The global electrical appliances market continues to expand at a robust pace, driven by rising urbanization, increasing disposable incomes, and growing demand for energy-efficient and smart home technologies. According to Mordor Intelligence, the market was valued at approximately USD 640 billion in 2023 and is projected to grow at a CAGR of over 5.8% from 2024 to 2029. A similar outlook is provided by Grand View Research, which reports the market size exceeded USD 600 billion in 2022 and anticipates sustained growth fueled by advancements in IoT integration and demand for premium, automated appliances. As innovation accelerates and consumer preferences evolve, a select group of manufacturers are leading the charge in technology, sustainability, and global market share—setting the standard in this competitive landscape.

Top 10 Electrical Appliances Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Manufacturing Specialty Appliances Since 1969

Domain Est. 1998

Website: summitappliance.com

Key Highlights: Summit Appliance, a division of Felix Storch, Inc., is a manufacturer and distributor of specialty major appliances for residential, commercial, ……

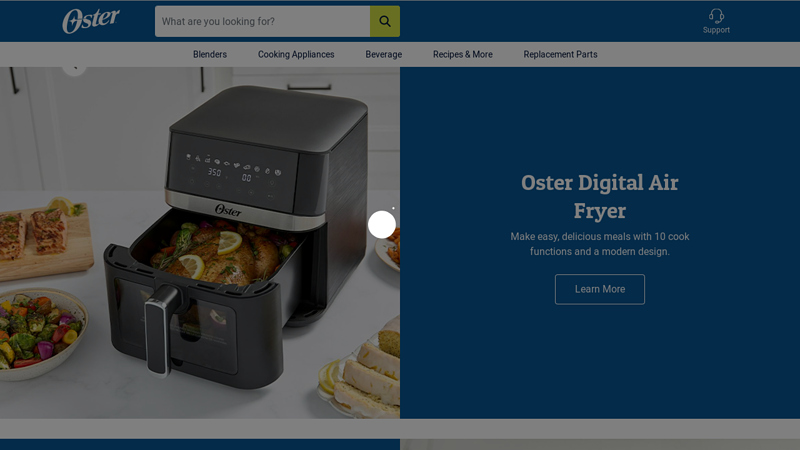

#2 Oster

Domain Est. 1995

Website: oster.com

Key Highlights: Oster is a leading producer of kitchen appliances and tools to make your life easier when cooking delicious meals. Explore Now….

#3 global

Domain Est. 1998

Website: midea.com

Key Highlights: Midea, the world’s leading manufacturer of home appliances, specializes in air treatment, refrigeration, laundry, large cooking appliances, large and small ……

#4 Frigidaire

Domain Est. 1995

#5 Electrolux

Domain Est. 1996

#6 Luxury & Kitchen Appliances

Domain Est. 1996

Website: fisherpaykel.com

Key Highlights: Discover Fisher & Paykel’s award-winning luxury home appliances for kitchen, laundry, and outdoors. Explore our range of refrigerators, dishwashers, ovens, ……

#7 Whirlpool Corporation

Domain Est. 1998

Website: whirlpoolcorp.com

Key Highlights: Whirlpool Corporation, in constant pursuit of improving life at home. Follow our journey with The Washing Machine Project Learn more Company, ……

#8 BSH Appliances Corporation

Domain Est. 2000

Website: bsh-group.com

Key Highlights: Our home appliances brands like Bosch, Siemens, Gaggenau and Neff make life worldwide more enjoyable and convenient. Discover our outstanding quality, ……

#9 GE Appliances, a Haier company

Domain Est. 2020

Website: geappliancesco.com

Key Highlights: GE Appliances designs & builds the world’s best appliances. We are based in Louisville, Ky., and are a leader in innovation, leadership & corporate ……

#10 Kenmore

Domain Est. 1999

Website: kenmore.com

Key Highlights: New Kenmore Top Freezer Refrigerators are designed to fit your life and your style. find my model. The next generation of clean. The power to handle more messes ……

Expert Sourcing Insights for Electrical Appliances

2026 Market Trends for Electrical Appliances

The electrical appliances market is poised for significant transformation by 2026, driven by technological innovation, evolving consumer preferences, and global sustainability goals. As smart homes become mainstream and energy efficiency gains regulatory momentum, manufacturers and retailers must adapt to remain competitive.

Smart Integration and IoT Dominance

By 2026, the integration of the Internet of Things (IoT) into household appliances will be nearly ubiquitous. Smart refrigerators, ovens, washing machines, and vacuum cleaners will leverage AI-powered assistants and real-time data analytics to optimize performance. Consumers will expect seamless connectivity across devices via centralized home ecosystems such as Google Home, Amazon Alexa, and Apple HomeKit. This trend will spur demand for appliances with predictive maintenance, remote control via mobile apps, and personalized usage patterns.

Energy Efficiency and Sustainability

Sustainability will be a primary driver in the 2026 electrical appliances market. Stricter global regulations—such as the EU’s Ecodesign Directive and U.S. ENERGY STAR standards—will compel manufacturers to produce ultra-efficient models. Demand for low-energy consumption appliances will rise, particularly in regions facing energy insecurity or high electricity costs. Additionally, eco-conscious consumers will favor products made from recyclable materials and those with extended lifespans, promoting a circular economy. Brands emphasizing carbon-neutral manufacturing and end-of-life recycling programs will gain competitive advantage.

Growth in Emerging Markets

Developing economies in Asia-Pacific, Africa, and Latin America will experience robust growth in electrical appliance adoption. Rising urbanization, expanding middle classes, and improved electricity infrastructure will fuel demand for essential appliances like refrigerators, air conditioners, and washing machines. Localized product designs—such as voltage-stable or solar-compatible appliances—will cater to regional needs. Affordable smart appliances tailored for first-time buyers will also emerge as a key market segment.

Premiumization and Design Innovation

Consumers in developed markets will increasingly prioritize aesthetics and premium features. Minimalist designs, customizable finishes, and appliances integrated into kitchen cabinetry will reflect a growing emphasis on home as a lifestyle statement. High-end smart ovens with camera-assisted cooking, refrigerators with internal cameras and grocery tracking, and voice-enabled laundry systems will define the premium segment. Manufacturers will invest in design partnerships and user experience to differentiate their offerings.

Supply Chain Resilience and Localization

Post-pandemic and geopolitical disruptions will lead to a reevaluation of supply chains. By 2026, companies will increasingly adopt localized production and nearshoring strategies to mitigate risks. Automation and AI-driven logistics will enhance efficiency, while blockchain technology may be used to ensure transparency in sourcing and manufacturing. Resilient supply chains will be critical to meeting just-in-time delivery demands and maintaining customer trust.

Conclusion

The electrical appliances market in 2026 will be shaped by intelligence, sustainability, and inclusivity. Success will depend on a company’s ability to innovate rapidly, respond to environmental imperatives, and cater to diverse global consumer bases. As the line between appliance and digital assistant blurs, the industry will transition from selling products to delivering integrated lifestyle solutions.

Common Pitfalls When Sourcing Electrical Appliances (Quality and Intellectual Property)

Sourcing electrical appliances from global suppliers can offer cost advantages, but it also presents significant risks related to product quality and intellectual property (IP) protection. Overlooking these pitfalls can lead to safety hazards, financial losses, brand damage, and legal complications. Below are key challenges to be aware of:

Quality Control Issues

One of the most prevalent risks in sourcing electrical appliances is inconsistent or substandard product quality. Many suppliers—especially in low-cost manufacturing regions—may prioritize cost-cutting over reliability, leading to several quality-related pitfalls:

- Inadequate Safety Standards Compliance: Appliances may not meet essential safety certifications (e.g., UL, CE, CCC), increasing the risk of electrical fires, shocks, or malfunctions.

- Use of Low-Grade Components: Suppliers may substitute inferior materials (e.g., subpar wiring, plastic casings, or motors) to reduce costs, impacting durability and performance.

- Inconsistent Manufacturing Processes: Lack of standardized production can result in wide quality variances between batches.

- Insufficient Testing: Products may not undergo proper electrical safety, thermal, or durability testing before shipment.

To mitigate this, conduct third-party inspections, require certifications, and implement a strict quality assurance protocol throughout the supply chain.

Intellectual Property (IP) Risks

Sourcing from regions with weak IP enforcement exposes businesses to significant risks, including counterfeiting, design theft, and unauthorized production:

- Design and Patent Infringement: Suppliers may copy patented designs or use protected technologies without authorization, leading to legal liability for the buyer.

- Unauthorized Production (Overruns): Factories may produce extra units beyond the agreed order and sell them on the gray market, undermining brand exclusivity.

- Reverse Engineering: Sharing product specifications increases the risk of competitors replicating your designs.

- Lack of IP Clauses in Contracts: Without clear agreements on ownership, usage rights, and confidentiality, legal recourse is limited.

Mitigation strategies include registering IP in target markets, using non-disclosure agreements (NDAs), including strict IP clauses in supplier contracts, and working with legally vetted manufacturers.

Supply Chain and Compliance Gaps

Beyond quality and IP, sourcing electrical appliances often involves navigating complex regulatory landscapes:

- Regulatory Non-Compliance: Appliances must meet country-specific energy efficiency, electromagnetic compatibility (EMC), and environmental standards (e.g., RoHS, REACH). Failure to comply can result in shipment rejections or fines.

- Lack of Traceability: Poor documentation makes it difficult to trace defective parts or investigate safety issues.

- Hidden Costs from Re-work or Recalls: Defective appliances may require costly rework, returns, or even full-scale recalls, damaging brand reputation.

Ensure suppliers are audited for compliance, maintain transparency in documentation, and conduct pre-shipment inspections.

Supplier Reliability and Transparency

Choosing unreliable suppliers can amplify both quality and IP risks:

- Misrepresentation of Capabilities: Some suppliers exaggerate certifications, production capacity, or experience.

- Subcontracting Without Approval: Factories may outsource production to unvetted subcontractors, leading to inconsistent quality and IP exposure.

- Poor Communication and Responsiveness: Language barriers or lack of accountability can delay issue resolution.

Perform due diligence through factory audits, request references, and consider using sourcing agents with on-the-ground experience.

Final Considerations

To successfully source electrical appliances while minimizing risks:

– Partner with reputable, certified suppliers.

– Implement rigorous quality control checkpoints.

– Protect IP through legal agreements and registrations.

– Stay informed about international regulatory requirements.

Proactive management of these pitfalls ensures safer, more reliable products and protects your brand’s integrity.

Logistics & Compliance Guide for Electrical Appliances

Navigating the logistics and compliance landscape for electrical appliances requires careful attention to safety, regulatory standards, and transportation protocols. This guide outlines key considerations to ensure your products move efficiently and legally across supply chains globally.

Understanding Regulatory Requirements

Electrical appliances must comply with region-specific safety and performance standards. Common regulatory frameworks include:

– United States: FCC (Federal Communications Commission) certification for electromagnetic interference, UL (Underwriters Laboratories) safety certification.

– European Union: CE marking, which includes compliance with the Low Voltage Directive (LVD), Electromagnetic Compatibility (EMC) Directive, and RoHS (Restriction of Hazardous Substances).

– United Kingdom: UKCA marking (post-Brexit), with similar requirements to CE.

– Canada: CSA (Canadian Standards Association) or cUL certification, ISED (Innovation, Science and Economic Development Canada) for radiofrequency devices.

– Australia & New Zealand: RCM (Regulatory Compliance Mark) and compliance with AS/NZS standards.

Ensure all documentation, including test reports and certificates of conformity, is up to date and accessible for customs clearance.

Product Safety and Labeling

All electrical appliances must be clearly labeled with essential information:

– Manufacturer or importer name and address

– Model and serial number

– Voltage, frequency, and power rating

– Safety warnings and usage instructions

– Compliance marks (e.g., CE, UL, UKCA)

Labels must be durable, legible, and permanently affixed. Multilingual labeling may be required for international markets.

Packaging and Transportation Standards

Proper packaging ensures appliances arrive undamaged and meet shipping regulations:

– Use anti-static and shock-absorbing materials for sensitive electronics.

– Clearly mark packages with handling labels (e.g., “Fragile,” “This Side Up”).

– Include compliance labels on outer packaging where required.

– Ensure packaging is recyclable and complies with environmental regulations (e.g., EU Packaging Waste Directive).

Import/Export Documentation

Accurate documentation is critical for smooth customs processing:

– Commercial invoice

– Packing list

– Bill of lading or air waybill

– Certificate of origin

– Test reports and compliance certificates

– Import licenses (if applicable)

Verify Harmonized System (HS) codes to determine tariffs and duties. Electrical appliances typically fall under HS chapters 85 (Electrical Machinery and Equipment).

Environmental and Disposal Compliance

Many regions enforce strict rules on hazardous substances and end-of-life management:

– RoHS Compliance: Restricts lead, mercury, cadmium, and other hazardous materials.

– WEEE Directive (EU): Requires producers to finance the collection and recycling of electronic waste.

– Battery Regulations: If appliances contain batteries, comply with local battery disposal and labeling laws.

Design products with recyclability in mind and register with national producer compliance schemes where required.

Logistics Partner Selection

Choose logistics providers experienced in handling electrical goods:

– Confirm their familiarity with IEC (International Electrotechnical Commission) standards.

– Ensure they comply with IATA (air), IMDG (sea), or ADR (road) regulations for hazardous materials if applicable (e.g., lithium batteries).

– Verify cold chain or climate-controlled options if temperature sensitivity is a concern.

Risk Mitigation and Insurance

Electrical appliances are high-value and susceptible to damage or regulatory rejection:

– Obtain comprehensive cargo insurance covering transit, customs delays, and compliance-related seizures.

– Conduct pre-shipment inspections to verify compliance and product integrity.

– Maintain a compliance audit trail for recalls or regulatory inquiries.

Post-Market Surveillance and Recalls

Even after successful distribution, ongoing compliance is essential:

– Monitor regulatory updates in target markets.

– Establish a recall plan in case of safety issues.

– Report incidents to relevant authorities as required (e.g., CPSC in the U.S., RAPEX in the EU).

Staying proactive ensures brand reputation and long-term market access.

In conclusion, sourcing electrical appliances requires a strategic approach that balances quality, cost, reliability, and compliance with safety standards. Whether sourcing locally or internationally, it is essential to conduct thorough supplier evaluations, consider energy efficiency and technical specifications, and ensure adherence to regulatory requirements. Building strong relationships with reputable suppliers, leveraging bulk purchasing advantages, and staying informed about technological advancements can lead to cost savings and improved product performance. Additionally, sustainability and after-sales service should not be overlooked, as they contribute to long-term value and customer satisfaction. A well-planned sourcing strategy ultimately ensures the acquisition of durable, efficient, and safe electrical appliances that meet both operational needs and environmental goals.