environmental regulations such as the EU Packaging and Packaging Waste Directive. Tamper-evident seals and anti-counterfeiting measures are recommended, especially for implantable or reusable sensors.

Shipping, Storage, and Handling

EMG sensors may contain sensitive electronic components and, in some cases, sterile elements, necessitating careful handling throughout the supply chain. Devices should be shipped in temperature-controlled environments if specified by the manufacturer, typically between 15°C and 30°C, and protected from moisture, shock, and electromagnetic interference. Storage areas must be clean, dry, and secure, with documented environmental monitoring where required. Battery-powered sensors should be shipped in a partial charge state to reduce risk, in compliance with IATA Dangerous Goods Regulations if lithium batteries are included. Special handling instructions must be communicated to logistics partners, and cold chain or climate-controlled logistics may be necessary for certain components.

Import/Export Compliance

International shipping of EMG sensors requires compliance with import/export regulations, including proper classification under the Harmonized System (HS Code)—typically 9018.19 for electromedical equipment. Exporters must obtain necessary licenses or authorizations, particularly when shipping to countries with strict medical device import controls. Accurate commercial invoices, packing lists, certificates of origin, and regulatory certificates (e.g., Certificate to Foreign Government, CFS) must accompany shipments. Compliance with U.S. Commerce Department’s Export Administration Regulations (EAR) or International Traffic in Arms Regulations (ITAR) may apply depending on sensor technology. Additionally, importers must ensure conformity with local customs, taxation (e.g., VAT, GST), and medical device registration requirements in the destination country.

Post-Market Surveillance and Reporting

After market release, manufacturers are obligated to implement a post-market surveillance (PMS) system to monitor device performance and detect adverse events. Under FDA and EU MDR, any malfunction, serious injury, or death related to the EMG sensor must be reported within specified timelines (e.g., 30 days for FDA, 15 days for EU serious incidents). Field safety corrective actions (FSCAs), such as recalls or updates, must be documented and communicated to regulatory authorities and customers. Regular periodic safety update reports (PSURs) are required under MDR for Class II devices. Manufacturers must also maintain a robust complaint handling system and conduct trend analysis to identify potential risks and ensure continuous compliance.

Environmental and Disposal Compliance

EMG sensors may contain electronic waste (e-waste) and potentially hazardous materials, requiring compliance with environmental directives such as the EU’s Waste Electrical and Electronic Equipment (WEEE) Directive and Restriction of Hazardous Substances (RoHS) Directive. Devices must be labeled with the crossed-out wheeled bin symbol, and manufacturers must participate in take-back and recycling programs. Proper disposal instructions should be included in the IFU, especially for single-use or battery-containing sensors. Shipping used or defective devices for repair or recycling must follow local and international hazardous waste transport regulations (e.g., Basel Convention). Sustainable packaging and end-of-life management strategies are increasingly important for global compliance and corporate responsibility.

Conclusion for Sourcing Electromyography (EMG) Sensors

In conclusion, sourcing electromyography (EMG) sensors requires a careful evaluation of intended application, performance specifications, budget, and ease of integration. Whether for research, clinical diagnostics, rehabilitation, or human-machine interfaces, selecting the right EMG sensor involves balancing factors such as signal accuracy, noise immunity, portability, power consumption, and data transmission capabilities.

Off-the-shelf solutions from reputable suppliers offer reliability and technical support, making them ideal for time-sensitive or standardized applications. Conversely, custom or open-source platforms may provide greater flexibility and cost-efficiency for specialized or innovative projects, though they demand greater expertise in signal processing and hardware integration.

Key considerations include choosing between surface and intramuscular EMG sensors based on invasiveness and signal resolution needs, ensuring compatibility with data acquisition systems, and verifying regulatory compliance (e.g., FDA, CE) for medical use. Additionally, advancements in wireless and wearable EMG technologies are expanding accessibility and usability in real-world environments.

Ultimately, a well-informed sourcing strategy—one that aligns sensor capabilities with project goals—ensures high-quality data acquisition, reproducible results, and successful implementation across diverse applications in healthcare, sports science, and assistive technologies.