The global dust collection systems market is experiencing robust growth, driven by increasing industrial automation, stringent environmental regulations, and a growing focus on worker health and safety. According to Grand View Research, the market was valued at USD 4.08 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This expansion is fueled by rising demand across industries such as pharmaceuticals, food processing, metal fabrication, and chemical manufacturing, where effective air quality management is critical. Additionally, regulatory mandates from agencies like OSHA and the EPA continue to push industries toward adopting advanced dust collection solutions. As manufacturing activities intensify globally, particularly in emerging economies, the need for high-efficiency industrial dust collectors has never been more pressing—making the selection of reliable, technologically advanced manufacturers a strategic priority for operations managers and procurement professionals alike.

Top 10 Dust Collection Industrial Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Dustcontrol

Domain Est. 2002

Website: dustcontrol.us

Key Highlights: Dustcontrol manufactures mobile dust extractors for industrial and construction use, fixed extraction systems, peripheral equipment and accessories….

#2 C&W DustTech

Domain Est. 2020

Website: cwdusttech.com

Key Highlights: We are the experts in industrial dust collection systems for dust issues related to the Ready-Mix, Concrete and Pre-Cast industries….

#3 Superior Filtration, Industrial Dust and Mist Collector

Domain Est. 1995

Website: parker.com

Key Highlights: We offer a range of efficient and cost-effective air pollution control solutions, including industrial DustHog dust and Smoghog mist collectors….

#4 Flex

Domain Est. 1998

Website: cecoenviro.com

Key Highlights: Flex-Kleen provides custom-designed industrial dust collection systems for a wide range of industries. Contact us for expert solutions today!…

#5 Dust Collector Manufacturers

Domain Est. 2000

Website: dustcollectingsystems.com

Key Highlights: Instantly connect with the leading dust collector manufacturers and suppliers in the USA whose high performance products are designed to protect both people ……

#6 AGET Manufacturing

Domain Est. 2000

Website: agetmfg.com

Key Highlights: Our exclusive collection systems, Dustkop & Mistkop, are efficient and highly-effective air filtration systems for small and large industries….

#7 Industrial Dust Collectors

Domain Est. 2002

Website: amtechlc.com

Key Highlights: A vast selection of horizontally and vertically- ……

#8 Dust Collector Manufacturers

Domain Est. 2012

Website: dustcollectormanufacturers.org

Key Highlights: Instantly connect with the leading dust collector manufacturers and suppliers whose products are high performance and designed to protect people as well as ……

#9 Camfil APC

Domain Est. 2013

Website: camfilapc.com

Key Highlights: Industrial dust collection equipment and replacement filters for manufacturing & industrial processes. We offer a wide range of replacement filters ……

#10 Cyclone Dust Collectors Made in USA

Domain Est. 1998

Website: oneida-air.com

Key Highlights: Free delivery · 30-day returnsWe’ve dedicated ourselves to providing the most innovative and high performance dust control solutions available – proudly made in the USA!…

Expert Sourcing Insights for Dust Collection Industrial

2026 Market Trends for Industrial Dust Collection Systems

The industrial dust collection market is poised for significant evolution by 2026, driven by tightening regulations, technological advancements, and shifting industrial priorities. Here’s an analysis of the key trends shaping the sector:

1. Stricter Environmental and Safety Regulations Driving Demand

By 2026, governments worldwide are expected to enforce more stringent air quality and occupational health standards. Regulations like the U.S. EPA’s revised National Emission Standards for Hazardous Air Pollutants (NESHAP) and the EU’s Industrial Emissions Directive will compel industries—including manufacturing, pharmaceuticals, and metalworking—to upgrade or install high-efficiency dust collection systems. Compliance is no longer optional, making dust collectors a critical capital investment rather than a cost center.

2. Smart Dust Collection and IIoT Integration

The integration of Industrial Internet of Things (IIoT) technologies will become mainstream by 2026. Smart dust collectors equipped with sensors for real-time monitoring of pressure drop, filter condition, airflow, and particulate concentration will allow for predictive maintenance and optimized performance. Cloud-based platforms will enable remote diagnostics and data analytics, reducing downtime and improving operational efficiency across facilities.

3. Rising Adoption of Energy-Efficient and Sustainable Solutions

With growing emphasis on ESG (Environmental, Social, and Governance) goals, manufacturers will prioritize energy-efficient dust collection systems. Trends include the use of variable frequency drives (VFDs) on fans, regenerative thermal oxidizers (RTOs) paired with dust collectors for volatile organic compound (VOC) control, and systems designed for lower pressure drops. Additionally, recyclable filter media and modular designs that extend equipment lifespan will gain favor.

4. Growth in High-Performance Filtration Technologies

Demand for advanced filtration media—such as nanofiber, PTFE-coated, and ultra-low penetration air (ULPA) filters—will increase. These materials offer higher efficiency, longer service life, and better performance with fine and hazardous particulates (e.g., in additive manufacturing or lithium battery production). Cartridge-style collectors will continue to displace traditional baghouses in many applications due to their superior efficiency and compact footprint.

5. Expansion in Emerging Industrial Sectors

New manufacturing hubs in electric vehicles (EVs), battery production, and advanced materials will drive demand for specialized dust collection. These industries generate unique dust profiles (e.g., conductive or explosive lithium dust), requiring explosion-proof designs, ATEX compliance, and custom engineered solutions. The 2026 market will see increased innovation to meet these niche requirements.

6. Consolidation and Regional Market Shifts

The global market will likely experience consolidation among equipment manufacturers and service providers, enhancing service capabilities and technological integration. Meanwhile, Asia-Pacific—especially China and India—will lead growth due to rapid industrialization and improving regulatory enforcement. North America and Europe will focus on retrofitting and upgrading aging infrastructure.

In summary, the 2026 industrial dust collection market will be defined by smarter, cleaner, and more compliant systems. Companies that invest in innovation, sustainability, and digital integration will be best positioned to capture growth amid rising regulatory and environmental pressures.

Common Pitfalls When Sourcing Industrial Dust Collection Systems (Quality and IP)

Sourcing industrial dust collection systems requires careful attention to both performance quality and intellectual property (IP) considerations. Overlooking these aspects can lead to operational inefficiencies, safety hazards, legal risks, and increased total cost of ownership. Below are key pitfalls to avoid:

Inadequate Assessment of Build Quality and Material Specifications

Many buyers focus solely on initial cost, neglecting the long-term impact of substandard materials. Using undersized carbon steel or non-corrosion-resistant components in harsh environments leads to premature failure, contamination risks, and unplanned downtime. Always verify material certifications (e.g., ASTM, ISO) and ensure construction aligns with your process requirements (e.g., explosive dust, high temperature).

Overlooking System Performance Validation

Vendors may provide inflated performance claims without third-party testing data. Relying on unverified airflow (CFM), pressure drop, or filtration efficiency metrics can result in undersized or ineffective systems. Demand test reports from accredited labs (e.g., CE, UL, ISO 16890) and request references from similar industrial applications.

Ignoring Compliance with Industry and Safety Standards

Failure to ensure the system meets regional and industry-specific regulations (e.g., OSHA, NFPA 654, ATEX, EU Directive 2014/34/EU) poses serious safety and legal risks. Non-compliant systems may not handle combustible dust safely or meet emission limits, resulting in fines or shutdowns. Confirm all certifications are current and applicable to your operational jurisdiction.

Underestimating Maintenance and Total Cost of Ownership

Low upfront pricing often masks high lifecycle costs. Poorly designed access points, non-standard filter elements, or inefficient cleaning mechanisms increase maintenance labor and downtime. Evaluate ease of service, filter replacement frequency, and energy consumption (e.g., fan efficiency) to assess true operational cost.

Neglecting Intellectual Property (IP) Protection and Risks

Sourcing from manufacturers without proper IP safeguards exposes your business to legal liabilities. Using systems that incorporate patented technologies without licensing—or sourcing from suppliers who reverse-engineer competitors’ designs—can lead to infringement lawsuits. Conduct due diligence on the supplier’s IP portfolio and request documentation showing licensed or proprietary technology use.

Selecting Suppliers Without Proven Application Experience

Generic dust collectors may not address unique process challenges (e.g., sticky dust, high moisture, variable loads). Choosing a vendor without domain expertise in your industry (e.g., pharmaceuticals, metalworking, woodworking) increases the risk of poor system design. Prioritize suppliers with documented success in similar applications and site-specific engineering capabilities.

Failing to Secure Proper Documentation and As-Built Drawings

Incomplete technical documentation—including schematics, control logic, and IP ownership records—complicates maintenance, upgrades, and regulatory audits. Ensure contracts require delivery of full documentation, including software source codes (if applicable) and proof of licensed components, to protect your operational and legal interests.

Avoiding these pitfalls ensures a dust collection system that is safe, compliant, efficient, and legally sound—protecting both your operations and your organization’s intellectual integrity.

Logistics & Compliance Guide for Industrial Dust Collection Systems

Understanding Industrial Dust Collection Systems

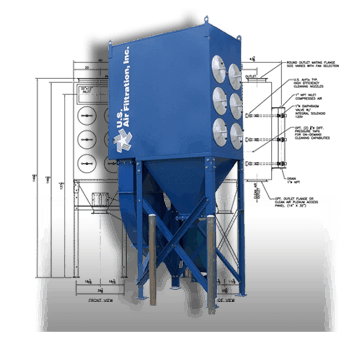

Industrial dust collection systems are critical engineering controls designed to capture, convey, and contain airborne particulates generated during manufacturing, processing, and material handling operations. These systems protect worker health, ensure regulatory compliance, minimize fire and explosion risks, and maintain product quality. Key components typically include hoods, ductwork, fans, dust collectors (e.g., baghouses, cartridge filters, cyclones), and filtration media. Proper logistics and compliance management are essential for system performance, safety, and legal adherence.

Regulatory Compliance Framework

Industrial dust collection systems must comply with various national and international regulations to ensure safety and environmental protection. Key regulatory bodies include OSHA (Occupational Safety and Health Administration), the EPA (Environmental Protection Agency), NFPA (National Fire Protection Association), and local environmental agencies. OSHA’s permissible exposure limits (PELs) under 29 CFR 1910.1000 define acceptable airborne contaminant concentrations. NFPA 652 (Standard on the Fundamentals of Combustible Dust) and NFPA 654 (Standard for the Prevention of Fire and Dust Explosions) mandate hazard evaluations, housekeeping, and equipment design for combustible dust environments. The EPA regulates emissions under the Clean Air Act, particularly for hazardous air pollutants (HAPs) via NESHAP standards. Compliance includes regular air monitoring, documentation, and hazard assessments.

System Design and Installation Logistics

Proper design and installation are foundational to effective dust collection. System logistics begin with a site assessment to determine dust characteristics (e.g., particle size, toxicity, explosivity), airflow requirements (CFM), and duct velocity. Design must follow engineering best practices to minimize pressure drop and avoid dust settling in ducts. Installation requires coordination with facility operations, structural assessments for equipment load, and integration with existing HVAC or process systems. Pre-installation planning includes obtaining permits, scheduling shutdowns, ensuring skilled labor availability, and verifying compatibility with electrical and exhaust systems. Documentation of as-built designs and commissioning reports supports ongoing compliance and troubleshooting.

Transportation and Handling of Components

Transporting large dust collection components—such as baghouses, duct sections, and fans—requires careful logistical planning. Oversized loads may need special permits and route approvals. Handling must prevent damage to sensitive components like filter cartridges or control panels. Use of cranes, forklifts, or rigging equipment must follow safety protocols (e.g., OSHA 1926 Subpart CC for crane operations). Packaging should protect against moisture and impact during transit. Upon delivery, conduct a visual and functional inspection, and store components in a dry, secure location until installation. Maintain a chain-of-custody log for critical parts to support warranty and compliance audits.

Maintenance, Inspection, and Recordkeeping

Routine maintenance ensures continued system performance and compliance. A preventive maintenance (PM) schedule should include filter replacement, duct cleaning, fan balancing, and leak testing. NFPA 652 requires documented dust hazard analyses (DHAs) and regular housekeeping inspections. OSHA mandates medical surveillance for workers exposed to certain dusts (e.g., silica, hexavalent chromium). Recordkeeping must include maintenance logs, air quality test results, DHA updates, training documentation, and incident reports. Digital asset management systems can streamline record access during audits and inspections.

Waste Disposal and Environmental Compliance

Spent filters, collected dust, and contaminated components may be classified as hazardous waste depending on dust composition (e.g., heavy metals, carcinogens). Waste must be characterized according to RCRA (Resource Conservation and Recovery Act) regulations. Proper storage in labeled, sealed containers and disposal through licensed hazardous waste handlers is required. Maintain manifests and disposal records for at least three years. For non-hazardous dust, recycling or landfill disposal must still comply with local environmental codes. Dust with explosive potential requires special handling and storage per NFPA standards to prevent ignition.

Training and Operational Safety

Personnel involved in operating, maintaining, or working near dust collection systems must receive comprehensive training. Topics include system operation, lockout/tagout (LOTO) procedures (OSHA 1910.147), combustible dust hazards, PPE requirements, and emergency response. Refresher training should occur annually or after system modifications. Training records must be maintained and accessible for compliance audits. A safety culture emphasizing reporting of malfunctions or dust accumulations supports long-term compliance and risk reduction.

Emergency Preparedness and Incident Response

Dust collection systems, especially those handling combustible dust, pose explosion and fire risks. Facilities must have emergency response plans aligned with NFPA 69 (Explosion Prevention Systems) and OSHA emergency action standards (29 CFR 1910.38). This includes installation of explosion vents, suppression systems, and isolation valves. Employees should be trained in emergency shutdown procedures and evacuation routes. Conduct regular drills and maintain communication with local fire departments. After any incident involving the dust system, perform a root cause analysis and update safety protocols accordingly.

Audits, Certifications, and Continuous Improvement

Regular internal and third-party audits verify compliance with regulatory and industry standards. Audit checklists should cover system performance, maintenance records, training, and hazard controls. Certifications such as ISO 14001 (Environmental Management) or OHSAS 18001/ISO 45001 (Occupational Health and Safety) can demonstrate commitment to best practices. Use audit findings to drive continuous improvement in system efficiency, safety, and regulatory adherence. Stay updated on evolving regulations and technological advancements in filtration and monitoring to maintain compliance over time.

Conclusion: Sourcing Industrial Dust Collection Systems

Sourcing an industrial dust collection system is a critical investment that directly impacts workplace safety, regulatory compliance, equipment longevity, and overall operational efficiency. A well-chosen system not only protects employee health by maintaining air quality but also helps avoid costly fines related to environmental and occupational safety standards.

When sourcing dust collection solutions, businesses must evaluate key factors such as the type of dust generated, airflow requirements (CFM), filtration efficiency, system design (e.g., cartridge, baghouse, cyclone), maintenance needs, and compatibility with existing processes. Additionally, considerations around energy efficiency, ease of integration, and lifecycle costs play a significant role in long-term sustainability and cost-effectiveness.

Partnering with reputable suppliers who offer technical expertise, customized solutions, and reliable after-sales support ensures optimal performance and durability of the system. Conducting thorough vendor assessments, obtaining detailed quotes, and reviewing case studies or client references can greatly enhance procurement confidence.

In conclusion, a strategic, informed approach to sourcing industrial dust collection systems will result in improved air quality, compliance assurance, enhanced productivity, and a safer working environment—making it an indispensable component of modern industrial operations.