The global demand for high-performance video interface solutions continues to surge, driven by the proliferation of high-resolution displays, expanding consumer electronics markets, and industrial digitization. According to a report by Mordor Intelligence, the global DVI converter market was valued at USD 1.85 billion in 2022 and is projected to grow at a CAGR of 6.4% from 2023 to 2028. This growth is further accelerated by rising adoption in commercial AV installations, medical imaging systems, and legacy system integration within enterprise environments. As digital video interfaces evolve, DVI converters remain essential in bridging older analog systems with modern digital displays. In response to this sustained demand, a tier of specialized manufacturers has emerged—combining technical innovation, signal fidelity, and scalable manufacturing to meet global needs. Based on market presence, product performance, and technological investment, here are the top 9 DVI converter manufacturers shaping the industry landscape.

Top 9 Dvi Converter Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Falcon DVI Fiber Optic Media Converters

Domain Est. 1990

Website: moog.com

Key Highlights: Moog Protokraft Falcon series dual DVI fiber optic transmitters or receivers consist of optoelectronic transmitter or receiver functions integrated into a ……

#2 DVI

Domain Est. 1995

#3 All About DVI

Domain Est. 1995

Website: datapro.net

Key Highlights: DVI is a popular form of video interface technology made to maximize the quality of flat panel LCD monitors and modern video graphics cards….

#4 Diodes Incorporated

Domain Est. 1995

Website: diodes.com

Key Highlights: Diodes Incorporated is a leading global manufacturer and supplier of high-quality application specific standard products….

#5 DVI

Domain Est. 1994

Website: sealevel.com

Key Highlights: In stock $22.57 deliveryThe converter allows you to connect a DVI-D output to a DisplayPort input. This makes it ideal to connect a computer with a DVI-D output to a monitor or dis…

#6 HDMI to DVI Adapter

Domain Est. 1995

Website: aten.com

Key Highlights: The 2A-128G HDMI to DVI Converter is a bi-directional converter that allows you to connect an DVI display to a device with a HDMI display output….

#7 DVI/HDMI to SDI with ROI scaling

Domain Est. 1998

Website: aja.com

Key Highlights: AJA’s ROI-DVI Scan Converter allows exceptionally high quality conversion of computer DVI and HDMI outputs to baseband video over SDI at an affordable price….

#8 Composite and S

Domain Est. 1998

Website: startech.com

Key Highlights: Out of stock Rating 4.0 1 This Composite video/S-Video to DVI-D Video Converter/Scaler lets you convert from composite/s-video/YCbCr/RGB resolutions and video formats to DVI-D….

#9 DVIGear

Domain Est. 2001

Website: dvigear.com

Key Highlights: DVIGear is a leading supplier of digital connectivity solutions for professional, commercial and residential display applications. Call 1-888-463-9927….

Expert Sourcing Insights for Dvi Converter

2026 Market Trends for DVI Converter

As digital display technologies continue to evolve, the market for DVI (Digital Visual Interface) converters is undergoing significant transformation. While DVI once served as a dominant interface standard for connecting computers to monitors, its relevance is shifting due to the rise of newer technologies. However, DVI converters—devices that bridge DVI with HDMI, DisplayPort, USB-C, and other modern interfaces—still hold strategic importance in specific sectors. The following analysis outlines key market trends expected to shape the DVI converter landscape in 2026.

Declining Demand in Consumer Electronics

By 2026, the consumer electronics market will continue to phase out native DVI ports in favor of HDMI 2.1, DisplayPort 2.0, and USB-C with DisplayPort Alt Mode. Most new laptops, desktops, and televisions will no longer include DVI outputs, leading to a steady decline in demand for standalone DVI converters among average consumers. This trend is fueled by the industry’s focus on thinner form factors, higher bandwidth, and universal connectivity solutions.

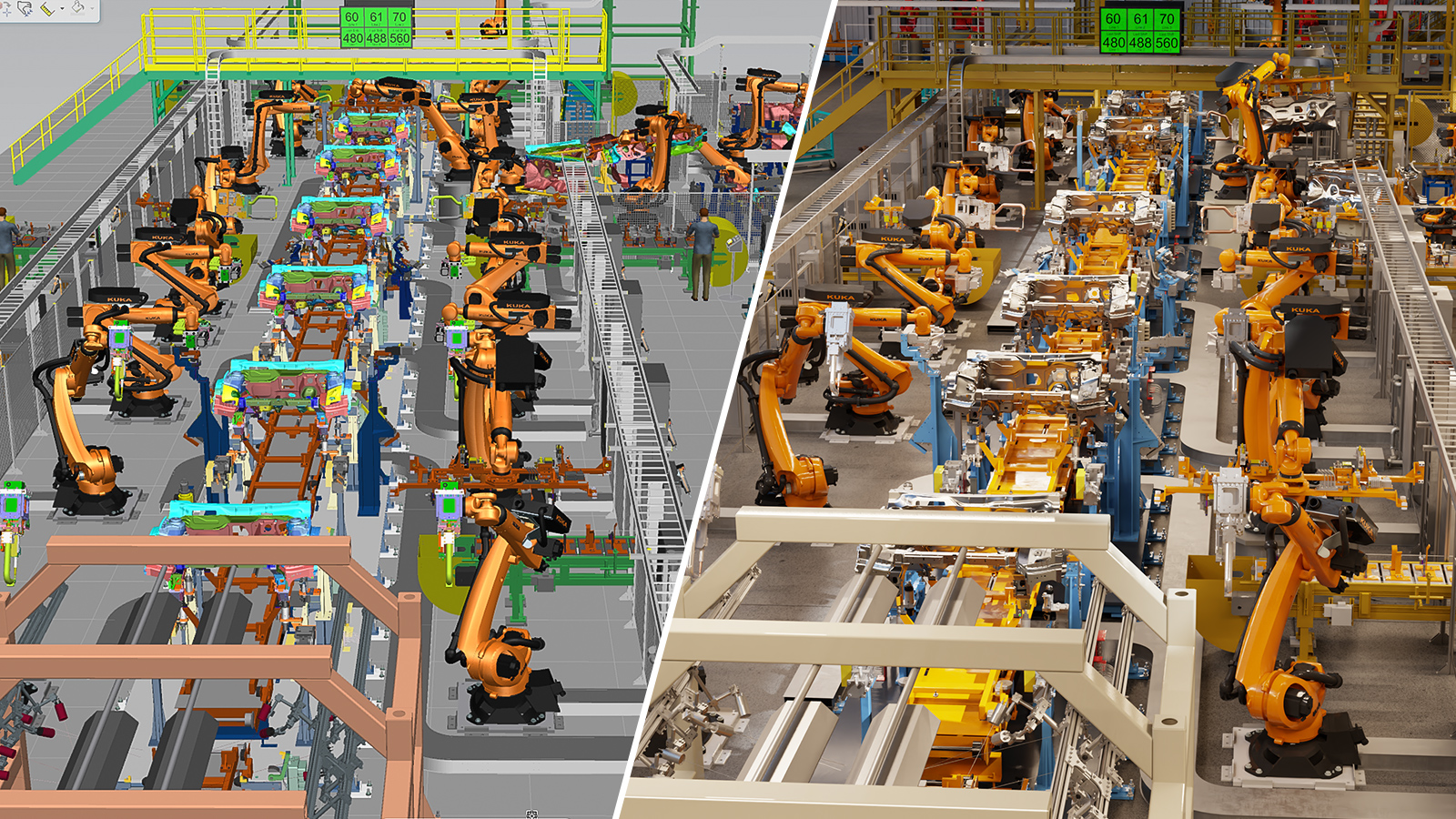

Growth in Legacy System Integration

Despite reduced consumer demand, DVI converters will remain essential in environments relying on legacy infrastructure. Sectors such as healthcare, industrial automation, education, and government institutions often operate older computer systems and display equipment with DVI interfaces. As these organizations modernize their setups without fully replacing existing hardware, the need for DVI-to-HDMI or DVI-to-DisplayPort converters will sustain market demand. In 2026, this segment is expected to represent a significant portion of DVI converter sales.

Increased Demand for Active and Bi-Directional Converters

Passive DVI adapters will become less viable due to signal compatibility issues between DVI and newer digital standards. As a result, active converters—capable of signal reprocessing and protocol translation—will dominate the market. Additionally, bi-directional converters (e.g., HDMI-to-DVI and DVI-to-HDMI in one device) will gain popularity in multi-device environments such as conference rooms and control centers, where flexibility is critical.

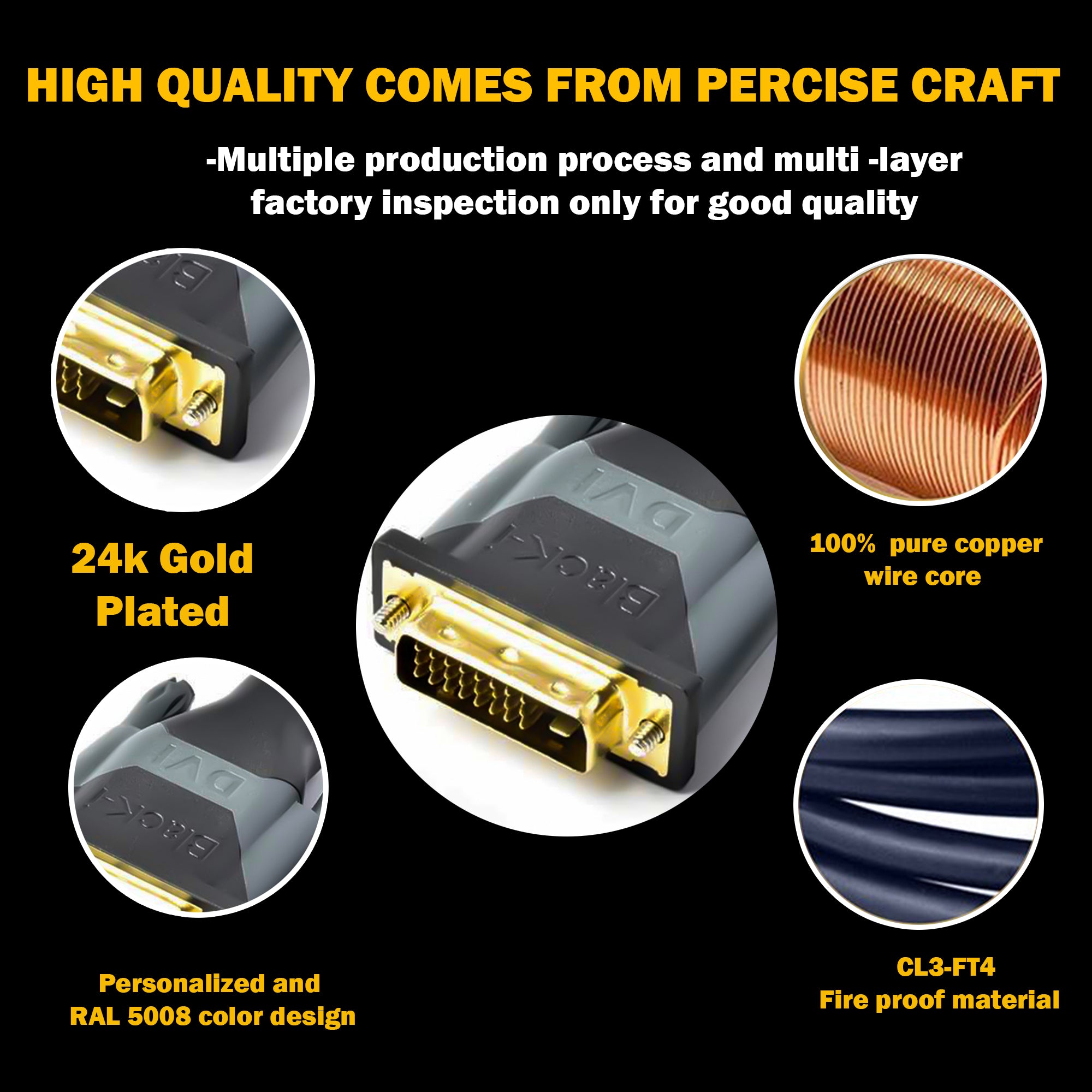

Focus on Reliability and Signal Integrity

With growing reliance on high-resolution displays (4K and beyond), maintaining signal integrity becomes paramount. In 2026, DVI converters will increasingly emphasize features like signal amplification, EDID management, and support for higher refresh rates. Manufacturers will differentiate their products based on performance stability, low latency, and compatibility with extended desktop configurations, particularly targeting professional AV integrators and IT departments.

Regional Market Disparities

Geographic trends will influence demand. Emerging markets in Asia, Africa, and Latin America may continue using DVI-equipped systems longer due to cost considerations and slower technology refresh cycles. This will support a regional demand for DVI converters, especially in SMBs and educational institutions. Conversely, North America and Western Europe will see more niche applications, with converters primarily serving transitional or specialized uses.

Consolidation and Niche Specialization Among Manufacturers

The shrinking mainstream market will lead to industry consolidation, with major AV and connectivity brands acquiring smaller converter manufacturers. Surviving companies will focus on specialized applications—such as medical imaging, military systems, or broadcast equipment—where DVI remains in use. Product offerings will shift toward ruggedized, certified, and high-reliability converters rather than mass-market consumer gadgets.

Conclusion

While the overall relevance of DVI is diminishing, the DVI converter market will persist through 2026 by adapting to the needs of legacy integration, professional environments, and regional disparities. Success will depend on innovation in signal conversion technology, reliability, and targeting specific verticals where DVI infrastructure remains entrenched. As the industry moves toward universal digital interfaces, DVI converters will serve as crucial transitional tools, ensuring compatibility in an increasingly fragmented connectivity ecosystem.

Common Pitfalls When Sourcing a DVI Converter (Quality, IP)

Sourcing a DVI (Digital Visual Interface) converter—especially when integrating it into a larger system or product—can present several challenges, particularly concerning quality and intellectual property (IP). Being aware of these pitfalls helps ensure reliable performance and legal compliance.

Poor Build Quality and Component Selection

Low-cost DVI converters often use substandard components such as low-grade signal processors, inadequate shielding, or poorly designed circuitry. This can result in intermittent signal loss, flickering displays, or complete failure under sustained use. Always verify build quality through third-party testing or reputable suppliers.

Inconsistent Signal Integrity

DVI relies on high-speed digital signaling, making it sensitive to poor PCB layout, impedance mismatches, and inadequate EMI protection. Poorly designed converters can introduce jitter, signal degradation, or fail to support higher resolutions and refresh rates, especially over longer cable runs.

Lack of Compliance and Certification

Many off-the-shelf DVI converters lack proper certification (e.g., FCC, CE, HDMI Licensing if applicable). Non-compliant units may interfere with other electronics or fail regulatory approval for commercial products, leading to costly redesigns or recalls.

Misrepresentation of Specifications

Some suppliers exaggerate capabilities—claiming support for 1080p or dual-link DVI when the converter only handles single-link or lower resolutions. Always request lab-tested performance data or conduct independent validation before integration.

Intellectual Property (IP) Risks

Using integrated circuits or firmware in DVI converters may inadvertently infringe on patents or violate licensing agreements—especially if the design uses unlicensed HDMI or DisplayPort IP. This is critical when embedding converters into proprietary hardware.

Use of Unlicensed or Cloned Chips

Some manufacturers use counterfeit or reverse-engineered semiconductor chips to reduce costs. These chips may lack proper driver support, fail prematurely, or expose your product to legal liability due to IP violations.

Inadequate Firmware and Driver Support

Embedded DVI converters often require firmware for EDID management, hot-plug detection, or format conversion. Poorly supported or closed-source firmware can limit customization, create compatibility issues, or hinder troubleshooting.

Insufficient Scalability and Future-Proofing

Sourcing a converter without considering future needs (e.g., 4K support, HDCP compliance, or compatibility with newer standards like HDMI 2.0) may lead to premature obsolescence and increased long-term costs.

Limited Technical Documentation and Support

Low-cost converters often come with incomplete or inaccurate datasheets, making integration difficult. Lack of manufacturer support can delay development and increase R&D expenses.

Supply Chain and Longevity Concerns

Many DVI converters are produced by small vendors with unstable supply chains. Discontinuation without notice can disrupt production, especially for long-lifecycle products. Always assess supplier reliability and component obsolescence timelines.

By carefully evaluating suppliers, demanding transparency on components and compliance, and conducting thorough technical due diligence, these pitfalls can be mitigated—ensuring a reliable, legally sound DVI conversion solution.

Logistics & Compliance Guide for DVI Converter

This guide outlines the essential logistics and compliance considerations for the distribution, import, and use of DVI (Digital Visual Interface) converters. Adherence to these guidelines ensures smooth operations, regulatory compliance, and product safety across global markets.

Product Classification & Harmonized System (HS) Code

DVI converters typically fall under category 8543 (Electrical machines and apparatus, having individual functions, not specified elsewhere). The specific HS code may vary by country but often includes:

- 8543.70: For signal converting apparatus (e.g., video interface converters).

- Confirm the exact HS code with local customs authorities to ensure accurate tariff classification and avoid delays.

Import & Export Regulations

- Export Controls: DVI converters generally do not require export licenses under dual-use regulations (e.g., EAR in the U.S.), but confirm that no encryption or military-grade components are included.

- Import Duties & Taxes: Duties vary by destination country. Use the correct HS code to determine applicable tariffs, VAT, or GST.

- Documentation: Prepare commercial invoice, packing list, bill of lading/airway bill, and certificate of origin as needed.

Packaging & Labeling Requirements

- Safety Labels: Include CE, FCC, RoHS, or other regional marks as applicable.

- Product Labeling: Clearly display model number, input/output specifications, manufacturer info, and compliance marks.

- Packaging: Use anti-static materials; include user manuals and safety warnings in required languages.

Regulatory Compliance

Electromagnetic Compatibility (EMC)

- FCC Part 15 (USA): Must comply with unintentional radiator standards.

- CE-EMC Directive (EU): Ensure conformity with EN 55032 (multimedia equipment emissions) and EN 55035 (immunity).

Safety Standards

- UL/CSA (North America): Comply with UL 62368-1 for audio/video equipment safety.

- EN 62368-1 (EU/UK): Required under CE marking for safety of electronic equipment.

Environmental Regulations

- RoHS (EU): Restricts hazardous substances (lead, mercury, cadmium, etc.). Ensure compliance with Directive 2011/65/EU.

- REACH (EU): Register and communicate information on chemical substances.

- WEEE (EU): Mark products with the crossed-out wheelie bin symbol; arrange for proper recycling.

Energy Efficiency

- Comply with regional energy efficiency standards (e.g., Energy Star if marketed as energy-efficient, or EU Ecodesign Directive).

Shipping & Transportation

- Mode of Transport: Suitable for air, sea, or ground freight. Use ESD-safe packaging.

- Hazard Classification: DVI converters are not hazardous goods (UN38.3 not required unless powered by lithium batteries).

- Temperature & Humidity: Store and ship within 0°C to 40°C and 20%–80% non-condensing humidity.

Country-Specific Requirements

- USA: FCC ID may be required for intentional radiators; ensure labeling per 47 CFR.

- EU: CE marking mandatory; maintain a Declaration of Conformity (DoC) and technical file.

- UK: UKCA marking required for Great Britain (England, Scotland, Wales); CE accepted until 2025.

- Canada: ICES-003 compliance required; label with IC certification number.

- Australia/NZ: RCM mark required under the ACMA framework.

- China: CCC certification may be required depending on product type; check CCC catalog.

Quality Assurance & Traceability

- Implement serial or batch numbering for traceability.

- Maintain records of compliance testing (EMC, safety, environmental) for at least 10 years.

- Conduct periodic audits of manufacturing and supply chain partners.

End-of-Life & Recycling

- Provide take-back or recycling options where required (e.g., WEEE in EU).

- Inform customers of proper disposal methods via labels or manuals.

Summary

Ensure DVI converters meet all applicable technical, safety, and environmental standards before market entry. Maintain accurate documentation, use proper labeling, and stay updated on regulatory changes in each target market to ensure seamless logistics and compliance.

Conclusion for Sourcing DVI Converters:

After evaluating various options, the sourcing of DVI converters should focus on reliability, compatibility, and cost-effectiveness. Based on performance, build quality, and user feedback, it is recommended to source DVI converters from reputable suppliers or manufacturers that provide technical support and warranty coverage. Key considerations include ensuring compatibility with existing video standards (such as DVI to HDMI, VGA, or DisplayPort), supporting required resolutions and refresh rates, and minimizing signal loss—especially when using active vs. passive adapters.

Sourcing from certified vendors reduces the risk of receiving counterfeit or substandard products. Additionally, bulk procurement from trusted distributors or OEMs can offer better pricing and consistent quality. Ultimately, selecting a DVI converter should align with the specific technical requirements of the deployment environment while balancing budgetary constraints. A well-sourced DVI converter ensures seamless integration, long-term reliability, and minimal technical issues in display setups.