The diesel particulate filter (DPF) market has experienced robust growth driven by tightening global emissions regulations and increased adoption of clean diesel technologies. According to a report by Mordor Intelligence, the global DPF market was valued at USD 8.3 billion in 2023 and is projected to register a CAGR of over 6.2% from 2024 to 2029. This expansion is fueled by stringent norms from regulatory bodies such as the Environmental Protection Agency (EPA) and the European Union’s Euro 6 standards, which mandate reduced particulate matter emissions from diesel engines. Additionally, rising urbanization and growing demand for commercial vehicles—especially in Asia-Pacific and North America—are accelerating the need for efficient after-treatment systems. As original equipment manufacturers (OEMs) and fleet operators prioritize compliance and sustainability, DPFs have become critical components in modern diesel exhaust systems. This growing demand has led to intensified innovation and competition among key players in the sector. Based on market presence, technological expertise, production scale, and compliance with international standards, the following are the top 10 DPF manufacturers shaping the industry landscape today.

Top 10 Dpf Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Active Diesel Particulate Filter Systems

Domain Est. 1997

Website: rypos.com

Key Highlights: Rypos active DPF emission control systems capture and burn off up to 95% of diesel particulate matter (PM)—the tiny soot that most directly harms human health….

#2 Clean Diesel Technologies, Inc. – Purifilter

Domain Est. 1997

Website: epa.gov

Key Highlights: Criteria to achieve emission reductions · The engine exhaust temperature must be at least 280° C for at least 25% of the applicable duty cycle….

#3 DuraFit™

Domain Est. 2006

Website: apemissions.com

Key Highlights: DuraFit replacement DPFs and DOCs combine exact-fit design for easy installation with design enhancements over many OEM and aftermarket units that improve ……

#4 DPFXFIT by GESi

Domain Est. 2017

Website: dpfxfit.com

Key Highlights: DPFXFIT aftermarket line of replacement Diesel Particulate Filters (DPF) & Diesel Oxidation Catalysts (DOC) to meet or exceed OEM requirements….

#5 Redline Emissions Products

Website: rep.direct

Key Highlights: We offer OEM quality diesel emissions truck parts & DPF Cleaning Machine systems. Grow your revenue. Become a REP parts distributor! Start Cleaning DPFs!…

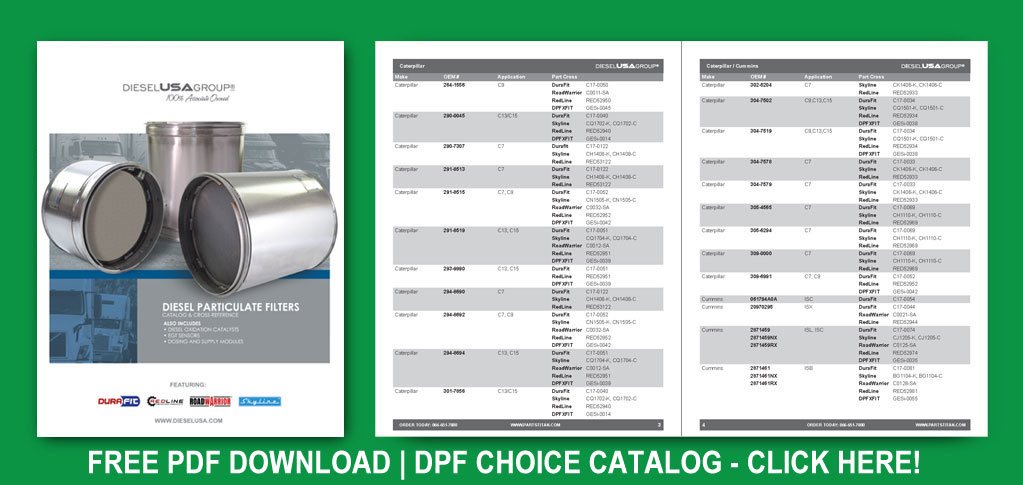

#6 DPF Choice Program and Catalog

Domain Est. 2000

Website: dieselusa.com

Key Highlights: This catalog provides cross-references by application for easier DPF and DOC replacement. All DPFs and DOCs provided by DieselUSA are 100% brand new….

#7 Diesel Emissions Service

Domain Est. 2008

Website: dieselemissionsservice.com

Key Highlights: DES is your West Coast headquarters for diesel emissions such as DPF Cleaning, Clean Truck Checks, diagnostics, aftertreatment parts, Retrofits, ……

#8 DPF Parts Direct

Domain Est. 2013

Website: dpfpartsdirect.com

Key Highlights: Explore high-quality aftermarket diesel parts with DPF Parts Direct. Need help finding a diesel emissions part? Talk to one of our experts today!…

#9 Skyline Emissions

Domain Est. 2015

#10 Diesel Particulate Filter (DPF)

Website: tyk.co.jp

Key Highlights: TYK Corporation is producing ceramics filters of silicon carbide for DPFs. Their wide application in many emission control fields is possible….

Expert Sourcing Insights for Dpf

H2: 2026 Market Trends for Diesel Particulate Filters (DPF)

As we approach 2026, the global market for Diesel Particulate Filters (DPFs) is undergoing significant transformation, shaped by tightening environmental regulations, technological innovation, and shifts in transportation dynamics. Despite the growing adoption of electric vehicles (EVs), DPFs continue to play a crucial role in reducing harmful emissions from diesel engines, particularly in commercial, industrial, and off-road applications. Below are the key trends expected to define the DPF market in 2026:

1. Stricter Emissions Regulations Driving Demand

Governments worldwide are enforcing more stringent emissions standards, such as Euro 7 in Europe and Tier 5 in North America, aimed at reducing particulate matter (PM) and nitrogen oxides (NOx). These regulations are compelling manufacturers to adopt advanced after-treatment systems, including high-efficiency DPFs. In emerging markets, urban air quality concerns are also spurring the adoption of retrofit DPFs for older diesel fleets, further expanding market potential.

2. Growth in Heavy-Duty and Off-Road Applications

While light-duty diesel vehicles are declining in popularity due to electrification, demand for DPFs remains strong in heavy-duty trucks, construction equipment, mining machinery, and agricultural vehicles. These sectors rely on diesel power for high torque and durability, and DPFs are essential for compliance with off-road emissions standards (e.g., EU Stage V, U.S. EPA Tier 4 Final). The increasing focus on sustainable mining and green construction is accelerating DPF integration in non-road mobile machinery.

3. Advancements in DPF Materials and Regeneration Technology

By 2026, DPF technology is expected to feature next-generation materials such as silicon carbide (SiC) and cordierite composites with enhanced thermal durability and filtration efficiency. Active and passive regeneration systems are becoming smarter, integrating with vehicle telematics and AI-driven diagnostics to optimize cleaning cycles, reduce fuel penalties, and extend filter life. Continuous regeneration filters (CRFs) and catalyzed DPFs (CDPFs) are gaining traction for improved performance in stop-and-go operations.

4. Rise in Retrofit and Aftermarket DPF Solutions

With aging diesel fleets still in operation—especially in developing regions—there is a growing aftermarket for DPF retrofits. Municipalities and transport companies are investing in retrofitting older vehicles to meet urban low-emission zone (LEZ) requirements. This trend is supported by government subsidies and incentives in regions like India, Southeast Asia, and Latin America, creating a robust aftermarket segment for DPFs.

5. Integration with Hybrid Powertrains

As hybrid diesel-electric systems gain ground in delivery fleets and public transit, DPFs are being adapted for intermittent engine use. Challenges such as incomplete regeneration due to low exhaust temperatures are being addressed through hybrid-specific DPF designs with electric heating elements or integration with selective catalytic reduction (SCR) systems. This convergence supports cleaner urban logistics without full electrification.

6. Sustainability and Circular Economy Initiatives

By 2026, environmental scrutiny extends beyond emissions to lifecycle impacts. Leading DPF manufacturers are focusing on recyclable substrates, reduced use of precious metals, and regeneration systems that lower fuel consumption. Additionally, DPF recycling—especially recovery of platinum group metals (PGMs) from spent filters—is emerging as a sustainable business model, aligning with circular economy goals.

7. Regional Market Divergence

- Europe: Mature market with high DPF penetration; growth driven by retrofitting and Euro 7 compliance.

- North America: Steady demand in freight and off-road sectors; emphasis on durability and warranty performance.

- Asia-Pacific: Fastest-growing region due to urbanization, industrialization, and rising emission norms in countries like India and China.

- Rest of World: Increasing adoption in Africa, Middle East, and Latin America driven by air quality regulations and international aid programs.

Conclusion

Although the long-term future of diesel engines is uncertain due to electrification, the DPF market remains resilient through 2026. Innovation, regulatory pressure, and the need for cleaner combustion technologies in hard-to-electrify sectors ensure continued relevance. Companies investing in smart, durable, and sustainable DPF solutions are well-positioned to capitalize on both compliance-driven demand and emerging opportunities in hybrid and retrofit markets.

Common Pitfalls Sourcing DPFs (Diesel Particulate Filters): Quality and Intellectual Property (IP)

When sourcing Diesel Particulate Filters (DPFs), especially from non-OEM or international suppliers, companies often encounter significant risks related to product quality and intellectual property infringement. Failing to address these pitfalls can lead to regulatory non-compliance, equipment failure, legal disputes, and reputational damage.

Quality-Related Pitfalls

1. Substandard Materials and Manufacturing

Many aftermarket or low-cost DPFs are produced using inferior ceramic substrates or metallic materials that don’t meet OEM specifications. This results in reduced filtration efficiency, lower thermal durability, and increased risk of cracking or melting under normal operating conditions. Poor manufacturing processes, such as inconsistent wall thickness or inadequate coating application, further compromise performance.

2. Inaccurate Filtration Efficiency Claims

Suppliers may overstate a DPF’s filtration efficiency (e.g., claiming >90% particulate matter capture) without third-party validation. Without proper testing to ISO 8178 or equivalent standards, these claims can be misleading, leading to non-compliance with emissions regulations (e.g., EPA, Euro VI).

3. Lack of Certification and Compliance Documentation

Reputable DPFs should come with emissions compliance certifications (e.g., EPA or EU type-approval) and material test reports. Sourcing from suppliers who cannot provide verifiable documentation increases the risk of installing non-compliant parts, potentially resulting in fines or equipment downtime.

4. Poor Fit and Integration

Even if a DPF functions well in isolation, improper dimensions, flange configurations, or sensor placements can lead to installation issues, exhaust leaks, or incompatibility with the vehicle’s engine control unit (ECU), disrupting regeneration cycles and triggering fault codes.

Intellectual Property (IP) Pitfalls

1. Design and Patent Infringement

DPF designs, especially those from major OEMs (e.g., Cummins, Bosch, Tenneco), are often protected by patents covering substrate geometry, coating formulations, and integration methods. Sourcing DPFs that replicate these designs without authorization exposes buyers to legal liability for patent infringement, even if they were unaware of the violation.

2. Counterfeit or “Look-Alike” Products

Some suppliers produce DPFs that mimic the appearance and branding of genuine OEM parts. These counterfeit units may bear fake part numbers, logos, or packaging. Using such components not only breaches IP rights but also voids warranties and compromises system reliability.

3. Unclear or Missing Licensing Agreements

When sourcing from third-party manufacturers, it’s essential to confirm whether they possess proper licensing to produce patented DPF technologies. Absence of such agreements increases the legal risk for both the supplier and the end buyer, particularly in jurisdictions with strict IP enforcement.

4. Reverse Engineering Without Legal Clearance

Some suppliers reverse-engineer OEM DPFs to create compatible alternatives. While functional equivalence may be achieved, doing so without analyzing patent landscapes or securing design-around solutions can lead to unintentional IP violations and costly litigation.

Mitigation Strategies

- Verify Supplier Credentials: Work only with reputable suppliers who provide full traceability, certifications, and quality control documentation.

- Request Independent Testing Reports: Demand proof of filtration efficiency, backpressure performance, and durability from accredited labs.

- Conduct IP Due Diligence: Consult legal experts to assess whether sourced DPFs infringe on existing patents or trademarks.

- Use Authorized Channels: Whenever possible, source through OEM-approved distributors or licensed manufacturers to ensure compliance and performance.

Ignoring these pitfalls can lead to operational failures, regulatory penalties, and legal exposure. Proactive due diligence is essential when sourcing DPFs to ensure both quality and IP compliance.

Logistics & Compliance Guide for DPF (Diesel Particulate Filter)

Overview of DPF Requirements

The Diesel Particulate Filter (DPF) is a critical emissions control device designed to reduce particulate matter (soot) from diesel engine exhaust. Compliance with DPF regulations is mandatory in many regions, including the United States (EPA), European Union (Euro standards), and other jurisdictions with strict air quality laws. This guide outlines key logistics and compliance considerations for handling, transporting, installing, and maintaining DPF systems.

Regulatory Compliance Standards

All DPF systems must comply with region-specific emissions regulations:

– United States: Governed by the Environmental Protection Agency (EPA) under 40 CFR Part 86 and Part 1033. Tampering with or removal of a DPF is prohibited and subject to fines.

– European Union: Must meet Euro 5 and Euro 6 standards. Vehicles are subject to periodic emissions testing (e.g., MOT in the UK, TÜV in Germany).

– Other Regions: Canada (Canadian Environmental Protection Act), Australia (ADR 79/02), and others have similar DPF mandates. Always verify local regulations before importing, exporting, or servicing DPF-equipped vehicles.

Transportation and Handling Procedures

When shipping or handling DPF units:

– Ensure units are sealed in protective packaging to prevent contamination or physical damage.

– Label packages clearly as “Emissions Control Device – Handle with Care.”

– Avoid exposure to moisture, dust, and extreme temperatures during transit.

– Maintain chain-of-custody documentation for compliance audits, especially for recycled or replacement DPFs.

Installation and Maintenance Compliance

- DPF installation must be performed by certified technicians following OEM specifications.

- Any replacement DPF must be EPA- or EU-certified and matched to the engine and vehicle model.

- Maintenance records, including regeneration cycles, inspections, and part replacements, must be documented and retained for a minimum of 8 years (as per EPA requirements).

- Forced or passive regeneration processes must be logged as part of routine service protocols.

Prohibited Actions and Penalties

Under most environmental regulations:

– DPF removal, defeat, or tampering is illegal and voids vehicle certification.

– Use of “tune-out” software or delete kits is a violation of federal and international laws.

– Penalties include heavy fines (up to $45,268 per violation in the U.S.), vehicle impoundment, and loss of operating permits for fleets.

Documentation and Recordkeeping

Maintain the following records to demonstrate compliance:

– Bill of materials for DPF components

– Proof of certification (EPA or EU type-approval numbers)

– Service logs, including dates, technician details, and DPF condition assessments

– Shipping manifests and import/export declarations (if applicable)

End-of-Life Disposal and Recycling

- Spent DPFs must be disposed of or recycled through authorized facilities due to the presence of precious metals (e.g., platinum, palladium) and hazardous materials.

- Recycling providers must issue certificates of recycling for compliance tracking.

- Landfilling or unapproved disposal may result in environmental penalties.

Fleet Operator Responsibilities

Fleet managers must:

– Train drivers and maintenance staff on DPF care and legal requirements.

– Implement telematics or monitoring systems to detect DPF faults or tampering.

– Conduct periodic audits to ensure all vehicles remain DPF-compliant.

– Report DPF failures or malfunctions promptly to regulatory bodies if required.

Conclusion

Adherence to DPF logistics and compliance protocols ensures environmental protection, legal operation, and long-term vehicle reliability. Staying informed about evolving emissions standards and maintaining meticulous documentation are essential for all stakeholders — from manufacturers to end-users.

Conclusion for Sourcing DPF (Diesel Particulate Filter):

Sourcing a Diesel Particulate Filter (DPF) requires a strategic approach that balances cost, quality, compliance, and supply chain reliability. After evaluating potential suppliers, technical specifications, OEM vs. aftermarket options, and regulatory requirements, it is clear that selecting the right DPF involves more than just price comparison. Ensuring that the DPF meets emission standards (such as Euro 6 or EPA regulations), fits the intended vehicle or machinery application, and is backed by proper certification and warranty is critical.

Furthermore, building relationships with reputable suppliers who offer consistent quality, technical support, and timely delivery helps mitigate risks related to downtime and non-compliance. In the long term, investing in high-quality, properly sourced DPFs contributes to environmental sustainability, regulatory compliance, and improved engine performance.

In conclusion, effective DPF sourcing is a vital component of maintaining efficient and eco-friendly diesel operations. A well-structured procurement strategy focusing on quality, compliance, and supplier reliability will ensure optimal performance, regulatory adherence, and cost-effectiveness over the lifecycle of the equipment.