The global disk stack centrifuge market is experiencing robust growth, driven by increasing demand across industries such as pharmaceuticals, food and beverage, and petrochemicals. According to Mordor Intelligence, the centrifuge market was valued at USD 6.8 billion in 2023 and is projected to grow at a CAGR of over 6.5% from 2024 to 2029. Similarly, Grand View Research reports rising adoption of high-efficiency separation technologies, particularly in biopharmaceutical manufacturing and dairy processing, fueling innovation and competition among equipment manufacturers. This growth underscores the critical role of advanced separation technology, positioning disk stack centrifuges as essential assets in modern industrial processes. As demand for precision, automation, and energy-efficient solutions increases, a select group of manufacturers has emerged as leaders in engineering excellence and global market reach. Here are the top 9 disk stack centrifuge manufacturers shaping the future of industrial separation.

Top 9 Disk Stack Centrifuge Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

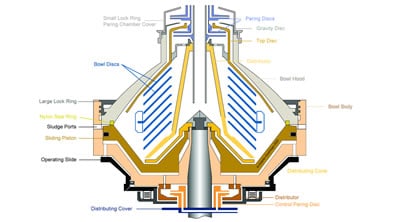

#1 Disc Stack Centrifuge

Domain Est. 2012

Website: dolphincentrifuge.com

Key Highlights: A disc stack centrifuge is a specifically designed industrial centrifuge with a stack of cone-shaped discs. The additional surface increases the settling area ……

#2 Centrifugal Separator

Domain Est. 1995

Website: gea.com

Key Highlights: GEA separators are designed for liquid-based applications. Using centrifugal force, they are used for separating suspensions consisting of two or more phases ……

#3 Suitable plate separators for every application

Domain Est. 1996

Website: flottweg.com

Key Highlights: Flottweg’s disc stack centrifuges epitomize German engineering excellence, offering robust purification and clarification for a diverse range of applications….

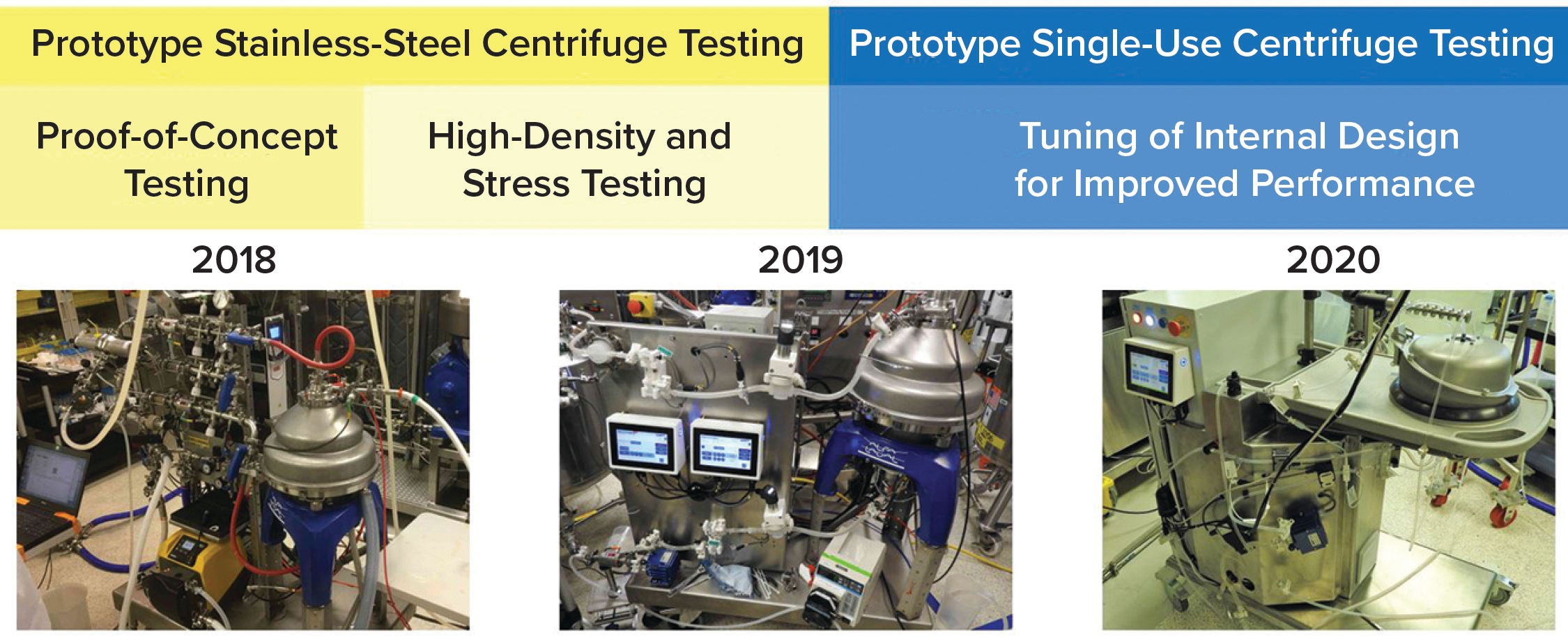

#4 Alfa Laval Disk Stack Centrifuge

Domain Est. 1997

Website: abpdu.lbl.gov

Key Highlights: The disc stack centrifuge is key for separating large volumes of cells and liquid while harvesting material from a 300L fermentation….

#5 High speed centrifugal separators

Domain Est. 2002

Website: alfalaval.us

Key Highlights: With sterile, fully hermetic disc stack centrifuges for three-phase separation and high solids-handling capacity, we can help you find the perfect equipment for ……

#6 Disc Stack Centrifuge

Domain Est. 2009

Website: huading-separator.com

Key Highlights: The disc stack centrifuge is used to remove solids (usually impurities) from liquids or to separate two liquid phases from each other by means of an enormously ……

#7 Separation Equipment : Disc Stack Centrifuge

Domain Est. 2011

Website: gnsolidsamerica.com

Key Highlights: GN Disc Stack Centrifuge is Vertical centrifuge, it is driven by one motor that rotates at high speed. Inside the rotating bowl of the disc Centrifuge is a set ……

#8 Disc Stack Centrifuge for Pharma and Biotech

Domain Est. 2016

Website: innovabiomed.com

Key Highlights: The disc stack centrifuge separates solids and one or two liquid phases from each other in one single continuous process, using extremely high centrifugal ……

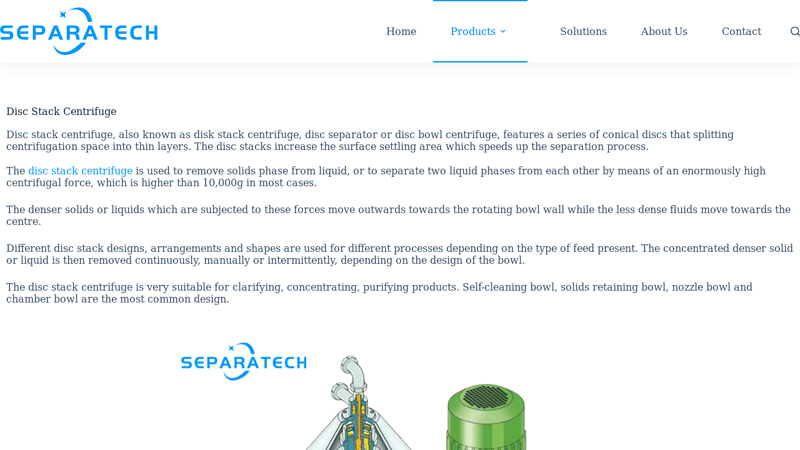

#9 Excellent Disc Stack Centrifuge with different bowl from SEPARATECH

Domain Est. 2020

Website: separatech.com

Key Highlights: The disc stack centrifuge is very suitable for clarifying, concentrating, purifying products. Self-cleaning bowl, solids retaining bowl, nozzle bowl and chamber ……

Expert Sourcing Insights for Disk Stack Centrifuge

Market Trends for Disk Stack Centrifuges in 2026

Rising Demand Across Key Industries

By 2026, the disk stack centrifuge market is expected to experience robust growth driven by increased demand in critical sectors. The pharmaceutical and biotechnology industries will continue to adopt advanced centrifugation technologies for cell harvesting, clarification of fermentation broths, and purification of monoclonal antibodies. Similarly, the food and beverage industry—particularly in dairy, edible oils, and brewing—will expand its use of disk stack centrifuges for efficient separation of fats, proteins, and contaminants, aligning with rising consumer demand for high-purity products.

Technological Advancements and Automation

Innovation will be a key trend shaping the 2026 market landscape. Manufacturers are integrating smart technologies such as IoT-enabled monitoring, predictive maintenance systems, and AI-driven process optimization into disk stack centrifuges. These advancements improve operational efficiency, reduce downtime, and ensure consistent product quality. Fully automated systems with remote diagnostics are becoming standard, especially in large-scale industrial applications requiring continuous operation and minimal human intervention.

Focus on Energy Efficiency and Sustainability

Sustainability will play a central role in equipment selection by 2026. End-users will prioritize centrifuges with lower energy consumption, reduced waste generation, and enhanced water recovery capabilities. Equipment designed for longer service intervals and minimal use of consumables will be favored, supporting corporate environmental, social, and governance (ESG) goals. Regulatory pressures and carbon footprint reduction initiatives will accelerate the adoption of eco-friendly centrifuge models.

Expansion in Emerging Markets

Emerging economies in Asia-Pacific, Latin America, and Africa are projected to become high-growth regions for disk stack centrifuge adoption. Rapid industrialization, increasing investments in pharmaceutical manufacturing, and expanding food processing infrastructure will drive market penetration. Localized production and partnerships with regional distributors will enable global suppliers to capture these growing opportunities.

Customization and Modular Solutions

A shift toward modular and customizable centrifuge systems will meet the diverse processing needs of different industries. By 2026, suppliers will increasingly offer scalable units that can be adapted for batch or continuous processing, varying feed compositions, and specific hygienic standards (e.g., FDA, EHEDG compliance). This flexibility allows end-users to optimize capital expenditure and adapt to evolving production requirements.

Consolidation and Competitive Dynamics

The market is likely to see further consolidation among key players through mergers, acquisitions, and strategic alliances. Established manufacturers will seek to broaden their product portfolios and geographic reach, intensifying competition. At the same time, niche innovators focusing on specialized applications—such as biofuel processing or wastewater reuse—will emerge as disruptive forces, fostering innovation and diversification within the sector.

Common Pitfalls in Sourcing Disk Stack Centrifuges: Quality and Intellectual Property Risks

Sourcing disk stack centrifuges, especially from international or less-established suppliers, involves significant risks related to product quality and intellectual property (IP) infringement. Failing to address these pitfalls can lead to operational inefficiencies, safety hazards, legal disputes, and reputational damage. Below are key challenges to consider:

Quality-Related Pitfalls

Substandard Materials and Manufacturing

Some suppliers may use inferior-grade materials (e.g., lower-grade stainless steel or subpar seals) to reduce costs, leading to premature wear, contamination risks, and failure under high-speed operation. Without proper quality control and traceability, such units may not meet industry standards (e.g., ASME, FDA, or EHEDG).

Inadequate Performance Verification

Many suppliers lack the testing infrastructure to validate centrifuge performance under real-world conditions. Buyers may receive units that do not achieve specified separation efficiency, throughput, or G-force, resulting in process downtime and increased operational costs.

Poor Documentation and Calibration

Incomplete or falsified documentation—including missing material certifications, calibration records, or performance test reports—undermines compliance with regulatory requirements and makes maintenance and troubleshooting difficult.

Lack of After-Sales Support and Spare Parts Availability

Low-cost suppliers often lack a reliable service network. This leads to extended downtime when repairs are needed, especially if genuine spare parts are unavailable or take months to source.

Intellectual Property (IP) Risks

Counterfeit or Reverse-Engineered Designs

Unscrupulous manufacturers may produce centrifuges that closely mimic patented designs from reputable brands (e.g., Alfa Laval, GEA, Westfalia). These units may infringe on protected technologies related to bowl design, discharge mechanisms, or automation systems.

Unauthorized Use of Trademarks and Branding

Some suppliers sell equipment with logos or model names that resemble those of established brands, misleading buyers into believing they are purchasing original equipment. This can expose end-users to legal liability, particularly in regulated industries.

Limited Innovation and Proprietary Technology Access

Sourcing from generic manufacturers may mean missing out on proprietary advancements such as self-cleaning mechanisms, advanced control systems, or energy-efficient designs protected by IP. This limits long-term performance and scalability.

Risk of Legal Liability and Supply Chain Disruptions

Using or importing a centrifuge that infringes on IP rights can result in customs seizures, lawsuits, or forced equipment removal. Companies may also face reputational damage and lose customer trust, especially in pharmaceuticals or food processing sectors.

Mitigation Strategies

To avoid these pitfalls, buyers should:

– Conduct thorough supplier audits, including site visits and third-party inspections.

– Require full documentation, including material test reports and performance validation data.

– Verify IP compliance by checking patent databases and consulting legal experts.

– Prioritize suppliers with established reputations, certifications (ISO, CE), and transparent supply chains.

– Include IP indemnification clauses in procurement contracts.

Proactively addressing quality and IP concerns ensures reliable operation, regulatory compliance, and protection against legal and financial risks.

Logistics & Compliance Guide for Disk Stack Centrifuge

Shipping and Transportation

Ensure the disk stack centrifuge is securely crated and protected against moisture, shock, and vibration during transit. Use wooden export crates with internal padding (e.g., foam or bubble wrap) to immobilize moving parts. Confirm that the shipping container is weatherproof and labeled with appropriate handling instructions, including “Fragile,” “This Side Up,” and weight specifications. Coordinate with carriers experienced in handling industrial machinery, particularly those familiar with heavy or precision equipment. Verify compliance with international shipping regulations, including IATA for air freight or IMDG for sea transport, if applicable.

Import/Export Documentation

Prepare complete documentation for customs clearance, including a commercial invoice, packing list, bill of lading or air waybill, and certificate of origin. Depending on the destination country, an import license or special permit may be required. For dual-use or high-speed rotating equipment, confirm whether the centrifuge falls under export control regulations such as the Wassenaar Arrangement or ECCN (Export Control Classification Number). Submit required documentation to customs authorities in advance to avoid delays. Maintain records for audit purposes in accordance with local and international trade laws.

Installation and Site Requirements

Verify that the installation site meets structural, electrical, and environmental specifications. The centrifuge must be installed on a rigid, level foundation to prevent vibration-related damage. Ensure adequate clearance for maintenance and access to service points. Confirm electrical supply compatibility (voltage, phase, frequency) and install proper grounding. Provide appropriate ventilation and temperature control, especially if processing volatile or heat-sensitive materials. Comply with local building codes and industrial safety standards such as OSHA (USA) or Machinery Directive 2006/42/EC (EU).

Safety and Operational Compliance

Adhere to manufacturer-recommended operating procedures and safety protocols. Equip the centrifuge with necessary safety features, including vibration sensors, automatic shutdown systems, and emergency stop mechanisms. Personnel must be trained in safe operation and emergency response. Follow local occupational health and safety regulations, including PPE requirements and lockout/tagout (LOTO) procedures. Conduct regular safety audits and maintain logs of inspections and maintenance. Ensure compliance with ISO 13730 (centrifuge safety) and other relevant industry standards.

Environmental and Waste Management

Implement procedures for handling process residues, cleaning solvents, and waste generated during operation or maintenance. Classify waste according to local environmental regulations (e.g., RCRA in the U.S., Waste Framework Directive in the EU). Store hazardous materials in approved containers and dispose of them through licensed waste management providers. Prevent leaks or spills by using secondary containment systems. Monitor emissions, especially if processing volatile organic compounds (VOCs), and comply with air and water discharge permits as required by environmental agencies.

Regulatory Certifications and Standards

Confirm that the disk stack centrifuge meets relevant regulatory and quality standards prior to deployment. Required certifications may include CE marking (for EU markets), UL or CSA (for North America), or ATEX/IECEx (for explosive environments). Maintain documentation of conformity assessments, test reports, and quality management system compliance (e.g., ISO 9001). Periodically verify ongoing compliance through audits and recertification as needed, particularly after major modifications or repairs.

Maintenance and Recordkeeping

Establish a preventive maintenance schedule based on the manufacturer’s recommendations and operational intensity. Keep detailed records of all servicing, part replacements, and performance verifications. Calibration of sensors and control systems should be performed regularly and documented. Retain logs for a minimum of five years (or as required by local regulations) to support compliance audits and warranty claims. Use a digital asset management system where possible to track service history and schedule inspections.

Training and Personnel Qualifications

Ensure that all operators and maintenance personnel receive certified training on the specific centrifuge model. Training should cover startup/shutdown procedures, routine maintenance, troubleshooting, and emergency response. Maintain training records and conduct refresher courses periodically. Verify that staff are qualified according to local labor and safety regulations. For pharmaceutical or food processing applications, ensure GMP (Good Manufacturing Practice) training is provided and documented.

Conclusion on Sourcing a Disk Stack Centrifuge

Sourcing a disk stack centrifuge requires a comprehensive evaluation of technical specifications, operational requirements, supplier reliability, and total cost of ownership. These high-performance machines are critical in industries such as pharmaceuticals, food and beverage, biodiesel, and chemical processing, where efficient separation of liquids and solids or immiscible liquids is essential.

When selecting a supplier, it is important to prioritize manufacturers with proven engineering expertise, adherence to international quality standards (such as ISO, GMP, or ATEX where applicable), and a strong track record of after-sales support. Customization capabilities, availability of spare parts, and access to technical service and maintenance training are crucial for ensuring long-term operational efficiency.

Additionally, evaluating energy consumption, automation features, and cleaning-in-place (CIP) compatibility can significantly impact productivity and compliance. While initial acquisition cost is a consideration, lifecycle costs—including maintenance, energy use, and downtime—should guide the final decision.

In conclusion, the successful sourcing of a disk stack centrifuge hinges on balancing performance, reliability, and support. A well-informed procurement strategy will ensure optimal separation efficiency, regulatory compliance, and a strong return on investment over the equipment’s operational lifespan.