The global discharge lamp market continues to demonstrate steady growth, driven by rising demand for energy-efficient lighting solutions across industrial, commercial, and public infrastructure sectors. According to a 2023 report by Mordor Intelligence, the market was valued at USD 11.4 billion in 2022 and is projected to grow at a CAGR of 4.3% from 2023 to 2028. This expansion is fueled by increasing adoption of high-intensity discharge (HID) lamps in street lighting, automotive headlamps, and architectural lighting, alongside technological advancements improving luminous efficacy and lifespan. Despite emerging competition from LED technologies, discharge lamps remain critical in niche applications requiring high lumen output and color rendering. As demand sustains, a select group of manufacturers have emerged as leaders through innovation, global supply chain reach, and product reliability. Based on market presence, revenue performance, and technological development, the following seven companies represent the forefront of the discharge lamp industry.

Top 7 Discharge Lamp Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 High intensity discharge lamps

Domain Est. 1996

Website: signify.com

Key Highlights: As the manufacturer of Philips products, Signify.com is the new home of the Philips lighting catalog, alongside Dynalite and other Signify brands….

#2 Light Sources

Domain Est. 1997

Website: light-sources.com

Key Highlights: We develop and manufacture high-quality germicidal lamps found in a multitude of water, air and surface disinfection applications worldwide….

#3 Discharge lamps

Domain Est. 2004

Website: smart-elements.com

Key Highlights: Research & development – leading manufacturer for 2D-Materials, high purity elements, periodic table displays for research, education and collection. Living ……

#4 EarthTronics

Domain Est. 2005

Website: earthtronics.com

Key Highlights: We manufacture and sell LED lighting designed for peak performance and long life. Our products are available to distributors, resellers, contractors and ……

#5 High intensity discharge lamps

Domain Est. 1987

Website: lighting.philips.com

Key Highlights: Free delivery · 30-day returnsPhilips’ introduce a wide range of High Intensity Discharge lamps and light bulbs, which offers bright illumination to large spaces like streets, war…

#6 High

Domain Est. 1999

Website: energy.gov

Key Highlights: High intensity discharge (HID) lamp means an electric-discharge lamp in which (1) The light-producing arc is stabilized by the arc tube wall temperature….

#7 PIAA Corporation

Domain Est. 1999

Website: piaa.com

Key Highlights: PIAA is the global leader in the design and manufacture of LED and Halogen lighting systems and Silicone Wiper Blades to enhance visibility and safety….

Expert Sourcing Insights for Discharge Lamp

H2: 2026 Market Trends for Discharge Lamps

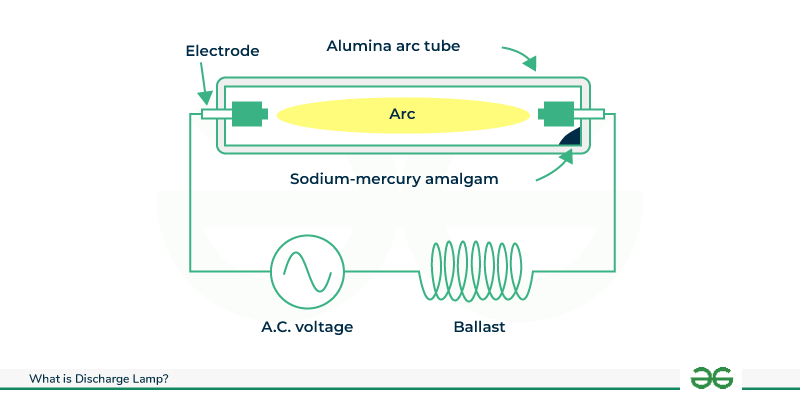

As the global lighting industry evolves, the discharge lamp market is expected to experience a mix of challenges and opportunities by 2026. While once dominant in commercial, industrial, and outdoor lighting applications, discharge lamps—such as high-intensity discharge (HID) lamps including metal halide, high-pressure sodium (HPS), and mercury vapor lamps—are facing increasing competition from solid-state lighting technologies, particularly LEDs. Despite this, certain niche applications and regional dynamics continue to sustain demand. The following analysis highlights key market trends expected to shape the discharge lamp industry in 2026.

-

Declining Market Share Amid LED Dominance

By 2026, discharge lamps are projected to hold a shrinking share of the overall lighting market. LED technology continues to outperform discharge lamps in energy efficiency, lifespan, maintenance costs, and environmental impact. Governments and businesses worldwide are accelerating LED retrofits, reducing demand for new discharge lamp installations. The trend is especially pronounced in developed markets such as North America and Western Europe. -

Niche Applications Sustain Demand

Despite overall decline, discharge lamps will retain relevance in specific applications where their unique spectral output and high luminous intensity are advantageous. Industries such as horticulture (especially high-pressure sodium in greenhouse lighting), industrial high-bay lighting, and certain outdoor street lighting in developing regions will continue to utilize discharge technology. Additionally, specialty applications in film production, scientific research, and UV curing processes will maintain a stable demand. -

Regulatory Pressures and Environmental Concerns

Environmental regulations, such as the EU’s Ecodesign Directive and restrictions on mercury-containing products under the Minamata Convention, are phasing out less-efficient and hazardous lamp types. Mercury vapor lamps, in particular, are being phased out globally. By 2026, compliance with these regulations will limit the production and sale of certain discharge lamps, further accelerating the shift to mercury-free alternatives like LEDs. -

Regional Disparities in Adoption Rates

While discharge lamp usage is declining in developed economies, some emerging markets in Africa, South Asia, and parts of Latin America may still rely on HID lighting due to lower upfront costs and existing infrastructure. However, even in these regions, falling LED prices and international development funding for energy-efficient lighting are expected to reduce dependence on discharge lamps by 2026. -

Innovation and Hybrid Solutions

A few manufacturers are investing in hybrid or enhanced discharge technologies to extend product viability. Examples include pulse-start metal halide lamps with improved efficiency and longer life, or integrated control systems that enhance performance. However, such innovations are unlikely to reverse the broader market trend but may help retain marginal market segments. -

End-of-Life Infrastructure and Recycling Growth

With millions of discharge lamps reaching end-of-life by 2026, there will be increased focus on safe disposal and recycling, especially due to mercury content. This is expected to drive growth in lamp recycling services and stricter enforcement of take-back programs, particularly in regulated markets.

Conclusion

By 2026, the discharge lamp market will be in a state of gradual contraction, driven by technological obsolescence, regulatory pressures, and the dominance of LED alternatives. While niche and regional demand will prevent a complete market collapse, the long-term trajectory points toward managed decline. Stakeholders in the discharge lamp value chain—manufacturers, distributors, and recyclers—will need to adapt through diversification, compliance strategies, or transition to newer lighting technologies to remain viable.

Common Pitfalls When Sourcing Discharge Lamps: Quality and Intellectual Property (IP) Risks

Sourcing discharge lamps—such as high-intensity discharge (HID), metal halide, high-pressure sodium, or xenon lamps—requires careful attention to both quality assurance and intellectual property (IP) compliance. Overlooking these aspects can lead to performance failures, safety hazards, legal disputes, and reputational damage. Below are key pitfalls to avoid.

Quality-Related Pitfalls

Inconsistent Lamp Performance and Lifespan

Discharge lamps from unreliable suppliers often exhibit significant variation in lumen output, color temperature, and operational life. Poor quality control during manufacturing—such as inconsistent gas filling, electrode misalignment, or impurities in materials—can result in early failures or unpredictable performance. Buyers may receive lamps that fall short of specified lumen maintenance or fail prematurely, increasing maintenance costs and downtime.

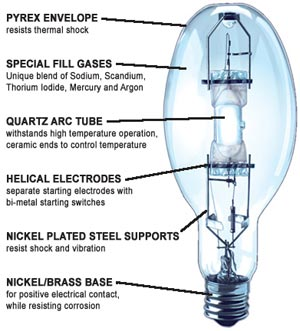

Substandard Materials and Construction

Low-cost suppliers may use inferior quartz glass, subpar electrode materials, or inadequate sealing techniques. This compromises thermal stability and increases the risk of arc tube rupture or leakage. Poorly constructed lamps are also more vulnerable to thermal shock and vibration, especially in demanding environments such as industrial or outdoor lighting.

Lack of Certification and Compliance

Many suppliers, particularly in unregulated markets, provide lamps that lack essential safety and performance certifications (e.g., CE, UL, RoHS, or IEC standards). Using non-compliant lamps can violate local regulations, void equipment warranties, and pose fire or electrical hazards. Always verify third-party test reports and certifications before procurement.

Inadequate Thermal and Electrical Design

Discharge lamps require precise ballast matching and thermal management. Sourcing lamps without proper compatibility data or testing can lead to unstable arc performance, flickering, or catastrophic failure. Suppliers may misrepresent electrical characteristics (e.g., wattage, voltage), resulting in incompatibility with existing systems.

Intellectual Property (IP) Risks

Counterfeit or Cloned Products

A major IP concern is the proliferation of counterfeit lamps that mimic well-known brands (e.g., Philips, Osram, GE). These products often replicate logos, packaging, and product names without authorization. While they may appear identical, counterfeit lamps typically use inferior components and lack proper engineering, leading to safety risks and performance issues.

Unauthorized Use of Patented Technologies

Many discharge lamp designs incorporate patented technologies—such as specific arc tube geometries, gas mixtures, or electrode coatings. Sourcing from suppliers that infringe on these patents exposes buyers to legal liability, especially in regions with strong IP enforcement. Even unintentional use of infringing products can result in cease-and-desist orders, import bans, or litigation.

Lack of Transparency in Supply Chain

Opaque sourcing channels make it difficult to trace the origin of lamps and verify IP compliance. OEMs or distributors may source components from unauthorized or unlicensed manufacturers, unknowingly violating IP rights. Transparent supplier audits and contractual IP warranties are essential to mitigate this risk.

Weak Contractual Protections

Purchase agreements that fail to include IP indemnification clauses leave buyers vulnerable. If a supplier delivers lamps that infringe on third-party patents, the buyer—not the supplier—may be held responsible for damages. Ensure contracts explicitly state that the supplier warrants IP compliance and assumes liability for infringement claims.

Best Practices to Avoid Pitfalls

- Conduct Supplier Audits: Visit manufacturing facilities or request third-party audit reports to assess quality control processes.

- Verify Certifications: Require valid test reports from accredited laboratories for safety, performance, and environmental compliance.

- Perform Sample Testing: Test lamps under real-world conditions before full-scale procurement.

- Check IP Status: Work with legal counsel to confirm that sourced products do not infringe on active patents, especially in target markets.

- Include IP Clauses in Contracts: Demand warranties of non-infringement and indemnification for IP-related claims.

- Source from Authorized Distributors: Prioritize suppliers with documented authorization from original lamp manufacturers.

By addressing both quality and IP concerns proactively, organizations can ensure reliable performance, regulatory compliance, and legal safety in their discharge lamp sourcing strategies.

H2: Logistics & Compliance Guide for Discharge Lamps

Discharge lamps—including high-intensity discharge (HID) lamps such as metal halide, high-pressure sodium, and mercury vapor—present unique logistical and regulatory challenges due to their composition, handling requirements, and environmental impact. This guide outlines key considerations for the safe and compliant transportation, storage, and disposal of discharge lamps.

H2: Regulatory Compliance

1. Hazardous Materials Classification

Discharge lamps often contain mercury and other hazardous substances, classifying them as dangerous goods under international and national regulations:

– UN Number: Most mercury-containing discharge lamps fall under UN 3506, “Lamps, electric, containing mercury” (Class 8, Corrosive, PG III).

– IMDG Code (Maritime): Regulates sea transport; requires proper packaging, labeling, and documentation.

– IATA DGR (Air): Air shipments must comply with IATA Dangerous Goods Regulations; restrictions may apply based on mercury content.

– 49 CFR (U.S. Ground): Enforced by the DOT; mandates labeling, training, and packaging standards.

– ADR (Europe Ground): Governs road transport in Europe; aligns with UN recommendations.

2. Environmental & Waste Regulations

– EPA Universal Waste Rule (U.S.): Discharge lamps containing mercury are regulated as universal waste, allowing simplified handling but requiring proper storage, labeling, and disposal via certified recyclers.

– WEEE Directive (EU): Waste Electrical and Electronic Equipment Directive mandates collection, recycling, and recovery of discharge lamps; producers may have extended producer responsibility (EPR).

– RoHS Compliance: Restriction of Hazardous Substances limits mercury and other substances in new lamps sold in the EU and many other regions.

3. Country-Specific Requirements

– Canada: Transported under TDG (Transportation of Dangerous Goods) Regulations; waste managed under provincial e-waste programs.

– China: Subject to MEP hazardous waste regulations and import/export controls.

– Australia: Regulated under ADG Code for transport and state-based e-waste schemes for disposal.

H2: Packaging & Handling

1. Packaging Standards

– Use UN-certified packaging designed for UN 3506.

– Inner containers must prevent breakage; use cushioning (e.g., foam, cardboard dividers).

– Outer packaging must be durable (e.g., rigid fiberboard or plastic cases) and labeled with:

– Proper shipping name: “Lamps, electric, containing mercury”

– UN 3506

– Class 8 label (Corrosive)

– Orientation arrows (if applicable)

– “This Way Up” markings

2. Handling Procedures

– Handle with care to avoid breakage and mercury release.

– Use gloves and eye protection during packing/unpacking.

– Do not stack heavy items on lamp shipments.

– Train personnel in hazardous material handling and emergency response.

H2: Transportation Requirements

1. Mode-Specific Rules

– Air: IATA limits quantity per package and may restrict passenger aircraft transport. Check current IATA DGR for exemptions.

– Sea: IMDG requires documentation (Dangerous Goods Declaration), stowage away from foodstuffs, and segregation.

– Road: ADR/DOT requires placarding (for larger quantities), driver training, and vehicle documentation.

2. Documentation

– Shipper’s Declaration for Dangerous Goods (when required).

– Safety Data Sheet (SDS) – Section 14 covers transportation.

– Waste manifests (for spent lamps under universal/hazardous waste rules).

H2: Storage & Inventory Management

- Store new and spent lamps in a dry, secure area, protected from physical damage.

- For used lamps: Label containers “Universal Waste – Lamps” or “Hazardous Waste” as applicable.

- Limit storage time: 1 year for universal waste (U.S.), unless permitted otherwise.

- Use spill kits and mercury vapor monitors in storage areas.

H2: End-of-Life & Recycling

- Partner with certified lamp recyclers (e.g., EPA-approved, R2 or e-Stewards certified).

- Maintain recycling certificates for compliance audits.

- Never dispose of discharge lamps in regular trash due to mercury content.

H2: Training & Recordkeeping

- Ensure staff are trained in:

- Hazardous material handling

- Emergency procedures for mercury spills

- Regulatory compliance (DOT, IATA, EPA, etc.)

- Keep records of:

- Training

- Shipments (bills of lading, manifests)

- Recycling certificates

- Incident reports

Adhering to this guide ensures legal compliance, minimizes environmental risk, and promotes safe logistics for discharge lamps across the supply chain. Always verify current local and international regulations before shipment or disposal.

In conclusion, sourcing discharge lamps requires careful consideration of several key factors including the specific application requirements, lamp type (such as metal halide, high-pressure sodium, or fluorescent), performance specifications (like luminous output, color rendering, and energy efficiency), compatibility with existing fixtures and ballasts, and compliance with relevant safety and environmental standards. Additionally, evaluating suppliers based on reliability, product quality, cost-effectiveness, and after-sales support is crucial to ensuring long-term operational success. While discharge lamps continue to serve important roles in industrial, commercial, and outdoor lighting, it is also prudent to assess emerging alternatives like LED technology, which may offer superior energy efficiency and lifespan. Ultimately, a well-informed sourcing decision will balance technical needs, operational costs, and sustainability goals to deliver optimal lighting performance.