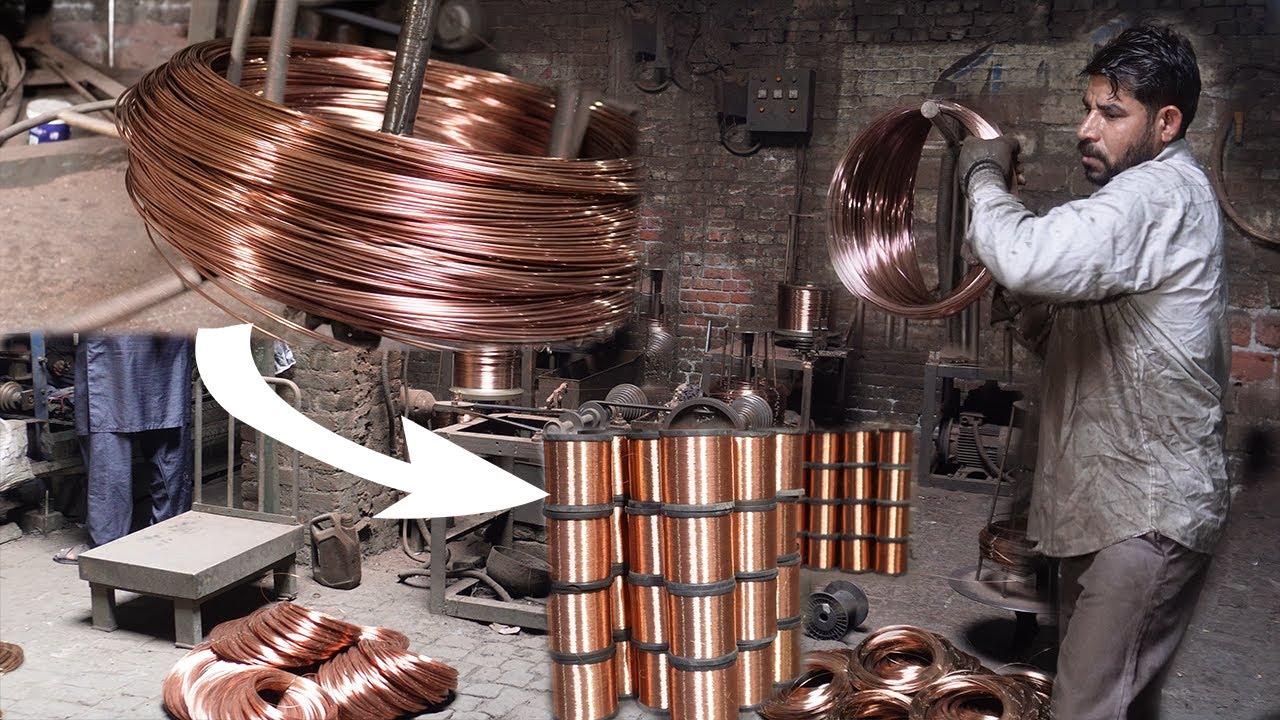

The global electrical wire and cable market is experiencing robust growth, driven by rising infrastructure investments, expanding power transmission networks, and the rapid adoption of renewable energy systems. According to Mordor Intelligence, the market was valued at USD 230.27 billion in 2024 and is projected to reach USD 305.52 billion by 2029, growing at a CAGR of 5.7% during the forecast period. This growth is further amplified by increasing urbanization, stringent energy efficiency standards, and the electrification of transportation. As demand surges, manufacturers are scaling production, innovating with low-smoke zero-halogen (LSZH) and fire-resistant cables, and expanding their global footprint. In this highly competitive landscape, a select group of industry leaders continues to dominate through advanced R&D, vertical integration, and strategic partnerships—shaping the future of safe, efficient, and reliable electrical connectivity worldwide.

Top 10 Electrical Wire Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Wire and Cable Manufacturers

Domain Est. 1996

Website: encorewire.com

Key Highlights: Encore Wire is the leading manufacturer of copper and aluminum for residential, commercial and industrial wire needs. We’re unlike any other wire company….

#2 Service Wire Company

Domain Est. 1996 | Founded: 1968

Website: servicewire.com

Key Highlights: Since 1968, we’ve built a reputation for safely manufacturing high-quality wire and cable, delivering industry-leading service levels….

#3 We Are Champlain Cable

Domain Est. 1996

Website: champcable.com

Key Highlights: America’s premier innovator, designer and manufacturer of high performance wire and cable with a 60-year history of providing solutions to the toughest problems ……

#4 Allied Wire & Cable

Domain Est. 1997

Website: awcwire.com

Key Highlights: We specialize in the latest wire, cable, and connectivity products, as well as tailored solutions, serving diverse industries such as Communications, OEM, Data ……

#5 Electrical Wire & Cable Distributors

Domain Est. 1997 | Founded: 1975

Website: houwire.com

Key Highlights: Founded in 1975, Houston Wire and Cable is a master distributor of industrial wire and cable, supplying electrical distributors throughout the USA….

#6 Nehring Electrical Works Company

Domain Est. 1998

Website: nehringwire.com

Key Highlights: We bring by delivering bare, tinned, covered, or clad aluminum and copper wire to your specifications….

#7 Priority Wire & Cable

Domain Est. 1999

Website: prioritywire.com

Key Highlights: Priority Wire & Cable supplies wire & cable from the largest stock in the U.S. and offers same day shipping. This includes Industrial, Aluminum, and many ……

#8 Remington Industries

Domain Est. 2000

Website: remingtonindustries.com

Key Highlights: Our value-added services make us a one-stop-shop wire supplier; we offer customizations to your industrial and electrical wire, as well as 3D printing services….

#9 Southwire

Domain Est. 1994

Website: southwire.com

Key Highlights: Choose Southwire for your wire and cable needs – we offer high-performance products that are built to last….

#10 Copper Wire Supplier

Domain Est. 1996

Website: cerrowire.com

Key Highlights: Cerrowire is a leading copper wire supplier offering MC cables, aluminum wire, and building cables for reliable electrical solutions….

Expert Sourcing Insights for Electrical Wire

H2: 2026 Market Trends for Electrical Wire

The electrical wire market in 2026 is poised for robust growth, driven by global shifts toward electrification, renewable energy, and smart infrastructure. Key trends shaping the market include:

1. Surge in Renewable Energy Infrastructure

The global push for decarbonization will accelerate investments in solar, wind, and hydroelectric power. Electrical wire demand will rise significantly for grid interconnections, solar farms, and offshore wind projects, particularly in regions like North America, Europe, and Asia-Pacific.

2. Expansion of Electric Vehicle (EV) Ecosystems

With EV adoption expected to grow exponentially by 2026, demand for specialized high-voltage and charging infrastructure wiring will climb. This includes EV charging stations, battery manufacturing facilities, and upgraded power distribution networks to support increased load.

3. Smart Grid and Grid Modernization Initiatives

Governments and utilities are investing heavily in modernizing aging power grids to improve reliability, efficiency, and integration of distributed energy resources. This drives demand for intelligent cabling systems capable of supporting real-time monitoring and data transmission.

4. Growth in Building and Construction Sectors

Urbanization, especially in emerging economies, will boost construction of residential, commercial, and industrial buildings—each requiring extensive low- and medium-voltage wiring. Green building standards will also increase demand for energy-efficient and low-emission cables.

5. Technological Advancements and Material Innovation

Manufacturers are focusing on developing lightweight, fire-resistant, and halogen-free cables. Copper remains dominant, but aluminum conductors are gaining traction due to cost and weight advantages in specific applications like overhead transmission.

6. Supply Chain Resilience and Localization

Ongoing geopolitical tensions and supply chain disruptions have prompted companies to regionalize production. By 2026, nearshoring and localized manufacturing of electrical wires will grow, especially in North America and Europe, to reduce dependency on single-source suppliers.

7. Regulatory and Safety Standards Tightening

Stricter fire safety, environmental, and energy efficiency regulations—such as the EU’s CPR and evolving NEC codes in the U.S.—will influence product design and drive demand for compliant, high-performance cables.

In summary, the 2026 electrical wire market will be defined by sustainability, digitalization, and infrastructure modernization, offering substantial opportunities for innovation and expansion across multiple sectors.

Common Pitfalls When Sourcing Electrical Wire (Quality and IP)

Sourcing electrical wire involves more than just finding the lowest price—overlooking critical quality and intellectual property (IP) factors can lead to safety hazards, compliance failures, and long-term costs. Below are key pitfalls to avoid.

Poor Quality Control and Substandard Materials

One of the most frequent issues is receiving electrical wire made from inferior materials, such as copper-clad aluminum (CCA) instead of pure copper. CCA wires have higher resistance, leading to overheating and fire risks. Buyers may also encounter inconsistent insulation thickness, non-compliant jacketing materials, or failure to meet temperature and voltage ratings. These defects often stem from lax manufacturing standards or suppliers cutting corners to reduce costs.

Misrepresentation of IP and Certification

Suppliers may falsely claim that their products meet international standards (e.g., UL, CE, RoHS, or IEC certifications) without proper documentation or third-party testing. This misrepresentation not only breaches trust but can lead to legal liabilities and product recalls. Always verify certifications through official databases and request test reports from accredited laboratories.

Counterfeit or Non-Genuine Products

The electrical market is prone to counterfeit goods, especially when sourcing from less-regulated regions. Fake wires may imitate reputable brand markings, packaging, and labeling. These counterfeit products frequently fail under load and do not meet safety requirements. Conduct factory audits and use brand verification tools to mitigate this risk.

Inadequate IP Protection in Contracts

When developing custom or proprietary wire solutions, failing to secure intellectual property rights in supplier agreements is a major oversight. Without clear contractual terms, suppliers may replicate designs, sell to competitors, or claim ownership of innovations. Ensure all custom specifications, drawings, and formulations are protected under confidentiality and IP clauses.

Lack of Traceability and Documentation

Reputable wire suppliers should provide full traceability, including batch numbers, material certificates (e.g., mill test reports), and compliance documentation. Poor documentation makes it difficult to investigate failures, conduct recalls, or prove compliance during audits. Insist on complete paperwork as part of your procurement process.

Overlooking Environmental and Regulatory Compliance

Electrical wires must comply with environmental regulations like REACH, RoHS, and low-smoke zero-halogen (LSZH) requirements, especially for use in public or confined spaces. Sourcing non-compliant wire can result in project delays, fines, or rejected installations. Confirm material composition and regulatory alignment prior to purchase.

By addressing these pitfalls proactively—through rigorous vetting, clear contracts, and independent verification—organizations can ensure they source electrical wire that is both safe and compliant.

Logistics & Compliance Guide for Electrical Wire

Electrical wire is a critical component in construction, manufacturing, and infrastructure projects. Proper logistics and compliance management ensures product quality, safety, and adherence to legal requirements across supply chains. This guide outlines best practices and key regulations relevant to the transportation, storage, and regulatory compliance of electrical wire.

Classification and Regulatory Standards

Electrical wire must comply with national and international standards to ensure safety and performance. Key standards include:

- National Electrical Code (NEC) – NFPA 70 (USA): Specifies installation requirements and acceptable wire types based on use and environment.

- UL (Underwriters Laboratories) Certification: Mandatory for most electrical products sold in North America; UL 44 and UL 1581 cover wire and cable safety tests.

- IEC Standards (International Electrotechnical Commission): IEC 60227 and IEC 60245 define general requirements for PVC and rubber-insulated cables used globally.

- CE Marking (Europe): Indicates conformity with health, safety, and environmental protection standards for products sold within the European Economic Area.

- RoHS and REACH Compliance (EU): Restricts hazardous substances in electrical equipment and requires chemical safety assessments.

Ensure all electrical wire products have proper certification labels and documentation before shipment or distribution.

Packaging and Labeling Requirements

Appropriate packaging protects wire from damage and environmental exposure during transit. Labeling must include:

- Product type, gauge (AWG or mm²), voltage rating, and temperature rating

- Manufacturer name and part number

- Compliance marks (e.g., UL, CE, RoHS)

- Length and weight specifications

- Batch or lot number for traceability

- “Fragile” and “This End Up” indicators where applicable

Use sealed, moisture-resistant packaging for indoor storage or long-distance shipping. Spools or reels should be securely crated to prevent unspooling or deformation.

Storage Conditions

Proper storage preserves wire integrity and prevents degradation:

- Environment: Store in a dry, climate-controlled area (ideally 10°C to 30°C; 50°F to 86°F) with low humidity.

- Sunlight Exposure: Avoid direct UV exposure, which can degrade insulation materials (e.g., PVC, PE).

- Stacking: Do not stack spools or reels higher than recommended by the manufacturer to prevent crushing.

- Pests and Contaminants: Keep away from rodents, chemicals, and corrosive substances.

Regularly inspect stored inventory for signs of damage, moisture, or rodent activity.

Transportation and Handling

Secure handling during transit prevents mechanical damage:

- Loading/Unloading: Use forklifts or cranes with appropriate attachments to move heavy spools; avoid rolling spools on edges.

- Securement: Anchor spools and reels in trucks or containers to prevent shifting.

- Weather Protection: Use waterproof tarps or enclosed containers when transporting in wet conditions.

- Temperature Extremes: Avoid prolonged exposure to freezing temperatures or excessive heat, which may affect insulation properties.

For international shipping, ensure compliance with IATA, IMDG (for sea freight), or ADR (for road transport in Europe) if applicable, especially for wires containing restricted materials.

Import/Export Compliance

Cross-border movement of electrical wire requires attention to trade regulations:

- HS Codes: Use correct Harmonized System codes (e.g., 8544.42 or 8544.49 for insulated copper wire) for customs declarations.

- Country-Specific Approvals: Verify requirements in destination countries—e.g., INMETRO in Brazil, CCC in China, or S-Mark in Singapore.

- Documentation: Provide commercial invoice, packing list, certificate of origin, and test reports (e.g., UL, CE, IEC).

- Duty and Tax Assessment: Classify goods accurately to determine applicable tariffs and VAT/GST.

Work with licensed customs brokers to ensure smooth clearance.

Quality Control and Traceability

Maintain rigorous quality assurance throughout the supply chain:

- Conduct periodic batch testing for conductivity, insulation resistance, and flame resistance.

- Keep records of material sourcing, production dates, and compliance certifications.

- Implement a traceability system using lot numbers to manage recalls or field issues.

Partner only with suppliers who provide full compliance documentation and third-party test reports.

Environmental and Disposal Considerations

Electrical wire often contains copper, aluminum, and plastic insulation. Follow these guidelines:

- Recycling: Promote recycling of scrap wire through certified e-waste handlers.

- Waste Disposal: Comply with local regulations for disposal of non-recyclable or hazardous wire (e.g., lead-containing insulation).

- Sustainability: Source wire from manufacturers with environmental management systems (e.g., ISO 14001).

Summary

Managing the logistics and compliance of electrical wire requires attention to technical specifications, regulatory standards, safe handling, and documentation. By adhering to international standards, maintaining proper storage and transport protocols, and ensuring full traceability and certification, businesses can reduce risk, avoid delays, and ensure the safe delivery of electrical wire products worldwide.

In conclusion, sourcing electrical wire requires careful consideration of several key factors including wire type, gauge, insulation material, compliance with relevant standards (such as UL, CSA, or IEC), and the specific application environment (e.g., indoor, outdoor, high temperature, or corrosive conditions). Cost-effectiveness should be balanced with quality and safety to avoid long-term risks and failures. Establishing reliable suppliers, verifying certifications, and conducting regular quality checks are essential steps in ensuring a consistent and safe supply. Ultimately, a well-informed sourcing strategy not only supports operational efficiency but also enhances safety, compliance, and reliability of electrical systems.