The global electrical plugs and sockets market is experiencing steady growth, driven by rising urbanization, infrastructure development, and increased demand for safe and efficient electrical connectivity solutions across residential, commercial, and industrial sectors. According to a report by Mordor Intelligence, the market was valued at approximately USD 22.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2029. Similarly, Grand View Research estimates the market to exceed USD 25 billion by 2025, underpinned by advancements in smart building technologies and stringent safety regulations worldwide. As demand surges across emerging economies and developed regions alike, a select group of manufacturers have emerged as leaders in innovation, quality, and global reach. Here’s a data-driven look at the top 10 electrical plugs and sockets manufacturers shaping the future of electrical connectivity.

Top 10 Electrical Plugs & Sockets Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Leviton

Domain Est. 1995

Website: leviton.com

Key Highlights: Leviton offers a wide range of lighting controls, wiring devices and networking to meet the needs of today’s residential, commercial and industrial ……

#2 Arlington

Domain Est. 1998

Website: aifittings.com

Key Highlights: A leading manufacturer of quality metallic and non-metallic electrical fittings and connectors, supports; as well as, low voltage, security, and audio/video ……

#3 Industrial Plugs & Socket

Website: amphenol-industrial.de

Key Highlights: Amphenol’s CEE industrial plugs provide safety, durability, and reliability, are cost-effective, tested to IEC standards, and are designed for easy ……

#4 CEE plugs and sockets

Website: walther-werke.de

Key Highlights: The WALTHER range of NEO CEE plugs and sockets offers the right solution for a wide variety of applications: for industrial applications, on construction sites, ……

#5 Electrical Products

Domain Est. 1994

Website: molex.com

Key Highlights: Molex offers a complete line of reliable electrical solutions designed to support optimal worker safety and performance for today’s harsh duty environments….

#6 Plugs, Sockets, & Connectors

Domain Est. 1996

Website: interpower.com

Key Highlights: Our power plugs, sockets, and connectors are designed to meet electrical needs around the world. Choose from our various power plugs, sockets, and connectors….

#7 Arrow Hart wiring devices

Domain Est. 1996

Website: eaton.com

Key Highlights: Eaton’s Arrow Hart specification grade commercial wiring devices are engineered with unique features that can help reduce installation time, provide reliable ……

#8 Plugs and sockets

Domain Est. 1997

Website: catalogue.bals.com

Key Highlights: A large selection of Bals connectors. We manufacture plugs and sockets in different variants and thus cover all your needs for different connection solutions ……

#9 Light Switches and Sockets

Domain Est. 1997

Website: se.com

Key Highlights: Schneider Electric’s weatherproof and dedicated application light switches and sockets are designed to withstand the harshest elements. These heavy-duty devices ……

#10 World plugs

Website: iec.ch

Key Highlights: Select a location, electric potential or frequency to discover what plug type(s), voltage and frequency are used there….

Expert Sourcing Insights for Electrical Plugs & Sockets

H2: 2026 Market Trends for Electrical Plugs & Sockets

The global market for electrical plugs and sockets is poised for significant transformation by 2026, driven by technological innovation, regulatory shifts, and evolving consumer demands. As urbanization accelerates and smart infrastructure expands, the industry is adapting to meet higher standards for safety, efficiency, and connectivity. Below is an analysis of key trends expected to shape the electrical plugs and sockets market in 2026.

H2: Smart Integration and IoT Connectivity

One of the most influential trends in 2026 is the widespread integration of smart technology into electrical plugs and sockets. With the growing adoption of smart homes and buildings, consumers are increasingly opting for IoT-enabled outlets that allow remote control via smartphones or voice assistants. These smart sockets support energy monitoring, scheduling, and integration with broader home automation systems. Leading manufacturers are embedding Wi-Fi, Zigbee, and Matter protocol compatibility into their products to ensure interoperability across platforms.

H2: Focus on Energy Efficiency and Sustainability

Environmental concerns and regulatory pressures are pushing manufacturers to design more energy-efficient plugs and sockets. In 2026, devices featuring automatic power cutoff, low standby power consumption, and energy usage analytics are becoming standard in both residential and commercial settings. Additionally, the use of recyclable and non-toxic materials—such as bio-based plastics and flame-retardant composites—is gaining traction as companies respond to circular economy principles and stricter environmental regulations like the EU’s Ecodesign Directive.

H2: Global Standardization and Safety Regulations

The lack of universal plug and socket standards has long posed challenges for international travel and global product distribution. By 2026, there is a growing push toward harmonization, especially in regions undergoing rapid electrification. The International Electrotechnical Commission (IEC) standards, such as IEC 60884 and IEC 60309, are being increasingly adopted. Enhanced safety features—including child-safe shutters, overload protection, and arc-fault detection—are now mandated in many markets, reflecting a stronger emphasis on user protection.

H2: Expansion in Emerging Markets

Emerging economies in Asia-Pacific, Africa, and Latin America are driving demand for electrical plugs and sockets due to infrastructure development and rising electrification rates. Countries like India, Nigeria, and Indonesia are investing heavily in rural electrification and smart city projects, creating a surge in demand for reliable, durable, and affordable electrical accessories. Local manufacturing and partnerships with global suppliers are enabling faster market penetration and customization to regional standards.

H2: Growth in Industrial and Commercial Applications

Beyond residential use, the commercial and industrial sectors are major growth areas. Data centers, electric vehicle (EV) charging stations, and renewable energy installations require high-performance, industrial-grade sockets capable of handling higher voltages and currents. In 2026, specialized connectors compliant with IEC 62196 (for EVs) and ruggedized designs for harsh environments are seeing increased adoption. Demand is further fueled by the rollout of public and private EV charging networks.

H2: Design Innovation and User Experience

Aesthetic and ergonomic design are becoming differentiators in a competitive market. Consumers in 2026 prefer sleek, minimalist designs that blend with modern interiors. Modular socket systems, USB-C integrated outlets, and customizable faceplates offer enhanced functionality and convenience. Additionally, color-coded and labeled sockets are improving usability in multi-device environments such as offices and schools.

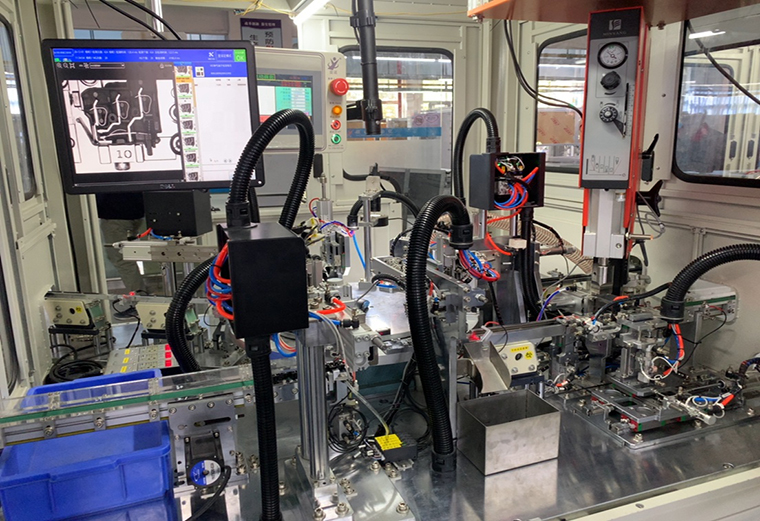

H2: Supply Chain Resilience and Regional Manufacturing

Geopolitical tensions and post-pandemic disruptions have prompted a reevaluation of supply chain strategies. By 2026, many manufacturers are shifting toward regional production hubs to reduce dependency on single-source suppliers and mitigate risks. Automation and digital twin technologies are being used to optimize manufacturing processes and ensure consistent quality across global operations.

Conclusion

The electrical plugs and sockets market in 2026 is characterized by a convergence of digitalization, sustainability, and safety. As smart infrastructure and clean energy initiatives expand, the role of electrical accessories is evolving from passive components to active elements in energy management systems. Companies that innovate in connectivity, eco-design, and user-centric functionality are best positioned to lead in this dynamic landscape.

Common Pitfalls Sourcing Electrical Plugs & Sockets (Quality, IP)

Sourcing electrical plugs and sockets involves significant risks if quality and Ingress Protection (IP) ratings are not carefully evaluated. Overlooking these aspects can lead to safety hazards, non-compliance, and costly failures. Below are key pitfalls to avoid:

Inadequate Verification of IP Ratings

Many suppliers claim high IP ratings (e.g., IP66, IP67), but these claims are often unverified or based on internal testing rather than certified third-party evaluations. Purchasers may receive products that fail under real-world conditions, especially in outdoor, industrial, or wet environments. Always demand valid test certificates from accredited laboratories (e.g., TÜV, UL, SGS) to confirm the IP rating.

Poor Material Quality and Construction

Low-cost plugs and sockets may use substandard materials such as brittle thermoplastics, undersized conductors, or low-grade metal contacts. This compromises durability, increases resistance (leading to overheating), and reduces mechanical strength. Inspect samples for signs of poor molding, weak strain relief, and lack of flame-retardant properties.

Lack of Compliance with Regional Standards

Electrical products must comply with regional safety standards (e.g., UL in North America, CE/IEC in Europe, CCC in China). Sourcing non-compliant plugs and sockets can result in product rejection, legal liability, or safety incidents. Verify that products carry the appropriate certification marks and are tested to the correct standards for the target market.

Inconsistent IP Performance Across Product Batches

Even if initial samples meet IP requirements, mass-produced units may vary in quality due to inconsistent manufacturing processes. Without ongoing quality control and batch testing, IP seals (e.g., gaskets, O-rings) may be missing, misaligned, or degraded. Implement supplier audits and regular sample testing to ensure consistency.

Overlooking Environmental and Mechanical Durability

IP ratings only address protection against solids and liquids—not mechanical stress, UV exposure, or temperature extremes. Plugs and sockets used outdoors or in industrial settings may degrade prematurely if not rated for UV resistance or thermal cycling. Confirm that materials and design suit the intended operating environment.

Misleading Marketing of “Waterproof” or “Industrial-Grade” Claims

Marketing terms like “waterproof” or “heavy-duty” are not standardized and can be misleading. These terms do not guarantee a specific IP rating or performance level. Always refer to documented IP ratings and test reports instead of relying on promotional language.

Insufficient Contact Quality and Current Rating Accuracy

Poor internal contacts can lead to arcing, overheating, and fire hazards. Some low-quality sockets have contacts that lose spring tension quickly, increasing resistance. Verify that the product’s current rating (e.g., 16A) is supported by proper contact design and material—don’t assume rated values are accurate without testing.

Inadequate Packaging and Moisture Protection During Shipping

Even IP67-rated products can be compromised if shipped in non-protective packaging, especially when exposed to humidity or temperature changes. Moisture ingress during transit can damage internal components before installation. Ensure suppliers use sealed, moisture-resistant packaging with desiccants when necessary.

Avoiding these pitfalls requires due diligence, independent testing, and strong supplier qualification processes. Prioritize certified, traceable products from reputable manufacturers to ensure safety, reliability, and compliance.

Logistics & Compliance Guide for Electrical Plugs & Sockets

Introduction

Electrical plugs and sockets are essential components in global power distribution systems. Due to their direct interaction with electrical networks and potential safety risks, they are subject to strict regulatory, safety, and logistical requirements. This guide outlines key considerations for the international logistics and compliance of electrical plugs and sockets, ensuring safe transportation, market access, and adherence to standards.

Regulatory & Safety Standards

Electrical plugs and sockets must comply with region-specific safety and performance standards. Key regulatory frameworks include:

– IEC Standards (International Electrotechnical Commission): IEC 60884 (plugs and socket-outlets for household and similar purposes) provides a global baseline.

– UL/CSA (North America): In the U.S. and Canada, devices must meet UL 498 (plug and receptacle standards) and be certified by recognized bodies like UL or CSA.

– CE Marking (European Union): Compliance with the Low Voltage Directive (2014/35/EU) and EN 50075/EN 50076 standards is mandatory. Product conformity must be demonstrated via CE marking.

– UKCA Marking (United Kingdom): Post-Brexit, UKCA marking is required for sale in Great Britain, with compliance to BS 1363 (Type G plugs) being essential.

– CCC Certification (China): Mandatory for plugs and sockets sold in China under GB 2099 and GB 1002 standards.

– Other Regional Standards: Include PSE (Japan), SASO (Saudi Arabia), BIS (India), and SAA (Australia/NZ), each with specific testing and certification requirements.

Product Certification & Documentation

Ensure all products are certified by accredited testing laboratories. Required documentation includes:

– Test reports from accredited labs (e.g., TÜV, Intertek, SGS)

– Certificate of Conformity (CoC)

– Technical construction files

– Declaration of Conformity (DoC) for CE, UKCA, or other regional marks

– Safety data sheets (if applicable)

Maintain digital and physical copies for customs and market surveillance inspections.

Packaging & Labeling Requirements

Proper packaging and labeling are critical for compliance and logistics:

– Labeling: Include manufacturer name, model number, voltage/current ratings, certification marks (e.g., CE, UL, CCC), and safety warnings in the local language.

– Packaging: Use durable, anti-static materials to protect components. Clearly mark packages with handling instructions (e.g., “Fragile,” “Do Not Stack”).

– Retail vs. Bulk Shipments: Retail packaging must meet local labeling laws; bulk shipments should include detailed packing lists and compliance documentation.

Import/Export Regulations

Understand customs procedures and import restrictions:

– HS Codes: Use accurate Harmonized System codes (e.g., 8536.69 for electrical accessories) for tariff classification.

– Duties & Taxes: Research import duties, VAT, and excise taxes in destination countries. Preferential trade agreements may reduce tariffs.

– Restricted/Prohibited Items: Some countries ban non-compliant or uncertified electrical products. Verify admissibility before shipping.

– Customs Documentation: Prepare commercial invoice, packing list, bill of lading/airway bill, CoC, and import license (if required).

Logistics & Transportation

Special handling may be needed due to product sensitivity:

– Mode of Transport: Air freight for urgent, high-value shipments; sea freight for bulk orders.

– Storage Conditions: Store in dry, temperature-controlled environments to prevent corrosion or insulation degradation.

– Inventory Management: Track batch numbers and certifications to enable rapid recall if non-compliance is identified.

– Reverse Logistics: Establish procedures for handling returns, especially for non-compliant or defective units.

Market Surveillance & Post-Market Compliance

Compliance does not end at import:

– Surveillance: Regulatory bodies (e.g., RAPEX in EU) monitor market products. Non-compliant items may be recalled or banned.

– Product Registration: Some markets (e.g., Saudi Arabia, South Korea) require pre-market registration.

– Incident Reporting: Implement systems to report and address safety incidents or customer complaints promptly.

– Updates & Recalls: Stay informed of standard revisions and initiate recalls if products fail to meet current requirements.

Best Practices for Compliance & Logistics

- Conduct regular audits of suppliers and production facilities.

- Use third-party compliance consultants for complex markets.

- Maintain a centralized compliance database with certification expiry dates.

- Train logistics teams on electrical product handling and documentation.

- Partner with freight forwarders experienced in regulated goods.

Conclusion

Successfully navigating the logistics and compliance landscape for electrical plugs and sockets requires meticulous attention to regional regulations, certification processes, and supply chain management. Proactive compliance not only ensures market access but also protects consumers and brand reputation. By adhering to this guide, businesses can minimize delays, avoid penalties, and ensure the safe global distribution of electrical accessories.

Conclusion: Sourcing Electrical Plugs & Sockets

Sourcing electrical plugs and sockets requires careful consideration of safety, compliance, compatibility, and quality. Due to the wide variation in electrical standards across regions—such as plug types (e.g., Type C, G, I), voltage, and current ratings—it is essential to select products that meet the specific regulatory requirements of the target market. Compliance with international standards (e.g., IEC, BS, AS/NZS) and local certifications (e.g., CE, UL, CCC) ensures safety, reliability, and legal marketability.

When sourcing, prioritize reputable suppliers with proven manufacturing standards, clear documentation, and a history of compliance. Conducting factory audits, requesting product testing reports, and obtaining samples for evaluation can mitigate risks associated with counterfeit or substandard components.

Additionally, consider factors such as material durability, ease of installation, environmental resistance (e.g., IP ratings for moisture and dust), and long-term maintenance. For global operations or multinational projects, standardizing on versatile, high-quality components that meet or exceed regional specifications can streamline procurement and reduce logistical complexity.

In summary, successful sourcing of electrical plugs and sockets hinges on balancing regulatory adherence, quality assurance, and cost-effectiveness, ensuring both operational safety and supply chain efficiency.