The global demand for dump bed utility vehicles has seen steady growth, driven by increasing infrastructure development, rising adoption in agriculture and construction sectors, and the need for efficient material handling in challenging terrains. According to a report by Grand View Research, the global utility vehicle market size was valued at USD 19.8 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 7.3% from 2023 to 2030. This growth is further supported by technological advancements, including the introduction of electric and hybrid utility vehicles, particularly in regions emphasizing sustainable operations. As industry needs evolve, manufacturers are focusing on durability, payload capacity, and versatility—key factors influencing procurement decisions. In this competitive landscape, a select group of manufacturers have emerged as leaders, consistently delivering innovative, high-performance dump bed utility vehicles across diverse applications. The following list highlights the top 10 manufacturers shaping the industry through engineering excellence, global reach, and data-backed market presence.

Top 10 Dump Bed Utility Vehicle Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

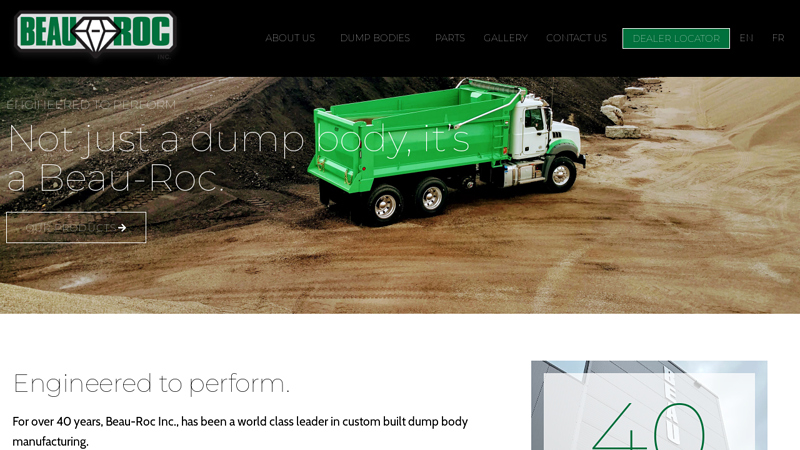

#1 Dump Truck Bodies Manufacturers

Domain Est. 1998

Website: beauroc.com

Key Highlights: Beau-Roc Inc. is a leading dump truck bodies manufacturer across Canada and North America. Call (613) 443-0044 today for more details!Missing: utility vehicle…

#2 Dump Bodies, Spreaders, & Hoists leading manufacturer.

Domain Est. 1996

Website: dumptrucks.com

Key Highlights: Warren, LLC is the leading manufacturer of a full line of dump bodies, hoists, trailers, and spreaders. We provide top-quality products with a commitment to ……

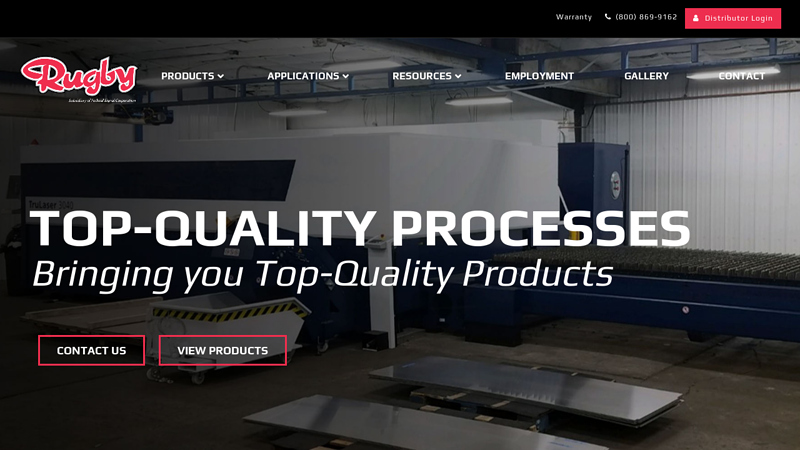

#3 Rugby Manufacturing

Domain Est. 1997

Website: rugbymfg.com

Key Highlights: Rugby is North America’s leading designer and manufacturer of Class 3 – 7 dump truck bodies, landscape bodies, platform bodies, truck and trailer hoists….

#4 Polaris RANGER

Domain Est. 1992

Website: polaris.com

Key Highlights: The hardest working, smoothest riding Polaris RANGER side-by-side (SxS) utility vehicles for the trail, farm, or hunt. Choose from two-seat, full-size and ……

#5 Utility Vehicles (UTVs)

Domain Est. 1997

Website: bobcat.com

Key Highlights: Bobcat UTVs offer industry leading payload, comfort and performance for any job. Gas and diesel models. View specs, features and pricing. Start Today!…

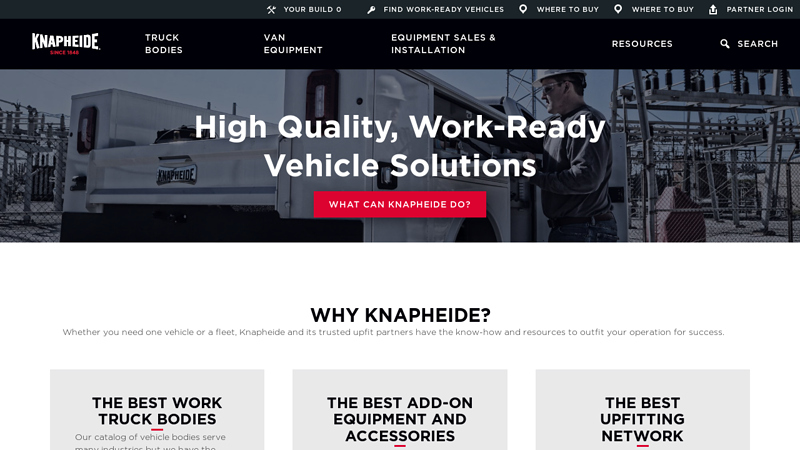

#6 Knapheide

Domain Est. 1998

Website: knapheide.com

Key Highlights: Our catalog of vehicle bodies serve many industries but we have the capability and capacity to create custom solutions too….

#7 PJ Trailers

Domain Est. 1999

Website: pjtrailers.com

Key Highlights: The #1 professional grade trailer company in the USA. Durable dump, gooseneck, tilt, equipment, and utility trailers. View our selection!…

#8 Diamond C Trailers

Domain Est. 2000

Website: diamondc.com

Key Highlights: We offer a robust lineup of premium grade trailers for sale: dump, gooseneck, equipment, tilt, step deck, and car hauler trailers….

#9 AMP

Domain Est. 2001

Website: landmaster.com

Key Highlights: The AMP series by Landmaster is our all-electric UTV, built to provide all the power, performance, and features you’d expect from a gas-powered UTV….

#10 Utility Vehicles (UTV)

Domain Est. 2014

Website: kubotausa.com

Key Highlights: Learn more about Kubota’s utility vehicles. The RTV & RTV-X Series have something to offer for any commercial or residential/recreational activity….

Expert Sourcing Insights for Dump Bed Utility Vehicle

H2: Projected 2026 Market Trends for Dump Bed Utility Vehicles

The global dump bed utility vehicle (DBUV) market is poised for significant evolution by 2026, driven by industrial expansion, technological innovation, and shifting consumer demands across key end-use sectors. These versatile vehicles—commonly used in construction, agriculture, landscaping, and municipal operations—are benefiting from increasing infrastructure development and the need for efficient material handling solutions. Below are the major trends expected to shape the DBUV market in 2026:

1. Rising Demand in Emerging Economies

Developing regions such as Southeast Asia, Latin America, and Africa are witnessing accelerated infrastructure and urban development projects. Governments are investing heavily in roads, utilities, and public works, fueling demand for durable, cost-effective dump bed utility vehicles. Local manufacturing and favorable import policies are also making DBUVs more accessible in these markets.

2. Electrification and Sustainable Powertrains

Environmental regulations and corporate sustainability goals are pushing manufacturers toward electric and hybrid dump bed utility vehicles. By 2026, electric DBUVs are expected to gain market share, particularly in urban and indoor applications where noise and emissions are concerns. Major players are investing in battery technology and charging infrastructure to support this shift.

3. Technological Integration and Smart Features

Advancements in telematics, GPS tracking, remote diagnostics, and fleet management systems are being integrated into DBUVs. These features enhance operational efficiency, improve maintenance scheduling, and reduce downtime. In 2026, connected dump bed utility vehicles will likely become standard in enterprise fleets, especially in logistics and municipal services.

4. Customization and Modular Designs

End-users are increasingly demanding vehicles tailored to specific applications. Manufacturers are responding with modular dump beds, customizable bed sizes, payload capacities, and attachments (e.g., hydraulic lifts, side dumps). This trend is driven by diverse use cases across agriculture, mining, and waste management sectors.

5. Growth in Rental and Shared Fleet Models

The high capital cost of DBUVs is prompting businesses—especially SMEs—to adopt rental and leasing models. Equipment rental companies are expanding their DBUV inventory, offering flexible terms and maintenance support. This trend is expected to grow steadily by 2026, particularly in construction and event management industries.

6. Competitive Landscape and Market Consolidation

The market is becoming increasingly competitive, with established players like Polaris, Kubota, and John Deere expanding their DBUV offerings. At the same time, regional manufacturers are gaining traction through localized production and pricing. Strategic partnerships, mergers, and acquisitions are anticipated as companies seek to broaden their geographic reach and technological capabilities.

7. Focus on Operator Comfort and Safety

Regulatory standards and user expectations are driving improvements in ergonomics, cabin design, rollover protection systems (ROPS), and operator visibility. By 2026, safety certifications and comfort features will be key differentiators in product marketing and procurement decisions.

In conclusion, the 2026 dump bed utility vehicle market will be defined by innovation, electrification, and regional growth. Companies that prioritize sustainability, smart technology, and customer-centric design will be well-positioned to lead in this dynamic and expanding sector.

Common Pitfalls When Sourcing Dump Bed Utility Vehicles (Quality, IP)

Sourcing Dump Bed Utility Vehicles—especially from international suppliers—can present significant challenges related to product quality and intellectual property (IP) protection. Being aware of these pitfalls is critical to ensuring reliable performance, legal compliance, and long-term value.

Poor Manufacturing Quality and Material Standards

One of the most frequent issues when sourcing dump bed utility vehicles is inconsistent or substandard build quality. Many suppliers, particularly in low-cost manufacturing regions, may use inferior materials such as thin-gauge steel for the dump bed or underpowered hydraulic systems. This leads to premature wear, structural deformation, and safety hazards under load. Additionally, inadequate welding practices and poor paint or corrosion protection reduce vehicle lifespan, especially in harsh operating environments.

Lack of Independent Quality Verification

Buyers often rely solely on supplier claims or basic certifications without third-party validation. Without independent inspections (e.g., pre-shipment inspections or factory audits), there is a high risk of receiving vehicles that do not meet agreed specifications. Missing or inconsistent component testing—such as load capacity or hydraulic lift cycle validation—can result in field failures and costly downtime.

Non-Compliance with Regional Safety and Emissions Standards

Dump bed utility vehicles must comply with local regulations regarding emissions, noise, safety features (e.g., lighting, braking), and operational limits. Sourcing from regions with lax regulatory enforcement may result in vehicles that fail to meet standards in the destination market (e.g., EPA or CE requirements). This can lead to import rejections, fines, or the need for expensive retrofits.

Intellectual Property Infringement Risks

Many generic or low-cost dump bed utility vehicles replicate designs, control systems, or branding from established manufacturers without authorization. Sourcing such vehicles exposes buyers to IP infringement claims, especially if the vehicles are imported into jurisdictions with strong IP enforcement. This includes risks related to patented hydraulic mechanisms, chassis designs, or even look-alike branding that may constitute trademark violations.

Inadequate Documentation and Technical Support

Suppliers may provide incomplete technical documentation, lack clear manuals, or offer minimal after-sales support. This complicates maintenance, spare parts procurement, and warranty claims. Without proper schematics or service guides, operators face extended downtime and higher repair costs.

Hidden Costs from Warranty and Service Limitations

While initial pricing may appear attractive, many low-cost suppliers offer limited or non-enforceable warranties, especially across international borders. Repairing or replacing defective components often requires sourcing parts directly from the supplier, incurring high shipping costs and long lead times. This undermines the total cost of ownership advantages of the initial purchase price.

Mitigation Strategies

To avoid these pitfalls, buyers should:

– Conduct thorough due diligence on suppliers, including site audits and reference checks.

– Require third-party quality inspections and compliance testing.

– Verify IP clearance and request indemnification clauses in contracts.

– Ensure technical documentation and after-sales support are contractually guaranteed.

– Choose suppliers with proven export experience and adherence to international standards.

By proactively addressing these common issues, organizations can secure reliable, compliant, and legally safe dump bed utility vehicles that deliver long-term operational value.

Logistics & Compliance Guide for Dump Bed Utility Vehicle

This guide outlines key considerations for the safe, efficient, and compliant operation of Dump Bed Utility Vehicles (DBUVs) in logistics and transportation activities. Adherence to these guidelines ensures regulatory compliance, promotes safety, and optimizes operational performance.

Vehicle Specifications and Classification

Understand your DBUV’s specifications to ensure appropriate use and compliance:

– Gross Vehicle Weight Rating (GVWR): Never exceed the manufacturer’s specified GVWR. Exceeding this limit violates federal and state regulations and compromises safety.

– Payload Capacity: Calculate payload by subtracting the vehicle’s curb weight from the GVWR. Overloading reduces braking efficiency, increases wear, and poses rollover risks.

– Classification: Most DBUVs fall under Class 1–3 light-duty vehicles. Confirm classification with the manufacturer or vehicle registration, as this determines applicable regulations (e.g., CDL requirements, registration fees).

Licensing and Driver Requirements

Ensure drivers meet all legal qualifications:

– Valid Driver’s License: Operators must hold a valid state-issued driver’s license appropriate for the vehicle class.

– Commercial Driver’s License (CDL): Generally not required for DBUVs under 26,001 lbs GVWR unless transporting hazardous materials or operating in intrastate commerce under specific conditions. Verify state-specific rules.

– Training: Provide documented training on safe dumping procedures, load securing, and vehicle handling, especially on uneven terrain.

Load Management and Securement

Proper loading practices prevent accidents and regulatory violations:

– Weight Distribution: Distribute load evenly across the dump bed to maintain stability during transport and dumping.

– Load Containment: Use tarps, nets, or sideboards to prevent material spillage during transit, complying with state debris laws.

– Avoid Overfilling: Do not load material above the sidewalls of the dump bed. Loose materials must be fully contained.

– Pre-Trip Inspection: Check for debris buildup, hydraulic leaks, and bed latch integrity before each use.

Operational Safety Protocols

Implement safety procedures to protect operators and others:

– Pre-Use Inspection: Conduct daily checks of lights, tires, brakes, hydraulic systems, and safety decals.

– Dumping Safety: Always dump on level, stable ground. Engage parking brake, chock wheels if necessary, and ensure no personnel are near the dumping zone.

– Hydraulic System Maintenance: Follow manufacturer guidelines for fluid checks and system servicing to prevent failures.

– Visibility: Ensure mirrors are clean and unobstructed. Use spotters when backing or operating in congested areas.

Regulatory Compliance

Adhere to federal, state, and local regulations:

– Registration and Titling: Maintain current registration and title in the operating state. Display valid license plates.

– Emissions Standards: Comply with EPA and state emissions requirements (e.g., CARB in California). Keep records of emissions-related repairs.

– Noise Regulations: Operate within local noise ordinances, especially in urban or residential zones during dumping cycles.

– Hours of Service (HOS): While typically not applicable to non-CDL DBUVs, track driver hours if used in commercial operations to prevent fatigue.

Maintenance and Recordkeeping

Proper maintenance ensures reliability and compliance:

– Scheduled Maintenance: Follow the manufacturer’s maintenance schedule for engine, suspension, dump mechanism, and safety systems.

– Repair Logs: Maintain detailed records of all inspections, repairs, and part replacements.

– Vehicle Inspections: Conduct periodic safety inspections (e.g., quarterly) to identify wear or damage early.

Environmental and Site Compliance

Minimize environmental impact and follow site rules:

– Spill Prevention: Use drip trays during hydraulic servicing and clean up any spills immediately.

– Dust Control: Apply water or dust suppressants when handling dry, loose materials in sensitive areas.

– Job Site Regulations: Comply with site-specific safety plans, speed limits, and access protocols on construction or industrial sites.

Documentation and Insurance

Ensure all operational documentation is current:

– Proof of Insurance: Maintain liability, collision, and comprehensive coverage. Confirm coverage includes utility and dump body use.

– Vehicle Logbook: Record mileage, fuel usage, maintenance, and operational hours for fleet management and audits.

– Compliance Certificates: Keep copies of safety inspection reports, operator training records, and emissions compliance documents onboard or digitally accessible.

By following this guide, operators and fleet managers can ensure Dump Bed Utility Vehicles are used safely, efficiently, and in full compliance with applicable laws and industry standards.

Conclusion for Sourcing a Dump Bed Utility Vehicle

Sourcing a dump bed utility vehicle is a strategic decision that can significantly enhance operational efficiency, especially in industries such as construction, landscaping, agriculture, and facility maintenance. After evaluating key factors such as payload capacity, durability, fuel efficiency, ease of maintenance, and total cost of ownership, it is clear that selecting the right vehicle requires a balance between performance and long-term value.

Partnering with reputable suppliers or manufacturers ensures access to quality-built vehicles equipped with reliable dump mechanisms and versatile configurations tailored to specific operational needs. Additionally, considering after-sales support, warranty options, and availability of spare parts contributes to minimizing downtime and maximizing return on investment.

In conclusion, a well-sourced dump bed utility vehicle not only improves material handling and site productivity but also supports cost-effective and sustainable operations. By conducting thorough research, defining clear requirements, and engaging trusted vendors, organizations can make informed procurement decisions that align with their operational goals and deliver lasting benefits.