The global dyno tester market is undergoing robust expansion, driven by increasing demand for vehicle performance testing, stringent emission regulations, and the rise of electric vehicle (EV) development. According to Mordor Intelligence, the automotive dynamometer market was valued at USD 3.2 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 6.8% from 2024 to 2029. This growth is further accelerated by advancements in testing technologies and the integration of data analytics and IoT in dynamometer systems. As manufacturers ramp up R&D investments—particularly in powertrain efficiency and emissions compliance—the need for accurate, reliable, and versatile dyno testers has never been greater. This increasing demand has led to fierce innovation and competition among key players worldwide. Based on market presence, technological capabilities, product range, and global reach, the following ten companies have emerged as leaders in dyno tester manufacturing.

Top 10 Dyno Tester Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Magtrol

Domain Est. 1995

Website: magtrol.com

Key Highlights: Manufacturer of motor testing dynamometers, hysteresis brakes and clutches for tension and torque control, torque transducers, load-force-weight measurement ……

#2 About Dyno Tech Services, pto dynamometer manufacturer

Domain Est. 2013 | Founded: 1980

Website: dynotechdynamometer.com

Key Highlights: Since 1980, Dyno Tech Services – Our history – we offer new dynamometers, rebuilt dynamometers, dynamometer parts, and dynamometer maintenance….

#3 Froude, Dynamometer Test Equipment

Domain Est. 2016

Website: froudedyno.com

Key Highlights: Froude is widely recognized as the world’s leader for engine and turbine test systems in gas turbine, aerospace, marine, industrial and automotive markets….

#4 Dynamometers & Flowbenches

Domain Est. 1995

Website: superflow.com

Key Highlights: SuperFlow engine dynos test gasoline, diesel and CNG engines and several of our water brake dynos are used for AC motor testing. We frequently provide custom ……

#5 Rototest

Domain Est. 1996

Website: rototest.com

Key Highlights: Rototest has established a new benchmark for Powertrain Dynamometers. Time optimizing and cost reducing solutions that will advance your R&D into the next ….

#6 Dynamometers

Domain Est. 1999

Website: dyno-one.com

Key Highlights: We provide a wide variety of dynamometers, including AC, DC, EV, Hub, Inertia, and Eddy Current water brake systems….

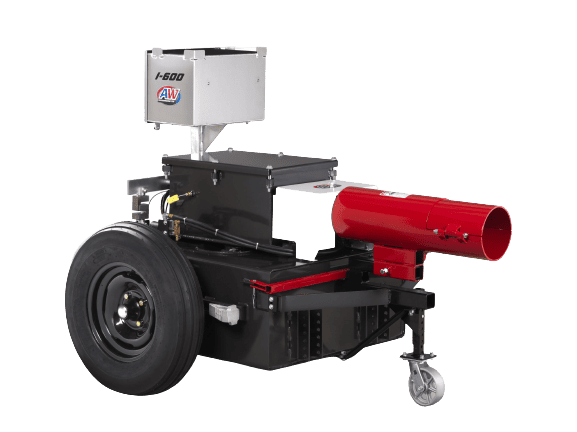

#7 AW Dynamometer

Domain Est. 2000 | Founded: 1957

Website: awdynamometer.com

Key Highlights: High Quality Dynamometers. Built 100% In-house. Manufacturing & Servicing Dynamometers Since 1957 QUALITY with INTEGRITY…

#8 About

Domain Est. 2002

Website: dynocom.net

Key Highlights: Dynocom Industries Inc leads the world in both hub/axle, custom and standard chassis dynamometers systems, with a constant focus on customers….

#9 Power Test Dynamometer

Domain Est. 2009

Website: powertestdyno.com

Key Highlights: Power Test Dynamometer is industry leader in the design and manufacture of dynamometers, heavy equipment testing and data acquisition systems….

#10

Website: dyno.com.au

Key Highlights: The world renowned DynoDynamics has been designing and manufacturing chassis dynamometers and engine dynamometers for over 40 years….

Expert Sourcing Insights for Dyno Tester

H2: 2026 Market Trends for Dyno Testers

By 2026, the global dyno tester market will be shaped by converging technological advancements, evolving regulatory landscapes, and shifting industrial priorities, particularly in automotive, aerospace, and renewable energy sectors. Key trends include:

1. Electrification Driving Innovation

The rapid adoption of electric vehicles (EVs) and hybrid systems will dominate demand. Dyno testers will increasingly specialize in high-voltage battery testing, regenerative braking simulation, and electric motor efficiency analysis. Integration with battery management systems (BMS) and power electronics will become standard, requiring dyno systems with bidirectional energy flow capabilities and advanced thermal management testing.

2. Integration with AI and Predictive Analytics

Artificial intelligence and machine learning will enhance dyno testing through predictive maintenance, anomaly detection, and automated test optimization. AI-powered software will analyze vast datasets from repeated tests to forecast component lifespan, optimize performance parameters, and reduce development time—especially critical in competitive EV and autonomous vehicle R&D.

3. Expansion into Renewable Energy and Aerospace

Beyond automotive, dyno testers will see growing applications in wind turbine gearbox validation, hydrogen fuel cell testing, and electric aviation propulsion systems. These emerging sectors require high-torque, low-speed capabilities and environmental simulation features (e.g., altitude, temperature extremes), pushing the development of more versatile and robust dynamometer platforms.

4. Emphasis on Sustainability and Energy Recovery

Regulatory pressure and corporate ESG goals will accelerate the adoption of regenerative dyno systems that feed energy back into the grid, reducing operational costs and carbon footprints. Manufacturers will prioritize energy-efficient designs and promote the sustainability benefits of closed-loop testing environments.

5. Standardization and Cybersecurity in Connected Testing

As dyno systems become more connected (IoT-enabled) and integrated into digital twin ecosystems, standardization of data formats and communication protocols (e.g., OTX, ASAM) will improve interoperability. Simultaneously, cybersecurity will become a critical concern, with increased demand for secure firmware, encrypted data transmission, and protected remote access.

6. Rise of Modular and Portable Solutions

Demand for flexible, modular dyno systems will grow, especially among Tier-2 suppliers and specialty performance shops. Portable and bench-top dynamometers will gain traction for field diagnostics, motorsports tuning, and small-scale R&D, offering cost-effective alternatives to large fixed installations.

In summary, by 2026, the dyno tester market will be characterized by smart, sustainable, and specialized systems tailored to electrification and digitalization, positioning dynamometers as essential tools in next-generation mobility and energy innovation.

Common Pitfalls Sourcing a Dyno Tester (Quality, IP)

Sourcing a dynamometer (dyno) tester involves significant investment and technical complexity. Overlooking key factors related to quality and intellectual property (IP) can lead to costly mistakes, operational downtime, and legal risks. Below are common pitfalls to avoid:

Poor Build Quality and Inadequate Calibration

Many low-cost dyno testers, especially from less-regulated markets, suffer from substandard materials, imprecise sensors, and poor manufacturing tolerances. This leads to inconsistent readings, frequent mechanical failures, and shortened equipment lifespan. Inadequate or undocumented calibration procedures further undermine data reliability, making test results unusable for certification or R&D purposes.

Lack of Traceable Calibration and Certification

Reputable dyno systems come with traceable calibration certificates compliant with international standards (e.g., ISO 17025). Sourcing from vendors who cannot provide these documents risks non-compliance with regulatory or internal quality requirements. Without traceability, validating performance claims or defending test data in audits becomes nearly impossible.

Hidden Software Limitations and Proprietary Lock-In

Some suppliers use proprietary software that restricts data access, limits integration with third-party tools, or requires expensive annual licenses to unlock basic features. This creates vendor lock-in and prevents customization or long-term scalability. Always assess software openness, API availability, and data export formats before purchase.

Intellectual Property Risks with Custom Solutions

When working with suppliers to develop customized dyno systems, unclear IP ownership agreements can result in loss of control over design modifications, software algorithms, or test methodologies. Without explicit contracts stating that IP developed for your application belongs to your organization, you may face restrictions on use, resale, or future development.

Inadequate Technical Support and Documentation

Low-cost suppliers may offer minimal or outsourced technical support, leading to extended downtime during failures. Poorly documented systems—especially in terms of schematics, error codes, and maintenance procedures—make troubleshooting difficult and increase reliance on the vendor for routine service.

Non-Compliance with Regional Safety and Emissions Standards

Dyno testers used for emissions or performance validation must meet regional regulatory standards (e.g., EPA, EU directives). Sourcing equipment that doesn’t comply can result in rejected test data, legal liability, or facility shutdowns. Always verify that the system meets the regulatory requirements of your target market.

Counterfeit or Refurbished Equipment Misrepresented as New

Some suppliers sell used, cloned, or reverse-engineered dyno systems as new. These units often lack genuine components, original firmware, or manufacturer warranties. Conduct due diligence by verifying serial numbers, requesting factory inspections, and sourcing only from authorized distributors.

Insufficient Cybersecurity and Data Protection

Modern dyno systems are network-connected and generate sensitive performance data. Systems with weak cybersecurity protocols (e.g., unencrypted data transfer, default passwords) expose your organization to data breaches or IP theft. Ensure the system supports secure access controls, data encryption, and compliance with your internal IT policies.

Avoiding these pitfalls requires thorough vendor evaluation, clear contractual terms on quality and IP, and verification through on-site inspections or third-party audits. Prioritizing long-term reliability and legal protection over initial cost savings is essential when sourcing dyno testing equipment.

Logistics & Compliance Guide for Dyno Tester

This guide outlines the essential logistics and compliance considerations for the safe, legal, and efficient operation of a dyno (dynamometer) tester in automotive, industrial, or research environments. Adherence to these guidelines ensures equipment longevity, personnel safety, regulatory compliance, and accurate performance data.

Equipment Transportation & Setup

Ensure the dyno tester is transported securely using appropriate lifting and rigging equipment. Use crated or palletized shipping with shock-absorbing materials to prevent damage during transit. Upon arrival, verify the installation site meets requirements for floor load capacity, ventilation, power supply (voltage, phase, amperage), and emergency shutdown access. Follow the manufacturer’s installation manual precisely and conduct a post-installation inspection to confirm proper alignment, grounding, and calibration status.

Regulatory Compliance

Comply with all applicable local, national, and international regulations. This includes electrical safety standards (e.g., OSHA, NEC, IEC), noise emission limits (e.g., EPA, EU directives), and environmental requirements for exhaust gas handling. If testing involves emissions measurements, ensure the facility and equipment meet certification standards such as those from the EPA, CARB, or EU type-approval frameworks. Maintain updated documentation for equipment certification, safety inspections, and operator training.

Safety Protocols

Implement strict safety procedures, including mandatory personal protective equipment (PPE) such as safety glasses, hearing protection, flame-resistant clothing, and steel-toed boots. Install physical barriers, interlocks, and emergency stop buttons within easy reach. Conduct pre-test safety checks on vehicle restraints, cooling systems, and data acquisition links. Prohibit unauthorized personnel from entering the test cell during operation and enforce lockout/tagout (LOTO) procedures during maintenance.

Calibration & Maintenance

Perform regular calibration of torque, speed, load, and temperature sensors according to the manufacturer’s schedule and recognized standards (e.g., ISO 17025). Keep a detailed log of all calibration dates, results, and personnel involved. Schedule preventive maintenance for rollers, bearings, cooling systems, and control electronics. Use only OEM or approved replacement parts to maintain system integrity and measurement accuracy.

Data Management & Traceability

Ensure all test data is recorded securely with timestamps, environmental conditions, vehicle/engine details, and operator identification. Store data in a controlled system with backup and access restrictions to maintain integrity. For regulated testing (e.g., certification or warranty validation), implement audit trails and version control to support traceability and compliance with quality standards such as ISO 9001 or IATF 16949.

Environmental Controls

Manage exhaust emissions using properly designed extraction systems, such as ducted exhaust or dilution tunnels, especially during high-load or emissions testing. Monitor ambient temperature, humidity, and barometric pressure, and apply correction factors as per standards like SAE J1349 or ISO 1585. Prevent fluid leaks by inspecting hoses, couplings, and fluid reservoirs regularly, and dispose of waste (oil, coolant, filters) in accordance with environmental regulations.

Operator Training & Certification

Only trained and authorized personnel should operate the dyno tester. Training must cover equipment operation, emergency procedures, data interpretation, and compliance requirements. Maintain training records and conduct periodic competency assessments. For emissions or homologation testing, operators may require specific certifications from regulatory or accreditation bodies.

Conclusion: Sourcing a Dyno Tester

After thorough evaluation of available options, technical requirements, and supplier capabilities, sourcing a dynamometer (dyno) tester is a strategic investment that will significantly enhance our testing, development, and quality assurance processes. The selected dyno tester meets our performance specifications, offers reliable data acquisition, and aligns with both current and future testing needs.

Key factors such as accuracy, durability, ease of integration, after-sales support, and total cost of ownership were carefully considered. The chosen supplier demonstrates proven expertise, timely delivery, and comprehensive training and maintenance services, ensuring minimal downtime and long-term operational efficiency.

In conclusion, procuring this dyno tester will improve testing precision, support product innovation, and strengthen our competitive advantage. The investment is justified by anticipated gains in R&D efficiency, product reliability, and compliance with industry standards. Approval is recommended to move forward with the purchase and implementation.