The global electric bus market is undergoing rapid transformation, driven by increasing urbanization, stringent emissions regulations, and growing investments in sustainable public transportation. According to a report by Mordor Intelligence, the electric bus market was valued at USD 15.63 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 16.8% from 2024 to 2029, reaching an estimated USD 41.2 billion by the end of the forecast period. Similarly, Grand View Research reports that rising government initiatives to reduce carbon footprints and the declining cost of lithium-ion batteries are accelerating adoption, particularly in regions like China, Europe, and North America. With over 600,000 electric buses already in operation worldwide—China alone accounting for more than 98% of global electric bus deployments as of recent data—the demand for high-performance, reliable manufacturers has never been greater. As cities commit to decarbonizing transit fleets, the following top 10 electric bus manufacturers are leading innovation, scaling production, and shaping the future of urban mobility.

Top 10 Electric Bus Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 page – New Flyer

Domain Est. 1995

Website: newflyer.com

Key Highlights: New Flyer is North America’s heavy-duty transit bus leader offering innovative mobility solutions through buses and technology. Learn more!…

#2

Domain Est. 2024

Website: phoenixev.ai

Key Highlights: The leading manufacturer of all-electric Transit Buses & Medium Duty shuttles buses, flatbed trucks, work trucks, and school buses….

#3 Gillig

Domain Est. 1997

Website: gillig.com

Key Highlights: Modernize your fleet with GILLIG’s advanced charging solutions, intuitive software, and expert support designed to keep your Battery Electric Buses ready from ……

#4 Yutong Bus

Domain Est. 1997

Website: en.yutong.com

Key Highlights: Yutong Bus is the No.1 global sales of electric buses & coaches. We offer various new energy bus, tourist coach, and city bus for public transportation….

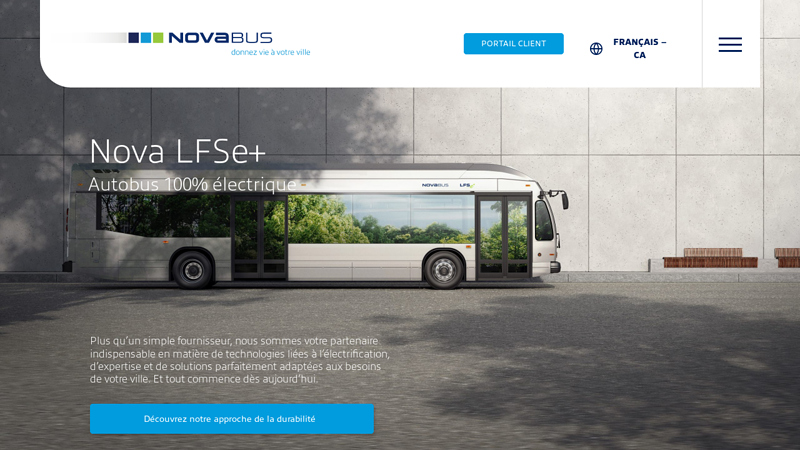

#5 Nova Bus

Domain Est. 1998

#6 Wrightbus

Domain Est. 2000

Website: wrightbus.com

Key Highlights: Wrightbus is leading the way in zero-emissions vehicles by driving the industry into a new era of energy efficient transport with its fuel cell vehicles….

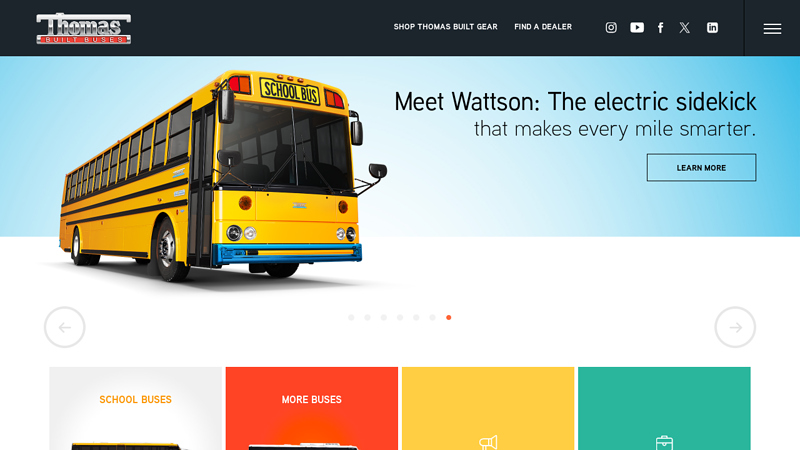

#7 Thomas Built Buses

Domain Est. 2001

Website: thomasbuiltbuses.com

Key Highlights: At Thomas Built Buses, we only build buses we’d want our own children to ride. That’s why, from construction to customer service, all we do is guided by ……

#8 Alexander Dennis

Domain Est. 2004

Website: alexander-dennis.com

Key Highlights: Any part. Any service. Any make. Any time. AD24 is your world-class bus and coach support from Alexander Dennis….

#9 Ebusco®

Domain Est. 2006

Website: ebusco.com

Key Highlights: Fully electric city and regional buses – Our electric buses ensure clean and quiet cities. We the transition to sustainable transport!…

#10 Switch Moblity

Domain Est. 2022

Website: switchmobilityev.com

Key Highlights: Switch Mobility, a Hinduja Group company, is a global leader specializing in the manufacturing of electric buses and electric light commercial vehicles….

Expert Sourcing Insights for Electric Bus

2026 Market Trends for Electric Buses: Hydrogen’s (H2) Expanding Role

While battery electric buses (BEBs) remain the dominant force in the electric bus market, 2026 is projected to be a pivotal year for Hydrogen Fuel Cell Electric Buses (FCEBs), marking significant growth and strategic positioning. Hydrogen is transitioning from a niche technology to a crucial component of comprehensive zero-emission transit strategies.

H2 Adoption Accelerates Beyond Pilots

- Moving Beyond Demonstration: 2026 will see the widespread transition of H2 buses from isolated pilot programs to meaningful fleet deployments. Cities and transit agencies will move past the “test phase” and commit to operational H2 fleets, particularly in regions with supportive infrastructure plans (e.g., California, parts of Europe, China, Japan, South Korea).

- Focus on Challenging Routes: FCEBs will solidify their value proposition for specific operational niches where BEBs face limitations:

- Long-Distance & High-Mileage Routes: High-capacity H2 buses will target intercity routes, suburban lines with long spans, and high-utilization urban corridors where frequent charging disrupts schedules.

- Heavy-Duty & High-Altitude Operations: H2’s consistent performance regardless of temperature and weight (compared to large battery packs) makes it ideal for demanding conditions like mountainous regions or heavy-duty applications (e.g., articulated buses, double-deckers).

- Fleets with Limited Depot Charging Space: H2 refueling resembles diesel refueling in speed and space requirements, offering a solution for depots with severe space constraints for large-scale BEB charging infrastructure.

Infrastructure Development Gains Critical Momentum

- “Chicken-and-Egg” Breakthrough: 2026 will witness concerted efforts to break the infrastructure deadlock. Coordinated public-private partnerships will drive the deployment of strategically located H2 refueling stations, often clustered around key depots or major transit corridors. Government funding (like the US Bipartisan Infrastructure Law, EU Hydrogen Bank, China’s subsidies) will be crucial.

- Focus on “Green” Hydrogen: While “grey” hydrogen (from fossil fuels) may dominate initially due to cost, pressure for true zero-emission goals will push agencies and suppliers towards increasing procurement of “green” hydrogen (produced via electrolysis using renewable electricity). Scaling up green H2 production remains a key challenge but the trend towards it will be clear.

- Standardization Efforts: Expect progress on refueling protocols and safety standards to improve interoperability and reduce costs across different bus manufacturers and infrastructure providers.

Cost Competitiveness Begins to Improve (But Challenges Remain)

- Falling FCE Costs: Continued technological advancements and economies of scale in fuel cell stack manufacturing will lead to gradual reductions in the upfront cost of H2 buses, narrowing (though not closing) the gap with BEBs.

- Total Cost of Ownership (TCO) Calculations Mature: Transit agencies will develop more sophisticated TCO models incorporating not just vehicle and fuel costs, but also infrastructure investment, maintenance complexity, energy source costs (especially green H2), and operational flexibility. H2’s TCO advantage in specific high-utilization scenarios will become more quantifiable.

- H2 Fuel Cost Volatility: The cost of hydrogen fuel, particularly green hydrogen, remains a significant uncertainty. Government subsidies and long-term supply contracts will be essential to provide price stability and make H2 fleets financially viable in 2026.

Geopolitical and Policy Drivers Intensify

- Energy Security & Diversification: Concerns about battery mineral supply chains (lithium, cobalt, nickel) and energy dependence will bolster political will to support H2 as a diversified energy vector for transportation.

- Ambitious Decarbonization Targets: Stricter regional and national mandates for zero-emission transit (e.g., California’s 100% ZEB mandate by 2040, EU’s Fit for 55) will force agencies to consider all viable zero-emission technologies, including H2 for applications where BEVs are less suitable.

- Industrial Strategy: Major economies (EU, US, China, Japan, S. Korea) view H2 as a strategic technology. National hydrogen strategies released in prior years will translate into targeted funding and support programs specifically benefiting FCEB deployment and supply chain development by 2026.

Market Landscape and Competition

- Expanding Player Base: Traditional bus OEMs (e.g., New Flyer, Gillig, BYD, Yutong, Solaris, Van Hool) will offer more H2 models alongside their BEV lines. Specialized FCEV manufacturers and new entrants will also compete.

- Supply Chain Development: The ecosystem for H2 storage tanks, fuel cell systems (from suppliers like Ballard, Cummins, Hyundai), and refueling equipment will mature, improving reliability and reducing costs.

- Consolidation & Partnerships: Expect increased strategic partnerships between bus manufacturers, fuel cell developers, energy companies (supplying H2), and infrastructure developers to deliver integrated solutions.

Conclusion for 2026:

Hydrogen fuel cell buses will not displace battery electrics as the primary zero-emission solution in 2026. However, H2 will emerge as the indispensable complementary technology for decarbonizing segments of the bus market where BEVs face practical or economic hurdles. Success in 2026 will hinge on overcoming the infrastructure gap, driving down green H2 costs, and demonstrating reliable, high-utilization operations. The year will be characterized by scale-up, strategic deployment, and increasing recognition of H2’s critical role in achieving comprehensive, practical zero-emission public transportation.

Common Pitfalls in Sourcing Electric Buses: Quality and Intellectual Property (IP) Concerns

Sourcing electric buses presents unique challenges beyond traditional vehicle procurement, especially concerning quality assurance and intellectual property (IP) protection. Overlooking these aspects can lead to operational failures, safety risks, and legal exposure. Below are key pitfalls to avoid:

Quality-Related Pitfalls

1. Inadequate Due Diligence on Manufacturer Track Record

Many buyers focus on price and delivery timelines while neglecting to verify a manufacturer’s real-world performance. Pitfalls include:

– Relying solely on marketing materials or pilot projects rather than long-term fleet data.

– Failing to audit manufacturing facilities or assess supply chain resilience (e.g., battery sourcing).

– Overlooking third-party validation (e.g., independent safety testing or field performance reports).

2. Poor Battery Performance and Lifespan Management

Battery quality is central to electric bus reliability. Common issues include:

– Misrepresentation of battery capacity, cycle life, or degradation rates under real-world conditions.

– Lack of clear warranty terms covering battery health (e.g., depth of discharge, temperature sensitivity).

– Sourcing from manufacturers using unproven or low-tier battery cells without proper thermal management systems.

3. Inconsistent Vehicle Build Quality

Variability in assembly processes, especially among newer or cost-driven manufacturers, can result in:

– Electrical system faults, connector failures, or software bugs.

– Poor integration between chassis, powertrain, and auxiliary systems (e.g., HVAC).

– Inadequate corrosion protection or durability in extreme climates.

4. Insufficient After-Sales Support and Spare Parts Availability

Electric buses require specialized maintenance. Pitfalls include:

– Limited local technical expertise or training from the supplier.

– Delays in spare parts delivery due to centralized or global-only supply chains.

– Lack of documented service procedures or access to diagnostic tools.

Intellectual Property (IP)-Related Pitfalls

1. Unclear IP Ownership in Customized Solutions

When modifications or software integrations are developed for specific transit networks, ambiguities can arise:

– Contracts may not specify who owns custom firmware, control algorithms, or telematics interfaces.

– Risk of third-party claims if the manufacturer uses open-source or licensed software without proper attribution or rights.

2. Dependence on Proprietary Systems Without Licensing Agreements

Some manufacturers lock buyers into closed ecosystems:

– Diagnostic, charging, or fleet management software may be proprietary with no API access.

– Lack of licensing terms can hinder integration with existing IT systems or future vendor switching.

3. Risk of IP Infringement by the Supplier

Sourcing from manufacturers in jurisdictions with weak IP enforcement increases exposure:

– The electric bus or its components (e.g., motor controllers, BMS) may incorporate patented technology without authorization.

– Buyers could face legal claims or recalls even if unaware of infringement.

4. Inadequate Protection of Buyer’s Operational Data

Telematics and usage data collected from buses may contain sensitive IP:

– Contracts often lack clauses on data ownership, usage rights, or cybersecurity standards.

– Risk of data being used by suppliers for competitive benchmarking without consent.

Mitigation Strategies

To avoid these pitfalls:

– Conduct thorough technical audits and request verifiable performance data from existing fleets.

– Specify battery performance warranties (e.g., 70% capacity after 8 years) and include penalties for non-compliance.

– Include clear IP clauses in contracts—defining ownership, licensing rights, and data usage.

– Require open standards (e.g., ISO 15118, OCPP) and access to diagnostic tools and software APIs.

– Engage legal and technical experts during procurement to assess compliance and IP risks.

By proactively addressing quality and IP concerns, transit agencies can ensure reliable, secure, and sustainable electric bus deployments.

Logistics & Compliance Guide for Electric Buses

Introduction to Electric Bus Logistics and Compliance

The transition to electric buses (e-buses) requires careful planning across logistics and regulatory compliance. Unlike conventional diesel or CNG buses, e-buses introduce new challenges related to charging infrastructure, battery handling, weight distribution, permits, safety standards, and environmental regulations. This guide outlines key considerations for efficient logistics management and regulatory compliance in the deployment and operation of electric buses.

Vehicle Procurement and Transportation

When acquiring electric buses, logistics planning must begin at the procurement stage. E-buses are heavier than traditional buses due to battery weight, which affects transportation requirements. Ensure that transport vehicles (e.g., low-bed trailers) are rated for the gross vehicle weight (GVW) of e-buses. Coordinate with manufacturers for delivery timelines, route planning, and unloading procedures at depots. Proper securing during transit is critical to prevent damage to sensitive electrical components.

Charging Infrastructure and Site Planning

A functional charging network is essential for e-bus operations. Logistics planning must include site assessments for depot charging stations, considering electrical capacity, grid connection requirements, and cable routing. AC (slow) and DC (fast) charging stations require different infrastructure investments. Work with utility providers early to ensure adequate power supply and explore options for load management or renewable integration. Safety clearances, weather protection, and accessibility for maintenance must also be incorporated into site design.

Battery Logistics and Handling

Lithium-ion batteries used in electric buses are classified as dangerous goods under international transport regulations (e.g., ADR, IATA, IMDG). When transporting replacement or spare batteries, compliance with UN 38.3 testing, proper packaging, labeling, and documentation is mandatory. On-site battery storage must follow fire safety codes, including segregation from combustible materials, temperature control, and containment systems. Establish protocols for handling damaged or defective batteries, including emergency response plans.

Regulatory Compliance and Certification

Electric buses must meet regional and national safety and emissions standards. In the U.S., compliance with FMVSS (Federal Motor Vehicle Safety Standards) and EPA regulations is required. In the EU, e-buses must conform to UNECE regulations and EU Whole Vehicle Type Approval ( WVTA). Ensure that all vehicles have valid certifications for electrical systems, electromagnetic compatibility (EMC), and high-voltage safety. Operators must also comply with accessibility standards such as ADA (U.S.) or PRM (EU).

Permitting and Operational Approvals

Operating electric buses may require additional permits, especially for charging infrastructure. Local zoning laws, building codes, and electrical safety standards (e.g., NEC in the U.S., IEC in Europe) apply to charging station installations. Coordinate with municipal authorities for construction permits, fire department approvals, and utility interconnection agreements. For intercity or cross-border operations, verify that e-buses meet regional registration and roadworthiness requirements.

Maintenance and Service Logistics

E-bus maintenance differs significantly from conventional buses, with an emphasis on high-voltage system safety and battery health monitoring. Technicians must be certified in high-voltage systems (e.g., NFPA 70E in the U.S.). Establish a maintenance schedule that includes battery diagnostics, thermal system checks, and software updates. Spare parts logistics should account for longer lead times for specialized components such as battery modules or power electronics.

Data Management and Cybersecurity Compliance

Electric buses generate large volumes of operational data, including battery performance, energy consumption, and location tracking. Operators must comply with data protection regulations such as GDPR (EU) or CCPA (California). Implement secure data transmission protocols and access controls. Ensure that telematics and fleet management systems meet cybersecurity standards to prevent unauthorized access or system tampering.

Environmental and Sustainability Reporting

E-bus adoption supports sustainability goals, but compliance with environmental reporting may be required. Track and report greenhouse gas reductions, energy sources (e.g., renewable vs. grid electricity), and end-of-life battery recycling. Follow local regulations for hazardous waste disposal when batteries are decommissioned. Some regions offer incentives or mandates tied to sustainability reporting (e.g., California’s Innovative Clean Transit rule).

Training and Workforce Compliance

Ensure that drivers, maintenance staff, and dispatchers receive specific training on electric bus operations, including regenerative braking, range estimation, charging procedures, and emergency shutdown protocols. Document training to meet occupational safety regulations (e.g., OSHA in the U.S.). Include high-voltage safety and first-response procedures in emergency preparedness plans.

Incident Response and Emergency Preparedness

Develop emergency response plans tailored to electric bus risks, such as battery fires or electrical faults. Coordinate with local fire departments to provide e-bus specifications and high-voltage isolation procedures. Equip depots with appropriate firefighting materials (e.g., Class D extinguishers, thermal imaging cameras) and establish lockdown procedures for damaged vehicles.

Conclusion and Continuous Compliance

Logistics and compliance for electric buses are dynamic and require ongoing monitoring. Stay updated on evolving regulations, standards, and technological advancements. Establish a compliance management system to track certifications, permits, maintenance records, and training logs. Proactive planning ensures safe, efficient, and legally sound electric bus operations.

Conclusion for Sourcing Electric Buses

The sourcing of electric buses represents a strategic and sustainable step toward modernizing public transportation, reducing carbon emissions, and achieving long-term operational efficiency. As cities and transit agencies strive to meet environmental targets and improve urban air quality, electric buses offer a clean, quiet, and increasingly cost-effective alternative to traditional diesel or gasoline-powered fleets.

While the initial acquisition cost of electric buses may be higher, the total cost of ownership over time is often lower due to reduced fuel and maintenance expenses, along with available government incentives and grants. Advances in battery technology, charging infrastructure, and fleet management systems have significantly improved reliability and range, making electric buses a viable option for diverse operating conditions.

Successful sourcing requires a comprehensive evaluation of vehicle performance, supplier reputation, charging infrastructure needs, workforce training, and lifecycle costs. Collaboration with experienced manufacturers, utilities, and local stakeholders is essential to ensure seamless integration into existing transit networks.

In conclusion, sourcing electric buses is not only an environmentally responsible decision but also a forward-thinking investment in resilient, sustainable, and efficient public transportation. With careful planning and strategic partnerships, transit agencies can transition effectively to electrified fleets, contributing to cleaner cities and a healthier future for all.